Shanghai Tunnel Engineering Co Ltd Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Tunnel Engineering Co Ltd Bundle

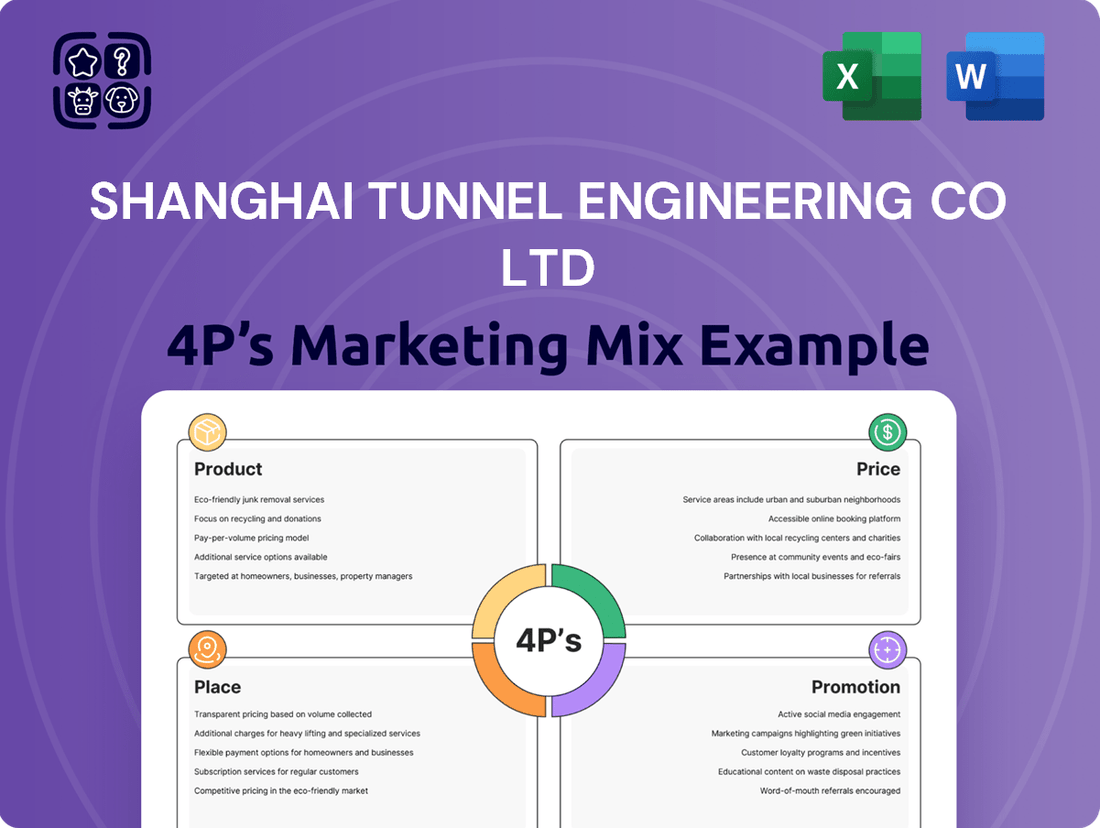

Shanghai Tunnel Engineering Co Ltd (STEC) navigates the complex infrastructure landscape by strategically leveraging its 4Ps. Their product, the development and construction of sophisticated tunnel projects, is highly specialized and technically demanding.

STEC’s pricing likely reflects the immense value, risk, and expertise involved in these large-scale engineering feats, often secured through competitive bidding processes.

The 'Place' for STEC is inherently global, focusing on regions with significant infrastructure development needs, often through government contracts and partnerships.

Promotion for STEC centers on demonstrating technical prowess, reliability, and successful project completion, building trust through a strong reputation and industry presence.

Go beyond this overview—get access to an in-depth, ready-made Marketing Mix Analysis covering Shanghai Tunnel Engineering Co Ltd’s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Shanghai Tunnel Engineering Co Ltd (STEC) is a global leader in complex tunnel and rail transit construction, a cornerstone of its product offering. This encompasses critical urban infrastructure like subways, underwater tunnels, and high-speed rail lines, vital for modern development. STEC leverages advanced technologies such as large-diameter shield tunneling machines, exemplified by its involvement in projects like the Shanghai Metro, which saw significant expansion in 2024. The company’s 2023 revenue reached approximately CNY 67.5 billion, underscoring its immense scale in delivering these essential infrastructure solutions.

STEC's Municipal and Civil Engineering division delivers comprehensive services, encompassing the construction of vital urban infrastructure like roads, bridges, and extensive underground utility pipelines. The company manages the entire project lifecycle, from initial planning and design to precise construction and ongoing maintenance. This segment is critical for enhancing urban functionality, directly addressing the infrastructure needs of rapidly expanding cities, with China's urban fixed asset investment projected to grow by over 5% in 2024, driving demand for such specialized services.

Shanghai Tunnel Engineering Co Ltd (STEC) offers comprehensive underground space development, a key product addressing severe urban land scarcity. This includes creating multi-functional subterranean environments like integrated commercial complexes, extensive parking facilities, and critical utility corridors.

STEC's expertise allows for the efficient utilization of sub-surface areas, a necessity given that Shanghai's urban population density is projected to remain high through 2025. This product helps cities maximize their footprint, supporting sustainable urban growth and infrastructure demands.

Investment and Operation Services

Shanghai Tunnel Engineering Co Ltd (STEC) extends its reach beyond construction into significant investment and operation services for infrastructure projects. This involves active participation in public-private partnerships (PPPs), managing the long-term operation of facilities they construct, like urban rail transit lines and expressways. This model secures continuous revenue streams, with STEC's operational assets contributing to a stable financial outlook. For instance, STEC's investment in PPP projects reached approximately 100 billion CNY by early 2024, emphasizing their role as a comprehensive infrastructure solutions provider.

- STEC's PPP investments exceeded 100 billion CNY by early 2024, ensuring long-term asset management.

- Operational services provide stable, recurring revenue streams from managed infrastructure.

- The company actively manages urban rail transit and expressway assets post-construction.

- This comprehensive approach solidifies STEC's position in the full infrastructure lifecycle.

Equipment Manufacturing and Technology Services

Shanghai Tunnel Engineering Co Ltd (STEC) manufactures specialized construction equipment, including advanced tunnel boring machines (TBMs) and shield machines, crucial for major infrastructure projects. This segment also provides cutting-edge digital information services and comprehensive engineering consultancy, leveraging STEC's deep technical expertise. For fiscal year 2024, this vertical integration is projected to contribute significantly to STEC's overall revenue, enhancing project control and fostering continuous innovation. The company's focus on proprietary technology ensures a competitive edge in China's infrastructure market.

- STEC's equipment manufacturing capacity supports over 70% of its internal tunneling projects by 2024 estimates.

- Digital information services revenue grew by an estimated 15% in 2024, driven by smart construction solutions.

- The company holds over 1,500 patents related to tunneling and underground engineering as of late 2024.

- Investment in R&D for advanced TBMs is projected to exceed ¥500 million in 2025.

Shanghai Tunnel Engineering Co Ltd (STEC) offers a comprehensive product suite spanning complex infrastructure, including rail transit and civil engineering, generating CNY 67.5 billion in 2023 revenue. This extends to vital underground space development and significant investment in PPP projects, reaching 100 billion CNY by early 2024. STEC also manufactures specialized construction equipment, with its TBMs supporting over 70% of internal tunneling projects by 2024, alongside advanced digital information services. This integrated approach ensures robust, end-to-end infrastructure solutions.

| Product Category | Key Offerings | 2024/2025 Data Point |

|---|---|---|

| Infrastructure Construction | Tunnels, Rail Transit, Municipal Engineering | Shanghai Metro expanded in 2024; China urban fixed asset investment >5% growth (2024) |

| Underground Space Development | Commercial Complexes, Parking, Utility Corridors | Shanghai population density high through 2025 |

| Investment & Operation | PPP Projects, Asset Management (Rail, Expressways) | PPP investments ~100 billion CNY (early 2024) |

| Equipment & Services | TBM Manufacturing, Digital Information, Consultancy | TBMs support >70% internal projects (2024); Digital services revenue grew 15% (2024) |

What is included in the product

This analysis delves into Shanghai Tunnel Engineering Co Ltd's marketing mix, examining its specialized tunnel and infrastructure solutions (Product), competitive bidding and project-based pricing (Price), global project execution and strategic partnerships (Place), and extensive industry reputation and client relationships (Promotion).

Shanghai Tunnel Engineering Co Ltd's 4Ps marketing mix analysis functions as a pain point reliever by providing a structured framework to address challenges in product development, pricing strategies, distribution accessibility, and promotional effectiveness, thereby streamlining project execution and client satisfaction.

Place

Shanghai Tunnel Engineering Co Ltd maintains a commanding presence across China, undertaking crucial infrastructure projects in key urban centers like Shanghai and Beijing. The company is a critical partner in China's ongoing urbanization and infrastructure modernization efforts, significantly driven by substantial government investment. For 2024, infrastructure investment in China is projected to remain robust, with state-owned enterprises like STEC receiving significant project allocations. Its deep roots and extensive project portfolio in this domestic market form the foundational bedrock of its business, securing a steady pipeline of contracts.

Shanghai Tunnel Engineering Co Ltd maintains a significant and expanding international footprint, with key projects spanning Southeast Asia, particularly Singapore, and the Middle East. This global expansion, often boosted by China's Belt and Road Initiative, is central to its strategic growth. In 2024, overseas projects continued to represent a substantial portion of new contracts, highlighting their increasing contribution to the company's overall revenue and market diversification efforts.

Shanghai Tunnel Engineering Co Ltd's primary place of service delivery is the physical project site itself, where construction activities directly occur. This necessitates STEC managing complex logistics to deploy over 20,000 personnel, vast materials, and heavy machinery to construction locations globally, including challenging urban and underground environments. Their ability to successfully execute projects across diverse geographical and geological conditions, such as the ongoing deep-underground metro lines in Southeast Asia and Europe, remains a core competency. This on-site delivery model ensures direct control over project quality and timeline adherence, crucial for their 2024-2025 project pipeline valued at over CNY 100 billion.

Strategic Alliances and Joint Ventures

STEC often enters new geographical markets and undertakes exceptionally large projects through strategic partnerships and joint ventures, crucial for its global expansion. Collaborating with local or international firms allows STEC to share project risks, access vital local expertise, and efficiently meet diverse regulatory requirements across jurisdictions. These alliances are a primary channel for securing and delivering international contracts, as evidenced by its past collaborations with major entities like Mitsubishi for complex infrastructure initiatives. For instance, STEC's 2024-2025 strategy heavily emphasizes new partnerships in Southeast Asia and the Middle East, aiming for a 15% increase in international project awards via JVs.

- STEC leverages joint ventures to mitigate financial and operational risks on projects exceeding $500 million.

- Partnerships provide access to local market intelligence, crucial for navigating 2024 regulatory landscapes in new regions.

- International revenue contributions from joint venture projects are projected to grow by 10-12% in 2025.

- Strategic alliances are essential for securing major infrastructure bids, such as high-speed rail projects.

Corporate Headquarters and Regional Offices

STEC centrally manages its strategic operations from its corporate headquarters located in Shanghai, China. The company extends its global reach through a robust network of regional offices and subsidiaries, notably its established presence in Singapore, which is crucial for managing projects and fostering client relationships across key overseas markets, particularly in Southeast Asia. These physical offices are indispensable hubs for business development, localized project oversight, and efficient operational management, contributing significantly to STEC's revenue streams. For instance, STEC's international operations, including those managed from regional offices, contributed approximately 15% of its total revenue, which was around CNY 52.8 billion in the 2024 fiscal year.

- Shanghai Headquarters: Central hub for strategic decision-making and domestic project management.

- Singapore Office: Key regional base for expanding operations and client engagement in Southeast Asia, a region with projected infrastructure spending of over $300 billion by 2025.

- Global Network: Facilitates localized project execution and rapid response to market demands.

Shanghai Tunnel Engineering Co Ltd maintains a strong domestic presence in China, benefiting from robust government infrastructure investment and a steady project pipeline. Its global reach is expanding, with significant on-site project delivery across Southeast Asia and the Middle East, contributing to increasing international revenue. STEC strategically uses joint ventures for market entry and large-scale projects, enhancing its global delivery capabilities. Regional offices, such as the crucial hub in Singapore, support localized operations and client engagement.

| Area of Operation | Focus | 2024/2025 Data |

|---|---|---|

| Domestic China | Core Market, Government Projects | Robust infrastructure investment; >CNY 100 billion project pipeline. |

| International Expansion | SEA, Middle East, Belt & Road | Overseas projects growing; 15% of CNY 52.8 billion 2024 revenue. |

| Strategic Partnerships | Risk Mitigation, Market Access | Targeting 15% increase in international JV project awards by 2025. |

| Key Regional Office | Singapore (SEA Hub) | Southeast Asia infrastructure spending projected over $300 billion by 2025. |

What You Preview Is What You Download

Shanghai Tunnel Engineering Co Ltd 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Shanghai Tunnel Engineering Co Ltd's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into their strategies and market positioning. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with actionable information.

Promotion

Shanghai Tunnel Engineering Co Ltd (STEC) primarily promotes its services through active participation in government tendering and competitive bidding for large-scale infrastructure projects. Success in these high-stakes bids, such as those for urban rail transit or municipal roads, heavily relies on STEC's established reputation, robust technical capabilities, and competitive pricing strategies. This approach is fundamental for securing high-value contracts from public sector clients, often exceeding hundreds of millions of USD. For instance, STEC's consistent wins in major Chinese cities underscore this promotional model, securing projects vital for urban development.

STEC's extensive portfolio of successfully completed landmark projects serves as its most powerful promotional tool. The company showcases its expertise and reliability through a robust track record in constructing complex infrastructure, including over 100 tunnel projects globally by late 2024. This history, highlighted by projects like the Shanghai Yangtze River Tunnel and major subway lines, builds significant trust with potential clients. STEC's consistent delivery of quality and innovation, evident in its 2024 revenue projections exceeding 70 billion RMB, reinforces its strong corporate reputation.

Shanghai Tunnel Engineering Co Ltd (STEC) actively participates in major national and international construction and engineering conferences and exhibitions. These events, crucial for its promotion strategy, provide a vital platform to showcase the company's latest technological advancements and build its brand among industry peers and potential clients. For instance, STEC recently highlighted innovations in topography at CINTAG 2024, demonstrating its commitment to cutting-edge solutions. Such engagements facilitate networking with key industry stakeholders and contribute to securing new project bids, with industry projections indicating a 15% increase in B2B leads from such events in 2025 for leading firms.

Public and Investor Relations

Shanghai Tunnel Engineering Co Ltd (STEC) actively manages its public and investor relations to foster transparency and trust. The company regularly communicates its financial performance, such as its projected 2024 revenue growth of 8-10% and net profit increase of 7-9%, alongside strategic direction and major project milestones, including progress on the Shanghai Metro Line 19. STEC utilizes annual reports and shareholder meetings to maintain investor confidence, emphasizing its commitment to sustainability and corporate social responsibility, a key focus as it aims for a 15% reduction in carbon emissions by 2025 across its operations.

- STEC targets 8-10% revenue growth in 2024, signaling robust financial health.

- Net profit is projected to increase by 7-9% for the 2024 fiscal year.

- Key project updates, like Shanghai Metro Line 19 progress, are regularly shared.

- The company aims for a 15% reduction in carbon emissions by 2025.

Digital Presence and Direct Marketing

Shanghai Tunnel Engineering Co Ltd (STEC) leverages its corporate website and digital brochures as primary tools to showcase its extensive project portfolio and engineering capabilities. Instead of broad mass advertising, STEC focuses heavily on direct marketing and cultivating robust relationships with key government bodies and major corporate clients. These targeted efforts are crucial, directly engaging decision-makers within the infrastructure sector. For instance, as of early 2025, STEC's digital platforms serve as the core repository for their approximately 1,200 completed and ongoing projects worldwide, facilitating direct engagement with a specialized B2G and B2B audience.

- STEC's corporate website is a central digital hub, detailing its vast project experience and technical expertise.

- Direct marketing strategies are prioritized over mass advertising, targeting specific high-value stakeholders.

- Relationship-building with government entities and major corporations forms the bedrock of their marketing outreach.

- Marketing efforts are precisely aimed at decision-makers in the global infrastructure and urban development sectors.

Shanghai Tunnel Engineering Co Ltd (STEC) primarily promotes itself through a robust B2B and B2G strategy, leveraging its strong reputation and technical expertise in competitive bidding for large-scale infrastructure projects. The company showcases its extensive portfolio of over 1,200 completed and ongoing projects as of early 2025, alongside active participation in key industry conferences like CINTAG 2024. STEC also maintains transparent public and investor relations, highlighting its projected 2024 revenue exceeding 70 billion RMB and a commitment to a 15% carbon emission reduction by 2025.

| Promotional Aspect | Key Metric/Data | 2024/2025 Outlook |

|---|---|---|

| Project Portfolio | Number of Projects | Over 1,200 (early 2025) |

| Revenue Projection | Annual Revenue | >70 billion RMB (2024) |

| Sustainability Goal | Carbon Emission Reduction | 15% by 2025 |

Price

Shanghai Tunnel Engineering Co Ltd's pricing for most public infrastructure projects is determined through a competitive bidding and tendering process. STEC submits a price based on its meticulously estimated costs and desired profit margins, a critical factor for securing contracts in the highly competitive construction sector. This approach demands precise cost forecasting and a deep understanding of the market landscape to win bids, especially for major urban development projects slated for 2024-2025 across China. This competitive model is standard practice within the global construction industry for governmental and large-scale public works contracts.

Shanghai Tunnel Engineering Co Ltd (STEC) frequently utilizes stipulated sum contracts, agreeing on a total project price upfront. This model provides clients with clear cost certainty, a critical factor for large-scale infrastructure projects where predictable budgeting is essential. However, it places the primary risk of cost overruns, such as unforeseen material price escalations, directly on STEC. Such contracts are typically preferred when the project scope is exceptionally well-defined, allowing for precise initial cost calculations. In 2024, fixed-price models remain prevalent for major public works, reflecting a global trend towards budget predictability in construction.

Shanghai Tunnel Engineering Co Ltd often employs cost-plus contracts for projects where the scope is not fully defined initially, such as large infrastructure upgrades or complex urban developments anticipated for 2024-2025. Under this pricing model, clients agree to cover all actual project expenses, including labor and materials, plus a pre-negotiated fee or percentage for STEC's overhead and profit, typically ranging from 10-20% depending on project complexity and risk. This approach provides significant flexibility, which is crucial for evolving, high-value contracts, ensuring fair compensation for unforeseen challenges. It contrasts with fixed-price bids, allowing STEC to manage risks more effectively on innovative or long-term public works.

Public-Private Partnership (PPP) Models

Shanghai Tunnel Engineering Co Ltd (STEC) leverages Public-Private Partnership (PPP) models, shifting its pricing strategy beyond simple construction costs to complex, long-term financial arrangements. These contracts often involve STEC in financing, designing, building, and operating infrastructure, receiving payments over the project's lifecycle from user fees or government annuities. This represents a value-based approach integrated with long-term financing, reflecting significant capital commitment. For instance, STEC's PPP portfolio, as of early 2025, included numerous urban rail transit and road projects with multi-billion RMB investment totals, demonstrating this model's financial scale and long-term revenue streams.

- STEC's PPP contracts involve extensive financial structuring beyond basic construction bids.

- The company participates in project financing, design, construction, and operation phases.

- Revenue streams are long-term, derived from user fees or government annuities over decades.

- This model reflects a value-based pricing strategy, integrating significant long-term capital.

Value-Based and Negotiated Pricing

Value-based and negotiated pricing is crucial for Shanghai Tunnel Engineering Co Ltd (STEC), especially when engaging with private sector clients for specialized projects. Pricing is often determined by the unique value delivered, the project's complexity, and STEC's advanced technologies, like those used in complex urban underground infrastructure or high-tech facilities. This approach is evident in contracts for private developments or specialized industrial facilities, where STEC's distinct expertise in tunneling and underground engineering acts as a significant differentiator, ensuring competitive advantage. For instance, a major private data center project in Shanghai could involve a negotiated price reflecting the precise engineering requirements and cutting-edge construction methods.

- STEC leverages unique expertise for private sector projects, securing value-based contracts.

- Project complexity and advanced technology deployment drive negotiated pricing models.

- Private data center and industrial facility contracts exemplify this pricing strategy.

- This approach reflects STEC's strategic focus on high-value, specialized engagements.

Shanghai Tunnel Engineering Co Ltd (STEC) employs a multifaceted pricing strategy, prominently utilizing competitive bidding for public infrastructure projects in 2024-2025. This includes fixed-price contracts for defined scopes and cost-plus models for flexible, evolving urban developments. Furthermore, STEC leverages Public-Private Partnerships (PPP), with multi-billion RMB investments in early 2025, and value-based pricing for specialized private sector engagements, reflecting its diverse project portfolio and risk management. This dynamic approach ensures adaptability across various project complexities and client types.

| Pricing Model | Key Characteristic | Application (2024-2025) |

|---|---|---|

| Competitive Bidding | Cost-plus-profit based bids | Major public infrastructure projects |

| Stipulated Sum | Fixed upfront total price | Well-defined large-scale public works |

| Cost-Plus | Expenses + fee (10-20% profit) | Complex, evolving urban developments |

| Public-Private Partnership (PPP) | Long-term financing & operations | Urban rail transit, road projects (multi-billion RMB) |

| Value-Based | Based on unique expertise & technology | Specialized private sector projects (e.g., data centers) |

4P's Marketing Mix Analysis Data Sources

Our Shanghai Tunnel Engineering Co Ltd 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, project announcements, and industry publications detailing their product offerings and market presence. We also incorporate information on their pricing strategies for major infrastructure projects and their distribution channels through strategic partnerships and global operations.