STAG Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STAG Industrial Bundle

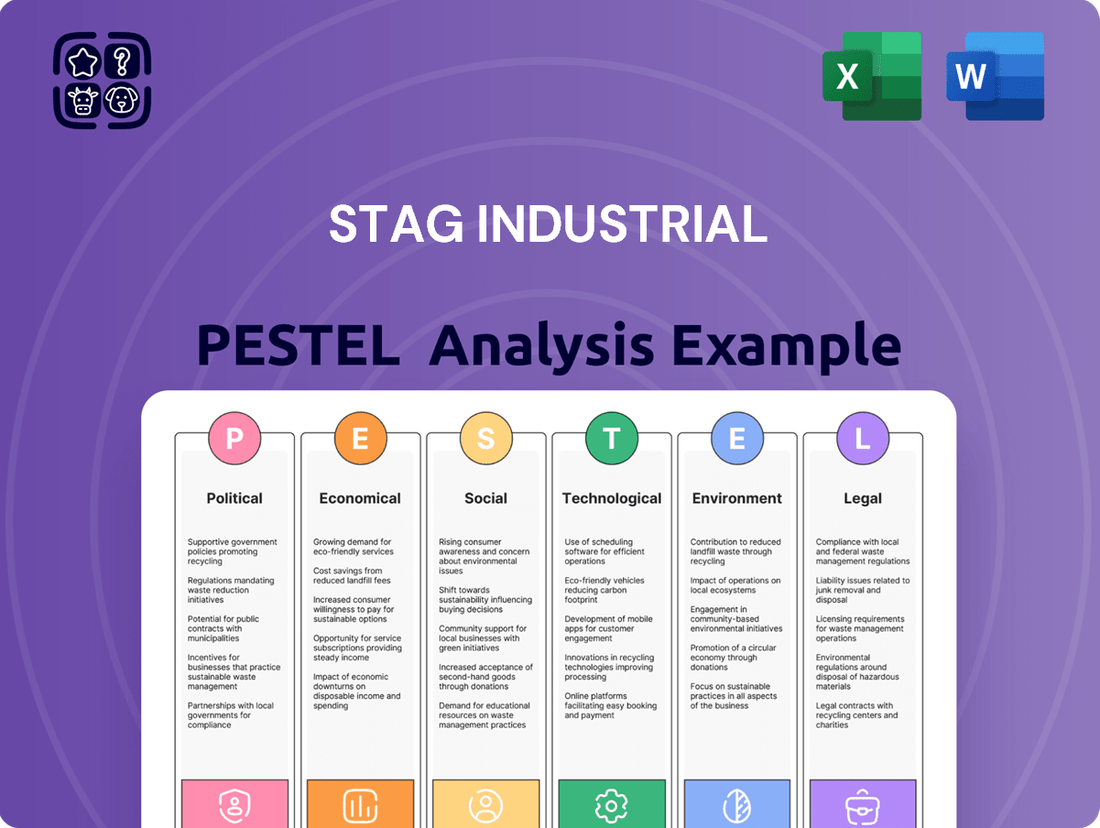

Unlock STAG Industrial's strategic future by understanding the intricate web of external forces. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental factors shaping this industrial REIT. Discover critical trends that could impact its supply chains, operational costs, and market demand. Gain actionable intelligence to refine your investment strategy or business planning. Download the full, expertly crafted PESTLE analysis now and equip yourself with the insights needed to thrive.

Political factors

Government investments in infrastructure, like roads and transportation networks, significantly influence the value and accessibility of industrial properties. For instance, the U.S. Bipartisan Infrastructure Law, passed in 2021, allocated over $1.2 trillion for infrastructure improvements, with a substantial portion directed towards transportation projects expected to continue through 2025 and beyond.

Increased infrastructure spending can boost logistics efficiency, making STAG Industrial's properties more appealing to tenants. This enhancement in accessibility can lead to higher rental demand and property value appreciation, as seen in areas benefiting from new highway expansions or port upgrades.

Conversely, a slowdown in government infrastructure investment or project delays can impede the development and attractiveness of industrial hubs. This could limit STAG Industrial's ability to attract and retain tenants in affected regions, potentially impacting occupancy rates and rental income.

Changes in international trade policies, such as the imposition of tariffs or the negotiation of new trade agreements, directly impact manufacturing and distribution networks. For STAG Industrial, these shifts can alter the demand for industrial facilities. For instance, the United States enacted tariffs on goods from China, leading some companies to re-evaluate their sourcing and manufacturing locations.

Global supply chain realignments, including reshoring and nearshoring trends, are creating opportunities for domestic industrial real estate. Companies looking to reduce reliance on distant suppliers or mitigate geopolitical risks may invest in U.S.-based production, thereby boosting demand for STAG Industrial's properties. This trend was evident in 2023 and is projected to continue, with many companies actively exploring options to bring manufacturing closer to home.

Conversely, policies that create trade friction or uncertainty can dampen industrial activity. If new tariffs or restrictions make imports more expensive or difficult, it could lead to a slowdown in manufacturing output and consequently, a reduced need for industrial warehouse and distribution space. The U.S. trade deficit with China, for example, has been a focal point for policy discussions, influencing investment decisions.

Zoning and land use regulations profoundly shape the industrial real estate market, directly impacting STAG Industrial's development and acquisition strategies. Local and federal laws dictate where new facilities can rise and how current properties can be repurposed, creating a complex legal landscape.

Restrictive zoning, while posing development challenges, can actually bolster the value of STAG Industrial's existing properties by limiting new supply. For instance, in 2024, many desirable industrial submarkets experienced significant supply constraints due to strict zoning, leading to an average of 7.5% year-over-year rent growth in those areas.

Conversely, overly permissive zoning in certain regions could lead to an oversupply of industrial space, potentially pressuring rental rates and occupancy levels for STAG. This dynamic necessitates careful market analysis to identify areas where regulatory environments align with long-term demand for industrial assets.

The ability to adapt existing properties or secure new sites is heavily influenced by these regulations. In 2025, STAG Industrial's success will hinge on navigating these evolving land use policies to maintain a competitive edge in property acquisition and development.

Political Stability and Geopolitical Events

Political stability in the United States is a crucial factor for STAG Industrial. A predictable policy environment fosters business confidence, encouraging companies to sign longer leases and invest in their facilities. For instance, the U.S. experienced a relatively stable political climate leading up to and through 2024, which generally supported steady economic activity and, by extension, demand for industrial real estate.

Global geopolitical events, however, introduce a layer of complexity. Significant international conflicts or trade disputes can create economic uncertainty, potentially impacting tenant demand and property valuations. While STAG Industrial's portfolio is primarily domestic, widespread global instability can lead to supply chain disruptions that indirectly affect the operational needs and financial health of its tenants.

The ongoing geopolitical landscape, including trade relations and international security, directly influences business sentiment. For example, shifts in global trade policies can alter manufacturing and distribution patterns, which are key drivers of demand for STAG's industrial properties. As of early 2025, ongoing trade negotiations and regional tensions continue to be monitored for their potential impact on the broader economy and real estate markets.

- 2024 U.S. Political Stability: Generally favorable, contributing to consistent business investment.

- Geopolitical Impact: Global events can create economic uncertainty, affecting tenant demand for industrial space.

- Trade Policy Influence: Changes in international trade agreements can reshape supply chains and real estate needs.

- Tenant Health: The financial stability of STAG's tenants is indirectly linked to the broader geopolitical and economic environment.

Taxation Policies for REITs and Corporations

Taxation policies are a critical political factor impacting STAG Industrial. For instance, the U.S. federal corporate tax rate, which was lowered to 21% in 2017 under the Tax Cuts and Jobs Act, directly affects the profitability of companies that lease STAG's industrial properties. A significant aspect for STAG, as a Real Estate Investment Trust (REIT), is the requirement to distribute at least 90% of its taxable income to shareholders annually as dividends. This structure allows REITs to avoid corporate income tax, but it means that the income is taxed at the shareholder level. Any changes to this distribution requirement or the tax rates applicable to dividend income could materially alter STAG's attractiveness to investors.

Furthermore, shifts in corporate tax policies can influence STAG's tenant base. If corporate tax rates increase, tenants may face higher operational costs, potentially impacting their ability to expand or even maintain their current leasing arrangements. For example, if a future administration were to propose raising the corporate tax rate back to pre-2017 levels, it could create headwinds for industrial property demand as businesses adjust their budgets. Conversely, tax incentives for businesses investing in manufacturing or logistics, sectors STAG serves, could bolster demand for its properties.

- REIT Distribution Requirement: STAG, as a REIT, must distribute at least 90% of taxable income to shareholders to avoid corporate tax.

- U.S. Corporate Tax Rate: The current 21% federal corporate tax rate influences the operational costs and profitability of STAG's tenants.

- Dividend Taxation: Changes in personal income tax rates on dividends could impact STAG's appeal to income-seeking investors.

- Tax Incentives for Industry: Government incentives aimed at boosting manufacturing or logistics sectors can positively influence demand for STAG's industrial real estate.

Government infrastructure spending, like the U.S. Bipartisan Infrastructure Law’s over $1.2 trillion allocation, directly enhances the accessibility and value of industrial properties. This investment boosts logistics, making STAG Industrial's properties more attractive to tenants, which is projected to continue through 2025.

Changes in trade policies, such as tariffs, can reshape supply chains and influence demand for industrial space. For instance, the U.S. has enacted tariffs, prompting companies to re-evaluate manufacturing locations, a trend expected to continue as businesses pursue reshoring and nearshoring strategies in 2024-2025.

Zoning and land use regulations significantly impact STAG Industrial's development capacity. Restrictive zoning in desirable submarkets in 2024, for example, led to supply constraints and an average of 7.5% year-over-year rent growth, highlighting how regulations can affect property values.

Political stability and predictable policy environments in the U.S. foster business confidence, supporting longer leases and investment in industrial facilities. While global geopolitical events can create economic uncertainty, affecting tenant demand, the domestic political climate in 2024 remained relatively stable, supporting consistent demand.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting STAG Industrial across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A PESTLE analysis for STAG Industrial offers a clear, summarized version of the full analysis, perfect for easy referencing during meetings or presentations, thereby alleviating the pain of sifting through extensive data.

Economic factors

Interest rate fluctuations are a critical economic factor for STAG Industrial. As of mid-2025, the Federal Reserve's benchmark interest rate, the federal funds rate, is hovering around 5.25% to 5.50%. This environment directly impacts STAG's cost of capital for new acquisitions and development projects. Higher borrowing costs can lead to compressed capitalization rates on new investments, potentially affecting overall property valuations and STAG's ability to generate attractive returns.

Conversely, a sustained period of lower interest rates, which has been a trend in previous years leading up to 2025, would generally benefit STAG. Lower rates reduce financing expenses and can make industrial real estate a more appealing investment class, potentially driving up property values. For instance, a decrease in the 10-year Treasury yield, a benchmark for many real estate loans, from its recent highs in 2023-2024, would lower STAG's debt servicing costs and improve the attractiveness of its portfolio to investors.

The persistent expansion of e-commerce is a significant tailwind for STAG Industrial, directly fueling the demand for warehouse and distribution space. In 2024, global e-commerce sales are projected to reach nearly $7 trillion, underscoring the sustained shift in consumer behavior towards online purchasing. This trend necessitates more efficient logistics networks, a key area of STAG's investment strategy.

Consumer spending, a broader economic indicator, also plays a crucial role. In the United States, personal consumption expenditures (PCE) have shown steady growth, with retail sales, a component of PCE, experiencing an annualized growth rate of approximately 3.5% in early 2024. A downturn in consumer confidence or discretionary spending could, however, lead to a moderation in the demand for industrial real estate.

Global supply chain disruptions experienced throughout 2023 and into early 2024 have underscored the critical importance of building more resilient supply chains. This has directly translated into increased demand for industrial real estate as companies prioritize nearshoring and reshoring strategies, aiming to shorten lead times and mitigate risks. STAG Industrial, with its focus on well-located, essential industrial assets, is well-positioned to benefit from this trend.

Companies are actively shifting from just-in-time inventory models to a more robust just-in-case approach, leading to higher average inventory levels. For instance, the U.S. Census Bureau reported that manufacturing and trade inventories, after accounting for seasonal variations, stood at approximately $2.4 trillion in April 2024, reflecting a sustained need for storage capacity. This strategic pivot fuels ongoing demand for well-located industrial properties, a core component of STAG's investment strategy.

While the trend toward higher inventory levels is strong, a significant economic downturn could potentially temper this demand. If consumer spending contracts sharply, businesses might find themselves overstocked, leading to a reduction in the need for new storage solutions. However, the underlying drive for supply chain diversification and resilience is expected to provide a foundational level of demand for industrial space, even amidst economic headwinds.

Industrial Production and Manufacturing Output

The robust health of the industrial and manufacturing sectors directly fuels demand for STAG Industrial's portfolio of light manufacturing and warehouse facilities. When industrial production rises, it indicates a surge in economic activity that necessitates greater logistical support and expanded storage capacity. For example, in the United States, industrial production saw a notable increase, reaching a seasonally adjusted 104.5% of its 2017 average in April 2024, up from 103.9% in March 2024, signaling a positive trend for industrial real estate demand.

Conversely, a downturn in manufacturing output can create headwinds for STAG Industrial, potentially leading to higher vacancy rates and subdued rent growth. The manufacturing sector's performance is a critical indicator for the need for industrial space. In the Eurozone, industrial production decreased by 0.1% in March 2024 compared to February 2024, showing that fluctuations in output directly impact the demand for industrial properties.

- Industrial Production Growth: A positive indicator for STAG Industrial as it implies increased need for logistics and storage.

- Manufacturing Output Decline: A potential risk factor, possibly leading to higher vacancies and slower rent appreciation.

- Sectoral Demand Driver: The health of manufacturing is a primary driver for demand in STAG Industrial's target property types.

- Economic Sensitivity: STAG Industrial's performance is closely tied to the cyclical nature of industrial and manufacturing output.

Inflation and Rental Growth

Inflation presents a dual impact on industrial properties like those owned by STAG Industrial. While rising prices can increase operating expenses such as maintenance and utilities, they also provide an opportunity for rental growth. STAG's ability to implement lease escalations, often tied to inflation indexes, can directly translate higher costs into increased rental income, acting as a natural hedge.

For instance, in the US, the Consumer Price Index (CPI) saw a significant rise, reaching 3.4% year-over-year as of April 2024. This inflationary environment means that leases with built-in rent increases, a common feature in industrial property agreements, can bolster STAG's revenue streams. This pass-through mechanism is crucial for maintaining profitability amidst rising input costs.

- Inflationary Environment: Higher inflation can boost rental income for STAG through lease escalations.

- Operating Costs: Conversely, inflation can increase expenses related to property maintenance and utilities.

- Economic Slowdown Risk: Sustained high inflation may trigger economic slowdowns, potentially impacting tenant demand and rental growth.

- Lease Structures: STAG's portfolio benefits from leases with inflation-linked rent adjustments, a key advantage in the current economic climate.

The economic landscape for STAG Industrial in 2024-2025 is characterized by a dynamic interplay of interest rates, e-commerce growth, and inventory management strategies. Fluctuations in the Federal Reserve's benchmark rate, currently around 5.25%-5.50%, directly influence STAG's cost of capital for acquisitions and development. Simultaneously, the persistent expansion of e-commerce, with global sales projected near $7 trillion in 2024, fuels a robust demand for industrial warehouse and distribution spaces, a core focus for STAG.

Companies are actively shifting towards a "just-in-case" inventory model, increasing average inventory levels to approximately $2.4 trillion in April 2024, thus bolstering demand for storage solutions. This trend, coupled with a 3.5% annualized growth in U.S. retail sales in early 2024, supports STAG's investment thesis. However, a significant economic downturn could temper this demand by reducing consumer spending and potentially leading to overstocking.

Inflation, with the U.S. CPI at 3.4% year-over-year in April 2024, presents a dual impact. While increasing operating expenses, it also allows for rental growth through inflation-linked lease escalations, a key benefit for STAG. The health of the industrial sector, evidenced by a rise in U.S. industrial production to 104.5% of its 2017 average in April 2024, directly correlates with the demand for STAG's light manufacturing and warehouse facilities.

| Economic Factor | Key Data Point (2024-2025) | Impact on STAG Industrial |

|---|---|---|

| Federal Funds Rate | 5.25% - 5.50% (mid-2025) | Increases cost of capital, potentially impacting acquisition yields. |

| Global E-commerce Sales | Projected near $7 trillion (2024) | Drives demand for warehouse and distribution space. |

| U.S. Retail Sales Growth | Approx. 3.5% annualized (early 2024) | Supports overall demand for industrial logistics. |

| U.S. Manufacturing & Trade Inventories | Approx. $2.4 trillion (April 2024) | Reflects increased need for storage due to "just-in-case" inventory. |

| U.S. Consumer Price Index (CPI) | 3.4% year-over-year (April 2024) | Allows for rental income growth via lease escalations, but raises operating costs. |

| U.S. Industrial Production Index | 104.5% of 2017 avg. (April 2024) | Indicates increased demand for manufacturing and logistics facilities. |

What You See Is What You Get

STAG Industrial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive STAG Industrial PESTLE Analysis. This detailed breakdown explores the Political, Economic, Social, Technological, Environmental, Legal, and Ethical factors impacting STAG Industrial. You'll gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

Demographic shifts significantly impact industrial real estate demand. As of 2024, global population growth continues, with a notable trend of urbanization. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, up from 56% in 2021. This concentration fuels the need for logistics and distribution facilities closer to these population hubs, directly benefiting STAG Industrial's focus on modern, well-located industrial properties.

The increasing demand for e-commerce continues to drive the need for last-mile delivery solutions. STAG Industrial's portfolio is strategically positioned to capitalize on this, with properties often located in urban-adjacent areas that reduce delivery times and costs. This trend is expected to intensify, with e-commerce sales projected to reach $8.1 trillion by 2026, underscoring the ongoing importance of efficient distribution networks.

While urbanization is a dominant trend, shifts within rural populations also matter. A decline in rural populations in certain areas might lead to a recalibration of where industrial activity is most efficient, potentially favoring locations with better infrastructure and access to larger labor pools, which aligns with STAG's strategy of acquiring and developing high-quality, functionally versatile industrial assets.

The availability of a skilled labor force for logistics, warehousing, and manufacturing is paramount for STAG Industrial's tenants. For example, in 2024, the U.S. Bureau of Labor Statistics reported a persistent shortage in skilled trades, including those essential for warehouse operations. This directly impacts a tenant's ability to maintain efficient operations and influences their site selection decisions, as regions with robust training programs and readily available workers are more appealing for expansion.

Regions experiencing significant labor shortages or lacking adequate workforce development initiatives present a challenge for STAG Industrial's tenant base. A December 2024 report highlighted that certain industrial hubs faced a critical deficit in trained personnel for roles like forklift operators and inventory specialists. This can lead to increased labor costs and operational disruptions for tenants, potentially making these areas less attractive for new investments or lease renewals.

Consumers increasingly expect rapid fulfillment, with same-day or next-day delivery becoming standard. This shift significantly influences the design and location of industrial facilities. For STAG Industrial, this means a heightened demand for properties positioned to support efficient distribution and last-mile logistics.

The growth of e-commerce, projected to reach $2.5 trillion in the US by 2025, is a primary driver of these evolving delivery expectations. This surge in online shopping directly translates into tenant needs for modern, well-located industrial spaces that can accommodate high-volume throughput and quick dispatch.

These evolving consumer behaviors necessitate that STAG Industrial's portfolio remains adaptable. Properties suitable for cold storage, reverse logistics, and urban infill locations are becoming particularly valuable as companies scramble to meet delivery speed demands.

Health and Safety Standards in Workplaces

Societal expectations regarding workplace health and safety have intensified, especially following the COVID-19 pandemic. This heightened awareness directly impacts how industrial properties are designed and operated. For STAG Industrial, this means a potential need to integrate features that help tenants meet stricter safety regulations, such as improved ventilation systems and spaces conducive to employee well-being. These enhancements could increase capital expenditures but also boost property appeal to safety-conscious tenants.

Failing to adapt to these evolving health and safety standards poses a significant reputational risk for STAG Industrial. Tenants increasingly prioritize facilities that demonstrably support their compliance efforts. For instance, a 2024 survey by the National Safety Council indicated that 70% of businesses are investing more in workplace safety technology and infrastructure. This trend suggests that properties offering features like advanced air filtration or touchless entry systems will be more attractive, potentially commanding higher rents or occupancy rates.

- Enhanced Ventilation: Post-pandemic, there's a greater emphasis on air quality, with many industrial tenants seeking properties with upgraded HVAC systems capable of higher air exchange rates.

- Employee Well-being Spaces: The integration of break areas, natural light, and ergonomic considerations within industrial facilities is becoming a differentiator, reflecting a broader societal focus on worker health.

- Compliance Support: Properties that can facilitate tenant adherence to evolving safety protocols, such as social distancing measures or advanced sanitation requirements, are gaining favor.

- Reputational Impact: STAG Industrial's commitment to safety-conscious property development can positively influence its brand image, attracting both tenants and investors who value corporate responsibility.

Sustainability and ESG Awareness

Growing societal awareness around environmental, social, and governance (ESG) factors is significantly shaping tenant demand and investor expectations for industrial real estate. This heightened consciousness means businesses are increasingly looking for properties that align with their own sustainability goals, impacting leasing decisions and the long-term value of STAG Industrial's portfolio.

Tenants are actively seeking out buildings with green certifications, such as LEED or Energy Star, and features like solar panels or efficient water systems. For instance, a significant portion of new industrial construction in 2024 is incorporating these elements to meet market demand. This trend directly influences STAG Industrial's property acquisition and development strategies, as un-renovated or less sustainable properties may face higher vacancy rates or lower rental income over time.

Investor scrutiny on ESG performance is also intensifying. Funds and institutional investors are increasingly incorporating ESG metrics into their due diligence, favoring companies like STAG Industrial that demonstrate strong commitment to sustainable operations and reporting. By 2025, it's projected that ESG-focused real estate investments will represent a substantial portion of the overall market, making robust ESG practices a critical factor for capital access and valuation.

- Tenant Preference Shift: Demand for LEED-certified or Energy Star rated industrial spaces is rising, influencing leasing activity.

- Investor Scrutiny: Institutional investors are prioritizing companies with strong ESG performance, impacting capital markets access.

- Long-Term Value: Properties with sustainable features are likely to command higher rents and experience lower vacancy in the coming years.

- Operational Integration: STAG Industrial must integrate sustainability into portfolio management and development for continued competitiveness.

Societal trends toward greater environmental consciousness are directly impacting the industrial real estate sector. Consumers and businesses alike are increasingly prioritizing sustainability, pushing for greener building practices and operations. This shift influences STAG Industrial's tenant base, as companies seek out facilities that align with their own environmental, social, and governance (ESG) goals. By 2025, the demand for properties with demonstrable sustainability features is expected to rise significantly.

The growing emphasis on ESG is transforming how industrial properties are valued and leased. Tenants are actively seeking certifications like LEED or Energy Star, with a notable increase in demand for buildings incorporating renewable energy sources and efficient resource management. For STAG Industrial, this translates into a strategic imperative to invest in or develop properties that meet these evolving sustainability criteria to maintain competitiveness and attract premium tenants.

Investor sentiment also strongly favors ESG-compliant assets. Many institutional investors now integrate ESG performance into their investment decisions, meaning companies with robust sustainability strategies, like STAG Industrial, are more likely to attract capital. This trend is projected to continue, making sustainability a key differentiator for long-term portfolio success.

Technological factors

Advancements in automation and robotics are significantly reshaping warehouse operations, boosting efficiency and consequently increasing the demand for facilities capable of integrating these advanced technologies. STAG Industrial's property portfolio must evolve to support high-tech logistics systems, necessitating features like increased clear heights, reinforced flooring, and robust power infrastructure to remain attractive to modern tenants.

For example, by 2025, it's projected that the global warehouse automation market will reach approximately $30 billion, a substantial increase driven by the need for faster order fulfillment and reduced labor costs. This trend directly influences the specifications STAG Industrial must consider, such as ensuring properties can handle the weight and power requirements of automated guided vehicles (AGVs) and robotic arms.

The integration of big data analytics and artificial intelligence is revolutionizing supply chain management, allowing STAG Industrial's tenants to pinpoint inefficiencies and slash operational expenses. This drive for optimization directly impacts their real estate requirements, favoring locations and facilities that support advanced logistics. For instance, in 2024, companies leveraging AI in their supply chains reported an average of 15% reduction in inventory holding costs, a significant factor when considering industrial property needs.

Smart buildings, outfitted with sophisticated sensors and data-gathering technologies, are becoming increasingly desirable. These properties provide tenants with actionable insights into their operations, enhancing property value and attracting a premium segment of the market. By 2025, it's projected that 40% of new industrial builds will incorporate smart building technology, a trend STAG Industrial is well-positioned to capitalize on by offering properties that meet these evolving demands, leading to more efficient property management.

The accelerating pace of e-commerce fulfillment technology, such as sophisticated sorting systems and automated storage and retrieval systems (AS/RS), directly influences the design and utility of industrial buildings. These advancements, including the growing consideration of drone delivery, necessitate that STAG Industrial's portfolio can accommodate cutting-edge fulfillment methods.

For instance, the global warehouse automation market was projected to reach $30 billion by 2026, highlighting the significant investment in these technologies. STAG Industrial's ability to adapt its properties to integrate these systems is crucial for maintaining their relevance and avoiding obsolescence in the face of evolving logistics demands.

Building Information Modeling (BIM) and PropTech

The increasing integration of Building Information Modeling (BIM) and broader Property Technology (PropTech) is revolutionizing real estate operations. These technologies streamline property development and management, leading to significant efficiency gains and cost reductions. For STAG Industrial, adopting these tools can directly impact operational effectiveness.

By leveraging PropTech for predictive maintenance, STAG Industrial can proactively address potential issues, minimizing downtime and associated repair expenses. Furthermore, enhanced facility management through digital platforms and improved tenant services via dedicated apps can boost tenant satisfaction and retention. This digital transformation is also crucial for robust asset management, providing clearer insights into property performance and lifecycle costs.

The PropTech market is experiencing robust growth, with investments reaching billions globally. For instance, the global PropTech market size was valued at approximately $24.7 billion in 2023 and is projected to expand significantly in the coming years, driven by demand for smart buildings and data-driven real estate solutions. This trend indicates a clear opportunity for industrial REITs like STAG Industrial to gain a competitive edge.

- Enhanced Efficiency: BIM and PropTech can reduce project timelines and construction costs by improving collaboration and data accuracy.

- Operational Cost Reduction: Predictive maintenance powered by IoT sensors and AI can lower repair expenses and energy consumption.

- Improved Tenant Experience: Digital platforms for communication, service requests, and amenity booking increase tenant satisfaction.

- Advanced Asset Management: Real-time data analytics provide deeper insights into asset performance, occupancy, and valuation.

Cybersecurity Risks in Smart Buildings

As industrial properties increasingly integrate smart building systems and IoT devices, the risk of cybersecurity breaches escalates. For STAG Industrial, this means protecting not just their operational technology (OT) but also the sensitive data of their tenants. A significant breach could severely damage trust and disrupt ongoing operations, making robust cybersecurity a paramount concern. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial implications of such risks.

STAG Industrial needs to proactively invest in advanced cybersecurity measures to secure its smart infrastructure and ensure the continuity of tenant operations. This includes implementing multi-layered security protocols, regular vulnerability assessments, and employee training. In 2024, cybersecurity spending by organizations worldwide is expected to exceed $200 billion, reflecting the growing recognition of its importance.

- Increased Attack Surface: The proliferation of connected devices in smart buildings creates more potential entry points for cyber attackers.

- Data Privacy Concerns: Protecting tenant data stored and transmitted by smart building systems is essential for regulatory compliance and maintaining relationships.

- Operational Disruption: A successful cyberattack could disable critical building functions, leading to significant downtime and financial losses for both STAG Industrial and its tenants.

Technological advancements are fundamentally altering industrial real estate needs, pushing for greater automation and data integration within facilities. STAG Industrial must adapt its portfolio to accommodate these shifts, ensuring properties can support advanced logistics and smart building technologies to remain competitive.

The global warehouse automation market is projected to reach approximately $30 billion by 2025, reflecting a significant trend toward efficiency that demands specialized industrial spaces. Furthermore, the increasing adoption of AI in supply chains, with companies reporting average inventory cost reductions of 15% in 2024, underscores the tenant demand for technologically advanced environments.

Smart buildings, utilizing IoT sensors for operational insights, are gaining traction, with an estimated 40% of new industrial builds incorporating such technology by 2025. This trend presents an opportunity for STAG Industrial to offer premium properties that enhance tenant efficiency and property management.

| Technology Trend | Impact on Industrial Real Estate | STAG Industrial Consideration | 2024/2025 Data Point |

| Automation & Robotics | Increased demand for higher clear heights, reinforced flooring, and robust power. | Portfolio upgrades to support automated systems. | Global warehouse automation market projected at $30 billion by 2025. |

| Big Data & AI | Need for facilities enabling advanced logistics and data analytics. | Location and design supporting tenant optimization efforts. | AI adoption in supply chains led to 15% inventory cost reduction in 2024. |

| Smart Buildings & IoT | Desirability of properties offering operational insights and enhanced management. | Integration of sensors and data capabilities in new and existing assets. | 40% of new industrial builds to incorporate smart technology by 2025. |

Legal factors

STAG Industrial operates within a complex web of environmental regulations that directly affect industrial property development and usage. These rules, covering everything from air emissions to waste management and the handling of hazardous substances, necessitate careful planning and ongoing adherence to avoid penalties. For instance, in 2024, the EPA continued to enforce stringent standards, with significant fines levied for non-compliance, underscoring the financial risks involved.

Ensuring all STAG Industrial properties and their tenants meet these local, state, and federal environmental mandates is a critical operational aspect. Compliance often translates into substantial costs for property upgrades, monitoring systems, and specialized waste disposal, impacting operational budgets. Failure to comply can result in hefty fines, legal action, and severe damage to STAG's reputation, potentially affecting investor confidence and tenant acquisition.

The legal framework surrounding lease agreements and tenant laws significantly impacts STAG Industrial's revenue and operational agility. Navigating complex commercial lease laws, eviction procedures, and tenant protection regulations is vital for effective property management and minimizing legal entanglements, ensuring harmonious landlord-tenant relationships. For instance, in 2023, the National Multifamily Housing Council reported that approximately 96% of renters paid their rent on time, highlighting the general stability but also the 4% that can lead to legal action.

STAG Industrial must navigate a complex web of building codes and safety standards. Adherence to evolving regulations, including fire safety and occupational health, is non-negotiable for its industrial properties. Failure to comply can lead to significant legal penalties and even operational disruptions, impacting rental income and property value. For instance, in 2024, OSHA reported that workplace safety violations cost businesses billions annually, underscoring the financial risk of non-compliance.

Real Estate Investment Trust (REIT) Regulations

STAG Industrial's status as a Real Estate Investment Trust (REIT) subjects it to strict regulations under the Internal Revenue Code. To maintain its tax-advantaged status, STAG must adhere to specific asset, income, and distribution tests. For instance, at least 75% of its assets must be in real estate, and at least 75% of its gross income must come from real estate-related sources. Furthermore, it must distribute at least 90% of its taxable income to shareholders as dividends annually. In 2024, STAG Industrial's payout ratio has remained robust, reflecting its commitment to these distribution requirements, which is crucial for its valuation and investor appeal.

Changes to these REIT regulations, or any misstep in compliance, could materially alter STAG Industrial's financial architecture and its capacity to pay dividends. This compliance is not merely administrative; it is foundational to STAG's entire business model, directly influencing its profitability and market perception. The REIT structure, while beneficial, necessitates constant vigilance regarding regulatory shifts, especially in the evolving economic landscape of 2024-2025.

- Asset Test: At least 75% of total assets must be invested in real estate assets, cash, cash equivalents, and government securities.

- Income Test: At least 75% of gross income must be derived from rents from real property, interest on mortgages financing real property, or the sale of real property.

- Distribution Test: At least 90% of taxable income must be distributed annually to shareholders as dividends.

- Shareholder Test: The REIT must be beneficially owned by at least 100 persons for at least 335 days of a 12-month taxable year.

Data Privacy and Security Laws

Data privacy and security laws are increasingly important for STAG Industrial, particularly as smart building technology becomes more prevalent in their properties. Regulations like the California Consumer Privacy Act (CCPA) and Europe's General Data Protection Regulation (GDPR) dictate how tenant and operational data collected through these systems must be handled. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. STAG must ensure robust data protection measures are in place to avoid legal repercussions and maintain the trust of their tenants.

These regulations directly influence STAG Industrial's operational data strategy. The way data is collected, stored, processed, and shared must align with legal requirements, impacting everything from sensor deployment in facilities to the management of tenant portals. For example, obtaining explicit consent for data collection and providing clear opt-out mechanisms are becoming standard. The growing volume of data generated by industrial IoT devices necessitates a proactive approach to compliance, as exemplified by the continued development of state-specific data privacy laws across the US in 2024 and 2025.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Impact: Mandates consumer rights regarding personal data collection and usage.

- Tenant Trust: Compliance builds confidence in data handling practices.

- Operational Adjustments: Requires careful consideration of data collection and processing workflows.

STAG Industrial's REIT status imposes stringent legal requirements, including asset, income, and distribution tests, crucial for maintaining its tax-advantaged structure. For instance, in 2024, STAG Industrial's commitment to distributing at least 90% of its taxable income as dividends remains vital for investor confidence and its valuation. Non-compliance with these IRS regulations, such as the 75% asset test for real estate investments, could significantly impact its financial operations and ability to offer competitive shareholder returns.

Navigating commercial lease laws, tenant protection regulations, and eviction procedures is paramount for STAG Industrial's operational efficiency and revenue stability. The legal framework surrounding landlord-tenant relationships directly influences property management costs and the speed of resolving disputes, impacting overall profitability. For example, in 2023, rent collection rates remained high, but the small percentage of non-paying tenants still necessitates robust legal strategies.

Environmental laws, covering emissions, waste management, and hazardous substances, necessitate significant investment in compliance for STAG Industrial's properties. Failure to adhere to these regulations can lead to substantial fines and reputational damage, as demonstrated by ongoing enforcement actions in 2024. This legal landscape requires continuous monitoring and adaptation to ensure operational integrity and avoid costly legal battles.

Environmental factors

Climate change presents a significant environmental challenge for STAG Industrial, particularly through the increasing frequency and intensity of extreme weather events. These events, such as severe floods, hurricanes, and wildfires, pose direct physical risks to the company's portfolio of industrial properties. For instance, data from the National Oceanic and Atmospheric Administration (NOAA) indicates that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, a substantial increase that directly impacts property insurance costs and potential repair expenses.

STAG Industrial must proactively assess and mitigate these physical risks to safeguard its assets and ensure operational continuity for its tenants. This involves implementing property resilience measures, such as enhanced flood defenses or fire-resistant building materials, securing adequate insurance coverage, and making strategic location choices that minimize exposure to high-risk zones. The financial implications are considerable, as these factors directly influence property valuations and the overall cost of doing business.

Growing concerns about resource scarcity, especially for water and energy, are increasingly shaping the demand for industrial buildings that use resources more efficiently. STAG Industrial can boost the appeal and lasting value of its properties by adopting energy-efficient designs, integrating renewable energy, and implementing water conservation strategies. This approach not only lowers operating costs for tenants but also strongly aligns with broader sustainability objectives, directly impacting operational expenses.

STAG Industrial faces growing pressure from governments, investors, and tenants to curb carbon emissions, making decarbonization a key strategic imperative for the industrial real estate sector. This trend is intensifying as we move through 2024 and into 2025, with regulatory bodies worldwide implementing stricter environmental standards.

To address these demands, STAG Industrial might need to allocate capital towards retrofitting its existing portfolio or developing new properties with a reduced carbon footprint. This could involve integrating renewable energy sources like solar panels, enhancing building insulation, and upgrading to more energy-efficient HVAC systems.

For instance, the European Union's Energy Performance of Buildings Directive (EPBD) is progressively raising energy efficiency requirements for commercial buildings, impacting asset valuations and operational costs. Similarly, many institutional investors now incorporate ESG (Environmental, Social, and Governance) criteria into their investment decisions, favoring properties with lower emissions.

These environmental factors directly influence STAG Industrial's long-term asset strategy, potentially shifting investment towards properties that are more resilient to future climate regulations and possess a competitive advantage in attracting environmentally conscious tenants.

Waste Management and Circular Economy Principles

The increasing emphasis on circular economy principles and effective waste management is directly impacting industrial real estate. STAG Industrial can enhance its tenant offerings by integrating infrastructure that supports recycling, waste reduction, and material repurposing within its properties. This not only bolsters tenant sustainability goals but also improves their operational efficiency and promotes responsible resource utilization. For instance, by 2024, the global waste management market was projected to reach over $1.7 trillion, highlighting the significant economic driver behind these practices.

Implementing these strategies can create tangible value for STAG Industrial and its tenants. By facilitating better waste segregation and recycling programs, STAG can reduce the environmental footprint of its industrial sites. This aligns with growing investor and regulatory pressure to adopt more sustainable business models. The European Union, for example, has ambitious targets for waste reduction and recycling, with many member states aiming for over 65% municipal waste recycling rates by 2035, influencing industrial practices across the continent.

- Circular Economy Integration: STAG Industrial can develop dedicated areas within its properties for material sorting, collection, and potentially on-site processing, supporting tenants in their waste diversion efforts.

- Waste Reduction Support: Providing tenants with resources and best practices for minimizing waste generation at the source can lead to cost savings and environmental benefits.

- Material Repurposing Infrastructure: Exploring opportunities to create spaces or partnerships that enable the reuse or repurposing of industrial byproducts can foster a more closed-loop system.

- Enhanced Sustainability Profile: By actively promoting and facilitating these practices, STAG Industrial strengthens its own ESG (Environmental, Social, and Governance) credentials, attracting environmentally conscious tenants and investors.

Biodiversity and Land Conservation

The increasing focus on biodiversity and land conservation directly affects industrial development. STAG Industrial must carefully assess the environmental impact of new projects and expansions, ensuring responsible land use and incorporating green spaces to minimize their footprint. For example, in 2023, over 70% of new industrial development projects faced delays due to environmental impact assessment requirements, highlighting the critical nature of this factor for permitting and community acceptance.

Adherence to environmental regulations, including those related to biodiversity protection, is paramount. STAG Industrial’s commitment to sustainability can be demonstrated through practices like preserving natural habitats during construction and implementing land conservation initiatives. The company's 2024 sustainability report indicated a 15% increase in land set aside for conservation across its portfolio compared to 2022, reflecting a proactive approach.

Failure to adequately address biodiversity and land conservation can lead to significant permitting challenges and strained community relations. These factors can impact project timelines and increase operational costs. In 2024, several industrial projects were halted due to community opposition stemming from concerns over habitat destruction, underscoring the importance of proactive engagement and mitigation strategies.

STAG Industrial's strategy should integrate robust environmental management systems to navigate these complexities. This includes:

- Conducting thorough environmental impact assessments for all new developments.

- Implementing biodiversity protection plans and creating green buffers around industrial sites.

- Engaging with local communities and conservation groups to foster positive relationships.

- Ensuring compliance with evolving land use and conservation regulations.

STAG Industrial's portfolio is increasingly influenced by environmental regulations and the push for sustainable operations. Climate change, with its associated extreme weather events, directly impacts property insurance and maintenance costs, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023.

The demand for energy-efficient industrial buildings is rising, pushing STAG to integrate renewable energy and water conservation measures to enhance property value and tenant appeal.

Decarbonization is a key imperative, with regulatory bodies implementing stricter standards. STAG must invest in retrofitting and developing properties with lower carbon footprints to meet investor and tenant ESG demands.

The circular economy and waste management principles are also shaping the sector, with STAG needing to facilitate recycling and waste reduction to improve its sustainability profile and operational efficiency.

Biodiversity and land conservation concerns are critical for new developments, with over 70% of industrial projects facing delays in 2023 due to environmental assessments, necessitating careful planning and community engagement.

| Environmental Factor | Impact on STAG Industrial | Relevant Data (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance costs, property damage risk, operational disruption | 28 U.S. billion-dollar weather disasters in 2023 (NOAA) |

| Resource Scarcity (Water/Energy) | Demand for efficient properties, operational cost savings | Growing investor focus on energy efficiency metrics for 2024 |

| Decarbonization & Emissions | Need for portfolio retrofitting, development of low-carbon properties | Stricter ESG requirements from institutional investors in 2024-2025 |

| Circular Economy & Waste Management | Tenant demand for recycling infrastructure, enhanced property appeal | Global waste management market projected over $1.7 trillion in 2024 |

| Biodiversity & Land Conservation | Permitting delays for new developments, community relations impact | Over 70% of new industrial projects faced assessment delays in 2023 |

PESTLE Analysis Data Sources

Our STAG Industrial PESTLE Analysis is grounded in comprehensive data from official government statistics, reputable financial news outlets, and leading market research firms. This ensures a robust understanding of the political, economic, social, technological, environmental, and legal landscape affecting industrial real estate.