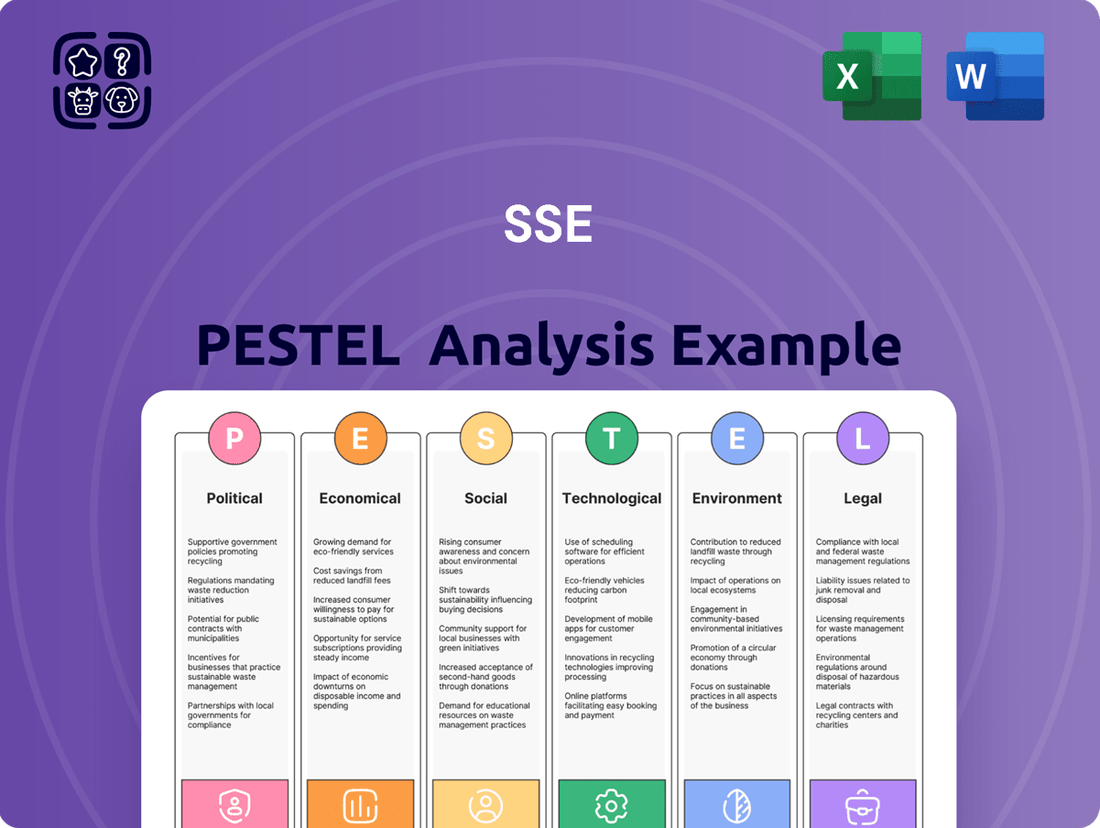

SSE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSE Bundle

Navigate the complex external environment impacting SSE with our comprehensive PESTLE analysis. Understand the political stability, economic fluctuations, and social shifts that influence its operations.

Our expert-crafted report delves into the technological advancements and environmental regulations affecting SSE, offering actionable insights for strategic planning.

Gain a competitive edge by leveraging our detailed examination of the legal landscape and its implications for SSE's future growth and market position.

Don't get left behind – equip yourself with the knowledge to anticipate challenges and capitalize on opportunities within SSE's operating sphere.

Download the full PESTLE analysis now to unlock a wealth of strategic intelligence and make informed decisions for your business or investment.

Political factors

The UK and Irish governments' unwavering commitment to achieving net-zero emissions by 2050 provides a robust political foundation for SSE's renewable energy strategy. Policies such as the UK's 'Clean Power by 2030' action plan, reinforced by the 2024/2025 policy landscape, directly align with SSE's core focus on large-scale wind and hydro projects. This sustained governmental backing fosters long-term certainty for SSE's significant capital expenditure, including its projected £18 billion investment in low-carbon infrastructure through 2027. Such political stability is crucial for accelerating the deployment of clean energy solutions.

As a key network operator, SSE faces significant influence from Ofgem, the energy regulator, particularly through price controls such as the upcoming RIIO-ED3 framework which will define revenue allowances and performance incentives from April 2028. Shifts in this regulatory environment directly impact SSE's transmission and distribution revenues and investment returns. For instance, Ofgem's recent decision, affirmed in late 2024, to maintain a national pricing system for wholesale electricity, rather than regional pricing, provides crucial policy clarity. This stability reduces investment risk, supporting SSE's £18 billion net zero acceleration programme through 2027.

Government support schemes, like Contracts for Difference (CfD), remain vital for the financial viability of SSE's new renewable energy projects. The upcoming CfD Allocation Round 6 in 2024, with its adjusted administrative strike prices, directly influences the profitability of future wind farm developments. Any changes in the availability or terms of these subsidies, such as those seen in CfD AR5, significantly impact SSE's investment decisions and development pipeline. Furthermore, the UK government's industrial strategy and funding initiatives for clean energy supply chains, including port infrastructure, present growth opportunities for SSE through 2025.

Energy Security and Independence

Heightened geopolitical focus on energy security significantly boosts the political will to reduce reliance on imported fossil fuels, directly benefiting UK and Ireland-based energy producers like SSE. This drive encourages substantial investment in domestic renewable sources, aligning perfectly with SSE's extensive portfolio in offshore wind and hydro power. For instance, the UK's target to achieve 50 GW of offshore wind capacity by 2030 underscores this national priority for homegrown energy. SSE's capital expenditure of approximately £18 billion through 2027 is largely directed towards building this critical infrastructure, enhancing energy independence.

- UK aims for 50 GW offshore wind by 2030, enhancing energy security.

- SSE plans £18 billion capital investment by 2027, primarily in renewables.

- Political support for domestic generation reduces reliance on volatile global markets.

- This strategy directly supports SSE's core business in renewable energy development.

Planning and Consenting Regimes

The process of securing planning permission for SSE's large infrastructure projects, like new offshore wind farms or grid upgrades, remains notably lengthy and complex across the UK. Political decisions, such as the UK Government's National Policy Statement EN-1, can either accelerate or significantly hinder the development of essential energy infrastructure. Delays in this consenting regime often necessitate adjustments to SSE's capital investment plans, impacting project timelines and costs. For instance, achieving consent for a major transmission link can take over four years, affecting the delivery of critical 2025 renewable capacity.

- Consent for major transmission projects can exceed four years.

- UK grid upgrades, vital for 2025 renewable targets, face planning bottlenecks.

- Delays impact SSE's projected £18 billion investment plan through 2027.

Government policies targeting net-zero by 2050, like the UK's Clean Power by 2030 plan, strongly support SSE's renewable energy focus. Regulatory frameworks such as Ofgem's RIIO-ED3, effective from April 2028, shape SSE's network revenues and investment returns. Crucially, schemes like CfD Allocation Round 6 in 2024 directly impact new project profitability. Geopolitical energy security drives further investment in domestic generation, benefiting SSE's £18 billion capital program through 2027.

| Factor | Policy/Target | Impact on SSE |

|---|---|---|

| Net-Zero | UK 2050 target | Supports £18bn renewables investment |

| Regulation | Ofgem RIIO-ED3 | Influences post-2028 revenues |

| Subsidies | CfD AR6 (2024) | Affects project viability |

What is included in the product

The SSE PESTLE analysis meticulously examines how external macro-environmental forces—Political, Economic, Social, Technological, Environmental, and Legal—shape the operating landscape for the SSE.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, removing the pain of manually compiling information.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the stress of being unprepared for strategic conversations.

Economic factors

High inflation, as seen with UK CPI hovering around 2.3% in April 2024, directly elevates SSE's operational costs and the cost of capital for its extensive infrastructure projects. However, a significant portion of SSE's revenues, particularly from its regulated networks like SSEN Transmission, are indexed to inflation, providing a crucial partial hedge against rising prices. Fluctuating interest rates, with the Bank of England base rate at 5.25% as of May 2024, directly impact the cost of borrowing for SSE's substantial £18 billion net investment program planned through 2027. This financial environment necessitates careful capital management to fund their energy transition initiatives.

SSE is undertaking a substantial capital investment plan, committing approximately £17.5 billion over five years to 2027, specifically for net zero infrastructure development. This significant investment is vital for the company's growth, yet it also exposes SSE to financial risks tied to project execution and dynamic market conditions. Given the prevailing macroeconomic environment, SSE has recently adjusted its investment strategy. This reflects a pragmatic response to economic pressures, aiming to balance ambitious growth with financial prudence in the 2024/2025 period.

While SSE has divested its retail supply business, its generation assets are still significantly exposed to wholesale electricity price volatility. Lower price volatility, as seen with European wholesale power prices stabilizing in late 2024, can reduce profits from its flexible thermal generation and gas storage assets. Conversely, SSE's diversified business model, with regulated networks contributing over 60% of its adjusted operating profit in fiscal year 2024, provides stable returns that help to offset market-based fluctuations. This robust network income helps to mitigate the impact of unpredictable energy market swings on overall profitability.

Economic Contribution and Job Creation

SSE is a crucial economic contributor in both the UK and Ireland, supporting thousands of jobs across its operations. This substantial economic footprint, including billions invested in local infrastructure, strengthens its relationships with governments and communities. For instance, SSE Renewables alone contributed over £2 billion to the UK and Irish economies in its last reported financial year, reinforcing its social license to operate.

- SSE is a major economic contributor in the UK and Ireland.

- It supports thousands of jobs directly and indirectly.

- Billions are invested in local infrastructure projects annually.

- SSE Renewables contributed over £2 billion to these economies.

Supply Chain Costs and Constraints

Global demand for critical renewable energy components, such as offshore wind turbines and high-voltage cables, continues to exert significant pressure on supply chains, driving up project costs in 2024 and 2025. SSE's ability to effectively manage these complex supply chains is paramount for delivering its ambitious large-scale projects, like the 2.6 GW Eastern Green Link 2 (EGL2) transmission project, on time and within budget. The company actively collaborates with strategic partners to build more resilient supply networks, mitigating risks from geopolitical shifts and raw material price volatility. These efforts are crucial for maintaining project viability and meeting clean energy targets.

- Wind turbine prices saw a notable increase of over 15% in 2023, impacting new project economics.

- Supply chain disruptions added an estimated 10-15% to capital expenditures for major offshore wind farms in 2024.

- SSE's capital expenditure for green energy and infrastructure is projected to exceed £18 billion through 2027.

High inflation and interest rates, such as the UK CPI at 2.3% and the Bank of England rate at 5.25% in May 2024, directly increase SSE's operational and borrowing costs for its £18 billion investment program. While wholesale electricity price volatility remains a factor, over 60% of SSE's FY2024 adjusted operating profit came from stable regulated networks. Significant supply chain pressures are also elevating project costs, with wind turbine prices up over 15% in 2023, impacting new infrastructure development through 2025.

| Economic Factor | 2024/2025 Data Point | Impact on SSE | ||

|---|---|---|---|---|

| UK CPI Inflation | 2.3% (April 2024) | Increases operational costs; partially hedged by indexed revenues. | ||

| BoE Base Rate | 5.25% (May 2024) | Elevates borrowing costs for £18bn investment. | ||

| Wind Turbine Prices | +15% (2023) | Raises capital expenditure for new renewable projects. |

What You See Is What You Get

SSE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This SSE PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors affecting SSE businesses.

You'll gain valuable insights into market trends, competitive landscapes, and potential challenges or opportunities.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed and actionable framework.

Sociological factors

Public demand for clean energy and climate action significantly boosts SSE's business model, creating a favorable social climate. Recent 2024 surveys indicate over 85% public support for renewable energy in the UK, underpinning the societal shift away from fossil fuels. This broad backing strengthens SSE's long-term strategy in renewable generation and electricity networks. However, specific infrastructure projects can still encounter localized opposition, requiring careful community engagement. This dual dynamic shapes SSE's strategic planning.

SSE heavily invests in communities, providing funds for local projects and fostering goodwill, which is crucial for social license to operate. For its network expansion, SSEN Transmission's strategy prioritizes engaging with communities to ensure they share in the value of new infrastructure projects. This proactive and positive community engagement is vital for gaining acceptance for significant developments, such as the £10 billion RIIO-T2 investment program continuing through 2026. Such efforts directly contribute to social cohesion and project viability, with benefit-sharing schemes enhancing local economic resilience.

The widespread electrification of transport and heat is poised to significantly increase overall electricity demand, creating a robust long-term growth driver for SSE's generation and network businesses as the UK transitions towards net-zero targets by 2050. However, in the short term, prevailing high energy prices and increased energy efficiency measures among consumers have led to a notable reduction in domestic energy consumption. This trend saw UK domestic energy consumption hit a record low in 2023, reflecting immediate behavioral shifts. This dual dynamic presents both substantial future opportunities and current demand management considerations for SSE's operational planning into 2024 and 2025.

Focus on a 'Just Transition'

Societal expectations increasingly demand a just transition to a net-zero economy, ensuring fairness and job creation without leaving communities behind. SSE's commitment as a real Living Wage employer, covering 100% of its direct employees by early 2024, aligns with this principle. This focus on creating quality green jobs, such as those supporting its £18 billion capital investment plan through 2027, strengthens its corporate reputation. This approach helps maintain public trust and attracts skilled labor.

- SSE committed £18 billion in capital investment by 2027 to drive green energy projects.

- 100% of SSE's direct employees were paid the real Living Wage by early 2024.

- The transition aims to create quality jobs in renewables and network infrastructure.

Skills and Workforce Development

The energy transition to a renewable-led system demands a highly skilled workforce, particularly in new green technologies. SSE actively addresses this by investing in substantial apprenticeship and training programs, aiming to build a robust talent pipeline. Access to this specialized workforce is a critical sociological factor for delivering its ambitious infrastructure projects, like the £18 billion investment planned through 2027. For 2024, SSE aims to recruit 200 new apprentices and graduates, ensuring future project delivery.

- SSE plans to invest £18 billion by 2027, largely in renewable infrastructure.

- A skilled workforce is essential for executing projects such as new wind farms and grid upgrades.

- In 2024, SSE targets recruiting 200 new apprentices and graduates.

Sociological factors significantly shape SSE's operations, driven by strong public support for renewable energy—over 85% in the UK in 2024. This societal shift, alongside demands for a just transition, influences SSE's commitment to community engagement and paying 100% of its direct employees the Real Living Wage by early 2024. The long-term trend of electrification promises increased demand, while a focus on developing a skilled green workforce is crucial for delivering projects, with 200 new apprentices and graduates targeted for 2024.

| Sociological Factor | 2024/2025 Data Point | Impact on SSE |

|---|---|---|

| Public Support for Renewables | >85% UK public support (2024) | Strong backing for green infrastructure |

| Just Transition & Wages | 100% direct employees paid Real Living Wage (early 2024) | Enhances social license and reputation |

| Skilled Workforce Development | 200 new apprentices/graduates targeted (2024) | Ensures capacity for £18bn investment by 2027 |

| Community Engagement | £10bn RIIO-T2 investment program (through 2026) | Crucial for project acceptance and viability |

Technological factors

Continuous innovation in renewable technologies, like more powerful offshore wind turbines and efficient solar cells, directly improves the productivity and cost-effectiveness of SSE's assets. For instance, new turbine models are boosting capacity factors for projects like the 3.6 GW Dogger Bank Wind Farm, set to be fully operational by 2026. SSE is also actively exploring emerging technologies such as green hydrogen and carbon capture, utilisation and storage (CCUS) to decarbonise its flexible generation. The company is a key partner in major CCUS and hydrogen cluster projects, including the Net Zero Teesside Power and Keadby 3 Carbon Capture Power Station, both progressing towards final investment decisions in 2024/2025. These advancements are critical for SSE to meet its Net Zero targets by 2040.

Technological advancements in large-scale energy storage, like batteries and pumped hydro, are crucial for balancing the grid given the rise of intermittent renewable generation. SSE is developing the Coire Glas pumped hydro project, which is set to be the UK's first such development in over 40 years, offering a potential 1.5 GW capacity. This project is vital for grid stability, especially as renewable energy sources are projected to make up a significant portion of the UK's power generation by 2025. Continued innovation in these storage technologies remains key to enabling a fully renewable-powered electricity system.

SSE is heavily investing in the digitalization of its electricity networks, developing advanced smart grids that leverage real-time data and automation. These innovations aim to significantly boost efficiency and enhance network resilience, particularly as energy flows from decentralized renewable sources increase. By 2025, SSE expects its digital twin deployments across its transmission assets to optimize maintenance schedules, reducing operational costs by an estimated 8-10%. The integration of AI-driven analytics is further streamlining energy management, enhancing grid stability and accelerating the transition to a net-zero system.

High-Voltage Direct Current (HVDC) Technology

High-Voltage Direct Current (HVDC) technology is crucial for transmitting vast amounts of power over long distances, particularly from the growing number of offshore wind farms. SSEN Transmission, part of SSE, achieved a world-first in HVDC interoperability by late 2024, enabling systems from different manufacturers to work seamlessly together. This innovation significantly reduces costs and mitigates supply chain risks associated with building the extensive offshore grid network required for the UK's renewable energy targets. The Shetland HVDC link, operational by 2024, exemplifies this advancement, supporting over 270 MW of renewable generation.

- HVDC is vital for transmitting over 2 GW from new offshore wind projects by 2025.

- SSEN Transmission's interoperability breakthrough reduces offshore grid development costs by an estimated 10-15%.

- The Shetland HVDC link, operational in 2024, showcases this advanced technology supporting over 270 MW.

Decarbonisation of Heat and Transport

Technological shifts towards electric vehicles and electric heating systems, like heat pumps, are fundamental drivers of future electricity demand. SSE's strategy is well-positioned to meet this growing need by expanding its renewable generation capacity. The company aims to invest £18 billion by 2027, primarily in renewables and networks, to support the UK's decarbonization goals. This includes reinforcing electricity networks to handle the increased load from electrification of transport and heat.

- By 2027, SSE targets £18 billion investment, with a significant portion allocated to renewable generation.

- The UK government projects millions of heat pump installations by 2030, substantially increasing electricity demand.

- EV adoption is rapidly accelerating, with over 1.1 million pure electric cars registered in the UK by early 2024.

- SSE Renewables aims to deliver 50 GW of renewable generation by 2030 across its markets.

SSE leverages continuous innovation in offshore wind and energy storage, like the 1.5 GW Coire Glas pumped hydro, to enhance grid stability and renewable integration. Digitalization efforts, including AI-driven smart grids, are set to cut operational costs by 8-10% by 2025. HVDC breakthroughs, such as SSEN Transmission's interoperability by late 2024, reduce offshore grid development costs by 10-15% for projects transmitting over 2 GW. This technological edge supports SSE's £18 billion investment by 2027 to meet surging electricity demand from EVs and heat pumps.

| Technology Area | Key Innovation/Project | 2024/2025 Impact |

|---|---|---|

| Renewable Generation | Dogger Bank Wind Farm | 3.6 GW capacity, enhancing cost-effectiveness |

| Energy Storage | Coire Glas Pumped Hydro | 1.5 GW capacity, vital for grid balancing |

| Digitalization | Smart Grid/Digital Twins | 8-10% operational cost reduction by 2025 |

| Transmission | HVDC Interoperability | 10-15% offshore grid cost reduction |

| Electrification | EV & Heat Pump Integration | Driving increased electricity demand |

Legal factors

The UK's Climate Change Act of 2008 and the Energy Act of 2023 form the foundational legal framework driving the nation's transition to a low-carbon economy. These acts empower the government and regulators to implement policies directly supporting SSE's strategic objectives. For example, the Sixth Carbon Budget, covering 2033-2037, legally commits the UK to a 78% reduction in emissions compared to 1990 levels, significantly influencing SSE's investment in renewables. The Energy Act 2023 also facilitates new business models for emerging technologies like hydrogen and carbon capture, utilization, and storage, crucial for SSE's future growth and decarbonization efforts aiming for over 50% renewable energy generation by 2025.

SSE's electricity network businesses, including SSEN Distribution, face rigorous economic regulation by Ofgem. These regulations impose legally binding price controls, such as the RIIO-ED2 framework active until March 2028, which dictate the revenue they can earn. The upcoming RIIO-ED3 price control, effective from April 2028, will be crucial in shaping future investment and operational strategies for distribution networks. These controls are specifically designed to ensure network companies invest efficiently to meet the UK's net-zero emissions targets by 2050.

SSE's extensive operations and new development projects rigorously comply with environmental laws, requiring numerous permits for habitat protection, emissions, and biodiversity across the UK. New regulations, such as the mandatory Biodiversity Net Gain for major developments in England from January 2024, introduce significant compliance obligations. Changes to the UK Emissions Trading Scheme, with its 2024 cap at 87.15 million tonnes of CO2e, also create evolving compliance demands. The National Policy Statements for energy infrastructure further provide the essential legal framework guiding consenting decisions for SSE's major projects.

Corporate Sustainability Reporting

Increasing legislation, like Europe's Corporate Sustainability Reporting Directive (CSRD), mandates detailed corporate disclosure on sustainability. SSE must adhere to these evolving standards, demanding greater transparency on its environmental, social, and governance (ESG) performance. The company publishes extensive annual sustainability and net-zero transition reports, with its 2024 Net Zero Transition Plan outlining targets to reduce scope 1 and 2 emissions by 80% by 2030 from 2018 levels. This proactive reporting aligns with anticipated 2025 regulatory requirements.

- CSRD compliance is critical for 2025 financial reporting cycles.

- SSE's 2024 reports detail its progress towards 2030 emission reduction targets.

- Transparency on ESG performance is now a legal imperative for large companies.

Health and Safety Law

As a major operator of industrial and construction sites, SSE navigates comprehensive health and safety legislation in the UK, including the Health and Safety at Work etc. Act 1974 and specific construction regulations. Maintaining a robust safety record is not just a core company value but a strict legal mandate, with the company aiming for zero harm across its projects. Compliance is paramount to safeguarding its workforce and the public, preventing severe legal ramifications and substantial financial penalties. For instance, HSE fines for corporate manslaughter or serious breaches can reach millions of pounds, alongside significant reputational damage, making proactive safety management critical for SSE's 2024-2025 operational stability.

- Legal compliance is crucial for SSE to avoid fines, which can exceed £10 million for severe safety breaches in the UK.

- SSE’s safety performance directly impacts its operational license and public trust in its energy infrastructure projects.

The UK's legal framework, including the Energy Act 2023 and RIIO-ED2 (until March 2028), heavily influences SSE's operations and investments, particularly for net-zero targets by 2050. Mandatory Biodiversity Net Gain from January 2024 and evolving UK ETS rules impact project compliance. Furthermore, CSRD compliance is crucial for SSE's 2025 reporting, detailing its 2024 net-zero transition plan aiming for 80% scope 1 and 2 emission reduction by 2030. Strict health and safety laws, like the Health and Safety at Work etc. Act 1974, mandate robust safety, preventing fines potentially exceeding £10 million for severe breaches.

| Legal Area | Key Impact on SSE | Relevant Data/Timeline |

|---|---|---|

| Climate & Energy | Investment in renewables & new tech | UK Net-Zero by 2050; Energy Act 2023 |

| Economic Regulation | Revenue & investment for networks | RIIO-ED2 until Mar 2028; RIIO-ED3 from Apr 2028 |

| Environmental Compliance | Project permitting & emissions | Biodiversity Net Gain Jan 2024; UK ETS 2024 cap: 87.15M tonnes CO2e |

| Corporate Reporting | ESG transparency | CSRD for 2025 reports; SSE 2030 target: 80% Scope 1&2 reduction |

| Health & Safety | Operational compliance & risk management | Potential fines >£10M; Health and Safety at Work etc. Act 1974 |

Environmental factors

SSE's strategy directly aligns with the UK's legally binding 2050 net-zero emissions target and its international commitments under the Paris Agreement. This drives SSE's substantial investment in renewable energy and grid infrastructure, crucial for decarbonizing the power sector to meet these objectives. SSE has established its own ambitious science-based targets, validated to be consistent with limiting global warming to 1.5°C. For instance, SSE aims to reduce its Scope 1 and 2 emissions by 80% by 2030 from a 2018 baseline, reflecting its commitment to these global climate ambitions and shaping its 2024-2025 investment priorities.

Growing regulatory and societal pressure is compelling companies like SSE to actively protect and enhance biodiversity, with new UK legislation like Biodiversity Net Gain (BNG) becoming mandatory from early 2025 for most developments. SSE is committed to achieving biodiversity net gain for its new onshore projects, reflecting this evolving landscape. Their strategy prioritizes protecting and restoring nature around critical infrastructure, including careful management of ecosystems near hydro dams, wind farms, and network assets. This proactive approach aims to minimize environmental impact while maximizing natural capital benefits across their operations.

Minimizing waste and embracing circular economy principles are critical for large industrial companies like SSE, especially in 2024 and 2025 as sustainability pressures intensify. SSE's strategy actively focuses on reducing its reliance on fossil fuels and significantly minimizing waste generation and disposal. This commitment spans the entire lifecycle of its assets, from the initial construction phases of new renewable energy projects to the eventual decommissioning of older infrastructure. For instance, SSE aims to achieve a zero-waste-to-landfill target for its operational sites, demonstrating a tangible shift towards resource efficiency and environmental stewardship in line with evolving regulatory landscapes.

Physical Climate Risks

SSE's infrastructure, particularly its vital hydro stations and extensive transmission networks across Scotland, faces significant physical climate risks. Extreme weather events, such as increased flooding and high winds, pose direct threats to operational continuity and asset integrity. For instance, the Met Office reported 2023 as among the wettest years on record, elevating flood risks for energy infrastructure. Investing in resilience, with SSE aiming for over £18 billion capital expenditure by 2027, is crucial to safeguard energy supply security amidst these changing climate patterns.

- SSE's 2024/25 capital expenditure plans prioritize resilience upgrades.

- UK climate projections indicate rising frequency of extreme rainfall by 2040.

- Transmission network hardening is underway to mitigate wind damage risks.

- Hydro asset protection against increased water flow is a key focus.

Greenhouse Gas Emissions Reduction

A core focus for SSE's environmental performance in 2024 and 2025 is the significant reduction of its greenhouse gas emissions. The company meticulously tracks and reports its carbon intensity, which has shown a consistent decline as its renewable energy output continues to expand, aligning with net-zero targets. Furthermore, SSE is actively investing in advanced technologies like Carbon Capture and Storage (CCS) to effectively abate emissions from its remaining thermal power stations, aiming for substantial decarbonization efforts. This strategic approach underpins their commitment to a lower-carbon energy system, impacting their operational costs and regulatory compliance.

- SSE aims for a 60% reduction in carbon intensity by 2030 from 2018 levels.

- The company's renewable energy capacity is set to increase significantly by 2027.

- Investment in CCS projects, such as Keadby 3, is crucial for abating over 3 million tonnes of CO2 annually.

SSE's environmental strategy for 2024-2025 is fundamentally shaped by the UK's net-zero targets and growing physical climate risks, driving substantial investment in renewable energy and grid resilience. New regulations like Biodiversity Net Gain, mandatory from early 2025, also influence project development and operational practices. The company prioritizes significant emissions reduction and waste minimization, targeting a zero-waste-to-landfill goal for operational sites. These efforts underpin SSE's commitment to a lower-carbon energy system and safeguarding infrastructure against extreme weather events.

| Environmental Focus Area | Key Metric (2024/2025 Context) | Target/Impact |

|---|---|---|

| Emissions Reduction | Scope 1 & 2 Emissions | 80% reduction by 2030 from 2018 baseline |

| Climate Resilience | Capital Expenditure (2022-2027) | Over £18 billion for infrastructure upgrades |

| Biodiversity Net Gain | Applicability | Mandatory for most new UK developments from early 2025 |

PESTLE Analysis Data Sources

Our SSE PESTLE Analysis is meticulously crafted using data from reputable sources like the International Energy Agency (IEA), the International Renewable Energy Agency (IRENA), and leading environmental research institutions. We also integrate insights from government policy documents and financial market reports to ensure a comprehensive view.