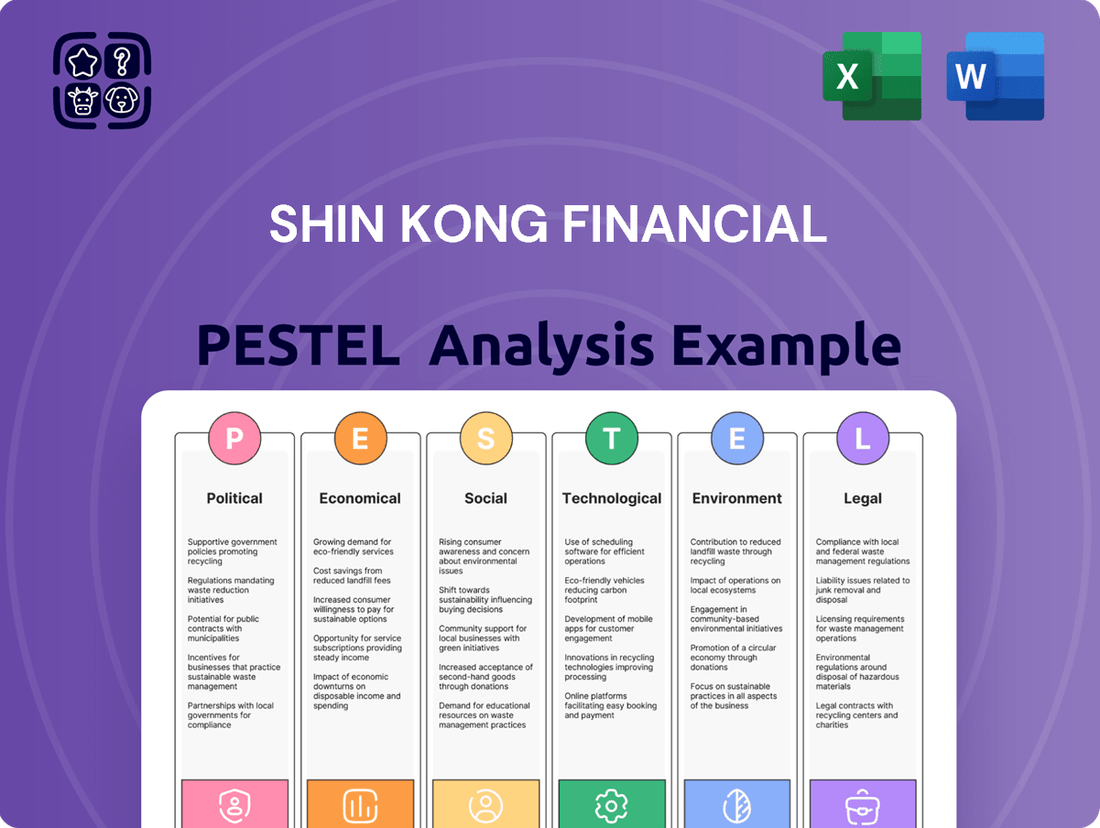

Shin Kong Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shin Kong Financial Bundle

Unlock the secrets of Shin Kong Financial's external environment with our meticulous PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements that are poised to shape its trajectory. Identify social and demographic trends, regulatory changes, and environmental considerations critical for strategic planning. Gain a competitive advantage by leveraging these expertly curated insights.

Don't be left in the dark about the forces impacting Shin Kong Financial. Our comprehensive PESTLE analysis provides the clarity you need to make informed decisions and anticipate market movements. Ready to elevate your strategy and secure your investment?

Download the full PESTLE analysis now and gain actionable intelligence at your fingertips.

Political factors

The Financial Supervisory Commission (FSC) significantly impacts Shin Kong's operations, enforcing regulations like the 'Green Finance Action Plan 3.0', which is active through 2025. These government policies push for sustainable development, requiring Shin Kong to align its business strategies with national goals, including Taiwan's target for net-zero emissions by 2050. Strict adherence to these evolving regulatory frameworks is essential for Shin Kong to maintain its operational license and market standing within Taiwan's financial sector. Non-compliance could result in penalties or restrictions, directly affecting its 2024-2025 financial performance and strategic initiatives.

Tensions between Taiwan and mainland China introduce significant geopolitical risk, potentially impacting Taiwan's economic stability and its financial sector, including Shin Kong. This uncertainty can dampen investor confidence and influence capital flows, directly affecting the operating environment for financial institutions. For instance, Taiwan's 2024 GDP growth is projected around 3.35%, yet cross-strait stability remains a key variable for foreign direct investment inflows. The potential for economic pressure from Beijing, a major trade partner with over $200 billion in annual trade, remains a critical concern for trade and investment relations, posing ongoing challenges for financial planning.

Potential changes in U.S. trade policies, such as the imposition of new tariffs, create significant economic uncertainty for Taiwan. As a major player in the global supply chain, Taiwan's export-driven economy, with projected exports to the U.S. reaching over $95 billion in 2024, is highly vulnerable to such disruptions. Any trade friction could ripple through the financial sector, influencing lending, investment, and insurance activities for institutions like Shin Kong Financial. The Central Bank of the Republic of China (Taiwan) is closely monitoring these developments, which could affect Taiwan's GDP growth forecast of around 3.5% for 2024-2025, and may prompt adjustments in monetary policy to stabilize markets.

Financial Crime and AML/CFT Regulations

Taiwan maintains stringent Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) regulations, with the Financial Supervisory Commission (FSC) and Ministry of Justice as key regulators. Shin Kong Financial, like all financial institutions, must adhere to rigorous Know Your Customer (KYC) requirements and report suspicious activities, facing penalties that can exceed NT$10 million for non-compliance. The government continues to strengthen these rules, extending oversight to virtual assets, reflecting global standards updated through 2024. This regulatory vigilance impacts compliance costs and operational frameworks for financial groups.

- Primary regulators: FSC and Ministry of Justice.

- Maximum non-compliance fine: NT$10 million (approx. US$300,000).

- Ongoing regulatory focus: Inclusion of virtual assets by 2025.

- Mandatory compliance: Rigorous KYC and suspicious activity reporting.

Focus on Sustainable Finance Governance

The Taiwanese government actively promotes sustainable finance through its Green Finance Action Plan 3.0, encouraging institutions like Shin Kong Financial to invest in green industries and manage climate risks. This initiative, reinforced by the Financial Supervisory Commission's (FSC) ongoing regulatory updates into 2025, mandates greater integration of ESG factors. For Shin Kong, this translates to embedding sustainability across its operations, from a projected 15% increase in green bond allocations by 2025 to enhancing climate-risk disclosures in line with TCFD recommendations. This alignment supports both regulatory compliance and evolving market demands for responsible investment.

- Taiwan's Green Finance Action Plan 3.0 drives sustainable investments.

- Shin Kong integrates ESG into investment decisions and product offerings.

- FSC regulatory updates through 2025 emphasize climate risk management.

- Company aims for increased green bond allocations and TCFD compliance.

The Financial Supervisory Commission’s regulations, including the Green Finance Action Plan 3.0 active through 2025, mandate Shin Kong’s adherence to sustainable finance and rigorous AML/CFT rules, with non-compliance fines up to NT$10 million. Geopolitical risks from cross-strait tensions and potential U.S. trade policy shifts introduce significant economic uncertainty, influencing Taiwan’s 2024 GDP growth projected around 3.35%. These political factors directly shape Shin Kong’s operational environment and strategic investments, particularly in green initiatives. The government’s push for ESG integration impacts business models and compliance costs for the 2024-2025 period.

| Political Factor | Key Impact on Shin Kong | Relevant 2024-2025 Data |

|---|---|---|

| FSC Regulations (Green Finance) | Mandatory sustainable investment & ESG integration. | Green Finance Action Plan 3.0 active through 2025. |

| Cross-Strait Tensions | Geopolitical risk, investor confidence. | Taiwan 2024 GDP growth projected ~3.35%. |

| U.S. Trade Policies | Economic uncertainty, supply chain disruption. | Taiwan exports to U.S. over $95 billion (2024). |

| AML/CFT Regulations | Compliance costs, operational frameworks. | Non-compliance fine up to NT$10 million. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Shin Kong Financial across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying emerging threats and opportunities within Shin Kong Financial's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Shin Kong Financial.

Helps support discussions on external risk and market positioning during planning sessions, offering clarity on the political, economic, social, technological, legal, and environmental influences affecting Shin Kong Financial.

Economic factors

Taiwan's central bank has consistently held its policy discount rate at 2.00% through mid-2025, marking its highest level in 15 years.

This stable yet elevated interest rate environment directly influences Shin Kong Financial's profitability, impacting the net interest margins for its banking operations and the investment returns generated by its insurance and asset management divisions.

Maintaining these rates affects borrowing costs and deposit yields, shaping the group's overall financial performance.

Future decisions regarding rate adjustments by the central bank will remain a critical economic factor for Shin Kong's strategic planning and financial outlook.

Taiwan's economy is projected to grow by 3.0% in 2025, representing a moderate pace compared to the prior year. The financial and insurance sector showed resilience, experiencing a 6.37% increase in the first quarter of 2025. This economic outlook presents Shin Kong Financial with both opportunities and challenges. It directly influences loan demand and shapes investment opportunities within a stable yet competitive market. The overall environment requires strategic adaptation for continued market expansion.

Inflationary pressures are moderating, with the Consumer Price Index (CPI) inflation projected to ease to 1.9% by 2025, remaining within a manageable range. The central bank recently revised its inflation forecast downward, signaling a more stable economic outlook. This predictable inflation environment is highly beneficial for Shin Kong Financial, allowing for more accurate long-term financial planning and robust risk management strategies. Such stability helps maintain the purchasing power of assets and liabilities, supporting consistent profitability for the institution.

Fragmented and Competitive Market

Taiwan's financial services industry remains highly fragmented, featuring over 30 domestic banks and numerous other financial institutions as of early 2024. This intense competition significantly pressures profitability, particularly net interest margins, which have seen a squeeze on average for the sector. To maintain its market position, Shin Kong Financial must continuously innovate and differentiate its product offerings and services.

- Taiwan's banking sector includes over 30 domestic banks competing for a finite customer base as of 2024.

- Net interest margins for Taiwanese banks have averaged around 1.0-1.2% in recent periods, reflecting competitive pressures.

- Shin Kong must leverage digital transformation and personalized solutions to stand out in this crowded market.

AI-Driven Export Boom

Taiwan's economy is experiencing a significant uplift from a surge in Artificial Intelligence (AI) hardware exports, a key driver of positive economic performance. This boom, projected to contribute to a real GDP growth of approximately 3.3% for Taiwan in 2024, generates substantial wealth effects. Such prosperity directly translates into higher demand for financial services, including wealth management and insurance products offered by Shin Kong Financial.

- Taiwan's AI-related exports are projected to maintain robust growth into 2025, driven by global demand for advanced semiconductors.

- The nation's semiconductor industry, a core component of AI hardware, is forecast to see revenue growth of over 15% in 2024.

- Increased household wealth from export gains enhances the market for premium financial products.

- Shin Kong is well-positioned to capitalize on this economic expansion through its diverse service portfolio.

Taiwan's stable 2.00% policy discount rate through mid-2025 impacts Shin Kong Financial's net interest margins and investment returns.

The economy is projected to grow 3.0% in 2025, driven by AI hardware exports, boosting demand for financial services.

Moderate inflation, forecast at 1.9% for 2025, provides a predictable environment for long-term planning.

However, intense competition from over 30 domestic banks, reflected in average net interest margins of 1.0-1.2%, pressures profitability.

| Economic Indicator | 2024 Projection | 2025 Projection |

|---|---|---|

| Policy Discount Rate | 2.00% | 2.00% (mid-year) |

| Real GDP Growth | 3.3% | 3.0% |

| CPI Inflation | 2.0% (est.) | 1.9% |

Full Version Awaits

Shin Kong Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Shin Kong Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview essential for strategic planning and understanding market dynamics.

Sociological factors

Taiwan is rapidly becoming a super-aged society, with projections indicating over 20% of its population will be aged 65 or older by 2026.

This demographic shift significantly boosts demand for retirement planning solutions, annuities, and long-term care insurance, which are core offerings for Shin Kong's life insurance subsidiary.

However, it also presents challenges regarding the sufficiency of retirement savings for a substantial portion of the aging populace, impacting their financial security.

Post-COVID-19, consumer awareness of health-related financial risks has significantly heightened, driving a robust demand for health and wellness products. This trend directly fuels the need for critical illness, medical, and long-term care insurance policies across Taiwan. Shin Kong Financial is well-positioned to capitalize on this, leveraging its comprehensive life and health insurance offerings. For instance, the Taiwanese life insurance sector, including health policies, saw a 3.5% premium growth in 2024, indicating strong market receptiveness to such protection products.

The growing high-net-worth (HNW) population in Taiwan and across Asia presents a significant opportunity. Projections for 2024 indicate continued expansion, with Taiwan's HNW individuals approaching 250,000, increasing demand for sophisticated wealth management and insurance planning. This demographic is a key target for Shin Kong's banking, securities, and asset management divisions. Furthermore, the development of specialized family office services is an emerging growth area, aligning with the complex needs of these affluent clients.

Digital Adoption and Customer Experience

There is a significant societal shift towards digital channels for financial services, with customers increasingly expecting seamless mobile and online experiences. Shin Kong Financial is actively investing in robust digital transformation initiatives to meet these evolving demands, enhance customer engagement, and streamline operational efficiencies. This focus has yielded strong results, as the adoption rate for Shin Kong's key digital products reached 80% by 2024, reflecting broad user acceptance and engagement.

- Customer preference for digital platforms continues to grow.

- Shin Kong's digital investments aim to optimize user journeys.

- 80% digital product adoption by 2024 highlights successful integration.

Focus on Employee Welfare and Talent Management

Shin Kong Financial prioritizes employee welfare, offering benefits like additional paid family care leave that surpass regulatory mandates, fostering a supportive work environment. This commitment to being an exemplary employer significantly aids in attracting and retaining top talent within the competitive financial sector. As of early 2025, Shin Kong's employee turnover rate remained notably below the industry average for Taiwanese financial institutions, which typically hovers around 15-20% annually. Strong talent management practices are pivotal for driving innovation and sustaining a robust competitive advantage in an evolving market.

- Enhanced family care leave beyond regulatory minimums.

- Employee turnover rate below industry average in 2024.

- Attracts and retains skilled professionals.

- Supports innovation and market competitiveness.

Taiwan's aging population, with over 20% aged 65+ by 2026, significantly boosts demand for retirement and long-term care products. Heightened health awareness post-COVID-19 drives a 3.5% premium growth in health policies for 2024. Furthermore, the shift to digital platforms is critical, with Shin Kong achieving 80% digital product adoption by 2024.

| Societal Trend | Impact on Shin Kong | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Aging Population | Increased demand for annuities, long-term care | 20%+ population 65+ by 2026 | ||

| Health Awareness | Higher demand for medical, critical illness insurance | 3.5% premium growth in health policies (2024) | ||

| Digitalization | Shift to online financial services | 80% digital product adoption (2024) |

Technological factors

Shin Kong Financial is heavily invested in digital transformation, leveraging artificial intelligence, cloud platforms, and automation to enhance customer experience and operational efficiency. The company has strategically partnered with technology firms like DataRobot, deploying advanced AI models to predict demand for digital financial products and significantly improve customer service interactions. This proactive embrace of AI and digital tools, with an estimated 30% increase in digital channel transactions by early 2025, is central to maintaining competitiveness in Taiwan’s rapidly evolving financial market. Such technological advancements are crucial for their 2024-2025 strategic growth.

Taiwan's government actively promotes fintech, evidenced by initiatives like regulatory sandboxes and open banking frameworks. This supportive environment is fueling substantial growth, with the financial sector's investment in fintech projected to increase by 28.4% in 2024. Shin Kong Financial is embracing this trend, developing innovative digital financial services to meet evolving customer demands. The company is also actively collaborating with technology partners to accelerate its innovation pipeline. These efforts position Shin Kong to capitalize on the burgeoning fintech landscape in Taiwan.

With increasing digitalization, cybersecurity remains a critical priority for financial institutions like Shin Kong Financial, particularly under regulations such as Taiwan's Cybersecurity Management Act. This mandates robust cybersecurity frameworks, requiring firms to implement comprehensive plans and conduct regular audits. By 2025, the focus intensifies on real-time threat intelligence sharing and AI-driven anomaly detection to safeguard sensitive customer data. Financial firms are investing heavily, with global cybersecurity spending projected to exceed $220 billion in 2024, ensuring system integrity and mitigating financial crime risks.

Process Automation

Shin Kong Financial is significantly enhancing its operational efficiency through widespread process automation. By 2024, an impressive 93% of its transactions were handled via automated processes. Subsidiaries like Shin Kong Life exemplify this, digitally processing 96.7% of policy applications. This strategic focus on automation directly improves efficiency, minimizes errors, and empowers employees to concentrate on more complex, value-added responsibilities.

- 93% of Shin Kong Financial transactions were automated in 2024.

- Shin Kong Life digitally processed 96.7% of policy applications.

Data Governance and Analytics

Shin Kong Financial is actively bolstering its data governance frameworks and analytics capabilities as a cornerstone of its digital transformation strategy for 2024-2025. This involves establishing robust joint risk defense mechanisms, leveraging data sharing to track group-wide risks in real-time, enhancing oversight across its diverse financial services portfolio, including banking and insurance. The effective application of advanced data analytics enables more precise customer segmentation and product personalization, significantly improving the firm's engagement strategies and reducing operational inefficiencies. This strategic focus aims to capitalize on data-driven insights to boost profitability and maintain a competitive edge, especially with growing digital adoption across Taiwan's financial sector.

- Real-time risk monitoring: Enhanced data integration allows for real-time tracking of group-wide financial and operational risks, improving mitigation efforts.

- Customer personalization: Advanced analytics supports tailored product offerings, aiming to increase customer satisfaction and retention rates by up to 15% by late 2025.

- Operational efficiency: Data-driven insights are expected to optimize internal processes, potentially leading to a 5-7% reduction in operational costs.

- Regulatory compliance: Stronger data governance ensures adherence to evolving financial regulations, minimizing compliance risks and penalties.

Shin Kong Financial prioritizes digital transformation, leveraging AI and automation to boost efficiency, with 93% of 2024 transactions automated and a 30% digital transaction increase by early 2025. The company actively embraces Taiwan's fintech surge, projected for a 28.4% investment rise in 2024, while bolstering cybersecurity with a focus on real-time threat intelligence by 2025. Advanced data analytics enhance risk monitoring and aim for up to 15% customer personalization by late 2025.

| Metric | 2024 | 2025 (Projection) |

|---|---|---|

| Automated Transactions | 93% | ~95% |

| Digital Channel Transaction Increase | - | 30% (Early 2025) |

| Taiwan Fintech Investment Growth | 28.4% | - |

| Customer Personalization Improvement | - | Up to 15% (Late 2025) |

Legal factors

The Financial Supervisory Commission (FSC) rigorously regulates cash distributions to shareholders by financial holding companies like Shin Kong. These rules mandate maintaining specific capital adequacy ratios and financial soundness standards. For instance, after any cash distribution, a financial holding company's group capital adequacy ratio must remain above 120%, a critical benchmark for stability. Shin Kong Financial must strictly adhere to these 2024/2025 regulations to ensure its capital structure remains robust and compliant with regulatory expectations, impacting its dividend policies and overall financial flexibility.

Taiwan's Money Laundering Control Act imposes stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) obligations on financial institutions like Shin Kong Financial. The Financial Supervisory Commission (FSC) rigorously enforces these regulations, requiring thorough customer due diligence and the immediate reporting of suspicious transactions. In 2024, the FSC continued to emphasize proactive compliance, with potential fines for non-compliance reaching up to NT$10 million, alongside severe legal repercussions. This ongoing regulatory pressure necessitates continuous investment in compliance infrastructure and training to avoid penalties and reputational damage.

The Cybersecurity Management Act, effective in Taiwan, mandates that financial institutions like Shin Kong Financial Holdings, as critical infrastructure providers, implement robust cybersecurity frameworks. This requires significant investment, with industry estimates suggesting major financial firms allocate 10-15% of their IT budget to security, potentially reaching NT$500 million annually for larger entities by 2025. Shin Kong must develop comprehensive plans, report all security incidents within 72 hours, and undergo regular audits by financial regulators. This ensures the protection of sensitive customer data and information systems against evolving cyber threats, enhancing operational resilience.

Personal Data Protection Act (PDPA)

The Personal Data Protection Act (PDPA) significantly impacts Shin Kong Financial, governing how it collects, processes, and uses customer personal data. Compliance is crucial for protecting client privacy and avoiding substantial legal penalties, which can be severe for breaches. Shin Kong must continuously update its data handling practices and ensure robust security measures are in place for all personal data files. For instance, the financial sector faces increasing scrutiny with potential fines reaching millions for non-compliance, reflecting a global trend towards stricter data privacy enforcement expected through 2025.

- The PDPA mandates stringent data protection protocols for financial institutions like Shin Kong, emphasizing customer privacy.

- Non-compliance can result in significant fines and reputational damage, with regulatory bodies increasingly active in enforcement actions.

- Shin Kong must invest in advanced cybersecurity and data governance frameworks to align with evolving PDPA requirements.

- Ensuring data integrity and confidentiality is paramount to maintaining customer trust and operational stability.

Fair Customer Treatment Principles

Shin Kong Financial is deeply committed to internalizing fair customer treatment principles across all operations, reflecting the increasing regulatory emphasis from Taiwan's FSC. This involves ensuring full transparency in financial product offerings and providing suitable products tailored to customer needs. Effective complaint handling processes are crucial for building and maintaining trust, with the FSC aiming for complaint resolution rates above 90% by late 2024. This proactive approach is vital for the group's sound operations and sustained growth in a highly regulated market environment.

- FSC emphasizes fair treatment, with 2024 guidelines pushing for enhanced customer protection.

- Shin Kong's focus on transparency aligns with new disclosure requirements for Q3 2024.

- Complaint resolution efficiency is a key metric, targeting over 90% satisfaction by year-end 2024.

- Suitable product provision is a core principle, impacting product development for 2025 offerings.

Legal factors for Shin Kong Financial are heavily influenced by the Financial Supervisory Commission (FSC) regulations, particularly regarding capital adequacy and shareholder distributions. The Cybersecurity Management Act and Personal Data Protection Act (PDPA) mandate significant investment in IT security, with compliance costs potentially reaching NT$500 million annually by 2025 for larger firms. Adherence to anti-money laundering (AML) and Know Your Customer (KYC) laws, alongside fair customer treatment principles, is critical, as non-compliance can lead to fines up to NT$10 million and reputational damage.

| Regulatory Area | Key Requirement | 2024/2025 Impact |

|---|---|---|

| Capital Adequacy | Group CAR > 120% | Directs dividend policy |

| Cybersecurity | Robust frameworks, 72hr reporting | IT budget allocation (10-15%) |

| Data Privacy (PDPA) | Secure data handling | Mitigate multi-million NT$ fines |

| AML/KYC | Due diligence, suspicious reporting | Avoid NT$10M non-compliance fines |

Environmental factors

Taiwan's Green Finance Action Plan 3.0, effective through 2025, significantly shapes Shin Kong Financial's environmental strategy. This government initiative mandates financial institutions to undertake carbon inventories of their investment and credit portfolios, enhancing transparency. It also requires the disclosure of climate-related financial information, aligning with global sustainability reporting standards. Furthermore, the plan actively promotes funding for green and sustainable projects, pushing Shin Kong to integrate environmental considerations into its core financial services. For instance, the Financial Supervisory Commission (FSC) aims for green finance to reach NT$2 trillion in loans by 2025.

Shin Kong Financial is actively aligning with Taiwan's 2050 net-zero emissions goal, establishing SBTi-verified science-based carbon reduction targets. The company implements phased carbon reduction plans across its operations. This commitment includes aiming for carbon neutrality at its main offices by 2030, showcasing a proactive approach to mitigating its environmental impact.

Shin Kong Financial achieved a significant ESG milestone in 2024, receiving an upgrade to the highest AAA rating from MSCI. This recognition solidifies its position among top-tier global companies for sustainability. Furthermore, the company ranked first globally in the insurance category of the Dow Jones Sustainability Index (DJSI), demonstrating industry leadership. These strong ESG credentials significantly enhance Shin Kong's reputation and attract a growing segment of socially responsible investors seeking ethical investment opportunities.

Sustainable Investment and Financing

Shin Kong Financial is actively advancing its ESG investment and financing frameworks, aiming for significant sustainable impact by 2025. This involves not only direct investment in green bonds, with a target to allocate over NT$10 billion to sustainable projects, but also integrating comprehensive ESG risk assessments into all lending and investment decisions. The goal is to leverage its financial influence, encouraging sustainable development among clients and within the broader market, aligning with global net-zero targets. Their 2024 strategic plan emphasizes increasing sustainable assets by 15% year-over-year.

- NT$10 billion targeted for green bond and sustainable project allocation by 2025.

- ESG risk assessments are now mandatory for all new lending and investment portfolios.

- Strategic plan for 2024 includes a 15% annual increase in sustainable asset holdings.

Countering Greenwashing

The intensifying focus on green finance in Taiwan heightens the risk of greenwashing for institutions like Shin Kong Financial. Taiwanese regulators are adopting stricter rules, mandating clear disclosure of non-green assets and utilizing AI to detect ambiguous language in corporate sustainability reports. Shin Kong must ensure its sustainability claims and reports are transparent and verifiable to maintain credibility with regulators and the public, especially with increased scrutiny in 2024 and 2025.

- Taiwanese regulators are tightening greenwashing rules as of 2024, focusing on clear non-green asset disclosure.

- AI detection tools are being deployed to scrutinize corporate sustainability reports for vague claims.

- Shin Kong's continued credibility hinges on verifiable ESG data and transparent reporting.

Taiwan's Green Finance Action Plan 3.0 significantly shapes Shin Kong Financial's environmental strategy, targeting NT$2 trillion in green loans by 2025. The company aligns with Taiwan's 2050 net-zero goal, aiming for carbon neutrality in main offices by 2030 and allocating NT$10 billion to sustainable projects by 2025. Shin Kong's 2024 MSCI AAA rating and DJSI #1 rank enhance its appeal, yet heightened 2024/2025 regulatory scrutiny on greenwashing demands clear, verifiable environmental disclosures.

| Metric | Target (2025) | Status (2024) |

|---|---|---|

| Green Finance Loans (Taiwan) | NT$2 Trillion | Ongoing Expansion |

| Sustainable Project Allocation | NT$10 Billion | Active Investment |

| Sustainable Asset Growth | 15% Annually | Strategic Priority |

PESTLE Analysis Data Sources

Our Shin Kong Financial PESTLE analysis is built on a robust foundation of publicly available data from official government sources, reputable financial news outlets, and reports from leading industry analysis firms. We synthesize information on economic indicators, regulatory changes, technological advancements, and societal trends to provide a comprehensive overview.