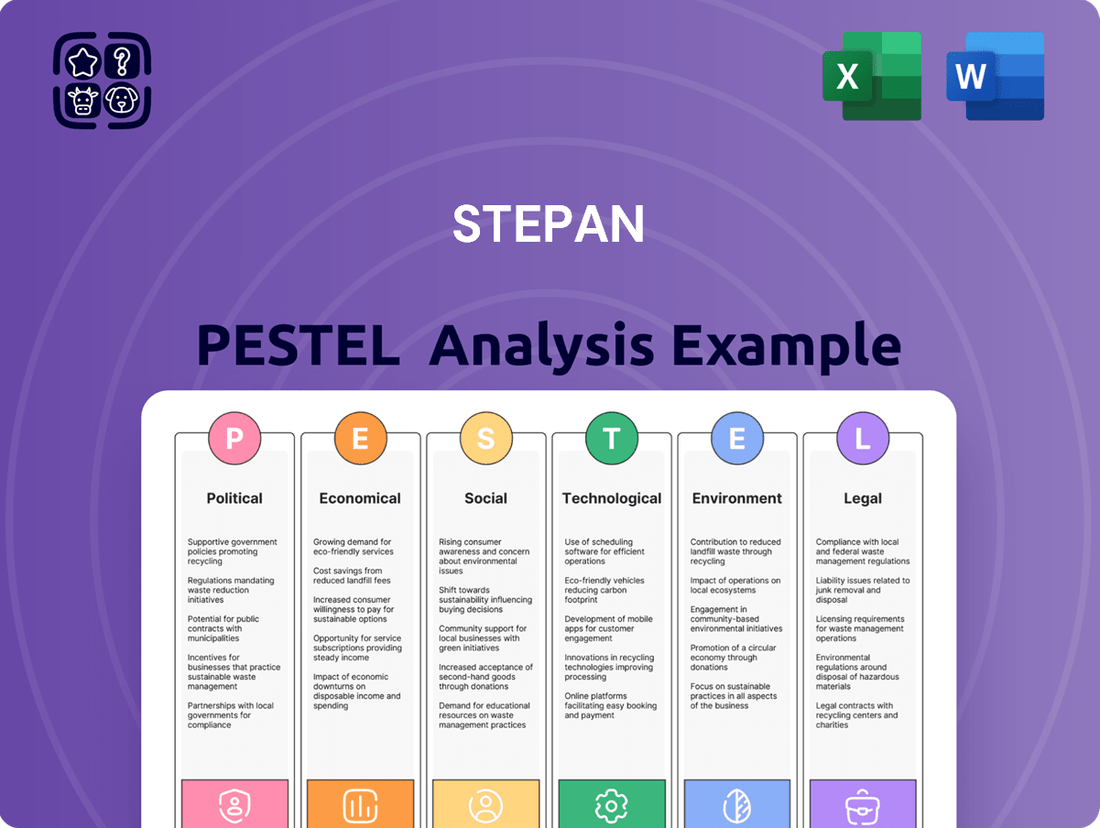

Stepan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stepan Bundle

Uncover the critical external forces shaping Stepan's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the nuanced environment impacting their operations. This insightful report equips you with the knowledge to anticipate challenges and seize opportunities. Download the full version now and gain a strategic advantage in understanding Stepan's future market position.

Political factors

Global trade policies and potential tariffs between major economic blocs like the US, EU, and China directly influence Stepan Company's import and export costs for raw materials and finished goods. Anticipated shifts in trade agreements or new tariffs in 2025 could significantly impact supply chain strategies and profitability. For instance, potential US tariff increases could disrupt global chemical trade flows, affecting Stepan's sourcing and sales.

Government regulations significantly shape Stepan's operational landscape. These rules, covering chemical production, usage, and safety, are always changing, meaning Stepan must consistently adjust its methods and product designs. For example, increased environmental and health standards can lead to higher compliance expenses and the need for new technological investments.

Stepan actively prepares for upcoming regulations. The European Deforestation Regulation (EUDR) and the Corporate Sustainability Reporting Directive (CSRD), both in effect or being implemented around 2024-2025, are key areas of focus, requiring detailed tracking and adaptation of supply chains and reporting practices to ensure continued market access and compliance.

Geopolitical instability, particularly in regions critical for chemical sourcing, poses a significant risk to Stepan's operations. For instance, ongoing conflicts or trade disputes can directly impact the availability and cost of key raw materials like crude oil derivatives and agricultural products, which are vital inputs for Stepan's surfactants and specialty chemicals. The chemical sector, in general, experienced supply chain disruptions in 2023 and early 2024 due to these tensions, highlighting the critical need for adaptable sourcing strategies.

Building robust supply chain resilience is paramount for Stepan to navigate these complexities. This involves diversifying suppliers, exploring alternative raw material sources, and potentially increasing inventory levels for critical components. Recent events have underscored that agility in responding to regional policy shifts, such as new import/export regulations or sanctions, alongside the increasing frequency of climate-related disruptions, can significantly affect production continuity and cost structures for companies like Stepan.

Industrial Policies and Incentives

Government industrial policies significantly shape the landscape for companies like Stepan. Incentives for specific manufacturing sectors, particularly those aligning with green chemistry, can unlock substantial growth opportunities. Conversely, regions lacking supportive policies may present hurdles for investment and operational expansion. For instance, the European Union's commitment to developing local raw material sources, with significant funding allocated, presents a potential advantage for chemical companies that can adapt their supply chains to these new initiatives.

These policies can directly impact Stepan's cost structure and market access. A focus on sustainable manufacturing, for example, could make Stepan's greener product lines more competitive, especially in markets with strong environmental regulations. Conversely, regions that do not prioritize such policies might see slower adoption of advanced chemical technologies, potentially limiting Stepan's market penetration or requiring tailored strategies.

- Green Chemistry Initiatives: Government support for sustainable chemical production can lower capital costs and operational expenses for Stepan.

- Local Sourcing Incentives: Policies encouraging domestic raw material sourcing, like those in the EU, can reduce supply chain volatility and transportation costs.

- Trade Policies: Industrial policies often intertwine with trade agreements, influencing import/export duties and market access for Stepan's products.

- R&D Funding: Government grants and funding for research and development in areas like biotechnology or advanced materials can accelerate innovation for Stepan.

Political Stability in Operating Regions

Stepan's global manufacturing footprint and supply chains mean that political stability in its operating regions is paramount. Unforeseen political upheavals can directly impact production, logistics, and the safety of its assets and personnel. For example, ongoing geopolitical tensions in Eastern Europe, a region where Stepan has significant operations, could pose risks to supply chain continuity and market access, potentially affecting raw material sourcing and product distribution.

The company's reliance on diverse geographic locations for both manufacturing and sourcing necessitates a proactive approach to political risk assessment. Stepan must continuously monitor the political landscapes of countries such as Mexico, where it operates production facilities, and China, a key sourcing hub. Changes in trade policies, regulatory environments, or the outbreak of civil unrest in these areas could lead to increased operational costs or even temporary shutdowns, impacting Stepan's financial performance and market competitiveness.

Monitoring political stability is not just about avoiding disruptions; it also involves understanding potential opportunities. A stable political environment often correlates with favorable investment conditions and predictable regulatory frameworks, allowing Stepan to plan for long-term growth and capital expenditures. Conversely, political instability can deter investment and create an unpredictable business climate, impacting Stepan's ability to execute its strategic objectives effectively in 2024 and beyond.

- Geopolitical Risk Monitoring: Stepan's operations in regions like Eastern Europe are subject to ongoing geopolitical scrutiny, requiring constant evaluation of potential impacts on supply chains and market access.

- Regulatory Environment Assessment: Stepan's facilities in Mexico and sourcing activities in China are influenced by evolving regulatory landscapes, demanding continuous assessment of compliance and potential cost implications.

- Investment Climate Impact: Political stability directly affects Stepan's ability to make strategic investments, with unstable environments posing significant challenges to long-term planning and growth initiatives.

Government industrial policies significantly shape the landscape for companies like Stepan. Incentives for specific manufacturing sectors, particularly those aligning with green chemistry, can unlock substantial growth opportunities. Conversely, regions lacking supportive policies may present hurdles for investment and operational expansion. For instance, the European Union's commitment to developing local raw material sources, with significant funding allocated, presents a potential advantage for chemical companies that can adapt their supply chains to these new initiatives.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Stepan, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights to understand market dynamics, identify potential risks and opportunities, and inform strategic decision-making for Stepan's future growth.

Provides a clear and actionable framework for identifying and mitigating external threats, thereby reducing uncertainty and risk in strategic decision-making.

Economic factors

Global economic growth is a critical driver for Stepan, as its specialty and intermediate chemicals are fundamental to a wide array of consumer and industrial products. The chemical industry is projected for moderate growth in 2025, though demand will vary significantly by sector. Stepan is positioning itself for a rebound in 2025, adapting to evolving market dynamics and striving for a balance between immediate and future objectives.

Fluctuations in the cost of Stepan's key raw materials, including petroleum-based feedstocks, palm oil, and ethylene oxide, directly affect production expenses and profit margins. For instance, the price of ethylene oxide, a crucial component, saw significant swings. In late 2023 and early 2024, its market price experienced upward pressure due to supply chain disruptions and increased demand in various downstream industries.

Chemical prices, in general, have demonstrated notable volatility recently, largely influenced by energy costs and ongoing geopolitical tensions. These external factors create an unpredictable environment for chemical manufacturers like Stepan. The global energy markets, particularly crude oil prices, have been a primary driver of this volatility, impacting the cost of many petrochemical-derived inputs.

To navigate this challenging landscape, Stepan employs hedging programs designed to mitigate the financial impact of raw material price volatility. These strategies aim to lock in prices for key inputs, providing a degree of cost predictability and protecting against sharp, adverse price movements that could otherwise erode profitability. For example, in 2024, the company continued to utilize financial instruments to manage its exposure to oil and gas price fluctuations.

High inflation continues to pressure Stepan's operational costs, impacting everything from raw material procurement to employee wages. This inflationary environment, coupled with elevated interest rates, presents a dual challenge for the company's profitability and investment capacity.

Rising interest rates have demonstrably slowed capital expenditures within the chemical sector throughout 2024. While projections suggest a potential uptick in investment activity for 2025 if interest rates begin to decline, the immediate impact is a more cautious approach to large-scale projects.

Stepan's financial performance in Q1 2025 directly reflects these economic headwinds, with the company reporting an increase in interest expenses. This rise in borrowing costs adds to the financial strain, necessitating careful management of debt obligations.

Supply Chain Costs and Efficiency

Stepan's global supply chain efficiency and associated costs are paramount economic considerations. Fluctuations in transportation and logistics expenses directly influence delivery schedules and overall profitability. For instance, in 2024, Stepan reported significant savings from its cost-out and cost avoidance initiatives, underscoring the financial impact of supply chain management.

The company is actively working to further enhance these savings through strategic investments. The anticipated improvements stemming from new facilities are expected to yield even greater efficiencies in 2025, directly benefiting Stepan's bottom line by mitigating potential disruptions and controlling expenditure.

- Global Logistics Costs: Rising fuel prices and container shortages in 2024 continued to exert pressure on shipping costs, impacting margins for chemical manufacturers like Stepan.

- Cost Savings Initiatives: Stepan achieved substantial cost-out and cost avoidance savings in 2024, demonstrating proactive management of supply chain expenses.

- Facility Expansion Impact: The opening of new facilities in 2025 is projected to streamline operations and further improve supply chain savings, enhancing overall cost-effectiveness.

- Delivery Time Reliability: Supply chain disruptions, such as port congestion experienced in late 2024, can delay raw material arrivals and finished product shipments, affecting Stepan's ability to meet customer demand.

Currency Exchange Rate Fluctuations

As a global manufacturer, Stepan's financial performance is directly influenced by shifts in foreign currency exchange rates. These fluctuations can significantly alter the reported value of its international sales, operational costs, and the worth of its overseas assets. For instance, during the first quarter of 2024, the strengthening of the U.S. dollar against other major currencies would have likely reduced the reported dollar value of sales generated in those foreign markets.

Stepan actively manages this risk by employing financial instruments like forward contracts. These contracts are used to hedge specific foreign currency transactions and outstanding balances, thereby reducing the company's exposure to unpredictable exchange rate movements. This strategy aims to provide greater stability and predictability to its international earnings. For example, if Stepan anticipates a large payment in Euros in six months, it might enter into a forward contract to buy Euros at a predetermined rate, locking in the cost regardless of market fluctuations.

- Impact on Revenue: A stronger U.S. dollar can decrease the reported revenue from countries where Stepan operates or sells, as foreign currency earnings translate into fewer dollars.

- Cost Management: Conversely, a weaker U.S. dollar can increase the cost of imported raw materials or components purchased in foreign currencies.

- Hedging Strategy: Stepan's use of forward contracts in 2024 aimed to offset potential losses from adverse currency movements, particularly for anticipated sales in regions like Europe and Asia.

- 2024 Performance Indicator: While specific figures are proprietary, the company's financial reports would detail gains or losses related to foreign currency translation and hedging activities, offering insight into the actual impact.

Economic factors significantly shape Stepan's operating environment, influencing raw material costs and global demand. In 2025, the chemical industry anticipates moderate growth, with Stepan strategically positioning itself for market shifts, aiming to balance immediate needs with long-term growth objectives.

Raw material price volatility, particularly for petroleum-based feedstocks and ethylene oxide, directly impacts Stepan's cost structure and profitability. For instance, ethylene oxide prices experienced upward pressure in late 2023 and early 2024 due to supply chain constraints and increased demand from downstream sectors.

Inflationary pressures and elevated interest rates in 2024 continued to challenge Stepan's operational costs and investment capacity. High inflation affects everything from material procurement to wages, while rising interest rates have tempered capital expenditure within the chemical sector, with a potential for increased investment in 2025 contingent on rate declines.

Stepan's global supply chain efficiency is a key economic consideration, with logistics costs directly affecting profitability. The company achieved significant cost savings through its initiatives in 2024, and new facilities opening in 2025 are expected to further enhance operational efficiencies and mitigate disruptions.

| Economic Factor | Impact on Stepan | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for specialty chemicals | Moderate industry growth projected for 2025 |

| Raw Material Prices | Affects production costs and margins | Ethylene oxide prices saw upward pressure in late 2023/early 2024 |

| Inflation & Interest Rates | Increases operational costs, impacts investment | Inflation pressured costs; rising rates slowed CapEx in 2024, potential for 2025 upturn |

| Supply Chain Costs | Influences delivery and profitability | Substantial cost savings achieved in 2024; new facilities in 2025 to boost efficiencies |

| Currency Exchange Rates | Affects international sales and costs | 2024 saw potential impact from strong USD on foreign sales; hedging strategies employed |

Full Version Awaits

Stepan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Stepan PESTLE Analysis.

This comprehensive Stepan PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. The content and structure shown in the preview is the same document you’ll download after payment, providing you with actionable insights.

What you’re previewing here is the actual file—fully formatted and professionally structured for your strategic planning needs regarding Stepan.

No placeholders, no teasers—this is the real, ready-to-use Stepan PESTLE analysis file you’ll get upon purchase, enabling immediate application.

Sociological factors

Consumers are increasingly seeking out products that are kind to the planet, opting for sustainable, eco-friendly, and bio-based ingredients, especially in everyday items like detergents and personal care products. This shift directly fuels the demand for Stepan's innovative green chemistry solutions and its range of sustainable surfactants. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their purchasing habits to reduce their environmental impact, highlighting a significant market opportunity.

This growing environmental consciousness translates into a willingness to spend more. Many consumers are now prepared to pay a premium for products that clearly demonstrate strong sustainability credentials. A recent survey by Accenture in late 2024 found that over 60% of consumers consider sustainability a key factor in their purchasing decisions, and a substantial portion of these are willing to pay more for it, directly benefiting companies like Stepan that prioritize these values.

Consumers are increasingly prioritizing health and wellness, directly impacting ingredient choices across food, flavor, and pharmaceutical sectors. This growing awareness fuels demand for natural and healthier product formulations, pushing companies like Stepan to innovate continually. For instance, the global wellness market was valued at $5.6 trillion in 2022 and is projected to reach $7.0 trillion by 2025, highlighting the significant shift in consumer priorities.

Stepan's specialty products are well-positioned to capitalize on these trends, as they often serve as key components in the development of healthier or more natural consumer goods. The company's focus on surfactants and specialty chemicals aligns with the industry's move towards ingredients perceived as safer and more environmentally friendly. This necessitates ongoing research and development to adapt to evolving consumer preferences for clean labels and sustainable sourcing.

In the beauty and personal care industry, a notable trend is the reformulation of products to exclude potentially harmful chemicals. This includes a move away from parabens, sulfates, and phthalates, driven by consumer concern and regulatory scrutiny. Stepan's role in providing ingredients for these reformulated products means it must stay ahead of these ingredient phase-outs and offer effective, safe alternatives to maintain its market relevance and support its clients' product development efforts.

Evolving consumer lifestyles, particularly a heightened emphasis on home hygiene and convenience, are significantly shaping the demand for cleaning and personal care products. Stepan's surfactants are crucial components in these everyday items, meaning these lifestyle shifts directly influence Stepan's market. For instance, the post-pandemic era has seen a sustained increase in the use of disinfectant and cleaning agents, a trend that is likely to continue as consumers prioritize a healthy living environment.

These changes in daily routines and purchasing habits are directly impacting the market for consumer goods that rely on Stepan's chemical solutions. The surfactants market, in particular, is experiencing a notable surge, largely fueled by this persistent demand for effective cleaning and personal care items. In 2024, the global surfactants market was valued at approximately $65 billion, with projections indicating continued growth, underscoring the importance of these evolving consumer behaviors for companies like Stepan.

Demographic Shifts and Urbanization

Global demographic shifts, such as a growing and increasingly urbanized population, are directly influencing the demand for Stepan’s products. As more people move to cities and economies expand, the need for chemicals and surfactants in everything from cleaning supplies to construction materials rises, effectively widening Stepan's potential market.

Developing regions, especially in Asia-Pacific, are at the forefront of this trend. These areas are experiencing robust population and economic growth, which translates into a substantial increase in chemical consumption. For instance, the United Nations projects that by 2050, 70% of the world’s population will live in urban areas, with a significant portion of that growth occurring in Asia and Africa, directly benefiting companies like Stepan that supply essential chemical components.

This urbanization and population expansion create a fertile ground for Stepan’s market growth. The increasing demand for consumer goods, personal care products, and agricultural solutions, all reliant on chemical inputs, is a direct consequence of these demographic trends.

Key demographic and urbanization trends impacting Stepan include:

- Global population growth: The world population is projected to reach 9.7 billion by 2050, increasing demand for consumer and industrial products.

- Urbanization rates: By 2050, 70% of the global population is expected to reside in urban areas, driving demand for chemicals in construction and infrastructure.

- Emerging market growth: Asia-Pacific, in particular, is a key driver of chemical consumption due to its expanding middle class and rapid urbanization.

- Aging populations in developed markets: While growth is slower, aging populations in developed nations still contribute to demand for specialized chemical products in healthcare and personal care sectors.

Brand Reputation and Ethical Sourcing

Consumer and investor scrutiny regarding ethical business practices and responsible sourcing throughout the value chain is significantly impacting brand reputation. For Stepan, this means a strong emphasis on sustainability and transparent reporting of environmental and social performance, as detailed in their sustainability reports, is vital for building trust and attracting environmentally conscious consumers and investors.

Stepan's 2023 sustainability report, for instance, highlighted a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2020 baseline, demonstrating a tangible commitment to environmental stewardship.

- Brand Reputation: Negative perceptions stemming from unethical sourcing can lead to boycotts and reduced market share.

- Investor Confidence: Investors increasingly favor companies with robust ESG (Environmental, Social, and Governance) profiles, impacting access to capital.

- Consumer Loyalty: Consumers, especially younger demographics, actively seek out and support brands perceived as ethical and sustainable.

- Supply Chain Resilience: Ethical sourcing often correlates with more resilient and stable supply chains, mitigating risks.

Sociological factors significantly influence Stepan's market by shaping consumer preferences and lifestyle demands. Growing environmental awareness, evidenced by 73% of global consumers willing to alter habits for environmental impact (Nielsen, 2024), drives demand for Stepan's sustainable solutions. Similarly, the emphasis on health and wellness, with the global wellness market projected to reach $7.0 trillion by 2025, propels the need for natural ingredients, a sector where Stepan's specialty chemicals play a crucial role.

Technological factors

Continuous advancements in green chemistry and bio-based technologies are vital for Stepan to develop more sustainable chemical products. The company's investment in R&D for bio-based surfactants and polymers directly addresses the increasing industry demand for reduced environmental impact. For instance, the global bio-based chemicals market was valued at approximately $100 billion in 2023 and is projected to grow significantly, driven by sustainability initiatives.

This trend is particularly evident in the surfactants market, which is experiencing a notable shift towards bio-based and eco-friendly alternatives. Stepan's focus on these areas positions it to capitalize on this market evolution, as consumers and businesses increasingly prioritize products with a lower carbon footprint and improved biodegradability, supporting Stepan's strategic alignment with global environmental goals.

Stepan is actively pursuing process innovation and automation to drive efficiency and cost reduction. By integrating digital technologies like AI and predictive analytics, the company aims to speed up advancements and boost operational effectiveness. This focus on technological upgrades is key to maintaining competitiveness in the chemical manufacturing sector.

A prime example of this investment is the new alkoxylation facility in Pasadena, Texas, which signifies a substantial capital outlay for advanced production capabilities. This facility is designed to leverage cutting-edge automation and process control, enhancing output and product consistency. Such investments are critical for meeting growing market demands and improving overall production economics.

Stepan's polymer business is poised to benefit from ongoing research and development in novel materials. Innovations like smart polymers and advanced composites are creating entirely new avenues for market penetration. For instance, the global advanced composites market was valued at approximately $23.5 billion in 2023 and is projected to grow significantly, offering Stepan a chance to integrate these materials into its product lines.

Key trends in custom polymer synthesis, such as the growing demand for biodegradable and bio-based polymers, present a strong opportunity for Stepan. The market for bioplastics is expected to reach over $100 billion by 2030, driven by environmental concerns and regulatory pushes. Stepan can leverage this by developing and marketing sustainable polymer solutions.

Furthermore, the emergence of smart polymers tailored for specific applications, particularly in the healthcare sector, opens up high-value market segments. These materials, capable of responding to stimuli like temperature or pH, are finding use in drug delivery systems and advanced diagnostics. The global smart polymers market is anticipated to exceed $60 billion by 2028, showcasing substantial growth potential for Stepan.

Advanced manufacturing techniques, including 3D printing and additive manufacturing, are also creating new demand for specialized polymers. These technologies enable intricate designs and on-demand production, requiring polymers with precise properties. Stepan's ability to adapt its polymer offerings to support these manufacturing advancements could unlock new customer bases and revenue streams in the coming years.

Digitalization of Supply Chain and R&D

Stepan is increasingly leveraging digital technologies to boost its supply chain's visibility and responsiveness. This digital transformation, driven by advancements like Artificial Intelligence (AI), aims to streamline operations and improve efficiency. For instance, AI can optimize production schedules and inventory management, crucial for a company like Stepan that deals with complex chemical manufacturing and distribution.

The company is also focusing on using digital tools to enhance its Research and Development (R&D) processes. AI and other digital platforms can accelerate the discovery and development of new chemical formulations and applications. This is vital for staying competitive in the chemical industry, where innovation is key. In 2024, investments in digital R&D platforms are expected to grow significantly across the sector, with companies like Stepan looking to gain an edge.

Furthermore, digitalization plays a critical role in Stepan's sustainability efforts. Digital tools are being implemented to track and manage carbon emissions throughout the entire value chain, from raw material sourcing to product delivery. This focus on environmental impact is becoming a significant factor for stakeholders and regulatory bodies. For example, by 2025, many chemical companies are setting ambitious targets for emission reductions, supported by digital tracking and reporting capabilities.

- Enhanced Supply Chain Visibility: Digital platforms provide real-time tracking of goods, improving inventory management and reducing lead times.

- R&D Acceleration: AI-powered analytics can speed up the identification of new product opportunities and optimize formulation development.

- Sustainability Tracking: Digital tools enable precise measurement and reporting of carbon footprints across the supply chain.

- Operational Efficiency: Automation and data analytics in production processes lead to cost savings and improved output quality.

Intellectual Property and Innovation Protection

Intellectual property protection is paramount for Stepan, a leader in specialty and Stepan chemical manufacturing. Safeguarding innovations through patents and trade secrets ensures the company maintains its competitive advantage. For instance, Stepan’s commitment to R&D is evident in its continuous efforts to develop novel formulations and efficient manufacturing processes, which are critical for market differentiation.

Stepan's investment in research and development directly fuels its ability to innovate and protect its creations. In 2024, the company’s focus on developing sustainable chemical solutions, such as bio-based surfactants, underscores the importance of IP in securing future market share. Robust IP strategies are essential to prevent competitors from replicating these advancements, thereby protecting Stepan's investment and market position.

- Patents and Trade Secrets: Essential for safeguarding Stepan's unique chemical formulations and production methods.

- R&D Investment: Crucial for driving innovation and maintaining a competitive edge in the specialty chemicals sector.

- Innovation Pipeline: Protecting new product developments ensures sustained market leadership and profitability for Stepan.

Technological advancements in green chemistry and bio-based materials are critical for Stepan's product development, aligning with the growing demand for sustainable solutions. The company's R&D efforts in bio-based surfactants and polymers directly address this market shift, capitalizing on a sector projected for significant growth, with the bio-based chemicals market estimated to reach over $100 billion by 2023.

Legal factors

Stepan navigates a complex web of global chemical regulations, including the Toxic Substances Control Act (TSCA) in the United States and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in Europe. These regulations dictate how chemicals are produced, managed, and utilized, making strict adherence essential for avoiding fines and preserving market access. For instance, REACH compliance in the EU requires extensive data submission for chemicals manufactured or imported in significant quantities, impacting Stepan's product portfolio and market strategies.

The company actively monitors and adapts to new regulatory frameworks, such as the proposed updates to TSCA or the European Union's Corporate Sustainability Reporting Directive (CSRD). The CSRD, for example, mandates detailed reporting on environmental, social, and governance (ESG) matters, directly influencing how Stepan communicates its chemical stewardship and sustainability efforts to stakeholders. Failure to comply with these evolving legal landscapes could result in substantial penalties, as seen in historical cases of chemical companies facing multi-million dollar fines for non-compliance with environmental regulations.

Stepan operates under stringent product liability laws and safety standards, particularly for chemicals used in sensitive applications like personal care, food, and pharmaceuticals. These regulations mandate thorough testing and robust quality control processes to ensure consumer safety. Failure to comply can lead to significant legal repercussions, including substantial fines and damage to brand reputation. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.5 billion in recalls due to safety hazards, highlighting the financial stakes involved.

Stepan operates under stringent environmental laws concerning emissions, waste disposal, and water consumption, necessitating specific permits for its manufacturing sites. These regulations create significant legal hurdles, often involving lengthy approval timelines and substantial investment in compliance technologies to meet evolving environmental standards, such as those aimed at reducing greenhouse gas emissions.

For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations on volatile organic compounds (VOCs) and hazardous air pollutants, directly impacting chemical manufacturers like Stepan. In 2024, companies are increasingly focusing on Scope 1 and Scope 2 emissions reductions, with Stepan publicly stating its commitment to a lower environmental footprint and greenhouse gas intensity.

Labor Laws and Workforce Safety

Stepan's global operations necessitate strict adherence to a complex web of labor laws, encompassing fair wages, equitable employment practices, and, critically, worker safety. For a chemical manufacturer like Stepan, maintaining rigorous safety protocols is not merely a social responsibility but a fundamental legal obligation. In 2024, Stepan continued to prioritize employee well-being, investing heavily in training and safety equipment to foster a robust safety-first culture. This commitment is crucial for mitigating risks and ensuring regulatory compliance across all its facilities.

Ensuring compliance with labor laws, particularly those concerning worker safety, fair wages, and ethical employment practices, is paramount for Stepan's worldwide operations. The chemical industry, by its nature, demands an unwavering focus on safety. Stepan demonstrates this commitment through substantial investments in employee safety programs and the continuous reinforcement of a safety-first ethos. This approach is vital for legal compliance and operational integrity.

Stepan's dedication to labor law compliance, especially concerning workforce safety, directly impacts its operational efficiency and reputation. As of 2024, the company's investments in safety training and protective measures underscore its commitment to meeting and exceeding legal standards. This proactive stance helps prevent workplace incidents, which can lead to significant financial penalties and operational disruptions for chemical manufacturers.

- Worker Safety Investments: Stepan allocates significant capital to advanced safety training and personal protective equipment, crucial for compliance with evolving labor regulations.

- Fair Wage Compliance: Adherence to minimum wage laws and equitable compensation structures across different jurisdictions is a key legal requirement for Stepan's global workforce.

- Employment Practices Scrutiny: Stepan must navigate diverse international labor laws governing hiring, termination, and employee rights, ensuring fair and legal employment practices.

- Regulatory Landscape: The company continuously monitors and adapts to changes in labor legislation, including those impacting workplace safety standards and employee benefits, to maintain full compliance.

Antitrust and Competition Laws

Stepan's operations are significantly shaped by antitrust and competition laws across its global markets. These regulations are crucial for maintaining a level playing field, preventing any single entity from dominating, and ensuring fair pricing for consumers. For instance, the company's strategic decisions regarding mergers, acquisitions, and even how it sets prices for its chemical products must all align with these legal frameworks. The global chemical industry, characterized by both large, established players and emerging innovators, presents a dynamic competitive environment where adherence to these laws is paramount.

Consider the implications for Stepan's growth strategies. If Stepan were to consider acquiring another chemical manufacturer, antitrust regulators in relevant jurisdictions, such as the U.S. Federal Trade Commission (FTC) or the European Commission, would scrutinize the deal to ensure it doesn't unduly reduce competition. For example, in 2023, the FTC blocked several proposed mergers in various sectors due to antitrust concerns, highlighting the stringent review processes companies face. Stepan's pricing strategies for its surfactants, polymers, and specialty chemicals are also subject to scrutiny to prevent anti-competitive practices like price-fixing or predatory pricing.

- Regulatory Oversight: Stepan must comply with antitrust and competition laws in all operating regions, impacting M&A and pricing.

- Market Dynamics: The chemical industry's competitive landscape, featuring established firms and new entrants, necessitates strict adherence to these laws.

- Merger & Acquisition Scrutiny: Potential acquisitions by Stepan are subject to review by bodies like the FTC or European Commission to prevent monopolistic tendencies.

- Pricing Controls: Stepan's pricing strategies for its diverse chemical portfolio are monitored to ensure they do not engage in anti-competitive behaviors.

Stepan's global operations are significantly influenced by intellectual property (IP) laws, protecting its proprietary chemical formulations and manufacturing processes. The company must actively safeguard its patents and trademarks to maintain a competitive edge and prevent infringement, which could lead to substantial financial losses. For instance, IP disputes can result in costly litigation and the loss of market exclusivity for key products, a risk Stepan actively mitigates through robust IP management strategies.

Environmental factors

Stepan faces increasing global pressure to address climate change, translating into stricter regulations on greenhouse gas emissions. This necessitates a proactive approach to reducing its carbon footprint across operations.

Stepan has established ambitious targets for lowering its Scope 1 and 2 emissions. Notably, the company has already achieved substantial reductions compared to its 2016 baseline, demonstrating a commitment to its environmental goals.

The broader chemical industry is actively improving its emissions reporting and accelerating decarbonization initiatives. This trend suggests a supportive ecosystem for Stepan's sustainability efforts and potential for industry-wide innovation in reducing environmental impact.

Stepan faces increasing pressure to embrace a circular economy model and adhere to tighter waste management rules. This trend requires significant innovation in how they reduce, reuse, and recycle materials, alongside designing products with sustainability at their core. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation, expected to be fully implemented in 2024-2025, will mandate more rigorous lifecycle assessments and recycled content for many products, directly impacting chemical manufacturers like Stepan.

Companies globally are actively investing in product designs that facilitate easier recycling and are exploring biodegradable or bio-based materials to lessen their environmental footprint. This shift is driven by both regulatory demands and growing consumer preference for eco-friendly options. In 2023, the global market for biodegradable plastics was valued at approximately $50 billion and is projected to grow significantly, highlighting a tangible market opportunity for Stepan to align its product development with these sustainable trends.

Water scarcity in key operational regions and increasingly stringent regulations on industrial water usage present significant environmental challenges for Stepan's manufacturing. These factors directly influence production costs and operational continuity, particularly in areas facing drought conditions or strict water withdrawal limits.

Stepan is actively managing its water footprint, with recent data indicating a reduction in absolute freshwater consumption across its global sites. For instance, the company reported a decrease in total water withdrawal, reflecting its commitment to efficient water management practices and compliance with evolving environmental standards.

Sustainable Sourcing and Raw Material Impact

Stepan's commitment to sustainable sourcing is increasingly critical as consumer demand for eco-friendly products grows. The company is actively exploring bio-based and renewable resources to mitigate the environmental footprint of its raw materials. In 2023, Stepan reported that approximately 20% of its raw materials were derived from renewable sources, a figure it aims to increase to 30% by 2028.

To achieve this, Stepan is fostering collaborations with its supply chain partners. These partnerships are focused on identifying and implementing sustainable energy sourcing and exploring novel raw material alternatives that reduce environmental impact. For instance, a pilot program initiated in late 2024 with a key supplier aims to transition to 100% renewable electricity for raw material processing by 2026.

- Exploration of Bio-based Feedstocks: Stepan is investing in research and development to integrate more plant-derived and biodegradable materials into its product lines.

- Supply Chain Transparency Initiatives: The company is enhancing traceability to ensure raw materials are sourced ethically and with minimal environmental degradation, with 85% of its tier-1 suppliers audited for sustainability practices in 2024.

- Partnerships for Renewable Energy: Collaborations are underway to secure renewable energy for manufacturing processes, aiming to reduce Scope 2 emissions associated with raw material production.

- Circular Economy Principles: Stepan is investigating opportunities to incorporate recycled content and design products for recyclability, aligning with broader environmental goals.

Pollution Control and Environmental Remediation

Stepan operates under stringent pollution control regulations affecting air, water, and soil quality. The company may also be liable for cleaning up contamination from past activities. For instance, in 2023, Stepan reported capital expenditures of $73.4 million, with a portion allocated to environmental compliance and upgrades across its facilities to meet evolving standards.

Continuous investment in environmental protection is crucial for Stepan to avoid fines and maintain positive relationships with the communities where it operates. The company's 2024 sustainability goals include targets for reducing greenhouse gas emissions and improving water usage efficiency.

- Regulatory Compliance: Stepan must meet evolving environmental standards for emissions, wastewater discharge, and waste management.

- Remediation Liabilities: Potential costs associated with historical contamination require ongoing assessment and mitigation strategies.

- Sustainability Investments: Ongoing capital allocation for environmental protection is vital for operational continuity and corporate reputation.

- Community Relations: Demonstrating commitment to environmental stewardship is key to maintaining social license to operate.

Stepan is navigating increasing global pressure to address climate change, leading to stricter regulations on greenhouse gas emissions. This necessitates a proactive approach to reducing its carbon footprint across operations, with the company having established ambitious targets for lowering Scope 1 and 2 emissions, showing substantial reductions compared to its 2016 baseline.

The company faces pressure to embrace a circular economy and adhere to tighter waste management rules, requiring innovation in reducing, reusing, and recycling materials, alongside designing products with sustainability at their core. For example, the European Union's proposed Ecodesign for Sustainable Products Regulation, expected to be fully implemented by 2025, will mandate more rigorous lifecycle assessments and recycled content for many products.

Water scarcity and stringent regulations on industrial water usage present significant environmental challenges, impacting production costs and operational continuity. Stepan is actively managing its water footprint, with recent data indicating a reduction in absolute freshwater consumption across its global sites, reflecting its commitment to efficient water management practices.

Stepan's commitment to sustainable sourcing is critical, with the company actively exploring bio-based and renewable resources. In 2023, approximately 20% of its raw materials were derived from renewable sources, a figure it aims to increase to 30% by 2028, fostered through collaborations focused on sustainable energy sourcing and novel raw material alternatives.

| Environmental Factor | Stepan's Actions/Data (2023-2025) | Industry Trend/Impact |

|---|---|---|

| Greenhouse Gas Emissions | Targeting Scope 1 & 2 reductions; achieved reductions from 2016 baseline. | Industry-wide acceleration of decarbonization initiatives. |

| Waste Management & Circular Economy | Adapting to stricter rules; exploring recycled content. | EU's Ecodesign Regulation (2024-2025) mandates lifecycle assessments and recycled content. |

| Water Usage | Reducing absolute freshwater consumption globally. | Water scarcity and strict regulations impacting operational continuity. |

| Sustainable Sourcing | 20% renewable raw materials in 2023; target of 30% by 2028. | Growing consumer demand for eco-friendly products. |

PESTLE Analysis Data Sources

Our Stepan PESTLE Analysis is grounded in comprehensive data from reputable sources like the World Bank, International Monetary Fund, and leading industry-specific market research firms. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends to provide accurate insights.