STAG Industrial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STAG Industrial Bundle

STAG Industrial operates within a competitive landscape shaped by several key forces. Understanding the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry provides a crucial lens through which to view STAG's strategic positioning. This brief overview hints at the complexities, but the full picture is far more revealing.

The complete report reveals the real forces shaping STAG Industrial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For STAG Industrial, the bargaining power of individual land sellers is notably limited. This is primarily because land sellers are numerous and often geographically dispersed, preventing any single seller from wielding substantial influence over STAG's property acquisition strategies. STAG's operational model, which involves acquiring properties across a broad national portfolio, further dilutes the power of any individual seller.

STAG's capacity to source land from various markets effectively neutralizes the leverage any single land parcel owner might possess. The company's diversified approach means that if one seller's terms are unfavorable, STAG has numerous alternative options available.

The fragmented nature of land ownership within many industrial zones is a key factor. This fragmentation provides STAG with a wide array of choices, thereby reducing the concentration of supplier power and allowing STAG to negotiate from a position of strength.

While general construction services are plentiful, specialized contractors for industrial facilities demanding unique features like heavy-duty flooring, extreme ceiling heights, or robust power infrastructure can wield considerable influence. This is especially true in specialized sectors or for highly bespoke projects. However, STAG Industrial's primary strategy of acquiring and managing existing single-tenant industrial properties significantly curtails its direct dependence on new construction, thereby dampening this specific supplier bargaining power.

In instances where STAG does engage in new development or substantial redevelopment, the scarcity of skilled labor and specialized construction equipment can elevate the bargaining power of suppliers. For example, a report from the Bureau of Labor Statistics in 2024 indicated a persistent shortage in skilled trades, potentially impacting project timelines and costs for those requiring specialized industrial builds.

STAG Industrial's reliance on capital markets as its primary supplier means that factors like interest rates and investor confidence directly influence its ability to grow and operate. For instance, in 2024, rising interest rates could increase STAG's borrowing costs, thereby impacting its profitability and acquisition capacity. The REIT's established access to debt and equity markets provides some buffer, but macroeconomic trends remain a significant force.

Commoditized property management services

The bargaining power of suppliers in commoditized property management services for STAG Industrial is relatively low. This is primarily because the market for these services is highly competitive, with a large number of providers offering similar standard offerings. STAG's substantial portfolio size allows it to leverage its scale, negotiating more favorable terms and pricing from property management companies.

Switching costs for basic property management functions are also minimal, further diminishing the leverage of individual suppliers. For instance, in 2024, the industrial property management sector saw a steady supply of firms capable of handling routine leasing, maintenance, and tenant relations. This abundance of choice means STAG can easily find alternative providers if terms become unfavorable.

- Low Switching Costs: For standard property management tasks, STAG can switch providers with relative ease.

- Fragmented Supplier Market: The presence of numerous property management firms dilutes the power of any single supplier.

- STAG's Portfolio Scale: STAG's significant number of industrial properties enhances its negotiating position with service providers.

- Competitive Pricing: The competitive landscape allows STAG to secure competitive rates for property management services.

Utility providers' fixed influence

Utility providers, such as electricity, water, and gas companies, often function as regional monopolies. This structural characteristic grants them a substantial, though largely fixed, degree of bargaining power. For STAG Industrial, this translates to limited flexibility in negotiating utility rates, typically confined to standard commercial tariffs.

While STAG cannot significantly alter these rates, the direct financial burden is often mitigated. Utility costs are generally passed through to tenants as part of their occupancy expenses. This arrangement shields STAG’s core profitability from direct utility price fluctuations, though it does influence the overall cost of doing business for its lessees.

In 2024, commercial electricity prices in the United States saw an average increase. For instance, the average retail price for electricity for the industrial sector reached approximately 7.67 cents per kilowatt-hour in April 2024, a slight uptick from the previous year, underscoring the consistent, albeit sometimes growing, cost pressure from utility providers.

- Utility providers often operate as regional monopolies, giving them inherent bargaining power.

- STAG Industrial's ability to negotiate utility rates is restricted to standard commercial tariffs.

- Utility costs are primarily absorbed by tenants, insulating STAG's direct profit margins.

- Tenant absorption of utility costs impacts their overall occupancy expenses.

The bargaining power of suppliers for STAG Industrial is generally low due to the fragmented nature of land sellers and the availability of numerous property management firms. While specialized construction contractors and utility providers can exert more influence, STAG's business model of acquiring existing properties and passing utility costs to tenants mitigates much of this power.

What is included in the product

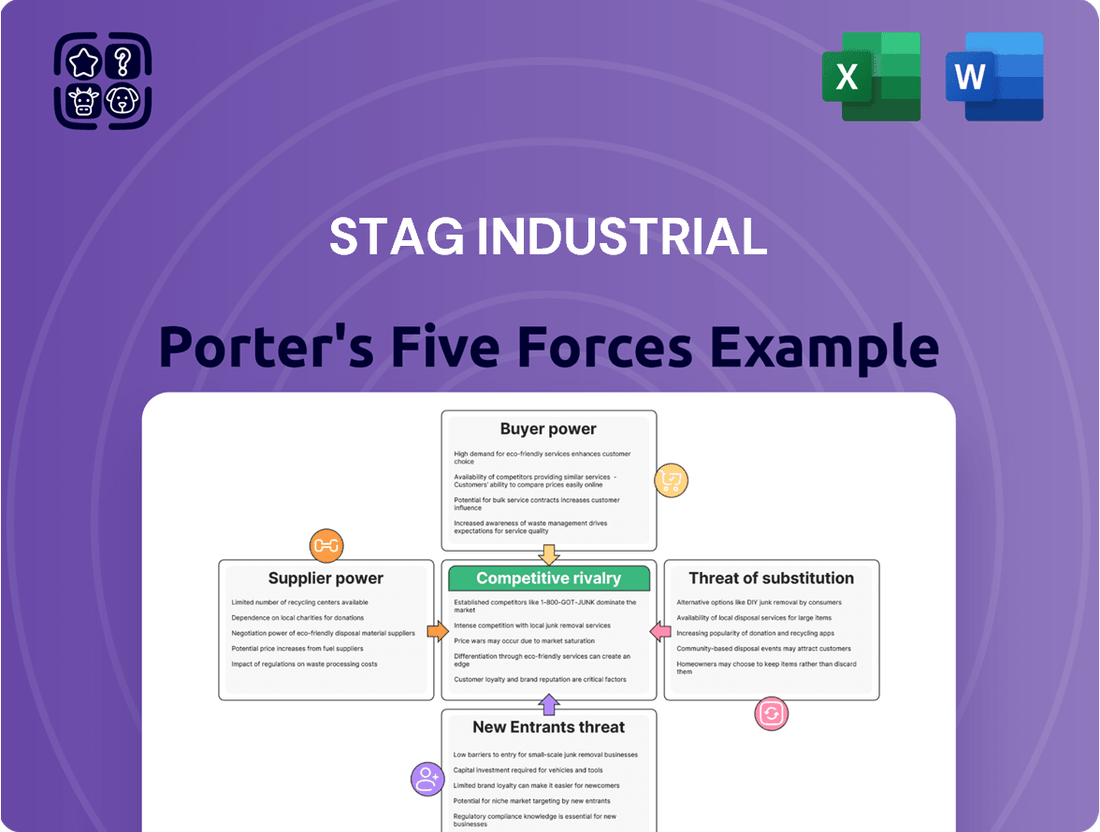

This Porter's Five Forces analysis delves into the competitive landscape for STAG Industrial, specifically examining industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes within the industrial real estate sector.

Instantly understand competitive pressures within the industrial real estate sector with a clear, visual representation of STAG Industrial's Porter's Five Forces.

Gain actionable insights into the forces shaping STAG Industrial's profitability, enabling more confident strategic planning and competitive positioning.

Customers Bargaining Power

STAG Industrial's focus on single-tenant properties inherently gives larger tenants more bargaining power due to the significant space they occupy. These tenants, especially those with long-term leases, can leverage their importance during renewal negotiations, potentially influencing rental rates or lease terms. For instance, a major tenant in a specific geographic area might have considerable sway.

However, STAG's diversification strategy across numerous single-tenant assets across various U.S. markets significantly dilutes the power of any individual customer. This broad tenant base, which numbered 461 as of the first quarter of 2024, means that the loss or renegotiation with one tenant has a limited impact on the overall business.

Industrial tenants, especially those with specialized machinery or intricate operational setups, encounter considerable expenses and logistical hurdles when considering a move. These costs encompass the physical relocation of assets, the potential need to re-engineer facilities at a new site, and the inherent risk of operational downtime. For example, a tenant heavily reliant on specific manufacturing equipment might face millions in moving and reinstallation costs.

Consequently, these elevated switching costs act as a significant deterrent for tenants looking to change properties. The financial burden and operational complexity associated with relocating often outweigh the potential benefits of seeking a new lease, thereby diminishing their leverage during renewal negotiations. This dynamic inherently strengthens STAG Industrial's position with its tenant base.

The bargaining power of STAG Industrial's customers is directly tied to the availability of alternative industrial spaces. When there are many vacant, suitable properties in a particular submarket, tenants gain leverage. For instance, as of early 2024, certain industrial submarkets experienced a slight uptick in vacancy rates compared to the historically low levels of previous years, giving some tenants more options.

Tenant diversification strategy

STAG Industrial's strategy of tenant diversification significantly curtails customer bargaining power. By spreading its properties across various industries, geographic locations, and tenant sizes, the company mitigates the risk associated with any single tenant. For instance, as of the first quarter of 2024, STAG reported having 566 tenants across its portfolio, with no single tenant representing more than 3.0% of its annualized rent. This broad base means that the departure or renegotiation of a lease by one tenant has a minimal effect on STAG's overall financial stability, thus limiting that tenant's leverage.

This approach strengthens STAG's negotiating position, as it's not overly reliant on any one customer. The ability to absorb the impact of losing a tenant, or to withstand aggressive lease renewal demands, is a direct result of this diversified tenant mix. The company's focus on essential industries further solidifies this advantage.

Key aspects of STAG's tenant diversification include:

- Geographic Dispersion: Properties are located across 43 states, reducing concentration risk in any single market.

- Industry Variety: Tenants operate in diverse sectors such as e-commerce fulfillment, food and beverage, manufacturing, and building products.

- Tenant Size Spectrum: The portfolio includes a mix of large, publicly traded companies and smaller, privately held businesses.

- Lease Expiration Management: A staggered lease expiration schedule prevents a large portion of the portfolio from facing renewal negotiations simultaneously.

Demand for e-commerce and logistics infrastructure

The robust and expanding demand for e-commerce and logistics infrastructure significantly bolsters the bargaining power of customers within this sector, as it directly impacts STAG Industrial's leasing environment. This trend, fueled by evolving consumer habits and the ongoing digital transformation of retail, creates a consistent need for well-positioned warehouse and distribution spaces. Consequently, businesses actively seeking these critical facilities are often willing to accept less favorable lease terms to secure essential operational capacity.

The increasing reliance on efficient supply chains and the growth of online sales mean that companies are in a constant race to acquire and maintain strategically located logistics assets. This competitive environment for space inherently weakens the tenant's negotiating leverage. For instance, in 2024, e-commerce sales continued their upward trajectory, with projections indicating sustained growth throughout the year and into 2025, underscoring the persistent demand for logistics facilities.

- E-commerce Growth: Global e-commerce sales are projected to reach trillions of dollars, highlighting the sustained demand for underlying logistics infrastructure.

- Supply Chain Optimization: Companies are investing heavily in optimizing their supply chains, increasing the need for modern and well-located distribution centers.

- Tenant Competition: The high demand leads to increased competition among tenants for desirable properties, reducing their individual bargaining power.

- Lease Renewals: Existing tenants often face higher renewal rates due to the difficulty of finding comparable alternative space in a competitive market.

STAG Industrial's customer bargaining power is tempered by high tenant switching costs and its diversified portfolio, which limits the impact of any single tenant. For example, in Q1 2024, STAG had 566 tenants, with no single tenant accounting for more than 3.0% of annualized rent, significantly diluting individual tenant leverage.

The strong demand for industrial and logistics spaces, driven by e-commerce growth, also reduces tenant bargaining power. Companies needing these facilities often accept less favorable terms to secure essential operational capacity, especially when comparable alternatives are scarce.

However, larger tenants or those occupying significant portions of a property can still exert influence, particularly during lease renewals. Their ability to negotiate favorable terms is amplified if alternative spaces are readily available in specific submarkets, a scenario that saw some submarkets experience slight vacancy increases in early 2024.

| Metric | Value (Q1 2024) | Implication for Customer Bargaining Power |

|---|---|---|

| Number of Tenants | 566 | High diversification limits individual tenant leverage. |

| Largest Tenant % of Annualized Rent | 3.0% | No single tenant has significant power due to low concentration. |

| Geographic Dispersion | 43 States | Reduces reliance on any single market, weakening tenant leverage in localized markets. |

Same Document Delivered

STAG Industrial Porter's Five Forces Analysis

The document you see here is the complete STAG Industrial Porter's Five Forces Analysis, precisely what you will receive immediately after purchase. This comprehensive breakdown offers an in-depth examination of the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry within the industrial real estate sector. You're previewing the final, professionally formatted version, ensuring no surprises and immediate usability for your strategic planning.

Rivalry Among Competitors

The industrial REIT market, despite its substantial size, is characterized by intense competition. STAG Industrial faces a broad array of rivals, including other publicly traded REITs, well-capitalized private equity firms, and major institutional investors, all vying for similar assets.

Even within its niche of single-tenant industrial properties, STAG encounters significant competition from entities with similar investment strategies. This competitive dynamic is fueled by the ongoing pursuit of attractive acquisition opportunities and the critical need to secure reliable tenants, pushing competition for favorable cap rates and lease agreements.

For instance, in 2024, the industrial sector continued to see robust transaction volumes. While specific market share figures for STAG against all competitors are proprietary, the sheer number of industrial REITs and private real estate funds actively acquiring assets underscores the fragmented nature of the market. This fragmentation means no single player dominates entirely, intensifying the rivalry for prime properties.

The industrial real estate sector, including companies like STAG Industrial, is experiencing robust demand. This surge is largely fueled by the relentless expansion of e-commerce, which necessitates more warehousing and distribution facilities, and the ongoing trend of supply chain reshoring, bringing manufacturing closer to home. These powerful demand drivers help to soften the impact of direct competition among property owners, as there’s generally enough business to go around.

However, the competitive landscape can still heat up if the construction of new industrial spaces outpaces the absorption rate in specific local markets. In such scenarios, landlords might find themselves competing more aggressively for tenants, potentially leading to concessions on rent or lease terms. This intensified competition could also affect STAG Industrial's ability to secure new acquisitions at favorable prices.

For STAG Industrial, the overall positive trajectory of the industrial market in 2024 provides a significant tailwind. As of the first quarter of 2024, the U.S. industrial vacancy rate remained historically low, hovering around 4.5%, according to various industry reports. This tight supply-demand balance generally supports rental growth and occupancy levels, benefiting STAG’s portfolio performance despite localized competitive pressures.

STAG Industrial thrives on a differentiated portfolio strategy, primarily focusing on single-tenant industrial properties. This specialization, combined with a data-driven approach to acquiring assets, allows them to carve out a unique position in the market. Their competitive edge isn't just in owning warehouses, but in the specific attributes of those properties and their strategic placement.

Even within seemingly similar industrial assets, significant differentiation exists. Factors like prime locations offering logistical advantages, advanced property features such as cross-dock capabilities or high clear heights, and the overall quality of property management play a crucial role. For instance, STAG's commitment to acquiring properties in supply-constrained markets with strong tenant demand, a strategy evident throughout their portfolio, helps mitigate direct price wars.

In 2024, STAG continued to emphasize portfolio quality and tenant diversification, a key element in reducing rivalry intensity. By acquiring properties with desirable characteristics and strong tenant credit profiles, they reduce the likelihood of tenants easily switching to competitors based solely on price. This focus on asset quality and location utility directly combats the pressure from rivals offering comparable, but less differentiated, spaces.

Acquisition competition for attractive assets

STAG Industrial faces intense competition when bidding for attractive industrial properties. This rivalry often inflates asset prices and squeezes capitalization rates, making it more challenging to achieve target investment returns. For instance, in the first quarter of 2024, industrial property transaction volumes saw fluctuations, with buyer demand remaining strong for well-located, modern assets.

The company contends with a diverse pool of competitors for these sought-after properties, including other publicly traded REITs, private equity firms, and institutional investors. This necessitates a highly effective property sourcing strategy and rigorous underwriting to identify and secure assets that align with STAG's specific investment criteria.

- High Demand for Industrial Assets: Continued strong demand for industrial real estate, particularly for logistics and distribution facilities, fuels competitive bidding.

- Compressed Cap Rates: Aggressive competition has led to lower capitalization rates on average for industrial properties, impacting potential yields.

- Diversified Competitor Base: STAG competes against a broad spectrum of investors, from large institutional funds to smaller, opportunistic buyers.

- Importance of Sourcing: A robust pipeline and the ability to identify off-market opportunities are critical differentiators in this competitive landscape.

Capitalization and cost of capital advantages

Larger, well-capitalized real estate investment trusts (REITs) like STAG Industrial often possess a significant edge due to their superior access to lower-cost capital. This is particularly impactful in the capital-intensive industrial real estate sector.

Companies with robust balance sheets and higher credit ratings can secure financing at more attractive interest rates. For instance, as of early 2024, STAG Industrial's credit rating from agencies like Moody's and S&P allows for more favorable borrowing terms compared to smaller, less established players.

This financial strength translates into a competitive advantage, enabling STAG to:

- Pursue larger-scale acquisition opportunities that might be beyond the reach of smaller competitors.

- Undertake development projects with greater financial flexibility, potentially leading to higher returns.

- Better weather economic downturns or market volatility due to a stronger financial cushion.

The competitive rivalry within the industrial REIT sector is significant, with STAG Industrial facing numerous players. This includes other publicly traded REITs, private equity firms, and institutional investors all targeting similar single-tenant industrial properties. The drive for attractive acquisitions and reliable tenants intensifies competition for favorable cap rates and lease terms.

In 2024, the industrial market continued to attract substantial investor interest, leading to robust transaction volumes. While specific market share data against all competitors is not publicly disclosed, the presence of many active industrial REITs and private real estate funds highlights a fragmented market where no single entity dominates, thereby intensifying rivalry for prime assets.

STAG Industrial differentiates itself through a focus on single-tenant industrial properties and a data-driven acquisition approach. This specialization, combined with acquiring assets in supply-constrained markets with strong tenant demand, helps to mitigate direct price competition. For instance, as of Q1 2024, the U.S. industrial vacancy rate was around 4.5%, indicating a tight supply-demand balance that generally supports rental growth and benefits STAG's portfolio performance despite localized competitive pressures.

The company's competitive edge also stems from its emphasis on portfolio quality and tenant diversification, a strategy that reduces the likelihood of tenants switching based solely on price. This focus on asset quality and location utility directly combats the pressure from rivals offering less differentiated spaces.

| Metric | STAG Industrial (as of Q1 2024) | Industry Average (Approx.) |

|---|---|---|

| U.S. Industrial Vacancy Rate | ~4.5% | ~4.5% |

| Capital Access Advantage | Higher credit ratings (e.g., Moody's, S&P) | Varies significantly by competitor size and financial health |

| Acquisition Strategy Focus | Single-tenant industrial properties in supply-constrained markets | Diverse (e.g., multi-tenant, development, various property types) |

SSubstitutes Threaten

Companies can opt to buy and own their industrial buildings instead of leasing from a real estate investment trust (REIT) such as STAG Industrial. This presents a direct substitute, especially for major corporations or those with very specific property requirements. For instance, a large manufacturing firm might find it more advantageous to own its extensive production facility rather than lease it, allowing for greater customization and long-term control.

The choice between owning and leasing often boils down to a company's capital allocation strategy and balance sheet objectives. While leasing offers flexibility and frees up capital for core business operations, outright ownership provides direct asset control and potential long-term appreciation. In 2024, many businesses are carefully weighing these factors, with some large corporations, like those in the automotive sector, opting for ownership of their vast campus-style facilities to integrate operations seamlessly.

While STAG Industrial primarily focuses on single-tenant industrial properties, multi-tenant industrial spaces and logistics parks can act as substitutes for certain businesses. These alternatives offer more flexibility, especially for smaller companies or those with variable space requirements. For instance, co-warehousing solutions allow businesses to lease only the space they need, potentially reducing costs.

However, these substitutes often come with trade-offs. They may not offer the same level of control, customization, or dedicated infrastructure that STAG's typical single-tenant clients require. This makes them less appealing for larger operations or those with specialized logistical needs, thereby limiting the direct substitutability for STAG's core market.

Technological advancements like advanced automation and vertical farming could eventually reduce the need for extensive physical warehouse and distribution spaces. For instance, companies are exploring robotic picking systems that optimize existing footprints, potentially slowing the demand for new, large-scale facilities. While these technologies are still developing, they signal a long-term shift in how goods are manufactured and delivered, which could impact the industrial real estate sector.

Shift to alternative supply chain models

The increasing adoption of alternative supply chain models poses a significant threat of substitutes for STAG Industrial's traditional large-scale distribution centers. As companies rethink their logistics, the demand for the very assets STAG specializes in could be impacted.

Decentralized micro-fulfillment centers, strategically placed closer to urban populations, are gaining traction. This shift, coupled with a rise in direct-to-consumer shipping directly from manufacturing facilities, alters the landscape of industrial real estate needs. For instance, the e-commerce boom, which saw a 15.1% increase in online retail sales in the US during 2023, fuels this trend towards localized fulfillment.

- Shifting Demand: While these new models may create opportunities for different types of industrial spaces, they can diminish the demand for STAG's core offering of large, single-tenant distribution facilities.

- Evolving Logistics: Companies are exploring more agile and responsive supply chain solutions to meet consumer expectations for faster delivery.

- Impact on Vacancy: A widespread move towards these alternative models could lead to increased vacancy rates in STAG's existing portfolio if tenant needs fundamentally change.

- Competitive Pressure: This presents a substitute for traditional distribution, potentially impacting rental income and asset values for STAG.

Outsourcing logistics to third-party providers (3PLs)

The threat of substitutes for STAG Industrial's core business, which involves owning and operating industrial real estate for logistics, is present through the rise of integrated Third-Party Logistics (3PL) providers. These 3PLs can manage a company's entire supply chain, including warehousing and distribution, effectively replacing the need for a company to own or lease dedicated industrial space directly from a landlord like STAG.

This trend poses a significant challenge as 3PLs, while often leasing space from STAG, could consolidate demand. This consolidation might grant them greater bargaining power with landlords, or conversely, incentivize them to develop their own extensive real estate portfolios, thereby becoming direct competitors.

For instance, major logistics players are increasingly offering end-to-end solutions. In 2024, the global 3PL market was valued at over $1.3 trillion, with significant growth driven by e-commerce expansion and the demand for streamlined supply chains.

This presents a dynamic where STAG must consider the evolving role of 3PLs:

- Centralized Tenant Demand: Large 3PLs can aggregate the space needs of multiple clients, increasing their leverage in lease negotiations.

- Portfolio Development: A strategic shift by 3PLs to build their own real estate assets could reduce their reliance on traditional industrial REITs.

- Integrated Service Offering: 3PLs providing a full suite of services, including real estate, can be a direct substitute for STAG's leasing model.

- Bargaining Power Shift: As 3PLs grow in scale and capability, they may command more favorable terms, impacting STAG's rental income potential.

Companies can choose to own their industrial buildings rather than lease from REITs like STAG Industrial, especially larger firms needing specific facilities. This direct substitute offers greater control and customization, a factor many businesses, such as those in the automotive sector, are prioritizing in 2024 by acquiring their own extensive campuses.

The rise of decentralized micro-fulfillment centers and direct-to-consumer shipping models also presents a substitute for STAG's large distribution centers. The US e-commerce market saw a 15.1% growth in online retail sales in 2023, fueling this trend toward localized fulfillment and potentially impacting demand for STAG's core assets.

Integrated Third-Party Logistics (3PL) providers offer a comprehensive substitute by managing entire supply chains, including warehousing. The global 3PL market exceeded $1.3 trillion in 2024, with these providers potentially consolidating demand and gaining leverage or even developing their own real estate portfolios.

| Substitute Type | Description | Impact on STAG | 2024 Relevance/Data |

|---|---|---|---|

| Building Ownership | Companies acquiring their own industrial facilities. | Reduces demand for leased space. | Large corporations in manufacturing and automotive sectors often prefer ownership for customization and long-term control. |

| Micro-Fulfillment Centers | Smaller, strategically located warehouses closer to consumers. | Shifts demand away from large, single-tenant distribution centers. | E-commerce growth (15.1% US online retail sales increase in 2023) drives this trend. |

| Third-Party Logistics (3PLs) | Companies managing end-to-end supply chains, including warehousing. | Can consolidate demand, increase bargaining power, or become direct competitors by owning real estate. | Global 3PL market valued over $1.3 trillion in 2024; major players offer integrated solutions. |

Entrants Threaten

The industrial real estate sector, particularly for large-scale players like STAG Industrial, presents a formidable barrier to new entrants due to exceptionally high capital requirements. Acquiring and developing a substantial portfolio of single-tenant industrial properties demands hundreds of millions, if not billions, of dollars in upfront investment. This immense capital need significantly restricts the pool of potential competitors capable of entering the market at a meaningful scale, thus protecting incumbent firms.

The industrial real estate sector, particularly for a company like STAG Industrial, requires a deep well of specialized knowledge. This includes everything from finding the right properties to ensuring they are managed efficiently. New companies entering this space would need to build this expertise from the ground up, which is a significant hurdle.

Successfully navigating property acquisition and management involves a complex process of sourcing, thorough due diligence, precise underwriting, skillful lease negotiation, and hands-on property management. For STAG Industrial, this expertise is not just a nice-to-have; it's fundamental to its operations. New entrants face a steep learning curve and substantial investment in developing these capabilities, making it challenging to compete effectively.

STAG Industrial has cultivated established, efficient processes and assembled a seasoned team with years of experience in these critical areas. This internal capacity acts as a substantial barrier to entry for potential competitors who lack such a foundation. In 2024, the industrial real estate market continues to see significant demand, but the barriers to entry related to operational expertise remain high.

STAG Industrial's advantage lies in its deeply entrenched network within the industrial real estate sector. This established reputation grants STAG preferential access to off-market deals, meaning opportunities that aren't publicly advertised, and a steady stream of potential acquisitions. For example, in Q1 2024, STAG announced acquisitions totaling $200 million, showcasing their ability to consistently source attractive properties through these established channels.

Newcomers face a significant hurdle in replicating STAG's access to deal flow and its robust network of relationships. Without these existing connections, new entrants would find it considerably more challenging to identify and secure desirable industrial properties and to attract high-quality tenants. This disparity in access creates an immediate competitive disadvantage for any new player entering the market.

The development of such an extensive and valuable network isn't a quick process; it requires years of dedicated effort, consistent engagement, and a proven track record of successful transactions. Consequently, new entrants would need to invest substantial time and resources simply to build a comparable foundation, a task that new entrants would find very difficult to replicate quickly.

Regulatory and zoning complexities

Regulatory and zoning complexities represent a significant hurdle for new entrants aiming to establish industrial properties. Navigating the intricate web of local zoning laws, environmental regulations, and stringent building codes can prove to be a time-consuming and costly endeavor. Newcomers lacking established local expertise and prior experience often encounter substantial delays and inflated development expenses, effectively raising the barrier to entry.

The sheer complexity of these regulatory landscapes adds a considerable layer of operational challenge for businesses venturing into the industrial real estate sector for the first time. For instance, in 2024, the average time to obtain building permits for commercial projects in major US metropolitan areas could range from 6 to 18 months, depending on the jurisdiction and project scope. Environmental impact assessments alone can add months and significant costs, especially for sites with potential historical contamination or proximity to sensitive ecosystems.

- Regulatory Hurdles: Compliance with diverse federal, state, and local regulations necessitates specialized knowledge and resources.

- Zoning Restrictions: Industrial land availability and permissible uses are often dictated by strict zoning ordinances, limiting expansion or development opportunities for new players.

- Environmental Compliance: Adhering to environmental protection laws, including those related to emissions, waste disposal, and site remediation, can be a major capital expenditure for new entrants.

- Building Code Adherence: Meeting evolving building codes related to safety, energy efficiency, and accessibility requires ongoing investment and technical expertise, which can be a barrier for less capitalized new firms.

Economies of scale in portfolio management

The threat of new entrants in the industrial real estate sector, particularly for REITs like STAG Industrial, is significantly mitigated by entrenched economies of scale in portfolio management. Larger, established REITs can spread crucial administrative, legal, and asset management costs across a much broader base of properties. This leads to lower per-unit operating expenses compared to newer, smaller players.

For instance, STAG Industrial, with its substantial portfolio, can leverage its size to negotiate better terms with vendors, service providers, and lenders. This financial advantage is hard for new entrants to replicate quickly. In 2024, the average industrial REIT's operating expense ratio can be substantially lower than a startup REIT's due to these scale efficiencies.

- Economies of scale in portfolio management: Larger REITs can amortize fixed costs over a greater number of assets, reducing the per-unit cost of management.

- Financing advantages: Established REITs typically access capital markets at lower interest rates due to their size, creditworthiness, and proven track record. For example, a well-established REIT might secure debt at a rate 50-100 basis points lower than a new entrant.

- Operational efficiencies: Bulk purchasing of services like property maintenance, insurance, and technology solutions offers cost savings that smaller portfolios cannot achieve.

- Market penetration costs: New entrants face higher initial marketing and acquisition costs to build a comparable portfolio and brand recognition.

The threat of new entrants in the industrial real estate sector, particularly for established players like STAG Industrial, is significantly constrained by the enormous capital requirements necessary to acquire and develop a substantial portfolio. This immense financial barrier prevents most potential competitors from entering the market at a scale that could meaningfully challenge incumbents.

New entrants also face a steep learning curve and substantial investment in developing specialized expertise in property acquisition, underwriting, lease negotiation, and property management. STAG Industrial’s established operational efficiencies and seasoned team, honed over years of experience, create a formidable advantage that is difficult and time-consuming for newcomers to replicate. In 2024, the ongoing demand in the industrial real estate market does not diminish these high barriers related to operational know-how.

The regulatory and zoning landscape presents another major hurdle. Navigating complex local laws, environmental regulations, and building codes can lead to significant delays and increased costs for new entrants lacking established local expertise. For example, obtaining permits in 2024 can take 6 to 18 months in many US metropolitan areas, with environmental assessments adding further time and expense.

Economies of scale also play a crucial role. STAG Industrial, like other large REITs, can spread fixed costs across a larger portfolio, leading to lower per-unit operating expenses and better financing terms. In 2024, these scale efficiencies allow established REITs to operate more cost-effectively than smaller, newer entities, further protecting them from new competition.

| Barrier to Entry | Description | Impact on New Entrants | STAG Industrial's Position | 2024 Relevance |

|---|---|---|---|---|

| Capital Requirements | Acquiring and developing industrial properties demands massive upfront investment. | Limits the number of capable competitors. | Well-capitalized, enabling large-scale operations. | Still a primary constraint in a capital-intensive market. |

| Specialized Expertise | Requires deep knowledge in property sourcing, underwriting, and management. | Steep learning curve and investment needed. | Possesses years of experience and a seasoned team. | Operational efficiency remains a key differentiator. |

| Regulatory & Zoning Complexity | Navigating diverse laws, environmental rules, and building codes. | Causes delays and increased development costs. | Established processes for compliance. | Permitting times and environmental assessments remain significant factors. |

| Economies of Scale | Spreading fixed costs over a larger property base. | Leads to lower per-unit operating expenses and better financing. | Benefits from significant cost advantages. | Scale efficiencies continue to provide a competitive edge. |

Porter's Five Forces Analysis Data Sources

Our STAG Industrial Porter's Five Forces analysis is built upon a robust foundation of data, drawing from STAG Industrial's SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research reports and publicly available data on real estate investment trusts (REITs) and industrial properties.