SSE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSE Bundle

SSE's position in the energy market is shaped by intense competition and evolving customer demands. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this landscape. The influence of suppliers and the potential for new entrants also present significant challenges.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore SSE’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The development of SSE's wind and hydro power projects relies heavily on specialized technology and equipment, such as advanced turbines and generators. Key suppliers in this concentrated market, like Vestas and Siemens Gamesa, wield significant bargaining power. For instance, these two companies alone accounted for a substantial share of global wind turbine installations in 2023, showcasing their market dominance. The specialized nature of their products, coupled with high switching costs for energy companies like SSE, further solidifies their strong position. This concentration means SSE must navigate these essential supplier relationships carefully to manage project costs and timelines effectively.

While SSE is heavily invested in renewables, it still operates flexible gas-fired generation, like the Keadby 2 power station. Suppliers of natural gas, such as those influenced by geopolitical events, can exert significant cost pressure; for instance, European gas prices, though lower than 2022 peaks, remained susceptible to supply disruptions in 2024. The volatility in the carbon credit market, with EU ETS prices fluctuating, also directly impacts operational expenses. Global energy prices and factors influencing gas supply give these suppliers considerable bargaining power over SSE's fossil fuel-based assets.

SSE relies heavily on specialized construction and engineering contractors for its substantial energy infrastructure projects, like the Seagreen Offshore Wind Farm expansion or upgrading transmission networks. The pool of firms possessing the necessary expertise for such complex, large-scale endeavors is quite limited globally. This scarcity empowers key contractors, particularly for new projects like those planned for 2024, to command higher prices and more favorable terms. Given the critical nature of these projects to SSE's strategic goals and its £18.6 billion net zero acceleration plan through 2027, the bargaining power of these specialized suppliers remains significant.

Land and Seabed Rights Holders

For SSE to develop new onshore and offshore renewable projects, securing land and seabed rights is absolutely crucial. Landowners and The Crown Estate, who manage the UK seabed, act as essential suppliers of these necessary assets. Their exclusive control over these vital locations grants them significant bargaining power in negotiating lease and purchase agreements.

- In 2024, The Crown Estate's offshore wind leasing rounds, such as Offshore Wind Leasing Round 4, underscored the high demand and competitive nature, influencing lease costs.

- Land lease rates for onshore wind farms in the UK can vary significantly, often reflecting the site's suitability and grid proximity.

- Control over strategic land and seabed can lead to substantial upfront costs and ongoing rental obligations for developers like SSE.

- Negotiations often involve long-term agreements, impacting project profitability over decades.

Financial Institutions and Capital Markets

Large-scale energy projects are inherently capital-intensive, necessitating substantial funding from financial institutions and capital markets. These financial suppliers, including banks, bondholders, and diverse investors, wield considerable power due to their capacity to provide the essential capital. Their specific terms and prevailing interest rates directly influence the feasibility and profitability of SSE's strategic projects.

However, SSE effectively mitigates this supplier power through its robust financial standing. As of 2024, SSE maintains an investment-grade credit rating, typically A- by S&P and A3 by Moody's, which demonstrates its financial strength and reduces borrowing costs.

- Energy projects demand significant external capital.

- Financial institutions influence project viability through funding terms.

- SSE's strong balance sheet reduces reliance on unfavorable terms.

- Investment-grade credit ratings (e.g., A3/A-) lower borrowing costs in 2024.

SSE faces significant supplier bargaining power across several key areas, notably from highly specialized technology providers like turbine manufacturers and critical construction contractors for its large-scale energy projects planned for 2024. Suppliers of natural gas and those controlling vital land and seabed rights, such as The Crown Estate for offshore wind leasing, also exert considerable influence over costs and project feasibility. While financial institutions provide essential capital, SSE's strong investment-grade credit rating in 2024 (A3/A-) helps mitigate their power by securing favorable borrowing terms. Overall, the reliance on specialized inputs and limited suppliers necessitates careful management to control costs and ensure project delivery.

What is included in the product

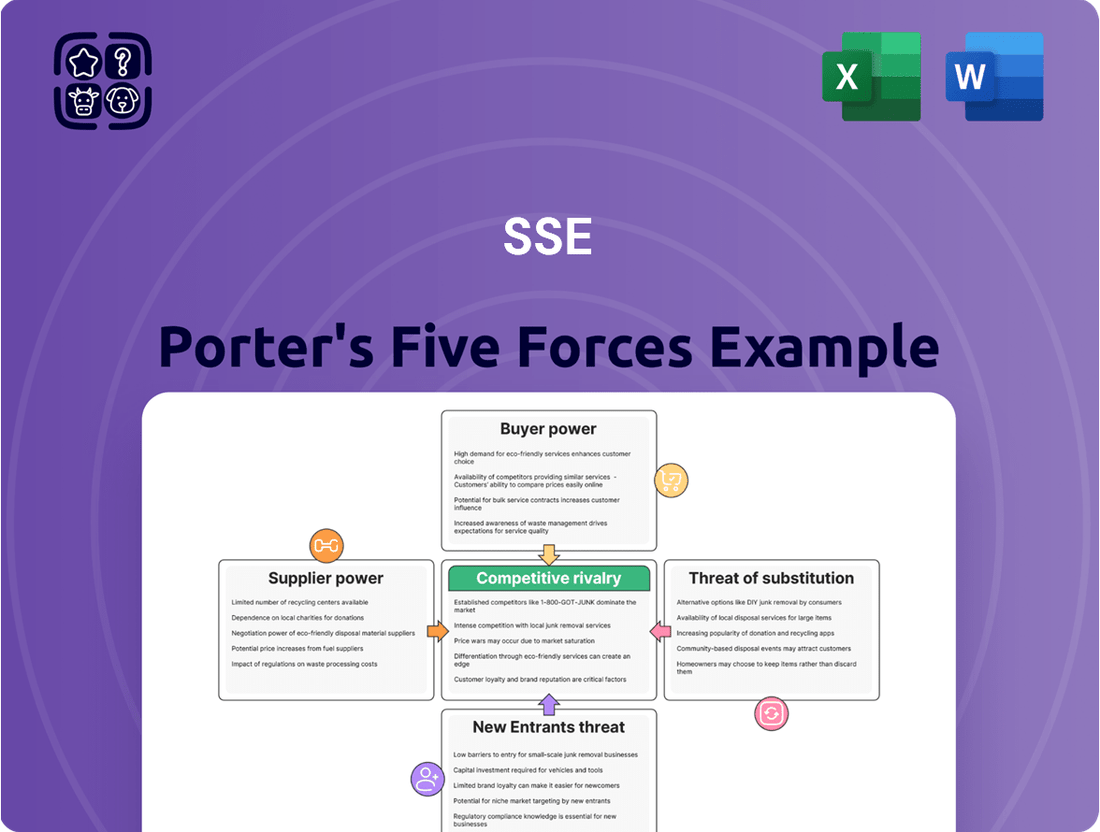

This analysis examines the five competitive forces impacting SSE, revealing the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the availability of substitutes.

Visually represent competitive intensity with a dynamic five forces diagram, instantly highlighting critical threat areas.

Customers Bargaining Power

For its electricity transmission and distribution networks, SSE's primary customers are energy suppliers and the end consumers, whose prices are tightly regulated by Ofgem. Ofgem, through its RIIO price controls like RIIO-ED2, effective from April 2023, effectively sets the revenue SSE can collect from these network services. This regulatory body acts as a powerful proxy for all customers, dictating both price and service standards. This robust oversight significantly limits SSE's pricing power, as seen in the fixed revenue allowances set by Ofgem for network operators.

In the wholesale electricity market, SSE sells its generated power to energy suppliers and large industrial users. This is a highly competitive environment where buyers can choose from numerous generators, including major players across the UK. Wholesale electricity prices are largely dictated by overall supply and demand dynamics, significantly limiting the bargaining power of any single generator like SSE. For instance, the UK wholesale electricity market in 2024 continued to show price sensitivity to gas prices and renewable output, underscoring collective market forces.

Large corporate customers are increasingly seeking to buy renewable energy directly from generators through Power Purchase Agreements (PPAs), enhancing their bargaining power. These significant volume buyers, including major tech firms, command substantial negotiating leverage. In 2024, corporate PPA volumes saw continued growth, reflecting a strong desire for long-term price certainty. This scale enables them to secure favorable pricing and contract terms, mitigating exposure to volatile wholesale energy markets. Such direct agreements empower customers to dictate terms more effectively.

Government as a Key Counterparty

The UK government, through schemes like Contracts for Difference (CfD), acts as a primary counterparty for renewable energy developers like SSE. Its centralized buying power is substantial, directly influencing project revenue by setting strike prices in CfD auctions. This governmental role profoundly impacts the financial viability and profitability of new renewable investments. For example, the upcoming CfD Allocation Round 6 in 2024 will continue to shape future project economics.

- CfD Allocation Round 6 is expected to be a key determinant for future renewable project revenue in 2024.

- Government-set strike prices directly dictate the long-term income streams for renewable energy assets.

- This centralized procurement mechanism ensures the government holds significant leverage over the entire renewable energy market.

Divestment of Retail Business

The divestment of SSE's retail business to OVO Energy in 2020 significantly reshaped its customer base, moving away from millions of individual residential consumers. This strategic shift means SSE now primarily serves a smaller, but more influential, group of larger entities. These include regulated bodies, substantial wholesale buyers, and corporate power purchase agreement (PPA) partners. While their numbers are fewer, the individual bargaining power of these major customers is considerably higher in 2024, influencing contract terms and pricing for SSE's energy generation and infrastructure.

- Post-2020, SSE's customer portfolio shifted from millions of retail accounts to a focused B2B and wholesale model.

- Major customers now include large industrial users and network operators.

- The average contract value with these larger entities is substantially higher than former residential accounts.

- Their increased individual leverage necessitates more tailored negotiations and competitive offerings from SSE.

Customer bargaining power for SSE is largely dictated by powerful entities like the regulator Ofgem, which sets non-negotiable network prices. In the wholesale market, numerous buyers benefit from competitive dynamics, while large corporate customers leverage direct Power Purchase Agreements. The UK government also acts as a dominant buyer for renewable energy via CfD auctions, directly influencing project economics.

| Customer Segment | Bargaining Power Indicator | Impact on SSE (2024) |

|---|---|---|

| Ofgem (Network Customers) | Regulatory Price Controls (RIIO-ED2) | Limits revenue, dictates service standards. |

| Wholesale Market Buyers | Market Competition, Supply/Demand | Influences wholesale electricity prices. |

| Corporate PPA Buyers | Volume, Direct Negotiation | Secures favorable long-term contract terms. |

| UK Government (CfD) | Centralized Procurement, Strike Prices | Determines renewable project revenue. |

Full Version Awaits

SSE Porter's Five Forces Analysis

You're previewing the final version of our SSE Porter's Five Forces Analysis. Precisely the same document, meticulously researched and formatted, will be available to you instantly after purchase. This comprehensive analysis details the competitive landscape of the SSE, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. Gain actionable insights to strategize effectively within this market.

Rivalry Among Competitors

SSE faces robust competition from integrated energy giants like Ørsted, ScottishPower (Iberdrola), and RWE across the UK and Irish energy markets. These major players pursue comparable strategies, emphasizing renewable energy projects and critical network infrastructure, intensifying the contest for new development sites and government support contracts. For instance, the UK aims for a decarbonized power system by 2035, driving significant investment and fierce rivalry. This intense competition means companies like SSE constantly vie for market share and project pipeline, with the UK renewable energy sector projected for substantial growth through 2024 and beyond.

A growing number of independent power producers, including specialized renewable energy developers, intensify competition for SSE. These agile firms often focus on specific niches within the renewables sector, such as the 2024 surge in UK solar and battery storage projects. This creates a highly competitive landscape for new energy development opportunities. The market sees continuous entry of new players, challenging established utilities like SSE for market share in green energy generation.

SSE faces strong competitive rivalry from state-owned enterprises and international energy giants actively expanding their renewable energy portfolios across the UK and Ireland. Companies like Equinor and TotalEnergies are significant players, leveraging substantial financial backing and global expertise to develop large-scale projects. For instance, TotalEnergies continues significant offshore wind investments in the UK, while Equinor is a key player in UK offshore wind. This influx of well-resourced entities intensifies the competitive landscape for SSE in securing new projects and market share in 2024.

Regulated Network Monopolies

SSE's electricity networks operate as natural monopolies within their licensed areas, meaning direct competition in building and running transmission and distribution grids is limited. However, rivalry manifests through regulatory comparisons. Ofgem, the UK energy regulator, actively benchmarks SSE's performance and costs against other network operators like National Grid and SP Energy Networks to foster efficiency and innovation. This drives continuous improvement in areas such as network reliability and investment returns, influencing future price controls.

- Ofgem's RIIO-ED2 framework (2023-2028) sets stringent performance targets for network operators, including SSE.

- In 2024, Ofgem continues to utilize comparisons, pushing operators to reduce costs and enhance service quality.

- SSE's Scottish Hydro Electric Power Distribution (SHEPD) and Scottish Hydro Electric Transmission (SHE Transmission) are subject to these benchmarks.

- Regulatory penalties or incentives are tied to performance relative to these peer comparisons.

Competition for Capital and Talent

Competition for SSE extends beyond project bids to a fierce contest for capital and skilled professionals. All major energy companies vie for the same investor pool, increasingly prioritizing ESG criteria, with global sustainable investment assets reaching over $30 trillion in 2024. This necessitates robust ESG reporting and demonstrable green credentials to attract funding. Simultaneously, a significant 'war for talent' is underway for specialized roles like renewable energy engineers and project managers, crucial for delivering complex energy infrastructure.

- Global sustainable investment assets surpassed $30 trillion by early 2024.

- Demand for renewable energy engineers increased by 15% in 2024.

- ESG-aligned capital allocations are projected to grow by 10-12% annually through 2025.

- The average salary for a wind turbine technician rose by 8% in 2024.

SSE faces intense competitive rivalry from integrated energy giants and agile independent developers, all vying for renewable energy projects and market share, especially in the UK’s rapidly growing sector. This competition extends to securing ESG-aligned capital, with over $30 trillion in global sustainable investment assets in 2024, and attracting critical skilled talent. Ofgem’s 2024 regulatory benchmarking further drives efficiency and innovation pressure on SSE’s network operations.

| Rivalry Aspect | 2024 Data Point | Impact on SSE |

|---|---|---|

| Sustainable Investment | Global assets > $30T | Increased competition for capital |

| Talent Demand (Engineers) | 15% increase in demand | Higher recruitment costs, talent scarcity |

| UK Decarbonization Goal | Target by 2035 | Intensified project bidding, market rivalry |

SSubstitutes Threaten

The rise of decentralized energy resources (DERs) presents a significant substitute threat to SSE's traditional centralized model. Rooftop solar installations, for instance, are projected to reach over 15 GW in the UK by 2024, enabling consumers to generate their own power. This includes residential, commercial, and community energy projects, alongside microgrids, which collectively reduce reliance on the national grid and conventional suppliers like SSE. The increasing viability of self-generation directly impacts SSE's electricity generation and network revenue streams, as customers invest in alternative energy solutions.

Advances in battery storage, especially in 2024, pose a significant threat as a substitute for traditional grid balancing. For instance, UK battery storage capacity is projected to reach approximately 10 GW by 2026, up from around 3.5 GW in early 2024. This allows businesses and residential users to store excess renewable energy, reducing reliance on SSE's flexible generation plants and certain network services. As battery costs continue to fall, this trend lessens the demand for conventional grid services.

While the UK is shifting towards renewables, natural gas remains a crucial transitional substitute for SSE's generation, especially during periods of low wind and solar output. As of 2024, natural gas still contributes significantly to the UK's electricity mix, ensuring grid stability. The government's energy security strategy acknowledges the ongoing need for gas-fired power plants, projecting their role into the 2030s to balance intermittent renewable generation. This sustained reliance on gas means it continues to exert a strong substitute threat, influencing investment decisions in new renewable capacity. For instance, in Q1 2024, gas-fired power often filled supply gaps when renewable output fluctuated.

Energy Efficiency and Demand Reduction

The negawatt, or energy saved through efficiency, is a potent substitute for new generation capacity. Government policies, such as the UK’s commitment to achieving net-zero emissions by 2050, drive significant energy efficiency improvements in homes and industries. This reduces overall electricity demand, directly lowering the need for new generation and network investment from companies like SSE.

- UK electricity demand in 2024 continues a long-term decline, partly due to efficiency.

- Government initiatives target improved building energy performance, reducing consumption.

- Smart meter penetration, reaching over 35 million in the UK by early 2024, empowers demand-side management.

- Ofgem's RIIO-ED2 framework incentivizes network operators to facilitate demand reduction.

Alternative Green Technologies

While SSE holds a strong position in wind and hydro energy, the threat from emerging alternative green technologies is growing. Green hydrogen, for instance, is seeing substantial investment, with global project pipelines exceeding 380 GW by early 2024, positioning it as a viable substitute for power generation, industrial heating, and transport fuels. Advances in tidal and geothermal energy also present long-term alternatives for large-scale, low-carbon power, potentially diversifying the energy mix beyond traditional renewables.

- Green hydrogen investment surged by over 40% in 2023, reaching multi-billion dollar commitments.

- Tidal energy projects, like those in the UK, continue to advance, with a 2024 pipeline of over 1 GW.

- Geothermal capacity is projected to increase by 20-30% globally by 2030, offering baseload power.

New energy technologies and efficiency measures pose significant substitute threats to SSE's traditional model. Rooftop solar, projected to exceed 15 GW in the UK by 2024, enables self-generation, while battery storage, reaching 3.5 GW in early 2024, reduces grid reliance. Increased energy efficiency, driven by UK net-zero targets and smart meter adoption (over 35 million by early 2024), further lowers overall electricity demand, directly impacting SSE's revenue streams.

| Substitute Threat | 2024 UK Data Point | Impact on SSE |

|---|---|---|

| Rooftop Solar | Over 15 GW capacity | Reduces grid demand |

| Battery Storage | Around 3.5 GW capacity | Lessens grid balancing needs |

| Smart Meter Penetration | Over 35 million meters | Drives demand-side management |

Entrants Threaten

The energy generation and transmission sectors demand immense capital, posing a significant hurdle for new entrants. Developing projects like large-scale offshore wind farms or major grid infrastructure upgrades requires billions of pounds. For instance, SSE itself plans to invest around £17.5 billion from 2023/24 to 2027/28, primarily in renewables and electricity networks. This substantial financial commitment effectively deters most potential newcomers lacking vast financial resources, solidifying the market position of established players like SSE.

New entrants into the UK energy market face significant barriers due to the strict regulatory and licensing framework. They must navigate a complex web of rules and secure licenses from bodies like Ofgem, which oversees market operations and consumer protection. The planning and consenting process for major energy infrastructure, such as new power generation or transmission assets, is notoriously lengthy, often taking over five years to complete from conception to operation. For instance, the National Grid's 2024 network development plans highlight the extensive lead times for new connections. This robust regulatory environment effectively shields established players like SSE from a flood of new competition.

Incumbent energy companies like SSE benefit immensely from vast economies of scale across procurement, operational management, and large-scale project delivery. SSE, for instance, is progressing with its Net Zero Acceleration Programme Plus, planning around £18 billion in capital expenditure through March 2027, predominantly in renewables and electricity networks, demonstrating an unmatched scale. This also means decades of experience and deeply embedded relationships with key suppliers, contractors, and governmental bodies. New entrants face a significant hurdle in replicating such established scale and invaluable experience, making market penetration very challenging.

Grid Connection and Access

A significant hurdle for new electricity generators is securing a timely connection to the national grid. The queue for connections is notably long, with National Grid ESO reporting over 200 GW of projects awaiting connection in 2024, a process that can be complex and costly, often delaying new projects for years. SSE, as a major network operator itself, benefits from an inherent advantage and deep understanding of this intricate process.

- Grid connection queues for new generators can extend over a decade.

- The cost of grid upgrades for new connections can reach hundreds of millions of pounds.

- SSE’s existing infrastructure provides a strategic competitive edge.

Government Policy and Auction Systems

Government policies and auction systems, while designed to foster investment, paradoxically create significant barriers for new entrants. The competitive Contracts for Difference (CfD) auction process, such as the UK’s Allocation Round 6 (AR6) in 2024, heavily favors experienced developers like SSE with robust financial backing and proven track records. These established players can submit more sophisticated bids and manage the complexities of securing projects. Furthermore, the government’s continued reliance on a national pricing model, rather than zonal pricing, provides crucial stability for incumbent energy generators, making it harder for smaller, regional new players to compete effectively. This structure solidifies the market position of existing large-scale operators.

- CfD Allocation Round 6 (AR6) for 2024 highlights the competitive landscape.

- Experienced developers possess a clear advantage in complex bidding processes.

- National pricing models ensure revenue predictability for large incumbents.

- New entrants struggle to match the financial and operational scale of established players.

The threat of new entrants in the UK energy sector for SSE remains low due to formidable capital requirements and a complex regulatory environment, exemplified by strict Ofgem licensing and lengthy planning for new infrastructure. Established players like SSE benefit from immense economies of scale and existing grid connections, with over 200 GW of projects awaiting grid access in 2024. Government auction systems like CfD AR6 for 2024 also favor experienced incumbents with robust financial backing, making it extremely challenging for newcomers to compete effectively.

| Barrier Type | Key Factor | 2024 Data/Impact |

|---|---|---|

| Capital Intensity | High Investment Needs | SSE plans £18bn capex through Mar 2027; deters new entry. |

| Regulatory Hurdles | Strict Licensing & Planning | Planning often takes over 5 years; complex Ofgem rules. |

| Infrastructure Access | Grid Connection Bottlenecks | Over 200 GW of projects await UK grid connection. |

| Market Dynamics | Auction Bias & Scale | CfD AR6 favors experienced developers; national pricing benefits incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive blend of proprietary market research reports, industry-specific trade publications, and publicly available financial statements from key industry players.

We also incorporate data from government regulatory filings and economic databases to provide a thorough understanding of competitive dynamics.