Stepan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stepan Bundle

Stepan's current market position is defined by its strong presence in specialty chemicals, particularly in surfactants and polymers. However, understanding the nuances of their competitive landscape and potential growth avenues requires a deeper dive.

While their established customer relationships are a significant strength, the volatile raw material costs present a notable challenge that impacts profitability. Furthermore, their commitment to innovation is a key driver, but the pace of technological change in the industry demands constant adaptation.

Want the full story behind Stepan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Stepan Company's global diversification is a significant strength, with operations spanning North America, Europe, and Asia. This broad geographical footprint allows them to serve a wide array of industries across different regions, reducing dependence on any single market. For instance, in 2023, net sales from their International segment represented a substantial portion of their total revenue, demonstrating their established market reach.

Stepan's strength lies in its broad and essential product portfolio, encompassing specialty and intermediate chemicals like surfactants, polymers, and products for food, flavor, and pharmaceuticals. Surfactants alone constitute a significant portion, exceeding 70% of their sales, which effectively mitigates risk by reducing reliance on any single product category. This diversification ensures consistent demand, as their chemicals are vital components in a wide array of everyday consumer and industrial applications, making them relatively resilient to economic downturns.

Stepan's chemicals are essential components in several thriving industries, including personal care, home care, food, and agriculture. This broad reach across high-demand sectors like detergents and cleaning products provides a resilient foundation for their sales. For instance, the company reported double-digit growth in its agricultural and oilfield segments during the first quarter of 2025, highlighting robust demand in these crucial areas.

Innovation and R&D Capabilities

Stepan's commitment to innovation is a significant strength, underpinned by substantial investments in research and development. This dedication is clearly demonstrated by their new Agricultural Innovation Center, a facility equipped with a greenhouse for practical plant testing and advanced laboratories for sophisticated formulation design. Such infrastructure is vital for staying ahead in a dynamic market.

This focus on R&D is not just about facilities; it's about a strategic approach to long-term growth and competitiveness. For instance, Stepan has projected a 7.5% increase in product innovation investment for 2024. This proactive investment ensures they can adapt to changing market demands and increasingly stringent regulatory landscapes, a critical factor for sustained success in the chemical industry.

- Robust R&D Infrastructure: The Agricultural Innovation Center, featuring live plant testing greenhouses and advanced formulation labs, highlights Stepan's dedication to scientific advancement.

- Strategic Investment in Innovation: A projected 7.5% increase in product innovation investment for 2024 signals a clear commitment to developing new and improved solutions.

- Adaptability to Market Needs: Stepan's R&D capabilities enable them to respond effectively to evolving customer requirements and regulatory changes, a key differentiator.

- Competitive Edge: Continuous innovation through R&D is crucial for maintaining and enhancing Stepan's position in the competitive global chemical market.

Commitment to Sustainability and Operational Efficiency

Stepan's dedication to sustainability is a significant strength, evident in their 2024 Sustainability Report which details efforts to minimize environmental impact and foster responsible practices. This focus translates into tangible product innovation, including the development of bio-based surfactants.

Furthermore, the company is actively pursuing operational efficiency gains. Initiatives like the DRIVE program and targeted capital investments are designed to bolster operational stability and systematically remove inefficiencies.

These strategic efforts are geared towards positioning Stepan for sustained earnings growth and robust positive free cash flow generation in the coming years.

- Sustainability Focus: Stepan's commitment to environmental stewardship and responsible management is a key differentiator.

- Product Innovation: Development of sustainable products like bio-based surfactants addresses growing market demand.

- Operational Excellence: Programs like DRIVE and strategic capital allocation aim to streamline operations and reduce waste.

- Future Growth: These initiatives are foundational for enhancing profitability and cash flow in the medium to long term.

Stepan's global reach is a considerable strength, with operations across North America, Europe, and Asia, reducing reliance on any single market. This diversification was evident in their 2023 financial reports, where international sales contributed significantly to their overall revenue, underscoring their established presence in key global markets.

Their product portfolio is both broad and essential, featuring specialty and intermediate chemicals vital to numerous industries. Surfactants, a core product, account for over 70% of sales, providing a stable revenue base. This wide range of chemicals, used in everything from personal care to agriculture, ensures consistent demand across diverse economic conditions.

Stepan's commitment to innovation is a key differentiator, supported by substantial R&D investments. Their new Agricultural Innovation Center, equipped with advanced labs and greenhouses, exemplifies this focus. Projected R&D spending increases, like the 7.5% planned for 2024, demonstrate a proactive strategy to meet evolving market and regulatory demands.

Sustainability is another significant strength, as highlighted in their 2024 Sustainability Report. Efforts to minimize environmental impact and develop bio-based surfactants cater to growing consumer and regulatory preferences for eco-friendly products. Coupled with operational efficiency programs, these initiatives position Stepan for sustained growth and strong cash flow.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Global Diversification | Operations across North America, Europe, and Asia | International segment sales a substantial portion of 2023 total revenue. |

| Diverse Product Portfolio | Essential chemicals like surfactants, polymers, etc. | Surfactants exceed 70% of sales; vital for consumer and industrial applications. |

| Commitment to Innovation | Investment in R&D, new facilities | 7.5% increase in product innovation investment projected for 2024; Agricultural Innovation Center operational. |

| Sustainability Focus | Environmentally responsible practices, bio-based products | Detailed in 2024 Sustainability Report; development of bio-based surfactants. |

What is included in the product

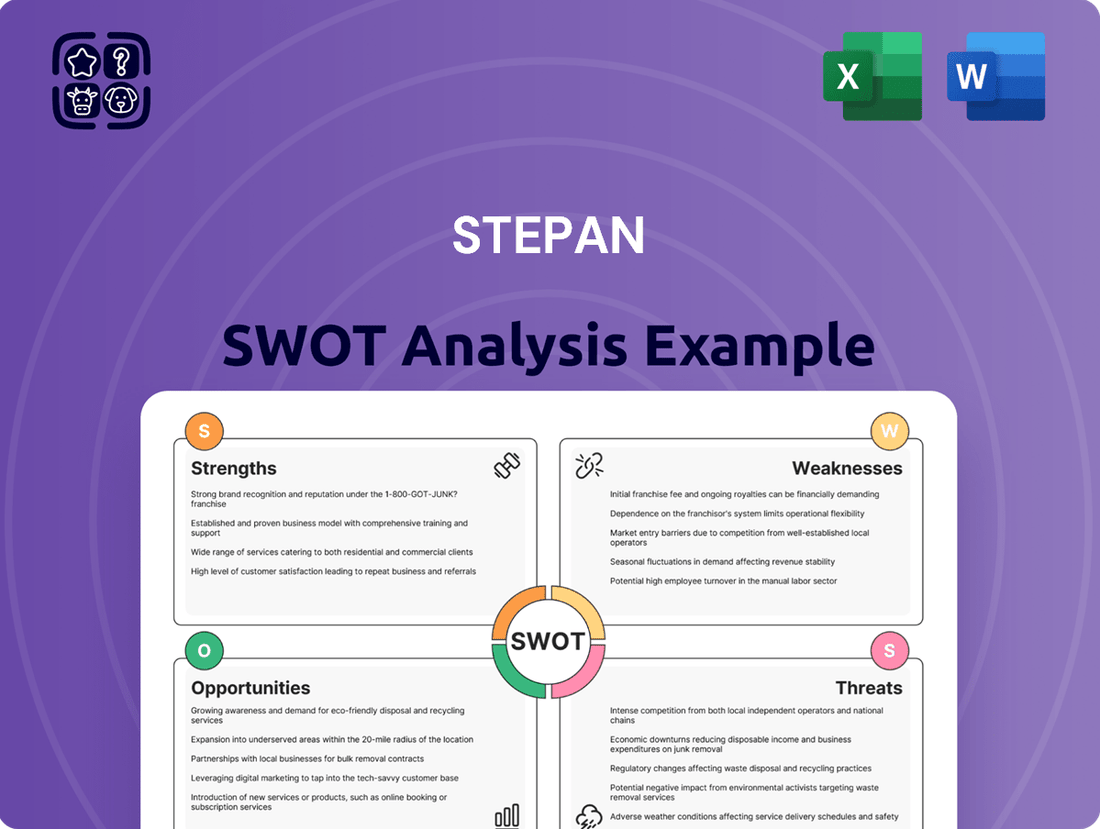

Delivers a strategic overview of Stepan’s internal strengths and weaknesses, alongside external market opportunities and threats.

Simplifies complex SWOT data into actionable insights for immediate strategic adjustments.

Weaknesses

Stepan Company's earnings are quite sensitive to changes in the cost of its key ingredients. Many of these are derived from oil or plants, meaning their prices can swing unpredictably. For instance, a sharp rise in the cost of ethylene, a common petrochemical feedstock, could directly impact Stepan's production expenses. In 2023, the company noted that fluctuations in energy and agricultural commodity prices, which are core to its raw material inputs, remained a significant factor influencing its financial performance.

When these raw material costs climb, Stepan faces a challenge. If they can't fully pass these higher expenses onto their customers, their profit margins shrink. This is a constant balancing act. For example, if the price of palm kernel oil, a key ingredient for some of their surfactants, spikes, it puts pressure on their ability to maintain profitability without losing sales volume.

Effectively navigating this price volatility is crucial for Stepan. They employ strategies like forward contracts, which lock in prices for certain commodities, such as their natural gas purchases. This helps to create a more predictable cost structure. However, the global supply chain and geopolitical events can still create unexpected price shocks that these strategies might not fully mitigate.

Stepan operates in a specialty chemicals arena characterized by fierce rivalry. This market includes a multitude of global giants and agile regional competitors, all vying for market share. The pressure from these numerous players can indeed squeeze pricing power and make expanding market reach a significant challenge.

To counter this intense competition, Stepan must constantly innovate and find ways to stand out from the crowd. This often translates to substantial investments in cutting-edge technology and dedicated market development initiatives. For instance, the polymers sector has demonstrated how aggressive pricing from competitors can create headwinds, underscoring the need for continuous differentiation.

Stepan, like other chemical manufacturers, faces a significant burden from constantly changing environmental, health, and safety regulations globally. This necessitates ongoing investment in compliance measures, impacting both capital spending and day-to-day operational costs. For instance, in 2023, the chemical industry saw increased scrutiny on PFAS chemicals, potentially requiring costly reformulation or phase-out strategies for affected products.

Impact of Economic Cycles on Demand

While Stepan's chemical products are often foundational, their demand isn't entirely immune to the ebb and flow of economic cycles. Broadly speaking, industrial applications are more susceptible to economic downturns, which can curb manufacturing activity and, consequently, the need for chemicals. This was observed in early 2024, where weaker demand in Stepan's Polymers segment presented a challenge, even as their Surfactants business showed resilience.

This cyclical sensitivity means that periods of economic slowdown could lead to reduced sales volumes and impact overall profitability. For instance, a widespread dip in consumer spending, often a hallmark of recessions, could indirectly affect demand for Stepan's ingredients used in consumer goods. Therefore, Stepan must maintain agile operations and robust demand forecasting to navigate these economic fluctuations effectively.

- Economic Sensitivity: Demand for Stepan's products, particularly in industrial sectors, can be significantly influenced by economic cycles.

- 2024 Observation: Weakness in the Polymers segment in early 2024 highlighted this sensitivity, partially offsetting growth in Surfactants.

- Impact of Downturns: Recessions can lead to reduced manufacturing output and consumer spending, directly impacting sales volumes and profitability.

- Strategic Imperative: The company needs strong demand forecasting and operational flexibility to mitigate the effects of economic downturns.

High Capital Expenditures for Growth and Maintenance

Stepan's pursuit of growth, exemplified by its new alkoxylation facility in Pasadena, Texas, necessitates substantial capital expenditures. These investments, though vital for long-term expansion and operational efficiencies, can temporarily strain free cash flow. For instance, Q1 2025 data indicated a negative free cash flow, a direct consequence of these strategic outlays.

Furthermore, the execution of these large-scale projects often involves pre-commissioning expenses. These costs, incurred before a facility becomes fully operational, can directly impact reported quarterly adjusted net income, creating short-term headwinds.

- Significant Capital Outlay: Stepan's strategic investments, like the Pasadena facility, require considerable capital, impacting cash flow.

- Short-Term Cash Flow Impact: Large investments can lead to negative free cash flow in the immediate term, as observed in Q1 2025.

- Pre-commissioning Expenses: Costs incurred before project completion can negatively affect quarterly adjusted net income.

Stepan faces significant competitive pressure from both large global chemical players and smaller, more agile regional competitors. This intense rivalry can limit their pricing power and make market share expansion a considerable hurdle, forcing continuous investment in innovation and differentiation to stand out.

The company's reliance on commodity-based raw materials, such as ethylene and agricultural products, exposes it to price volatility. Fluctuations in these input costs directly affect production expenses, and any inability to pass these increases onto customers can compress profit margins, as seen in 2023 when energy and agricultural commodity prices were key influencers.

Stepan's operations are subject to a complex and evolving global regulatory landscape concerning environmental, health, and safety standards. Compliance with these regulations necessitates ongoing investment, impacting both capital expenditures and operational costs, with areas like PFAS scrutiny in 2023 posing potential reformulation challenges.

Demand for Stepan's products, particularly in industrial applications, is susceptible to economic cycles. Weakness observed in the Polymers segment in early 2024, even with Surfactant resilience, illustrates how economic downturns can reduce manufacturing activity and curb demand, thereby impacting sales volumes and profitability.

Full Version Awaits

Stepan SWOT Analysis

The file shown below is not a sample—it’s the real Stepan SWOT analysis you'll download post-purchase, in full detail.

You’re viewing a live preview of the actual Stepan SWOT analysis file. The complete version becomes available after checkout.

This is the same Stepan SWOT analysis document included in your download. The full content is unlocked after payment.

The preview below is taken directly from the full Stepan SWOT report you'll get. Purchase unlocks the entire in-depth version.

Opportunities

The global push for greener products presents a significant opportunity. Consumers and regulators are increasingly favoring environmentally friendly chemical solutions, creating a strong market pull for sustainable alternatives.

Stepan can capitalize on this trend by expanding its portfolio of bio-based surfactants and other green chemicals. This strategic investment taps into a burgeoning market segment, reinforcing their commitment to responsible business, as evidenced in their 2024 Sustainability Report.

By focusing on sustainable crop protection, Stepan is already demonstrating its alignment with these market demands. This focus not only bolsters their corporate social responsibility but also unlocks new revenue streams in a rapidly expanding sector.

Stepan is well-positioned to capitalize on the rapid industrialization and growing consumer incomes in emerging economies, especially within the Asia-Pacific region. These markets represent a significant opportunity for the company's chemical products.

By strategically expanding its manufacturing, distribution, and sales infrastructure in these burgeoning regions, Stepan can access new customer segments and broaden its revenue base, reducing reliance on existing markets.

Furthermore, the increasing demand for specialized products in high-growth sectors such as advanced materials, unique food ingredients, and sophisticated personal care items presents a chance for Stepan to achieve higher profit margins.

For instance, the global specialty chemicals market, which includes many of Stepan's product categories, was projected to reach over $750 billion in 2024, with emerging markets being key drivers of this expansion.

Stepan can pursue strategic acquisitions of smaller, innovative companies or forge partnerships to broaden its product offerings and integrate cutting-edge technologies. This inorganic growth approach can significantly accelerate market share expansion and strengthen its competitive standing. For instance, in 2023, Stepan acquired the specialty and consumer chemical business of Oakwood Chemical, a move that expanded its portfolio in key markets.

Leveraging New Production Capacities and Technologies

Stepan's strategic expansion, notably the Q1 2025 startup of its Pasadena, Texas alkoxylation facility, is poised to unlock significant volume growth and achieve substantial supply chain cost reductions. This new capacity, complemented by a 25% increase in Alpha Olefin Sulfonates (AOS) production, directly addresses escalating customer demand while bolstering operational efficiency.

The company is actively enhancing its manufacturing capabilities. Beyond the Pasadena site, Stepan has also implemented other strategic upgrades, including the aforementioned AOS capacity boost, which is critical for serving key markets effectively.

These investments in advanced manufacturing technologies are fundamental to Stepan's growth trajectory. By embracing innovation, the company aims to further optimize its production processes and solidify its market position.

- Pasadena Alkoxylation Facility: Startup expected in Q1 2025, driving volume growth and supply chain savings.

- AOS Capacity Increase: A 25% boost in production to meet growing demand.

- Technology Investment: Continued focus on advanced manufacturing to enhance efficiency and competitiveness.

Increasing Focus on Cost Management and Efficiency Programs

Stepan's commitment to cost management is a significant opportunity, evidenced by their successful execution of cost-out initiatives. In 2024 alone, the company achieved $48 million in cost-out savings, directly contributing to improved operational stability and enhanced profitability.

These ongoing efforts are crucial for bolstering financial health, especially as the company anticipates a market recovery. This strategic focus on efficiency is projected to drive earnings growth and generate positive free cash flow in the near future.

Further optimization of manufacturing facilities and supply chains through programs like DRIVE is set to reinforce Stepan's long-term financial resilience.

- $48 million in cost-out savings achieved in 2024

- Ongoing cost management and cost avoidance initiatives

- Anticipated market recovery to drive earnings growth

- Programs like DRIVE to optimize factories and supply chains

Stepan is well-positioned to benefit from the increasing demand for sustainable and bio-based chemical solutions, a trend underscored by consumer preferences and regulatory pressures. The company's strategic expansion into emerging markets, particularly in Asia-Pacific, offers substantial growth potential due to industrialization and rising incomes. Furthermore, Stepan's focus on specialty products in high-growth sectors like advanced materials and personal care allows for higher profit margins, a segment projected to exceed $750 billion in 2024.

| Opportunity Area | Key Driver | Stepan's Action/Benefit | Market Data/Fact |

| Sustainability | Consumer & Regulatory Push | Expanding bio-based surfactants & green chemicals | Market growing, driven by eco-consciousness |

| Emerging Markets | Industrialization & Income Growth | Expanding infrastructure in Asia-Pacific | Significant untapped customer base |

| Specialty Products | Demand for advanced solutions | Focus on high-margin segments (e.g., personal care) | Specialty chemicals market > $750B in 2024 |

| Strategic Acquisitions | Innovation & Market Share | Acquired Oakwood Chemical (2023) | Accelerates portfolio expansion |

Threats

Stepan's profitability is directly challenged by fluctuating raw material costs. For instance, crude oil and vegetable oil prices, key inputs for many of their chemical products, can swing dramatically. In 2023, the price of West Texas Intermediate (WTI) crude oil averaged around $77.50 per barrel, a notable increase from previous years, directly impacting Stepan's petrochemical-derived product costs.

Global supply chains present another considerable threat. Geopolitical tensions, such as ongoing conflicts and trade disputes, alongside the lingering effects of the COVID-19 pandemic, continue to create unpredictable bottlenecks. These disruptions can delay the receipt of essential raw materials and the shipment of finished goods, potentially leading to increased operational expenses and a negative impact on customer relations.

The chemical industry, in particular, relies on a complex web of international logistics. A disruption anywhere along this chain, from shipping lane congestion to port delays, can have cascading effects on Stepan's ability to meet demand. For example, shipping costs saw significant spikes in late 2023 and early 2024, adding further pressure to the company's cost structure.

The chemical sector, including Stepan, faces escalating environmental, health, and safety regulations worldwide. These can lead to costly product reformulations or production adjustments. For instance, the increasing scrutiny on per- and polyfluoroalkyl substances (PFAS), often termed 'forever chemicals,' presents a significant challenge. Failure to adapt to evolving rules, such as those anticipated in 2024/2025 concerning PFAS, could result in market exclusion and substantial compliance expenses.

Economic downturns present a significant threat to Stepan, as severe recessions or prolonged low growth can dampen demand across its varied end markets. This directly impacts industrial output and consumer confidence, leading to less spending on products that utilize Stepan's chemicals.

Reduced consumer and industrial spending can translate into lower sales volumes for Stepan and put downward pressure on pricing, directly affecting the company's revenue and profitability. For instance, Stepan observed demand weakness in its Polymers segment during 2024, highlighting the immediate impact of economic slowdowns.

New Competitors or Disruptive Technologies

The chemical industry is constantly evolving, and Stepan faces the significant threat of new competitors entering the market or existing players introducing disruptive technologies. These innovations, particularly in areas like advanced materials and biotechnology, could create entirely new product categories or superior alternatives to Stepan's current portfolio. For instance, the rise of bio-based surfactants, driven by sustainability trends, could directly impact the demand for Stepan's petroleum-derived products. In 2024, investments in green chemistry research and development across the sector saw a notable uptick, signaling a competitive push towards more sustainable and potentially disruptive solutions.

The potential for substitute products to emerge, rendering Stepan's existing offerings less competitive or even obsolete, is a persistent concern. Companies developing novel chemical formulations or entirely new manufacturing processes could gain a significant market advantage. This threat is amplified by the increasing pace of scientific discovery. For example, advancements in nanotechnology could lead to new functional materials that outperform traditional chemicals in various applications, impacting Stepan's specialty chemicals segment.

To counter this, Stepan must remain vigilant in monitoring technological advancements and strategically invest in future-proof solutions. This includes exploring partnerships or internal R&D focused on emerging areas like biodegradable polymers, advanced catalysts, or digital manufacturing techniques. The company's ability to adapt and innovate will be crucial in maintaining its market position against these evolving competitive forces.

Key areas of concern include:

- Emergence of bio-based alternatives: Increased R&D in bio-surfactants and oleochemicals could challenge Stepan's traditional product lines.

- Advancements in material science: Innovations in areas like composites or advanced polymers might offer superior performance, displacing existing chemical solutions.

- Digitalization of chemical manufacturing: New competitors leveraging AI and advanced automation could achieve cost efficiencies and faster product development cycles.

Foreign Currency Exchange Rate Fluctuations

Stepan Company's global operations expose it to the risks associated with foreign currency exchange rate fluctuations. As a significant portion of its sales are international, shifts in currency values can directly impact reported revenues and profitability. For example, a strengthening U.S. dollar against other currencies can reduce the dollar value of earnings generated from overseas markets.

While Stepan employs financial instruments like forward contracts to hedge against some of this currency risk, these measures are not always perfect. For instance, in 2024, the U.S. dollar experienced periods of strength against the Euro and emerging market currencies, potentially creating headwinds for companies like Stepan with substantial international sales. Even with hedging, unexpected or extreme currency movements can still materially influence Stepan's financial performance.

- Exposure to Volatile Exchange Rates: Global sales mean that fluctuating currency values directly affect reported financial results.

- Impact of a Strong U.S. Dollar: A stronger dollar can diminish the reported value of earnings and sales generated in foreign currencies.

- Limitations of Hedging Strategies: Forward contracts and other hedges can mitigate, but not entirely eliminate, the impact of currency volatility.

- Potential for Material Financial Impact: Significant and unforeseen exchange rate swings can still lead to substantial deviations in actual financial performance compared to expectations.

Stepan faces threats from escalating raw material costs, particularly for crude and vegetable oils, which directly impact production expenses. For example, WTI crude oil averaged around $77.50 per barrel in 2023, a significant increase. Global supply chain disruptions, fueled by geopolitical tensions and logistical bottlenecks, add further cost pressures, as evidenced by shipping cost spikes in late 2023 and early 2024.

The company is also vulnerable to stricter environmental regulations, especially concerning substances like PFAS, with anticipated new rules in 2024/2025 potentially requiring costly adaptations. Economic downturns can significantly reduce demand for Stepan's products, leading to lower sales volumes and pricing pressure, as seen with demand weakness in its Polymers segment during 2024.

Competitive threats include the emergence of bio-based alternatives and advancements in material science, which could displace Stepan's traditional offerings. For instance, the growing focus on green chemistry in 2024 highlights the push for more sustainable and potentially disruptive solutions.

Finally, Stepan's international sales expose it to foreign currency exchange rate fluctuations. A strengthening U.S. dollar, as observed in periods of 2024 against the Euro and emerging market currencies, can reduce the reported value of overseas earnings, even with hedging strategies in place.

SWOT Analysis Data Sources

This Stepan SWOT analysis is built upon a robust foundation of data, drawing from Stepan's official financial reports, comprehensive market research on the specialty and insulation chemicals sectors, and expert industry analysis to ensure a thorough and accurate strategic assessment.