SiteOne Landscape Supply Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SiteOne Landscape Supply Bundle

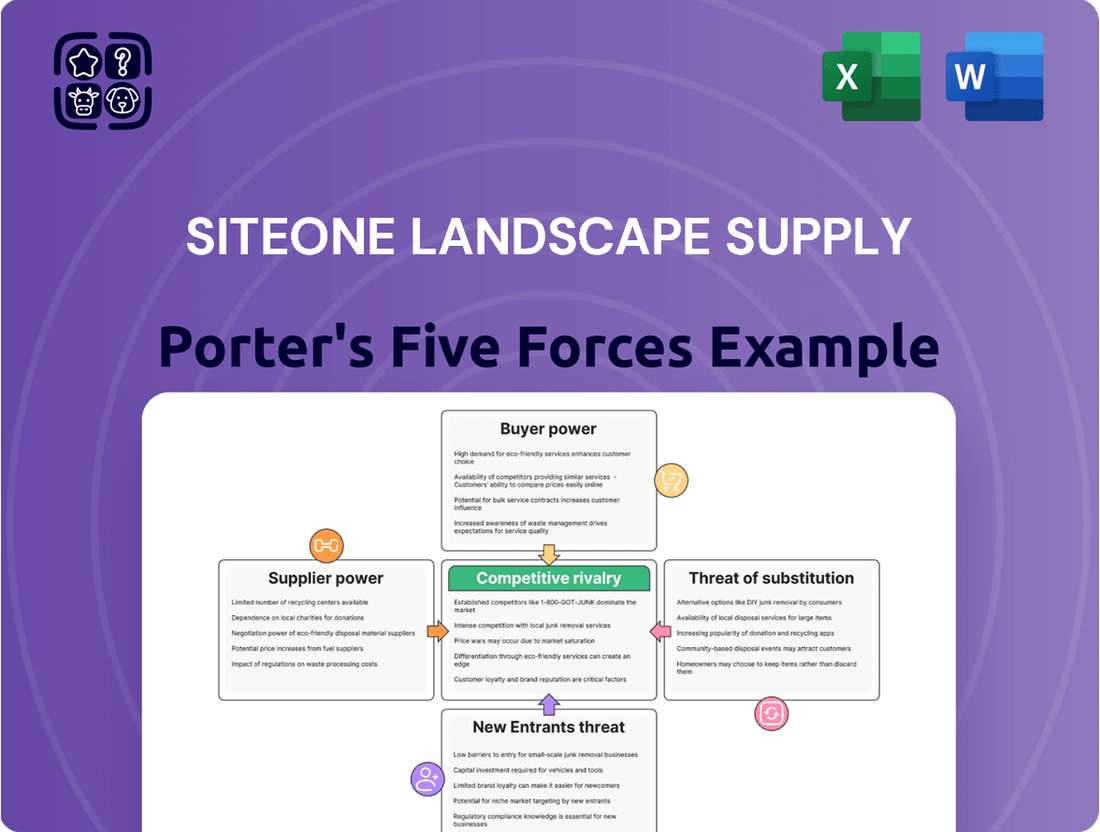

SiteOne Landscape Supply navigates a competitive landscape shaped by several key forces. Understanding the bargaining power of both buyers and suppliers is crucial to its success.

The threat of new entrants and the intensity of rivalry among existing players significantly impact SiteOne's market share and pricing strategies.

Furthermore, the presence of substitute products or services can challenge SiteOne's traditional offerings, requiring continuous innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore SiteOne Landscape Supply’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for SiteOne Landscape Supply is significantly shaped by how concentrated and specialized the supplier market is. When it comes to highly specialized products, such as advanced irrigation technology or unique plant varieties, a smaller pool of suppliers often means they have more sway. This can translate into higher prices for SiteOne, as seen with the increasing demand for water-efficient irrigation systems, where a few key manufacturers dominate the market.

For more common landscape materials, like mulch, soil, or basic hardscaping stones, SiteOne's considerable purchasing power gives it an advantage. With its extensive network and large order volumes, SiteOne can negotiate more favorable terms with a broader, more fragmented base of suppliers. This leverage is crucial in managing costs for these widely available products, ensuring competitive pricing for their customers.

SiteOne Landscape Supply's bargaining power with its suppliers is directly influenced by the switching costs associated with changing those suppliers. If it’s expensive for SiteOne to switch, for example, due to the need for retooling equipment, obtaining new certifications, or facing significant disruptions to its existing supply chains, then suppliers gain more leverage. This means suppliers can potentially command higher prices or dictate more favorable terms.

However, SiteOne's considerable scale and its widespread network of distribution centers offer a significant advantage in mitigating supplier power. This allows for diversified sourcing across a broad range of product categories, which inherently reduces the switching costs for many of these items. By having multiple options readily available, SiteOne can negotiate more effectively and avoid over-reliance on any single supplier.

Furthermore, SiteOne is actively cultivating strategic partnerships with key suppliers. These collaborations are designed not just for immediate supply needs but to build more resilient and mutually beneficial supply chains for the long term. Such partnerships can lead to more stable pricing, improved product quality, and a greater ability for SiteOne to influence supplier practices, thereby dampening supplier bargaining power.

Suppliers could pose a threat by integrating forward, meaning they might start distributing directly to landscape professionals, bypassing SiteOne. While this is less common for broad product lines, specialized manufacturers might consider it for their high-value offerings. For instance, a niche irrigation system manufacturer with a strong brand might explore direct sales to large commercial landscapers.

SiteOne's robust value-added services, such as technical support and design assistance, along with its extensive distribution network, act as significant deterrents against such forward integration by suppliers. In 2024, SiteOne reported a substantial network of over 500 branches across North America, solidifying its market reach and making direct competition by individual suppliers challenging.

Importance of SiteOne to Suppliers

SiteOne Landscape Supply, as the largest wholesale distributor in North America, holds considerable sway with its suppliers. This immense scale means that many suppliers view SiteOne as a critical, even essential, customer. For these suppliers, maintaining a strong relationship with SiteOne is paramount to accessing its extensive network of over 500 locations and broad customer base. This dependence inherently tempers the bargaining power suppliers might otherwise wield.

Suppliers are thus motivated to offer competitive pricing and favorable terms to secure and retain their business with SiteOne. The potential loss of such a significant sales channel is a powerful deterrent against aggressively pushing for higher prices or less favorable contract conditions. In 2023, SiteOne reported net sales of $4.4 billion, highlighting the sheer volume of business it represents for its supply partners.

SiteOne's strategic approach further solidifies its position. By leveraging its size, the company can negotiate better terms and pass on value to its suppliers through increased sales volume and market access. This creates a symbiotic relationship where suppliers benefit from SiteOne's reach, reinforcing SiteOne's ability to manage supplier relationships effectively.

- SiteOne's Dominance: As North America's largest wholesale distributor of landscaping products, SiteOne offers unparalleled market access.

- Supplier Dependence: Suppliers often rely on SiteOne for a substantial portion of their sales, limiting their leverage.

- Pricing Pressure: The need to retain SiteOne's business encourages suppliers to offer competitive pricing.

- Strategic Value: SiteOne's scale allows it to deliver significant value to suppliers through increased distribution and customer reach.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for SiteOne Landscape Supply. If SiteOne can readily find alternative materials or products from different suppliers or even different geographical regions, the leverage of any individual supplier is reduced. This flexibility is crucial for maintaining competitive pricing and ensuring supply chain resilience.

SiteOne actively works on enhancing its sourcing flexibility. By investing in supply chain improvements and de-risking initiatives, the company aims to mitigate reliance on any single supplier or input. This strategic approach, which includes more intensive strategic partnering, directly counters concentrated supplier power.

- Reduced Supplier Leverage: Access to a wider pool of alternative inputs diminishes the ability of any single supplier to dictate terms.

- Cost Control: The presence of substitutes allows SiteOne to negotiate better prices, contributing to cost efficiency.

- Supply Chain Resilience: Diversified sourcing options protect SiteOne from disruptions caused by single-source failures.

- Strategic Partnering: Developing stronger relationships with multiple suppliers can unlock access to a broader range of inputs and innovations.

SiteOne Landscape Supply's bargaining power with suppliers is generally high due to its immense scale as North America's largest wholesale distributor, often representing a significant portion of a supplier's sales. This market dominance means suppliers are incentivized to offer competitive pricing and favorable terms to secure SiteOne's business, directly limiting their leverage.

The company's extensive distribution network, boasting over 500 branches in 2024, further solidifies its position. This broad reach makes it difficult for individual suppliers to bypass SiteOne and sell directly to end customers, reinforcing SiteOne's ability to negotiate effectively and maintain cost control across its vast product catalog.

SiteOne’s strategic focus on diversifying its supplier base and cultivating strong partnerships also plays a crucial role. By reducing reliance on any single supplier and actively seeking alternative inputs, SiteOne effectively mitigates the potential for suppliers to exert undue influence through price hikes or unfavorable contract terms, ensuring supply chain resilience and cost efficiency.

| Factor | SiteOne's Position | Supplier Leverage |

|---|---|---|

| Market Share | Largest wholesale distributor in North America | Low |

| Supplier Dependence | Significant portion of sales for many suppliers | Low |

| Distribution Network | Over 500 branches (2024) | Low |

| Sourcing Strategy | Diversified, strategic partnerships | Low |

What is included in the product

This analysis details SiteOne Landscape Supply's competitive environment by examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the landscape supply industry.

SiteOne Landscape Supply's Five Forces Analysis offers a pain point reliever by providing a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

SiteOne Landscape Supply operates in a market characterized by a highly fragmented customer base. The vast majority of its clientele consists of landscape professionals, a segment populated by numerous small to medium-sized businesses. This widespread distribution of customers means that no single entity, or even a small cluster of them, holds substantial sway over SiteOne's sales volume.

With hundreds of thousands of customers, SiteOne benefits from a diffused demand structure. This fragmentation significantly dilutes the bargaining power that individual customers might otherwise wield. The sheer number of buyers prevents any one from dictating terms or demanding preferential pricing that could negatively impact SiteOne’s profitability.

For basic landscape supplies, the effort for professionals to switch from SiteOne to a competitor is minimal, which generally means customers have a good amount of power. This low barrier means they can easily move if prices or service levels aren't competitive.

However, SiteOne works to reduce this power by offering more than just products. They provide services like design assistance, educational workshops, and business management tools. These extras make it more inconvenient and costly for customers who rely on these integrated solutions to switch.

In 2023, SiteOne reported its customers often stayed with them because of these value-added services, indicating that while switching for basic goods is easy, the overall customer relationship can be strengthened. This creates a higher effective switching cost for those deeply engaged with their support systems.

SiteOne Landscape Supply distinguishes itself through an extensive product catalog, boasting 160,000 stock keeping units (SKUs), and offering valuable services like design assistance and business management tools. This comprehensive approach moves beyond simple product distribution, making customers less focused solely on price.

By providing convenience, a wide selection, and expert advice, SiteOne encourages customers to value the overall offering more than minor price variations. This focus on integrated solutions diminishes the customer's ability to demand lower prices based on price alone.

Customer Price Sensitivity

Customer price sensitivity is a key factor for SiteOne Landscape Supply. Landscape professionals frequently face competitive bidding environments, making them keenly aware of pricing for materials. This can put pressure on SiteOne to offer competitive rates to maintain its customer base.

However, SiteOne leverages its extensive network of local branches and its comprehensive product offering, acting as a one-stop shop. This convenience, coupled with the assurance of reliable supply, can reduce the overall cost of doing business for these professionals, thereby mitigating pure price sensitivity. For instance, in 2024, SiteOne's focus on operational efficiency aims to help manage costs effectively.

- Price Sensitivity Mitigation: SiteOne's broad product range and local accessibility serve as a counterpoint to customer price sensitivity driven by competitive bidding.

- Volume Growth Strategy: The company plans to offset potential price deflation by increasing sales volume, a strategy that was likely a focus throughout 2024 and into 2025.

- Operational Efficiency: Efforts to improve operational efficiencies in 2024 are crucial for managing costs and maintaining competitive pricing.

- Reliable Supply Chain: Ensuring a consistent and dependable supply of materials is a significant value proposition that can lessen a customer's focus solely on price.

Threat of Backward Integration by Customers

The threat of landscape professionals integrating backward to buy directly from manufacturers is generally low for SiteOne Landscape Supply. This is primarily due to the significant logistical hurdles and the substantial economies of scale needed for efficient direct procurement. For instance, in 2024, the cost of managing a direct supply chain for thousands of individual landscape businesses would be prohibitive.

SiteOne's vast network of branches and its robust warehousing infrastructure provide a distinct advantage that smaller, individual landscape businesses struggle to replicate. This widespread presence allows for convenient, just-in-time delivery and access to a broad range of products, something a single business attempting backward integration would find challenging to match.

- Logistical Complexity: Direct purchasing from manufacturers requires significant investment in inventory management, transportation, and warehousing, which is often beyond the capacity of individual landscape contractors.

- Economies of Scale: Manufacturers typically offer better pricing for large, consolidated orders, a benefit that individual businesses cannot achieve compared to a large distributor like SiteOne.

- SiteOne's Infrastructure: SiteOne's extensive branch network, serving numerous customer locations across North America, represents a significant capital investment and operational efficiency that is difficult for competitors to bypass.

SiteOne's customer base is highly fragmented, with thousands of small to medium-sized landscape businesses. This means no single customer has significant leverage to demand lower prices or dictate terms. While customers can easily switch for basic supplies due to low switching costs, SiteOne mitigates this by offering value-added services and a comprehensive product range, effectively increasing the overall switching cost.

In 2024, SiteOne's strategy to offset potential price deflation through increased sales volume highlights the ongoing need to manage customer price sensitivity. Their focus on operational efficiency in 2024 is key to maintaining competitive pricing. The company's extensive network and one-stop-shop approach further reduce the customer's inclination to solely focus on price, as convenience and reliable supply are significant benefits.

The threat of customers bypassing SiteOne to buy directly from manufacturers remains low due to the substantial logistical and scale requirements. SiteOne's robust infrastructure and economies of scale in procurement are difficult for individual landscape businesses to replicate, making direct purchasing impractical for most.

| Factor | Impact on SiteOne | Mitigation Strategy |

|---|---|---|

| Customer Fragmentation | Low individual bargaining power | Focus on broad customer acquisition |

| Low Switching Costs (Basic Goods) | Potential for customer churn | Value-added services, comprehensive offerings |

| Price Sensitivity | Pressure on pricing | Operational efficiency, volume growth, convenience |

| Backward Integration Threat | Low due to logistical barriers | Leveraging existing infrastructure and scale |

Preview the Actual Deliverable

SiteOne Landscape Supply Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for SiteOne Landscape Supply details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You are previewing the final version—precisely the same document that will be available to you instantly after buying, offering a thorough understanding of the strategic factors influencing SiteOne's market position.

Rivalry Among Competitors

The landscape supply distribution market is quite crowded, featuring both large, national companies and a multitude of smaller, regional and local businesses. SiteOne Landscape Supply stands out as the dominant force, holding approximately 17% of the market share in the $25 billion wholesale landscaping products distribution sector. Despite its leading position, SiteOne still contends with a diverse array of competitors, indicating a fragmented market structure.

The landscaping services market is expected to see continued expansion, with North America anticipated to be a dominant region. While 2024 presented some variability, the forecast for 2025 points towards more favorable conditions, especially for lawn and garden equipment and supplies.

This projected market growth offers a beneficial dynamic for companies like SiteOne Landscape Supply. As the overall pie gets bigger, businesses have the opportunity to increase their revenue by capturing a larger slice of this expanding market rather than solely focusing on taking market share from competitors.

For instance, the U.S. landscaping services industry generated approximately $134.8 billion in revenue in 2023, with projections indicating further growth through 2024 and beyond. This upward trend can soften the intensity of competitive rivalry by providing avenues for organic growth.

While many landscape supplies are essentially commodities, leading to a strong emphasis on price, SiteOne Landscape Supply actively works to stand out. They achieve this differentiation through offering a complete range of products, a wide-reaching network of physical locations, and services that add extra value for their customers. This strategy aims to move the competition beyond just who has the lowest price.

Competitors that can match SiteOne's broad product selection and extensive service offerings are the ones that truly intensify rivalry in this space. For instance, large regional distributors or national chains that also provide a full suite of landscape materials, from plants and hardscapes to irrigation and lighting, directly challenge SiteOne's market position. The ability of these rivals to offer similar convenience and product availability can significantly impact SiteOne's ability to maintain its competitive edge solely on breadth of offering.

Exit Barriers

SiteOne Landscape Supply faces intensified competitive rivalry due to high exit barriers. Significant investments in physical assets like extensive inventory, a widespread network of branches, and specialized landscaping equipment make it difficult and costly for competitors to leave the market. This often means that even less profitable companies continue to operate, contributing to sustained price pressures and potential oversupply in various geographic areas.

These exit barriers can trap companies in a cycle of low profitability. For instance, a competitor with substantial real estate holdings for their distribution centers might be reluctant to sell at a loss, even if their operational performance is weak. This retention of underperforming players keeps the overall competitive intensity high.

The implications for SiteOne include a market where pricing discipline is challenged. Competitors, unwilling or unable to exit, may engage in aggressive pricing strategies to maintain market share, directly impacting SiteOne's profit margins. This dynamic is particularly evident in regions with a high concentration of these fixed assets.

- High Investment in Assets: SiteOne's competitors often have substantial capital tied up in inventory, real estate for branches, and specialized equipment, creating significant hurdles to exiting the market.

- Sustained Price Pressure: The reluctance of companies to exit due to these barriers leads to a persistently competitive pricing environment, impacting overall industry profitability.

- Oversupply Risk: Competitors continuing operations despite lower profitability can contribute to an oversupply of products and services in certain markets, further intensifying rivalry.

Strategic Acquisitions and Market Consolidation

SiteOne Landscape Supply's aggressive acquisition strategy significantly fuels competitive rivalry within the industry. By actively consolidating the fragmented market, SiteOne aims to bolster its market share and expand its geographic footprint. This approach directly challenges smaller, independent distributors, forcing them to compete more fiercely or consider consolidation themselves.

In 2024, SiteOne acquired seven companies, demonstrating a clear commitment to this growth strategy. Looking at 2025, the company has already completed two acquisitions year-to-date, signaling continued momentum. This consolidation trend can lead to a more concentrated market structure over time, intensifying the competitive landscape for all players.

- Aggressive Acquisition Pace: SiteOne added seven companies in 2024 and two year-to-date in 2025.

- Market Consolidation Goal: The strategy aims to consolidate a fragmented landscape.

- Increased Market Share and Reach: Acquisitions enhance SiteOne's competitive position.

- Impact on Rivals: Intensifies rivalry for smaller, independent distributors.

Competitive rivalry is a significant factor for SiteOne Landscape Supply, operating in a market with numerous players ranging from large national firms to smaller local outfits. Despite SiteOne's dominant 17% market share in the $25 billion wholesale landscaping products distribution sector, the market remains fragmented, meaning intense competition is a constant. This rivalry is further amplified by SiteOne's aggressive acquisition strategy; the company acquired seven businesses in 2024 and two by mid-2025, actively consolidating the industry and intensifying pressure on rivals to either compete more aggressively or merge.

The landscape services industry, valued at approximately $134.8 billion in 2023, is projected for continued growth through 2024 and into 2025, particularly in North America. This expansion offers a buffer, allowing companies like SiteOne to grow organically rather than solely through market share battles. However, the inherent commodity nature of many landscape supplies means price remains a key competitive lever, though SiteOne attempts to differentiate through a comprehensive product range, extensive branch network, and value-added services.

| Competitor Type | Market Share Impact | Competitive Strategy |

|---|---|---|

| Large National Companies | Moderate to High | Broad product offerings, economies of scale |

| Regional Distributors | Moderate to High | Similar product breadth, localized service |

| Local Businesses | Low to Moderate | Niche specialization, personalized service |

SSubstitutes Threaten

The threat of substitutes for SiteOne Landscape Supply primarily stems from alternative ways landscape professionals can obtain their necessary materials. These include direct purchasing from manufacturers or even turning to large retail chains, often referred to as big-box stores.

While big-box retailers can offer a selection of landscape supplies, they generally fall short when compared to SiteOne's specialized offerings. These alternatives often lack the breadth of product variety, the ability to purchase in bulk quantities, and the crucial expert advice and technical support that SiteOne's customer base relies on for their businesses.

For instance, a professional landscaper might find a limited selection of plants or hardscaping materials at a big-box store, whereas SiteOne provides a comprehensive inventory tailored to the needs of the industry. This specialization, combined with the convenience of one-stop shopping for a wide range of professional-grade supplies, significantly mitigates the threat from these less specialized alternatives.

Homeowners increasingly desire attractive outdoor spaces, driving demand for professional landscaping. However, the rise of DIY landscaping and direct purchasing of materials by consumers presents a potential threat. For instance, in 2023, the home improvement market saw significant growth, with many homeowners undertaking projects themselves, potentially bypassing traditional landscape supply channels. This trend could reduce the volume of business for professional landscapers and, consequently, for wholesale suppliers like SiteOne.

New technologies are emerging that could offer alternatives to traditional landscaping services and materials, posing a substitution threat. For instance, the adoption of robotic lawn mowers, which gained significant traction in 2024 with market growth projections exceeding 15% annually, could decrease the reliance on manual labor and associated equipment like gas-powered mowers and trimmers.

Furthermore, advancements in synthetic turf and other artificial landscaping materials are becoming more sophisticated and aesthetically pleasing, potentially reducing demand for natural grass seed, sod, and the fertilizers and pesticides used to maintain them. The global artificial turf market was valued at approximately $5.5 billion in 2023 and is expected to grow, indicating a tangible shift in consumer preferences for certain applications.

These technological shifts represent a long-term substitution threat for companies like SiteOne Landscape Supply, requiring ongoing evaluation of their product portfolios and potential investment in or partnership with providers of these alternative solutions to remain competitive.

Price-Performance Trade-off of Substitutes

Customers weigh substitutes by comparing their price against the performance and convenience they offer. For professional contractors, the specialized product range, readily available inventory, and expert advice from SiteOne often justify a higher price point compared to general retailers. This is particularly true when considering the significant time savings and reduced risk of project delays.

The trade-off is clear: while basic landscaping materials might be found at a lower upfront cost elsewhere, the integrated services and product quality provided by SiteOne deliver superior value for businesses focused on efficiency and reliability. For example, a contractor needing specific irrigation components or high-quality turf might find the convenience and assurance of a specialized supplier like SiteOne far more cost-effective in the long run, even if the initial unit price is higher than a big-box store's offering.

- Price vs. Performance: Basic supplies might be cheaper at general retailers, but SiteOne's specialized selection and quality often provide better long-term value for professionals.

- Convenience and Time Savings: Professional contractors prioritize time. SiteOne's comprehensive inventory and accessible locations reduce the time spent sourcing materials, a significant factor in project profitability.

- Technical Support: SiteOne offers expert advice and technical support, which is invaluable for complex projects, mitigating risks and ensuring proper material application, a service often lacking at general retailers.

- Risk Mitigation: By providing reliable, high-quality products and knowledgeable staff, SiteOne helps contractors avoid costly mistakes and project delays, outweighing marginal price differences.

Customer Willingness to Switch

Landscape professionals' willingness to switch suppliers hinges on the value they receive. SiteOne Landscape Supply cultivates loyalty by offering a compelling package, making switching less appealing. Their strategy focuses on creating stickiness by addressing key customer needs.

This high-touch service, extensive product selection, and widespread branch network are designed to minimize the perceived benefit of exploring alternatives. For instance, a contractor needing specialized irrigation parts on short notice might find SiteOne's inventory and accessibility far more valuable than the potential savings from a less specialized supplier. In 2024, customer retention remains a critical metric, and SiteOne's approach directly combats the threat of substitutes.

- Value Proposition: Customer willingness to switch is directly tied to the perceived benefits offered by a supplier, including product availability, service quality, and price.

- SiteOne's Strategy: SiteOne aims to reduce switching by fostering long-term relationships through personalized service, a comprehensive product range, and convenient branch access.

- Reducing Propensity to Switch: By excelling in these areas, SiteOne makes it less attractive for landscape professionals to move to suppliers that may offer lower prices but lack the same breadth of offerings or service.

- Competitive Landscape: While other suppliers exist, SiteOne's integrated approach aims to be the path of least resistance and greatest convenience for its core customer base, effectively mitigating the threat of substitutes.

The threat of substitutes for SiteOne Landscape Supply is moderate but growing, driven by evolving consumer preferences and technological advancements. While direct purchase from manufacturers or big-box retailers presents an option, SiteOne's specialized product range and expert support offer significant advantages to professionals. The increasing popularity of DIY landscaping and the rise of artificial turf, with the global market valued at approximately $5.5 billion in 2023, are tangible factors that could reduce demand for traditional landscaping materials and services.

Entrants Threaten

The wholesale landscape supply distribution industry demands substantial upfront capital. Businesses need significant funds for extensive inventory, establishing a widespread network of branches, and developing robust logistics infrastructure, all of which create formidable barriers for newcomers.

SiteOne Landscape Supply, for instance, leverages considerable economies of scale. This scale allows them to operate more efficiently and offer competitive pricing, making it incredibly challenging for new entrants to match their cost structure or the sheer breadth of products and services they provide.

In 2024, SiteOne's extensive operational footprint, comprising over 500 branches across North America, underscores the capital intensity required to compete effectively. This vast network facilitates efficient distribution and localized customer support, advantages that are difficult and expensive for new players to replicate quickly.

SiteOne Landscape Supply's formidable presence, boasting over 500 branches across the U.S. and Canada, creates a significant barrier for new entrants. Replicating this extensive distribution network requires immense capital investment and time, making it difficult for newcomers to gain comparable market access.

Furthermore, SiteOne's long-standing relationships with thousands of suppliers are crucial. These established connections often translate into preferential pricing, reliable supply chains, and exclusive product offerings, advantages that new competitors would struggle to match in their early stages.

In 2024, the landscape supply industry continues to see consolidation, further solidifying the advantages of established players like SiteOne. Any new entrant would need to overcome not only the physical distribution challenge but also the supplier loyalty and favorable terms that SiteOne has cultivated over years.

SiteOne Landscape Supply has built significant brand loyalty among landscape professionals, a key factor in deterring new entrants. Their extensive network and focus on value-added services, like training and technical support, foster strong customer relationships that are difficult for newcomers to replicate. For instance, SiteOne's investment in technology platforms that streamline ordering and inventory management further solidifies its customer base.

Regulatory and Permitting Hurdles

New entrants into the landscape supply industry, while not facing the intense scrutiny of some sectors, still encounter a web of regulations. These can span from local zoning laws impacting warehouse locations to state and federal rules governing the transportation of goods, especially any landscape chemicals or potentially hazardous materials. For instance, the Environmental Protection Agency (EPA) has specific guidelines for the handling and disposal of certain pesticides and fertilizers, which are common products for landscape supply companies. Navigating these regulatory landscapes can significantly increase the upfront investment and slow down the market entry timeline.

These regulatory and permitting hurdles can act as a significant barrier. For example, obtaining the necessary permits for storing and distributing chemicals might require extensive documentation and compliance checks, adding considerable time and expense.

- Local Zoning Laws: Affecting where distribution centers and retail outlets can be established.

- Transportation Regulations: Including compliance with Department of Transportation (DOT) rules for vehicle operation and freight handling.

- Environmental Compliance: Such as adherence to EPA standards for chemical storage, runoff, and disposal, which can involve specialized containment systems.

- Business Licensing: General business licenses and permits are required at various governmental levels.

Experience and Industry Knowledge

The landscape supply industry demands a sophisticated understanding of its products, regional market nuances, and complex logistics. Newcomers face a steep learning curve in mastering these critical areas.

SiteOne Landscape Supply benefits immensely from its seasoned teams and well-honed operational processes. This accumulated expertise acts as a substantial barrier, making it difficult for new entrants to replicate their efficiency and market penetration rapidly.

- Deep Product Knowledge: SiteOne's staff possess extensive knowledge of a wide array of landscape materials, from plants and hardscaping to irrigation systems, a crucial asset in guiding customer choices.

- Regional Demand Acumen: The company demonstrates a nuanced understanding of how demand for specific products and services varies across different geographic locations, allowing for tailored inventory and marketing.

- Logistical Mastery: SiteOne has developed robust supply chain and distribution networks, ensuring timely and cost-effective delivery, a capability that requires significant investment and time to build.

- Competitive Advantage: This combination of experience and industry knowledge creates a significant competitive moat, as new entrants would need substantial time and resources to develop comparable capabilities.

The threat of new entrants in the wholesale landscape supply distribution industry is generally low due to high capital requirements for inventory, logistics, and branch networks. SiteOne Landscape Supply's extensive reach, with over 500 branches in 2024, highlights the significant investment needed to compete. Furthermore, established supplier relationships and brand loyalty cultivated by companies like SiteOne create substantial hurdles for newcomers seeking favorable terms and customer trust.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for SiteOne Landscape Supply leverages data from industry-specific market research reports, competitor financial filings, and trade association publications. We also incorporate insights from economic databases and news archives to capture current market trends and competitive dynamics.