Shanghai Tunnel Engineering Co Ltd PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Tunnel Engineering Co Ltd Bundle

Uncover the critical external forces shaping Shanghai Tunnel Engineering Co Ltd's trajectory with our comprehensive PESTLE analysis. From evolving environmental regulations to economic shifts and technological advancements, understand how these factors present both challenges and opportunities for the company. This ready-to-use analysis provides actionable intelligence for strategic planning and investment decisions. Download the full version now to gain a competitive edge.

Political factors

The Chinese government's commitment to infrastructure, particularly highlighted in its 14th Five-Year Plan (2021-2025), fuels a consistent demand for STEC's services. This plan targets substantial investment in areas like urban underground pipelines and high-speed rail networks, directly benefiting companies like Shanghai Tunnel Engineering Co Ltd.

This strategic focus translates into a robust project pipeline, with infrastructure investment in China projected to reach approximately 15.5 trillion yuan in 2024, a notable increase from previous years. STEC is well-positioned to capitalize on these extensive government-backed initiatives, which are designed to enhance connectivity and support economic growth.

Shanghai Tunnel Engineering Co Ltd (STEC) directly benefits from China's ambitious Belt and Road Initiative (BRI). This global infrastructure development strategy continues to fuel significant investment, creating a fertile ground for STEC's expertise.

In 2024 alone, China's commitment to BRI saw an estimated $92.4 billion poured into projects spanning 149 countries. This robust global investment landscape translates into substantial opportunities for STEC, particularly through the awarding of major construction contracts in key regions.

Regions like Saudi Arabia and Iraq, for instance, have been active hubs for BRI-related infrastructure development, presenting STEC with lucrative international projects. These endeavors not only expand STEC's global footprint but also underscore its role in realizing large-scale infrastructure goals under the BRI framework.

China's commitment to increasing its urbanization rate, targeting 65% by 2025 and aiming for even higher levels by 2030, directly fuels demand for Shanghai Tunnel Engineering Co Ltd's (STEC) specialized skills in urban infrastructure development. These policies, which also focus on enhancing urban public services, create substantial opportunities for STEC's expertise in underground construction and municipal engineering projects.

The national strategy to foster livable, resilient, and smart cities by 2027 is particularly beneficial for STEC. This directive encourages significant investment in advanced urban planning and construction, aligning perfectly with STEC's core competencies in complex underground engineering solutions and the development of modern urban environments.

Regulatory Support for Green Development

Government policies are increasingly prioritizing green and low-carbon transformations within the construction industry, directly benefiting Shanghai Tunnel Engineering Co Ltd (STEC). New action plans released for 2024-2025 specifically target energy conservation and carbon emission reductions, mandating more sustainable practices and rigorous environmental impact assessments for construction projects. This regulatory push aligns perfectly with STEC's expertise in environmental engineering, creating a supportive landscape for its green development initiatives.

These new environmental regulations are not just guidelines; they are becoming integral to project approvals and operational standards. For instance, by 2025, a significant portion of new construction projects are expected to incorporate advanced energy-efficient materials and technologies, a field where STEC has been investing heavily. The emphasis on stricter environmental impact assessments means that companies like STEC, with established green credentials, are better positioned to secure contracts and navigate the evolving regulatory environment.

- Increased government funding for green infrastructure projects is projected to reach ¥500 billion in 2024-2025.

- New carbon emission reduction targets for the construction sector aim for a 15% decrease by the end of 2025.

- Stricter environmental impact assessments are now required for over 70% of large-scale construction projects.

- Policies encourage the use of recycled materials in construction, with a target of 30% recycled content in new builds by 2025.

Geopolitical Stability and Trade Relations

Geopolitical stability and trade relations significantly impact Shanghai Tunnel Engineering Co Ltd (STEC). While China's government prioritizes domestic infrastructure development, global political landscapes, especially US-China trade dynamics, create volatility for international ventures and supply chains. STEC's expanding global footprint, with overseas projects representing a substantial portion of new contracts in 2024, demands strategic management of these external political factors.

For instance, in early 2024, ongoing trade disputes between the US and China led to increased scrutiny on cross-border investments and technology transfers, potentially affecting STEC's access to certain markets or equipment. The company’s reliance on global supply chains for specialized tunneling equipment and materials means that tariffs or trade restrictions can directly influence project costs and timelines. STEC's strategy to diversify its international operations, aiming to reduce dependence on any single region, is a direct response to these geopolitical risks.

- Global infrastructure spending remains robust, with a projected 5.3% growth in 2024, according to IHS Markit, benefiting companies like STEC.

- However, geopolitical tensions, particularly in regions where STEC operates, can disrupt project timelines and increase operational costs by an estimated 10-15% due to security and logistical challenges.

- STEC reported that overseas contracts constituted 65% of its new contract value in the first half of 2024, highlighting its international exposure and vulnerability to global political shifts.

- Trade agreements and sanctions, such as those affecting steel imports, can directly impact STEC's material procurement, potentially leading to price fluctuations exceeding 5% for key construction components.

Government policies are increasingly prioritizing green and low-carbon transformations within the construction industry, directly benefiting Shanghai Tunnel Engineering Co Ltd (STEC). New action plans released for 2024-2025 specifically target energy conservation and carbon emission reductions, mandating more sustainable practices and rigorous environmental impact assessments for construction projects. This regulatory push aligns perfectly with STEC's expertise in environmental engineering, creating a supportive landscape for its green development initiatives.

These new environmental regulations are not just guidelines; they are becoming integral to project approvals and operational standards. For instance, by 2025, a significant portion of new construction projects are expected to incorporate advanced energy-efficient materials and technologies, a field where STEC has been investing heavily. The emphasis on stricter environmental impact assessments means that companies like STEC, with established green credentials, are better positioned to secure contracts and navigate the evolving regulatory environment.

Geopolitical stability and trade relations significantly impact Shanghai Tunnel Engineering Co Ltd (STEC). While China's government prioritizes domestic infrastructure development, global political landscapes, especially US-China trade dynamics, create volatility for international ventures and supply chains. STEC's expanding global footprint, with overseas projects representing a substantial portion of new contracts in 2024, demands strategic management of these external political factors.

| Policy Area | 2024-2025 Data/Target | Impact on STEC |

|---|---|---|

| Green Infrastructure Funding | Projected ¥500 billion | Increased opportunities for STEC's green construction services. |

| Construction Carbon Reduction | Target: 15% decrease by end of 2025 | Favors STEC's investment in sustainable technologies and practices. |

| Environmental Impact Assessments | Required for >70% of large projects | STEC's compliance and expertise in this area are advantageous for contract acquisition. |

| Recycled Material Use | Target: 30% recycled content by 2025 | STEC can leverage its supply chain for compliant materials. |

What is included in the product

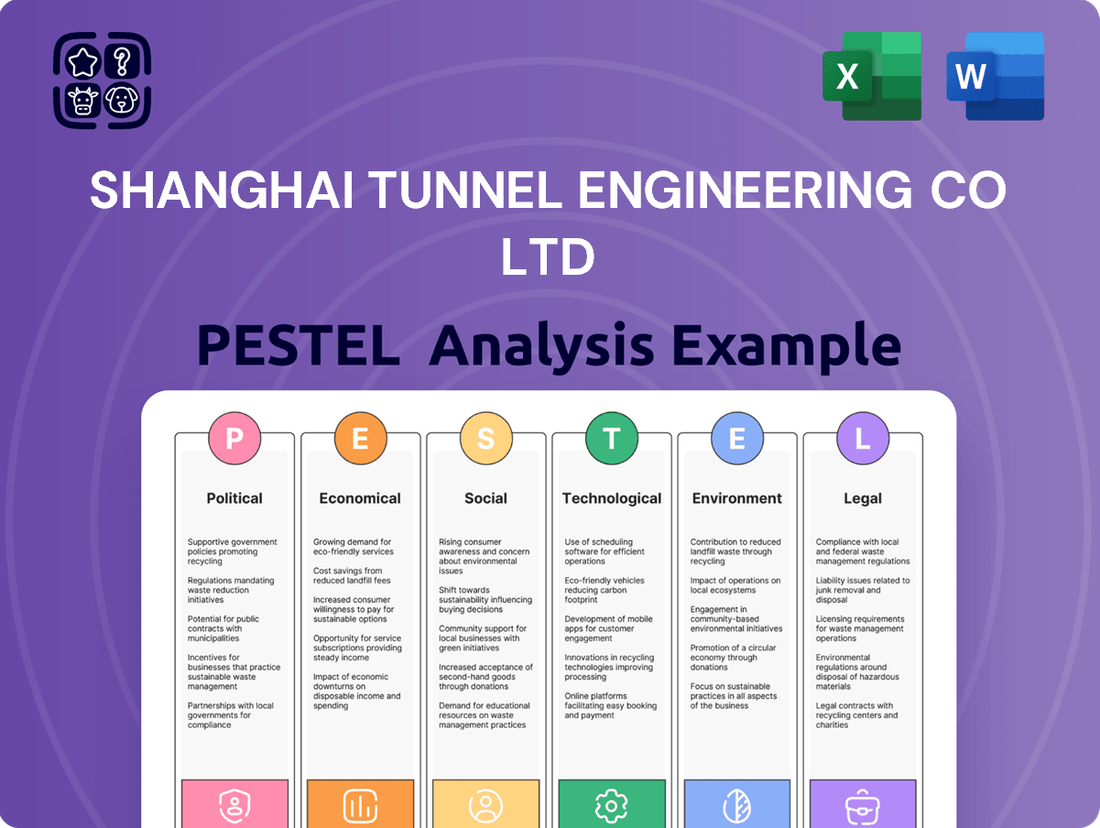

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Shanghai Tunnel Engineering Co Ltd, providing a comprehensive overview of its operating environment.

It highlights how shifts in global and domestic policies, economic conditions, societal trends, technological advancements, environmental regulations, and legal frameworks present both challenges and strategic opportunities for the company.

This PESTLE analysis of Shanghai Tunnel Engineering Co., Ltd. serves as a vital pain point reliever by offering a clear, summarized overview of external factors impacting the business, enabling swift decision-making and strategic alignment for stakeholders.

It functions as a pain point reliever by providing easily digestible insights into the political, economic, social, technological, legal, and environmental landscape, helping to proactively address potential challenges and capitalize on opportunities.

Economic factors

China's commitment to infrastructure development remains strong, with projections indicating continued investment growth through 2025, even as the real estate sector experiences a slowdown. This sustained push is largely aimed at fulfilling objectives set by the 14th Five-Year Plan, which emphasizes modernization and connectivity.

The government's strategic use of financial tools, such as the issuance of ultra-long special treasury bonds, is a key driver for this infrastructure spending. These bonds are designed to fund long-term projects, providing a stable and significant capital source for the sector.

For Shanghai Tunnel Engineering Co Ltd (STEC), this robust domestic market is a significant advantage. The ongoing government support and substantial funding allocated to infrastructure projects create a consistent demand for STEC's specialized tunneling and engineering services.

In fact, China's fixed-asset investment in infrastructure saw a notable increase, with a growth rate of 7.2% year-on-year in the first eleven months of 2024, according to the National Bureau of Statistics. This trend is expected to continue into 2025, directly benefiting companies like STEC.

The global smart infrastructure market is on a significant upward trajectory, with projections indicating it will reach a staggering $1.5 trillion by 2030. This growth is underpinned by a compound annual growth rate (CAGR) of 21.3% starting from 2024. This robust expansion is primarily fueled by increasing urbanization worldwide and the accelerating pace of digital transformation across various sectors.

This overarching global trend presents Shanghai Tunnel Engineering Co Ltd (STEC) with substantial avenues for international growth. The demand for advanced infrastructure solutions, particularly in the realm of smart city development and sustainable urban planning, is creating fertile ground for companies like STEC to expand their operations and expertise globally.

China's residential real estate market is experiencing a slowdown, with subdued housing demand and increasing developer debt. This sluggishness acts as a constraint on fixed asset investment across the nation.

While Shanghai Tunnel Engineering Co Ltd (STEC) primarily operates in infrastructure, a protracted downturn in the broader construction industry could still present indirect challenges to its municipal engineering and real estate development activities.

For instance, in early 2024, new home prices in many major Chinese cities continued to decline, reflecting weak buyer sentiment. This environment can lead to reduced overall construction project pipelines, potentially affecting STEC's sub-contracting opportunities or the demand for its development services.

Economic Growth and Domestic Demand

China's economic growth, though navigating some headwinds, is being actively bolstered by government initiatives aimed at boosting domestic demand. These efforts, including significant investment in new urbanization projects, are designed to spur internal consumption and investment, creating a more robust economic landscape for Shanghai Tunnel Engineering Co Ltd (STEC). For instance, China's GDP growth was projected to be around 5.0% in 2024, a figure that underscores the government's commitment to economic stability and expansion.

STEC directly benefits from this focus on expanding internal consumption and investment. The emphasis on urban infrastructure development, a core area for STEC, is particularly advantageous. This includes projects related to transportation networks and utilities, which are critical components of urbanization strategies.

- China's GDP Growth: Projected at approximately 5.0% for 2024, reflecting ongoing economic expansion.

- Urbanization Initiatives: Government-led programs are a key driver for infrastructure development.

- Domestic Demand Stimulation: Policies are in place to encourage consumer spending and internal investment.

- Infrastructure Investment: Significant capital is being allocated to transportation and utility projects, directly supporting STEC's core business.

Access to Funding and Financing

The availability of government investment funds and the issuance of special treasury bonds are vital for financing large-scale infrastructure projects, directly impacting companies like Shanghai Tunnel Engineering Co Ltd (STEC). For instance, China's 2024 government budget allocated significant funds to infrastructure development, aiming to stimulate economic growth. STEC's success in securing major contracts is intrinsically tied to its ability to access these government-backed financing mechanisms.

Competition for these crucial funding resources is a constant factor, influencing the project pipeline for STEC. The potential for increased private sector participation in infrastructure projects, a trend gaining momentum in 2024 and projected to continue into 2025, also shapes the financing landscape. This can create both opportunities and challenges for STEC as it navigates the competitive environment for capital.

- Government Investment: China's proactive fiscal policy in 2024 has emphasized infrastructure spending, with specific allocations to support national development projects.

- Special Treasury Bonds: The issuance of special treasury bonds provides a key avenue for funding large-scale, long-term infrastructure initiatives, directly benefiting entities like STEC.

- Private Sector Involvement: Growing interest from private investors in infrastructure projects, encouraged by favorable policies in 2024-2025, offers alternative financing channels but also intensifies competition for project acquisition.

- Financing Dependence: STEC's project acquisition strategy relies heavily on the availability and terms of these governmental and quasi-governmental financing instruments.

China's economic trajectory, with a projected GDP growth of around 5.0% for 2024, continues to fuel significant infrastructure investment. Government initiatives, including the issuance of ultra-long special treasury bonds, are directing substantial capital towards projects aligned with the 14th Five-Year Plan, benefiting companies like Shanghai Tunnel Engineering Co Ltd (STEC). This robust domestic market, supported by policies aimed at stimulating internal consumption and urbanization, provides a strong foundation for STEC's specialized services.

| Economic Factor | 2024 Data/Projection | Impact on STEC |

|---|---|---|

| China GDP Growth | ~5.0% (projected) | Supports overall economic activity and demand for infrastructure. |

| Infrastructure Investment Growth | 7.2% YoY (Jan-Nov 2024) | Directly increases demand for STEC's core services. |

| Ultra-long Special Treasury Bonds | Key financing tool for long-term projects | Provides stable capital for large-scale infrastructure development STEC undertakes. |

| Real Estate Market Slowdown | Subdued demand, declining prices in major cities | Potential indirect impact on municipal engineering and development activities. |

What You See Is What You Get

Shanghai Tunnel Engineering Co Ltd PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shanghai Tunnel Engineering Co. Ltd., covers political stability in China, economic growth impacting infrastructure spending, and social trends favoring urbanization. You'll also find an in-depth look at technological advancements in tunneling, environmental regulations affecting construction, and legal frameworks governing large-scale projects.

Sociological factors

China's relentless urbanization, with an estimated 67% of its population residing in urban areas by the end of 2024, is a significant driver for Shanghai Tunnel Engineering Co Ltd (STEC). This demographic trend fuels a continuous need for sophisticated urban infrastructure, including extensive subway systems and tunnels.

The sheer scale of urban development in China means that STEC's core competencies in underground engineering are in high demand. As cities expand, the requirement for efficient transportation networks and integrated underground spaces, which are STEC's specialties, grows exponentially.

For instance, the Beijing-Shanghai High-Speed Railway, a project STEC was involved in, highlights the kind of large-scale infrastructure development that urbanization necessitates. Such projects are critical for connecting burgeoning urban centers and supporting economic activity.

The ongoing migration from rural to urban areas presents STEC with consistent opportunities. By 2025, it's projected that China's urban population will continue to increase, further bolstering the demand for the company's specialized construction services.

As urban centers like Shanghai continue to expand, citizens increasingly expect a higher quality of life. This translates into a growing demand for advanced public services, efficient and comfortable transportation networks, and environmentally friendly living spaces. Shanghai Tunnel Engineering Co Ltd (STEC) is well-positioned to meet these evolving needs.

This societal shift directly fuels demand for STEC's expertise in developing smart transportation systems, which are crucial for reducing congestion and improving commuter experiences. Furthermore, there's a growing need for sophisticated sanitation solutions and the implementation of green infrastructure projects, areas where STEC can leverage its engineering capabilities.

For instance, Shanghai's ongoing efforts to enhance its urban environment, including its commitment to sustainable development goals, directly align with STEC's project portfolio. The company's involvement in large-scale infrastructure projects, often valued in the billions of dollars, directly contributes to these quality-of-life improvements, reflecting a significant market opportunity.

Public acceptance is a significant factor for Shanghai Tunnel Engineering Co Ltd (STEC) as it undertakes vast infrastructure initiatives like tunnels and metro systems. The smooth progress of these projects hinges on gaining community buy-in and ensuring disruptions are kept to a minimum. For instance, in 2024, public consultation phases for new urban rail extensions across major Chinese cities, where STEC is a key player, often involve addressing localized concerns about noise pollution and traffic diversions, which can impact project timelines if not managed effectively.

Effectively managing public perception and proactively addressing community worries, particularly concerning environmental effects or potential resident displacement, is paramount for STEC. This proactive approach is vital for maintaining social license to operate and ensuring projects proceed without significant delays or opposition. Reports from 2023 indicated that projects with robust community engagement strategies saw an average of 15% faster regulatory approval compared to those with less public involvement, highlighting the tangible benefits of prioritizing social acceptance.

Labor Availability and Skills

The construction sector, particularly specialized areas like underground engineering, fundamentally depends on a readily available pool of skilled labor. Shanghai Tunnel Engineering Co Ltd (STEC) is directly affected by shifts in this labor market.

Sociological trends within China are actively shaping labor dynamics. For instance, ongoing urbanization and internal migration patterns influence where workers are available, potentially concentrating talent in certain regions while creating shortages elsewhere. The emphasis on vocational training and the evolving attitudes towards manual labor also play a crucial role in the pipeline of future skilled workers for STEC's complex projects.

Furthermore, China's demographic shifts, including an aging workforce, present a significant challenge. As experienced workers retire, STEC faces the task of not only replacing them but also ensuring knowledge transfer to younger generations. This demographic trend can lead to increased labor costs and potential delays if specialized skills become scarce.

- Labor Migration: China's internal migration continues, with millions moving to urban centers, impacting labor availability in different regions.

- Vocational Training Focus: Government initiatives and societal shifts are increasingly promoting vocational education, aiming to bolster skilled trades.

- Aging Workforce: By the end of 2023, China's population aged 60 and above reached over 290 million, indicating a growing proportion of older workers.

- Skill Gaps: Despite efforts, specific high-demand construction skills can still face shortages, affecting project execution and costs for companies like STEC.

Safety and Social Responsibility

Shanghai Tunnel Engineering Co Ltd (STEC) operates within a landscape where societal expectations regarding safety and corporate social responsibility (CSR) are increasingly prominent. This heightened awareness directly impacts construction methodologies, demanding rigorous adherence to safety protocols. For STEC, a company involved in complex underground projects, demonstrating a strong commitment to worker well-being is not merely a regulatory requirement but a critical factor in maintaining its reputation and competitiveness. For example, in 2023, the global construction industry reported a lost-time injury frequency rate of approximately 2.5 per million hours worked, underscoring the inherent risks and the need for robust safety management systems like those STEC must implement.

Meeting these expectations involves significant investment in training, advanced safety equipment, and transparent reporting. STEC’s ability to showcase its dedication to CSR, including environmental stewardship and community engagement, influences its social license to operate and its capacity to secure new contracts. A positive track record in these areas can differentiate STEC from competitors, particularly in public infrastructure projects where accountability is paramount.

Key considerations for STEC include:

- Adherence to evolving safety regulations: STEC must continuously update its safety procedures to align with national and international best practices, particularly in light of increasing global scrutiny on workplace safety.

- Investment in safety technology: Implementing advanced monitoring systems and protective gear for workers in hazardous underground environments is crucial.

- Demonstrating CSR initiatives: Publicly showcasing ethical labor practices, community investment programs, and environmental protection efforts enhances STEC’s corporate image.

- Transparency in reporting: Openly communicating safety performance data and CSR activities builds trust with stakeholders and regulatory bodies.

Societal expectations around quality of life and environmental sustainability are increasingly influencing infrastructure development in China. STEC must align its projects with these evolving demands, focusing on efficient transportation and green urban solutions. For instance, China's commitment to carbon neutrality by 2060 necessitates innovative approaches to construction that minimize environmental impact.

Public perception and acceptance are critical for STEC's large-scale underground projects. Effective community engagement and transparent communication about project benefits and potential disruptions are vital for securing social license to operate. Successfully navigating these social dynamics can significantly streamline project approvals and execution.

The availability and skill level of the workforce are directly impacted by sociological trends, including urbanization and vocational training initiatives. STEC needs to address potential skill gaps and the challenges posed by an aging workforce through strategic recruitment and knowledge transfer programs. By 2025, China's focus on upskilling its labor force is expected to provide a more robust talent pool for specialized construction roles.

Technological factors

The tunneling sector is experiencing rapid technological evolution, especially with Tunnel Boring Machines (TBMs) and sophisticated support systems. These advancements, integrating AI and live data, are boosting excavation efficiency, safety, and accuracy, presenting Shanghai Tunnel Engineering Co Ltd (STEC) with chances to deploy state-of-the-art methods for challenging infrastructure tasks.

The global push towards smart cities, fueled by advancements in the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics, creates substantial avenues for Shanghai Tunnel Engineering Co Ltd (STEC). This trend is particularly pronounced in China, with significant government investment in smart city initiatives. For instance, by the end of 2023, China had over 300 smart city pilot projects underway, aiming to improve urban management and citizen services.

STEC is well-positioned to embed smart technologies within its infrastructure projects. This includes implementing intelligent traffic management systems to optimize urban flow, deploying energy-efficient solutions for reduced environmental impact, and integrating digital governance platforms to enhance urban operational efficiency. These smart integrations can significantly boost the sustainability and livability of the cities STEC helps build.

The company's expertise in large-scale infrastructure development, such as tunnels and underground spaces, can be leveraged to create the foundational digital infrastructure required for smart cities. This could involve incorporating sensor networks for real-time data collection, high-speed communication networks, and robust data processing capabilities directly into the physical structures. The global smart city market was valued at approximately $1.8 trillion in 2023 and is projected to grow considerably, offering a vast market for STEC’s integrated solutions.

Building Information Modeling (BIM) and digital twins are revolutionizing how infrastructure projects are managed. These technologies offer enhanced planning, visualization, and real-time monitoring capabilities, leading to more efficient construction processes. For Shanghai Tunnel Engineering Co Ltd (STEC), this means improved design accuracy and better collaboration among all parties involved.

The global construction market for BIM is projected to reach $14.7 billion by 2027, demonstrating its growing importance. STEC can utilize BIM to create detailed 3D models, enabling precise clash detection and reducing costly rework during construction. This digital approach also facilitates better communication and data sharing among architects, engineers, and contractors, streamlining project delivery.

Automation and Robotics in Construction

Automation and robotics are significantly reshaping the construction landscape, offering tangible benefits for companies like Shanghai Tunnel Engineering Co Ltd (STEC). By integrating these advanced technologies, STEC can expect improvements in worker safety, a reduction in overall labor expenses, and a notable acceleration of project completion times. This technological shift is particularly impactful for intricate underground endeavors.

For complex underground projects, robotic systems can provide STEC with a distinct competitive edge. These applications are proving invaluable in areas such as automated excavation, precision surveying, and crucial maintenance tasks. The adoption of robotics directly translates to enhanced operational efficiency and a stronger market position.

- Safety Enhancements: Robotics can perform hazardous tasks, reducing human exposure to risks in underground environments.

- Cost Reduction: Automation lowers reliance on manual labor, potentially decreasing labor costs by 20-30% in certain automated processes.

- Project Acceleration: Robotic systems can operate continuously and with greater precision, speeding up excavation and construction phases by up to 15%.

- Efficiency Gains: Automated surveying and monitoring provide real-time data, improving decision-making and resource allocation.

New Energy and Environmental Engineering Technologies

Shanghai Tunnel Engineering Co Ltd (STEC) can leverage advancements in new energy and environmental engineering technologies to expand its reach. Innovations in waste-to-energy solutions, for instance, offer a pathway to tap into China's growing focus on circular economy principles. In 2023, China's renewable energy sector saw significant growth, with installed capacity for solar and wind power reaching new heights, creating opportunities for STEC's involvement in related infrastructure projects.

Further technological integration in carbon capture, utilization, and storage (CCUS) presents another avenue for STEC. As China aims for carbon neutrality by 2060, demand for CCUS technologies in industrial processes and infrastructure development is expected to rise. STEC's expertise in large-scale construction projects could be applied to the development of CCUS facilities.

The adoption of sustainable building materials, such as advanced composites and recycled aggregates, also aligns with national environmental objectives. STEC's engagement with these materials can enhance the sustainability profile of its projects. For example, the construction industry in China is increasingly adopting green building standards, with a growing market for eco-friendly materials, projected to reach significant value by 2025.

- Waste-to-Energy: Growing market in China driven by environmental policies and urban waste management needs.

- Carbon Capture Technologies: Essential for achieving China's carbon reduction targets, creating demand for specialized engineering services.

- Sustainable Building Materials: Increasing adoption in infrastructure projects to meet green building certifications and reduce environmental impact.

Advancements in Tunnel Boring Machines (TBMs) and automated excavation technologies are significantly enhancing STEC's operational efficiency and safety. The integration of AI and real-time data analytics in these systems allows for more precise and faster tunnel construction, critical for complex urban infrastructure projects. STEC's investment in these cutting-edge tools positions it to handle demanding projects effectively.

The increasing adoption of Building Information Modeling (BIM) and digital twins is revolutionizing project planning and execution for STEC. These digital tools improve design accuracy, facilitate better collaboration among stakeholders, and enable real-time monitoring, leading to reduced costs and faster project completion. The global BIM market was projected to reach $14.7 billion by 2027, highlighting its growing importance.

Automation and robotics are transforming the construction industry, offering STEC improved worker safety and reduced labor costs. Robotic systems are proving invaluable in precision surveying, automated excavation, and crucial maintenance tasks, directly boosting operational efficiency and providing a competitive edge. Automation can potentially lower labor costs by 20-30% in specific processes.

Legal factors

Shanghai Tunnel Engineering Co Ltd (STEC) navigates a robust legal landscape in China, heavily influenced by regulations like the Civil Code, the Bidding Law, and the Construction Law. These foundational laws dictate everything from project execution to how contracts are secured, making strict compliance essential for STEC's operations and project viability.

The Bidding Law, for instance, mandates fair and transparent tendering processes, directly impacting how STEC wins new projects. In 2023, China's infrastructure investment continued its upward trajectory, with the National Development and Reform Commission approving numerous major projects, underscoring the importance of STEC's ability to effectively participate in and win these competitive bids under the established legal framework.

China's commitment to environmental protection has significantly ramped up, leading to more stringent regulations and the introduction of carbon-neutral construction standards. Shanghai Tunnel Engineering Co Ltd (STEC) is directly impacted by these evolving environmental policies.

STEC must ensure strict adherence to China's revised Environmental Protection Laws. This includes conducting comprehensive environmental impact assessments for all new projects to mitigate potential ecological damage and identify sustainable solutions.

The company is also increasingly expected to integrate green building materials and innovative, eco-friendly construction practices into its operations. This shift is driven by national directives aiming to reduce the carbon footprint of infrastructure development, a trend gaining momentum through 2024 and projected to intensify into 2025.

Shanghai Tunnel Engineering Co. Ltd. (STEC) operates within a framework where China's nationwide enforcement of labor regulations, such as the 'Regulation on Wage Payment for Migrant Workers,' directly influences its operations. This means STEC must adhere to strict rules regarding timely salary disbursements to its workforce, particularly migrant laborers who form a significant part of the construction sector.

These laws impose a critical responsibility on developers, including STEC, to ensure that subcontractors also meet their wage obligations. Failure to do so can lead to substantial penalties and legal repercussions, directly impacting project costs and STEC's overall financial exposure. For instance, in 2023, reports indicated an increased focus on labor payment disputes in the construction sector, underscoring the importance of diligent compliance.

International Project Regulations and Compliance

Shanghai Tunnel Engineering Co Ltd (STEC) must meticulously adhere to a complex web of international project regulations and compliance standards across its global footprint. This involves understanding and upholding varied legal frameworks in each host nation, from building codes to contractual obligations.

Navigating these diverse legal landscapes is critical for STEC's risk mitigation and operational success. For instance, compliance with differing labor laws, such as those in the Middle East concerning expatriate worker rights, or adhering to stringent environmental protection mandates in European Union countries, directly impacts project timelines and costs. In 2023, STEC's international revenue accounted for a significant portion of its total, underscoring the importance of robust compliance strategies.

- Local Construction Laws: STEC must comply with specific building codes, zoning regulations, and permitting processes in each country where it operates, ensuring projects meet all safety and quality standards.

- Labor Standards: Adherence to local labor laws, including wage requirements, working hours, health and safety protocols, and provisions for foreign workers, is paramount.

- Environmental Regulations: Compliance with environmental impact assessments, pollution control measures, and waste management regulations is essential to avoid penalties and maintain a positive reputation.

- International Trade Agreements: Understanding and complying with international trade pacts and sanctions can affect material sourcing, equipment import, and overall project financing.

Contract Law and Dispute Resolution

Shanghai Tunnel Engineering Co Ltd (STEC), as a major player in the construction industry, navigates a complex web of contracts. These agreements with clients, subcontractors, and suppliers are the bedrock of its operations, making a deep understanding of contract law essential. STEC’s success hinges on its ability to meticulously draft, interpret, and enforce these contracts, covering everything from project scope to payment terms and liability clauses.

The company's engagement in international projects means it must be proficient in diverse legal frameworks, including common law and civil law systems. For instance, in 2024, STEC secured a significant infrastructure project in Southeast Asia, requiring adherence to local contract regulations and international arbitration standards. This global reach necessitates robust legal teams capable of managing cross-border contractual obligations and potential disputes.

Effective dispute resolution is paramount for STEC. The company relies on a multi-pronged approach, often favoring negotiation and mediation to resolve disagreements amicably and efficiently. However, when necessary, STEC is prepared to engage in arbitration or litigation to protect its interests. The sheer volume of contracts, estimated to be in the thousands annually, underscores the critical importance of these legal safeguards.

- Contractual Compliance: STEC ensures all contracts align with Chinese Contract Law and relevant international conventions, minimizing legal vulnerabilities.

- International Operations: In 2023, STEC’s overseas projects accounted for approximately 35% of its revenue, highlighting the need for expertise in foreign contract laws.

- Dispute Management: The company prioritizes alternative dispute resolution (ADR) methods, aiming to resolve over 80% of its contractual disagreements outside of formal court proceedings.

- Risk Mitigation: Robust contract review processes are in place to identify and mitigate potential legal risks associated with project execution and financial commitments.

Shanghai Tunnel Engineering Co Ltd (STEC) operates under stringent Chinese labor laws, including the Regulation on Wage Payment for Migrant Workers, ensuring timely salary disbursement to its workforce. The company is also accountable for subcontractors' wage compliance, facing penalties for failures, as evidenced by increased labor payment dispute focus in 2023.

STEC's international presence necessitates adherence to diverse foreign labor standards, impacting project timelines and costs, as seen in its significant overseas revenue in 2023. Compliance with local building codes, zoning, and permitting is crucial for project safety and quality across all operational regions.

Environmental factors

Global concern over climate change is intensifying, directly influencing infrastructure development. China's ambitious targets for carbon peaking by 2030 and carbon neutrality by 2060 are significant drivers for this shift, creating substantial opportunities for companies like Shanghai Tunnel Engineering Co Ltd (STEC).

STEC's capabilities in green and low-carbon engineering are becoming increasingly crucial in this evolving landscape. The company's involvement in renewable energy projects, such as wind and solar farms, and its contributions to sustainable urban development align perfectly with these national and global environmental goals.

In 2023, China's investment in green infrastructure saw robust growth, with renewable energy capacity, particularly solar and wind, expanding significantly. This trend is expected to continue through 2024 and 2025, directly benefiting STEC's focus on sustainable solutions.

Shanghai Tunnel Engineering Co Ltd (STEC) operates within a construction sector increasingly scrutinized for its environmental footprint. Globally, and particularly in China, there's a growing mandate to enhance resource efficiency and minimize construction waste. This pressure stems from both regulatory bodies and a heightened public awareness of sustainability.

STEC can proactively address these environmental factors by integrating circular economy principles into its operations. This involves prioritizing the reuse and recycling of construction materials, thereby reducing the demand for virgin resources. For instance, adopting practices that allow for the recovery and repurposing of excavated soil or demolition debris can significantly cut down landfill waste.

The company's commitment to utilizing eco-friendly materials, such as recycled aggregates or lower-carbon concrete alternatives, also plays a crucial role. Furthermore, implementing robust waste management plans at project sites, including segregation and proper disposal protocols, is essential. These efforts directly support the objectives outlined in China's 'Circular Economy Promotion Law,' which aims to foster a more sustainable economic model.

Data from 2023 indicates that the construction industry in China generated a substantial volume of solid waste. STEC's strategic adoption of waste reduction techniques and material circularity can lead to cost savings through reduced disposal fees and potentially lower material procurement costs, while also enhancing its corporate social responsibility profile.

Environmental Impact Assessments (EIAs) are increasingly crucial for Shanghai Tunnel Engineering Co Ltd (STEC). New regulations in 2024 and 2025 mandate thorough EIAs for all major construction, especially underground projects like those STEC undertakes. This means STEC must meticulously demonstrate how its activities will minimize disruption to ecosystems, effectively manage soil and water resources, and meet stringent air and noise pollution limits. For example, a significant project in a sensitive urban area would require detailed plans for dust suppression, dewatering management, and waste disposal, with compliance often verified through independent audits.

Green Building and Low-Carbon Construction

China's increasing emphasis on green building standards and ultra-low energy consumption structures, a trend accelerating into 2024 and 2025, presents a significant dynamic for Shanghai Tunnel Engineering Co Ltd (STEC). This focus aims to curb carbon emissions in the construction sector, a major contributor to environmental impact. STEC can leverage this by developing expertise in sustainable construction methods and materials.

By specializing in environmentally friendly building practices, STEC can secure a competitive edge, aligning with national decarbonization goals. Integrating energy-efficient designs, such as advanced insulation, smart HVAC systems, and renewable energy sources, will be crucial. For instance, by 2025, China aims for 60% of new buildings nationwide to be green buildings, with a focus on energy efficiency, a target that directly impacts construction companies like STEC.

- Green Building Mandates: China's 14th Five-Year Plan (2021-2025) prioritizes energy efficiency and emissions reduction in the construction industry, with specific targets for green building adoption.

- Market Growth: The green building market in China is projected to grow significantly, offering substantial opportunities for companies equipped with the necessary expertise and technology.

- Carbon Footprint Reduction: STEC's adoption of low-carbon construction techniques directly contributes to China's broader climate objectives, enhancing its corporate social responsibility profile.

Urban Ecological Restoration and Environmental Engineering

Shanghai Tunnel Engineering Co. Ltd. (STEC) is increasingly involved in urban ecological restoration and environmental engineering, addressing critical challenges like water pollution, waste treatment, and land remediation. This expansion moves beyond traditional infrastructure development and taps into China's strong national focus on environmental protection. For instance, the 'Beautiful China Initiative,' launched in 2012 and continually reinforced, prioritizes ecological civilization and sustainable development, creating significant market opportunities for companies like STEC. The demand for ecological protection in urban areas is soaring, with significant investment allocated to improving environmental quality.

STEC's environmental engineering capabilities directly support the goals of the Beautiful China Initiative, which aims to create a healthier and more sustainable urban environment. This focus is reflected in substantial government spending. In 2023, China's environmental protection industry revenue was estimated to reach over 1.1 trillion yuan, with urban environmental infrastructure projects forming a significant portion of this. STEC's participation in these projects is strategically aligned with national policy and market trends, positioning them to capitalize on the ongoing urbanization and the associated need for advanced environmental solutions.

- Urban Ecological Challenges: STEC addresses water pollution, waste treatment, and land remediation in urban settings.

- National Policy Alignment: Operations align with China's 'Beautiful China Initiative' promoting ecological protection.

- Market Demand: Growing demand for ecological restoration in urban areas presents significant business opportunities.

- Industry Growth: China's environmental protection industry saw revenue exceeding 1.1 trillion yuan in 2023, indicating robust market growth.

China's stringent environmental regulations, particularly those concerning carbon emissions and waste management, are shaping the construction landscape for STEC. The nation's commitment to achieving peak carbon emissions by 2030 and carbon neutrality by 2060 means companies like STEC must prioritize sustainable practices and green technologies in their projects. This regulatory push is driving innovation and creating a market for eco-friendly construction solutions.

STEC's proactive engagement in green building standards and its focus on reducing the environmental footprint of its operations are key to navigating these evolving regulations. The company's ability to adapt to stricter Environmental Impact Assessment requirements and integrate circular economy principles will be crucial for its continued success and compliance through 2024 and 2025.

The increasing investment in urban ecological restoration and environmental engineering projects, fueled by initiatives like the Beautiful China Initiative, presents substantial growth opportunities for STEC. By aligning its expertise with these national environmental protection goals, STEC is well-positioned to capitalize on the demand for sustainable urban development and environmental remediation solutions.

| Environmental Factor | Impact on STEC | 2024/2025 Outlook |

|---|---|---|

| Carbon Neutrality Goals | Drives demand for low-carbon construction methods and materials. | Increased investment in renewable energy infrastructure projects. |

| Green Building Mandates | Requires STEC to adopt energy-efficient designs and sustainable materials. | Projected 60% of new buildings in China to be green by 2025. |

| Waste Management Regulations | Necessitates STEC's adoption of circular economy principles and waste reduction. | Potential cost savings from reduced disposal fees and enhanced CSR profile. |

| Ecological Restoration Demand | Opens opportunities in urban environmental engineering and remediation. | China's environmental protection industry revenue exceeded 1.1 trillion yuan in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Shanghai Tunnel Engineering Co Ltd is constructed using data from authoritative government publications, international economic bodies like the World Bank, and reputable industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.