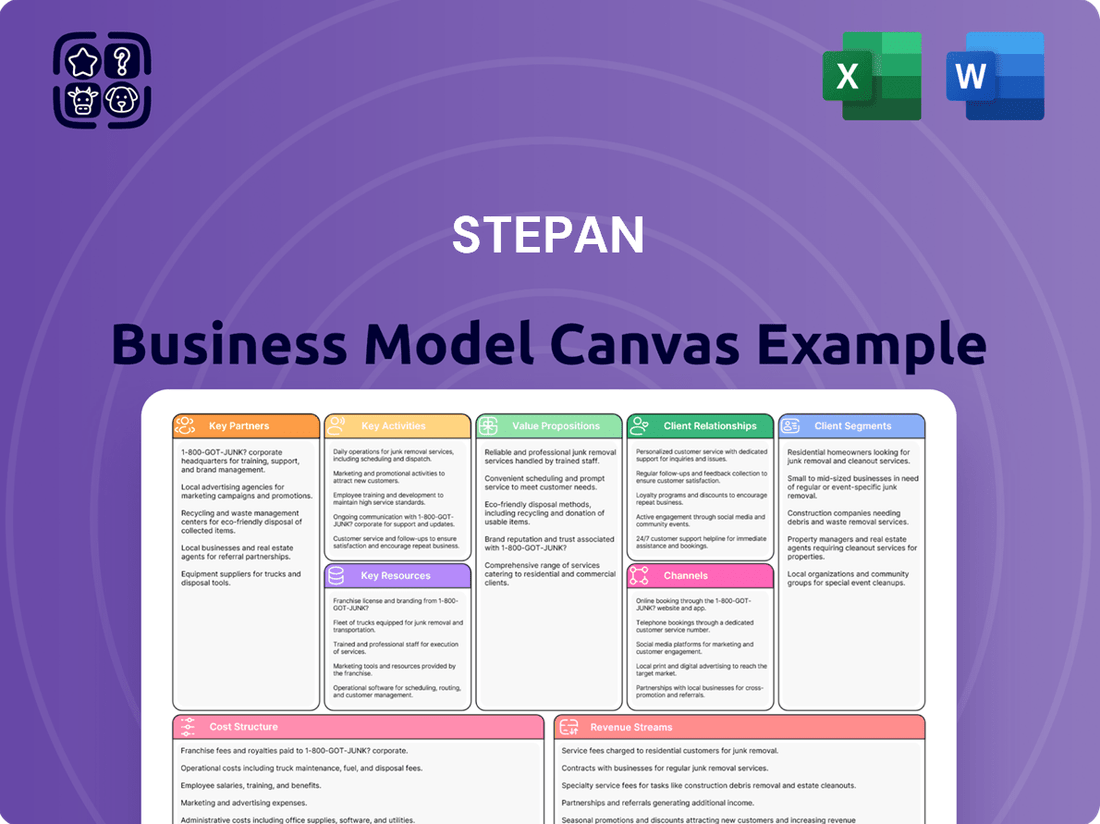

Stepan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stepan Bundle

Curious about the strategic engine driving Stepan's success? Our Business Model Canvas offers a granular look at their customer segments, value propositions, and revenue streams. Understand how they build and maintain their competitive edge in the chemical industry.

Unlock the complete blueprint of Stepan's operations with our full Business Model Canvas. This comprehensive document details their key resources, activities, and cost structure, providing invaluable insights for strategic analysis.

Dive into the specifics of Stepan's business model with our professionally crafted canvas. It meticulously outlines their partnerships, channels, and customer relationships, offering a clear roadmap to their market dominance.

Want to benchmark your own strategies against a market leader? The full Stepan Business Model Canvas is your essential tool, revealing their core competencies and competitive advantages.

Gain a competitive edge by understanding Stepan's strategic framework. Our downloadable canvas provides a complete, actionable overview of how they create, deliver, and capture value.

See how Stepan translates innovation into profit. This detailed canvas breaks down their revenue models and cost drivers, perfect for aspiring entrepreneurs and industry analysts alike.

Ready to dissect a proven business model? Download the full Stepan Business Model Canvas and explore every facet of their strategic design, from customer acquisition to operational efficiency.

Partnerships

Stepan Company's raw material suppliers are foundational to its operations, providing essential chemicals for its diverse product lines. These partnerships are vital for maintaining a consistent and cost-effective supply chain, directly influencing manufacturing throughput and product delivery timelines.

In 2023, Stepan reported that the cost of goods sold was $2.3 billion, highlighting the significant expenditure on raw materials. Strong relationships with a variety of suppliers are key to managing the inherent volatility in raw material pricing and safeguarding against potential supply chain interruptions.

Stepan's commitment to staying ahead in the chemical industry is heavily reliant on its key partnerships with research institutions and technology collaborators. These alliances are crucial for driving Stepan's product innovation and refining its manufacturing processes.

Through these collaborations, Stepan gains access to cutting-edge research and development capabilities, enabling the creation of novel chemical formulations and the improvement of existing product lines. For instance, in 2024, Stepan continued to invest in R&D, with a focus on developing sustainable and bio-based ingredients, a direct result of its work with academic and industry research partners.

These partnerships are not just about creating new products; they also facilitate the adoption of advanced manufacturing techniques. This focus on process optimization helps Stepan enhance efficiency, reduce waste, and meet stringent environmental regulations, solidifying its competitive advantage and commitment to sustainability goals. The ability to adapt to evolving market demands and regulatory landscapes, such as the increasing demand for biodegradable surfactants, is directly supported by these collaborative R&D efforts.

Stepan relies heavily on its global network of distribution partners to effectively reach its wide array of customers across different sectors and regions. These collaborations are crucial for ensuring products get to market efficiently.

For instance, in 2024, Stepan partnered with Brenntag to distribute its surfactants throughout Germany and Austria. This kind of strategic alliance allows Stepan to expand its market presence significantly beyond what its internal sales teams can manage, particularly in challenging international territories.

These distributor relationships are vital for market penetration, providing local expertise and established logistics. By leveraging these partnerships, Stepan can ensure timely and reliable delivery of its chemical solutions to a broader customer base, enhancing its overall market reach and customer service capabilities.

Strategic Industry Alliances

Stepan actively pursues strategic alliances within focused sectors like thermal insulation and agricultural solutions. These collaborations are crucial for co-developing highly specialized products, offering mutual benefits in market understanding and reduced R&D expenses. For example, in 2024, Stepan continued to leverage these partnerships to accelerate the introduction of innovative chemical applications, reinforcing its market leadership.

- Co-development of specialized products: Alliances enable the creation of tailored chemical solutions for specific industry needs, such as enhanced insulation materials or more effective crop protection agents.

- Shared development costs and risks: Partnering reduces the financial burden of research and development for new chemical formulations and applications.

- Accelerated market adoption: Joint efforts with industry leaders can speed up the testing, validation, and commercialization of new products, leading to quicker market penetration.

- Deeper market insights: Strategic partnerships provide valuable feedback and understanding of emerging trends and customer requirements within niche markets.

Sustainability Initiatives Partners

Stepan actively engages with external organizations and initiatives to bolster its sustainability efforts. A prime example of this is their recognition with a Silver Medal in the 2024 EcoVadis assessment, highlighting their dedication to responsible business practices across environmental, labor, human rights, ethics, and sustainable procurement criteria.

These collaborations are crucial for promoting sustainable sourcing of raw materials, driving energy efficiency improvements, and minimizing waste throughout Stepan's extensive value chain. By working with sustainability-focused partners, the company not only reinforces its commitment to ethical operations but also ensures alignment with evolving global environmental standards and best practices.

- EcoVadis Silver Medal 2024: Demonstrates strong performance in sustainability assessments.

- Sustainable Sourcing: Partnerships support responsible procurement of raw materials.

- Energy Efficiency & Waste Minimization: Collaborations drive improvements across operations.

- Enhanced Reputation: Aligns with global environmental standards and stakeholder expectations.

Stepan's network of distribution partners, exemplified by their 2024 agreement with Brenntag for surfactant distribution in Germany and Austria, is critical for market reach. These relationships leverage local expertise and established logistics, ensuring efficient product delivery to a wider customer base.

What is included in the product

A detailed, data-driven representation of Stepan's strategic approach to value creation, outlining key partnerships, activities, and resources.

Offers a clear, structured overview of Stepan's revenue streams, cost structure, and customer relationships for strategic analysis.

The Stepan Business Model Canvas effectively addresses the pain point of unclear strategic direction by providing a structured, visual representation of how the business creates, delivers, and captures value.

Activities

Stepan's key activities heavily rely on robust research and development to pioneer novel chemical solutions and enhance its current product portfolio. This focus drives the creation of higher value-added applications and streamlines production processes, alongside the exploration of new chemical formulations.

Significant financial commitment to R&D is a cornerstone of Stepan's strategy, ensuring its market leadership and responsiveness to dynamic market demands and regulatory shifts. For instance, Stepan's commitment to innovation is evident in its ongoing efforts to develop sustainable chemistries and advanced material solutions for various industries.

Stepan's core activity is the large-scale manufacturing of specialty and intermediate chemicals. This includes key product lines like surfactants, polymers, and other specialized chemical products crucial for various industries.

Operating a global network of modern production facilities is paramount to Stepan's chemical manufacturing and production. This global presence ensures consistent supply and adherence to high-quality output standards across all their operations.

Recent strategic investments bolster their manufacturing capabilities. For example, the new alkoxylation facility in Pasadena, Texas, significantly increases Stepan's capacity and operational efficiency for key chemical intermediates.

These manufacturing activities are foundational to Stepan's business, directly supporting their revenue generation and market position in the chemical sector.

Stepan's key activities center on managing a complex global supply chain. This involves everything from sourcing raw materials like ethylene oxide and propylene oxide to delivering finished specialty and intermediate chemicals to customers across the globe. In 2024, Stepan continued to focus on optimizing its logistics network and inventory levels to ensure efficient operations and meet diverse market demands.

Ensuring timely delivery is paramount, as Stepan serves industries that rely on consistent chemical supply. This operational efficiency directly impacts cost control, a crucial element for maintaining competitive pricing. For instance, effective inventory management helps mitigate risks associated with price volatility of key raw materials, a factor that can significantly influence profitability.

Customer satisfaction hinges on the reliability of this supply chain. Stepan's ability to consistently provide high-quality products on schedule is a core component of its value proposition. This requires robust planning and execution across all stages of the logistics process, from production scheduling to final transportation, to maintain strong customer relationships and market share.

Sales, Marketing, and Customer Technical Support

Stepan's key activities heavily involve actively promoting its chemical products to a wide array of industrial and consumer goods manufacturers through dedicated sales and marketing efforts. This includes showcasing innovation and value propositions to attract and retain clients in competitive markets.

Crucially, Stepan provides comprehensive technical support, guiding customers on optimal product application and developing customized solutions to meet specific manufacturing challenges. This hands-on approach is vital for ensuring customer satisfaction and building enduring partnerships.

- Sales & Marketing: Stepan actively engages in global sales and marketing to promote its specialty and intermediate chemicals, reaching diverse sectors like cleaning, agriculture, and personal care. In 2024, the company continued to focus on expanding its market reach and strengthening customer relationships through targeted campaigns and product showcases.

- Technical Support: Providing in-depth technical assistance is a cornerstone, helping customers integrate Stepan's products effectively into their formulations and processes. This support ensures optimal performance and fosters customer loyalty.

- Customer Relationship Management: Building and maintaining strong, long-term relationships with clients is paramount, driven by reliable product delivery and responsive support. This focus on customer success underpins repeat business and market growth.

Regulatory Compliance and Quality Assurance

Stepan's key activities heavily involve ensuring strict adherence to global chemical regulations, safety standards, and robust quality control protocols. This is a continuous and vital undertaking to maintain market access and uphold their reputation.

This commitment translates into actively monitoring emerging regulations, such as those impacting PFAS (Per- and Polyfluoroalkyl Substances), and conducting rigorous product testing to meet increasingly stringent industry and customer requirements.

Maintaining relevant certifications, like ISO 9001 for quality management, is paramount. For instance, in 2024, Stepan continued its focus on product stewardship, aligning with evolving environmental and safety legislation worldwide.

- Regulatory Monitoring: Actively tracking and adapting to evolving chemical regulations globally, including those related to sustainability and product safety.

- Quality Control: Implementing comprehensive testing and validation processes throughout the product lifecycle to ensure consistent quality and performance.

- Certification Maintenance: Upholding industry-specific certifications and standards to demonstrate commitment to quality and regulatory compliance.

- Product Stewardship: Engaging in responsible management of chemical products from development to disposal, prioritizing safety and environmental impact.

Stepan's key activities encompass research and development for innovative chemical solutions, large-scale manufacturing of specialty and intermediate chemicals, and managing a complex global supply chain. These are complemented by proactive sales and marketing, technical support, and rigorous adherence to regulatory and quality standards.

In 2024, Stepan continued to prioritize innovation, evident in its ongoing development of sustainable chemistries. The company also focused on optimizing its global supply chain and enhancing customer relationships through dedicated technical support and responsive service. Stringent quality control and regulatory compliance remain foundational to its operations, ensuring market access and customer trust.

| Key Activity | Description | 2024 Focus/Example |

|---|---|---|

| Research & Development | Pioneering new chemical formulations and enhancing existing products. | Developing sustainable chemistries and advanced material solutions. |

| Manufacturing | Large-scale production of specialty and intermediate chemicals. | Operating global facilities, exemplified by the Pasadena, Texas alkoxylation expansion. |

| Supply Chain Management | Sourcing raw materials, managing logistics, and ensuring timely delivery. | Optimizing logistics and inventory for efficiency and to manage raw material price volatility. |

| Sales & Marketing | Promoting products and building customer relationships. | Expanding market reach and strengthening customer ties through targeted campaigns. |

| Technical Support | Assisting customers with product application and customized solutions. | Ensuring optimal product performance and fostering customer loyalty through hands-on support. |

| Regulatory Compliance & Quality Control | Adhering to global regulations, safety standards, and quality protocols. | Monitoring evolving regulations (e.g., PFAS) and maintaining certifications like ISO 9001. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final, complete file. Upon completing your order, you will gain full access to this professional, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Stepan's manufacturing facilities are its core operational asset, with a global footprint spanning North and South America, Europe, and Asia. This network is essential for the large-scale production of its diverse chemical portfolio.

The company's physical infrastructure, including its state-of-the-art alkoxylation plant in Pasadena, Texas, represents a significant investment. This infrastructure directly supports the efficient and reliable supply of specialty and intermediate chemicals to its customers worldwide.

In 2024, Stepan continued to leverage these modern production sites to meet growing demand. The strategic location of these facilities allows for optimized logistics and closer proximity to key markets, enhancing its competitive advantage.

Stepan's intellectual property, particularly its proprietary chemical formulations, patents, and specialized process technologies, is a cornerstone of its competitive edge. These unique chemistries and manufacturing expertise allow Stepan to develop differentiated products with enhanced performance, setting them apart in the market. For example, in 2023, Stepan reported that its specialty chemicals segment, which heavily relies on these intellectual assets, saw significant growth.

The company's commitment to research and development is crucial for maintaining and expanding this valuable intellectual property. This ongoing investment ensures that Stepan remains at the forefront of chemical innovation, consistently introducing new and improved solutions. This focus on R&D directly translates to a stronger portfolio of intellectual property, reinforcing Stepan's market position.

Stepan's skilled workforce, encompassing chemists, engineers, and technical sales specialists, forms a core asset. This human capital is vital for driving innovation and supporting Stepan's diverse chemical offerings.

Specialized R&D talent is the engine behind new product development and process improvements. Their expertise directly fuels Stepan's competitive edge in the chemical industry, ensuring a pipeline of advanced solutions.

Experienced operational teams are essential for maintaining efficient and safe manufacturing. Their deep understanding of chemical processes guarantees product quality and adherence to stringent safety standards, a critical factor in Stepan's operations.

In 2023, Stepan reported a dedicated workforce of approximately 2,300 employees globally, a testament to the significant human resources invested in its operations and innovation efforts.

Global Supply Chain Network

Stepan’s global supply chain network is a critical asset, linking raw material sourcing with worldwide product distribution. This network includes vital relationships with suppliers and logistics providers, ensuring efficient product flow across continents.

In 2023, Stepan reported that approximately 70% of its sales were generated outside of North America, underscoring the global reach and importance of its distribution channels. This extensive network allows Stepan to navigate complex international trade environments and maintain operational continuity.

- Supplier Relationships: Stepan cultivates strong ties with key global suppliers of essential chemicals like ethylene oxide and propylene oxide.

- Logistics Infrastructure: The company utilizes a diverse range of transportation methods, including ocean freight, rail, and trucking, to move materials and finished goods efficiently.

- Distribution Channels: Stepan maintains a robust network of warehouses and distribution centers strategically located in major markets to serve its customer base effectively.

- Resilience and Cost: A well-managed supply chain is paramount for Stepan's operational stability and its ability to control costs, especially amidst fluctuating global market conditions.

Financial Capital and Investment Capacity

Stepan Company's access to financial capital is a cornerstone of its operational strength and strategic ambitions. This access directly fuels ongoing operations, enabling the company to manage inventory, meet payroll, and cover day-to-day expenses. Furthermore, it underpins significant capital expenditures, such as the substantial investment in its new Pasadena, Texas, manufacturing facility, which is designed to enhance production capacity and technological capabilities.

The company's financial health translates into a robust investment capacity, allowing for crucial Research and Development (R&D) initiatives. These R&D efforts are vital for developing innovative chemical solutions and maintaining a competitive edge in the market. For instance, in 2023, Stepan reported net sales of $3.96 billion, demonstrating its substantial revenue generation capabilities that support these investments.

Effective capital allocation is paramount for Stepan's sustained expansion and market competitiveness. By strategically deploying its financial resources, the company can pursue growth opportunities, whether through organic expansion, acquisitions, or technological upgrades. This disciplined approach ensures that capital is utilized where it can generate the highest returns and contribute most effectively to long-term objectives.

- Financial Capital Access: Stepan leverages strong financial health to fund operations, strategic investments, and R&D.

- Capital Expenditures: Significant investments, like the Pasadena facility, highlight the company's capacity for major capital projects.

- Revenue Support: Net sales of $3.96 billion in 2023 underscore the financial resources available for growth.

- Strategic Allocation: Efficient deployment of capital drives continued expansion and market position maintenance.

Stepan's key resources are its extensive manufacturing facilities, intellectual property including proprietary formulations and process technologies, and a skilled global workforce. These are complemented by a robust supply chain and strong access to financial capital, all of which are essential for its operations and competitive market position.

Value Propositions

Stepan's specialized chemical expertise in surfactant and polymer chemistry is a cornerstone of its business. They offer highly customized formulations designed to meet precise performance needs across various industries. This deep technical knowledge allows customers to achieve specific outcomes, like superior cleaning efficacy or advanced insulation capabilities in their final products.

This ability to tailor solutions is a significant competitive advantage for Stepan. For instance, in 2024, the company continued to invest in research and development, focusing on sustainable chemistries that offer enhanced biodegradability and reduced environmental impact, directly addressing evolving customer demands for greener alternatives.

Stepan's value proposition centers on delivering chemical products that meet stringent quality standards, ensuring consistency batch after batch. This unwavering quality is supported by robust supply chain management, giving customers confidence in the availability of essential materials. For instance, Stepan reported a 2023 net income of $287.3 million, reflecting operational strength that underpins their reliability.

Customers rely on Stepan for predictable product performance, which is crucial for maintaining the integrity of their own manufacturing operations and end products. This consistency is not just a benefit; it's a necessity for businesses that cannot afford disruptions or variations in their chemical inputs. Stepan's commitment to on-time delivery further solidifies this dependable partnership.

The consistent delivery of high-quality chemicals builds significant trust and fosters enduring customer relationships. This reliability translates directly into reduced risk for Stepan's clients, allowing them to focus on their core business rather than worrying about supply chain vulnerabilities. This trust is a cornerstone of Stepan's market position.

Stepan's dedication to innovation translates into sustainable chemical solutions tailored for today's market. They actively develop bio-based ingredients and products designed to minimize environmental impact, aligning with the growing demand for greener alternatives. This commitment is crucial for customers prioritizing sustainability and regulatory compliance.

Technical Support and Application Know-how

Stepan offers robust technical support and application know-how, a crucial element in their value proposition. This expertise helps customers seamlessly integrate Stepan's chemical solutions into their unique products and manufacturing processes, ensuring peak performance and efficiency.

This hands-on assistance goes beyond a simple product sale, actively aiding in troubleshooting complex challenges and accelerating new product development cycles for their clients. For instance, in 2024, Stepan's technical teams engaged with hundreds of customers globally, directly contributing to the successful launch of new formulations and process optimizations.

The value derived from this deep technical partnership significantly enhances the overall utility and effectiveness of Stepan's chemical offerings. Customers benefit from reduced development time and improved end-product quality, solidifying Stepan's role as a collaborative innovation partner.

- Application Expertise: Stepan’s technical teams provide tailored guidance for optimal chemical usage.

- Problem Solving: They actively assist customers in overcoming integration and performance hurdles.

- Product Development Support: Stepan’s know-how accelerates customer innovation cycles.

- Value Beyond Product: This partnership fosters deeper customer relationships and superior outcomes.

Diverse Product Portfolio for Multiple Industries

Stepan’s expansive product catalog addresses the chemical requirements of numerous sectors, from the everyday essentials in personal and home care to the specialized needs of agriculture, oilfield operations, construction, and even food and pharmaceuticals. This breadth means customers can consolidate their chemical sourcing, often finding multiple solutions from a single, reliable provider. For example, in 2023, Stepan reported that its specialty and consumer products segment, heavily influenced by these diverse applications, continued to be a significant revenue driver.

This strategy offers substantial benefits to clients. By acting as a one-stop shop, Stepan simplifies procurement processes and mitigates the risks associated with managing multiple suppliers. Customers gain efficiency and can potentially negotiate better terms due to the consolidated volume of business. The company’s commitment to serving such a wide array of industries underscores its adaptability and deep market penetration.

- Broad Industry Reach: Serves personal care, home care, agriculture, oilfield, construction, food, and pharmaceuticals.

- Supply Chain Simplification: Offers customers a single source for diverse chemical needs.

- Reduced Supplier Dependency: Helps clients minimize reliance on multiple, disparate chemical vendors.

- Market Resilience: Diversification across industries provides stability and reduces vulnerability to sector-specific downturns.

Stepan's value proposition is built on delivering specialized chemical solutions that empower its customers. Their expertise in surfactant and polymer chemistry allows for highly customized formulations, ensuring clients can achieve specific performance goals in their end products, from enhanced cleaning power to advanced material properties.

This dedication to tailored solutions is underscored by their ongoing investment in research and development, with a particular focus on sustainable chemistries. For example, Stepan continued to advance bio-based ingredients and biodegradable products throughout 2024, meeting the growing market demand for environmentally conscious alternatives and regulatory compliance.

Customers also benefit from Stepan's unwavering commitment to product quality and supply chain reliability. This consistency is vital for maintaining the integrity of their own manufacturing processes. Stepan's operational strength, reflected in its 2023 net income of $287.3 million, provides customers with the assurance of dependable material availability.

Furthermore, Stepan provides invaluable technical support and application know-how. This collaborative approach helps customers integrate Stepan's chemicals efficiently, troubleshoot challenges, and accelerate product development. In 2024 alone, Stepan's technical teams actively supported hundreds of customer projects globally, contributing to successful product launches and process optimizations.

Stepan's broad product portfolio serves a wide array of industries, including personal care, home care, agriculture, and construction. This extensive reach allows customers to consolidate their chemical sourcing, simplifying procurement and reducing reliance on multiple vendors, which enhances operational efficiency.

| Value Proposition Component | Description | Customer Benefit | 2024/2023 Data Point |

|---|---|---|---|

| Customized Chemical Formulations | Expertise in surfactant and polymer chemistry for tailored solutions. | Achieve specific performance outcomes in end products. | Focus on sustainable chemistries and bio-based ingredients in R&D. |

| Product Quality & Reliability | Consistent, high-quality chemical supply with robust supply chain management. | Ensures manufacturing integrity and reduces operational disruptions. | 2023 Net Income: $287.3 million, reflecting operational strength. |

| Technical Support & Innovation Partnership | Application expertise and problem-solving assistance. | Accelerates product development and optimizes manufacturing processes. | Hundreds of global customer engagements by technical teams in 2024. |

| Broad Industry Solutions | Diverse product catalog serving multiple sectors. | Simplifies procurement and reduces supplier dependency. | Specialty and consumer products segment a significant revenue driver in 2023. |

Customer Relationships

Stepan cultivates deep customer bonds through dedicated account managers who truly grasp each client's unique requirements, offering tailored support. This personalized touch is amplified by a strong technical service division, providing expert guidance and troubleshooting for product usage.

This dual focus on relationship building and technical expertise is a cornerstone of Stepan's strategy, driving significant customer satisfaction. For instance, in 2024, Stepan reported continued strength in its customer retention rates, a testament to these relationship management efforts.

Stepan actively cultivates strategic partnerships and co-creation with key customers, particularly in specialized sectors. For instance, in 2024, the company continued its focus on developing custom solutions for the consumer products industry, where innovation cycles are rapid. This collaborative effort involves joint R&D projects, allowing Stepan to deeply understand customer needs and tailor chemical formulations precisely.

This close integration fosters long-term, mutually beneficial relationships, moving beyond transactional sales. By co-creating, Stepan ensures its chemical solutions are not just inputs, but integral components driving customer product success and market differentiation. This approach is crucial for maintaining competitive advantage in a dynamic market, as evidenced by customer retention rates in their specialty chemicals divisions.

Stepan likely secures a substantial portion of its revenue through volume-based pricing and long-term supply agreements. These contracts offer predictable revenue streams for Stepan and stable supply chains for its customers, a common practice for large-volume chemical purchasers. For instance, in 2023, Stepan's surfactants segment, a major revenue driver, often involves such contractual arrangements.

Digital Engagement and Information Sharing

Stepan actively uses its corporate website and digital platforms to disseminate crucial information, including detailed product catalogs, comprehensive sustainability reports, and timely investor relations updates. This digital approach ensures transparency and broad accessibility for all stakeholders, from individual investors to industry professionals.

While direct, personal interactions remain vital for building strong customer relationships, Stepan's digital channels serve as a powerful supplement for wider information sharing. These online resources are designed to engage a larger audience by providing easy access to company news and performance data.

- Digital Information Hub: Stepan's corporate website functions as a central repository for product specifications, technical data sheets, and safety information, enabling customers to make informed purchasing decisions.

- Transparency in Reporting: The company leverages its online presence to share detailed sustainability reports, outlining environmental, social, and governance (ESG) initiatives and performance metrics. For instance, their 2023 ESG report highlighted a 15% reduction in greenhouse gas emissions intensity compared to a 2019 baseline.

- Investor Accessibility: Investor relations content, including financial statements, earnings call transcripts, and shareholder presentations, is readily available online, fostering trust and communication with the investment community.

- Digital Engagement Support: Online channels support broader stakeholder engagement by providing accessible updates on corporate developments and market insights, complementing direct communication efforts.

Industry Event Participation and Networking

Stepan's commitment to industry event participation is a cornerstone of its customer relationship strategy. In 2024, the company continued its active presence at key chemical sector trade shows and conferences, fostering direct engagement with both established clients and prospective partners. These gatherings are crucial for showcasing Stepan's latest innovations and understanding evolving market demands.

These events serve as vital platforms for Stepan to not only present its product portfolio but also to actively participate in discussions surrounding critical industry trends. By engaging directly with customers and peers, Stepan gains invaluable market intelligence, which informs product development and strategic planning. This proactive approach ensures they remain attuned to customer needs and industry shifts.

The networking opportunities at these industry gatherings are significant for lead generation and relationship building. For instance, Stepan's presence at major chemical expos in 2024 allowed for face-to-face interactions that are essential for strengthening trust and collaboration. These interactions are direct drivers for new business opportunities.

Key benefits of Stepan's industry event participation include:

- Direct Customer Engagement: Facilitates personalized interactions and feedback loops.

- Product Showcase: Offers a tangible way to demonstrate new chemical solutions and their applications.

- Market Intelligence Gathering: Provides insights into competitor activities and emerging customer requirements.

- Lead Generation: Creates direct opportunities to identify and connect with potential new clients.

Stepan's customer relationships are built on personalized service, technical expertise, and collaborative innovation. Dedicated account managers understand unique client needs, supported by a robust technical service division for expert guidance. This focus drives strong customer satisfaction and retention, as demonstrated by sustained positive performance in 2024.

Channels

Stepan's direct sales force is a cornerstone for engaging major industrial clients and key accounts worldwide. This approach enables direct negotiation and the development of tailored chemical solutions, vital for the intricate nature of their product offerings. In 2024, Stepan's commitment to this direct engagement model underpins its ability to foster robust, long-term partnerships, directly impacting their specialty and intermediate chemical segments.

Stepan's global distribution network is crucial for reaching a diverse customer base, especially smaller businesses and those in niche regional markets. These distributors act as vital intermediaries, facilitating market penetration and handling intricate local logistics.

This extensive network allows Stepan to effectively manage regional customer support, ensuring localized service and responsiveness. By leveraging these partnerships, Stepan significantly broadens its market reach and accessibility for a wide array of clients.

In 2024, Stepan continued to emphasize its distribution partnerships, which are key to its strategy for expanding into emerging markets and serving specialized industrial sectors. This channel is fundamental to the company’s ability to connect with a broader spectrum of customers worldwide.

Stepan's technical service and application laboratories are vital channels, offering customers expert guidance and tailored solutions. These resources provide direct access to product testing and formulation support, ensuring seamless integration of Stepan's chemicals into client processes.

For instance, in 2024, a significant portion of Stepan's R&D investment was directed towards enhancing these laboratory capabilities. This focus allows them to demonstrate product efficacy and troubleshoot application challenges effectively, fostering deeper customer relationships and driving innovation.

These specialized teams play a critical role in helping customers optimize the performance of Stepan's surfactants and specialty chemicals within their unique product formulations. This hands-on support is a key differentiator, solidifying Stepan's position as a solutions provider rather than just a chemical supplier.

Online Presence and Corporate Website

Stepan's corporate website functions as a crucial digital storefront, offering comprehensive company information, detailed product catalogs, and transparent sustainability reports. It is the primary channel for investor relations, providing access to official news and financial statements.

This online presence is vital for stakeholder engagement, ensuring easy access to financial reports and essential contact details, thereby fostering trust and clear communication.

- Website as Information Hub: Stepan's website is the central point for all official company communications, including press releases and annual reports.

- Investor Relations Focus: It serves as a key platform for disseminating investor-specific information, such as financial performance and strategic updates.

- Product and Sustainability Data: Visitors can find detailed product specifications and the company's latest sustainability initiatives.

- Stakeholder Accessibility: The site facilitates direct communication and information retrieval for customers, investors, and other interested parties.

Industry Trade Shows and Conferences

Stepan Company actively participates in key industry trade shows and conferences, acting as a crucial channel for customer relationships and market presence. These events allow for direct interaction with a broad spectrum of customers, from established partners to prospective clients, fostering deeper understanding of their evolving needs.

In 2024, participation in events like the American Cleaning Institute (ACI) Annual Meeting and Exposition and the Specialty & Custom Chemicals Show provided Stepan with significant opportunities. These platforms are essential for demonstrating new chemical technologies and innovative solutions directly to decision-makers in the consumer and industrial sectors.

These engagements are not merely about showcasing products; they are strategic avenues for:

- Gathering market intelligence: Understanding emerging trends and competitor activities directly from industry professionals.

- Client relationship building: Strengthening ties with existing customers through face-to-face discussions and problem-solving.

- Lead generation: Identifying and engaging with potential new business opportunities and partnerships.

- Brand amplification: Reinforcing Stepan's position as an industry leader and innovator in chemical solutions.

For instance, Stepan's presence at the 2024 ACI show allowed them to highlight advancements in sustainable surfactant technologies, a key area of focus for many clients seeking environmentally friendly formulations. Such direct engagement is invaluable for driving sales and informing future product development.

Stepan's channels include a direct sales force for large clients, a global distribution network for broader reach, technical service laboratories for tailored solutions, its corporate website as an information hub, and participation in industry trade shows for engagement.

In 2024, these channels collectively supported Stepan's market presence and customer relationships. The direct sales force facilitated key account management, while distributors ensured access in regional markets.

Technical labs provided critical application support, and the website served as the primary source for company and investor information.

Trade shows offered vital platforms for market intelligence and lead generation, reinforcing Stepan's role as a solutions provider.

Customer Segments

Consumer product manufacturers in the personal and home care sectors, ranging from major global brands to smaller specialized companies, represent a core customer segment for Stepan. These businesses rely on Stepan's surfactants as essential components in a vast array of everyday products, including laundry detergents, dish soaps, shampoos, conditioners, body washes, and fabric softeners. For instance, in 2024, the global market for surfactants in personal care alone was projected to reach over $35 billion, highlighting the immense demand for Stepan's offerings.

These manufacturers require not only high-quality and consistent chemical inputs but also often seek tailored solutions to meet specific product performance needs and evolving consumer preferences. Stepan's ability to provide reliable, customizable surfactant chemistries is therefore critical to their product development and manufacturing processes. The company's commitment to innovation ensures that these consumer product companies can create effective and appealing products for their end-users.

Industrial manufacturers focusing on cleaning and disinfection compounds form a crucial customer segment for Stepan. These businesses create specialized cleaning agents for commercial settings like hospitals, restaurants, and factories, as well as for niche markets requiring high-performance sanitization.

These manufacturers depend heavily on Stepan's surfactants to imbue their end products with essential cleaning, sanitizing, and germicidal capabilities. The effectiveness of their cleaning solutions directly correlates with the quality and performance of the chemical components they source.

In 2024, the global industrial cleaning market was valued at approximately $65 billion, with cleaning and disinfection compounds representing a substantial portion of this. Stepan’s role as a key supplier of surfactants positions them to capitalize on this growing demand, driven by increased hygiene awareness and regulatory standards.

Stepan's specialty surfactants, particularly those offering enhanced antimicrobial efficacy, are vital for formulators in this segment. These ingredients enable the creation of products that meet stringent performance criteria for various industrial and institutional applications.

Manufacturers in the construction industry, especially those focused on thermal insulation, represent a significant customer base for Stepan. These companies rely on Stepan’s specialized polyurethane polyols to create rigid foam insulation. This insulation is crucial for enhancing energy efficiency in new builds and retrofits, directly impacting building performance and sustainability.

In 2024, the global construction market continued its growth trajectory, with a particular emphasis on green building initiatives. This trend directly benefits suppliers like Stepan, as demand for energy-saving insulation materials escalates. For instance, the market for rigid polyurethane foam, a key application for Stepan's polyols, saw robust demand driven by stricter building codes and consumer preference for lower utility costs.

Stepan’s polymers are integral to producing insulation that meets stringent performance standards for thermal resistance and durability. These materials are engineered for applications ranging from wall and roof insulation to pipe insulation, all contributing to reduced energy consumption in buildings. The company's ability to supply consistent, high-quality polyols makes it a preferred partner for construction material producers aiming for superior product performance.

Agricultural and Oilfield Industries

Stepan’s agricultural segment relies on the company for emulsifiers critical for crop protection products, ensuring effective application and performance. This sector demands chemicals that boost yields and protect crops, and Stepan delivers specialized solutions. For instance, the global agrochemicals market was valued at approximately $269.4 billion in 2023 and is projected to grow, underscoring the importance of Stepan's contributions.

The oilfield industry represents another key customer segment for Stepan. Here, the company provides specialized chemicals essential for drilling, completion, and production operations. These chemicals are engineered to perform under extreme conditions, enhancing efficiency and safety in oil and gas extraction. The oilfield services market, a significant consumer of such chemicals, saw substantial activity in 2024, with capital expenditures in the upstream sector reflecting ongoing demand for advanced chemical solutions.

- Agricultural Sector Needs: High-performance emulsifiers for crop protection products to improve efficacy and yield.

- Oilfield Sector Needs: Specialized chemicals for drilling, completion, and extraction that withstand harsh environments and boost operational efficiency.

- Market Context (Agriculture): The global agrochemicals market was valued around $269.4 billion in 2023, indicating strong demand for agricultural inputs.

- Market Context (Oilfield): Significant upstream capital expenditures in 2024 highlight the continued need for advanced chemical solutions in oil and gas extraction.

Food, Flavor, and Pharmaceutical Companies

Stepan's customer segment encompassing food, flavor, nutritional supplement, and pharmaceutical companies is critical due to the high value and specialized nature of its offerings. These industries demand exceptional purity, safety, and performance from their ingredients, making Stepan's advanced chemical solutions particularly sought after.

For example, Stepan’s medium-chain triglycerides (MCTs) are vital for nutritional supplements and specialized food products, contributing to energy metabolism. In 2024, the global MCT oil market was projected to reach over $2.5 billion, highlighting the significant demand for these ingredients. Stepan's emulsifiers and solubilizers are equally important, enabling the stable formulation of flavors and active pharmaceutical ingredients (APIs), ensuring product efficacy and consumer appeal.

- Key Product Applications: Stepan supplies MCTs for nutritional supplements, emulsifiers for flavor encapsulation, and solubilizers for pharmaceutical formulations.

- Regulatory Compliance: Products for these segments must adhere to strict global standards like FDA, EFSA, and GMP, which Stepan actively meets.

- Market Growth Drivers: Increasing consumer focus on health and wellness, coupled with advancements in pharmaceutical drug delivery systems, fuels demand.

- Stepan's Value Proposition: Stepan offers high-purity, performance-driven ingredients backed by extensive technical support and a commitment to quality assurance.

Stepan serves diverse customer segments, including consumer product manufacturers in personal and home care, industrial cleaning compound producers, and construction material companies focused on insulation. These clients rely on Stepan's surfactants, antimicrobial agents, and polyurethane polyols for critical product formulations and performance enhancements.

Further key segments include the agricultural sector, requiring emulsifiers for crop protection, and the oilfield industry, needing specialized chemicals for extraction operations. Additionally, Stepan supplies high-purity ingredients like MCTs and emulsifiers to the food, flavor, nutritional supplement, and pharmaceutical industries, meeting stringent quality and regulatory demands.

| Customer Segment | Key Stepan Products | 2024 Market Context/Data |

|---|---|---|

| Personal & Home Care | Surfactants | Personal care surfactants market projected over $35 billion globally. |

| Industrial Cleaning | Surfactants (antimicrobial) | Global industrial cleaning market valued around $65 billion. |

| Construction (Insulation) | Polyurethane Polyols | Robust demand for rigid polyurethane foam driven by energy efficiency initiatives. |

| Agriculture | Emulsifiers | Global agrochemicals market valued around $269.4 billion in 2023. |

| Oilfield | Specialty Chemicals | Significant upstream capital expenditures in 2024 indicate demand for advanced solutions. |

| Food, Pharma, Nutrition | MCTs, Emulsifiers, Solubilizers | Global MCT oil market projected over $2.5 billion. |

Cost Structure

Raw material procurement is Stepan's most significant cost driver, forming the backbone of its chemical synthesis operations. The company's profitability hinges on effectively managing these expenditures, which are inherently volatile due to global commodity price fluctuations.

For instance, in 2023, Stepan reported that its cost of goods sold, heavily influenced by raw material prices, represented a substantial portion of its overall expenses. The company actively employs sophisticated procurement strategies and hedging mechanisms to mitigate the impact of price swings on its bottom line.

Stepan's manufacturing and production costs are substantial, driven by the energy-intensive nature of chemical processes and the upkeep of its worldwide production sites. These operational expenses include significant outlays for electricity, skilled labor required for plant operations, and the regular maintenance of specialized equipment. For instance, in 2023, the company reported total cost of sales as $3.3 billion, reflecting these core production expenditures.

Overheads associated with the complex chemical production processes also form a considerable part of this cost structure. These encompass a range of indirect costs necessary to keep the manufacturing operations running smoothly and efficiently. The company's commitment to expanding its global footprint, as seen with recent investments in new facilities like the Pasadena site, also brings pre-commissioning expenses into play, adding to the upfront manufacturing cost structure.

Stepan's investment in Research and Development (R&D) represents a significant component of its cost structure. These expenditures are crucial for fostering innovation, which is key to maintaining a competitive edge in the chemical industry.

These costs include the compensation for highly skilled scientists and engineers, the acquisition and maintenance of advanced laboratory equipment, and the purchase of various testing materials. Such investments are fundamental to Stepan's ability to develop novel products and enhance the performance of its existing offerings.

In 2024, Stepan continued its commitment to R&D, recognizing its pivotal role in driving future growth and market relevance. This focus ensures the company remains at the forefront of chemical advancements and can adapt to evolving customer needs.

Logistics and Distribution Costs

Stepan's cost structure is significantly impacted by logistics and distribution. These costs encompass the movement of raw materials to their manufacturing facilities and the delivery of finished goods to customers worldwide. This includes expenses like freight charges, warehousing fees, and the various customs duties associated with international trade.

For Stepan, efficient management of these logistical elements is not just about cost control but also about ensuring that products reach their destinations reliably and on time, which is critical for customer satisfaction and supply chain integrity. In 2024, global shipping rates saw fluctuations, with certain routes experiencing increased costs due to geopolitical factors and capacity constraints, directly affecting Stepan's distribution expenses.

- Freight Expenses: Costs associated with ocean, air, and land transportation of raw materials and finished products.

- Warehousing Costs: Expenses for storing inventory at various points in the supply chain, including handling and management.

- Customs and Duties: Taxes and fees levied on goods crossing international borders, impacting the final landed cost for customers.

- Supply Chain Optimization: Investments in technology and processes to streamline delivery routes and reduce transit times, thereby managing these significant costs.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses at Stepan encompass a broad range of operational costs. These include outlays for sales teams, marketing campaigns, executive and support staff compensation, and the essential IT infrastructure that underpins all business functions. Efficient management of these costs is paramount for sustaining robust profitability.

Stepan actively pursues cost-out initiatives and productivity enhancements to optimize its SG&A. For instance, in 2023, the company reported that its SG&A expenses represented a notable portion of its overall spending, highlighting the importance of these efficiency drives. The company's commitment to streamlining operations directly impacts its bottom line, ensuring resources are allocated effectively.

- Sales & Marketing: Costs associated with generating demand and supporting customer relationships.

- General & Administrative: Expenses covering corporate functions, executive salaries, and back-office operations.

- IT Infrastructure: Investments in technology systems and support crucial for business operations.

- Cost Optimization: Ongoing efforts to reduce SG&A as a percentage of revenue through efficiency gains.

Stepan's cost structure is heavily weighted towards raw materials, representing a significant portion of its expenses and directly influenced by market volatility.

Manufacturing and production costs, including energy and labor for its global sites, are substantial, with total cost of sales reported at $3.3 billion in 2023.

Investments in R&D, critical for innovation and market competitiveness, along with logistics, SG&A, and overheads, further shape the company's expenditure profile.

| Cost Category | 2023 Impact | Key Drivers |

|---|---|---|

| Raw Materials | Significant portion of COGS | Commodity price fluctuations |

| Manufacturing & Production | $3.3 billion (Total Cost of Sales) | Energy, labor, plant upkeep |

| Research & Development (R&D) | Ongoing investment | New product development, skilled personnel |

| Logistics & Distribution | Influenced by 2024 shipping rate changes | Freight, warehousing, customs |

| SG&A | Notable portion of spending | Sales, marketing, administration, IT |

Revenue Streams

Stepan Company's primary revenue driver is the sale of surfactants, essential components found in everything from household detergents and personal care products like shampoos to critical agricultural formulations. This segment represents the largest portion of their overall income, underscoring its importance to the business.

In 2023, the Surfactants segment generated approximately $1.9 billion in sales for Stepan, demonstrating its significant contribution to the company's financial performance. This highlights the widespread demand and essential nature of these chemical ingredients across numerous industries.

Stepan generates substantial revenue from selling polymers, with a primary focus on polyurethane polyols. These are crucial for thermal insulation in the construction sector. This core business also includes polyester resins and phthalic anhydride, contributing significantly to the company's financial performance.

In 2024, the demand for advanced insulation materials, driven by energy efficiency regulations and sustainable building practices, is expected to remain robust. Stepan's polymer sales are directly tied to the health of the construction and manufacturing industries, which have shown resilience in recent economic cycles.

For instance, the global polyurethanes market, a key area for Stepan's polymer sales, was valued at approximately $75 billion in 2023 and is projected to grow steadily. This growth underscores the importance of Stepan's polymer segment as a primary revenue driver.

Stepan's specialty products are a significant revenue driver, catering to demanding sectors like food, flavorings, nutritional supplements, and pharmaceuticals. These chemicals, including high-value medium-chain triglycerides, benefit from higher profit margins due to their specific applications and the stringent regulatory compliance they necessitate.

In 2024, Stepan continued to leverage its expertise in these niche markets. For example, the company's focus on ingredients for the booming supplement industry, which saw global market growth projections in the mid-to-high single digits for 2024, directly translates into robust sales within this segment.

Technical Services and Licensing (Potential)

While Stepan's core business focuses on manufacturing and selling chemical products, there's a notable potential for revenue generation through technical services and licensing. This avenue leverages their extensive chemical expertise and intellectual property, offering specialized consulting to other companies or licensing their unique formulations. This could provide a valuable, albeit perhaps less prominent, income stream.

For instance, imagine a smaller chemical company needing assistance with a complex formulation process. Stepan could offer expert consulting, acting as a technical partner. Alternatively, they might license a patented additive or process to a competitor or a company in an adjacent industry, creating a recurring revenue stream without the need for direct manufacturing involvement.

In 2024, the chemical industry saw significant investment in research and development, with companies actively seeking to innovate and improve their processes. Stepan, with its established track record and deep knowledge base, is well-positioned to capitalize on this trend. Such licensing and consulting agreements could be structured to provide upfront fees, ongoing royalties, or a combination of both, directly contributing to Stepan's top line.

- Leveraging Expertise: Stepan's deep chemical knowledge can be monetized through specialized technical consulting.

- Intellectual Property Monetization: Licensing proprietary chemical formulations or processes offers a pathway to new revenue.

- Industry Trends: The 2024 focus on R&D and innovation within the chemical sector creates opportunities for such services.

- Flexible Revenue Models: Agreements can be structured with upfront fees, royalties, or hybrid payment structures.

Global Sales Volume Growth

Stepan's revenue growth is fundamentally tied to its expanding global sales volume across its diverse product lines. This increase in volume is a direct result of meeting growing demand in crucial end markets. For instance, in 2024, the company continued to see robust demand for its specialty and intermediate chemicals, fueling higher unit sales.

Strategic capital expenditures are instrumental in facilitating this volume expansion and broadening global market penetration. The company's investment in its Pasadena, Texas facility, which became fully operational in late 2023, is a prime example. This facility is designed to significantly boost production capacity for key products, directly enabling higher sales volumes in 2024 and beyond.

- Global Sales Volume: Stepan experienced a notable increase in sales volume across its segments in 2024, driven by demand in North America, Europe, and Asia.

- Pasadena Facility Impact: The Pasadena expansion is projected to add substantial capacity, supporting an estimated 10-15% increase in production for certain product lines by the end of 2025.

- End Market Demand: Key end markets like agriculture, cleaning products, and personal care showed sustained demand throughout 2024, directly translating to higher sales volumes for Stepan's chemical solutions.

- Geographic Reach: Investments are strategically focused on markets with high growth potential, allowing Stepan to capture a larger share of global volume.

Stepan's revenue streams are primarily built upon the manufacturing and sale of chemical products, with surfactants forming the largest segment. This is complemented by substantial income from polymers, particularly polyols used in insulation, and a growing contribution from specialty chemicals targeting niche markets like food and pharmaceuticals. Additionally, Stepan explores revenue through technical services and licensing of its intellectual property.

| Revenue Stream | Primary Products | Key Markets Served | 2023/2024 Data Point |

| Surfactants | Anionic, nonionic, cationic, and amphoteric surfactants | Household & Industrial Cleaning, Personal Care, Agriculture | $1.9 billion in sales (2023) |

| Polymers | Polyurethane polyols, polyester resins, phthalic anhydride | Construction (insulation), Coatings, Adhesives, Sealants | Global polyurethanes market valued at $75 billion (2023) |

| Specialty Products | Medium-chain triglycerides (MCTs), specialty esters | Food & Beverage, Nutritional Supplements, Pharmaceuticals | Supplement industry growth projected in mid-to-high single digits (2024) |

| Technical Services & Licensing | Consulting, formulation assistance, process licensing | Chemical Industry, adjacent sectors | Focus on R&D and innovation in chemical sector (2024) |

Business Model Canvas Data Sources

The Stepan Business Model Canvas is informed by a blend of internal financial data, detailed market research, and strategic insights from industry experts. This comprehensive approach ensures each component of the canvas accurately reflects current operations and future potential.