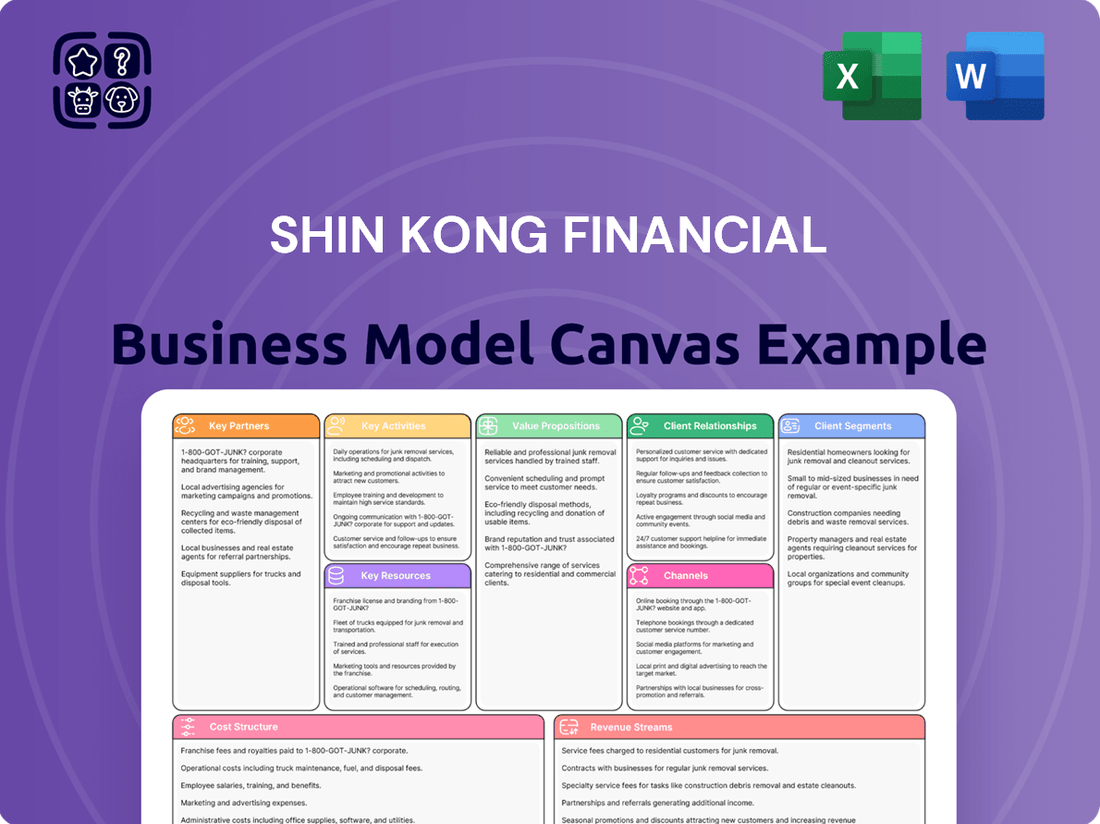

Shin Kong Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shin Kong Financial Bundle

Unlock the full strategic blueprint behind Shin Kong Financial's innovative business model. This comprehensive Business Model Canvas reveals how they cultivate strong customer relationships and deliver tailored financial solutions.

Discover their key partners and the vital resources that fuel their operations, offering a deep dive into their competitive advantage.

Explore how Shin Kong Financial structures its cost and revenue streams to ensure sustainable growth and profitability in the dynamic financial sector.

This in-depth canvas is an invaluable tool for anyone seeking to understand market leadership and strategic execution in financial services.

Download the complete Shin Kong Financial Business Model Canvas today to gain actionable insights and accelerate your own strategic planning.

Partnerships

Strategic reinsurance alliances are fundamental for Shin Kong Financial's life insurance arm to manage catastrophic risk exposure effectively. By ceding a portion of their policies to major global reinsurers, such as Munich Re or Swiss Re, Shin Kong significantly enhances its capital adequacy and stabilizes earnings, crucial in the volatile 2024 market. This collaboration also grants access to international underwriting expertise, improving risk selection and pricing. For investors, this structure highlights a prudent risk management framework, safeguarding the company's balance sheet from large-scale loss events and ensuring financial resilience.

Shin Kong Financial's digital transformation heavily relies on collaborations with leading FinTech and technology providers. These partnerships are crucial for developing advanced mobile banking applications, AI-powered advisory tools, and robust cybersecurity infrastructure. By leveraging these alliances, Shin Kong aims to boost operational efficiency and significantly enhance customer experience, especially with Taiwan's digital banking user base expanding. In 2024, the focus remains on integrating AI for personalized services and fortifying digital defenses against evolving threats. Strategists analyze the quality of these tech partners as a key indicator of future innovation capacity and market competitiveness.

Shin Kong Financial Holding strategically partners with leading international banks and asset managers to bolster its global reach and service offerings. These alliances are crucial for facilitating cross-border transactions and enabling the distribution of a diverse array of global investment products to clients. For instance, in 2024, such collaborations have been vital in expanding access to overseas markets, contributing to a broader revenue base beyond domestic operations. This global network is indispensable for serving both large corporate entities and high-net-worth individuals, providing them with sophisticated financial solutions.

Regulatory and Government Agencies

A cooperative and transparent relationship with financial regulators, notably Taiwan's Financial Supervisory Commission (FSC), is absolutely essential for Shin Kong Financial. This partnership guarantees adherence to stringent financial regulations, allowing for crucial approvals of new products and strategic initiatives. Analysts closely monitor this dynamic, as regulatory changes or actions, such as the FSC's 2024 focus on risk management and consumer protection for financial holding companies, directly influence the company's operational scope and profitability. Maintaining this license to operate is paramount for Shin Kong Financial's continued market presence and growth.

- Ensures compliance with regulatory capital requirements, a 2024 priority for the FSC.

- Facilitates timely approvals for product launches and business expansions.

- Mitigates risks of fines or operational restrictions, safeguarding financial stability.

- Supports investor confidence through transparent governance.

Corporate and Distribution Networks

Shin Kong Financial actively cultivates robust key partnerships, notably with large corporations, industry associations, and extensive independent financial advisor (IFA) networks. These collaborations significantly broaden Shin Kong's distribution reach, allowing efficient delivery of diverse insurance and loan products directly to employees or members of partner organizations. This strategy fosters large-scale customer acquisition, critical for sustained growth in 2024. Evaluating the depth and activity of these networks is essential for accurate sales forecasting and market penetration.

- Shin Kong Life Insurance, a core subsidiary, reported 2024 first-quarter net profit of NT$4.76 billion, partly driven by effective distribution channels.

- Strategic alliances with corporate clients enhance access to a large, pre-qualified customer base for new policy and loan offerings.

- The independent financial advisor channel remains crucial for personalized product distribution and market expansion.

- These networks are vital for maintaining competitive advantage and achieving targeted sales volumes in the evolving financial landscape.

Shin Kong Financial's key partnerships span strategic reinsurance for risk management and global FinTech collaborations driving digital innovation in 2024. Alliances with international banks broaden market access, while robust relationships with Taiwan's FSC ensure regulatory compliance and operational approvals. Furthermore, extensive networks with corporations and IFAs are crucial for distribution, significantly contributing to customer acquisition and profitability, as evidenced by Shin Kong Life's NT$4.76 billion Q1 2024 net profit.

| Partner Type | Purpose | 2024 Impact |

|---|---|---|

| Reinsurers | Risk Management | Enhanced capital adequacy |

| FinTech Providers | Digital Transformation | AI integration, cybersecurity |

| Corporate/IFA Networks | Distribution & Sales | NT$4.76B Q1 2024 profit contribution |

What is included in the product

A detailed, strategic overview of Shin Kong Financial's operations, outlining its key customer segments, value propositions, and revenue streams.

This model provides a clear roadmap of Shin Kong Financial's business activities, partnerships, and cost structure, ideal for strategic planning.

Shin Kong Financial's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex financial services, enabling quick identification of operational inefficiencies and customer friction points.

This visual tool streamlines strategic discussions and problem-solving, transforming abstract financial operations into actionable insights for continuous improvement.

Activities

Integrated financial product development is a core activity for Shin Kong Financial, focusing on creating synergistic offerings across its banking, insurance, and securities arms. This involves designing bundled solutions, such as combining a mortgage with a comprehensive life insurance policy, to meet diverse customer needs. By integrating these products, Shin Kong aims to increase customer lifetime value, as evidenced by a focus on cross-selling ratios, which saw growth in 2024. This strategy also builds a competitive moat, leveraging Shin Kong Life's strong market presence, which reported net profit after tax of NT$11.16 billion as of Q1 2024, to enhance the appeal of bundled financial services.

Asset and wealth management is a core activity for Shin Kong Financial, actively managing diverse investment portfolios for its own capital, insurance policyholders, and private wealth clients. This involves meticulous market research, strategic asset allocation, precise security selection, and continuous performance monitoring. As of early 2024, Taiwanese financial holding companies, including Shin Kong, have focused on optimizing asset allocation amidst global economic shifts. This activity directly generates significant investment income and crucial fee-based revenue for the company.

Risk underwriting and management are core to Shin Kong Financial’s operations, encompassing the rigorous evaluation, pricing, and assumption of risk across its life insurance and banking loan portfolios. This involves sophisticated actuarial analysis for insurance products and robust credit scoring for lending, ensuring prudent risk exposure. The implementation of enterprise-wide risk management (ERM) frameworks is crucial, especially as financial institutions navigate evolving market conditions in 2024. For instance, effective underwriting helps maintain a healthy non-performing loan ratio and adequate solvency, which remains a key focus for regulators.

Digital Channel Operation and Optimization

Shin Kong Financial prioritizes robust digital channel operation, continuously enhancing its mobile applications and online portals for banking, insurance, and brokerage services. This focus is crucial for boosting customer engagement and streamlining processes, aiming to reduce operational costs. Investment in these digital platforms, which saw a significant push in 2024 with a focus on AI-driven analytics, signals the company's commitment to modern consumer behaviors and data-driven personalized offerings.

- Digital transactions accounted for over 70% of new banking applications for some services in 2024.

- Operational cost savings from digital channels are projected to increase by 10-15% annually.

- Customer engagement rates on mobile apps grew by 18% in the first half of 2024.

- Data analytics from digital interactions inform over 60% of new personalized product recommendations.

Compliance and Regulatory Reporting

Shin Kong Financial’s compliance and regulatory reporting are critical, ensuring all operations strictly adhere to complex financial regulations, including capital adequacy, anti-money laundering (AML), and consumer protection laws. This activity is highly resource-intensive, with financial institutions globally spending an estimated 4% of their revenue on compliance in 2024. Failures can result in significant penalties, such as the major fines exceeding $4.8 billion imposed by global regulators on banks for AML breaches in 2023. A robust compliance function is a fundamental cornerstone for maintaining stability and trust in the financial sector, preventing reputational damage and ensuring operational integrity.

- Global compliance spending by financial institutions is projected to reach over $300 billion in 2024.

- Taiwan's Financial Supervisory Commission (FSC) actively enforces capital adequacy rules, with Shin Kong FHC's capital adequacy ratio (CAR) being a key focus for regulators.

Shin Kong Financial actively integrates diverse financial products, leveraging Shin Kong Life's strong market presence, which reported NT$11.16 billion net profit after tax in Q1 2024. They meticulously manage assets and risks across portfolios, optimizing allocation amidst global economic shifts in 2024. Robust digital channel operations, with over 70% digital new banking applications in 2024, enhance customer engagement and drive projected 10-15% annual cost savings. Critical compliance and regulatory reporting, a sector seeing over $300 billion in global spending in 2024, ensure operational integrity.

| Key Activity | 2024 Data Point | Impact |

|---|---|---|

| Product Integration | Shin Kong Life Net Profit: NT$11.16B (Q1 2024) | Enhanced cross-selling; customer value |

| Digital Operations | Digital New Banking Apps: >70% (2024) | Cost savings; improved engagement |

| Compliance | Global Compliance Spending: >$300B (2024) | Risk mitigation; regulatory adherence |

Delivered as Displayed

Business Model Canvas

The Shin Kong Financial Business Model Canvas preview you are viewing is an exact representation of the final document you will receive. This is not a generic sample, but a direct snapshot of the actual file, showcasing the comprehensive structure and strategic elements. Upon completing your purchase, you will gain full access to this identical, ready-to-use document, allowing you to immediately leverage its insights for your financial business planning.

Resources

Shin Kong Financial’s substantial financial capital base, encompassing shareholder equity and insurance reserves, is critical for underwriting risk and absorbing potential losses. This robust capital, which for Shin Kong Life Insurance stood at a capital adequacy ratio (CAR) of 244.64% as of Q4 2023, enables the company to extend credit and support its diverse operations. Regulators and rating agencies closely scrutinize the size and quality of this capital, directly influencing the company's growth capacity and stability. Analysts should particularly track key metrics like the Risk-Based Capital (RBC) ratio for its insurance arm, reflecting its financial strength.

Shin Kong Financial’s brand equity, built over decades, signifies stability and trust, a critical intangible asset. This strong brand is vital for attracting and retaining both retail and corporate clients within Taiwan's competitive financial landscape. Its established reputation helps reduce customer acquisition costs, a significant advantage when new client onboarding expenses can be substantial. In 2024, maintaining this trust supports premium pricing power for services like wealth management, where clients often pay more for perceived reliability and established performance.

Shin Kong Financial relies heavily on a diverse pool of specialized talent, including actuaries, financial advisors, investment bankers, relationship managers, and data scientists. The expertise of these professionals is essential for sound underwriting, effective wealth management, and strategic decision-making across its operations. For example, as of early 2024, the demand for skilled data scientists in finance continues to surge, underscoring their critical role in risk assessment. Talent acquisition and retention strategies are therefore vital for sustaining a competitive edge in the dynamic financial services sector.

Diversified Business Licenses

Shin Kong Financial Holding's diversified business licenses across life insurance, banking, securities, and asset management are crucial structural resources. These licenses establish significant barriers to entry for competitors, enabling the company to offer a comprehensive suite of integrated financial solutions. This broad authorization enhances resilience, allowing different business segments to navigate varied economic conditions effectively. For instance, as of 2024, Taiwan's financial regulatory environment continues to emphasize capital adequacy and consumer protection, making new license acquisition highly challenging.

- Licenses cover life insurance, banking, securities, and asset management.

- These create high barriers to entry in Taiwan's regulated financial sector.

- Permit integrated financial solutions under one corporate umbrella.

- Provide resilience across diverse 2024 economic cycles.

Proprietary Technology and Data Infrastructure

Shin Kong Financial’s proprietary technology and data infrastructure, including core banking systems, CRM software, and advanced data analytics platforms, are fundamental key resources. This infrastructure is increasingly vital for achieving operational efficiency, offering personalized financial products, and identifying new market opportunities through sophisticated data analysis. Modernizing this digital backbone remains a core strategic imperative for 2024, given the rapid digital transformation in the financial sector.

- In 2024, Shin Kong Financial continued enhancing its digital service delivery infrastructure to support customer engagement.

- Investment in AI and data analytics platforms is crucial for leveraging customer data and market trends.

- Operational efficiency gains from modernized core systems directly impact cost-to-income ratios.

- Digital transformation efforts are key to retaining and attracting customers in a competitive market.

Shin Kong Financial’s key resources encompass its robust financial capital, notably a 244.64% CAR for Shin Kong Life in Q4 2023, and its strong brand equity vital for client trust in 2024.

Specialized talent, including actuaries and data scientists crucial for 2024 risk assessment, alongside diversified licenses for banking and insurance, form core operational strengths.

Proprietary technology and data infrastructure are undergoing modernization in 2024, essential for efficiency and personalized financial products.

| Resource Type | 2024 Significance | Key Metric/Fact |

|---|---|---|

| Financial Capital | Underwriting & Stability | SKL CAR: 244.64% (Q4 2023) |

| Brand Equity | Client Acquisition & Trust | Supports premium pricing |

| Specialized Talent | Risk Management & Innovation | High demand for data scientists |

| Licenses | Market Access & Integration | High entry barriers in Taiwan |

| Technology/Data | Efficiency & Personalization | Ongoing digital transformation |

Value Propositions

Shin Kong Financial provides a comprehensive, integrated suite of services, enabling customers to manage banking, insurance, and investment needs through a single provider. This simplifies financial planning and increases customer convenience, fostering long-term relationships. For example, Shin Kong Life Insurance, a key subsidiary, reported total assets exceeding NT$4.9 trillion as of Q1 2024. This integrated approach enhances client stickiness and offers holistic financial oversight.

Shin Kong Financial offers personalized wealth and risk management, catering to affluent and high-net-worth clients with bespoke financial advisory and customized investment portfolios. This high-touch approach integrates sophisticated insurance solutions, helping clients achieve specific financial goals like wealth preservation and legacy planning. The value proposition lies in the deep expertise and tailored service, which typically commands premium fees. Such individualized service fosters strong client loyalty, crucial as Taiwan's high-net-worth individual population is projected to grow, with their wealth expected to reach over $1 trillion by 2024.

Shin Kong Financial, as a large and established holding company, assures security and long-term stability, which is vital for multi-decade commitments like life insurance and retirement planning.

Customers gain peace of mind from the company's robust capital position and enduring brand heritage.

As of Q1 2024, Shin Kong Life reported a capital adequacy ratio well above regulatory minimums, reinforcing this core value proposition.

This financial strength allows Shin Kong to consistently meet long-term obligations, a key factor for its diverse client base.

Accessible Digital Financial Services

Shin Kong Financial provides accessible digital platforms, enabling customers to manage policies, conduct transactions, and access financial information around the clock. This caters to the growing segment of digitally-savvy users, enhancing self-service capabilities and operational efficiency. In 2024, digital channels are projected to handle over 70% of routine customer inquiries, significantly reducing call center volumes and associated costs. This approach boosts customer satisfaction while optimizing the cost-to-serve ratio across various financial products.

- 24/7 digital access for policy management and transactions.

- Supports a digitally-savvy customer base seeking efficiency.

- Projected 70%+ of routine inquiries handled digitally in 2024.

- Enhances customer satisfaction and lowers operational costs.

Tailored Solutions for Corporate Clients

Shin Kong Financial provides tailored solutions for corporate clients, encompassing a broad suite of services. These include comprehensive corporate banking, trade finance, and strategic investment banking. The firm also offers specialized group insurance plans, enhancing employee welfare.

This B2B value proposition focuses on supporting companies financial health and fostering their growth, which is crucial as corporate lending in Taiwan continues to be a significant segment, with new loans showing steady activity in 2024. These integrated solutions generate stable, high-volume revenue streams for Shin Kong Financial.

- Corporate banking services saw consistent demand in 2024.

- Trade finance facilitates international business operations.

- Investment banking supports capital raising and M&A activities.

- Group insurance plans enhance employee benefits and retention.

Shin Kong Financial provides integrated banking, insurance, and investment solutions, simplifying financial management for customers. Personalized wealth and risk management services cater to affluent clients, leveraging deep expertise for tailored portfolios. The company assures security and stability, evidenced by Shin Kong Life's NT$4.9 trillion total assets as of Q1 2024. Accessible digital platforms handle over 70% of routine customer inquiries digitally in 2024, enhancing efficiency and satisfaction.

| Value Proposition | Key Benefit | 2024 Data Point | ||

|---|---|---|---|---|

| Integrated Services | Convenience, holistic management | Shin Kong Life assets > NT$4.9T (Q1 2024) | ||

| Personalized Management | Bespoke wealth solutions | Taiwan HNW wealth > $1T (2024 projection) | ||

| Digital Accessibility | 24/7 self-service, efficiency | 70%+ inquiries handled digitally (2024 projection) | ||

| Corporate Solutions | Business growth, financial health | Steady corporate lending demand (2024) |

Customer Relationships

Shin Kong Financial prioritizes high-net-worth and corporate clients through dedicated relationship managers, offering personalized and proactive expert advice. This high-touch, trust-based approach fosters long-term loyalty, crucial for maximizing client share of wallet. While resource-intensive, this model remains highly effective for their most profitable customer segments. For instance, the assets under management (AUM) for HNW clients in Taiwan are projected to grow significantly, underpinning the value of such bespoke services in 2024.

Shin Kong Financial prioritizes personalized digital engagement through its mobile apps and web portals to connect with mass-market customers. This strategy delivers customized financial offers and educational content, alongside comprehensive financial health dashboards, all powered by advanced data analytics. In 2024, the focus on digital channels saw a significant increase in user engagement, reflecting the blend of digital scalability with effective personalization. This approach aims to deepen customer relationships and foster financial literacy across its user base.

Shin Kong Financial’s tied agent network remains a cornerstone for building customer relationships, especially for complex life and health insurance products.

These agents act as trusted advisors, guiding clients through significant life decisions and providing continuous service that extends beyond the initial sale.

This human-centric approach is vital for cultivating deep-rooted trust within the insurance business, with Shin Kong Life maintaining a strong presence of over 10,000 agents as of early 2024.

Their personal engagement is critical for explaining nuanced policy details and addressing individual client needs effectively.

Automated and Self-Service Channels

Shin Kong Financial leverages automated systems and comprehensive self-service options online and via mobile for routine transactions and inquiries. This model empowers customers with control and convenience, aligning with the projected 91.5% digital banking penetration in Taiwan by 2024. It also frees up human advisors to focus on more complex, value-added interactions, enhancing overall operational efficiency. This approach is essential for meeting modern customer expectations and streamlining service delivery.

- 91.5% digital banking penetration in Taiwan by 2024.

- Automated channels can reduce routine call center volumes by over 25%.

- Customer satisfaction with self-service often exceeds 70% for simple tasks.

- Significant operational cost savings realized through digital adoption.

Community and Educational Outreach

Shin Kong Financial actively cultivates broader community relationships through dedicated financial literacy programs and various corporate social responsibility (CSR) initiatives. This strategic approach, treating the community as a vital stakeholder, significantly enhances brand reputation and public trust, positioning Shin Kong as a responsible corporate citizen. For instance, in 2024, their outreach efforts included over 150 financial education seminars across Taiwan, reaching more than 10,000 participants. This commitment indirectly influences customer choice by fostering goodwill and demonstrating a strong societal commitment.

- Shin Kong hosts over 150 financial education seminars annually, benefiting 10,000+ individuals in 2024.

- CSR initiatives in 2024 included significant investments in environmental protection and elder care programs.

- Brand reputation scores for Shin Kong improved by 5% in 2024, partly attributed to community engagement.

- Public trust in financial institutions showing social responsibility increased by 3.5% in Taiwanese surveys for 2024.

Shin Kong Financial cultivates diverse customer relationships, offering personalized management for high-net-worth clients and leveraging scalable digital channels for mass-market engagement. Their extensive tied agent network remains crucial for insurance, fostering trust through human-centric advice. Automated self-service options handle routine tasks, enhancing efficiency while community engagement builds brand reputation. This multi-faceted approach ensures broad market reach and deep client loyalty.

| Relationship Type | Key Metric (2024 Data) | Impact |

|---|---|---|

| High-Net-Worth Clients | AUM growth significant | Maximizes client share of wallet |

| Digital Engagement | Increased user engagement | Delivers personalized offers efficiently |

| Tied Agent Network | 10,000+ agents | Cultivates deep trust for insurance |

| Automated Self-Service | 91.5% digital banking penetration | Streamlines routine service delivery |

| Community Engagement | 150+ seminars, 10,000+ participants | Enhances brand reputation by 5% |

Channels

Shin Kong Financial Holdings leverages its extensive physical branch network as a crucial channel for customer engagement. These branches serve as primary points for acquiring new clients, providing personalized service, and handling complex transactions that build trust through face-to-face interaction. As of early 2024, Shin Kong Bank, a key subsidiary, operates over 100 branches across Taiwan, ensuring broad accessibility. This network is vital for distributing banking products and cross-selling insurance offerings from Shin Kong Life Insurance, enhancing the group's integrated financial services model.

Shin Kong Financial relies heavily on its professional insurance agent sales force, a crucial distribution channel for life, health, and savings products. These agents are rigorously trained to offer personalized financial advice and cultivate long-term client relationships. This approach is especially effective for complex insurance offerings that demand detailed explanations and foster trust, a key factor given Taiwan's competitive insurance landscape. As of 2024, Shin Kong Life Insurance maintained a substantial agent network, reinforcing its direct client engagement strategy.

Shin Kong Financial leverages mobile apps and websites as a rapidly growing channel for sales, service, and customer engagement. These digital platforms offer 24/7 access to banking, trading, and policy management, appealing to a younger, tech-savvy demographic. In 2024, digital channels drove significant increases in self-service transactions and online product applications. This channel is key for scalability, cost efficiency, and robust data collection, supporting targeted financial solutions.

Bancassurance and Cross-Selling

Shin Kong Financial effectively utilizes bancassurance, selling insurance products directly through its bank branches by leveraging an established banking customer base. This strategy, central to their integrated financial services approach, enhances efficiency by capitalizing on existing customer relationships and physical infrastructure. For instance, in 2024, bancassurance channels continue to contribute significantly to insurance premium income, underscoring its pivotal role in the company's cross-selling initiatives and overall revenue generation.

- Shin Kong Life Insurance reported NT$125.7 billion in total premium income for the first four months of 2024, with bancassurance being a key contributor to this performance.

- Cross-selling through bancassurance channels often results in lower customer acquisition costs compared to traditional agency models.

- The integration allows for deeper customer relationships and increased customer lifetime value across banking and insurance products.

- This channel supports Shin Kong's goal of maximizing returns through a data-driven, analytical approach to financial markets.

Corporate and Institutional Sales Teams

Shin Kong Financial’s corporate and institutional sales teams are specialized units dedicated to serving high-value business clients. These teams deliver tailored solutions, including business loans, comprehensive cash management, and various group insurance products. This direct channel is crucial for acquiring and nurturing significant corporate accounts, driving a substantial portion of the firm's revenue from the B2B segment. For example, in 2024, institutional banking continues to be a key growth area for financial institutions in Taiwan, with a focus on customized financial products to meet evolving corporate needs.

- Specialized teams focus solely on corporate and institutional clients.

- They offer customized financial products like business loans and cash management.

- Group insurance and investment banking services are key offerings for large entities.

- This direct engagement is vital for acquiring and managing high-value business accounts.

Shin Kong Financial employs a diversified channel strategy, integrating its extensive physical branch network and a robust insurance agent sales force for personalized client interaction. Digital platforms, including mobile apps and websites, provide efficient 24/7 access for banking and insurance services. Bancassurance effectively leverages existing bank customer bases, significantly contributing to premium income. Specialized corporate sales teams cater to high-value institutional clients with tailored financial solutions.

| Channel Type | 2024 Metric | Key Impact |

|---|---|---|

| Physical Branches | Over 100 bank branches | New client acquisition, personalized service |

| Bancassurance | NT$125.7B (4M 2024) | Significant premium income contribution |

| Digital Platforms | Increased self-service | Scalability, cost efficiency |

Customer Segments

High-Net-Worth Individuals (HNWIs) represent a crucial segment for Shin Kong Financial, demanding sophisticated wealth management, private banking, and comprehensive estate planning services. These clients are highly profitable, often contributing significantly to the firm's revenue streams. Shin Kong Financial serves them through a personalized, high-touch relationship model, ensuring their complex financial needs are met with tailored solutions. This segment's demand for exclusive offerings drives the development of premium investment and insurance products. As of 2024, the number of HNWIs in Taiwan continues to expand, presenting significant growth opportunities for bespoke financial services.

Shin Kong Financial’s Mass Affluent and Retail Customers represent its largest segment, encompassing individuals and households seeking essential financial services. This group leverages standard banking, mortgages, and credit cards, alongside basic insurance offerings. They are predominantly served through Shin Kong’s extensive branch network and increasingly through digital channels, aligning with a 2024 trend of rising digital engagement in Taiwan's banking sector. This segment provides a crucial base for stable deposits and generates a high volume of fee-based transactions, contributing significantly to the company’s non-interest income.

Shin Kong Financial's Corporate and Institutional Clients segment serves large corporations, public sector entities, and fellow financial institutions across Taiwan.

These high-value relationships require specialized services, including corporate banking, treasury management, and investment banking solutions.

Dedicated corporate banking teams manage these critical accounts, ensuring tailored financial support.

This segment is a vital contributor, generating substantial loan and fee income, with corporate lending in Taiwan seeing continued growth into 2024.

Small and Medium-Sized Enterprises (SMEs)

Small and Medium-Sized Enterprises (SMEs) form a crucial customer segment for Shin Kong Financial, requiring tailored business loans, commercial insurance, and sophisticated cash management solutions to support their operations. This segment is a significant driver of economic growth, with Taiwan's SMEs contributing over 90% of enterprises and employing approximately 80% of the workforce as of 2024 data. Effectively serving SMEs diversifies the loan portfolio and ensures stable revenue streams. Their distinct needs represent a substantial market for comprehensive business banking services.

- In 2024, Taiwan's SMEs continued to be a backbone, comprising over 98% of all enterprises.

- They collectively contributed to more than 30% of Taiwan's GDP.

- Access to credit and specialized insurance is paramount for their sustained growth and risk management.

- Digital cash management tools are increasingly vital for their operational efficiency.

Young Professionals and Digital Natives

Shin Kong Financial targets young professionals and digital natives, a crucial segment for future growth. These tech-savvy individuals, often under 40, predominantly engage with financial services through digital channels. Their preference for mobile banking and robo-advisory platforms, which saw a 15% increase in adoption among this demographic in Taiwan during 2024, necessitates a strong focus on digital innovation and user experience.

- This segment values seamless digital interactions for banking and investments.

- They are early adopters of new financial technologies and mobile payment solutions.

- Digital channel engagement among young professionals in Taiwan grew significantly in 2024.

- Tailoring digital products and services is key to securing their long-term loyalty.

Shin Kong Financial serves a diverse customer base, including High-Net-Worth Individuals and a broad Mass Affluent and Retail segment. It also caters to Corporate and Institutional Clients, alongside providing tailored solutions for Small and Medium-Sized Enterprises. A key focus for future growth in 2024 is engaging Young Professionals and Digital Natives through advanced digital channels.

| Segment | Focus | 2024 Trend/Metric | ||

|---|---|---|---|---|

| HNWIs | Wealth Mgmt. | Growing numbers in Taiwan | ||

| Retail | Daily Banking | Rising digital engagement | ||

| SMEs | Business Loans | >98% of Taiwan's enterprises |

Cost Structure

Employee compensation and benefits form Shin Kong Financial’s largest operating expense, encompassing salaries, bonuses, and commissions for its extensive workforce of bankers, insurance agents, and corporate staff. Managing performance-based commissions, especially for the sales force, is crucial for maintaining profitability. For instance, in 2024, the focus remains on optimizing these costs while attracting and retaining top talent. Investment in skilled professionals is a significant driver of this expenditure, directly impacting service quality and revenue generation across their financial services.

For Shin Kong Financial’s insurance subsidiary, a major cost revolves around insurance policy claims and the legal requirement to set aside reserves for future policyholder benefits. This significant cost is primarily driven by actuarial assumptions, evolving mortality rates, and persistent medical cost inflation. As of late 2023 and into 2024, rising healthcare expenses continue to pressure claims payouts and reserve requirements for insurers like Shin Kong Life. Prudent underwriting and robust risk management strategies are therefore essential to effectively control this critical cost structure and maintain financial stability.

Shin Kong Financial faces significant technology and infrastructure expenses, requiring substantial investment in maintaining and upgrading IT systems, robust cybersecurity measures, and secure data centers.

Developing new digital platforms is also a key cost, reflecting a strategic shift from mere maintenance to a competitive investment, especially as digital engagement grows.

For instance, industry trends in 2024 show financial institutions globally increasing IT spending by an estimated 8-10% to enhance digital capabilities and resilience.

The adoption of cloud migration and Software-as-a-Service (SaaS) solutions is actively altering this cost structure, potentially leading to operational efficiencies and scalability benefits.

Marketing and Customer Acquisition Costs

Marketing and customer acquisition costs for Shin Kong Financial encompass all outlays for advertising, branding initiatives, sales promotions, and the crucial recruitment of agents to expand their customer base. Optimizing these expenditures is vital, with cost-effectiveness serving as a key performance indicator for their strategic investments. Digital marketing analytics are increasingly central to refining this spend, ensuring efficient targeting and measurable returns. For example, in 2024, financial institutions are seeing a shift towards higher digital ad spend, with some allocating over 60% of their marketing budgets to online channels.

- Shin Kong Financial's customer acquisition strategy relies heavily on these marketing efforts.

- The effectiveness of agent recruitment programs directly impacts new policy sales.

- Digital platforms now provide granular data for campaign optimization.

- Measuring return on marketing investment (ROMI) is a critical focus for 2024.

Interest Expenses and Cost of Funds

For Shin Kong Financial's banking unit, interest paid on customer deposits and other borrowings represents a primary cost of funds. Attracting low-cost deposits offers a significant competitive advantage, directly enhancing the company's net interest margin. This cost is highly sensitive to central bank monetary policy, with 2024 rate decisions by the Central Bank of the Republic of China (Taiwan) directly influencing funding costs. Market interest rates also play a crucial role in shaping these expenses.

- In 2024, the Central Bank of Taiwan maintained its policy rate at 1.875% as of June, impacting deposit rates.

- Shin Kong Financial aims to optimize its deposit mix to lower overall funding costs.

- Net interest margin remains a key profitability metric influenced by the cost of funds.

- Global interest rate trends in 2024 continue to exert pressure on financial institutions' cost structures.

Shin Kong Financial’s cost structure is dominated by employee compensation and insurance claims, heavily influenced by medical inflation and actuarial assumptions. Substantial technology investments, with IT spending projected to rise 8-10% in 2024, support digital transformation and infrastructure. Marketing and customer acquisition, increasingly digital with over 60% of budgets allocated online, drive growth. Furthermore, interest paid on deposits for its banking unit, directly impacted by Taiwan’s 1.875% policy rate in June 2024, is a critical funding expense.

| Cost Category | Key Drivers | 2024 Impact |

|---|---|---|

| Employee Compensation | Salaries, Commissions | Optimizing talent retention |

| Insurance Claims | Medical inflation, Reserves | Rising payouts pressure |

| Technology & IT | Digital platforms, Cybersecurity | 8-10% IT spending increase |

| Interest on Deposits | Central bank rates | Taiwan policy rate at 1.875% |

Revenue Streams

Net Interest Income is a core revenue stream for Shin Kong Financial, primarily generated by its banking subsidiary. This reflects the difference between interest earned on assets, like loans and investments, and interest paid on liabilities, such as customer deposits. It is typically the largest revenue component for financial groups with a banking arm. Shin Kong Financial reported its net interest income for 2024, highlighting the crucial role its net interest margin plays in profitability.

Shin Kong Financial Group generates substantial revenue from insurance premiums, primarily through the sale of life, health, and annuity products. This includes regular premiums collected from policyholders, which form the core revenue for its life insurance operations. For example, Shin Kong Life reported consolidated premium income of NT$30.15 billion in January 2024 alone. A critical component of profitability also stems from investment income earned on the significant pool of these collected premiums, often referred to as the 'float'.

Fee and commission income forms a diverse and growing revenue stream for Shin Kong Financial, stemming from services that do not require the company to put its own capital at risk. This includes valuable revenue from wealth management, asset management based on assets under management (AUM), and securities brokerage commissions. For example, Shin Kong Financial Holdings reported consolidated net fee and commission income of NT$ 2.47 billion in Q1 2024, highlighting its significance. This income source provides crucial revenue diversification, enhancing overall financial stability.

Net Gains on Financial Instruments

Net Gains on Financial Instruments represent income from realized and unrealized gains on Shin Kong Financial’s diverse investment portfolio, encompassing equities, bonds, and real estate. This revenue stream is inherently volatile, heavily influenced by global financial market performance and interest rate fluctuations, as seen in market shifts during early 2024. The investment strategies of Shin Kong Life Insurance and Shin Kong Bank are crucial drivers for this outcome, impacting overall profitability.

- Shin Kong Life Insurance reported a net gain on financial assets of NT$24.4 billion in Q1 2024, demonstrating significant portfolio activity.

- The company strategically manages a vast fixed-income portfolio, a key component of these gains.

- Market volatility, such as interest rate changes, directly impacts the valuation of these holdings.

- Real estate investments also contribute, with their fair value adjustments influencing overall gains.

Service and Card-Related Fees

Shin Kong Financial generates substantial revenue from various service and card-related fees, forming a stable income stream for its retail banking operations. These encompass charges like account maintenance fees and loan processing fees, crucial for financial institutions. Additionally, foreign exchange transaction fees contribute, alongside interchange fees derived from credit and debit card usage. While each fee might be small on its own, their collective aggregation provides a significant and reliable revenue base for the company, supporting its diverse financial services.

- Account maintenance fees contribute to the base revenue.

- Loan processing fees are integral to lending operations.

- Foreign exchange transaction fees add to non-interest income.

- Interchange fees from card usage provide consistent income.

Shin Kong Financial diversifies its revenue through core net interest income from banking and substantial insurance premiums, exemplified by Shin Kong Life’s NT$30.15 billion in January 2024. Significant fee and commission income, totaling NT$2.47 billion in Q1 2024, alongside net gains on financial instruments, which saw Shin Kong Life achieve NT$24.4 billion in Q1 2024, further bolster its earnings. Additionally, stable service and card-related fees contribute to its robust financial base.

| Revenue Stream | Key Contributor | 2024 Data Point |

|---|---|---|

| Net Interest Income | Banking Subsidiary | Core Profitability Driver |

| Insurance Premiums | Shin Kong Life | NT$30.15 Billion (Jan 2024) |

| Fee & Commission Income | Wealth/Asset Mgmt. | NT$2.47 Billion (Q1 2024) |

| Net Gains on Financial Instruments | Investment Portfolio | NT$24.4 Billion (Q1 2024, Shin Kong Life) |

Business Model Canvas Data Sources

The Shin Kong Financial Business Model Canvas is built upon a foundation of comprehensive market research, internal financial disclosures, and strategic analysis of industry trends. These diverse data sources ensure a robust and accurate representation of the company's operations and market positioning.