Shriram Transport Finance Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Transport Finance Co. Bundle

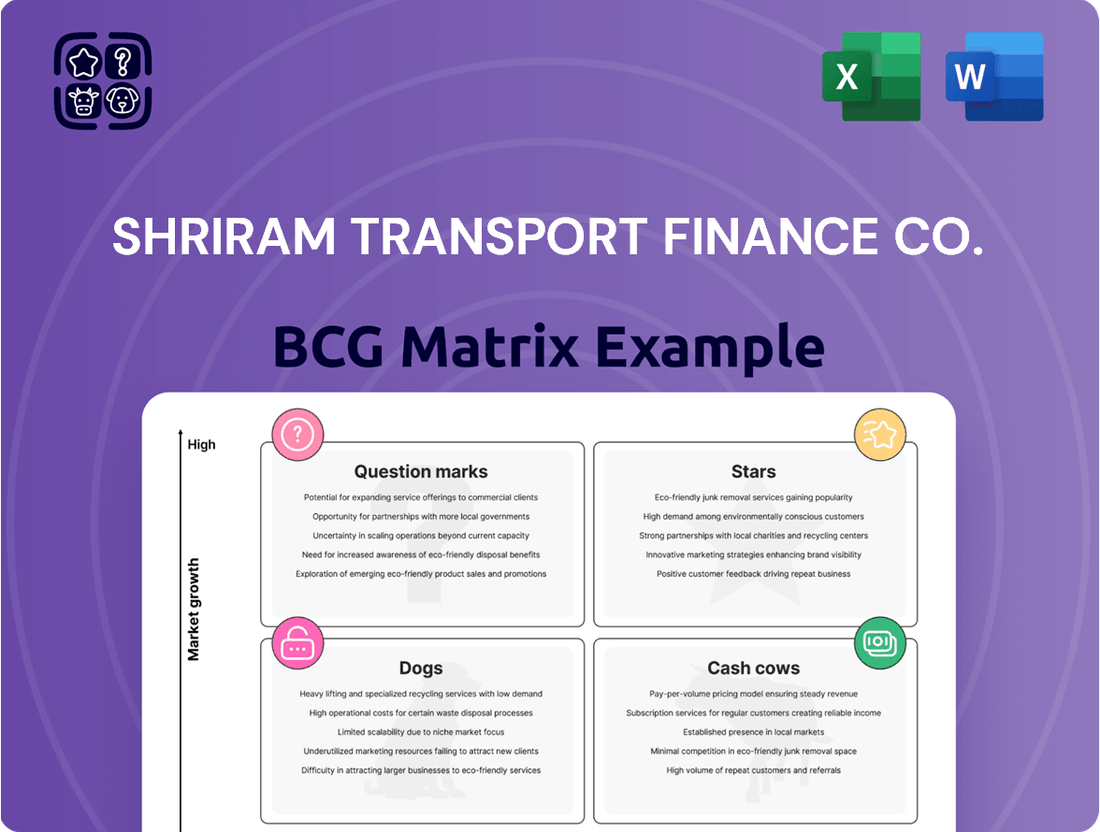

Curious about Shriram Transport Finance Co.'s strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio's potential, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understand where their strengths lie and which areas may require more attention.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Shriram Transport Finance Co.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity for Shriram Transport Finance Co.

Purchase now and get instant access to a beautifully designed BCG Matrix that’s both easy to understand and powerful in its insights—delivered in Word and Excel formats, specifically for Shriram Transport Finance Co.

Stars

Shriram Transport Finance Co. Limited, now Shriram Finance Limited, is seeing impressive expansion in its Micro, Small, and Medium Enterprises (MSME) loan offerings. This segment is a star performer, demonstrating a remarkable 42.7% increase in Assets Under Management (AUM) for FY25.

The company anticipates this dynamic sector to continue its upward trajectory, projecting a healthy medium-term growth rate of 18-20%. This positions MSME loans as a key growth driver for Shriram Finance, capitalizing on its strong presence in rural and semi-urban markets.

The passenger vehicle (PV) financing segment for Shriram Finance has shown robust expansion, recording a significant 25% year-on-year growth in the fiscal year 2025. This upward trend is anticipated to continue, with projections indicating an approximate 20% growth rate moving forward.

Given the ongoing expansion of India's automotive market, especially within the passenger vehicle segment, Shriram Finance is strategically positioned to enhance its market share. This strong growth trajectory and market potential clearly mark passenger vehicle financing as a Star performer within Shriram Transport Finance Co.'s BCG Matrix.

Shriram Transport Finance's strategic push into Electric Vehicle (EV) financing is a cornerstone of its future growth, positioning it as a potential Star in the BCG matrix. By consolidating its green financing efforts under 'Shriram Green Finance,' the company is targeting a significant INR 5,000 crore Asset Under Management (AUM) in this vertical within the next 3-4 years.

This focus on EVs, battery charging infrastructure, and renewable energy products taps into a high-growth, nascent market. Shriram's substantial investments signal an ambition to capture a leading market share. For instance, the Indian government has set ambitious targets for EV adoption, with projections suggesting a significant increase in the EV market size by 2030, creating a fertile ground for Shriram's expansion.

Digital Lending Initiatives

Shriram Finance is doubling down on digital lending for professionals and businesses, simultaneously growing its physical presence and digital tools. This move into digital channels is a key growth driver, offering opportunities for deeper market reach and improved operational efficiency.

The company is also investing heavily in its own technology, targeting an 80% in-house development to 20% outsourced ratio. This strategy aims to boost how quickly they can bring new products to market and tailor offerings to customer needs.

- Digital Lending Focus: Shriram Finance is actively expanding its digital lending services for both individuals and businesses.

- Technology Investment: A significant push is underway for in-house technology development, aiming for an 80:20 build-to-buy ratio.

- Growth Potential: The digital platform shift is identified as a high-growth area with substantial potential for market penetration.

- Efficiency Gains: This digital transformation is expected to yield significant improvements in operational efficiency.

Expansion into Newer Geographies/Tier 2 & 3 Markets

Shriram Finance is actively growing its presence in Tier 2 and Tier 3 markets, a key strategy for future asset growth. This expansion targets rural and semi-urban areas, which are crucial for their Assets Under Management (AUM). By focusing on these less saturated regions, they can access new customer bases and build on their established regional strength. This move is designed to cultivate these new areas as Stars within the BCG matrix, promising significant future returns.

- Branch Network Growth: Shriram Finance has been strategically increasing its branch count, particularly in underserved rural and semi-urban geographies.

- AUM Concentration: A substantial part of their existing AUM is already rooted in these Tier 2 and Tier 3 markets, validating the strategy.

- Market Penetration: Expansion allows them to tap into high-growth potential segments with less competition.

- Future Asset Growth: These newly developed markets are positioned to become significant drivers of future asset growth for the company.

Shriram Finance's burgeoning MSME loan portfolio is a clear Star. It achieved a remarkable 42.7% year-on-year growth in Assets Under Management (AUM) by FY25 and is projected to grow at 18-20% medium-term.

The company’s passenger vehicle financing also shines, with a 25% YoY growth in FY25 and anticipated 20% future growth, capitalizing on India's expanding automotive market.

Electric Vehicle (EV) financing, consolidated under Shriram Green Finance, is another emerging Star. The company aims for INR 5,000 crore AUM in this vertical within 3-4 years, tapping into a high-growth, government-supported market.

Digital lending for professionals and businesses, supported by significant in-house technology investment (targeting an 80:20 build-to-buy ratio), represents a strategic Star. This digital push promises deeper market reach and operational efficiencies.

Expansion into Tier 2 and Tier 3 markets is also a key Star initiative, focusing on new customer bases in underserved regions to drive future asset growth.

| Business Segment | FY25 AUM Growth (YoY) | Projected Medium-Term Growth | BCG Matrix Category |

|---|---|---|---|

| MSME Loans | 42.7% | 18-20% | Star |

| Passenger Vehicle Financing | 25% | ~20% | Star |

| Electric Vehicle (EV) Financing | - | Target INR 5,000 Cr AUM in 3-4 yrs | Star |

| Digital Lending | - | High Growth Potential | Star |

| Tier 2/3 Market Expansion | - | Key for Future AUM | Star |

What is included in the product

Shriram Transport Finance Co.'s BCG Matrix likely positions its core vehicle financing as a Cash Cow, while newer ventures are Question Marks needing investment.

The Shriram Transport Finance Co. BCG Matrix acts as a pain point reliver by visually clarifying which business units require investment (Stars/Question Marks) and which can generate cash (Cash Cows/Dogs), guiding strategic resource allocation.

This optimized matrix design provides a clear, actionable roadmap for Shriram Transport Finance Co. to address underperforming assets and capitalize on growth opportunities, easing financial strain.

Cash Cows

Shriram Transport Finance Limited's used commercial vehicle financing is a classic Cash Cow within their operations. This segment represents a significant portion of their business, making up around 45% of their total Assets Under Management (AUM) as of March 2025.

The company holds a leading position in this mature market, which translates into predictable and robust cash flows. Their long history and established presence allow them to consistently generate profits from this segment.

While the commercial vehicle market as a whole might see moderate growth, projected at 12-15%, Shriram's deep market penetration ensures their continued success and profitability in used CV financing.

Shriram Transport Finance's two-wheeler loan segment functions as a classic Cash Cow. This segment is characterized by its high volume and stability, contributing around 6% to the company's Assets Under Management (AUM). The company's deep penetration in semi-urban and rural markets solidifies its position here.

The maturity of the two-wheeler market, combined with Shriram Finance's established customer relationships and efficient operational processes, ensures this segment reliably generates substantial cash flow. This consistent revenue stream is vital for supporting other business units.

Shriram Finance's extensive customer base, exceeding 9.5 million individuals, serves as a fertile ground for cross-selling opportunities. This existing network allows the company to efficiently offer a suite of financial products, including personal loans and gold loans, to individuals with established creditworthiness.

By tapping into this loyal customer base, Shriram Finance benefits from reduced customer acquisition costs, leading to more predictable and stable revenue streams. The company's diversified product portfolio further enhances its ability to meet the varied financial needs of its existing clientele.

This strategy of leveraging existing relationships for additional product sales ensures consistent cash inflows, reinforcing its position as a cash cow within the BCG matrix framework. The proven repayment histories of these customers minimize risk and maximize the profitability of these cross-selling initiatives.

Fixed Deposits and Retail Funding

Shriram Transport Finance Company's Fixed Deposits and Retail Funding are clear cash cows. The company excels at gathering funds from the public and other local sources, securing them at competitive interest rates. This capability is a bedrock of its financial strength.

The robust growth in deposits underscores this. For instance, deposits saw a substantial increase of 25.2% in the financial year 2025. This surge reflects significant public confidence in Shriram Transport Finance, solidifying its position as a dependable and cost-effective source of capital.

This stable and expanding funding base is crucial. It ensures the company has ample liquidity to support its extensive lending activities. Consequently, this reliable funding stream directly contributes to consistent net interest income, a hallmark of a successful cash cow.

- Strong Public Trust: Deposits increased by 25.2% in FY25, showcasing high public confidence.

- Competitive Funding: Ability to mobilize funds at competitive rates ensures a low-cost capital base.

- Liquidity Fuel: Provides the necessary liquidity for extensive lending operations.

- Consistent Income: Drives stable net interest income through reliable and growing funding.

Established Branch Network and Rural Reach

Shriram Transport Finance Co. (now Shriram Finance) operates an impressive network of over 3,200 branches and rural centers across India, solidifying its position as a cash cow. This extensive reach, especially in underserved rural and semi-urban areas, acts as a powerful distribution engine for its diverse financial offerings. The company's deep penetration into these markets fosters strong customer relationships and ensures a steady flow of business, underpinning its consistent profitability.

The established branch network is a significant asset, generating reliable cash flows that are characteristic of a cash cow. This mature infrastructure allows Shriram Finance to efficiently serve its core customer base, which often includes individuals and small businesses in regions with limited access to traditional banking services. For instance, in the fiscal year ending March 31, 2023, Shriram Finance reported a net profit of ₹4,254 crore, reflecting the strength of its established operations.

- Extensive Network: Over 3,200 branches and rural centers pan-India.

- Rural Penetration: Strong presence in rural and semi-urban markets.

- Distribution Powerhouse: Facilitates robust product distribution and customer engagement.

- Stable Profitability: Consistent business volumes driven by mature infrastructure.

Shriram Finance's used commercial vehicle financing segment is a definite cash cow. This segment commands a significant share, representing approximately 45% of their total Assets Under Management (AUM) as of March 2025. The company's dominant position in this mature market yields consistent and substantial cash flows, bolstered by a projected market growth of 12-15% for commercial vehicles. Their established market penetration ensures continued profitability in this core area.

| Business Segment | BCG Matrix Category | Key Characteristics | Financial Year 2025 (Est.) Contribution to AUM |

|---|---|---|---|

| Used Commercial Vehicle Financing | Cash Cow | Market leader, mature market, predictable cash flows | ~45% |

| Two-Wheeler Loans | Cash Cow | High volume, stable, strong rural/semi-urban penetration | ~6% |

| Fixed Deposits & Retail Funding | Cash Cow | Low-cost capital, high public trust, drives net interest income | N/A (Funding Source) |

| Branch Network Reach | Cash Cow | Extensive rural/semi-urban presence, efficient distribution, stable profits | N/A (Infrastructure Asset) |

Preview = Final Product

Shriram Transport Finance Co. BCG Matrix

The preview you see is the complete, unwatermarked Shriram Transport Finance Co. BCG Matrix analysis, identical to the document you will receive upon purchase. This comprehensive report has been meticulously prepared with expert insights and market data, ensuring you get a fully actionable strategic tool. You can confidently use this preview as a direct representation of the professional, ready-to-implement BCG Matrix you'll download, empowering your business planning and decision-making processes.

Dogs

Within Shriram Transport Finance Co.'s portfolio, underperforming niche asset classes are akin to the 'dogs' in a BCG matrix. These are segments characterized by consistently low growth and minimal market penetration, often representing experimental lending or highly specialized equipment financing that hasn't achieved critical mass.

For instance, consider a hypothetical niche segment like financing for very specific, low-volume agricultural machinery. If this segment has seen less than 2% annual growth in recent years and accounts for less than 0.5% of the company's total loan book, it would fit the 'dog' profile.

These areas might drain operational resources, requiring dedicated teams and systems, yet deliver negligible returns. In 2024, such a segment might have shown a mere 1.5% year-on-year increase in outstanding loans, while its associated operational costs remained relatively high, leading to a negative return on assets for that specific niche.

The challenge with these 'dogs' is their potential to consume disproportionate management attention and capital without offering a clear path to significant market share or profitability, making them candidates for divestment or careful restructuring.

Shriram Transport Finance Co. (STFC) might classify some of its older vehicle financing products as legacy offerings with declining demand. These are typically products that were once popular but are now less appealing due to technological advancements or changing customer preferences, such as loans for older, less fuel-efficient commercial vehicles.

For instance, if STFC has financing options for trucks that are over a decade old and do not meet current emission standards, demand for these specific products would likely be on a downward trend. While these products might still generate some revenue, their contribution to STFC's overall market share and profitability could be diminishing. In 2023-24, STFC's focus has been on expanding its digital offerings and catering to newer, more modern fleets, which naturally de-emphasizes older product lines.

Shriram Transport Finance Co. (now Shriram Finance) might identify geographical pockets exhibiting stagnant growth. These are essentially regions where the company has a footprint but sees very little demand for its loans, and there’s not much room to grow either. Think of areas with sluggish economies or where local lenders are really entrenched, making it tough for Shriram Finance to capture significant market share.

For instance, if a particular district in a state like Bihar or Uttar Pradesh, where Shriram Finance has a strong rural presence, shows consistently low new loan disbursements and minimal increase in outstanding loan amounts year-on-year, it could be flagged. In fiscal year 2023-24, while overall AUM growth was robust, these pockets might have contributed disproportionately less, potentially dragging down regional performance metrics.

These underperforming areas could be characterized by a lack of diverse economic activity, a heavy reliance on a single, declining industry, or a saturation of competing financial institutions. The company's data might reveal that despite having branches and staff in these locations, the loan off-take remains stubbornly low, perhaps less than 5% of the national average for similar branches.

Reallocating resources—like marketing spend, personnel, or even branch infrastructure—from these stagnant pockets to more promising growth areas could be a strategic move. This would involve a deep dive into the company’s granular performance data by region, looking at metrics like new customer acquisition rates, average loan size, and non-performing assets (NPAs) in specific micro-markets to pinpoint these areas effectively.

High-Cost, Low-Volume Lending Channels

Shriram Transport Finance Co. (STFC) might identify certain high-cost, low-volume lending channels within its BCG Matrix. These are typically partnerships or distribution models that, despite ongoing investment, struggle to generate significant loan volumes. For instance, some niche tie-ups with smaller regional dealerships or specific informal sector aggregators could fall into this category, requiring substantial operational overhead for minimal returns. Such channels often lack the scalability and efficiency seen in STFC's more direct or digitally-driven lending approaches, proving to be a drain on resources.

These inefficient channels can significantly impact profitability. For example, if a particular partnership channel incurs operational costs of 5% of disbursed loan value but only accounts for 0.5% of STFC's total loan portfolio, it represents a clear drag. This contrasts sharply with STFC's stated goal of expanding its digital footprint, which aims to reduce customer acquisition costs and increase operational efficiency across its lending activities. The focus is on optimizing the portfolio, ensuring that every channel contributes positively to the overall business strategy.

Key characteristics of these channels include:

- High operational expenditure relative to disbursed loan amounts.

- Minimal contribution to overall loan origination volume.

- Poor alignment with the company's strategic digital transformation initiatives.

- Limited potential for scaling up efficiently.

Gold Loans (Recent Decline)

The gold loan portfolio at Shriram Transport Finance Co. has seen a notable dip, with its Assets Under Management (AUM) shrinking by 23% in the fiscal year 2025. This substantial contraction, despite the company’s anticipation of a future rebound, currently positions this segment within the ‘Dog’ quadrant of the BCG Matrix. The low market share combined with this negative growth trajectory are key indicators for this classification.

This downturn raises concerns about the gold loan business becoming a potential cash trap. If the decline persists without a robust recovery plan, it could end up consuming valuable resources without generating commensurate returns for the company.

- Gold Loan AUM Decline: A 23% decrease in FY25.

- BCG Matrix Classification: Currently in the 'Dog' quadrant due to low market share and negative growth.

- Risk: Potential cash trap if decline continues without a strong recovery strategy.

- Future Outlook: Company anticipates a rebound, but current performance dictates a cautious approach.

Shriram Finance's gold loan portfolio, experiencing a 23% AUM contraction in FY25, currently resides in the 'Dog' quadrant of the BCG matrix. This segment exhibits low market share and negative growth, posing a risk of becoming a cash trap if the decline persists without a strong recovery plan.

The company is exploring strategies to revitalize this segment, acknowledging the potential for a future rebound despite current underperformance. Careful resource allocation will be critical to manage this 'dog' effectively.

| Segment | Market Growth | Market Share | BCG Classification | FY25 AUM Change |

|---|---|---|---|---|

| Gold Loans | Low / Declining | Low | Dog | -23% |

| Legacy Vehicle Loans | Low | Declining | Dog | N/A (Specific data not provided) |

| Stagnant Geographical Pockets | Negligible | Low | Dog | N/A (Regional performance metrics vary) |

Question Marks

Shriram Finance's decision to enter the payments business marks a strategic move into a nascent, high-growth sector. This aligns with the company's potential positioning as a 'question mark' in the BCG matrix, given its low initial market share but significant potential within India's expanding digital payments ecosystem.

The Indian digital payments market is experiencing robust growth, with transaction volumes expected to reach substantial figures. For instance, the Unified Payments Interface (UPI) alone has seen exponential adoption, processing billions of transactions monthly. Shriram Finance's entry here, while starting from a low base, taps into this dynamic environment.

The success of this new venture hinges on Shriram Finance's ability to make strategic investments in technology and infrastructure, alongside developing effective market penetration strategies. Building a strong customer base and fostering trust in a competitive landscape will be critical for capturing market share and achieving growth.

Shriram Finance's pursuit of a primary dealership license signifies a strategic move into government debt underwriting, a sector poised for significant expansion. Government borrowing in India is projected to remain robust, offering a substantial market for underwriting services.

While this venture presents high growth potential, Shriram Finance, historically an asset financing NBFC, currently possesses a negligible market share in the primary dealership space. This new business line is therefore a nascent category for the company, essentially a question mark within its BCG matrix.

Shriram Finance is actively investing in its digital infrastructure, aiming to create a robust, future-ready core. A key initiative is the exploration and potential development of a 'Super App' that would integrate various financial services into a single platform.

While digital offerings represent a high-growth segment for Shriram Finance, their current market share and user adoption for newer digital products, including any nascent Super App features, remain relatively low. For instance, in the broader Indian digital lending market, while growing rapidly, established players often hold a significant portion of the user base.

The company recognizes the significant investment needed to build out these digital capabilities and drive user engagement in a highly competitive digital finance landscape. Shriram Finance’s commitment to this area is evident in its strategic focus, anticipating that substantial capital expenditure will be necessary to gain meaningful traction and market share in the digital ecosystem.

Expansion into New Asset Classes (Beyond Core)

Shriram Finance is strategically exploring opportunities in nascent asset classes, moving beyond its established strengths in vehicle and MSME financing. These ventures, while currently representing a small portion of their overall business, are positioned as high-growth potential areas. For instance, Shriram Finance might be looking into specialized financing for niche equipment or expanding into new, targeted retail loan segments. These initiatives require focused investment to capture a larger market share in the future.

These emerging asset classes are characteristic of 'question marks' in the BCG matrix. They operate in growing markets but have a limited current presence for Shriram Finance. For example, Shriram Finance's foray into specialized equipment financing for industries like renewable energy or advanced manufacturing would fit this description. The company needs to invest in building expertise and market reach to turn these into stars. As of the fiscal year ending March 31, 2024, while precise figures for these nascent segments aren't broken out separately, the overall loan portfolio growth indicates a dynamic market environment where such expansions are viable.

- Potential for high future growth

- Low current market share

- Requires strategic investment and development

- Diversification beyond core competencies

Strategic Partnerships and Co-lending Models

Shriram Finance’s ventures into strategic partnerships and co-lending models, especially within emerging or underserved financial segments, can be viewed as a Question Mark in the BCG matrix. These collaborations are designed to tap into high-growth potential by utilizing partners' established networks and specialized knowledge. For example, Shriram Finance has actively pursued partnerships in areas like MSME lending and vehicle financing for specific customer segments, aiming to expand its reach beyond traditional offerings.

These joint initiatives, while promising, represent areas where Shriram Finance's direct market share is still in its nascent stages of development. Success hinges on effective management and strategic execution to ensure profitability and sustainable growth. The company’s focus on leveraging these partnerships to reach new customer bases and offer tailored financial products highlights the strategic intent behind these Question Mark initiatives. As of recent reports, Shriram Finance has been actively exploring collaborations to enhance its digital lending capabilities and penetrate markets with significant untapped potential.

- High Growth Potential: Partnerships in underserved segments offer access to new customer bases and revenue streams.

- Developing Market Share: Direct attributable market share from these collaborations is still growing and requires strategic nurturing.

- Leveraging Partner Expertise: Collaborations allow Shriram Finance to utilize partners' specialized knowledge and reach, reducing initial investment and risk.

- Strategic Importance: These ventures are crucial for Shriram Finance's long-term strategy to diversify its product portfolio and expand its market presence in high-potential areas.

Shriram Finance's expansion into digital payments and the exploration of a 'Super App' represent significant 'Question Mark' initiatives. These ventures tap into a rapidly growing digital ecosystem in India, with UPI transactions alone exceeding 10 billion monthly in early 2024.

While these digital plays offer high growth potential, Shriram Finance's current market share in these nascent areas remains low, necessitating substantial investment in technology and customer acquisition. The company is actively building its digital infrastructure, signaling a commitment to capturing future market share in these competitive segments.

The pursuit of a primary dealership license and venturing into new asset classes, such as specialized equipment financing, also position Shriram Finance as a 'Question Mark'. These sectors, like government debt underwriting, are poised for growth, but Shriram Finance's current penetration is minimal, demanding strategic capital allocation to build presence.

Strategic partnerships and co-lending models in underserved financial segments further exemplify 'Question Marks'. These collaborations aim to leverage partner networks for high-growth potential, but Shriram Finance's direct market share in these nascent areas is still developing, requiring effective execution to drive profitability.

BCG Matrix Data Sources

Our Shriram Transport Finance Co. BCG Matrix is built on a foundation of reliable financial disclosures, comprehensive industry research, and official company reports to provide strategic clarity.