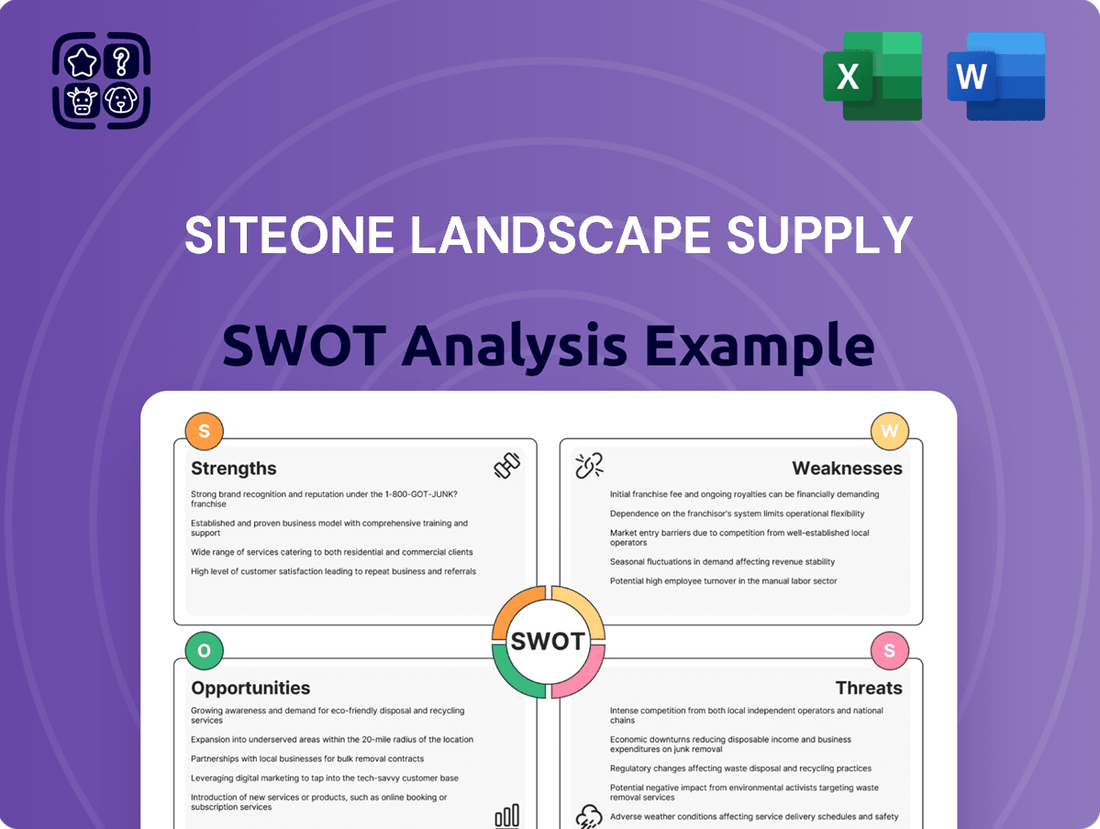

SiteOne Landscape Supply SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SiteOne Landscape Supply Bundle

SiteOne Landscape Supply boasts significant strengths in its extensive distribution network and strong supplier relationships, crucial for navigating the competitive landscape. However, understanding potential threats like economic downturns and the company's specific opportunities for expansion is key to a comprehensive view. This preview only scratches the surface of SiteOne's strategic positioning.

Want the full story behind SiteOne's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

SiteOne Landscape Supply holds a dominant position as the largest wholesale distributor in North America. Its extensive network of over 500 branches across the United States and Canada ensures broad market coverage and efficient product delivery, reaching a highly fragmented customer base.

This expansive footprint underpins SiteOne's market leadership, capturing an estimated 18% share of the approximately $25 billion wholesale landscaping market as of recent reports. This scale provides significant advantages in sourcing, logistics, and customer service.

SiteOne Landscape Supply boasts an extensive product catalog, featuring over 160,000 stock keeping units (SKUs) sourced from roughly 5,500 suppliers. This wide array covers essential categories like irrigation, fertilizer, hardscapes, outdoor lighting, and nursery stock, making it a true one-stop shop for landscape professionals.

Beyond just products, SiteOne provides crucial value-added services, including design assistance, educational training programs, and business management solutions. This comprehensive support system significantly enhances the value proposition for their customers, building strong loyalty.

This broad offering and integrated service model effectively differentiates SiteOne from smaller, less comprehensive competitors in the market. It cultivates a sticky customer base that relies on SiteOne for a majority of their operational needs.

SiteOne's standing as the largest distributor grants it substantial negotiating power with its suppliers. This leverage allows the company to secure a broad product selection and favorable pricing, which is a key advantage in the competitive landscape.

These robust, established relationships with suppliers are crucial for ensuring consistent product availability. For instance, in 2023, SiteOne reported that its supplier relationships allowed for a steady flow of goods, minimizing stockouts even during periods of high demand for landscaping materials.

The company's scale also facilitates the rapid introduction of new products to the market. By consolidating freight and reducing inventory risks for its partners, SiteOne acts as a vital conduit, benefiting both suppliers seeking market access and customers looking for the latest innovations.

This purchasing scale not only drives cost efficiencies but also strengthens SiteOne's market position. In the first quarter of 2024, SiteOne highlighted that its procurement advantages contributed to a gross margin improvement of 50 basis points compared to the prior year.

Strategic Acquisition Strategy

SiteOne Landscape Supply demonstrates a robust growth engine through its strategic acquisition approach. The company completed seven acquisitions in 2024 and added two more in early 2025, directly fueling its net sales expansion. This consistent M&A activity is a core strength, enabling SiteOne to broaden its operational footprint and enhance its product offerings.

This strategy is particularly effective in consolidating the highly fragmented landscape supply market. By acquiring smaller players, SiteOne not only gains market share but also integrates valuable talent and fills critical gaps in its product portfolio. For instance, these acquisitions have been instrumental in expanding its presence into new, high-growth regions, solidifying its position as an industry consolidator.

- Proven Acquisition Track Record: Completed seven acquisitions in 2024 and two in early 2025.

- Net Sales Contribution: Acquisitions are a significant driver of net sales growth.

- Market Consolidation: Effectively consolidates a fragmented landscape supply industry.

- Strategic Benefits: Expands geographic reach, fills product gaps, and acquires talent.

Focus on Customer Service and Operational Efficiency

SiteOne Landscape Supply places a strong emphasis on delivering exceptional customer service, including providing technical expertise and digital tools for project estimation. This focus aims to support their diverse customer base effectively.

The company is actively pursuing operational efficiencies through rigorous cost control measures and branch enhancements. By investing in these areas, SiteOne strives to streamline its operations.

Leveraging digital platforms such as SiteOne.com and DispatchTrack is a key strategy for SiteOne. These tools are designed to boost productivity and deepen customer engagement across their network.

For instance, in 2023, SiteOne reported a 12% increase in net sales to $4.4 billion, indicating successful execution of their strategies that likely include these customer service and operational improvements.

- Customer-Centric Approach: Offering knowledgeable support and technical resources for project planning.

- Operational Streamlining: Implementing cost controls and branch upgrades to enhance efficiency.

- Digital Integration: Utilizing SiteOne.com and DispatchTrack for improved productivity and customer interaction.

- Financial Performance: Achieved $4.4 billion in net sales in 2023, reflecting growth driven by these strengths.

SiteOne's expansive network of over 500 branches across North America positions it as the largest wholesale distributor in the landscaping sector, providing unparalleled market reach and efficient service to a fragmented customer base.

This scale, capturing an estimated 18% of the $25 billion wholesale landscaping market, grants significant leverage in sourcing and logistics, ensuring favorable pricing and product availability.

The company's comprehensive product catalog, featuring over 160,000 SKUs, and its value-added services, like design assistance and training, create a strong customer loyalty and a differentiated offering.

SiteOne's proven acquisition strategy, with seven acquisitions in 2024 and two in early 2025, effectively consolidates the market and drives net sales growth, expanding its operational footprint and product portfolio.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership & Scale | Largest wholesale distributor in North America. | Over 500 branches; 18% market share in a $25 billion market. |

| Extensive Product Offering | One-stop shop for landscape professionals. | Over 160,000 SKUs from ~5,500 suppliers. |

| Value-Added Services | Enhances customer loyalty and differentiation. | Design assistance, training programs, business solutions. |

| Supplier Relationships & Purchasing Power | Secures broad product selection and favorable pricing. | Contributed to 50 basis points gross margin improvement in Q1 2024. |

| Strategic Acquisitions | Drives growth and market consolidation. | 7 acquisitions in 2024, 2 in early 2025. |

What is included in the product

Delivers a strategic overview of SiteOne Landscape Supply’s internal and external business factors, highlighting its market position and growth potential.

Offers a clear, actionable roadmap for navigating SiteOne Landscape Supply's competitive landscape.

Weaknesses

SiteOne's financial performance is closely tied to the cyclical nature of the construction and housing industries. When these sectors slow down, demand for landscaping supplies naturally decreases, impacting SiteOne's top and bottom lines. For instance, higher interest rates in 2024 can dampen new home construction and renovations, directly affecting SiteOne's sales volume.

A significant portion of SiteOne's revenue is derived from residential and commercial landscaping projects. Economic headwinds, such as reduced consumer spending on non-essential items like outdoor upgrades, can lead to a pullback in these projects. This sensitivity means that periods of economic contraction or uncertainty can pose a notable risk to SiteOne's profitability and growth trajectory.

SiteOne Landscape Supply has faced headwinds from commodity price deflation, notably impacting key products such as PVC pipe and grass seed. This trend has put downward pressure on their organic daily sales figures and squeezed gross margins.

For instance, in the first quarter of 2024, SiteOne reported a 1.4% decrease in net sales, with a significant portion attributed to unfavorable price impacts, particularly in landscaping products. This demonstrates the tangible effect of falling commodity prices on their top-line performance.

While the company anticipates some moderation in these deflationary pressures, the persistence of these trends could continue to hinder price realization. This means that even if sales volumes remain stable or grow, the actual revenue generated might be lower due to declining prices.

Ultimately, sustained commodity price deflation poses a risk to SiteOne's overall profitability. The company must navigate this environment by focusing on operational efficiencies and potentially adjusting its product mix to mitigate the impact on its bottom line.

SiteOne Landscape Supply has seen its Selling, General, and Administrative (SG&A) expenses rise. This increase is partly a consequence of the company's aggressive acquisition strategy and efforts to consolidate branches, which naturally boosts overhead costs. For instance, in the first quarter of 2024, SG&A as a percentage of net sales stood at 24.8%, compared to 23.5% in the same period of 2023, reflecting this trend.

While SiteOne is actively working to enhance operational efficiency and achieve better SG&A leverage, the sheer scale and ongoing integration of its expanding network present a persistent management challenge. Successfully controlling these costs while continuing to grow organically and through acquisitions is crucial for maintaining profitability.

Relatively High Debt Levels from Acquisition Strategy

SiteOne's growth strategy relies heavily on acquisitions, which has understandably increased its financial leverage. As of the close of fiscal year 2023, the company reported total debt of approximately $2.3 billion. This level of debt, while fueling expansion, can present a challenge, particularly if market conditions become less favorable or if the integration of acquired businesses proves more complex than anticipated.

The substantial debt load could potentially constrain SiteOne's financial flexibility. This might limit its capacity to pursue further strategic opportunities or to weather unexpected economic downturns without significant strain. For instance, a prolonged economic slowdown could impact revenue generation, making debt servicing a more considerable burden.

- Aggressive acquisition strategy: SiteOne has consistently pursued mergers and acquisitions to expand its market presence and service offerings.

- Increased financial leverage: This growth-by-acquisition model has naturally resulted in higher debt levels on the company's balance sheet.

- Total debt as of December 2023: Approximately $2.3 billion, reflecting the financial commitments from its acquisition-driven growth.

- Potential limitations: High debt can reduce financial flexibility, especially during economic uncertainties or integration challenges.

Limited International Market Presence

SiteOne Landscape Supply's international market presence remains a notable weakness, with a substantial concentration of its revenue originating from U.S. markets. While the company has expanded into Canada, its global footprint is still relatively limited, potentially hindering access to broader growth avenues and diversification benefits. This reliance on a single major market, North America, exposes SiteOne to risks associated with regional economic downturns or competitive shifts. For instance, in 2023, U.S. operations accounted for the overwhelming majority of its net sales, underscoring this dependency.

This limited international reach presents several key drawbacks:

- Geographic Concentration Risk: Over-reliance on the U.S. market makes SiteOne vulnerable to economic fluctuations, regulatory changes, or increased competition specifically within North America.

- Missed Growth Opportunities: Significant portions of the global landscaping market, particularly in Europe and Asia, are not yet tapped by SiteOne, representing substantial unrealized growth potential.

- Limited Diversification: A broader international presence could offer a hedge against regional underperformance, allowing the company to offset slowdowns in one market with growth in another.

- Competitive Disadvantage: Competitors with more established international operations may benefit from economies of scale, diverse supply chains, and broader brand recognition that SiteOne currently lacks globally.

SiteOne's reliance on acquisitions for growth has led to increased financial leverage. As of fiscal year-end 2023, the company carried approximately $2.3 billion in total debt. This substantial debt burden can limit financial flexibility, especially during economic downturns or if the integration of acquired businesses becomes challenging.

Same Document Delivered

SiteOne Landscape Supply SWOT Analysis

You’re viewing a live preview of the actual SiteOne Landscape Supply SWOT analysis. This excerpt showcases the professional structure and insightful content you can expect. The complete version, offering a comprehensive exploration of SiteOne's Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

The landscape supply sector is still quite fragmented, presenting SiteOne with ample chances to pursue its acquisition strategy. By acquiring smaller, regional distributors, SiteOne can boost its market share, broaden its geographical reach, and enhance its product catalog. This approach capitalizes on SiteOne's established leadership and robust financial standing, allowing for continued expansion.

SiteOne can significantly boost its market presence by deepening investments in digital tools, including its SiteOne.com e-commerce platform and advanced delivery logistics. This focus on technology is a prime opportunity to elevate customer satisfaction and optimize operational efficiency, ultimately driving revenue growth.

The substantial 140% surge in digital sales during Q1 2025 underscores the immense potential for continued expansion in online channels. This trend highlights a clear pathway to increased productivity and sales through the strategic adoption of digital solutions.

Growing environmental consciousness and supportive government policies are fueling a significant uptick in demand for sustainable landscaping solutions. This shift presents a clear opportunity for SiteOne to expand its product lines with eco-friendly options such as water-saving plants, permeable paving materials, and advanced irrigation technologies.

Leveraging Demand for Outdoor Living Spaces

The robust and ongoing demand for outdoor living spaces presents a significant opportunity for SiteOne Landscape Supply. Homeowners are increasingly prioritizing investments in their backyards, encompassing everything from intricate hardscapes and fully equipped outdoor kitchens to meticulously designed gardens. This trend is not a fleeting fad; it represents a fundamental shift in how people utilize and value their homes, providing a foundational strength for SiteOne's product lines.

This sustained interest in enhancing outdoor environments offers a resilient market segment, even when the broader economy experiences fluctuations. For instance, in 2023, the U.S. market for outdoor living products, including furniture and structures, was estimated to be worth billions, with projections showing continued steady growth. This indicates a durable demand that SiteOne is well-positioned to capitalize on, ensuring a consistent revenue stream and avenues for expansion.

- Sustained Homeowner Investment: Continued spending on outdoor living amenities like patios, fire pits, and landscaping provides a consistent market.

- Resilience to Economic Downturns: The desire for enhanced outdoor spaces often persists even during periods of economic uncertainty, offering a stable demand base.

- Growing Market Size: The outdoor living market in the U.S. has shown consistent growth, with projections indicating further expansion in the coming years.

- Product Diversification: This trend supports SiteOne's broad product catalog, from hardscape materials to irrigation and lighting systems, all integral to creating desirable outdoor environments.

Operational Efficiency and Margin Improvement Initiatives

SiteOne is actively pursuing operational efficiency through disciplined cost control and enhanced gross margin management. These ongoing initiatives are designed to capitalize on the company's significant scale. The potential for price deflation to moderate in 2025 presents a favorable environment for margin expansion. This combination could lead to a notable improvement in EBITDA margins and overall profitability for SiteOne.

- Ongoing Cost Control: SiteOne's commitment to managing expenses is a core focus.

- Gross Margin Management: Strategies are in place to optimize gross profit on sales.

- Leveraging Scale: The company aims to translate its size into efficiency gains.

- Potential Price Deflation Moderation: A shift away from deflationary pricing could boost revenue and margins in 2025.

SiteOne has a significant opportunity to expand its market share by acquiring smaller, regional landscape distributors, leveraging its established leadership and strong financial position. The company's investment in digital tools, like its SiteOne.com platform, is crucial for enhancing customer satisfaction and operational efficiency, with digital sales showing a remarkable 140% surge in Q1 2025. Growing demand for sustainable landscaping solutions, driven by environmental awareness and supportive policies, allows SiteOne to broaden its eco-friendly product offerings.

The sustained homeowner investment in outdoor living spaces, a market valued in the billions and projected for steady growth, provides a resilient demand base for SiteOne's diverse product lines. Furthermore, the company's focus on operational efficiencies, including cost control and margin management, is set to improve profitability, especially with the potential moderation of price deflation in 2025.

| Opportunity Area | Key Driver | 2025 Projection/Data Point |

|---|---|---|

| Acquisitions | Fragmented Market | Continued expansion through strategic acquisitions |

| Digital Transformation | E-commerce Growth | 140% surge in digital sales (Q1 2025) |

| Sustainability | Environmental Demand | Expansion of eco-friendly product lines |

| Outdoor Living Market | Homeowner Spending | Billions in U.S. market value, steady growth |

| Operational Efficiency | Cost Control & Margin Management | Potential for EBITDA margin improvement |

Threats

Broader economic headwinds, such as persistently elevated interest rates and generally tighter financial markets, are continuing to put a strain on SiteOne Landscape Supply's net sales growth and overall net income. These conditions create a more challenging environment for discretionary spending, which can impact demand for landscaping services and products.

The risk of a significant recession or a prolonged slowdown in new housing starts, coupled with reduced consumer spending, poses a substantial threat. A downturn in the housing market directly affects new landscape installations, a key revenue driver for SiteOne. For instance, while housing starts saw some stabilization in late 2023 and early 2024, potential future contractions due to economic uncertainty remain a concern.

Despite SiteOne's significant national presence, the landscape supply industry is characterized by a highly fragmented competitive landscape. Thousands of smaller, privately held, or family-owned businesses operate at the local level, creating intense competition. This fragmentation can lead to significant pricing pressures, making it difficult for SiteOne to maintain consistent market share growth across all its operating regions.

SiteOne faces significant threats from ongoing global supply chain disruptions. These issues can lead to product shortages and increased costs for essential materials like concrete and lumber, directly impacting operational efficiency and profit margins. For instance, the Producer Price Index for construction materials excluding energy saw a notable increase in late 2023 and early 2024, reflecting these inflationary pressures.

Geopolitical instability and trade policies, including tariffs, further complicate SiteOne's ability to source products reliably and maintain stable pricing. These factors create uncertainty in product availability and can necessitate higher expenditure on raw materials and finished goods, potentially squeezing the company's margins.

Labor Shortages in the Landscaping and Construction Sectors

Labor shortages within the landscaping and construction sectors pose a significant threat to SiteOne Landscape Supply. These shortages can directly impact SiteOne's customer base, as contractors may struggle to find enough workers to complete projects. This limitation on their capacity could lead to fewer new projects being initiated, thereby dampening demand for the supplies SiteOne provides. For instance, the Associated General Contractors of America reported in early 2024 that 70% of construction firms were having trouble finding skilled labor, a persistent issue that directly curtails project volume.

Consequently, SiteOne's sales volume and overall growth trajectory could be negatively affected by this external labor market dynamic. If customers cannot execute projects due to staffing constraints, their purchasing of materials like hardscaping, plants, and irrigation systems will naturally decrease. This indirect impact on demand is a crucial consideration for SiteOne's revenue streams and market share expansion efforts in the coming years.

The persistent difficulty in finding skilled labor means that SiteOne's customers might also face increased labor costs, which could be passed on to end-consumers, potentially softening overall market demand for landscaping services. This creates a ripple effect throughout the supply chain.

Key impacts include:

- Reduced Project Pipeline: Customers' inability to staff projects leads to fewer new installations and maintenance contracts.

- Lower Supply Demand: Decreased project activity directly translates to less demand for SiteOne's diverse product offerings.

- Slower Revenue Growth: The combined effect of reduced project capacity and demand dampens SiteOne's sales performance and growth potential.

Changing Customer Preferences and Technological Disruption

SiteOne Landscape Supply faces a significant threat from rapidly evolving customer preferences, such as a growing demand for sustainable landscaping or a surge in do-it-yourself projects, which could reduce reliance on professional services. The company must remain agile to adapt its product and service offerings to these shifts. For example, a strong pivot towards water-wise landscaping solutions or readily available project kits could mitigate this risk.

Technological disruption from competitors is another major concern. New digital-first companies entering the market could challenge SiteOne's traditional distribution model by offering more convenient online purchasing or innovative service platforms. The landscaping industry, while often traditional, is not immune to digital transformation. Failure to integrate new technologies or develop a robust e-commerce presence could cede market share.

Specific to 2024-2025, anticipate continued growth in demand for smart irrigation systems and eco-friendly materials, driven by environmental awareness and potential regulatory changes. Companies that fail to stock and promote these items will be at a disadvantage. The increasing prevalence of online marketplaces for home improvement goods also presents a direct competitive threat to established distribution networks.

- Shifting Consumer Demand: Increased preference for drought-tolerant plants and native species in landscaping, particularly in regions facing water scarcity, could impact sales of traditional, water-intensive products.

- Digital Competition: Emergence of online-only retailers offering landscaping supplies with competitive pricing and direct-to-consumer delivery models threatens established brick-and-mortar distribution.

- DIY Trend: A continued rise in DIY landscaping projects, fueled by accessible online tutorials and affordable tools, may reduce the need for professional installation and, consequently, the demand for wholesale supply.

- Technological Obsolescence: Competitors adopting advanced inventory management, AI-powered design tools, or drone-based site analysis could create efficiency gaps that SiteOne must address.

Intense competition from a highly fragmented market, featuring numerous smaller local players, exerts significant pricing pressure on SiteOne. This makes it challenging to consistently grow market share, especially as economic headwinds like elevated interest rates continue to impact overall demand for landscaping services and products.

Labor shortages in the construction and landscaping sectors directly affect SiteOne's customer base, as contractors struggle with staffing, leading to fewer projects and thus reduced demand for supplies. For instance, in early 2024, a reported 70% of construction firms faced difficulties finding skilled labor, a persistent issue that curtails project volume and consequently dampens SiteOne's sales performance.

Evolving customer preferences, such as a growing demand for sustainable landscaping, and the rise of DIY projects present another threat, potentially reducing reliance on professional services and wholesale suppliers. Additionally, technological disruption from digital-first competitors offering convenient online purchasing models could erode SiteOne's traditional distribution dominance.

| Threat Category | Specific Threat | Impact on SiteOne | Supporting Data/Context (2024-2025) |

|---|---|---|---|

| Market Competition | Fragmented Landscape | Pricing pressure, difficulty in market share growth | Thousands of local, privately held businesses compete |

| Economic Factors | Labor Shortages | Reduced project pipeline, lower demand for supplies | 70% of construction firms reported difficulty finding skilled labor (Early 2024) |

| Customer Behavior | Shifting Preferences | Need for product and service adaptation | Growing demand for sustainable and DIY landscaping solutions |

| Technological Disruption | Digital Competitors | Potential loss of market share to online models | Emergence of online-only retailers with direct-to-consumer delivery |

SWOT Analysis Data Sources

This SiteOne Landscape Supply SWOT analysis is built on a foundation of comprehensive data, including publicly available financial reports, detailed market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.