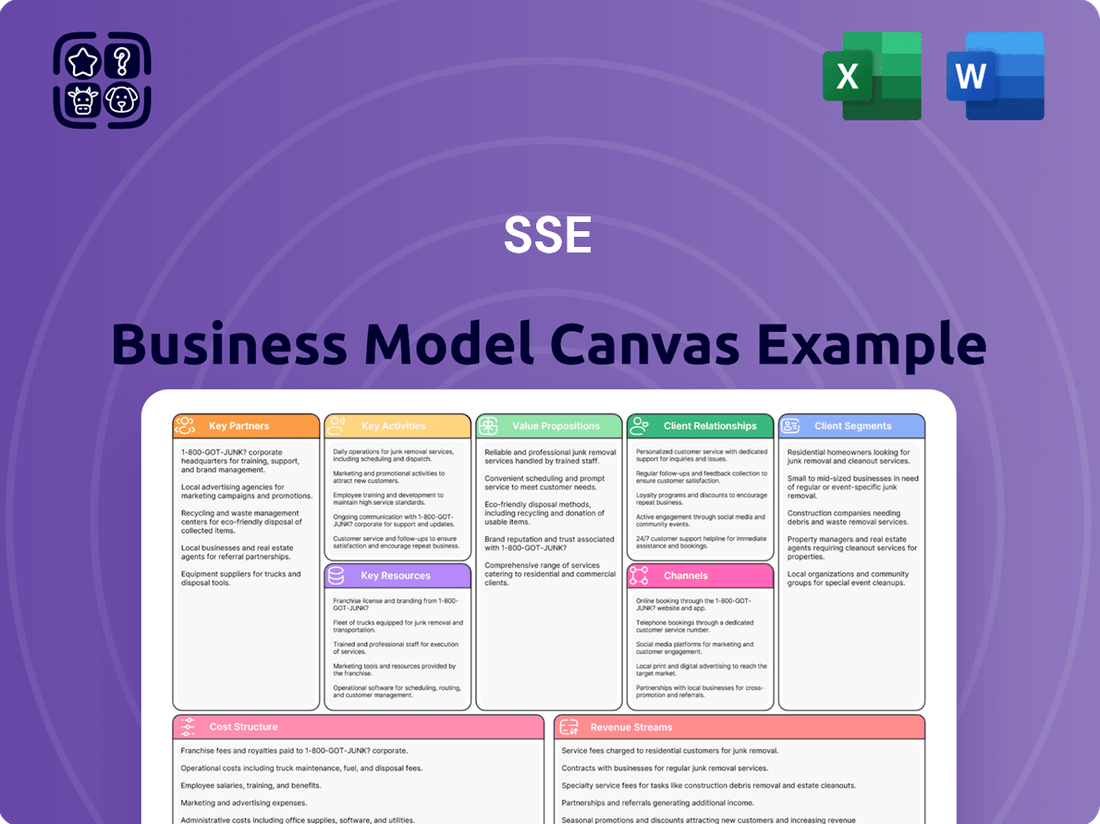

SSE Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSE Bundle

Unlock the full strategic blueprint behind SSE's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into SSE’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how SSE operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out SSE’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for SSE. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

See how the pieces fit together in SSE’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

SSE's large-scale renewable projects, including the multi-billion-pound Seagreen offshore wind farm, heavily depend on partnerships with leading manufacturers like Siemens Gamesa and Vestas for wind turbines. These relationships are crucial for securing the supply chain for projects, with SSE investing around £2.5 billion in 2024/25 towards its net zero acceleration programme. Access to the latest, most efficient technology, such as advanced battery storage solutions like SSE's 320MW Salisbury facility expected in 2024, is ensured through these collaborations. Strong partnerships enable co-development of solutions and secure favorable procurement terms for critical high-voltage cables and other essential equipment.

To de-risk and fund massive capital projects like the Dogger Bank offshore wind farm, SSE forms crucial joint ventures. These partnerships, such as with Equinor and Vårgrønn for the 3.6 GW Dogger Bank project, are essential for sharing immense capital expenditure. The first power from Dogger Bank A was delivered in 2024, showcasing the success of this model. This collaborative approach allows for the distribution of operational risk and the pooling of technical expertise across entities. Such strategic alliances are vital for delivering projects on a scale that would be challenging for a single company, enabling multi-billion pound investments.

SSE maintains crucial partnerships with regulators such as Ofgem in the UK and CRU in Ireland, plus various government bodies. These relationships dictate the regulated returns on network assets, like those under Ofgem’s RIIO-ED2 price control which began in April 2023. They also shape the framework for renewable energy auctions, including the UK’s Allocation Round 6 for Contracts for Difference set for 2024. Proactive engagement ensures a stable policy environment, supporting SSE's significant capital expenditure, such as over £3.6 billion projected for SSEN Transmission through 2026. This collaboration is vital for navigating the evolving energy landscape and securing investment for critical infrastructure.

Construction and Engineering Firms

SSE collaborates extensively with major engineering, procurement, and construction (EPC) contractors to build its intricate energy infrastructure. These specialized firms are crucial for the physical construction of projects like offshore wind foundations, substations, and the laying of vital transmission cables. Such partnerships are typically managed through long-term contracts, ensuring projects are delivered efficiently and within budget, reflecting a strategic approach to large-scale development.

- SSE Renewables’ Viking Energy Wind Farm, expected completion in 2024, relies on partnerships for its 443 MW capacity.

- Contractors like Siemens Energy and Aker Solutions are key in delivering high-voltage transmission projects.

- Major investment in offshore wind, such as the Dogger Bank Wind Farm where SSE holds a 40% stake, involves significant EPC contracts.

- These collaborations are essential for SSE’s 2024 capital expenditure plans aimed at renewable energy expansion.

Corporate Energy Buyers (PPA Partners)

SSE establishes long-term partnerships with large corporations through Power Purchase Agreements, providing them with a direct supply of renewable electricity. These agreements offer crucial revenue certainty for SSE's generation assets, insulating them from wholesale market volatility. Partners like Microsoft and Google enter these deals to meet their corporate sustainability and carbon reduction targets, driving demand for green energy. In 2024, the corporate PPA market continues to expand, reflecting a strong commitment to decarbonization.

- Secured long-term revenue streams for SSE's renewable assets.

- Access to direct, traceable renewable energy for corporate buyers.

- Mitigation of wholesale energy price volatility for both parties.

- Achievement of ambitious corporate environmental, social, and governance (ESG) goals.

SSE's strategy relies on key partnerships across its value chain, crucial for its net-zero transition. Collaborations with manufacturers like Siemens Gamesa secure critical technology for projects, supporting over £2.5 billion in 2024/25 investments. Joint ventures, such as Dogger Bank delivering first power in 2024, de-risk massive capital outlays. Regulatory engagement and EPC contractor alliances ensure project delivery and stable policy frameworks.

| Partnership Type | Key Partner Example | 2024 Impact |

|---|---|---|

| Technology & Supply | Siemens Gamesa | £2.5bn investment secured |

| Project Co-Funding | Equinor (Dogger Bank) | First power delivered |

| Regulatory & Policy | Ofgem | UK CfD Allocation Round 6 |

What is included in the product

The SSE Business Model Canvas provides a structured framework for understanding and articulating a company's strategic approach, detailing key elements like customer segments, value propositions, and revenue streams.

It serves as a comprehensive tool for strategic planning, enabling clear communication of the business model to stakeholders and facilitating informed decision-making.

Streamlines the often-complex process of articulating a social enterprise's value proposition and operational strategy, simplifying the identification of key impact drivers.

Offers a structured framework to clearly define how social impact is generated and sustained, alleviating the challenge of communicating a dual mission effectively.

Activities

The core of SSEs operations involves generating electricity from a vast portfolio of renewable assets, primarily onshore and offshore wind farms, alongside hydroelectric power stations. This activity leverages sophisticated weather forecasting and advanced asset optimization techniques to maximize output efficiently. For instance, SSE Renewables is actively developing projects like the Dogger Bank Wind Farm, which began supplying power in 2024, significantly bolstering its capacity. The focus remains on maximizing the availability and efficiency of these clean energy sources to meet demand.

SSE’s core activity involves operating, maintaining, and developing crucial electricity transmission and distribution networks across the north of Scotland and central southern England. These networks are vital for ensuring grid reliability and resilience, a key focus given the increasing demand. For instance, in 2024, SSE Networks continued significant capital investment, with their regulated asset value (RAV) reaching approximately £12.5 billion. They actively connect new demand and generation sources, supporting the transition to net-zero and providing essential national infrastructure services.

New project development and construction is central to SSE's growth, particularly in large-scale offshore wind farms. This involves a long-cycle process, beginning with site selection and securing seabed leases, such as for the ongoing Dogger Bank C which aims for completion in 2026. Obtaining complex planning consents and managing intricate construction logistics are critical steps. This activity drives SSE's future expansion and its significant contribution to global net-zero targets. For instance, SSE Renewables is targeting a net capacity of around 9 GW by 2027.

Capital Allocation and Financing

Efficient capital allocation is paramount, directing billions of pounds towards critical renewable and network projects. SSE's Net Zero Acceleration Programme 2.0, targeting around £18 billion in capital expenditure by March 2027, exemplifies this. This involves rigorous financial modeling, risk assessment, and securing diverse funding streams. Effectively managing the balance sheet through equity, debt, and project finance is vital for delivering these ambitious 2024 initiatives.

- Capital expenditure targeting £18 billion by March 2027.

- Focus on electricity networks and renewable energy projects.

- Funding secured through equity, debt, and project finance.

- Strategic balance sheet management for Net Zero Acceleration Programme.

Regulatory and Stakeholder Engagement

SSE actively engages with regulators, government bodies, and local communities to ensure its operations align with energy policy and maintain public acceptance. This critical activity involves participation in regulatory reviews, such as those under Ofgem’s RIIO-ED2 and RIIO-T2 frameworks, which govern network investments through 2028. For instance, SSE’s electricity networks committed over £3.9 billion in the RIIO-ED2 period for investment and operations, a figure influenced by regulatory dialogue. Extensive community consultations are also conducted for new projects, like offshore wind farms, helping to secure necessary public support and planning permissions.

- SSE engages with over 200 community groups annually across its operational areas.

- Regulatory frameworks like RIIO-ED2 for distribution and RIIO-T2 for transmission set price controls and investment mandates until 2028.

- SSE's Net Zero Acceleration Programme, a key investment plan, is largely shaped by ongoing regulatory discussions.

- The company contributed over £12 million to community funds in 2023, demonstrating direct local engagement.

SSE's key activities center on generating clean electricity from a growing renewable portfolio, including offshore wind like Dogger Bank which began supplying power in 2024. They also operate and develop crucial electricity networks, with significant capital investment in 2024. New project development, especially large-scale offshore wind, drives future growth, supported by efficient capital allocation through the Net Zero Acceleration Programme 2.0 targeting £18 billion by March 2027. Regulatory and community engagement ensures alignment and public support for these initiatives.

What You See Is What You Get

Business Model Canvas

This preview offers a direct glimpse into the actual SSE Business Model Canvas you will receive upon purchase. The sections you see are integral parts of the complete document, ensuring that what you preview is precisely what you will download. Rest assured, there are no mockups or sample pages; this is a genuine representation of the final deliverable, ready for your immediate use and customization.

Resources

SSE’s most critical resource is its vast portfolio of physical infrastructure assets. This includes a substantial renewable energy fleet, with its operational onshore and offshore wind capacity exceeding 4 gigawatts and significant hydro stations. Their SSEN Transmission and Distribution networks manage thousands of kilometers of electricity lines, essential for connecting power generation to consumers. These capital-intensive assets, reflecting a net property, plant, and equipment value of over £20 billion in 2024, are the very foundation of SSE's revenue generation. Their value is intrinsically linked to their operational efficiency and long lifespans, ensuring sustained energy supply.

Access to substantial financial capital is a critical resource, enabling SSE to fund its ambitious investment plan of over £20 billion through 2027. This funding is sourced from retained earnings, a strong credit rating that allows for favorable debt financing, and the ability to attract equity partners for large-scale projects. A robust balance sheet is essential for navigating the significant capital demands of the energy sector. In 2024, maintaining financial strength remains key to delivering on their net-zero commitments.

SSE’s operational backbone is its highly skilled workforce, encompassing engineers, project managers, data scientists, and specialized technicians. This human capital is crucial for designing, building, and maintaining complex energy infrastructure, including significant offshore wind projects. For example, SSE Renewables’ Seagreen offshore wind farm, fully operational in 2023, showcases the need for deep expertise in offshore engineering and grid management. Such specialized knowledge provides SSE with a significant competitive advantage in the evolving energy sector.

Operating Licenses and Seabed Leases

A crucial intangible resource for SSE is its extensive portfolio of operating licenses and seabed leases. These include government-issued licenses to operate regulated electricity networks, which in 2024 underpin stable revenue streams. Additionally, seabed leases grant SSE exclusive rights to develop offshore wind farms in specific, high-potential locations.

These rights are exceptionally valuable, long-term assets, creating significant barriers to entry for competitors. For instance, securing new offshore wind development rights, such as those in recent UK leasing rounds, can take years, solidifying SSE's market position.

- Licenses for regulated networks ensure stable revenue.

- Seabed leases provide exclusive offshore wind development rights.

- These assets are long-term and highly valuable.

- They create substantial barriers to market entry.

Data, Technology, and R&D

SSE leverages its vast proprietary operational data from energy assets, coupled with advanced weather modeling and sophisticated grid management technologies, to optimize performance and efficiency across its network. The company significantly invests in research and development, particularly for emerging green technologies like carbon capture and storage (CCS) and hydrogen. For instance, SSE plans to invest over £18 billion by March 2027 in low-carbon infrastructure, which includes such R&D. These technological resources are crucial for maintaining SSE's competitive edge and future-proofing its business model in a rapidly evolving energy landscape.

- SSE's operational data helps manage over 15 GW of generation capacity.

- Investment in R&D supports projects like Keadby 3 CCS, aiming for a 2020s operation.

- Grid management technologies optimize distribution for over 3.8 million homes and businesses.

- SSE's capital expenditure for 2024/25 is projected at around £2.5 billion, heavily focused on renewables and grids.

SSE’s key resources include over £20 billion in physical infrastructure like 4 GW+ renewables and extensive networks. Substantial financial capital supports a £20 billion investment plan through 2027. A skilled workforce, alongside valuable licenses and seabed leases, underpins its operations. Advanced technologies and R&D with significant 2024 spending ensure future growth.

| Resource | 2024 Data | |

|---|---|---|

| Net PPE | >£20bn | |

| Investment Plan | £20bn (to 2027) | |

| Renewable Capacity | >4GW |

Value Propositions

SSE offers a crucial value proposition by actively building and operating the essential infrastructure for decarbonization. The company develops and operates renewable generation and network assets, fundamental to achieving national and global net-zero targets. For instance, SSE is investing over £18 billion through 2027, with a significant portion allocated to transmission and distribution networks to support green energy integration. This positions SSE as a key enabler of the green energy transition, facilitating the shift towards a sustainable energy system for society, governments, and investors.

SSE delivers stable, long-term investment returns, often protected against inflation for investors. This stems from its regulated electricity network businesses, which operate under predictable price-control frameworks like RIIO-ED2 for distribution, ensuring consistent revenue streams. Furthermore, SSE’s renewable assets, including over 4 GW of operational onshore and offshore wind capacity in 2024, are frequently backed by long-term, fixed-price contracts. This structure provides a significantly lower-risk profile compared to more volatile, commodity-exposed energy businesses. The company targets an annual dividend increase of 5% through 2026, supported by these reliable income models.

SSE significantly enhances energy security for the UK and Ireland by developing robust domestic renewable energy sources. By focusing on home-grown wind and hydro power, like the ongoing construction of Dogger Bank Wind Farm, SSE directly reduces reliance on volatile imported fossil fuels. This strategic investment, alongside crucial grid infrastructure upgrades, bolsters a more independent and resilient national energy system. For 2024, SSE's commitment to investing approximately 18 billion pounds in clean energy infrastructure by 2027 underpins this vital proposition for national governments seeking energy independence.

Large-Scale Renewable Energy for Corporate Buyers

SSE empowers large corporate customers to achieve their sustainability goals via Corporate Power Purchase Agreements, securing long-term, reliable supplies of certified green electricity. This allows businesses to decarbonize operations and gain predictable energy costs, enhancing brand reputation and ESG credentials. As of 2024, corporate PPAs are a key driver for renewable energy growth, with SSE facilitating significant transitions for major businesses. This commitment supports global net-zero ambitions, offering a tangible pathway for corporate climate action.

- Direct access to renewable energy via PPAs.

- Long-term energy cost predictability.

- Enhanced corporate ESG performance.

- Significant contribution to decarbonization efforts in 2024.

Critical and Resilient National Infrastructure

SSE delivers the foundational value of reliable electricity infrastructure, serving millions of homes and businesses across central southern England and north of Scotland. Through its extensive transmission and distribution networks, SSE ensures power flows safely and consistently, underpinning the modern economy. In 2024, SSE continues significant investment in network resilience, with SSEN Distribution planning to invest over £4 billion in its network by 2028. This commitment ensures the critical infrastructure remains robust and capable of supporting future energy demands, including the integration of more renewable generation.

- SSE's networks serve 3.8 million homes and businesses.

- SSEN Distribution aims for 99.99% network availability.

- Over £4 billion planned for network investment by 2028.

- Supports UK's energy security and net-zero targets.

SSE offers crucial infrastructure for decarbonization and energy security, backed by over £18 billion in investments through 2027. It provides stable, inflation-protected returns via regulated networks and long-term renewable energy contracts, including over 4 GW of operational wind capacity in 2024. SSE also empowers corporate customers with green electricity PPAs and ensures reliable electricity supply to 3.8 million homes and businesses, with SSEN Distribution planning over £4 billion in network investment by 2028.

| Key Metric | 2024 Data | Impact |

|---|---|---|

| Planned Investment (2027) | >£18 Billion | Accelerates decarbonization & energy security |

| Operational Wind Capacity | >4 GW | Drives stable returns & green energy supply |

| Homes & Businesses Served | 3.8 Million | Ensures reliable electricity infrastructure |

Customer Relationships

For its wholesale and corporate Power Purchase Agreement (PPA) customers, SSE cultivates formal, long-term relationships managed by dedicated commercial teams. These partnerships are governed by detailed contracts, often spanning a decade or more, focusing on ensuring reliable energy supply and performance. In 2024, SSE continued to expand its renewable energy portfolio, with a strong emphasis on securing long-term PPA agreements, reflecting a strategic shift towards stable, non-volatile revenue streams. This approach prioritizes mutual strategic goals, fostering deep collaboration rather than merely transactional interactions.

For its networks business, SSE’s customer relationships, primarily with energy suppliers utilizing the grid, are strictly defined by a regulatory contract with Ofgem. This framework obligates SSE to maintain a high standard of service, ensuring network reliability and consistent connection access across Great Britain. The focus is less on conventional marketing and more on robust operational performance and strict compliance with mandated standards, such as those set by Ofgem's RIIO-ED2 price control period effective from April 2023. Their performance metrics for 2024 emphasize network availability and service quality rather than customer acquisition.

SSE maintains a highly active and transparent relationship with its shareholders and the broader financial community. This is managed through a dedicated investor relations team, providing regular updates and detailed financial reporting, such as their full-year results for FY2024 released in May 2024. They also host capital markets days and offer direct access to senior leadership, fostering confidence. The goal is to clearly communicate the company's strategy and value proposition, which includes significant investments in renewable energy infrastructure, with capital expenditure reaching £2.4 billion in FY2024.

Stakeholder and Community Engagement

SSE prioritizes robust stakeholder and community engagement for all projects, new and existing. This involves extensive consultation with local communities, landowners, and environmental groups to ensure operations align with social and environmental consent. Such dialogue is crucial for SSE to maintain its vital social license to operate. For example, in 2023, SSE's community funds surpassed £150 million invested, and they continue to allocate significant resources in 2024 to support local initiatives.

- SSE actively engages diverse stakeholders, including local communities, landowners, and environmental groups, for project development.

- This engagement involves comprehensive consultation processes to secure social and environmental consent.

- Community benefit funds are established, with over £150 million invested by SSE in communities by 2023.

- Ongoing dialogue ensures a strong social license to operate, critical for sustainable project delivery in 2024.

Government and Policy Partnership

SSE cultivates a partnership-driven relationship with government and regulatory bodies, emphasizing continuous dialogue and policy consultation. This collaboration aims to achieve shared national objectives, such as enhancing energy security and accelerating decarbonization efforts across the UK. A dedicated public affairs team meticulously manages this strategic relationship, ensuring corporate strategy aligns seamlessly with evolving public policy. For instance, SSE’s 2024 capital expenditure plans, exceeding £12.5 billion this decade, are heavily influenced by governmental net-zero targets and regulatory frameworks. This includes significant investments in offshore wind and grid infrastructure, directly supported by policy stability.

- SSE's 2024 strategic plan is closely tied to UK government energy policy.

- Policy engagement supports over £12.5 billion in planned capital expenditure this decade.

- Decarbonization targets drive joint initiatives in renewable energy development.

- Regulatory stability is crucial for long-term infrastructure investment certainty.

SSE manages diverse customer relationships, from formal, long-term PPA agreements with corporate clients to regulatory-driven interactions with energy suppliers.

Investor relations ensure transparency, with FY2024 capital expenditure reaching £2.4 billion in renewables.

Robust community and stakeholder engagement supports project development, while strategic government partnerships align with national decarbonization goals.

| Customer Group | Relationship Type | Key Metric (2024) |

|---|---|---|

| Corporate PPA | Long-term Partnership | Renewable portfolio expansion |

| Network Users | Regulatory Compliance | Network availability |

| Shareholders | Transparent Engagement | £2.4bn FY2024 capex |

Channels

SSE primarily channels electricity from its generation fleet through the wholesale energy markets in the UK and Ireland. Their dedicated trading teams actively utilize energy exchanges and over-the-counter platforms to sell power to a diverse range of buyers. This crucial channel exposes SSE to market price fluctuations, particularly for its uncontracted output. For instance, UK wholesale day-ahead electricity prices averaged around £80-£90/MWh in Q1 2024, impacting revenue from this exposure.

SSE reaches its large corporate customers through a direct sales and business development channel, leveraging a dedicated team to identify potential partners.

This team directly negotiates bespoke, long-term Power Purchase Agreements (PPAs), ensuring terms tailored to specific client needs.

It is a high-touch, direct-to-customer channel, critical for securing stable, long-term revenue streams.

For instance, corporate PPA volumes in Europe are projected to grow significantly, with over 10 GW of new deals expected in 2024, highlighting the importance of this direct channel for utilities like SSE.

This approach allows SSE to build strong relationships and lock in predictable income, supporting its renewable energy investments.

Revenue for SSE's electricity networks is collected through regulated tariffs, a non-negotiable channel. These charges, approved by Ofgem under frameworks like RIIO-ED2 and RIIO-T2, are levied on licensed energy suppliers, such as OVO and British Gas. In 2024, these tariffs ensure suppliers pay for using SSE's distribution and transmission grids to deliver power. Ofgem effectively sets the price for this essential infrastructure access.

Government Renewable Energy Auctions

SSE actively participates in government-run renewable energy auctions, notably the Contracts for Difference (CfD) scheme, to secure vital revenue for new projects. This involves submitting competitive bids to win long-term, index-linked contracts that guarantee a fixed price for the electricity produced, critical for project financing. Success in these auctions is a key channel for SSE's growth, ensuring stable income streams and enabling significant investment in the UK's energy transition. For instance, CfD Allocation Round 6 is expected in 2024, continuing to shape future energy supply.

- SSE secured 1.2 GW of capacity in CfD Allocation Round 4 (AR4) in 2022.

- The UK government aims for 50 GW offshore wind capacity by 2030, largely through CfD.

- CfD provides price certainty, reducing investment risk for large-scale renewable projects.

- Allocation Round 6 (AR6) in 2024 will introduce new parameters to attract investment.

Direct Engagement with System Operators

SSE maintains direct engagement with the National Grid Electricity System Operator (ESO), a crucial channel for its operations. Through this channel, SSE sells essential grid-balancing and ancillary services, helping manage the UK system stability. For its transmission business, the ESO serves as the primary client, coordinating significant investments and connections to the high-voltage grid. This direct relationship ensures the efficient operation and development of critical energy infrastructure, contributing to grid resilience.

- In 2024, SSE Renewables contributed significantly to grid stability services.

- SSE Transmission's regulated asset value (RAV) continues to grow, with the ESO approving investment plans.

- The ESO procures various balancing services from SSE, including frequency response and reserve power.

- SSE's direct engagement with the ESO is fundamental for its regulated electricity networks and renewables segments.

SSE distributes energy via wholesale markets, with UK day-ahead prices averaging £80-£90/MWh in Q1 2024. Direct corporate Power Purchase Agreements secure long-term revenue, with over 10 GW of new European deals expected in 2024. Regulated tariffs, like Ofgem's 2024 RIIO frameworks, fund network operations. Government CfD auctions, including AR6 in 2024, are vital for renewable project financing, alongside direct National Grid ESO engagement for balancing services.

| Channel | Mechanism | 2024 Relevance |

|---|---|---|

| Wholesale Markets | Energy Exchanges | UK Day-Ahead: £80-£90/MWh (Q1) |

| Corporate PPAs | Direct Sales | >10 GW new European deals |

| Regulated Tariffs | Ofgem RIIO | Network revenue via suppliers |

| CfD Auctions | Competitive Bids | AR6 expected; 50 GW UK offshore by 2030 target |

| National Grid ESO | Ancillary Services | Grid stability contributions |

Customer Segments

Wholesale energy traders and suppliers form a key customer segment, encompassing other utility companies, dedicated energy trading houses, and licensed electricity suppliers. These entities procure power in bulk from the dynamic wholesale market, where SSE sells its uncontracted renewable generation. As of early 2024, the UK wholesale electricity market continued to experience price volatility, influencing the trading strategies of these sophisticated customers. Operating on energy exchanges, they are highly price-sensitive, driven by marginal costs and market liquidity.

The National Grid Electricity System Operator (ESO) in Great Britain serves as the primary customer for SSE's vital electricity transmission business. This includes payments for the use of SSE's high-voltage network, which, for SSEN Transmission, supports a growing Regulated Asset Value (RAV) projected to reach approximately £8.5 billion by March 2026. The ESO also compensates SSE for essential ancillary services, ensuring the grid remains balanced and stable, a critical function given the increasing complexities of energy supply in 2024. This represents a single, highly strategic customer segment for SSE, crucial for its regulated revenue streams and operational stability within the UK energy market.

Licensed energy suppliers like Octopus Energy, E.ON, and ScottishPower form a crucial B2B customer segment for SSE, operating within its electricity distribution network regions. These companies are a captive customer base, as they have no alternative network provider for delivering electricity to their customers. They are obligated to pay SSE regulated charges for using its extensive infrastructure, which facilitates the transmission of power to homes and businesses. For example, SSEN Distribution, part of SSE, manages over 130,000 km of overhead lines and underground cables, serving millions of customers in 2024, generating significant regulated income from these network users.

Large Corporations and Industrial Users

This segment includes major corporations, spanning technology, manufacturing, and retail, which actively procure significant volumes of renewable energy directly from SSE. Their primary motivations include strong corporate social responsibility commitments and achieving ambitious ESG targets. These large users also seek long-term energy price stability, shielding them from market volatility.

- Global corporate PPA volumes reached a record 46 GW in 2023, reflecting strong demand.

- Over 1,500 companies globally have committed to 100% renewable electricity through RE100 initiatives.

- SSE's Corporate PPAs help clients like Amazon and Nestlé meet their 2024 decarbonization goals.

- Large corporations aim to stabilize energy costs, with some 2024 industrial electricity prices varying significantly.

Government and Taxpayers

The UK Government acts as an indirect customer for SSE, primarily through mechanisms like the Contracts for Difference (CfD) scheme. This framework is crucial for the government to procure new renewable generation capacity from SSE, aligning with national decarbonization targets, such as achieving 50GW of offshore wind by 2030. Ultimately, this significant investment is funded via a levy integrated into all consumer energy bills, effectively making taxpayers the final customer footing the bill.

- The UK Government is an indirect customer, procuring renewable energy via CfD.

- CfD supports national decarbonization, targeting 50GW offshore wind by 2030.

- Taxpayers fund this through levies on energy bills, making them the ultimate customer.

SSE serves diverse customers including wholesale energy traders driven by 2024 market volatility, and National Grid ESO for transmission, with SSEN Transmission's RAV projected to reach £8.5 billion by March 2026. Licensed energy suppliers, like those utilizing SSEN Distribution's 130,000 km network in 2024, are a captive B2B segment paying regulated charges. Major corporations seek renewable energy via PPAs, with global volumes hitting 46 GW in 2023, while the UK Government acts as an indirect customer through CfD schemes supporting the 50 GW offshore wind target by 2030.

| Customer Segment | Key Motivation | 2024 Relevance |

|---|---|---|

| Wholesale Traders | Price Sensitivity | UK market volatility |

| National Grid ESO | Grid Stability, Transmission | SSEN Transmission RAV ~£8.5bn |

| Corporations | ESG, Price Stability | 46 GW global PPA volume (2023) |

Cost Structure

Capital expenditure represents SSE's most significant cost, primarily driven by large-scale renewable energy projects and network upgrades. In 2024, SSE planned to invest over £2.5 billion, focusing on constructing major offshore wind farms like Dogger Bank. This includes substantial ongoing investment in its electricity networks, crucial for grid modernization and expansion. These capital-intensive projects are front-loaded, with returns realized over many decades, underscoring a long-term investment strategy.

Operating and Maintenance (O&M) costs represent the ongoing, day-to-day expenses for SSE's physical assets, crucial for sustained energy generation.

These include significant outlays for employee salaries, particularly for engineers and technicians managing complex infrastructure.

Regular and unforeseen maintenance on critical assets like wind turbines and power lines are substantial, ensuring operational integrity and safety.

Insurance premiums also contribute to these recurring costs, which are essential for asset performance and risk mitigation across SSE's diverse portfolio.

For 2024, energy sector O&M costs continue to be a primary expenditure, often representing a significant portion of total operating expenses for utilities like SSE.

Given SSE's capital-intensive operations, substantial debt is fundamental to financing its vast energy infrastructure projects. These interest payments represent a significant recurring cost, directly impacting the company's overall profitability. For instance, SSE reported net finance costs of £605.9 million in their full-year results for March 2024, highlighting the scale of these expenses. The cost of financing is a critical variable, meticulously managed by SSE's treasury department, influencing the viability and attractiveness of new investments.

Supply Chain and Procurement Costs

SSE’s supply chain and procurement costs are heavily influenced by major equipment like wind turbines and high-voltage cables sourced globally. The prices of key components and raw materials, such as steel and copper, significantly drive project expenditures, with commodity price volatility remaining a factor in 2024. To mitigate this, SSE employs long-term planning and strategic contracting, securing favourable terms for large-scale renewable projects. This foresight helps manage the economic impact of fluctuating global material costs.

- In 2024, global supply chain pressures continued to influence equipment costs for energy infrastructure projects.

- Steel and copper prices, crucial for cables and turbines, saw notable movements impacting procurement budgets.

- SSE's long-term contracts for major components can span 5-10 years, locking in prices.

- Large-scale offshore wind turbine costs, a significant expenditure, are a primary focus for procurement teams.

Regulatory and Environmental Compliance Costs

SSE incurs significant costs for regulatory and environmental compliance, crucial for its operational license. This includes substantial fees to The Crown Estate for seabed leases, vital for offshore wind projects like Dogger Bank, alongside payments to regulators. The company also invests in comprehensive environmental impact assessments to ensure sustainable development.

- In 2024, SSE's capital expenditure for renewables included significant outlays for permits and grid connections.

- Payments to The Crown Estate for seabed rights are a major ongoing expense for offshore wind farm development.

- Environmental impact assessments are mandatory for new energy infrastructure projects, adding to compliance costs.

- Regulatory fees ensure adherence to energy market and environmental standards set by authorities.

SSE's cost structure is heavily weighted towards capital expenditure, with over £2.5 billion planned for 2024, primarily for large-scale renewable projects and network upgrades. Significant ongoing expenses include operating and maintenance costs for assets, alongside substantial debt interest payments, which were £605.9 million for March 2024. Supply chain and procurement costs, influenced by volatile commodity prices in 2024, and regulatory compliance fees further shape SSE's financial outflows.

| Cost Category | 2024 Data | Impact |

|---|---|---|

| Capital Expenditure | >£2.5 billion planned | Long-term asset development |

| Net Finance Costs | £605.9 million (Mar 2024) | Debt servicing for infrastructure |

| O&M/Procurement | Significant, influenced by 2024 commodity prices | Operational stability & supply chain management |

Revenue Streams

Regulated network revenues form a highly stable and foundational part of SSE’s income, stemming from its electricity transmission and distribution assets. The UK energy regulator Ofgem sets the allowed revenue through RIIO-T2 and RIIO-ED2 price controls, ensuring a predictable stream. For instance, SSE’s Transmission business (SSEN Transmission) had an allowed revenue of approximately £1.1 billion in the year to March 2024. This revenue is long-term, typically linked to inflation, providing significant financial predictability for the company.

SSE primarily generates revenue by selling electricity produced from its extensive renewable assets, like its significant wind and hydro portfolio, directly onto the wholesale market. This revenue stream is inherently variable, depending heavily on both the volume of electricity generated, which can fluctuate with weather conditions, and the prevailing wholesale market prices. To manage this volatility and secure future earnings, SSE actively employs hedging strategies, with a substantial portion of its 2024 generation hedged to stabilize returns. For instance, SSE’s adjusted operating profit for its Thermal and Renewables division was significantly influenced by wholesale prices, emphasizing the importance of this revenue stream to its overall financial performance.

A significant and growing revenue stream for SSE comes from government-backed Contracts for Difference (CfDs).

These long-term agreements provide a guaranteed price, known as the strike price, for electricity generated from new renewable projects.

If the market price in 2024 falls below this strike price, SSE receives a top-up payment, ensuring robust revenue certainty.

For example, projects like Dogger Bank Wind Farm contribute substantially through CfDs, providing stable income streams.

Corporate Power Purchase Agreements (PPAs)

SSE secures stable, long-term revenue by selling renewable energy directly to large corporations through Corporate Power Purchase Agreements (PPAs). These contracts typically feature a fixed price for electricity over terms often spanning 10-15 years, as seen in deals signed in 2024. This significantly de-risks investment in new renewable assets, locking in a buyer and a predictable price before construction begins for projects, such as offshore wind farms.

- SSE’s operational renewable capacity was approximately 4.2 GW in 2024, with PPAs underpinning much of its output.

- The fixed pricing in PPAs provides certainty against volatile wholesale energy markets.

- These agreements are crucial for financing new clean energy projects, reducing developer risk.

- In 2024, corporate demand for renewable PPAs continued to drive significant market activity.

Ancillary and Balancing Services

SSE generates significant revenue by providing essential ancillary and balancing services to the National Grid Electricity System Operator (ESO).

These crucial services, including frequency response, reactive power, and black start capability, ensure grid stability and reliability.

As the UK integrates more intermittent renewable energy sources, the demand for these stability services is projected to increase, bolstering SSE's revenue streams in this area.

- In 2024, the need for flexible grid support remains a key driver for SSE's operational focus.

- SSE's hydro and pumped storage assets are particularly well-suited for providing rapid response balancing services.

SSE’s revenue mix is robust, anchored by stable regulated network income, which saw SSEN Transmission with approximately £1.1 billion allowed revenue to March 2024. Variable wholesale electricity sales from its 4.2 GW operational renewable capacity are strategically hedged. Long-term Contracts for Difference and Corporate Power Purchase Agreements provide predictable earnings, insulating from market volatility. Additionally, growing demand for ancillary grid services further diversifies and strengthens its financial profile.

| Revenue Stream | Key Characteristic | 2024 Data/Note |

|---|---|---|

| Regulated Networks | Predictable, inflation-linked | SSEN Transmission: ~£1.1bn allowed revenue (to Mar 2024) |

| Wholesale Generation | Variable, market-driven | Substantial 2024 generation hedged |

| CfDs & Corporate PPAs | Long-term, price certainty | 4.2 GW operational renewables underpin PPAs |

Business Model Canvas Data Sources

The SSE Business Model Canvas is built upon a foundation of extensive market research, operational data, and financial projections. These sources ensure each component, from value propositions to cost structures, is informed by real-world insights and validated by industry trends.