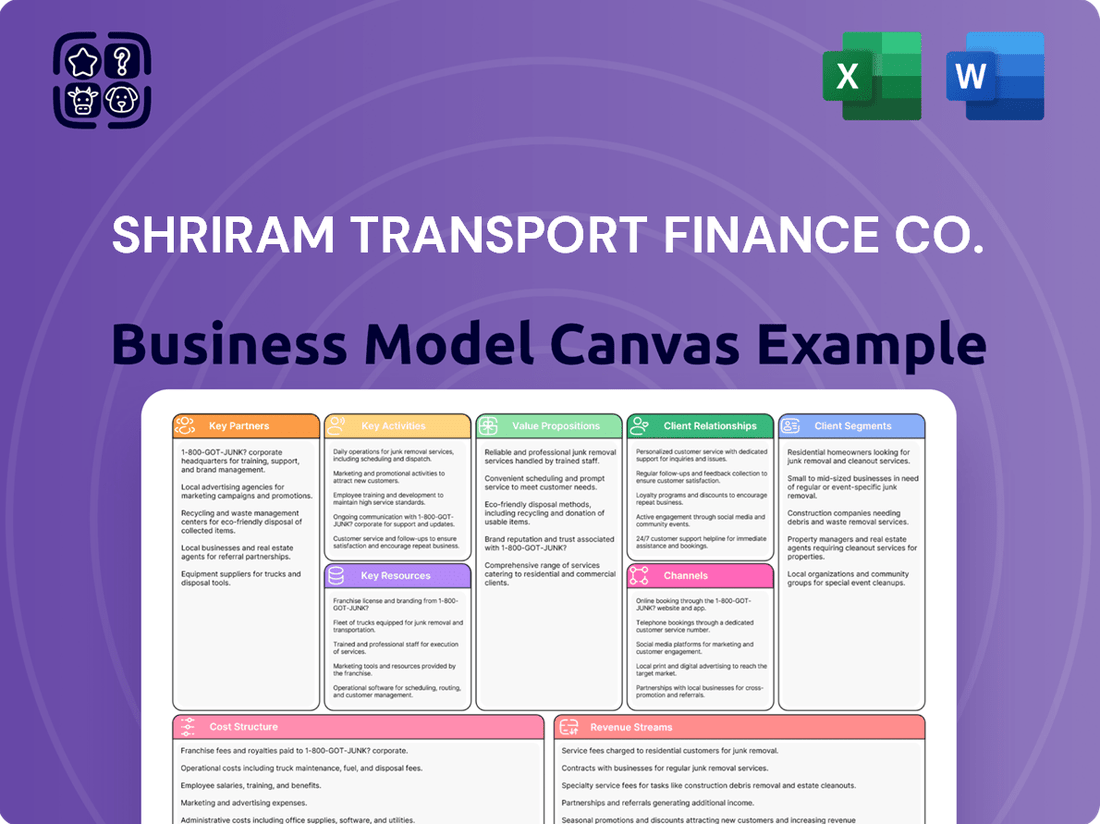

Shriram Transport Finance Co. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Transport Finance Co. Bundle

Unlock the full strategic blueprint behind Shriram Transport Finance Co.'s business model. This in-depth Business Model Canvas reveals how the company drives value through its focus on the transport sector, captures market share via strong customer relationships, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading NBFC.

Partnerships

Shriram Finance deeply integrates with vehicle manufacturers and dealerships, acting as a vital partner in offering on-the-spot financing for both new and pre-owned commercial vehicles. This synergy is instrumental in generating a steady stream of potential customers and provides direct access to individuals actively seeking vehicle purchases.

These collaborations streamline the entire loan application process, allowing for swift disbursement of funds to customers. For instance, in the fiscal year 2023-24, Shriram Finance reported a significant growth in its vehicle loan portfolio, underscoring the effectiveness of these manufacturer and dealer relationships in driving business volume and customer acquisition.

Shriram Transport Finance Company (STFC) actively collaborates with a diverse range of banks and financial institutions. These partnerships are crucial for facilitating co-lending arrangements, where STFC shares the risk and reward of lending with its partners, thereby extending its reach and capital efficiency. For instance, in the past, STFC has engaged in such collaborations to bolster its lending capabilities.

Securitization of its loan portfolios is another key area of partnership. By packaging and selling loans to financial institutions, STFC can convert its illiquid assets into cash, which is vital for maintaining strong liquidity and funding its ongoing operations. This process allows for a continuous flow of capital, enabling STFC to originate more loans.

Furthermore, these alliances are instrumental in sourcing funds through various channels, including inter-corporate deposits and lines of credit. This diversification away from solely relying on public deposits significantly reduces the company's overall cost of funds. For example, in the fiscal year ending March 31, 2024, STFC reported a Net Interest Margin, reflecting the impact of its efficient funding strategies.

Shriram Finance collaborates with leading insurance companies to bundle motor and life insurance with its vehicle loans. This strategic alliance allows them to offer customers a complete financial and protective package, simplifying the purchase process. For instance, in the fiscal year 2023-24, Shriram Finance saw significant cross-selling opportunities through these partnerships, contributing to a robust fee-based income.

Technology and Digital Solution Providers

Shriram Transport Finance (STF) actively partners with technology and digital solution providers to bolster its lending operations. These collaborations are crucial for building and managing sophisticated digital lending platforms, user-friendly mobile applications, and powerful data analytics systems. For instance, in 2024, STF's commitment to digital transformation means investing in partnerships that drive innovation in credit scoring and customer onboarding.

These strategic alliances are designed to significantly boost operational efficiency. By leveraging cutting-edge technology, STF can streamline its processes, from loan application to disbursement. This also directly translates into enhanced credit assessment capabilities, allowing for more accurate risk evaluation and quicker decision-making. Ultimately, these partnerships aim to deliver a superior and seamless digital experience for STF's diverse customer base.

Key aspects of these technology partnerships for STF include:

- Development of advanced digital lending platforms

- Enhancement of mobile application functionalities for customers

- Implementation of robust data analytics for improved credit assessment

- Ensuring operational efficiency through technological integration

Collection and Recovery Agencies

Shriram Finance collaborates with dedicated collection and recovery agencies to effectively manage non-performing assets (NPAs) and streamline the loan recovery process. This strategic alliance is vital for preserving the company's asset quality and controlling credit-related expenses, a key consideration for Non-Banking Financial Companies (NBFCs).

These partnerships are crucial for Shriram Finance's operational efficiency. By leveraging the expertise of specialized agencies, the company can navigate the complexities of loan recovery, ensuring a robust approach to managing delinquent accounts. This focus on asset quality directly impacts the company's financial health and its ability to lend responsibly.

As of the fiscal year ending March 31, 2024, Shriram Finance reported a Gross NPA ratio of 5.35% and a Net NPA ratio of 3.01%. The engagement of collection agencies plays a significant role in managing these figures and mitigating potential losses.

- Specialized Expertise: Collection agencies possess the necessary skills and resources for effective debt recovery.

- Improved Asset Quality: Partnerships help in reducing NPAs and maintaining a healthier loan portfolio.

- Cost Efficiency: Outsourcing recovery efforts can be more cost-effective than maintaining an in-house recovery team for an NBFC.

- Regulatory Compliance: Agencies ensure adherence to all relevant debt collection regulations.

Shriram Finance's key partnerships extend to regulatory bodies and industry associations, ensuring compliance and best practices in the lending sector. These relationships are foundational for maintaining operational integrity and fostering a stable financial environment, crucial for an NBFC like Shriram Finance.

Collaborations with rating agencies are also vital, providing independent assessments of financial health and creditworthiness. These ratings, such as those from CRISIL or ICRA, directly influence investor confidence and the cost of borrowing, impacting Shriram Finance's ability to secure capital effectively.

The company also engages with think tanks and research institutions to stay abreast of evolving market trends and economic policies. This forward-looking approach enables Shriram Finance to adapt its strategies proactively, ensuring long-term sustainability and growth in a dynamic financial landscape.

What is included in the product

This Shriram Transport Finance Co. Business Model Canvas outlines their strategy of providing financing solutions primarily to the commercial vehicle sector, focusing on truck owners and small and medium enterprises.

It details their customer segments, channels, and value propositions, reflecting real-world operations and offering insights for informed decision-making.

Shriram Transport Finance Co.'s Business Model Canvas acts as a pain point reliever by offering a high-level view of their operations, allowing for quick identification of core components and efficient problem-solving for their target market of truck owners and small transport operators.

Activities

Shriram Transport Finance Company's key activity revolves around the meticulous process of loan origination and disbursement. This encompasses everything from identifying and attracting potential borrowers, primarily commercial vehicle owners and fleet operators, to rigorously assessing their eligibility and meticulously processing their loan applications. The company disbursed approximately ₹17,800 crore in new loans during the fiscal year ended March 31, 2024, demonstrating the scale of this core operation.

This critical function includes the disbursement of various financial products, such as vehicle loans, which are central to their business, as well as working capital loans and other tailored financial solutions. The efficiency and accuracy in these stages are paramount to ensuring timely funding for their target customer base, thereby supporting the growth and operational needs of India's transport sector.

Shriram Finance places significant emphasis on its credit assessment process, diligently evaluating borrowers, many of whom may have less-than-perfect credit histories. This meticulous approach is fundamental to the company's operations, ensuring that loans are extended responsibly.

Robust risk management frameworks are actively deployed to mitigate potential losses and maintain the health of its extensive loan portfolio. These frameworks are critical for navigating the complexities of lending, particularly within the segments Shriram Finance serves.

As of the fiscal year ending March 31, 2024, Shriram Finance reported a Gross Non-Performing Assets (GNPA) ratio of 4.22%, demonstrating its ongoing efforts in managing asset quality and delinquencies within its diversified customer base.

The company's ability to effectively manage risk directly contributes to the stability and resilience of its loan book, a key factor in its sustained financial performance and market position.

Managing an active loan portfolio, ensuring timely EMI collections, and addressing overdue accounts are core functions for Shriram Transport Finance. Their operational efficiency hinges on these continuous activities.

Shriram Transport Finance Co. Ltd. has a substantial loan portfolio. For the fiscal year ending March 31, 2024, their Assets Under Management (AUM) stood at approximately ₹2.37 trillion. This vast portfolio requires diligent servicing and collection efforts.

The company's expansive branch network, which numbered over 4,000 branches as of March 2024, and its dedicated field staff are crucial. They facilitate direct engagement with borrowers for collections and loan servicing, particularly in semi-urban and rural areas where many of their customers reside.

Effective recovery strategies for non-performing assets (NPAs) are a critical component of their loan servicing. By March 2024, Shriram Transport Finance reported a Gross NPA ratio of around 5.5%, highlighting the ongoing importance of their collection processes.

Fundraising and Treasury Management

Shriram Finance's core operations rely heavily on its ability to continuously raise capital. In the financial year 2023-24, the company demonstrated robust fundraising capabilities, accessing funds through a mix of public deposits, term loans from various banks, and strategic bond issuances. This diverse funding strategy is critical to supporting its extensive lending activities, particularly in the commercial vehicle finance sector.

Effective treasury management is paramount for Shriram Finance, ensuring that raised funds are utilized optimally while strictly adhering to all regulatory liquidity requirements. This involves careful management of cash flows, investment of surplus funds, and maintaining adequate liquidity buffers to meet any unexpected demands. For instance, as of March 31, 2024, Shriram Finance reported total assets under management of over ₹2.6 trillion, underscoring the scale of its treasury operations.

- Fundraising Instruments: Public deposits, bank term loans, and bond issuances are key sources for capital.

- Liquidity Management: Ensuring sufficient liquid assets to meet short-term obligations and regulatory norms.

- Capital Adequacy: Maintaining a strong capital base to support asset growth and absorb potential risks.

- Cost Optimization: Managing the cost of funds through efficient sourcing and treasury strategies.

Customer Relationship Management and Outreach

Shriram Transport Finance Co. actively focuses on building and nurturing lasting connections with its customer base, particularly those situated in semi-urban and rural regions. This dedication translates into providing tailored services and deeply understanding individual financial requirements.

A significant part of their strategy involves leveraging established customer relationships to foster repeat business and generate valuable referrals, a testament to their client-centric approach. For instance, Shriram Transport Finance reported a robust disbursal growth in FY23, indicating continued trust and engagement from their customer segments.

- Personalized Service: Offering customized loan solutions and dedicated support to meet diverse customer needs.

- Needs Assessment: Continuously evaluating and adapting services based on evolving customer financial goals and challenges.

- Relationship Leveraging: Utilizing existing customer loyalty for cross-selling opportunities and new client acquisition through word-of-mouth.

- Outreach Programs: Implementing targeted campaigns and local engagement initiatives to connect with and serve underserved markets.

Shriram Transport Finance Company's key activities are centered on originating and disbursing loans, primarily to commercial vehicle owners. They meticulously assess borrower eligibility and process loan applications efficiently. For the fiscal year ending March 31, 2024, the company disbursed approximately ₹17,800 crore in new loans, highlighting the scale of this core operation.

Full Version Awaits

Business Model Canvas

The preview you see is a direct representation of the Shriram Transport Finance Co. Business Model Canvas you will receive. This isn't a sample or mockup; it's an authentic snapshot of the complete document, offering a clear view of its structure and content. Upon purchase, you'll gain immediate access to this exact, professionally formatted Business Model Canvas, ready for your strategic analysis and application.

Resources

Shriram Finance's extensive branch network and dedicated field staff are foundational to its business model, enabling direct engagement with customers, especially in less urbanized regions of India. This physical footprint is crucial for understanding local needs and building trust.

With over 2,900 branches as of the fiscal year ending March 31, 2024, Shriram Finance has a significant physical presence that facilitates direct customer outreach and loan origination, particularly in semi-urban and rural markets where traditional banking access might be limited.

The company leverages its large field force, comprising thousands of field executives, to conduct on-ground customer assessments, manage loan disbursements, and ensure efficient loan recovery processes. This hands-on approach is a key differentiator.

This vast network and workforce are instrumental in Shriram Finance's ability to penetrate deep into Tier 2, Tier 3, and rural areas, a strategy that has allowed it to capture a substantial market share in commercial vehicle finance and other lending segments.

Shriram Transport Finance Co. Ltd. (STFC) relies heavily on its robust financial capital, comprising equity, debt, and a significant base of public deposits, to fuel its core lending operations. This substantial financial foundation is the bedrock of its business, enabling it to extend credit to its target market.

Crucially, STFC maintains diverse funding lines, tapping into resources from commercial banks, various financial institutions, and the broader capital markets. As of the fiscal year ending March 31, 2024, STFC reported total assets of INR 2,30,765 crore, a testament to its strong financial footing and its ability to raise capital effectively to support its growing loan portfolio.

Shriram Transport Finance Co. (STFC) has built deeply ingrained, proprietary credit underwriting models over decades of serving India's commercial vehicle financing sector, particularly focusing on the underserved segments. This extensive experience, dating back to its inception, has allowed them to gather a vast and unique dataset on borrowers. For instance, by fiscal year 2023, STFC had a customer base exceeding 2.1 million, a testament to their reach and data accumulation capabilities.

This accumulated data and refined modeling expertise are crucial for STFC's business. It enables highly accurate risk profiling of individual borrowers, many of whom may not have traditional credit histories. This granular understanding of risk allows STFC to offer tailored loan products and competitive interest rates, directly addressing the specific needs of their target market, which is a significant competitive advantage.

The proprietary nature of these models and the wealth of data are key differentiators. They empower STFC to assess creditworthiness effectively, even in challenging economic environments, leading to a robust asset quality. In FY23, STFC reported a Gross Non-Performing Asset (GNPA) ratio of 4.36%, demonstrating the efficacy of their underwriting in managing risk.

Established Brand Reputation and Trust

Shriram Finance has cultivated a powerful brand reputation, especially among its core clientele of small truck owners and fleet operators. This trust, built over many years, acts as a significant draw for new customers and encourages loyalty from existing ones.

This established brand recognition is a key intangible asset for Shriram Finance. It translates into lower customer acquisition costs and a more stable revenue base, reinforcing their market position.

As of March 31, 2024, Shriram Finance reported a robust Assets Under Management (AUM) of INR 2.56 trillion, a testament to the deep trust placed in the brand by millions of customers.

The company's consistent focus on serving the unbanked and underbanked segments has further solidified its standing. This dedication has created a strong emotional connection with its customer base.

- Brand Equity: Decades of consistent service have fostered deep trust, making Shriram Finance a preferred lender for commercial vehicle financing.

- Customer Loyalty: A strong reputation leads to higher customer retention rates, reducing churn and marketing expenses.

- Market Penetration: The trusted brand allows Shriram Finance to penetrate deeper into its target markets, reaching even remote areas where trust is paramount.

- Competitive Advantage: Brand reputation acts as a significant barrier to entry for new competitors, protecting Shriram Finance's market share.

Technology Infrastructure and Digital Platforms

Shriram Transport Finance Co. heavily relies on its technology infrastructure and digital platforms as key resources. The company has made significant investments in robust IT systems and specialized loan management software to streamline its operations. These technological foundations are crucial for managing a large portfolio of vehicle finance loans efficiently.

The development and ongoing enhancement of digital platforms, such as the Shriram One app, are central to their business model. These platforms facilitate a seamless customer experience, enabling online loan applications, digital payment processing, and improved customer service interactions. This digital push is vital for reaching a wider customer base and enhancing operational agility.

- IT Systems: Investments in core banking and loan origination systems are foundational.

- Digital Platforms: The Shriram One app is a primary customer-facing resource for services.

- Loan Management Software: Essential for efficient processing, tracking, and servicing of loans.

- Data Analytics: Leveraging technology for data analysis to inform lending decisions and risk management.

Shriram Transport Finance Co. (STFC) leverages its deep understanding of its customer base and its extensive data, accumulated over decades of specialized lending. This proprietary credit underwriting expertise, honed by serving millions, allows for accurate risk assessment, particularly for individuals without traditional credit histories. In FY23, STFC served over 2.1 million customers, generating rich data for their models.

This data-driven approach, coupled with sophisticated underwriting models, is a core strength. It enables STFC to manage credit risk effectively, as evidenced by a Gross Non-Performing Asset (GNPA) ratio of 4.36% in FY23, demonstrating the reliability of their assessment methods even in diverse economic conditions.

| Key Resource | Description | Impact |

| Proprietary Credit Models | Decades of experience in commercial vehicle finance, particularly with underserved segments, have resulted in unique, data-backed credit scoring systems. | Enables accurate risk assessment for individuals with limited traditional credit history, leading to better loan performance. |

| Customer Data | Extensive data collected from over 2.1 million customers (as of FY23) provides deep insights into borrower behavior and repayment patterns. | Fuels the proprietary models, allowing for personalized loan offerings and effective risk management. |

| Underwriting Expertise | Specialized knowledge in assessing creditworthiness for small truck owners and fleet operators, often outside the traditional banking system. | Facilitates access to credit for a crucial segment of the economy, driving business growth and market penetration. |

Value Propositions

Shriram Finance champions financial inclusion by offering vital loan access to small truck owners, first-time buyers, and micro, small, and medium enterprises (MSMEs) primarily located in semi-urban and rural regions. These are segments often underserved by mainstream financial institutions.

This strategic focus directly addresses the financing gap, enabling entrepreneurs in these areas to secure commercial vehicles, a critical step in expanding their businesses and livelihoods. For instance, Shriram Finance's extensive network allows them to reach customers who might otherwise struggle to obtain credit.

By providing these essential financial services, Shriram Finance not only facilitates asset acquisition but also acts as a catalyst for economic growth at the grassroots level. Their commitment to these often-marginalized groups is a cornerstone of their business model, fostering self-employment and contributing to the wider economy.

Shriram Transport Finance Co. offers a suite of quick and flexible loan products, including vehicle loans, working capital solutions, and gold loans. These are designed with streamlined processes for rapid disbursal, addressing the immediate financial requirements of their customer base.

This agility in providing capital is crucial for Shriram's customers, many of whom are small business owners and transporters who depend on timely access to funds to maintain and grow their operations. For instance, in the fiscal year ending March 2024, Shriram Transport Finance Co. reported a robust disbursal pipeline, reflecting the demand for their swift financial services.

Shriram Finance's commitment to personalized, proximity-based service is a cornerstone of its business model. With an expansive network of over 3,000 branches across India, the company ensures that customers are never far from a touchpoint for support and guidance. This extensive reach allows for a deeply localized approach, fostering strong relationships built on trust and understanding.

Dedicated field staff actively engage with customers, often providing doorstep service. This hands-on approach is crucial for understanding the unique financial needs and challenges faced by individuals, particularly in rural and semi-urban areas where Shriram Finance has a significant presence. This direct interaction allows for tailored solutions and immediate assistance.

This localized strategy empowers customers by providing accessible financial support and guidance. For instance, in FY2024, Shriram Finance continued to focus on its core customer base, which includes small commercial vehicle operators and entrepreneurs, many of whom benefit immensely from this personal touch. The company's deep understanding of these segments allows it to offer products and services that truly resonate.

Reliable and Trustworthy Partner

Shriram Transport Finance Co. (now Shriram Finance Ltd.) has cultivated a reputation as a dependable and trustworthy ally in India's vehicle financing landscape. As a prominent Non-Banking Financial Company (NBFC) with decades of operation, its established presence and consistent track record provide significant assurance to its customer base.

This perceived reliability is particularly crucial for borrowers in the transport sector, many of whom may have limited access to traditional banking services or formal credit histories. Shriram Finance's customer-centric philosophy, which focuses on understanding and addressing the unique needs of truck owners and small transport operators, further solidifies this trust.

The company's commitment to accessibility and support, often demonstrated through its extensive branch network and tailored financial solutions, reinforces its image as a partner invested in its clients' success. For instance, by the end of the fiscal year 2023-24, Shriram Finance reported a robust Assets Under Management (AUM) exceeding ₹2.6 lakh crore, underscoring the scale of its operations and the widespread reliance on its services.

- Decades of Operational Experience: Shriram Finance has been a fixture in the Indian financial sector for over four decades, building a legacy of stability.

- Extensive Network Reach: With over 3,500 branches across India as of early 2024, the company ensures accessibility for a wide range of customers.

- Customer-Centric Approach: Focus on understanding and catering to the specific needs of transport operators, especially those with less formal credit backgrounds.

- Strong Financial Performance: Maintaining a healthy financial standing, evidenced by its substantial Assets Under Management (AUM) of over ₹2.6 lakh crore in FY24, signals operational strength and borrower confidence.

Comprehensive Financial Solutions

Shriram Transport Finance Co. (STFC) provides a broad spectrum of financial products, going beyond its core expertise in commercial vehicle financing. This diversified portfolio aims to be a single point of contact for its customers' various financial needs.

Their offerings extend to financing for Small and Medium Enterprises (SMEs), loans for two-wheelers, and personal loans. These products are frequently packaged with value-added services such as insurance, creating a more attractive and convenient solution.

- Diversified Loan Portfolio: Offers vehicle loans, SME financing, two-wheeler loans, and personal loans.

- Integrated Services: Often bundles financing with insurance products for enhanced customer value.

- One-Stop Financial Hub: Aims to meet multiple financial requirements of its diverse customer base.

Shriram Finance offers accessible capital to underserved segments, particularly in rural and semi-urban areas, facilitating economic empowerment. Their flexible loan products, including vehicle and working capital financing, cater to the immediate needs of small businesses and transporters, ensuring operational continuity and growth.

The company's value proposition is built on deep customer relationships fostered through an extensive branch network and personalized service, creating trust and reliability. By providing a diverse range of financial products and services, Shriram Finance acts as a comprehensive financial partner for its clientele, driving financial inclusion and supporting grassroots economic development.

Shriram Finance's extensive reach and customer-centric approach make them a trusted partner, especially for those with limited access to traditional banking. Their commitment to timely and tailored financial solutions, backed by a strong financial standing, underpins their value proposition.

Their diversified loan portfolio, including vehicle, SME, and personal loans, coupled with integrated services like insurance, positions them as a one-stop financial solution. This comprehensive offering addresses multiple customer needs, enhancing convenience and value.

Customer Relationships

Shriram Transport Finance Co. (now Shriram Finance) places significant emphasis on dedicated relationship management to cultivate robust customer connections. This involves assigning dedicated relationship managers and field officers who actively engage with their borrower base.

This direct interaction is crucial for understanding the unique financial needs and circumstances of each customer, thereby building a foundation of trust and providing tailored ongoing support.

For instance, Shriram Finance's extensive network of field officers, numbering in the thousands, allows for consistent on-ground engagement, a key factor in their success. As of March 31, 2024, the company reported a customer base exceeding 7 million, underscoring the scale at which this personalized approach operates.

Shriram Transport Finance Co. cultivates community-centric relationships by maintaining a strong local presence in semi-urban and rural areas through its extensive network of branches. This deep penetration allows the company to intimately understand local market nuances and customer behaviors, fostering robust bonds and encouraging valuable word-of-mouth referrals.

Shriram Finance actively reaches out to customers with loan status updates, repayment reminders, and information on new financial products. This proactive approach, seen in their consistent customer outreach, aims to foster trust and ensure clients are well-informed. For instance, in the fiscal year ending March 31, 2024, Shriram Finance reported a robust customer base, underscoring the importance of these communication channels.

Efficient Problem Resolution

Shriram Transport Finance Co. places a high priority on resolving customer issues quickly and with understanding, making sure the journey after a loan is disbursed remains positive. This commitment is crucial for keeping customers happy and encouraging them to stay with the company.

A strong customer service system directly impacts how satisfied customers are and how loyal they become. For instance, in the fiscal year ending March 31, 2024, Shriram Transport Finance reported a customer base of over 2.3 million, highlighting the sheer volume of interactions requiring efficient support.

- Customer Support Channels: Offering multiple avenues like phone, email, and branch visits ensures accessibility for diverse customer needs.

- Grievance Redressal Time: Aiming for swift resolution of complaints reduces customer frustration and builds trust.

- Customer Satisfaction Scores: Regularly tracking satisfaction metrics helps gauge the effectiveness of problem-solving efforts.

- Repeat Business: Efficient service often translates into a higher percentage of existing customers opting for future loans.

Focus on Repeat Business and Loyalty

Shriram Finance actively cultivates repeat business by offering flexible loan solutions tailored to evolving customer needs. This customer-centric approach, coupled with maintaining strong, personalized relationships, is key to securing ongoing engagement from their existing clientele. For instance, in FY23, Shriram Finance reported a robust customer base, demonstrating the success of their relationship-building efforts.

Loyalty is a cornerstone of Shriram Finance's strategy. By consistently delivering satisfactory service and support for initial loans, they encourage customers to return for future financing requirements. This focus on positive customer experiences translates directly into higher retention rates and a predictable revenue stream. The company’s consistent growth in Assets Under Management (AUM) further underscores this loyalty factor.

- Customer Retention: Shriram Finance aims to maximize repeat business by understanding and adapting to customer financial journeys.

- Loyalty Programs: While not explicitly detailed, satisfactory service for initial loans acts as a de facto loyalty driver, encouraging repeat engagement.

- Relationship Management: Proactive communication and personalized support are vital in nurturing long-term customer relationships.

- FY23 Performance: Shriram Finance’s continued expansion in its loan portfolio indicates a strong base of repeat customers.

Shriram Finance prioritizes personalized customer relationships through dedicated field officers and a strong local presence, fostering trust and tailored support. Their proactive communication, including loan updates and reminders, alongside efficient grievance redressal, enhances customer satisfaction and loyalty, driving repeat business.

| Metric | FY24 Data | Significance |

|---|---|---|

| Customer Base | Over 7 million | Demonstrates scale of personalized engagement |

| Field Officers | Thousands | Ensures consistent on-ground interaction |

| Customer Retention | High (implied by AUM growth) | Indicates success in fostering loyalty and repeat business |

Channels

Shriram Finance boasts an extensive branch network, a cornerstone of its business model, with a significant presence in semi-urban and rural India. As of December 2023, the company operated over 3,000 branches, acting as crucial hubs for customer interaction and service delivery. This widespread physical footprint allows for deep market penetration, particularly in regions underserved by traditional banking institutions.

Shriram Transport Finance Co. (STFC) relies heavily on its extensive network of direct sales agents and field executives. These individuals are the frontline of the company, actively engaging with potential borrowers, particularly in rural and semi-urban areas where digital penetration might be lower.

These agents are instrumental in identifying leads and providing the initial touchpoint for new customers. They explain loan products, gather necessary documentation, and guide applicants through the process, making it accessible for those less comfortable with online channels. In 2024, STFC continued to leverage this human capital to reach a wider customer base.

The company's success in serving the commercial vehicle financing segment, which often involves smaller businesses and individual operators, is significantly tied to the efforts of these field personnel. Their understanding of local markets and borrower profiles allows for more personalized and effective service delivery, contributing to STFC’s strong market presence.

Shriram Transport Finance Co. leverages vehicle dealership partnerships as a crucial channel for its business model. These collaborations are not just about selling vehicles; they are about embedding Shriram Finance's lending services directly at the point of sale, making it incredibly convenient for customers to finance their commercial vehicle purchases. This strategy allows Shriram Finance to directly engage with customers when they are most motivated to buy.

By working closely with commercial vehicle manufacturers and a network of used vehicle dealers, Shriram Finance ensures its financing solutions are readily available. This proximity to the customer during the acquisition phase is a significant competitive advantage. In India, where commercial vehicle sales are a massive industry, these partnerships are vital for reaching a broad customer base efficiently. For instance, in FY23, Shriram Finance reported assets under management of over ₹2.2 lakh crore, a testament to the scale of its operations facilitated by such channel partnerships.

Digital Platforms and Mobile App

Shriram Finance is significantly enhancing its digital presence through its website and the Shriram One mobile app. These platforms are crucial for managing loan inquiries, processing online applications, and providing seamless account management for customers.

The focus on digital channels caters to a growing segment of tech-savvy customers who value convenience and immediate access to financial services. This digital push is designed to broaden Shriram Finance's reach and improve customer engagement.

- Digital Reach: Shriram Finance reported a substantial increase in digital channel usage, with mobile app downloads and website traffic showing robust growth throughout 2024, indicating strong customer adoption.

- Customer Convenience: The Shriram One app allows customers to apply for loans, check status, and manage their accounts 24/7, streamlining the borrowing process.

- Operational Efficiency: Digitalization helps reduce paperwork and manual processing, leading to faster loan disbursals and improved operational efficiency for the company.

- Data Insights: Digital platforms provide valuable data on customer behavior and preferences, enabling Shriram Finance to tailor its offerings and marketing efforts more effectively.

Referral Networks and Word-of-Mouth

Shriram Transport Finance Co. leverages a powerful referral network, primarily driven by word-of-mouth from its extensive customer base. This organic channel is a cornerstone of their customer acquisition strategy, especially in the semi-urban and rural areas where personal relationships and trust are highly valued.

The company's long-standing presence, dating back to 1979, has cultivated a deep reservoir of satisfied customers who actively recommend its services. This informal marketing is exceptionally effective in regions where digital penetration might be lower, and community ties are strong.

- Customer Loyalty: A significant portion of Shriram Transport Finance's new business originates from referrals by existing, happy clients.

- Community Influence: Local community networks and associations play a crucial role in spreading awareness and building trust.

- Trust Factor: In areas where trust is paramount, a personal recommendation carries more weight than traditional advertising.

- Cost-Effectiveness: Word-of-mouth referrals are a highly cost-effective customer acquisition channel for the company.

Shriram Finance's channel strategy is multi-faceted, combining a robust physical presence with expanding digital capabilities and strategic partnerships. The company maintains over 3,000 branches as of December 2023, serving as crucial touchpoints, especially in semi-urban and rural India. Direct sales agents and field executives are key, fostering relationships and simplifying the application process for customers. This human-centric approach, combined with strategic tie-ups with vehicle dealerships, ensures financing is readily available at the point of purchase. The Shriram One mobile app and website are also vital, offering convenience and efficiency for a growing digitally-inclined customer base, with significant growth in app downloads and website traffic observed throughout 2024.

| Channel | Key Features | Customer Segment Focus | 2024 Impact Highlight |

|---|---|---|---|

| Branch Network | Extensive physical presence, direct customer interaction | Semi-urban and rural, less digitally inclined | Continued to be the primary channel for loan origination in many regions. |

| Direct Sales Agents/Field Executives | Personalized outreach, lead generation, documentation assistance | Rural, semi-urban, individual operators | Instrumental in expanding reach and trust-building in local communities. |

| Vehicle Dealerships | Point-of-sale financing, direct access to buyers | Commercial vehicle buyers, fleet operators | Facilitated seamless financing at vehicle purchase, driving significant loan volumes. |

| Digital Channels (App/Website) | Online applications, account management, 24/7 access | Tech-savvy customers, urban and semi-urban | Witnessed substantial growth in user engagement and digital loan applications. |

| Referral Network | Word-of-mouth, customer advocacy | All segments, particularly where trust is high | Remained a cost-effective and powerful source of new business acquisition. |

Customer Segments

Small truck owners and individual commercial vehicle operators represent Shriram Transport Finance Co.'s core customer base. This segment encompasses independent drivers and small businesses that rely on a limited number of commercial vehicles for their livelihood. They typically seek financing for both new and pre-owned trucks, often engaging in local or regional transportation services.

In India, the commercial vehicle finance sector is substantial. For instance, Shriram Transport Finance, a major player, reported disbursals of over ₹35,000 crore in the financial year 2023-24, largely catering to this segment. These operators are crucial for the last-mile delivery and intrastate goods movement, making their access to affordable finance vital for economic activity.

First-time commercial vehicle buyers, often individuals or small entrepreneurs, represent a crucial segment for Shriram Transport Finance. These customers are typically looking to enter the commercial transport business and require accessible financing to purchase their first truck or other commercial vehicle. Shriram Finance focuses on providing these aspiring business owners with the necessary capital, understanding their unique needs and often limited credit history.

Shriram Finance's commitment to this segment is evident in its tailored loan products designed for new entrants. For instance, as of early 2024, the company continued to emphasize support for small and medium-sized enterprises (SMEs) and individual entrepreneurs looking to expand their fleets. This focus helps these customers acquire essential assets, thereby fostering their growth and contributing to the broader logistics ecosystem.

Small and Medium Enterprises (SMEs) represent a significant customer segment for Shriram Finance, extending beyond individual vehicle owners. These businesses require financing not just for commercial vehicle fleets, but also for crucial working capital and broader business expansion initiatives. Shriram Finance has notably intensified its focus on this vital segment, especially following its merger, recognizing the growth potential and diverse financial needs within the SME landscape.

Used Commercial Vehicle Buyers

Shriram Transport Finance Co. (STFC) keenly focuses on used commercial vehicle buyers, recognizing them as a specialized and high-yield customer segment. This group actively seeks financing for pre-owned trucks and other commercial vehicles, often representing small to medium-sized fleet operators or individual owner-operators. STFC's deep understanding of this market is a significant competitive advantage.

STFC leverages its expertise in assessing the value of pre-owned commercial vehicles, a crucial factor in mitigating risk for the lender. Furthermore, the company has developed a nuanced understanding of the borrower profiles within this segment, enabling more accurate credit assessments and tailored financing solutions. This specialized knowledge allows STFC to cater effectively to a market that might be underserved by conventional lenders.

The company’s strong competitive position in this niche is underscored by its extensive network and long-standing relationships within the used commercial vehicle ecosystem. This allows for efficient sourcing of vehicles for valuation and a more robust understanding of market dynamics. For instance, reports from 2024 indicate a continued strong demand for pre-owned commercial vehicles, driven by cost-consciousness among businesses and the availability of reliable second-hand options.

- Specialized Focus: High-yield segment of buyers seeking pre-owned commercial vehicle financing.

- Competitive Advantage: Deep market understanding, including vehicle valuation and borrower profiling.

- Market Trend (2024): Continued strong demand for used commercial vehicles due to cost efficiencies.

- Risk Mitigation: Expertise in assessing pre-owned asset values and borrower creditworthiness.

Rural and Semi-Urban Entrepreneurs

Shriram Transport Finance Co. (now Shriram Finance) has a deep understanding of rural and semi-urban entrepreneurs, recognizing their unique financial needs. Many of these individuals are self-employed or run small businesses, often operating outside the typical banking system.

These customers frequently face challenges in accessing formal credit, which is where Shriram Finance steps in as a vital financial lifeline. The company's business model is built around serving these underserved segments.

- Geographic Reach: Shriram Finance has an extensive network of branches across India, with a significant presence in rural and semi-urban locations, facilitating easier access for entrepreneurs in these areas.

- Product Customization: Loan products are often tailored to the cash flow patterns of self-employed individuals and small businesses, such as those in transportation or small manufacturing.

- Asset-Based Lending: A core offering involves financing commercial vehicles, which are essential assets for many rural and semi-urban businesses, enabling them to generate income.

- Financial Inclusion: By providing credit to those often excluded by traditional banks, Shriram Finance plays a crucial role in fostering economic activity and growth in these regions.

As of March 31, 2024, Shriram Finance reported a total asset under management of ₹2.23 lakh crore, demonstrating its substantial scale in serving a diverse customer base, including a significant portion of rural and semi-urban entrepreneurs.

Shriram Transport Finance Co.'s customer segments are diverse, primarily focusing on individuals and small businesses involved in commercial transportation. This includes small truck owners, independent operators, and first-time vehicle buyers. A significant portion of their customer base also consists of SMEs looking for fleet expansion or working capital.

The company also actively serves used commercial vehicle buyers, leveraging its expertise in asset valuation and borrower profiling for this niche market. Furthermore, Shriram Finance has a strong presence in rural and semi-urban areas, providing crucial financial access to entrepreneurs often excluded by traditional banking systems.

| Customer Segment | Key Characteristics | Financial Year 2023-24 Data Highlight |

|---|---|---|

| Small Truck Owners / Individual Operators | Owner-operators, small fleets, local/regional transport | Disbursals exceeded ₹35,000 crore |

| First-time Buyers | Aspiring entrepreneurs, new to commercial transport business | Continued emphasis on supporting new entrants |

| Small and Medium Enterprises (SMEs) | Fleet expansion, working capital needs | Intensified focus on SME segment post-merger |

| Used Commercial Vehicle Buyers | Cost-conscious operators, small to medium fleets | Strong market demand driven by cost efficiencies |

| Rural & Semi-Urban Entrepreneurs | Self-employed, small businesses, often outside formal banking | Total Assets Under Management of ₹2.23 lakh crore (as of March 31, 2024) |

Cost Structure

Shriram Transport Finance Co. Ltd.'s primary cost driver is the interest paid on its borrowings. These funds are sourced from a mix of banks, financial institutions, and crucially, public deposits, which form a substantial part of their funding base.

For the fiscal year ending March 31, 2024, Shriram Finance reported an interest expense of ₹23,005.47 crore. This significant figure underscores the importance of managing borrowing costs effectively to ensure profitability and maintain competitive lending rates.

The company actively manages its cost of funds by diversifying its funding sources and optimizing its debt maturity profile. This strategic approach aims to secure stable and cost-effective funding, thereby supporting its core business of vehicle financing and lending to the transport sector.

Shriram Transport Finance Co. Ltd. (STFC) incurs significant operating expenses primarily from its extensive branch network and large workforce. These costs encompass rent for numerous physical locations, utilities, and the salaries, commissions, and benefits for its considerable employee base, including field staff essential for loan origination and recovery.

For the fiscal year 2023-24, STFC reported employee benefits expenses of INR 3,981.62 crore, reflecting the substantial investment in its human capital. This figure highlights the cost of maintaining a skilled workforce across various operational levels, from customer service to specialized financial roles.

The maintenance of a wide-reaching branch network, crucial for serving its target customer segment, contributes a considerable portion to these operating costs. Expenses related to branch infrastructure, including leases and upkeep, are vital for ensuring accessibility and operational presence across diverse geographical areas.

Overall, the personnel and branch network costs are foundational to STFC's business model, directly supporting its ability to reach and serve a large customer base in the commercial vehicle finance sector.

Shriram Transport Finance Co. (STFC) faces significant costs related to loan loss provisions and credit losses, a direct consequence of its focus on financing commercial vehicles, often for small operators and first-time buyers who may carry higher credit risk. These provisions, set aside to cover anticipated defaults and actual bad debts, are a crucial element of their operating expenses. For the fiscal year ending March 31, 2024, STFC reported its asset quality metrics, with Gross NPAs standing at 4.83% and Net NPAs at 2.93%, indicating the level of credit risk managed.

The company's ability to effectively manage its loan portfolio and mitigate credit risk directly impacts its profitability. STFC's proactive approach to risk assessment and collections is designed to keep these costs in check. In the financial year 2023-24, the company's provisioning coverage ratio was robust, demonstrating a commitment to absorbing potential credit shocks, a key factor in maintaining investor confidence.

Technology and Infrastructure Investment

Shriram Transport Finance Co. (STFC) incurs significant costs related to its technology and infrastructure. These ongoing investments are crucial for maintaining operational efficiency and supporting future growth.

The company consistently allocates capital towards enhancing its IT infrastructure, including robust loan management systems and advanced data analytics tools. These investments are fundamental to streamlining operations, improving scalability, and elevating the overall customer experience. For the fiscal year 2023-24, STFC continued its focus on digital transformation initiatives, which are intrinsically linked to these infrastructure expenditures.

- IT Infrastructure Upgrades: Continued spending on servers, software licenses, and network security to ensure reliable and scalable operations.

- Digital Platform Development: Investments in mobile applications, online portals, and customer relationship management (CRM) systems to enhance digital engagement and service delivery.

- Loan Management Systems: Costs associated with implementing and maintaining sophisticated systems for loan origination, servicing, and collections, aiming for greater automation and accuracy.

- Data Analytics and AI: Expenditure on tools and expertise for analyzing vast datasets to improve risk assessment, fraud detection, and personalized customer offerings.

Marketing, Business Development, and Regulatory Compliance

Shriram Transport Finance Co. (STFC) incurs substantial expenses in its Marketing, Business Development, and Regulatory Compliance functions. Customer acquisition costs, including advertising and sales efforts to reach a broad customer base, are a significant component. In the fiscal year ending March 31, 2024, STFC's total operating expenses, which encompass these areas, were ₹22,540 crore. This figure reflects the investment in brand building and expanding its reach across India.

The company also allocates resources to business development, which involves exploring new product offerings and expanding into different geographical regions to drive growth. Furthermore, maintaining compliance with the stringent regulatory framework governing the Non-Banking Financial Company (NBFC) sector in India is a critical and ongoing cost. These compliance costs ensure adherence to Reserve Bank of India (RBI) guidelines and other financial regulations.

- Customer Acquisition: Costs related to advertising, sales commissions, and promotional activities aimed at acquiring new borrowers.

- Brand Building: Investment in marketing campaigns and public relations to enhance brand visibility and trust.

- Business Development: Expenses incurred for market research, new product development, and geographical expansion initiatives.

- Regulatory Compliance: Costs associated with adhering to RBI regulations, legal frameworks, and reporting requirements, including audits and technology upgrades for compliance.

Shriram Transport Finance Co. (STFC) faces substantial costs in managing its extensive branch network and large workforce, crucial for its operations. Employee benefits alone amounted to INR 3,981.62 crore for FY24, highlighting the investment in human capital. The maintenance of numerous physical locations, including rent and utilities, adds to these significant operating expenses.

The company's primary cost is interest on borrowings, totaling ₹23,005.47 crore in FY24. This reflects the cost of funds sourced from various avenues, including public deposits. Additionally, STFC incurs costs related to technology and infrastructure upgrades, with continued spending on IT systems and digital platforms to enhance efficiency and customer experience.

| Cost Category | FY2024 (INR Crore) |

|---|---|

| Interest on Borrowings | 23,005.47 |

| Employee Benefits | 3,981.62 |

| Total Operating Expenses | 22,540.00 |

Revenue Streams

The core of Shriram Transport Finance Co.'s revenue generation lies in the interest earned from its extensive commercial vehicle financing operations. This segment, encompassing loans for both new and pre-owned trucks, buses, and various specialized transport vehicles, represents its most significant income source.

In the fiscal year 2024, Shriram Transport Finance Co. reported robust interest income from its loan portfolio. For instance, the company's Net Interest Income (NII) for the nine months ending December 31, 2023, stood at approximately ₹10,036 crore, showcasing the substantial earnings from its lending activities, predominantly in the commercial vehicle sector.

Shriram Transport Finance Co. also generates revenue through interest earned on a diversified portfolio of asset-backed loans beyond their core commercial vehicle financing. This includes income from financing two-wheelers, passenger vehicles, construction equipment, and farm equipment.

In the fiscal year ending March 31, 2024, Shriram Finance reported a significant Net Interest Income (NII) of ₹16,084 crore, reflecting the substantial contribution from its various lending activities, including these other asset-backed loan segments.

The company's strategy to diversify its loan book into segments like two-wheeler and passenger vehicle financing allows it to tap into a broader customer base and mitigate risks associated with over-reliance on a single asset class.

This multi-faceted approach to asset-backed lending, encompassing a wide range of vehicles and equipment, underpins a stable and growing revenue stream for Shriram Finance.

Shriram Transport Finance Company (STFC) generates substantial revenue through interest income derived from its working capital and Small and Medium Enterprise (SME) loan portfolios. This segment is crucial, especially after STFC's merger with Shriram City Union Finance, which expanded its reach and capabilities in serving the MSME sector. The company's focus on these areas allows it to tap into a large and growing market seeking essential financing.

For the fiscal year ending March 31, 2024, STFC reported robust interest income from its diverse lending operations. While specific breakdowns for just working capital and SME loans aren't always isolated in headline figures, the overall growth in net interest income reflects the strength of these core segments. For instance, the company's total interest income for FY24 was a significant contributor to its overall financial performance, underscoring the importance of these lending activities.

Processing Fees and Service Charges

Shriram Transport Finance Co. generates revenue through various fees beyond just interest on loans. These processing fees and service charges are crucial for their income diversification. For example, fees for loan origination, handling documentation, and managing accounts contribute significantly. In the fiscal year 2024, such non-interest income sources are vital for maintaining profitability.

These charges are typically levied to cover the administrative costs associated with providing financial services.

- Loan Processing Fees: A standard charge applied when a new loan is disbursed.

- Documentation Charges: Fees collected for preparing and managing loan-related paperwork.

- Late Payment Penalties: Charges incurred by borrowers who miss their scheduled repayment dates.

- Other Service Charges: This can include fees for services like cheque bounce, loan modification, or foreclosure.

Income from Securitization and Direct Assignment

Shriram Transport Finance Co. (STFC) generates revenue through the securitization of its loan portfolios and the direct assignment of loans to other financial entities. This strategy allows STFC to convert future income streams from its existing loans into immediate cash, thereby enhancing its liquidity and funding capabilities. By selling a portion of its loan assets, STFC can originate new loans and expand its business operations more efficiently.

This process is crucial for managing capital adequacy and regulatory compliance. For instance, in the financial year 2023-24, STFC continued to actively engage in securitization activities to manage its asset-liability profile. While specific figures for securitization revenue are often embedded within broader income statements, the company's consistent reliance on this method underscores its importance.

- Securitization Income: Revenue earned from pooling and selling loan assets to investors, often in the form of pass-through certificates or asset-backed securities.

- Direct Assignment: Income derived from the direct sale of individual or small pools of loans to other financial institutions, bypassing the formal securitization process.

- Capital Optimization: These activities free up capital that would otherwise be tied up in long-term loans, enabling STFC to support greater loan origination volumes.

- Liquidity Enhancement: Provides immediate cash inflows, improving the company's ability to meet its financial obligations and pursue growth opportunities.

Shriram Transport Finance Co. earns significant revenue from interest on its diverse loan portfolio, which includes commercial vehicles, two-wheelers, passenger cars, and construction equipment. This core lending activity is complemented by fee-based income such as processing fees and late payment charges. Furthermore, the company utilizes securitization and direct assignment of loans to manage liquidity and capital, generating revenue from these transactions.

| Revenue Stream | Description | FY24 Contribution (Approximate) |

| Interest Income | Earnings from financing commercial vehicles, two-wheelers, passenger cars, construction and farm equipment. | Largest component, reflected in FY24 Net Interest Income of ₹16,084 crore. |

| Fee Income | Charges for loan processing, documentation, late payments, and other services. | A vital component for income diversification. |

| Securitization/Loan Assignment | Revenue from selling loan assets to investors or other financial entities. | Supports liquidity and capital adequacy, crucial for continued business growth. |

Business Model Canvas Data Sources

The Shriram Transport Finance Co. Business Model Canvas is constructed using a blend of financial statements, regulatory filings, and in-depth market analysis of the commercial vehicle financing sector. These sources provide a robust foundation for understanding customer needs, revenue streams, and operational costs.