STAG Industrial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STAG Industrial Bundle

Unlock the strategic blueprint behind STAG Industrial's booming business model. This in-depth Business Model Canvas reveals how they effectively manage their vast industrial real estate portfolio, drive value, and capture significant market share.

Discover STAG Industrial's core activities, key resources, and crucial partnerships that fuel their success in the industrial property sector.

Gain clarity on their customer segments and the unique value propositions they offer to tenants and investors alike.

Understand the revenue streams and cost structure that underpin STAG Industrial's financial performance and growth strategy.

This comprehensive canvas is an invaluable tool for entrepreneurs, real estate investors, and business strategists seeking to learn from a proven industry leader.

Ready to dissect the success of STAG Industrial? Download the full, professionally crafted Business Model Canvas today and gain actionable insights to elevate your own business strategy.

Partnerships

STAG Industrial relies heavily on national and regional real estate brokerage firms for deal sourcing and tenant placement. These critical partnerships provide access to off-market opportunities and a broad pool of potential tenants. This is crucial for both portfolio growth, with STAG owning over 110 million square feet across 560+ properties in 2024, and maintaining high occupancy rates, which stood around 97.2% in early 2024. Strong relationships with brokers ensure a consistent pipeline of acquisition targets that meet STAG's specific investment criteria.

STAG Industrial cultivates strong ties with numerous banks, institutional lenders, and underwriters to ensure a robust capital pipeline. These partnerships are crucial for securing diverse financing, including their approximately $750 million revolving credit facility and various term loans. In 2024, such relationships enable the issuance of senior unsecured notes and common stock, supporting significant property acquisitions. This strategic approach ensures liquidity and maintains a flexible capital structure essential for growth and operational stability.

Major industrial tenants, including high-credit-quality companies like Amazon and FedEx, function as strategic partners for STAG Industrial. Securing long-term leases with these industry leaders significantly enhances portfolio stability and the predictability of cash flows. As of early 2024, STAG's portfolio benefits from a substantial portion of rent derived from investment-grade tenants, bolstering overall portfolio credit quality. These anchor tenant relationships are crucial, often facilitating more favorable financing terms for property acquisitions and developments. This symbiotic relationship underpins STAG's consistent operational performance.

Construction and Development Firms

STAG Industrial collaborates with reputable construction and development firms for build-to-suit projects and significant property renovations. These crucial partnerships enable STAG to deliver highly customized industrial facilities tailored to specific tenant operational requirements. Effective management of these collaborations is vital for ensuring projects are completed on time and within budget, strengthening tenant relationships and supporting STAG’s portfolio growth. For instance, the U.S. industrial construction pipeline remained robust in Q1 2024, with millions of square feet under development, highlighting the ongoing need for these partnerships.

- In Q1 2024, the U.S. industrial market saw over 450 million square feet of space under construction.

- These partnerships facilitate a 2024 delivery pipeline focused on modern logistics and e-commerce facilities.

- STAG's capital expenditures for development and re-development are strategically allocated to these projects.

- Tenant-specific requirements often drive the scope of these construction collaborations.

Legal and Advisory Services

STAG Industrial heavily relies on specialized legal firms, essential for managing complex real estate transactions, conducting thorough due diligence for acquisitions, and negotiating industrial property leases. These partnerships are crucial for ensuring compliance with evolving REIT regulations, especially as the industrial real estate market continues its growth into 2024. Additionally, STAG engages advisory firms for detailed market analysis and property valuation services, informing strategic investment decisions. These expert collaborations significantly mitigate operational risks and ensure all business activities, including their 2024 portfolio adjustments, are executed efficiently and legally compliant. Their focus on single-tenant industrial properties further emphasizes the need for precise legal and advisory support.

- Legal firms manage transaction support and regulatory compliance for REIT operations.

- Advisory firms provide market analysis and valuation crucial for strategic growth.

- These partnerships mitigate risks and ensure operational efficiency in 2024.

- Expert advice helps navigate complex real estate and financial landscapes.

STAG Industrial relies on specialized legal and advisory firms for navigating complex real estate and financial landscapes. These crucial partnerships ensure regulatory compliance for REIT operations and provide precise market analysis for strategic growth. Such expert advice mitigates risks, ensuring efficient 2024 operations and informed investment decisions within their portfolio.

| Partner Type | Key Function | 2024 Impact |

|---|---|---|

| Legal Firms | Transaction support, regulatory compliance | Ensures lawful acquisitions and REIT operations |

| Advisory Firms | Market analysis, property valuation | Informs strategic investment and growth decisions |

| Technology Partners | Data analytics, property management software | Enhances operational efficiency and portfolio insights |

What is included in the product

A detailed Business Model Canvas for STAG Industrial, outlining its industrial real estate acquisition, ownership, and management strategy, focusing on tenant relationships and long-term lease agreements.

This model highlights STAG's key partners, core activities in property management, and revenue streams derived from rental income, all within a framework of operational efficiency and strategic market positioning.

STAG Industrial's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework for understanding and optimizing their industrial real estate operations.

It simplifies complex strategies into a single, digestible page, easing the process of identifying and addressing operational inefficiencies.

Activities

Property acquisition and underwriting form STAG Industrial's core activity, focusing on identifying, evaluating, and acquiring single-tenant industrial properties aligned with their investment strategy. This involves rigorous due diligence, including in-depth market analysis and tenant credit assessments. STAG's proprietary risk assessment model is critical, enabling them to efficiently evaluate a high volume of potential deals. For instance, in 2024, STAG continued to strategically deploy capital, targeting acquisitions to enhance its diversified portfolio of industrial assets across the U.S.

STAG Industrial's asset and portfolio management involves strategic oversight to maximize property value and cash flow generation. Key activities include actively managing lease expirations and negotiating renewals, aiming for optimal occupancy and rental rates. For instance, STAG reported an occupancy rate of 97.7% as of Q1 2024, demonstrating effective portfolio management. They also identify opportunities for property expansion or redevelopment, alongside strategic asset dispositions to optimize long-term capital appreciation across their industrial real estate holdings.

Proactively managing the leasing process is critical for STAG Industrial, aiming for high occupancy rates across its industrial portfolio. This involves actively marketing vacant spaces and negotiating favorable lease terms. Maintaining strong, positive relationships with existing tenants is crucial for encouraging renewals, which significantly contributes to STAG’s stability. High tenant retention is a key performance indicator, reducing turnover costs and minimizing vacancy periods. In 2024, STAG Industrial consistently reported high occupancy, with their operating portfolio at 97.2% as of Q1 2024.

Capital Markets and Financing

STAG Industrial continuously engages with capital markets to fuel its growth and optimize its balance sheet. This involves actively raising equity through common stock offerings, such as their At-The-Market program, and issuing corporate bonds to diversify funding sources. The company also strategically manages its credit facilities, including its unsecured revolving credit facility, to ensure liquidity. This consistent activity provides the necessary capital for their industrial real estate acquisition strategy, while maintaining a net debt to adjusted EBITDA ratio of approximately 5.0x as of Q1 2024, supporting their investment-grade credit ratings.

- Net Debt to Adjusted EBITDA: Approximately 5.0x (Q1 2024).

- Credit Rating: Baa3 (Moody's) and BBB (S&P).

- Funding Sources: Common stock offerings, corporate bonds, unsecured credit facilities.

- Strategic Goal: Fund acquisitions while maintaining balance sheet strength.

Investor Relations and Reporting

As a publicly-traded REIT, STAG Industrial prioritizes robust investor relations. This involves consistently producing detailed quarterly and annual reports, such as their 2024 Q1 earnings report released in May, and conducting earnings calls to engage the investment community. Maintaining strict compliance with SEC regulations is paramount, ensuring transparency and fostering investor confidence.

Proactive communication through regular presentations at investor conferences, like those held throughout early 2024, is vital for a stable stock valuation and attracting new capital. This direct engagement helps clarify strategy and performance for stakeholders.

- Q1 2024 Earnings Call: May 1, 2024

- SEC Filings: Consistent 10-K and 10-Q submissions

- Investor Conferences: Active participation in industry events during 2024

- Shareholder Engagement: Regular updates on portfolio performance and growth initiatives

STAG Industrial's core activities include strategic acquisition and active management of single-tenant industrial properties, ensuring high occupancy rates like 97.2% in Q1 2024. They proactively manage leasing, aiming for optimal terms and strong tenant retention. Continuous engagement with capital markets, through equity offerings and bond issuances, fuels growth while maintaining a net debt to adjusted EBITDA ratio of approximately 5.0x as of Q1 2024. Robust investor relations, including Q1 2024 earnings reports, ensures transparency and investor confidence.

| Key Activity Area | 2024 Data Point | Metric |

|---|---|---|

| Asset Management | 97.7% (Q1 2024) | Occupancy Rate |

| Leasing Management | 97.2% (Q1 2024) | Operating Portfolio Occupancy |

| Capital Markets | ~5.0x (Q1 2024) | Net Debt to Adjusted EBITDA |

| Investor Relations | May 1, 2024 | Q1 2024 Earnings Call |

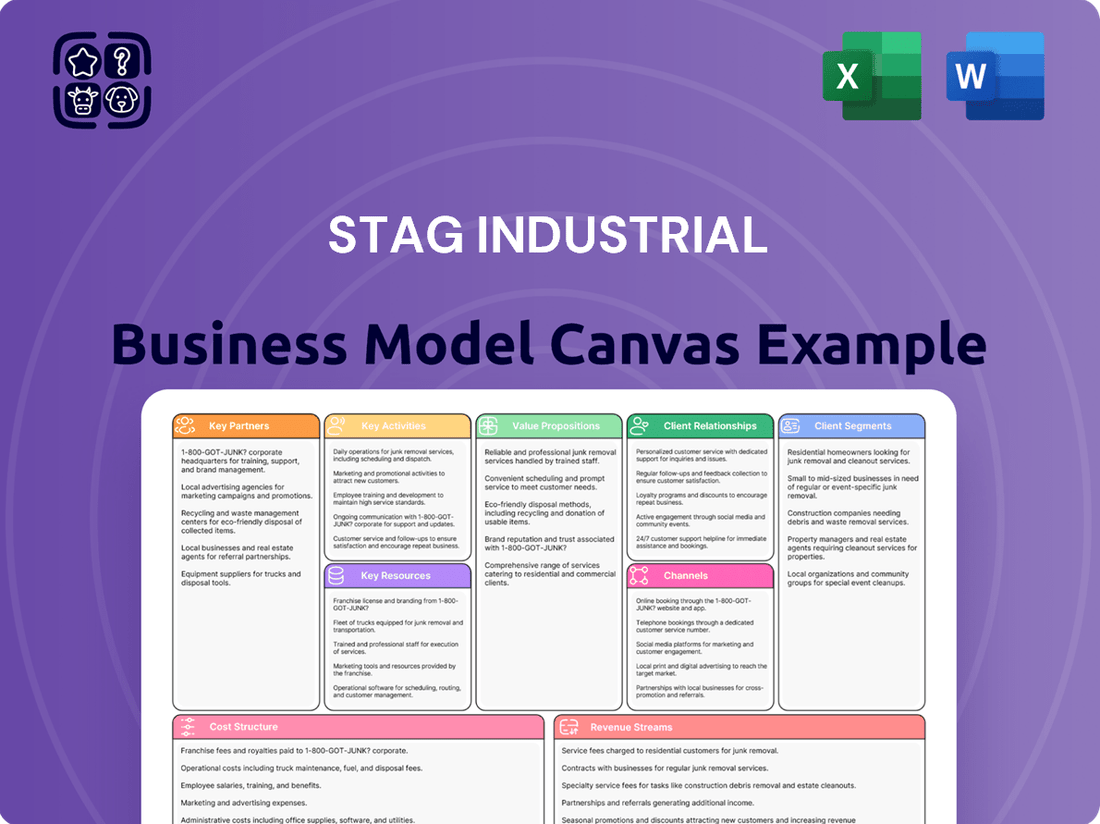

What You See Is What You Get

Business Model Canvas

This preview offers a direct glimpse into the STAG Industrial Business Model Canvas you will receive. The content and structure you see here are precisely what will be delivered upon purchase, ensuring no discrepancies. You are not viewing a sample, but a true representation of the final, comprehensive document. Once your order is complete, you will gain full access to this exact Business Model Canvas, ready for your immediate use.

Resources

STAG Industrial's core resource is its vast portfolio of single-tenant industrial properties. As of early 2024, this includes 563 buildings across 41 states, spanning approximately 112.5 million rentable square feet. This extensive physical asset base is the primary engine for revenue and consistent cash flow. The portfolio is highly diversified by geography, tenant, and industry, serving around 560 tenants. This strategic diversification significantly mitigates risks associated with any single market, tenant, or economic downturn.

STAG Industrial's status as a publicly-traded REIT on the NYSE provides crucial access to a deep and liquid pool of both equity and debt capital. This financial resource, supported by an investment-grade credit rating such as BBB from S&P Global Ratings as of early 2024, is a significant competitive advantage. It enables the company to efficiently fund large-scale acquisitions, like the over $200 million in acquisitions in Q1 2024, and maintain robust financial flexibility. A strong balance sheet underpins this capacity, allowing for strategic growth and market responsiveness.

STAG Industrial leverages its proprietary data and sophisticated analytical models for robust risk assessment and investment underwriting. This intellectual property allows the company to efficiently screen a vast pipeline of potential acquisitions, making data-driven decisions particularly in less transparent secondary markets. For instance, in 2024, STAG's models continued to support its strategy of identifying mispriced relative value across industrial properties. This resource is fundamental to their ability to achieve strong occupancy rates, which stood at 97.2% as of Q1 2024, by pinpointing optimal investment opportunities.

Experienced Management Team

STAG Industrial’s leadership team brings extensive expertise in industrial real estate, capital markets, and REIT management. Their collective experience, averaging over two decades per senior executive, is crucial for deal sourcing and negotiating complex transactions. This deep human capital directly contributes to STAG's strategic growth, evidenced by their 2024 acquisition volume. The team's industry relationships are invaluable for maintaining a robust pipeline and setting long-term portfolio strategy.

- The senior management team averages 20+ years of industry experience.

- Their expertise drives STAG's strategic acquisitions, reaching $118 million in Q1 2024.

- Strong relationships aid in sourcing properties across 41 states.

- Management’s acumen supports a portfolio of 569 buildings as of Q1 2024.

Strong Brand and Industry Reputation

STAG Industrial has cultivated a robust brand and industry reputation, recognized as a reliable and disciplined operator within the industrial real estate sector. This strong brand equity is crucial for fostering essential relationships with brokers, sellers, tenants, and capital providers. A positive reputation effectively attracts investment capital, as evidenced by its market capitalization of approximately $6.5 billion in mid-2024, and helps source high-quality acquisition opportunities, such as its 2024 focus on accretive single-tenant properties. This trust allows STAG to efficiently execute its investment strategy.

- Facilitates strong relationships with key stakeholders.

- Attracts significant investment capital.

- Aids in sourcing high-quality acquisition opportunities.

- Reinforces disciplined operational approach within the industry.

STAG Industrial's core resources are its extensive portfolio of 563 single-tenant industrial properties, spanning 112.5 million square feet across 41 states, maintaining 97.2% occupancy in Q1 2024. Crucial financial strength, evidenced by a BBB credit rating and a $6.5 billion mid-2024 market cap, ensures robust capital access for acquisitions exceeding $200 million in Q1 2024. This is further bolstered by proprietary data analytics and an experienced leadership team, averaging over two decades of industry expertise, which drives strategic growth and maintains a strong market reputation.

| Key Resource | 2024 Data Point | Details |

|---|---|---|

| Industrial Portfolio | 563 Buildings (Q1 2024) | 112.5M Rentable Sq Ft across 41 states |

| Financial Capital | BBB Credit Rating (S&P) | $6.5B Market Cap (mid-2024); $200M+ Q1 2024 Acquisitions |

| Human Capital | 20+ Years Avg. Executive Experience | Drives strategic acquisitions and market relationships |

Value Propositions

STAG Industrial offers investors a consistent and growing stream of monthly dividend income, appealing directly to those seeking reliable passive income. This income is robustly backed by cash flows from long-term leases with a highly diversified tenant base across its industrial portfolio. As a Real Estate Investment Trust, STAG is legally required to distribute at least 90% of its taxable income to shareholders, ensuring a strong payout. For 2024, STAG has continued its history of dividend growth, with an annualized dividend of $1.488 per share, paid monthly.

Investing in STAG Industrial provides targeted exposure to the secular growth of e-commerce and modern supply chain logistics. Its portfolio, encompassing over 112.5 million square feet across 569 properties as of Q1 2024, represents critical infrastructure supporting online retail. This allows investors to participate in a high-growth industry, as U.S. e-commerce sales are projected to exceed $1.1 trillion in 2024. STAG offers a stable, real-asset-backed investment vehicle, benefiting directly from the ongoing expansion of digital commerce. This strategy aligns with the increasing demand for efficient distribution networks.

STAG Industrial provides tenants with functional, well-located industrial facilities crucial for their daily operations, acting as a reliable, long-term landlord. These properties precisely meet the needs of logistics, distribution, and light manufacturing businesses. As of early 2024, STAG's portfolio spans over 110 million square feet across 42 states, supporting diverse tenant operations. This strategic approach allows tenants to focus on their core business without the significant capital outlay of owning real estate, enhancing their operational efficiency and financial flexibility.

For Investors: Risk Mitigation through Diversification

STAG Industrial mitigates risk for investors through its highly diversified portfolio of single-tenant industrial properties. By the first quarter of 2024, STAG owned 566 buildings across 41 states, spreading risk across hundreds of tenants and various industries. This extensive geographical and tenant diversification significantly reduces reliance on any single asset or economic downturn in a specific region, offering a stable investment for risk-averse capital.

- STAG's portfolio in Q1 2024 included 566 buildings.

- Properties are located across 41 U.S. states.

- Diversification spans numerous tenants and diverse industries.

- This strategy minimizes exposure to single-asset or regional economic risks.

For Tenants: Flexible Real Estate Solutions

STAG Industrial offers tenants flexible real estate solutions, from leasing existing industrial facilities to providing bespoke build-to-suit developments for unique operational needs. This adaptability makes STAG a prime partner for diverse industrial users, securing their long-term occupancy. As of Q1 2024, STAG's portfolio boasted an impressive 97.7% occupancy rate, showcasing strong tenant demand for these tailored options. The ability to customize and offer long-term leases helps attract and retain high-quality tenants, supporting stable cash flows.

- STAG's portfolio includes 563 buildings across 41 states as of March 31, 2024, offering diverse options.

- The company's in-house development capabilities support custom build-to-suit projects for specialized tenant requirements.

- Flexible lease terms and property modifications enhance tenant satisfaction and reduce turnover.

- High occupancy rates, such as 97.7% in Q1 2024, reflect strong market appeal for STAG's adaptable offerings.

STAG Industrial offers investors reliable monthly dividends, with a 2024 annualized payout of $1.488 per share, and targeted exposure to the growing e-commerce sector via its 112.5 million square feet portfolio as of Q1 2024. For tenants, it provides crucial, flexible industrial facilities across 41 states, maintaining a robust 97.7% occupancy rate in Q1 2024. This diversified approach also significantly mitigates investment risk by spreading assets across 566 properties and numerous tenants.

| Value Prop | Key Benefit | 2024 Data |

|---|---|---|

| Investor Income | Consistent Monthly Dividends | $1.488/share annualized |

| Market Exposure | E-commerce/Logistics Growth | 112.5M sq ft (Q1) |

| Tenant Solutions | Flexible Facilities | 97.7% Occupancy (Q1) |

Customer Relationships

STAG Industrial cultivates direct, professional relationships with its tenants through its dedicated in-house asset and property management teams. The core focus is on fostering long-term partnerships, which drives tenant satisfaction and contributes to strong retention rates. This approach ensures consistent lease renewals, reflecting a stable tenant base for 2024. Regular communication, responsive service, and proactive property maintenance are key to managing these vital relationships effectively.

STAG Industrial maintains a dedicated investor relations department for its shareholder customers, fostering transparent and consistent communication. This team provides accessible financial reports and investor presentations, alongside direct engagement. Through regular quarterly earnings calls, including those held on April 24, 2024, and July 24, 2024, they build trust. Their efforts aim to instill confidence in the company’s strategic direction and strong financial performance.

STAG Industrial actively cultivates robust relationships with national and local real estate brokerage communities, recognizing them as essential partners. These brokers serve as a primary channel for sourcing new industrial property acquisitions and identifying leasing opportunities across their portfolio. Through consistent communication, a reputation for reliable execution, and fair compensation, STAG ensures a steady pipeline of potential deals. This strategic engagement contributed to STAG's portfolio growth, reflecting a strong operational foundation in 2024.

Proactive Asset Management

STAG Industrial emphasizes proactive asset management, where each property or group of properties is overseen by a dedicated asset manager. This individual serves as the primary point of contact, ensuring tenants receive a personalized service model tailored to their specific operational needs. This direct relationship helps in deeply understanding tenant business requirements and proactively identifying opportunities for lease renewals or expansions, contributing to STAG’s high occupancy rates, which reached approximately 97.4% as of early 2024. This approach fosters long-term tenant satisfaction and retention across their diverse industrial portfolio.

- Dedicated asset managers oversee specific properties.

- Personalized service enhances tenant relationship management.

- Proactive engagement helps anticipate tenant expansion needs.

- Contributes to high occupancy, around 97.4% in early 2024.

Digital Portals and Self-Service

STAG Industrial likely offers secure digital portals for its diverse tenant base and investors, streamlining interactions. Tenants can efficiently manage rent payments, submit service requests, and access crucial lease documents online, enhancing operational convenience. For investors, these platforms provide easy access to account information, tax documents, and critical company reports, reflecting a commitment to transparent self-service options. This digital infrastructure is vital for managing their extensive portfolio, which included approximately 563 buildings across 41 states as of early 2024.

- Tenants utilize portals for rent payments, service requests, and lease document access.

- Investors access account information, tax documents, and company reports digitally.

- These platforms enhance efficiency and convenience for both user groups.

- Digital tools support the management of STAG Industrial's vast portfolio.

STAG Industrial builds strong customer relationships through direct tenant engagement via asset managers, fostering long-term partnerships that drive high retention rates. They maintain transparent communication with investors, including quarterly earnings calls, to instill confidence. Digital portals streamline interactions for both tenants and investors, supporting their portfolio of 563 buildings across 41 states as of early 2024.

| Customer Segment | Relationship Focus | 2024 Data Point |

|---|---|---|

| Tenants | Direct, Personalized Service | 97.4% Occupancy (early 2024) |

| Investors | Transparency, Trust | Q1 2024 Earnings Call (April 24, 2024) |

| Brokerage Community | Partnership, Deal Sourcing | Portfolio Growth (2024) |

Channels

STAG Industrial primarily leverages an expansive network of third-party commercial real estate brokers for both property acquisitions and tenant leasing. These brokers are crucial for sourcing potential industrial property purchases nationwide, given the fragmented market of individual asset sales. For instance, in 2024, broker relationships remain vital as industrial vacancy rates hover around 4-5% in many key U.S. markets, requiring efficient access to available spaces. They also market STAG's vacant industrial spaces to a broad tenant base, ensuring high occupancy rates and maximizing rental income, reflecting the essential role of intermediaries in today's competitive industrial real estate landscape.

STAG Industrial’s direct in-house teams are crucial for sourcing deals and negotiating leases, especially for larger, strategic acquisitions or with existing tenants. This direct engagement provides greater control over transactions and cultivates deeper tenant relationships, vital for long-term portfolio stability. For 2024, STAG continues to prioritize these direct channels, evidenced by their consistent occupancy rates, which stood at approximately 97.4% as of Q1 2024. These teams are particularly effective in managing lease renewals, which represented a significant portion of their leasing activity, demonstrating the value of direct, established connections.

The New York Stock Exchange (NYSE) serves as STAG Industrial's primary channel for investor customers to buy and sell its shares. This public listing ensures robust liquidity, with STAG averaging millions of shares traded daily on the NYSE in 2024, and provides broad access for diverse investors, from individuals to large institutions. The NYSE platform also facilitates transparency, as all corporate communications and financial disclosures, including quarterly earnings and SEC filings, are publicly accessible. This direct access on a major exchange underpins STAG's market valuation, which stood at approximately $7 billion in early 2024.

Investor Relations Website and Conferences

STAG Industrial effectively leverages its corporate investor relations website as a central hub, providing immediate access to essential financial reports, including its Q1 2024 earnings transcript, and comprehensive SEC filings. This digital channel ensures transparency and accessibility for all stakeholders. Additionally, STAG's management actively participates in key industry and investor conferences, such as those held in early 2024, to directly communicate strategic initiatives and future outlook to the financial community, fostering direct engagement.

- The website hosts all recent Q1 2024 financial results and annual reports.

- SEC filings, including 10-K and 10-Q forms from 2024, are readily available.

- Management regularly presents at major REIT and investor conferences.

- Webcast archives of past investor calls and presentations are accessible.

Industry Publications and Digital Marketing

STAG Industrial leverages industry publications, press releases, and digital marketing to solidify its brand and communicate its market position. This robust channel ensures high visibility among its target audience, including tenants and brokers, maintaining its reputation as a premier industrial real estate owner. For instance, STAG's portfolio expanded to 112.9 million square feet across 622 buildings in 2023, a figure regularly highlighted through these channels to reinforce its leadership.

- Utilizes industry publications for brand building.

- Employs press releases to communicate market position.

- Digital marketing enhances visibility among stakeholders.

- Reinforces reputation as a leading industrial REIT.

STAG Industrial utilizes a multi-pronged approach for its channels, primarily leveraging third-party brokers for acquisitions and leasing, alongside direct in-house teams for strategic deals and tenant relations, ensuring high occupancy rates of approximately 97.4% in Q1 2024. For investors, the New York Stock Exchange serves as the main conduit for share trading, with a market valuation around $7 billion in early 2024. Additionally, STAG employs its corporate investor relations website and participation in industry conferences to disseminate financial information, including Q1 2024 earnings, and uses industry publications for market positioning.

| Channel Type | Primary Function | 2024 Data Point |

|---|---|---|

| Third-Party Brokers | Acquisitions & Leasing | U.S. industrial vacancy 4-5% |

| Direct Teams | Strategic Deals & Retention | Q1 2024 Occupancy: 97.4% |

| NYSE Listing | Investor Access & Liquidity | Early 2024 Market Cap: ~$7B |

Customer Segments

E-commerce and Third-Party Logistics (3PL) companies are a primary and expanding customer segment for STAG Industrial. These tenants, from global giants to regional players, store and distribute goods sold online. They demand modern, strategically located distribution and fulfillment centers essential for rapid consumer delivery. This segment remains a significant driver of demand for STAG’s industrial properties, with e-commerce sales continuing to grow in 2024, driving demand for efficient logistics infrastructure.

Light manufacturing and assembly firms form a core customer segment for STAG Industrial, encompassing businesses performing value-added processing within their industrial spaces. These tenants require highly functional and flexible facilities to accommodate specialized production lines and operational workflows. STAG's portfolio caters to this need, with approximately 20.3% of its 2024 annualized base rent derived from manufacturing tenants. This segment provides STAG with stable, diversified income streams, contributing significantly to its overall tenant base.

Wholesale and bulk distribution companies form a core customer segment for STAG Industrial, requiring extensive warehouse spaces to store and distribute goods to businesses or retail outlets. These tenants prioritize facilities with efficient loading docks and high clear heights, essential for managing large inventory volumes. Despite being a mature sector, it remains a fundamental and stable driver of demand for industrial real estate. In 2024, the U.S. industrial vacancy rate for distribution was around 5.5%, indicating continued strong demand for such properties.

Income-Oriented Investors (Retail and Institutional)

Income-Oriented Investors, encompassing both retail individuals and large institutions like pension funds and endowments, seek stable, predictable income streams. These investors are strongly attracted to STAG Industrial's consistent monthly dividend, a key feature that continued throughout 2024. They value the defensive characteristics of STAG's diversified industrial real estate portfolio, which offers resilience against market fluctuations. Professional management further enhances their confidence, making them the primary buyers of STAG's stock.

- STAG's dividend yield was approximately 4.2% as of Q2 2024, appealing to income seekers.

- The company has paid monthly dividends without interruption since 2013.

- Its portfolio spans over 110 million square feet across 40+ states, reducing geographic and tenant concentration risk.

- Institutional ownership of STAG's stock remains significant, reflecting large-scale income mandates.

Air Freight and Logistics Providers

This specialized segment includes companies involved in air cargo, freight forwarding, and last-mile delivery services, crucial for STAG Industrial. These tenants require properties strategically located near major airports and transportation hubs to facilitate rapid inventory movement. The segment benefits from the increasing speed of global supply chains, with air cargo demand remaining robust. In 2024, global air freight volumes continued to see strong performance, driven by e-commerce and time-sensitive goods.

- Logistics providers demand facilities near key air hubs like those around Atlanta Hartsfield-Jackson or Dallas/Fort Worth.

- The global air freight market is projected to maintain growth, supporting demand for industrial real estate.

- Last-mile delivery services are increasingly integrating air freight for expedited shipping.

- STAG Industrial’s properties cater to the need for efficient cross-docking and distribution near airports.

STAG Industrial targets a diverse customer base, primarily e-commerce and third-party logistics firms, light manufacturing, and wholesale distribution companies. These tenants require modern, strategically located industrial properties for efficient storage, distribution, and production. In 2024, e-commerce growth and robust air freight volumes continued to drive demand for these facilities. STAG's portfolio caters to these varied operational needs, providing stable income streams.

| Customer Segment | Key Requirement | 2024 Data Point |

|---|---|---|

| E-commerce/3PL | Modern distribution centers | Driving demand as e-commerce sales grow |

| Light Manufacturing | Functional, flexible facilities | 20.3% of 2024 annualized base rent |

| Wholesale/Distribution | Extensive warehouse space | U.S. industrial vacancy around 5.5% |

Cost Structure

Property operating and maintenance expenses represent the direct costs of owning and managing STAG Industrial's real estate portfolio. These include essential outlays like property taxes, insurance premiums, necessary repairs, and external management fees. While a significant portion of these costs, such as property taxes and insurance, are typically reimbursed by tenants under triple-net (NNN) leases, STAG Industrial remains ultimately responsible for these operational lines. For instance, general and administrative expenses, which include some property-related oversight, were reported at approximately $62.6 million for the fiscal year 2023, reflecting ongoing operational commitments.

As a capital-intensive industrial REIT, a significant portion of STAG Industrial's cost structure is the interest expense paid on its debt. This includes payments on various instruments like mortgages, unsecured notes, and credit facilities. For the first quarter of 2024, STAG reported an interest expense of approximately $48.5 million. Managing interest rate risk and maintaining an optimal level of leverage are critical to controlling this major cost. These efforts directly impact the company's profitability and overall financial health.

General and Administrative (G&A) expenses represent the corporate overhead essential for STAG Industrial's operations, distinct from property-specific costs. These include executive and employee salaries, benefits, office rent, technology infrastructure, and marketing efforts. For 2024, STAG Industrial's G&A expenses are a crucial indicator of its operating efficiency. As a REIT, managing these overheads effectively, such as maintaining a competitive G&A as a percentage of revenue, is vital for maximizing investor returns and demonstrating a streamlined business platform.

Property Acquisition Costs

Each time STAG Industrial acquires a property, it incurs significant transaction costs, which are capitalized but represent a notable cash outlay. These costs typically include legal fees, comprehensive due diligence expenses, title insurance, and various other closing costs. Efficiently managing these expenditures is crucial for maximizing the return on new investments and ensuring favorable portfolio growth. For instance, in 2024, STAG has continued its strategic acquisitions, emphasizing cost-effective integration.

- Legal fees for property acquisition agreements.

- Due diligence to assess property condition and market fit.

- Title insurance premiums to protect against ownership claims.

- Closing costs, including transfer taxes and recording fees.

Depreciation and Amortization

Depreciation and amortization represent a significant non-cash expense for STAG Industrial, reflecting the accounting-based decline in the value of its industrial properties and other assets over time. While this expense reduces reported net income and taxable income, it crucially does not impact the company's immediate cash flow. Financial analysts closely monitor Funds From Operations (FFO) for REITs like STAG, as FFO adds back depreciation and amortization, providing a clearer measure of the company's true cash-generating ability from its operations.

- For Q1 2024, STAG Industrial reported FFO of $0.52 per share.

- Depreciation and amortization are typically the largest non-cash adjustments when calculating FFO for industrial REITs.

- This accounting treatment allows STAG to reinvest cash flow into property acquisitions and developments without immediate tax implications on the depreciated value.

- In 2023, STAG Industrial's total depreciation and amortization was approximately $226.7 million.

STAG Industrial's cost structure primarily involves property operating expenses, often reimbursed by tenants, alongside substantial interest expenses on its debt, which were $48.5 million in Q1 2024. Corporate overhead, encompassing general and administrative costs, is essential for operations and efficiency. Significant non-cash depreciation and amortization, totaling $226.7 million in 2023, also impact reported earnings. Additionally, each property acquisition incurs direct transaction costs, vital for portfolio expansion.

| Cost Category | Key Expense Type | 2024 Data (Q1) |

|---|---|---|

| Property Operations | Taxes, Insurance, Repairs | Largely tenant reimbursed |

| Financing Costs | Interest Expense | $48.5 million |

| Corporate Overhead | G&A Expenses | Crucial efficiency indicator |

Revenue Streams

STAG Industrial's primary revenue stream is the stable base rental income collected from tenants under long-term lease agreements on its industrial properties. This fixed rent, determined by the lease rate per square foot and the total occupied space, provides highly predictable cash flow. For example, STAG reported total revenues of approximately $169.7 million in Q1 2024, with rental income constituting the vast majority. This foundational income stream underpins their entire business model, ensuring consistent financial performance from their diversified portfolio.

Under STAG Industrial's prevalent triple-net (NNN) lease structure, tenants are responsible for paying their pro-rata share of property operating expenses. This crucial revenue stream includes reimbursements for property taxes, insurance, and common area maintenance. For instance, in the first quarter of 2024, STAG reported property operating expenses significantly offset by these tenant recoveries. The collection of these pass-through charges constitutes a major and stable revenue stream, directly offsetting the corresponding property-level expenses, enhancing net operating income.

While not a consistent operating revenue, STAG Industrial generates capital gains by strategically disposing of properties within its portfolio. If a property sells above its purchase price, the resulting gain, like the $4.5 million recognized from certain asset sales through Q1 2024, can be reinvested into new acquisitions. This activity is a key component of the company's active portfolio management strategy, optimizing asset allocation and enhancing overall returns. These dispositions are carefully timed to capitalize on market conditions and support long-term growth initiatives. The gains contribute to financial flexibility for future investments.

Lease Termination and Other Fees

STAG Industrial generates ancillary revenue from various fees beyond base rent. This includes fees from tenants who terminate leases early, late payment fees, and charges for specific services or property alterations. While less predictable than core rental income, these fees still contribute to the overall revenue picture. For instance, such other income, which includes these fees, represented a minor but consistent portion of total revenue for industrial REITs, typically less than 5% of total revenue.

- STAG Industrial's other income, including lease termination fees, was approximately $5.4 million for the nine months ended September 30, 2023, reflecting its ancillary revenue stream.

- These fees, while not a primary driver, offer a modest boost to net operating income.

- Early lease termination clauses provide a mechanism for compensation when tenants vacate properties ahead of schedule.

- The company also collects revenue from specific tenant services or property modifications.

Percentage Rents and Escalations

STAG Industrial largely generates revenue through long-term leases that feature contractual rent escalation clauses, ensuring predictable growth. These clauses typically mandate automatic annual rent increases, a common practice in industrial real estate. For instance, many 2024 leases include escalators often in the range of 2.0% to 3.0% per year, providing a steady upward trajectory for rental income. In rare instances, a lease might incorporate a percentage rent component, allowing STAG to capture additional revenue based on a tenant's sales performance above a defined threshold.

- Contractual rent escalations are a primary revenue driver, often 2.0-3.0% annually.

- These escalations are embedded in the majority of STAG's long-term lease agreements.

- Percentage rent clauses, though less common, offer potential upside linked to tenant sales.

- This structure provides consistent income growth and some variable upside.

STAG Industrial primarily generates revenue from stable base rental income, totaling approximately $169.7 million in Q1 2024, alongside tenant reimbursements for property expenses under NNN leases. Strategic property dispositions contribute capital gains, like $4.5 million in Q1 2024, enhancing financial flexibility. Ancillary fees, including lease terminations, supplement income. Moreover, contractual rent escalations, typically 2.0-3.0% annually, ensure predictable revenue growth.

| Revenue Stream | Q1 2024 Data | Description |

|---|---|---|

| Base Rental Income | ~$169.7M | Fixed rent from long-term leases. |

| Property Dispositions | ~$4.5M | Capital gains from asset sales. |

| Rent Escalations | 2.0-3.0% | Annual contractual increases. |

Business Model Canvas Data Sources

The STAG Industrial Business Model Canvas is built upon a foundation of extensive real estate portfolio data, financial disclosures, and market analysis. These sources ensure each component, from key resources to revenue streams, is informed by STAG's operational realities and market positioning.