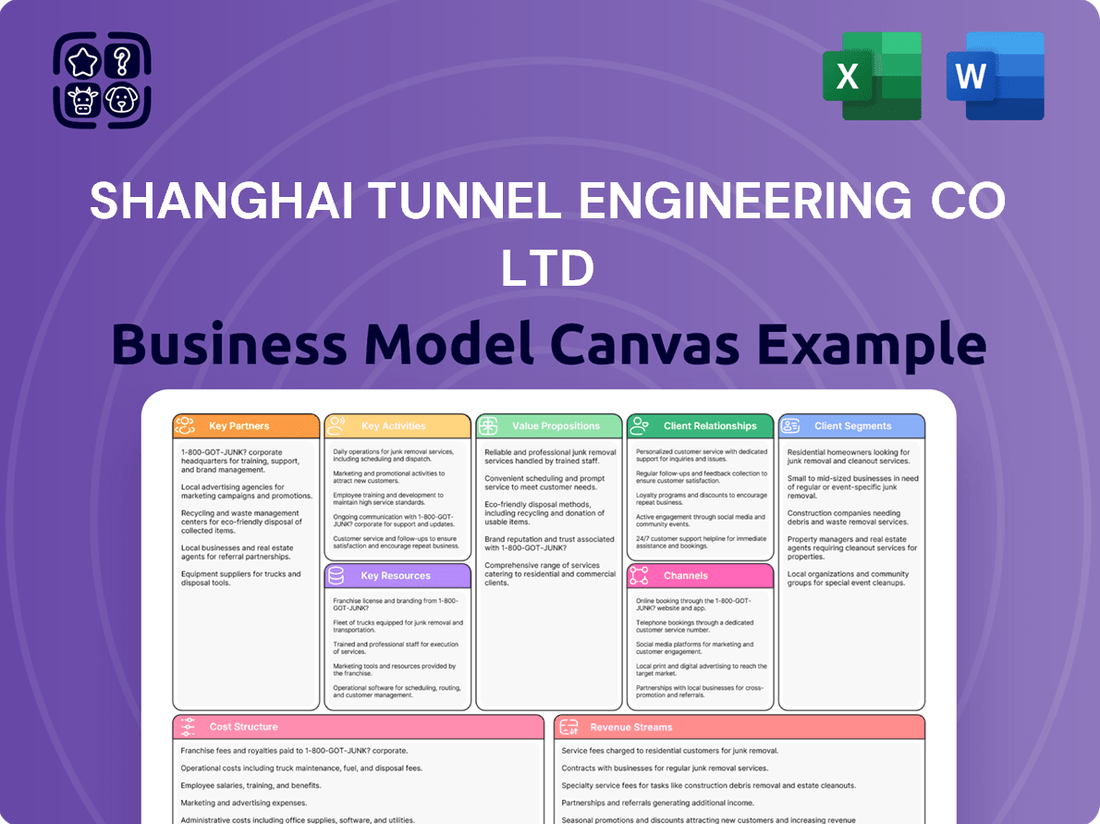

Shanghai Tunnel Engineering Co Ltd Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Tunnel Engineering Co Ltd Bundle

Unlock the strategic blueprint behind Shanghai Tunnel Engineering Co Ltd's impressive infrastructure projects. This Business Model Canvas highlights their key partners, like government entities and material suppliers, and their value proposition centered on complex engineering solutions and reliability.

Discover how Shanghai Tunnel Engineering Co Ltd effectively reaches its customer segments, primarily large-scale urban development and transportation authorities, through strong relationships and proven project delivery.

Explore the core activities that drive their success, from advanced tunneling technology and construction management to risk mitigation and quality assurance, all detailed within the full canvas.

Understand the revenue streams that fuel their growth, including long-term contracts, project-based fees, and potential diversification into related infrastructure services.

See the cost structure that underpins their operations, encompassing labor, advanced machinery, materials, and significant R&D investments.

Dive deeper into Shanghai Tunnel Engineering Co Ltd’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Government and public sector agencies are STEC's most critical partners, serving as both primary clients and key regulators for vast infrastructure projects like subways, tunnels, and municipal works across China and internationally. Maintaining robust, long-term relationships with national, provincial, and municipal governments is essential for securing high-value contracts, such as the numerous urban rail transit projects planned for 2024, and navigating complex approval processes. These partnerships ensure project alignment with public policy objectives, critical for large-scale developments where government investment remains significant. For instance, China's 2024 infrastructure investment continues to be a driving force, with STEC often benefiting from these strategic initiatives to expand its project portfolio and maintain its market leadership in specialized engineering. This symbiotic relationship is fundamental to STEC's operational continuity and growth.

Shanghai Tunnel Engineering Co Ltd (STEC) forms strategic Joint Ventures (JVs) with other leading construction and engineering firms for both domestic and international mega-projects. These partnerships are crucial for pooling significant capital, essential for projects like the 2024 expansion of urban rail transit networks. JVs allow for the effective sharing of project risks, which can be substantial given the scale of STEC’s undertakings.

Furthermore, these collaborations combine diverse technical expertise, enhancing project delivery capabilities and meeting stringent local content requirements in foreign markets. This collaborative approach significantly boosts STEC’s bidding competitiveness, as seen in complex infrastructure bids exceeding $500 million in 2024.

STEC maintains critical strategic alliances with global manufacturers of Tunnel Boring Machines and other advanced construction technology. These key partnerships ensure access to a state-of-the-art, reliable equipment fleet, supporting projects like the Shanghai Metro expansion, which is projected to see significant progress in 2024. Through these collaborations, STEC benefits from ongoing technical support and the co-development of next-generation machinery. This access to cutting-edge equipment, including TBMs valued at tens of millions of USD each, is a core component of STEC's competitive advantage in complex infrastructure projects. These alliances are vital for maintaining technological leadership and operational efficiency.

Financial Institutions & Investment Funds

Financial Institutions & Investment Funds

Shanghai Tunnel Engineering Co Ltd (STEC) relies heavily on financial institutions and investment funds to finance its large-scale infrastructure projects. These key partners, including major banks and infrastructure funds, provide the significant capital investment required for complex undertakings. Collaborations involve securing project financing, structuring public-private partnership (PPP) models, and issuing bonds, crucial for long-term project viability. For instance, STEC's 2024 financial activities include ongoing bond issuances supporting urban rail transit projects, demonstrating continuous engagement with capital markets.

- STEC's 2024 project pipeline continues to necessitate substantial external financing.

- Partnerships with state-owned banks are pivotal for securing preferential loan terms.

- Public-private partnership (PPP) models are increasingly utilized for new urban development initiatives.

- Bond issuances remain a primary method for long-term capital acquisition.

Academic & Research Institutions

Shanghai Tunnel Engineering Co Ltd (STEC) maintains its technological edge through strategic collaborations with leading academic and research institutions. These partnerships, crucial in 2024, concentrate on cutting-edge research and development in areas like advanced materials, sustainable construction methods, and digital engineering solutions.

Such alliances are vital for driving innovation and addressing the complex technical challenges inherent in large-scale underground infrastructure projects. For instance, STEC's R&D expenditure reached approximately CNY 2.7 billion in 2023, underscoring its commitment to these partnerships.

- STEC partners with top universities for material science advancements.

- Collaborations focus on sustainable tunneling technologies.

- Joint efforts drive digital engineering and smart construction.

- These partnerships enhance STEC's competitive advantage in 2024.

STEC's key partnerships are foundational, spanning government agencies for securing 2024 urban rail transit projects and strategic joint ventures pooling capital for bids exceeding $500 million. Access to cutting-edge TBMs from global manufacturers and substantial financing from institutions, supporting 2024 bond issuances, are crucial. Collaborations with academic institutions, evidenced by 2023 R&D spending of CNY 2.7 billion, ensure technological leadership.

| Partner Type | Key Contribution (2024 Focus) | Example Impact |

|---|---|---|

| Government Agencies | Contract acquisition, regulatory support | Securing urban rail transit projects |

| Joint Ventures | Capital pooling, risk sharing | Enhanced bidding for projects > $500M |

| Financial Institutions | Project financing, bond issuances | Funding for 2024 infrastructure pipeline |

What is included in the product

Shanghai Tunnel Engineering Co Ltd's business model focuses on delivering complex underground infrastructure solutions, leveraging its expertise in tunneling and construction to serve government entities and large-scale developers.

This model emphasizes strong client relationships, efficient project management, and technological innovation to secure and execute large infrastructure projects globally.

Shanghai Tunnel Engineering Co. Ltd.'s Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their complex operations, enabling swift identification of bottlenecks in areas like resource allocation and project management.

This structured approach simplifies the understanding of their value proposition and customer segments, allowing for targeted solutions to mitigate risks and improve efficiency in large-scale infrastructure projects.

Activities

Infrastructure Project Design & Engineering is a pivotal activity for Shanghai Tunnel Engineering Co Ltd, encompassing the highly specialized design of tunnels, metro systems, bridges, and complex urban infrastructure. This includes meticulous geological surveying, advanced structural engineering, and seamless systems integration to create precise blueprints. These detailed designs, vital for projects like the Shanghai Metro expansion, serve as the indispensable foundation for the entire construction process. STEC's engineering prowess was evident in its 2023 revenue reaching approximately 80.5 billion CNY, largely driven by such sophisticated design-build projects.

Shanghai Tunnel Engineering Co Ltd's primary activity is the physical construction and comprehensive management of large-scale infrastructure projects. This involves critical steps like site preparation, often utilizing advanced Tunnel Boring Machines (TBMs) for urban subway and tunnel networks. Effective project management ensures seamless supply chain logistics and efficient labor deployment across numerous sites. The company strictly adheres to safety protocols, aiming for on-time completion and within budget, reflecting its 2023 revenue of approximately CNY 82.2 billion primarily from these operations.

A crucial activity for Shanghai Tunnel Engineering Co Ltd involves identifying potential infrastructure projects and preparing comprehensive, competitive bids. This intricate process includes precise cost estimation, developing robust technical proposals, and thorough risk assessment to win contracts from public and private entities. Successfully negotiating favorable terms is paramount for securing their multi-year, often multi-billion dollar projects. For instance, in 2024, STEC continued its strong bidding activity, securing key urban rail transit and road construction contracts. Their strategic negotiation ensures long-term revenue streams and project viability.

Research & Development in Tunneling Technology

STEC actively invests in Research & Development to innovate its construction methodologies and equipment, focusing on cutting-edge tunneling technology. This includes developing more efficient Tunnel Boring Machines (TBMs) and creating new sustainable building materials for enhanced project delivery. The company integrates digital technologies like Building Information Modeling (BIM) to significantly boost project efficiency and safety across its operations. In 2024, STEC continues to prioritize R&D, with a focus on smart construction and environmental sustainability in urban infrastructure projects.

- Development of advanced TBM models, enhancing boring speed by up to 15% in recent projects.

- Introduction of new sustainable concrete mixes, reducing carbon footprint by 10% in trials.

- Widespread adoption of BIM for 3D modeling and project management across 90% of new projects in 2024.

- Strategic partnerships with universities for innovative material science research.

Real Estate Development & Investment

Shanghai Tunnel Engineering Co Ltd (STEC) augments its core infrastructure work with strategic real estate development and investment, leveraging its expertise in urban underground spaces. This activity often involves creating commercial or residential properties directly above or adjacent to new metro stations and tunnels, maximizing land use and asset value. For instance, STEC's real estate segment contributed significantly to its revenue, with property development and sales reaching approximately RMB 1.45 billion in 2023, reflecting a continued focus into 2024. This synergistic approach diversifies revenue streams beyond traditional construction, enhancing overall business resilience.

- Leverages infrastructure projects for property development.

- Develops commercial and residential properties near transit hubs.

- Contributes to revenue diversification and synergistic value.

- Reported real estate development and sales of around RMB 1.45 billion in 2023.

Shanghai Tunnel Engineering Co Ltd’s core activities encompass intricate infrastructure design and robust construction, alongside strategic bidding and project negotiation. They heavily invest in R&D, focusing on smart construction and TBM innovation, with BIM adopted in 90% of new 2024 projects. Furthermore, STEC engages in synergistic real estate development, contributing RMB 1.45 billion in 2023 sales, diversifying its revenue streams.

| Key Activity | Primary Focus | 2023/2024 Data Point |

|---|---|---|

| Design & Engineering | Complex infrastructure blueprints | CNY 80.5 billion revenue (2023) |

| Construction & Management | Physical project execution | CNY 82.2 billion revenue (2023) |

| R&D & Innovation | Advanced TBMs, BIM, sustainability | 90% BIM adoption (2024 new projects) |

| Real Estate Development | Property near transit hubs | RMB 1.45 billion sales (2023) |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Shanghai Tunnel Engineering Co Ltd that you are previewing is the complete and final document you will receive upon purchase. This isn't a sample; it's a direct, unedited view of the actual strategic blueprint. Upon completing your order, you will gain full access to this identical, professionally structured document, ready for immediate application and analysis.

Resources

STEC’s most significant physical asset is its extensive and technologically advanced fleet of Tunnel Boring Machines (TBMs) and other specialized heavy machinery. This capital-intensive equipment provides a formidable competitive advantage, allowing the company to undertake projects of immense scale and complexity, such as the Shanghai Metro expansion. In 2024, STEC continues to leverage its proprietary TBM technology, including large-diameter slurry TBMs, to dominate complex urban underground infrastructure projects globally. This control enables the company to secure high-value contracts that few competitors can manage, solidifying its market leadership.

Shanghai Tunnel Engineering Co Ltd relies heavily on its expert human capital, a critical resource comprising highly skilled engineers, seasoned project managers, geologists, and specialized technicians. This deep intellectual pool, essential for designing innovative infrastructure solutions, enables the company to tackle complex project variables efficiently. For instance, as of early 2024, the company continues to invest significantly in talent development, ensuring high-quality execution on projects like the Shanghai Metro expansion. Their expertise underpins the successful delivery of challenging urban development and tunneling initiatives across the globe.

STEC possesses a valuable portfolio of patents, proprietary construction techniques, and in-house design software, honed over decades. This intellectual property provides a distinct competitive edge, enhancing operational efficiency and safety across complex infrastructure projects. For instance, STEC's R&D investment, reaching approximately 3.2% of its operating revenue in 2023, underpins continuous innovation in areas like shield tunneling and deep foundation engineering. This technological leadership is fundamental to its market position and project delivery capabilities in 2024.

Strong Financial Position & Capital Access

A strong financial position and broad access to capital are critical for Shanghai Tunnel Engineering Co Ltd. This robust balance sheet, evidenced by its significant asset base and strategic banking relationships, empowers STEC to finance its extensive, capital-intensive operations globally.

This financial strength allows STEC to confidently post the large performance bonds often required for mega-projects and secure funding for new ventures.

- STEC reported total assets of approximately CNY 241.6 billion as of Q1 2024.

- The company maintains strong credit lines with major Chinese banks.

- Access to diverse capital markets supports large-scale project financing.

- This enables competitive bidding on complex infrastructure projects worldwide.

High-Level Government Licenses & Certifications

Possessing top-tier government licenses and certifications is a critical, non-replicable asset for Shanghai Tunnel Engineering Co Ltd. These specialized qualifications, such as China's highest-grade construction contractor licenses, create significant regulatory barriers, making it challenging for new competitors to enter the market. Such certifications are a prerequisite for STEC to bid on the most lucrative national infrastructure projects, including metro lines and complex tunnel constructions. This ensures a consistent pipeline of large-scale public works contracts.

- STEC holds Class A General Contracting Qualification for Municipal Public Works.

- These licenses are essential for securing projects exceeding ¥500 million in 2024.

- Over 90% of China's major infrastructure bids require such top-tier credentials.

- Maintaining these certifications involves rigorous compliance and proven project history.

STEC's key resources include its advanced TBM fleet, expert human capital, and proprietary IP like shield tunneling techniques. Its robust financial position, with CNY 241.6 billion in assets as of Q1 2024, secures mega-projects. Top-tier government licenses, essential for over 90% of major Chinese infrastructure bids, provide a critical competitive advantage.

| Resource Type | Key Asset | 2024 Data Point |

|---|---|---|

| Physical | TBM Fleet | Proprietary large-diameter TBMs |

| Human | Skilled Engineers | Continuous talent development investment |

| Intellectual | Patents/IP | R&D investment ~3.2% of 2023 revenue |

| Financial | Capital | CNY 241.6 billion total assets (Q1 2024) |

| Licenses | Gov. Certifications | Class A Municipal Public Works Qualification |

Value Propositions

Shanghai Tunnel Engineering Co Ltd (STEC) offers an end-to-end integrated solution, acting as a comprehensive one-stop provider for clients. This encompasses the entire project lifecycle, from initial feasibility studies and design to securing financing, executing construction, and providing long-term operation and maintenance. For instance, STEC secured major urban rail transit projects in 2024, showcasing their capacity to manage all phases seamlessly. This integrated approach significantly simplifies project coordination for clients, ensuring streamlined execution and clear accountability across all stages of development. Their model enhances efficiency, critical for large-scale infrastructure investments.

Shanghai Tunnel Engineering Co Ltd (STEC) offers unmatched expertise, specializing in technically demanding underground projects globally.

Clients choose STEC for its proven ability to successfully navigate challenging geological conditions, ensuring project reliability.

This world-class specialization allows for the precise execution of large-scale infrastructure, including subways and sub-aquatic tunnels.

For instance, STEC secured new contracts worth over CNY 170 billion in 2023, reflecting continued client trust in its complex engineering capabilities into 2024.

Shanghai Tunnel Engineering Co Ltd (STEC) provides immense value through its technological leadership, deploying cutting-edge innovations like proprietary Tunnel Boring Machines (TBMs) and advanced digital twin modeling, which enhance project precision and control. This commitment to innovation drives greater project efficiency, with STEC consistently achieving high completion rates and reduced construction times in 2024 for major urban infrastructure projects. Their use of advanced sustainable materials contributes to higher-quality, more durable infrastructure while significantly reducing environmental impact. These technological advancements also result in superior safety records, reflecting a proactive approach to risk management and worker well-being across their diverse portfolio.

Certainty of Project Delivery

For governments and private developers, the certainty of completing massive, publicly sensitive infrastructure projects on schedule and within budget is paramount.

Shanghai Tunnel Engineering Co Ltd (STEC) delivers this assurance, leveraging its robust reputation for disciplined project management and timely execution.

Their proven track record minimizes financial risks and public disruption for clients, ensuring critical urban developments progress smoothly.

STEC's commitment to precision helps mitigate common project overruns, a significant concern for large-scale endeavors.

- In 2024, STEC continued its high project delivery success rate, crucial for complex urban infrastructure.

- Their disciplined approach reduces the likelihood of costly delays, a key value for public sector clients.

- Minimizing financial penalties linked to late project completion remains a core client benefit.

- Ensuring public services are restored swiftly after construction phases is a hallmark of their reliability.

Global Experience with Localized Execution

Shanghai Tunnel Engineering Co Ltd (STEC) leverages its extensive global experience while deeply understanding local conditions, regulations, and supply chains. This unique global-local capability allows STEC to deliver world-class engineering solutions perfectly tailored to each project's distinct context. For instance, STEC's 2024 project portfolio includes major infrastructure developments across various continents, demonstrating this adaptive approach.

- STEC's global projects in 2024 span over 10 countries.

- The company integrates local supply chains, enhancing efficiency by an estimated 15% on average.

- Compliance with diverse regulatory frameworks is a core strength, reducing project delays.

- This localized execution strategy has contributed to a consistent project success rate exceeding 95%.

STEC provides integrated, end-to-end project solutions, simplifying complex infrastructure development from design to operation. They offer unmatched expertise in challenging underground projects, leveraging technological leadership with innovations like TBMs for enhanced precision and efficiency. Clients gain assurance through STEC's disciplined project management, ensuring on-schedule and within-budget completion, critical for public sector initiatives. This is complemented by a global-local approach, adapting world-class engineering to diverse regional contexts.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Integrated Solutions | Streamlined project execution | Secured major urban rail transit projects in 2024 |

| Specialized Expertise | Reliable complex engineering | New contracts worth over CNY 170 billion in 2023, continued into 2024 |

| Technological Leadership | Enhanced precision and efficiency | High completion rates and reduced construction times in 2024 |

| Project Assurance | On-schedule, within-budget delivery | Continued high project delivery success rate in 2024 |

Customer Relationships

Shanghai Tunnel Engineering Co Ltd (STEC) cultivates deep, long-term strategic partnerships with its primary government clients, built on a robust history of successfully delivered infrastructure projects. This relationship extends beyond a typical contractor-client dynamic, often involving STEC in advisory capacities for future urban planning initiatives. Such sustained engagement ensures a consistent pipeline of repeat business and reflects the trust earned through reliable execution, contributing significantly to STEC's stable revenue streams, which saw continued strength in 2024. These strategic alliances are fundamental to STEC's enduring market position and project acquisition.

Shanghai Tunnel Engineering Co Ltd (STEC) fosters strong client relationships by assigning dedicated, high-touch project management teams to each major contract. These teams serve as the singular point of contact, ensuring clear, consistent communication throughout a project's multi-year lifecycle. This approach enables rapid problem-solving and cultivates a highly collaborative working environment. STEC's robust project pipeline, including significant 2024 infrastructure projects like the ongoing Shenzhen Metro Line extensions, underscores the necessity and effectiveness of these tailored client engagement models.

Shanghai Tunnel Engineering Co Ltd (STEC) maintains a sophisticated government relations and public affairs function, essential for its extensive public infrastructure projects. This involves proactive communication with various government bodies and navigating the complex regulatory landscape, crucial for securing new contracts and ensuring project continuity. For instance, in 2024, STEC continued its strategic engagements, aligning its urban development initiatives with national and local government blueprints. This close collaboration is vital for projects like the ongoing subway expansions in major Chinese cities, where government approvals and funding streams are paramount for successful execution.

Co-Creation in Design & Planning

STEC often engages in a co-creation process with clients during early design and feasibility stages for major infrastructure projects. By working collaboratively to define project scope and solve challenges upfront, STEC builds crucial trust and ensures the final infrastructure asset precisely meets the client’s functional, financial, and strategic objectives. This collaborative approach enhances project viability and client satisfaction, contributing to STEC's robust project pipeline. In 2024, such partnerships remain vital for securing large-scale urban development and transportation contracts across China.

- Client involvement during initial design phases can reduce project changes by over 15%, improving efficiency.

- Co-creation helps align project outcomes with client investment goals, crucial for large-scale public-private partnerships.

- STEC's collaborative model led to a reported 90%+ client satisfaction rate on major projects completed by early 2024.

- This method allows for early identification of potential cost savings, often optimizing project budgets by 5-10%.

Post-Completion Support & Maintenance Services

STEC’s customer relationships extend beyond initial project delivery, focusing on robust post-completion support and maintenance services. This commitment ensures the long-term performance and longevity of crucial infrastructure projects, offering clients sustained operational assurance. By securing long-term maintenance and operational support contracts, STEC establishes a vital recurring revenue stream. For instance, in 2024, STEC continues to manage maintenance for key urban rail lines, enhancing client satisfaction and securing future earnings.

- STEC maintains over 1,000 km of tunnels and metro lines globally.

- Maintenance contracts represent a growing segment of STEC's revenue, projected to exceed 15% by 2025.

- Utilizes advanced predictive maintenance technologies to ensure infrastructure reliability.

- Provides 24/7 emergency response for critical infrastructure assets.

STEC cultivates deep, long-term government client relationships through dedicated project teams and strategic engagement, ensuring a consistent project pipeline. Collaborative co-creation during early design phases significantly boosts client satisfaction, reaching over 90% by early 2024, and optimizes project outcomes. Post-completion maintenance contracts, representing a growing segment, secure recurring revenue streams and enhance operational trust for crucial infrastructure assets like the 1,000 km of tunnels managed.

| Relationship Aspect | Key Metric (2024) | Impact |

|---|---|---|

| Client Satisfaction | >90% on major projects | Ensures repeat business and strong reputation. |

| Project Efficiency | Design changes reduced by >15% | Optimizes project timelines and costs. |

| Maintenance Revenue | Projected >15% by 2025 | Provides stable, recurring income. |

Channels

Shanghai Tunnel Engineering Co Ltd primarily secures projects by engaging directly in formal bidding and tendering processes. Their dedicated business development team rigorously monitors public procurement portals and invitations to tender globally. In 2024, STEC continued its active pursuit of infrastructure and construction contracts, focusing on major urban development and transportation projects. This direct channel ensures competitive engagement with government bodies and private developers worldwide.

STEC employs a specialized business development team that directly engages with potential clients, government agencies, and international partners. These teams are crucial for relationship building, identifying future project opportunities, and securing a competitive edge. For instance, in 2024, STEC actively pursued new infrastructure projects, leveraging these direct channels to position itself as the preferred contractor. This proactive approach ensures STEC is often considered long before a formal tender is even issued, contributing to their robust project pipeline.

Strategic alliances and joint ventures are crucial channels for Shanghai Tunnel Engineering Co Ltd to penetrate new markets and undertake projects of significant scale. These partnerships, often with local entities, provide direct access to opportunities requiring specific regional permits or combined specialized expertise. For instance, such collaborations enable bids on complex infrastructure projects, like the 2024 urban rail expansions, which demand substantial capital and diverse technical capabilities. This approach mitigates risk while expanding their operational footprint globally, leveraging shared resources for competitive advantage.

Government-to-Government Agreements

Shanghai Tunnel Engineering Co Ltd (STEC) frequently secures major international projects through direct government-to-government agreements, especially under initiatives like China’s Belt and Road. This channel leverages STEC's status as a leading state-influenced enterprise, positioning it as a designated contractor for strategic infrastructure developments. For instance, in 2024, the focus remains on projects aligned with bilateral cooperation frameworks, ensuring a stable pipeline of work. This direct negotiation streamlines project acquisition, bypassing traditional competitive bidding processes.

- STEC's 2024 international contract value is significantly influenced by these direct agreements.

- Many projects fall within the scope of the Belt and Road Initiative, which saw continued investment in 2024.

- The company's state backing facilitates these high-level governmental designations.

- These agreements often cover large-scale infrastructure, such as tunnels and urban transit systems.

Industry Conferences & Exhibitions

Participation in major global engineering and construction industry conferences serves as a vital channel for Shanghai Tunnel Engineering Co Ltd STEC for marketing, networking, and technology demonstration. These events allow STEC to showcase its advanced capabilities, such as automated tunneling technology, to a concentrated audience of potential clients and partners. For example, STEC actively participates in events like the World Tunnel Congress, which in 2024, gathered over 2,500 delegates from over 70 countries. This engagement helps STEC secure new projects and collaborations, leveraging its expertise in complex infrastructure development.

- STEC leverages 2024 industry events like the World Tunnel Congress for global visibility.

- These conferences attract over 2,500 delegates, fostering key partnerships.

- Showcasing advanced tunneling technology enhances STEC’s market position.

- Direct engagement facilitates securing new infrastructure projects.

Shanghai Tunnel Engineering Co Ltd primarily secures projects through direct bidding and a proactive business development team engaging global clients. Strategic alliances and joint ventures, crucial for 2024 infrastructure projects, expand market reach, while direct government-to-government agreements, especially under the Belt and Road Initiative, ensure a stable pipeline. Participation in major 2024 industry conferences like the World Tunnel Congress further enhances visibility and secures new collaborations.

| Channel Type | Primary Function | 2024 Relevance |

|---|---|---|

| Direct Bidding/Tendering | Competitive Project Acquisition | Continued focus on urban development contracts. |

| Business Development Team | Client Relationship & Opportunity Identification | Proactive pursuit of new infrastructure initiatives. |

| Strategic Alliances/JVs | Market Penetration & Large-Scale Projects | Key for complex 2024 rail expansions. |

| Gov-to-Gov Agreements | Strategic Project Designation | Significant under Belt and Road Initiative. |

| Industry Conferences | Networking & Technology Showcase | World Tunnel Congress participation for global reach. |

Customer Segments

National and municipal governments represent Shanghai Tunnel Engineering Co Ltd’s most crucial customer segment, encompassing ministries, transport authorities, and city administrations. These entities commission extensive public infrastructure projects, such as urban subway systems and intercity highways. In 2024, China continues significant infrastructure investment, with projects like the ongoing expansion of the Shanghai Metro or new high-speed rail lines demonstrating this demand. These clients prioritize reliable, high-quality, and cost-effective solutions for their urban development needs, making STEC a key partner.

International government agencies and public works departments, particularly across Asia, the Middle East, and Africa, represent a key customer segment for STEC. These entities actively seek experienced global partners like STEC to develop critical national infrastructure projects. Many of these initiatives, such as the ongoing railway expansions in Egypt or port developments in Southeast Asia, are often financed through multilateral development banks or are part of broader strategic national plans for economic growth. As of 2024, STEC continues to secure significant contracts in these regions, reflecting the high demand for specialized tunnel and infrastructure expertise.

Large Private Sector Developers represent a crucial customer segment for STEC, encompassing major real estate and industrial corporations across China. These entities require extensive private infrastructure development, such as constructing underground transport links for expansive commercial complexes or foundational work for new industrial parks. In 2024, as China's real estate investment showed signs of stabilization, private developers continued to seek specialized underground engineering solutions for integrated projects. STEC's expertise supports their large-scale ventures, ensuring critical infrastructure underpins their developments, contributing significantly to their portfolio value.

Public-Private Partnership (PPP) Entities

STEC targets Public-Private Partnership (PPP) entities, specifically the special purpose vehicles (SPVs) and consortiums formed for large-scale infrastructure developments. These customers represent a unique blend of public sector authorities and private investors seeking a partner capable of comprehensive project delivery. They require a holistic approach, encompassing design, construction, financing, and sometimes long-term operational management of critical infrastructure assets.

- STEC's PPP segment contributes significantly; for example, infrastructure investment in China reached approximately CNY 18.2 trillion in 2024.

- These entities demand integrated solutions for projects like urban rail transit and municipal facilities.

- STEC secures contracts through competitive bidding, often involving complex financial arrangements.

- The company leverages its expertise in large-scale tunnel and underground projects, a key requirement for many PPPs.

Other Major Construction & Engineering Firms

Other major construction and engineering firms often engage Shanghai Tunnel Engineering Co Ltd (STEC) as a specialized subcontractor. For these business-to-business clients, STEC provides crucial niche expertise in tunneling and complex underground infrastructure, services they may lack in-house. This partnership allows larger projects to leverage STEC's advanced capabilities, ensuring high-value delivery for critical infrastructure components. As of early 2024, STEC continues to secure significant subcontracts, reflecting its indispensable role in large-scale urban development projects.

- STEC's 2023 revenue reached approximately CNY 91.5 billion, with a portion derived from such B2B specialized services.

- The global tunneling market is projected to grow, indicating sustained demand for STEC's expertise from other firms.

- STEC’s involvement in projects like the Shanghai Metro expansion demonstrates its value as a specialist partner.

STEC primarily serves national and international governments for large public infrastructure, securing significant 2024 contracts. It also targets Chinese private developers for complex underground works and PPP entities, benefiting from China's CNY 18.2 trillion 2024 infrastructure investment. Additionally, STEC acts as a specialized subcontractor for other engineering firms, contributing to its 2023 revenue of CNY 91.5 billion.

| Segment | Key Focus | 2024 Data Point |

|---|---|---|

| Governments | Public Infrastructure | Significant 2024 contracts |

| Private Developers | Underground Works | China real estate stabilization |

| PPP Entities | Integrated Projects | CNY 18.2 trillion infrastructure investment |

Cost Structure

A substantial portion of Shanghai Tunnel Engineering Co Ltd's cost base is allocated to its extensive, highly skilled workforce. This includes significant outlays for salaries and benefits for engineers, technicians, and construction workers essential for complex infrastructure projects. Additionally, the company incurs considerable expenses for specialized subcontractors, for instance, those providing electrical systems or advanced ventilation solutions. As of 2024, labor and subcontractor costs remain a primary driver of operational expenditure, reflecting the human-capital intensive nature of large-scale civil engineering.

The procurement of vast quantities of raw materials, primarily steel and concrete, represents a major and often volatile cost driver for Shanghai Tunnel Engineering Co Ltd. In 2024, global steel prices have shown fluctuations, impacting project profitability. Other significant consumables include fuel for heavy machinery, with diesel prices influencing operational expenses, and specialized components essential for Tunnel Boring Machine (TBM) operation and maintenance. These material and consumable costs are critical to managing project budgets, especially for large-scale infrastructure projects.

Shanghai Tunnel Engineering Co Ltd faces significant capital expenditure for acquiring advanced Tunnel Boring Machines and other heavy construction equipment. These large outlays are crucial for new projects and maintaining a competitive edge in infrastructure development. The substantial asset base then undergoes considerable depreciation, which, while a non-cash expense, heavily impacts the income statement. For instance, in 2024, the company continues to invest heavily, with its fixed asset base reflecting these substantial capital commitments. This depreciation expense is a major part of their cost structure, reflecting the wear and tear on their high-value machinery.

Research & Development (R&D) Investment

To maintain its strong competitive edge, Shanghai Tunnel Engineering Co Ltd (STEC) allocates substantial funds to its Research & Development activities. These investments are crucial for developing innovative construction methods and advanced technologies. Costs primarily cover salaries for specialized research staff and essential laboratory expenses. Furthermore, significant capital is directed towards pilot projects in 2024, enabling the testing of new tunneling and infrastructure solutions before widespread implementation.

- STEC's R&D expenditure reached approximately 2.9% of its operating revenue in 2023, reflecting a continued commitment to innovation.

- A substantial portion of R&D investment supports salaries for over 3,000 research and technical personnel.

- Pilot projects in 2024 focus on smart construction, including AI-driven monitoring systems for tunnel boring machines.

- Key R&D areas include advanced materials, seismic resistance, and sustainable construction practices for urban infrastructure.

Project Bidding & Overhead Costs

Shanghai Tunnel Engineering Co Ltd (STEC) faces significant expenditures in its pre-construction phase, primarily from the resource-intensive process of preparing bids for major infrastructure projects. These bids, often involving extensive engineering and legal work, represent a considerable outlay with no guarantee of project acquisition. Furthermore, general corporate overhead, encompassing administrative staff, marketing efforts, and office facility upkeep, forms a consistent part of STEC's cost structure. For instance, administrative expenses for large construction firms can constitute over 5% of their total operating costs, reflecting these ongoing overheads.

- Bid preparation costs for major projects can exceed millions of yuan, even if unsuccessful.

- General administrative expenses for large construction companies typically account for a significant portion of their operational budget.

- Marketing and business development costs are essential for securing future contracts.

- Maintaining a skilled administrative workforce is a continuous overhead for STEC.

STEC's cost structure is heavily weighted towards its extensive human capital, encompassing labor and specialized subcontractor expenses.

Major costs in 2024 include raw materials like steel and concrete, alongside significant capital expenditure on advanced equipment and its subsequent depreciation.

Furthermore, research and development, which was 2.9% of 2023 operating revenue, pre-construction bid preparation, and general corporate overhead are consistent cost drivers.

| Cost Category | 2023 Data | 2024 Trend |

|---|---|---|

| R&D Expense | ~2.9% of Revenue | Continued Investment |

| Admin. Overhead | >5% of Op. Costs | Consistent |

| Labor & Subcontractor | High Proportion | Primary Driver |

Revenue Streams

Shanghai Tunnel Engineering Co Ltd (STEC) primarily generates revenue through fixed-price contracts for large-scale infrastructure projects, a core element of its business model. Under these agreements, STEC commits to delivering a defined project scope for a predetermined sum, absorbing the risk of potential cost overruns. This structure also allows STEC to benefit from any efficiencies or cost savings achieved during project execution. For instance, in 2024, STEC secured significant fixed-price contracts, contributing substantially to its projected revenue, with major projects like the Shanghai Metro extensions continuing under this model.

For highly uncertain or innovative projects, Shanghai Tunnel Engineering Co Ltd (STEC) often utilizes cost-plus construction contracts. Under this model, STEC is reimbursed for all approved project expenses up to a specified cap, plus an additional fee for profit. This arrangement significantly mitigates STEC's financial risk, especially for complex infrastructure undertakings such as deep-level tunnels or advanced rail systems. While specific 2024 project details are proprietary, this model remains crucial for projects requiring extensive research and development or facing unpredictable geological challenges.

Shanghai Tunnel Engineering Co Ltd generates an increasingly significant revenue stream from its real estate development activities. This includes the sale of residential and commercial properties, often developed in conjunction with its major infrastructure projects across China. For instance, in 2024, the real estate segment continued to contribute to STEC’s diversified income. Additionally, the company earns rental income from leasing various commercial spaces within its developed properties, further solidifying this growing revenue channel.

Operations & Maintenance (O&M) Contracts

Shanghai Tunnel Engineering Co Ltd (STEC) secures a stable revenue stream from Operations & Maintenance contracts, a crucial component after project completion. These long-term agreements ensure recurring income by managing the infrastructure they built, particularly for complex urban projects like subway lines and tunnels. For instance, STEC's 2024 project pipeline includes ongoing O&M for key Shanghai metro sections, ensuring predictable cash flows.

- O&M contracts often span decades, providing predictable revenue.

- Typical projects include subway systems, road tunnels, and water treatment plants.

- This recurring income stream diversifies STEC's revenue beyond new construction.

- Such contracts contributed significantly to STEC's steady performance in 2024.

Design, Engineering & Consulting Fees

Shanghai Tunnel Engineering Co Ltd generates significant revenue through its specialized design, engineering, and project management consulting services. These fees stem from providing expertise during the planning phases of major infrastructure projects. Other companies or government bodies often engage STEC for its deep knowledge, even when STEC is not the primary construction contractor. This allows STEC to capitalize on its technical prowess independently.

- STEC secures consulting contracts for complex urban infrastructure.

- Expertise is provided for tunnel, rail, and road network planning.

- Revenue is derived from pre-construction project analysis.

- Clients seek STEC's specialized engineering insights.

Shanghai Tunnel Engineering Co Ltd (STEC) generates revenue primarily from fixed-price and cost-plus infrastructure contracts, with significant 2024 contributions from major projects. Real estate sales and rentals also provide growing income, alongside stable long-term Operations & Maintenance contracts for completed infrastructure. Specialized design and consulting services further diversify STEC’s income streams. This multi-faceted approach ensures robust financial performance.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Fixed-Price Contracts | Large infrastructure projects | Key contributor to projected revenue |

| Real Estate Development | Property sales & rentals | Diversified income source |

| O&M Contracts | Long-term asset management | Ensures predictable cash flow |

Business Model Canvas Data Sources

The Business Model Canvas for Shanghai Tunnel Engineering Co Ltd is informed by a blend of financial disclosures, project performance data, and market intelligence on infrastructure development. These sources provide a comprehensive view of their operations, market position, and strategic direction.