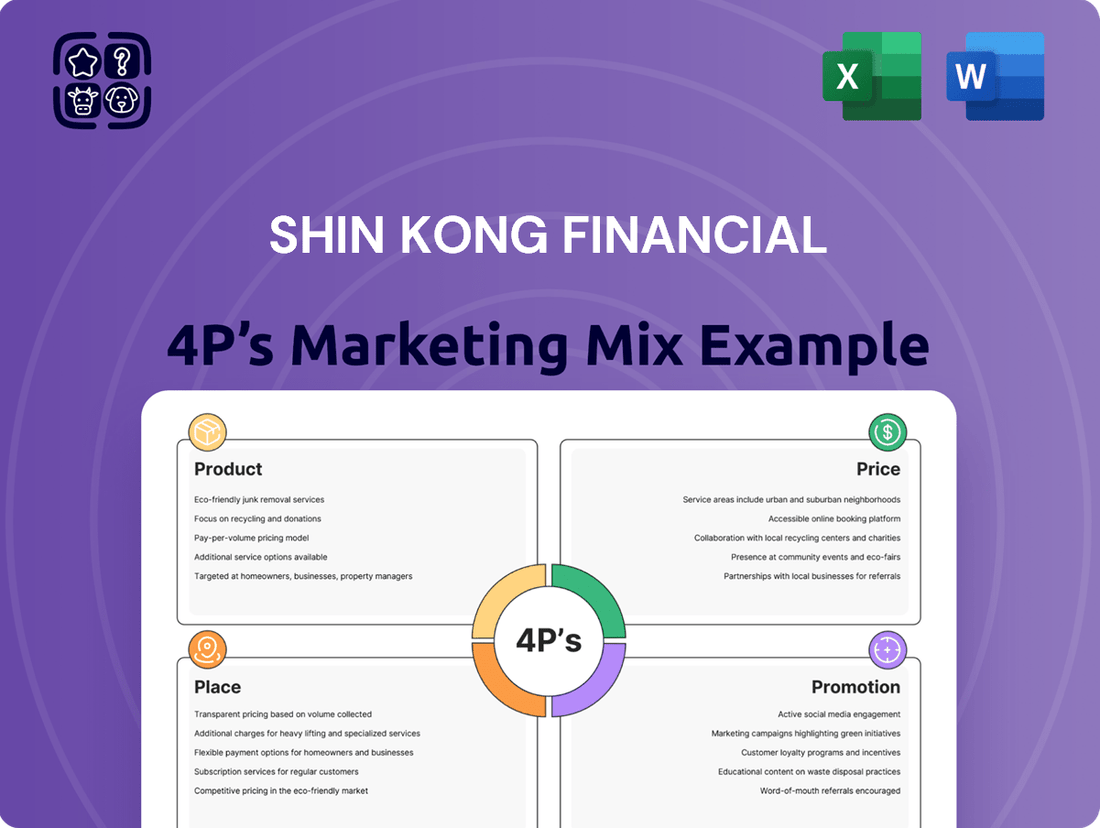

Shin Kong Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shin Kong Financial Bundle

Shin Kong Financial's marketing prowess is evident across its Product, Price, Place, and Promotion strategies. Delve into how their diverse financial products are tailored to meet evolving customer needs, and how their competitive pricing ensures market appeal. Discover their strategic distribution channels that maximize accessibility and their impactful promotional campaigns that build strong brand loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Shin Kong Financial's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leading financial institution.

Explore how this brand’s product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success in the competitive financial sector. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking on Shin Kong Financial—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of Shin Kong Financial. Professionally written, editable, and formatted for both business and academic use, it provides a clear roadmap to their marketing success.

Product

Shin Kong Financial, through Shin Kong Life, delivers a comprehensive array of insurance solutions, including traditional life, accident, health, and investment-linked policies. The company strategically prioritizes products like foreign currency policies, which contributed to Shin Kong Life's new business value reaching NT$23.7 billion by Q1 2024, alongside those with high contractual service margins (CSM). This diverse portfolio and focus on profitable segments effectively address a wide spectrum of customer needs, from essential protection to sophisticated long-term wealth accumulation. This approach optimizes profitability while managing risk efficiently across its product offerings.

Shin Kong Bank provides a comprehensive array of banking services for both individual and corporate clients, including robust deposit accounts and a growing loan portfolio. These offerings span consumer and corporate lending, with a strategic emphasis on supporting small and medium-sized enterprises, aligning with 2024 market trends. The bank actively expands its wealth management and foreign exchange transactions, aiming for increased fee income to drive stable growth. This diversified approach positions Shin Kong Bank as a holistic financial solutions provider for its customer base. The focus on fee-based services and SME lending is expected to enhance profitability through mid-2025.

MasterLink Securities, a key subsidiary of Shin Kong Financial, offers a comprehensive suite of investment services, including robust securities brokerage and active proprietary trading. This arm also specializes in underwriting and futures dealing, providing diverse capital market access for clients. The securities division has demonstrated strong performance, with its net income reaching approximately NT$1.3 billion for the first quarter of 2024, reflecting effective capitalization on market trends to boost brokerage and trading revenue. This strategic offering supports both investment and financing needs for a broad clientele.

Asset and Wealth Management

Shin Kong Financial offers comprehensive asset and wealth management services through Shin Kong Investment Trust (SKIT) and its group-wide wealth management efforts. SKIT provides diverse investment funds, retirement solutions, and discretionary portfolio management, catering to varied investor profiles. As of early 2025, SKIT actively manages a significant portfolio, emphasizing growth and stability. The group's wealth management strategy optimizes client asset allocation, integrating mutual funds and long-term insurance products for holistic financial planning.

- SKIT manages a range of funds, including equity and fixed-income, with assets under management (AUM) reflecting market trends into 2025.

- Wealth management leverages products like unit-linked insurance, a key component for long-term client asset growth.

- Retirement products are tailored to meet evolving demographic needs and regulatory changes in Taiwan for 2024-2025.

Digital Financial Platforms

Shin Kong Financial has significantly invested in digital financial platforms, enhancing customer experience and operational efficiency. This includes advanced mobile banking apps like OMNI-U, allowing for seamless digital account opening and online transactions. The strategic focus in 2024-2025 is on providing 24/7 access to services, such as online insurance application portals and AI-driven customer support, aiming to boost customer engagement and loyalty. This digital transformation supports a projected 15% increase in online service adoption by mid-2025 across their user base.

- OMNI-U mobile banking facilitates digital account opening.

- Online insurance application portals streamline customer access.

- AI-driven customer service enhances 24/7 support.

- Projected 15% increase in online service adoption by mid-2025.

Shin Kong Financial delivers a comprehensive product suite spanning insurance, banking, and wealth management, catering to diverse client needs. Key offerings include Shin Kong Life's foreign currency policies, contributing NT$23.7 billion in new business value by Q1 2024, and Shin Kong Bank's robust SME lending. MasterLink Securities provides essential brokerage services, with net income reaching NT$1.3 billion in Q1 2024. The group’s digital platforms like OMNI-U enhance product access, aiming for a 15% increase in online service adoption by mid-2025, ensuring holistic financial solutions.

| Product Area | Key Offering | 2024/2025 Data Point |

|---|---|---|

| Life Insurance | Foreign Currency Policies | NT$23.7B New Business Value (Q1 2024) |

| Banking Services | SME Lending, Fee Income | Strategic emphasis through mid-2025 |

| Securities | Brokerage, Proprietary Trading | NT$1.3B Net Income (Q1 2024) |

| Digital Platforms | OMNI-U Mobile Banking | 15% Online Adoption Increase (by mid-2025) |

What is included in the product

This analysis offers a comprehensive examination of Shin Kong Financial's marketing mix, detailing its Product, Price, Place, and Promotion strategies with actionable insights and real-world examples.

It provides a strategic overview for understanding Shin Kong Financial's market positioning and is ideal for professionals seeking to benchmark or develop their own marketing approaches.

Simplifies complex marketing strategies into actionable insights, relieving the pain of decision paralysis.

Provides a clear roadmap for product, price, place, and promotion, cutting through marketing jargon for efficient strategy execution.

Place

Shin Kong Financial maintains a robust physical presence across Taiwan through its subsidiaries. Shin Kong Bank operates over 100 branches, complemented by hundreds of Shin Kong Life outlets, ensuring broad accessibility for customers. This extensive network is vital for fostering customer relationships, delivering complex advisory services, and catering to preferences for in-person interactions. The proposed merger with Taishin FHC, projected for late 2024 or early 2025, is anticipated to establish Taiwan's largest private bank branch network, significantly enhancing market reach.

Shin Kong Financial prioritizes digital accessibility, offering robust platforms like the OMNI-U digital bank and comprehensive online banking. These platforms allow customers to open accounts, apply for loans, and manage investments seamlessly, with transactions available 24/7. Shin Kong Life complements this with online portals for purchasing insurance products and policy management, aligning with a contactless service model. As of early 2025, digital channels are crucial, with a significant portion of new account openings and policy renewals occurring online, enhancing market reach and customer convenience.

Shin Kong Life relies on an extensive network of tied agents, a cornerstone of its distribution strategy.

This direct sales force is crucial for delivering personalized financial advice and nurturing enduring client relationships. As of late 2024, Shin Kong Life maintained over 20,000 active agents, ensuring broad market penetration across Taiwan.

This model facilitates the detailed explanation of complex insurance products, tailoring solutions to individual needs and contributing significantly to the company's annual premium income, which exceeded NT$200 billion in 2024.

Bancassurance Channels

Shin Kong Financial leverages its robust bancassurance channels, primarily through Shin Kong Bank branches, to cross-sell insurance products from Shin Kong Life. This strategic model is a vital distribution channel, effectively reaching the bank's extensive customer base with integrated financial solutions. The synergy between banking and insurance entities allows for convenient one-stop shopping, enhancing customer value. In 2024, bancassurance channels contributed significantly to Shin Kong Life's new business premium, demonstrating continued strong performance in this segment.

- Shin Kong Bank's network spans over 100 branches, serving as key bancassurance points.

- Bancassurance accounted for over 40% of Shin Kong Life's total new business premiums in Q1 2024.

- The integrated financial offerings aim to increase customer stickiness and lifetime value.

Overseas Operations and Expansion

Shin Kong Financial maintains a strategic overseas presence, serving international clients and supporting Taiwanese enterprises abroad. Shin Kong Bank operates a key branch in Hong Kong, while the group has established venture capital offices and leasing operations across mainland China. The company is actively expanding into new markets, notably Vietnam, leveraging strategic partnerships to introduce innovative digital insurance products. This expansion aims to capture emerging market growth, with recent reports indicating a focus on digital channels for broader reach.

- Shin Kong Bank maintains a branch presence in Hong Kong.

- The group has venture capital and leasing operations in mainland China.

- Expansion efforts are targeting Vietnam for digital insurance products.

- Strategic partnerships are key to new market entry and digital service delivery.

Shin Kong Financial employs a diverse distribution strategy, blending extensive physical and digital channels. Its robust network includes over 100 Shin Kong Bank branches and hundreds of Shin Kong Life outlets across Taiwan, complemented by over 20,000 active tied agents as of late 2024. Digital platforms like OMNI-U facilitate significant online transactions and policy renewals by early 2025. The proposed Taishin FHC merger aims to create Taiwan's largest private bank network by early 2025, further enhancing its market reach.

| Channel Type | Key Metric (2024/2025) | Strategic Impact |

|---|---|---|

| Physical Branches | >100 Bank Branches, Hundreds Life Outlets | Broad Accessibility, Relationship Building |

| Tied Agents | >20,000 Active Agents (late 2024) | Personalized Advice, Market Penetration |

| Digital Platforms | Significant Online Transactions (early 2025) | 24/7 Convenience, Expanded Reach |

| Bancassurance | >40% of Life's New Business Premiums (Q1 2024) | Cross-selling, Customer Value |

Preview the Actual Deliverable

Shin Kong Financial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Shin Kong Financial 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain an in-depth understanding of how these elements are integrated to support their business objectives. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with actionable insights.

Promotion

Shin Kong Financial actively employs integrated digital marketing to engage customers and promote its diverse offerings across online platforms. Their mobile apps and official websites are crucial for showcasing new products and promotions, ensuring customers stay well-informed. The Shin Kong Life app and the bank's mobile application serve as primary channels for direct communication, service delivery, and processing over 70% of customer inquiries digitally by early 2025. This digital push aims to enhance user experience and expand their digital customer base, which saw a 15% year-over-year increase in active users by late 2024.

Shin Kong Financial actively integrates Corporate Social Responsibility (CSR) into its brand strategy, significantly enhancing its public image and demonstrating a deep societal commitment. The company champions environmental sustainability, participates in vital social welfare programs like food donations, and advances financial inclusion for disadvantaged groups across Taiwan. This dedication has earned Shin Kong numerous accolades, including recognition in the DJSI World Index for 2023-2024, solidifying its ESG efforts as a core component of its market identity.

Shin Kong Financial prioritizes brand reputation through its commitment to innovation, service, integrity, and giving back to society. The company actively promotes its consistent inclusion in global sustainability indices, such as the Dow Jones Sustainability Index World and Emerging Markets for 2023-2024, showcasing its industry leadership. Public relations efforts leverage these significant achievements, reinforcing Shin Kong's image as a reliable and responsible financial institution. This strategic approach builds trust and enhances brand equity among diverse stakeholders.

Strategic Partnerships and Alliances

Shin Kong Financial actively forms strategic partnerships to expand its market reach and diversify service offerings, a key component of its marketing mix. A significant move in 2024 involved its collaboration with AIFT to penetrate Vietnam's growing digital insurance market. This initiative was further strengthened by a partnership with PetroVietnam Insurance (PVI) to launch initial products, tapping into new customer segments.

The proposed merger with Taishin Financial, projected to finalize by late 2024 or early 2025, represents a major strategic alliance aimed at creating substantial synergies and significantly increasing market share across banking, insurance, and securities sectors.

- Vietnam digital insurance market entry via AIFT and PVI collaboration.

- Proposed Taishin Financial merger to enhance market share by an estimated 15-20% across key financial services.

- Strategic alliances bolster Shin Kong Financial's integrated financial service ecosystem for 2025 growth.

Customer-Centric Initiatives

Shin Kong Financial prioritizes customer-centric initiatives by developing products tailored to diverse needs. For instance, they offer specialized financial products for the elderly population, addressing their unique requirements. The company also extends microinsurance to economically disadvantaged groups, promoting financial inclusion. Utilizing AI and big data, Shin Kong enhances its understanding of vulnerable customers, ensuring fair treatment and effective service delivery, aligning with its 2024 strategic goals for social responsibility.

- Shin Kong supported over 150,000 financially vulnerable individuals with microinsurance products in 2024.

- Their financial literacy programs reached over 20,000 participants by mid-2025.

- AI-driven insights led to a 15% improvement in customer satisfaction for specific segments in 2024.

Shin Kong Financial leverages digital platforms, including mobile apps, for promotions, with over 70% of customer inquiries handled digitally by early 2025. Their strategic promotion also integrates robust CSR initiatives and strong brand reputation, highlighted by consistent inclusion in the DJSI World Index for 2023-2024. Key partnerships, like the 2024 AIFT and PVI collaboration for Vietnam's digital insurance, expand market reach. The proposed Taishin Financial merger aims to boost market share by 15-20% by early 2025.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Digital Inquiry Handling | ~65% | >70% |

| Active Digital Users Growth | 15% YOY | Continued Growth |

| Market Share Increase (Taishin Merger) | N/A | 15-20% |

Price

Shin Kong Life's insurance products are primarily priced through premiums, meticulously calculated based on actuarial assessments of risk, coverage levels, and policy duration. The company strategically focuses on foreign currency policies, with new foreign currency denominated policies constituting over 30% of first-year premiums in early 2025, and products offering longer payment terms, which helps stabilize margins amidst market fluctuations. For instance, their small-amount whole life insurance products are priced affordably, aiming to provide essential coverage, particularly for segments like the elderly, reflecting a commitment to accessible financial protection.

Shin Kong Bank's pricing is primarily driven by interest rate spreads on its loans and deposits, forming the core of its net interest income, which saw a 3.5% increase year-over-year in Q1 2025. Significant non-interest revenue also stems from service fees for wealth management and credit card transactions, contributing over 30% of total revenue in 2024. The bank actively grows its loan book, particularly in the SME sector, where loans expanded by 8% in early 2025, to further enhance interest income.

MasterLink Securities, a key Shin Kong Financial subsidiary, generates substantial revenue through commissions on brokerage services for stock and bond trading. It also earns fees from underwriting new securities issues, a vital service for corporate clients seeking capital. The fee structure remains highly competitive within Taiwan's brokerage industry, crucial for attracting and retaining active individual traders and corporate accounts. For instance, in Q1 2024, brokerage commissions continued to be a significant contributor to Shin Kong Financial's non-interest income, reflecting sustained market activity. This competitive approach ensures a steady flow of transactions and client engagement.

Asset Management Fees

Shin Kong Investment Trust (SKIT) prices its asset management services primarily through management fees, which are charged as a percentage of assets under management (AUM).

For specialized products like Exchange Traded Funds (ETFs), a Total Expense Ratio (TER) is applied, encompassing management, custodian, and other operational fees. This value-based pricing strategy directly links the company's revenue to the performance and scale of the funds it manages for clients.

- SKIT's AUM for investment trust funds reached approximately NT$220 billion by Q1 2024.

- Typical management fees for actively managed funds in Taiwan range from 0.5% to 1.5% annually.

- ETFs often feature lower TERs, with some Taiwanese equity ETFs having TERs below 0.3% in 2024.

Value-Driven and Integrated Pricing

Shin Kong Financial prioritizes value-driven pricing, reflecting its integrated financial services model where the convenience of a one-stop shop commands a premium. This strategy leverages cross-selling, exemplified by the strong synergy between banking and insurance, optimizing resource allocation and enabling attractive bundled offerings. The company focuses on high-value products with robust contractual service margins (CSM), like those contributing to its 2024 embedded value growth, ensuring long-term profitability and stability over mere volume. This approach supports sustainable returns and a strong capital base, projected to maintain a stable capital adequacy ratio above regulatory minimums through 2025.

- Value-driven pricing reflects integrated service convenience.

- Cross-selling synergies optimize resource allocation for bundled offerings.

- Focus on high-CSM products ensures long-term profitability.

- Strategy supports stable capital adequacy through 2025.

Shin Kong Financial employs a diverse pricing strategy across its subsidiaries, primarily driven by actuarial premiums for insurance products and interest rate spreads for banking services. Non-interest income, stemming from wealth management fees and brokerage commissions, significantly contributes to overall revenue, exceeding 30% of total revenue in 2024 for the bank. Shin Kong Investment Trust charges management fees based on assets under management, which reached approximately NT$220 billion by Q1 2024. The group's overarching focus is on value-driven pricing, leveraging cross-selling and high contractual service margin products to ensure long-term profitability and capital stability through 2025.

| Segment | Key Pricing Mechanism | 2024/2025 Data Point |

|---|---|---|

| Shin Kong Life | Actuarial Premiums | Foreign currency policies: >30% of first-year premiums (early 2025) |

| Shin Kong Bank | Interest Spreads, Service Fees | Non-interest revenue: >30% of total revenue (2024) |

| SKIT | Management Fees (AUM %) | AUM: NT$220 billion (Q1 2024) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Shin Kong Financial leverages a comprehensive blend of public financial disclosures, investor relations materials, and official corporate communications. We meticulously examine their product offerings, pricing structures, distribution channels, and promotional activities as presented in annual reports, press releases, and their corporate website.