SiteOne Landscape Supply PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SiteOne Landscape Supply Bundle

Uncover the critical external factors shaping SiteOne Landscape Supply's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes and economic fluctuations to technological advancements and environmental regulations, understand the forces driving change in the industry. This analysis provides actionable intelligence to inform your strategic planning and investment decisions. Download the full report now to gain a competitive advantage and navigate the future with confidence.

Political factors

Changes in land use and zoning laws significantly shape the landscaping industry. For SiteOne Landscape Supply, evolving regulations at both local and national levels can alter the scale and nature of projects, directly affecting product demand. For instance, mandates for increased green spaces in urban areas, as seen in many 2024 planning initiatives, can boost demand for native plants and sustainable materials. Conversely, stricter development restrictions might slow down large-scale commercial landscaping, impacting sales of hardscape materials. Staying ahead of these policy shifts is essential for strategic inventory management and market positioning.

Fluctuations in international trade policies, particularly the imposition of tariffs on key imported materials like steel, aluminum, and lumber, directly impact SiteOne's cost of goods. For example, tariffs enacted in recent years have already increased the cost of certain building materials used in landscaping projects.

These tariffs can lead to higher input costs for a range of SiteOne's products, including outdoor lighting fixtures, hardscape materials, and specific irrigation components. This cost pressure can strain SiteOne's profitability and necessitate adjustments to pricing strategies, potentially affecting customer affordability.

Looking ahead, the ongoing discussions and potential for new tariffs in 2025 present a continued risk to SiteOne's supply chain. An increase in tariffs on construction-related materials, which often include landscaping supplies, could further escalate input expenses for the company.

Government investment in infrastructure and public works plays a crucial role in shaping demand for landscape supplies. For instance, the US government's commitment to upgrading public parks and transportation networks often translates into increased opportunities for companies like SiteOne. In 2024, federal infrastructure spending, boosted by initiatives like the Bipartisan Infrastructure Law, is expected to continue supporting projects that require extensive landscaping and hardscaping materials.

Increased public spending on parks and commercial developments directly fuels SiteOne's revenue streams. These projects often necessitate large volumes of irrigation systems, turf products, and hardscape materials, areas where SiteOne holds significant market share. For example, state and local governments often allocate substantial budgets for park renovations and new community spaces, creating a consistent demand for these supplies.

Conversely, any contraction in government spending on these initiatives can present headwinds. Budgetary constraints or shifts in political priorities could lead to project delays or cancellations, directly impacting SiteOne's sales volumes for large-scale projects. This highlights the sensitivity of SiteOne's business to the fiscal health and spending priorities of various government levels.

Labor and Immigration Policies

The landscaping industry, a core market for SiteOne Landscape Supply, is highly sensitive to labor availability and immigration policies. In 2024, persistent labor shortages continued to challenge the sector, with many landscaping businesses reporting difficulties in finding and retaining qualified workers. This scarcity directly impacts the operational capacity of SiteOne's customer base, potentially limiting their ability to take on new projects and, consequently, their demand for SiteOne's products and services.

Changes in government regulations, particularly concerning immigration and temporary work visas like the H-2B program, can significantly affect the labor pool. For instance, the H-2B visa cap, which dictates the number of foreign workers who can temporarily come to the U.S. for non-agricultural jobs, has historically faced demand exceeding supply. In early 2024, the Department of Labor announced allocations for the H-2B program, but the availability and timing of these visas remain a critical factor for many landscaping companies relying on this workforce.

Furthermore, shifts in domestic labor laws, such as increases in the minimum wage, directly influence the cost of labor for SiteOne's customers. As of late 2024 and into 2025, several states and municipalities are implementing or considering higher minimum wage rates, which could increase operating expenses for landscaping firms. This could lead to price adjustments on services, potentially affecting project budgets and the overall demand for landscaping materials supplied by SiteOne.

- Labor Shortages: In 2024, the U.S. landscaping sector continued to grapple with a significant shortage of skilled and unskilled labor, impacting project completion timelines for many businesses.

- H-2B Visa Program: The H-2B visa program remains a crucial, albeit often unpredictable, source of seasonal labor for landscaping companies; demand for these visas frequently outstrips available allocations.

- Minimum Wage Increases: Anticipated minimum wage hikes in various U.S. states and cities throughout 2024-2025 are expected to raise labor costs for landscaping businesses, potentially influencing their pricing and purchasing decisions.

Political Stability and Economic Policy Shifts

Political stability is a key consideration for SiteOne Landscape Supply. Election cycles, such as the upcoming 2024 US presidential election, can create a period of uncertainty. This uncertainty might lead to a more cautious approach from consumers and businesses regarding discretionary spending on landscaping, directly impacting demand for SiteOne's offerings.

Shifts in economic policy are also critical. For instance, changes in interest rates or government spending on infrastructure and housing projects can significantly influence the construction and renovation sectors, which are major drivers for SiteOne's customer base. In 2023, the US Federal Reserve's monetary policy adjustments, including interest rate hikes, aimed at curbing inflation, likely had a dampening effect on new construction and home improvement projects, thus influencing demand for landscaping supplies.

Government incentives or tax credits related to homeownership or green initiatives could provide a tailwind for SiteOne. Conversely, tighter credit conditions or reduced consumer confidence due to political instability could pose headwinds. The Biden administration's focus on infrastructure spending, including elements that could support green infrastructure, presents potential opportunities for the landscaping sector.

- Election Cycle Impact: Uncertainty in election years (e.g., 2024 US Presidential Election) can temper consumer and business spending on landscaping projects.

- Fiscal Policy Influence: Changes in tax policies and government support for the housing market directly affect demand for SiteOne's products.

- Monetary Policy Effects: Interest rate decisions, like those made by the Federal Reserve in 2023 to combat inflation, can slow down construction and renovation, impacting landscaping supply demand.

- Infrastructure Spending: Government initiatives, such as the Bipartisan Infrastructure Law in the US, can create opportunities within the green infrastructure and landscaping sectors.

Government spending on infrastructure and public works projects, such as park upgrades and transportation networks, directly boosts demand for SiteOne's products. In 2024, federal infrastructure spending, supported by initiatives like the Bipartisan Infrastructure Law, continued to fuel projects requiring significant landscaping and hardscaping materials. This increased public investment translates into higher revenue for SiteOne, particularly in areas like irrigation systems and turf products.

Political decisions regarding land use and zoning laws critically influence the landscaping sector. Evolving regulations at local and national levels can impact project scale and material demand. For example, mandates for more urban green spaces in 2024 planning initiatives tend to increase demand for native plants and sustainable materials, benefiting companies like SiteOne.

Trade policies and tariffs on materials such as steel, aluminum, and lumber directly affect SiteOne's cost of goods sold. Tariffs implemented in previous years have already raised the cost of essential building materials used in landscaping, impacting profitability and potentially necessitating price adjustments for customers in 2024 and 2025.

Labor availability, heavily influenced by immigration policies and domestic labor laws, remains a key political factor for SiteOne. In 2024, ongoing labor shortages challenged the industry, affecting the capacity of SiteOne's clients. Changes to programs like the H-2B visa, which provides seasonal labor, and potential minimum wage increases in 2024-2025, further shape the operational costs and workforce dynamics for landscaping businesses.

What is included in the product

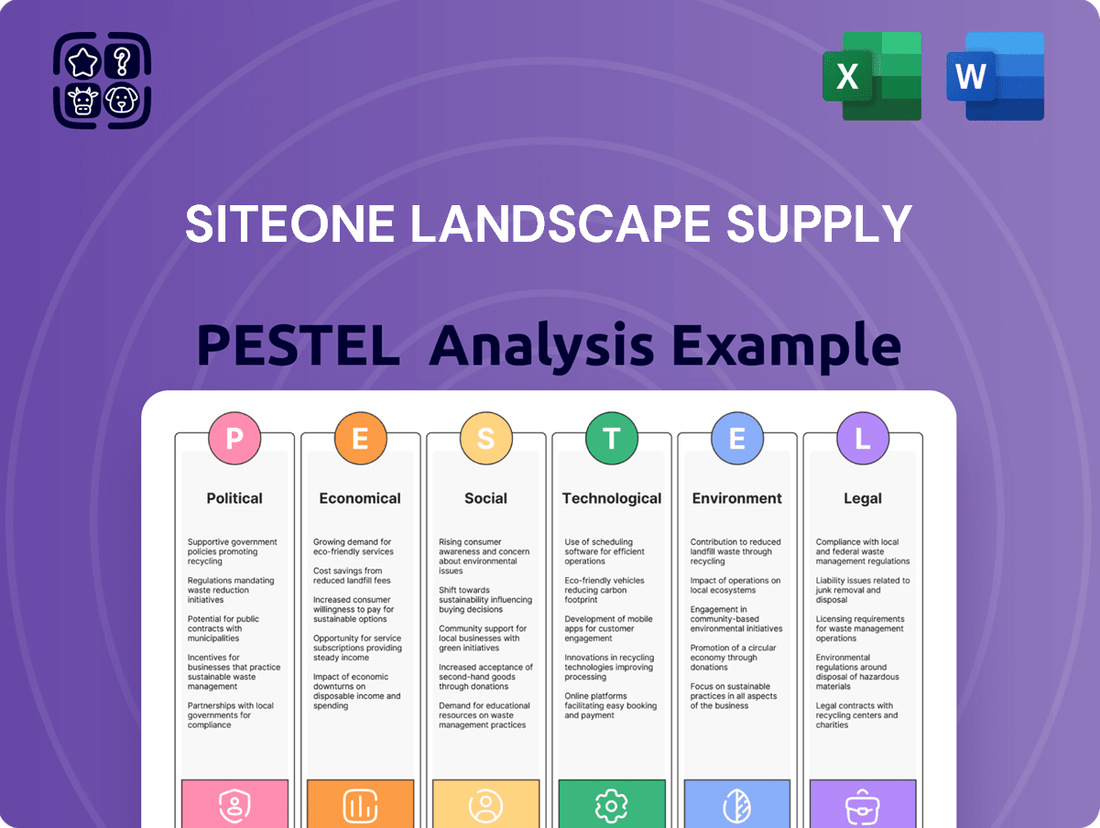

This PESTLE analysis of SiteOne Landscape Supply meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations and strategic positioning.

It provides actionable insights and forward-looking perspectives to identify potential threats and opportunities for SiteOne within the dynamic landscape supply industry.

This PESTLE analysis for SiteOne Landscape Supply acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during meetings, ensuring all stakeholders understand market dynamics.

Economic factors

The health of the U.S. housing market, especially single-family home construction and residential renovations, is a critical influencer for SiteOne Landscape Supply. As of late 2024 and into 2025, the market shows signs of stabilization after a period of adjustment. New housing starts, a key indicator, have seen fluctuations, but the underlying demand for residential properties remains a significant factor for landscape services.

A robust housing market directly translates to increased demand for SiteOne's offerings. When more homes are built or renovated, there's a greater need for new landscape installations, including irrigation systems, hardscaping elements, and plant materials. This uptick in construction activity fuels SiteOne's sales across its product categories.

Conversely, any downturn in housing construction or a slowdown in home sales can present challenges for SiteOne. Reduced new builds and fewer renovation projects mean less demand for the products and services the company provides, potentially impacting revenue and growth prospects. For instance, a projected 5% decrease in single-family housing starts for 2025 could mean a direct impact on demand for landscape materials.

Rising interest rates, particularly the Federal Reserve's benchmark rate which saw multiple increases throughout 2023 and continued into early 2024, directly impact SiteOne Landscape Supply. Higher borrowing costs can make it more expensive for SiteOne to finance inventory and expansion. This also affects their customers, especially larger commercial developers, who rely on credit for significant landscaping projects.

Elevated interest rates also dampen consumer spending on discretionary items like landscaping. With mortgage rates hovering around 7% in early 2024, potential homebuyers may postpone purchases or renovations. This reduced demand for new homes and home improvements directly translates to lower sales volumes for landscape materials such as pavers, mulch, and plants.

Inflationary pressures have a direct impact on SiteOne Landscape Supply, affecting the costs of essential inputs like raw materials, transportation, and labor. These rising costs can squeeze profit margins if not effectively managed or passed on to customers.

In 2024, SiteOne actually saw a period of commodity price deflation. While this might sound good, it temporarily put a damper on their organic daily sales growth, and also impacted their gross margin and adjusted EBITDA margin. This highlights how sensitive their financial performance is to these price swings.

Effectively navigating the volatility of material costs is paramount for SiteOne's profitability. Key components like fertilizer, materials for hardscapes, and parts for outdoor lighting are subject to price fluctuations that require careful management and strategic sourcing.

Consumer Spending and Disposable Income

Consumer confidence and the amount of disposable income individuals have directly impact how much they spend on things like home improvements and making their outdoor spaces nicer. When people feel good about the economy and have more money left over after bills, they tend to open their wallets for these kinds of projects.

A strong economy, marked by high consumer spending, typically means more business for SiteOne Landscape Supply. This is because people are more willing to buy their wide variety of products, from everyday lawn maintenance items to higher-end materials for patios and sophisticated outdoor lighting systems.

- Consumer Confidence Index: The Conference Board's Consumer Confidence Index in May 2024 stood at 102.0, indicating a cautious but generally stable outlook among consumers, which supports discretionary spending.

- Disposable Income Growth: Personal disposable income in the U.S. saw a notable increase in early 2024, providing consumers with more funds for non-essential purchases like landscaping and home enhancement projects.

- Home Improvement Spending Trends: Projections for 2024 suggest continued investment in home improvement, with outdoor living spaces being a particular focus, directly benefiting suppliers like SiteOne.

Overall Economic Growth and Recession Risks

The overall economic health is a crucial driver for SiteOne Landscape Supply. As of early 2025, economic indicators suggested continued, albeit moderating, growth in the US economy. Projections for 2025 GDP growth were around 2.0% to 2.5%, indicating a stable environment for discretionary spending, which includes landscaping services and supplies.

However, the specter of recession risks, though diminished from earlier forecasts, remains a concern. A significant economic slowdown or recession could curtail both new commercial development and homeowner investment in landscape upgrades. This would directly impact SiteOne's sales volumes, as projects are often deferred during periods of economic uncertainty.

The landscaping sector generally demonstrates a degree of resilience, often being one of the last sectors to be significantly impacted by economic downturns. Nevertheless, a sharp contraction in economic activity would inevitably lead to reduced demand for SiteOne's products and services. For instance, a decline in consumer confidence, a key indicator of future spending, could signal a downturn in residential project starts.

- GDP Growth: US GDP projected to grow between 2.0% and 2.5% in 2025, supporting consumer and business spending.

- Recession Risk: While moderate, potential for economic contraction could impact discretionary spending on landscaping.

- Consumer Confidence: Fluctuations in consumer sentiment directly influence demand for residential landscaping projects.

- Commercial Development: Economic stability is vital for new construction and renovation projects that require landscaping services.

Economic factors significantly influence SiteOne Landscape Supply. The health of the housing market and consumer confidence directly correlate with demand for landscaping services and materials. While economic growth in early 2025 projected around 2.0% to 2.5% GDP growth supports discretionary spending, any economic slowdown could impact project starts and sales volumes.

| Economic Indicator | Value/Projection (Early 2025) | Impact on SiteOne |

| US GDP Growth | 2.0% - 2.5% | Supports discretionary spending on landscaping. |

| Consumer Confidence Index | 102.0 (May 2024) | Indicates stable outlook, supporting home improvement spending. |

| Interest Rates (Fed Benchmark) | Hovering around 5.25%-5.50% | Increases borrowing costs for SiteOne and customers. |

Full Version Awaits

SiteOne Landscape Supply PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive SiteOne Landscape Supply PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping SiteOne's strategic landscape. Every section, from market trends to regulatory challenges, is presented as is, ensuring you get the complete picture for your business planning.

Sociological factors

The desire for expanded outdoor living areas is a significant sociological driver for SiteOne Landscape Supply. Homeowners are increasingly investing in creating functional and aesthetically pleasing outdoor spaces, transforming backyards into extensions of their indoor living environments. This trend fuels demand for materials like pavers and natural stone for patios, as well as components for outdoor kitchens and fire pits.

This shift is evident in market data, with the global outdoor living market projected to reach $128.7 billion by 2027, growing at a compound annual growth rate of 4.5% according to industry reports. SiteOne directly benefits from this as sales of hardscape materials, a core product category, saw robust growth in fiscal year 2023, driven by these consumer preferences.

Furthermore, the emphasis on landscaping as a means to enhance property value and personal well-being contributes to the demand for SiteOne's diverse product offerings. This includes specialized plant materials and outdoor lighting solutions, as consumers seek to create inviting and usable outdoor sanctuaries.

The landscaping sector, including SiteOne's customer base, continues to grapple with a significant labor shortage. This is largely due to an aging workforce, with many experienced professionals nearing retirement. For instance, in 2023, the average age of a landscape worker was reported to be in the late 40s, highlighting a demographic challenge.

Furthermore, there's a noticeable decline in younger generations expressing interest in demanding, manual outdoor labor. This lack of new entrants exacerbates the problem, creating a gap that's difficult to fill. Competition from other industries offering potentially more appealing work environments or benefits also draws potential workers away from landscaping.

This scarcity of skilled labor directly impacts SiteOne's professional clients. They may find it challenging to secure enough workers to complete projects on time and at the desired scale. Such operational hurdles for landscapers can translate into reduced project backlogs and potentially lower demand for the supplies and equipment SiteOne provides, indirectly affecting its sales volume.

The situation is further complicated by wage pressures. As labor becomes scarcer, companies are often forced to increase wages to attract and retain employees. In 2024, average hourly wages in the landscaping and grounds maintenance sector saw an approximate 5% increase compared to the previous year, adding to the operational costs for SiteOne's customers and potentially impacting their purchasing power.

Consumers and businesses are increasingly prioritizing eco-friendly and sustainable landscaping practices, a trend that significantly influences purchasing decisions. This societal shift is directly driving demand for products like drought-tolerant plants and water-saving smart irrigation systems.

The growing preference for sustainability is also boosting sales of organic fertilizers and permeable hardscape materials, pushing companies like SiteOne to expand their environmentally conscious product lines. For instance, in 2024, the market for green building materials, which includes sustainable landscaping elements, saw continued robust growth, with projections indicating a CAGR of over 7% through 2030.

Urbanization and Green Infrastructure Development

The accelerating pace of urbanization worldwide presents a significant opportunity for SiteOne Landscape Supply. As more people move into cities, there's a growing emphasis on creating livable urban environments, which directly fuels demand for landscape products and services. This trend is particularly evident in the push for green infrastructure, incorporating elements like parks, green roofs, and permeable pavements to manage stormwater and improve air quality.

SiteOne is well-positioned to capitalize on this shift. Their product offerings are essential for municipal projects and commercial developments focused on sustainability and enhancing urban aesthetics. For instance, the increasing adoption of vertical gardens and bioswales in city planning translates into greater demand for specialized soil, plants, and hardscaping materials that SiteOne supplies. This aligns perfectly with the global drive to create more resilient and environmentally friendly urban spaces.

Consider the impact of smart city initiatives: Many of these integrate green spaces as core components. For example, by 2025, it's projected that over 60% of the world's population will reside in urban areas, a statistic from the UN highlighting the scale of this demographic shift. This means more investment in public spaces and private developments that incorporate green infrastructure. SiteOne's role in providing the necessary materials for these projects is therefore critical.

- Urban Population Growth: Projections indicate continued urbanization, with a substantial portion of global population growth occurring in cities.

- Green Infrastructure Investment: Municipalities and private developers are increasingly allocating budgets towards green infrastructure projects to combat climate change impacts and improve urban livability.

- Demand for Sustainable Solutions: Consumer and governmental preferences are leaning towards environmentally friendly landscaping materials and practices, benefiting companies like SiteOne that offer such products.

- Vertical Farming & Green Walls: The growth in urban agriculture and the aesthetic appeal of green walls in commercial and residential buildings create niche markets for specialized landscape supplies.

Do-It-Yourself (DIY) vs. Professional Services Trends

Consumer behavior continues to evolve, with a noticeable split in landscaping preferences. While some homeowners are embracing DIY projects, driven by cost savings and a desire for personal fulfillment, a significant segment still relies on professional contractors for expertise and convenience. This dual trend directly affects how companies like SiteOne, which primarily caters to professionals, might see shifts in product demand or the potential growth of their retail distribution channels. For instance, a growing DIY market could lead to increased sales of smaller, more user-friendly products through big-box retailers, indirectly impacting the volume of bulk materials ordered by landscape professionals.

The DIY surge is often fueled by accessible online tutorials and a greater availability of consumer-grade tools and materials. However, the complexity of larger landscaping projects, such as intricate hardscaping or advanced irrigation systems, often necessitates professional intervention. Data from the National Association of Home Builders (NAHB) in 2024 indicated that while home improvement spending by homeowners remains robust, professional installation is still the preferred route for projects exceeding a certain complexity threshold. This suggests that while the DIY market might grow, the core professional market for SiteOne remains a strong anchor.

- DIY Market Growth: Homeowner interest in DIY landscaping projects has seen a steady rise, particularly for smaller-scale enhancements like planting annuals or mulching.

- Professional Reliance: For larger, more complex projects such as patio construction or full lawn renovations, a significant majority of homeowners (estimated over 60% in recent surveys) still opt for professional landscape contractors.

- Product Channel Impact: A strong DIY sector could increase demand for smaller, packaged goods sold through retail outlets, potentially diverting some volume from professional-grade bulk purchases.

- SiteOne's Position: SiteOne's focus on professional contractors means they are less directly impacted by the DIY trend but can benefit from increased overall market activity and potentially supply products to retail partners.

The increasing demand for outdoor living spaces remains a powerful sociological driver for SiteOne Landscape Supply. Homeowners are investing more in creating functional and attractive outdoor areas, boosting sales of hardscape materials and outdoor living components. This trend is supported by market data showing the global outdoor living market projected to reach $128.7 billion by 2027.

A significant challenge is the persistent labor shortage within the landscaping sector, exacerbated by an aging workforce and a lack of interest from younger generations in manual outdoor labor. In 2023, the average age of a landscape worker was in the late 40s, impacting SiteOne's professional clients' ability to complete projects and potentially reducing their demand for supplies.

Consumers and businesses are increasingly prioritizing eco-friendly and sustainable landscaping practices, driving demand for products like drought-tolerant plants and water-saving irrigation systems. The market for green building materials, including sustainable landscaping elements, saw robust growth in 2024, with projections indicating a CAGR of over 7% through 2030.

Urbanization continues to fuel demand for landscape products and services as cities focus on livable environments and green infrastructure. By 2025, over 60% of the global population is expected to reside in urban areas, increasing investment in public and private green spaces, which directly benefits SiteOne's supply chain.

Technological factors

Technological advancements in smart irrigation systems are rapidly transforming water management in landscaping. These systems, which leverage sensors and real-time weather data, are seeing significant uptake, with the global smart irrigation market projected to reach over $3.9 billion by 2027, growing at a CAGR of 15.3% according to some reports. This trend highlights a growing demand for efficient water usage solutions.

SiteOne Landscape Supply can capitalize on this by expanding its portfolio of advanced irrigation products. Offering solutions that emphasize water conservation directly addresses the needs of environmentally conscious consumers and clients operating in regions with water use restrictions. For instance, systems that can adjust watering schedules based on soil moisture levels or predicted rainfall can reduce water consumption by up to 50%.

The ongoing surge in e-commerce and digital platforms demands that SiteOne Landscape Supply bolster its online capabilities. This means investing in user-friendly ordering systems and digital resources for their clientele, particularly professional landscape contractors who value efficiency. In 2024, the global e-commerce market is projected to exceed $7 trillion, highlighting the critical need for SiteOne to maintain a strong digital presence.

Offering customers easy access to product information, real-time pricing, and streamlined order tracking through digital channels significantly improves customer satisfaction and internal operations. By 2025, it's anticipated that over 80% of B2B transactions will involve some form of digital interaction, underscoring the importance of these investments for SiteOne.

Beyond simple purchasing, SiteOne can further differentiate itself by providing advanced digital tools that assist customers with job planning and project management. This integrated approach supports contractors in managing their businesses more effectively, fostering loyalty and driving sales.

The growing integration of automation and robotics in landscaping presents a significant technological shift. For instance, the global robotic lawnmower market was valued at approximately $1.8 billion in 2023 and is projected to reach over $4.5 billion by 2030, indicating strong adoption trends. This trend directly impacts SiteOne's customer base, offering a solution to persistent labor shortages in the industry. Autonomous equipment can significantly boost operational efficiency, allowing landscaping businesses to take on more projects with fewer staff.

SiteOne Landscape Supply must strategically position itself to capitalize on this technological advancement. This may involve expanding its product catalog to include specialized blades, charging stations, or maintenance kits for robotic mowers and other autonomous units. Furthermore, exploring partnerships or direct distribution agreements with manufacturers of this innovative equipment could open new revenue streams and solidify SiteOne's role as a comprehensive supplier to the evolving landscaping sector.

Supply Chain Technology and Logistics Optimization

SiteOne Landscape Supply's reliance on efficient logistics means embracing advanced supply chain technologies is paramount. Innovations like AI-powered demand forecasting and real-time shipment tracking are key to optimizing inventory levels and minimizing delivery lead times across its extensive North American network. Automation in distribution centers further streamlines operations, ensuring product availability and reducing operational costs.

The company benefits significantly from these technological advancements by improving its ability to manage a diverse product catalog, from bulk landscape materials to specialized equipment. For instance, implementing predictive analytics can anticipate seasonal demand spikes, allowing for proactive inventory adjustments. This technological integration directly impacts SiteOne's resilience, enabling quicker responses to disruptions and maintaining service reliability for its customers.

Key technological factors influencing SiteOne include:

- AI-Driven Forecasting: Improved accuracy in predicting product demand, reducing stockouts and overstock situations.

- Real-Time Tracking: Enhanced visibility into inventory and shipments, leading to better route planning and reduced transit times.

- Warehouse Automation: Increased efficiency in order fulfillment and inventory management, lowering labor costs and speeding up processing.

- Supply Chain Visibility Platforms: Comprehensive data integration across the supply chain to identify bottlenecks and optimize flow.

By leveraging these technologies, SiteOne aims to achieve a competitive edge through superior operational efficiency and customer service. The ongoing digital transformation in logistics, with investments in areas like route optimization software and autonomous warehousing solutions, will continue to shape SiteOne's operational capabilities through 2025 and beyond.

Data Analytics and Business Intelligence

SiteOne Landscape Supply is increasingly leveraging data analytics and business intelligence to understand customer behavior and market trends. This allows for more precise inventory management, reducing waste and ensuring product availability, a critical factor in the seasonal landscape supply industry. For instance, by analyzing historical sales data and correlating it with weather patterns, SiteOne can optimize stock levels for specific regions, potentially saving millions in carrying costs and lost sales.

The insights generated from these technologies directly influence marketing strategies, enabling more targeted campaigns and personalized customer offers. This data-driven approach can also pinpoint operational bottlenecks, leading to improved efficiency across distribution centers and retail locations. By mid-2025, SiteOne aims to have integrated advanced predictive analytics into its supply chain, forecasting demand with up to 95% accuracy for key product categories.

- Enhanced Customer Insights: Analyzing purchasing data to tailor product offerings and promotions.

- Optimized Inventory Management: Using predictive analytics to reduce stockouts and overstock situations.

- Improved Operational Efficiency: Identifying and rectifying inefficiencies in logistics and distribution.

- Data-Informed Product Development: Understanding market demand to guide the introduction of new landscaping products.

Technological advancements in smart irrigation are driving efficiency, with the global market expected to surpass $3.9 billion by 2027. SiteOne can expand its offerings in water conservation solutions, potentially reducing water usage by up to 50% with advanced systems. Furthermore, the company must enhance its e-commerce presence, as over 80% of B2B transactions are projected to involve digital interaction by 2025, supporting a global e-commerce market exceeding $7 trillion in 2024.

Legal factors

Increasingly stringent water conservation regulations, particularly in states like California, are a significant legal factor affecting SiteOne Landscape Supply. These regulations, often spurred by climate change and drought, directly influence customer demand. For instance, California's mandates for efficient water use and restrictions on watering non-functional turf areas compel landscapers and consumers to seek out water-wise solutions.

This shift mandates that SiteOne actively supply a greater volume of drought-tolerant plants, advanced smart irrigation systems, and permeable hardscape materials. These product categories are becoming essential for compliance and are driving sales growth in affected regions. The legal framework directly shapes the market for SiteOne's offerings, pushing innovation and product mix towards sustainability.

Evolving regulations around pesticide and fertilizer use directly impact SiteOne Landscape Supply's product sales. For instance, as of early 2024, several states are implementing or considering bans on neonicotinoid pesticides, a common ingredient in many professional lawn care products, which could affect SiteOne's inventory and sales strategies.

This regulatory landscape necessitates a strategic shift for SiteOne. The company is increasingly focusing on distributing organic alternatives, bio-stimulants, and other environmentally friendly products to meet growing demand and comply with stricter environmental protection laws.

Compliance with chemical handling and storage regulations is also paramount. SiteOne must ensure its operations adhere to evolving standards, which could involve investments in infrastructure or training to safely manage its product lines, particularly as some jurisdictions tighten rules on specific fertilizer components like phosphorus.

Changes in local building codes and safety standards for hardscapes, like pavers and retaining walls, directly impact product specifications and installation methods. For instance, stricter seismic or wind load requirements in certain regions might necessitate different base materials or anchoring techniques, affecting product demand and design. SiteOne Landscape Supply must stay abreast of these evolving regulations across its operational areas to ensure its hardscape offerings, such as their interlocking paver systems, remain compliant and competitive. In 2023, the International Code Council released updated provisions for the 2024 International Building Code, which included refinements to soil reinforcement and retaining wall design standards that will likely cascade into local ordinances.

SiteOne's commitment to customer education on compliance is crucial. Providing resources and training on proper installation techniques that adhere to new safety standards, such as updated guidelines for permeable pavement infiltration rates, helps their landscape contractor customers avoid costly rework and legal issues. This proactive approach not only builds trust but also positions SiteOne as a knowledgeable partner in navigating the complex regulatory landscape of hardscape construction, ensuring projects meet the required safety benchmarks and longevity.

Labor Laws and Employment Regulations

SiteOne Landscape Supply must navigate a complex web of labor laws and employment regulations across its operating regions. Compliance with mandates like minimum wage, overtime, worker safety standards (OSHA), and employment eligibility verification (e.g., I-9 forms in the US) is non-negotiable for both SiteOne and its professional contractor customers. Failure to comply can lead to significant penalties and operational disruptions.

Recent data highlights the impact of these regulations. For instance, as of January 1, 2024, numerous US states and cities increased their minimum wage, directly affecting labor costs for businesses like SiteOne. The Bureau of Labor Statistics reported in late 2023 that the average hourly wage for landscaping and groundskeeping workers was around $18-$19, a figure that will likely see upward pressure due to these legislative changes.

Potential shifts in labor laws could influence SiteOne's hiring strategies and the availability of skilled labor within the landscaping sector. For example, proposed changes to independent contractor classifications could impact how SiteOne engages with certain service providers, potentially increasing its direct employee base and associated costs. Staying abreast of these evolving legal frameworks is crucial for maintaining operational efficiency and managing labor expenses effectively.

- Minimum Wage Adjustments: Federal minimum wage remains $7.25/hour, but many states and cities have significantly higher rates, impacting SiteOne's direct labor costs.

- Worker Safety Regulations: OSHA compliance is paramount, with fines for violations potentially reaching tens of thousands of dollars per instance, affecting operational budgets.

- Employment Eligibility Verification: Strict adherence to I-9 compliance is essential to avoid penalties and ensure a legal workforce for SiteOne and its partners.

- Potential Classification Changes: Evolving rules around worker classification could alter SiteOne's reliance on independent contractors, impacting its labor model and costs.

Product Liability and Environmental Compliance

SiteOne Landscape Supply, as a major distributor, faces significant product liability challenges. They must ensure the safety and quality of a vast array of landscape products, from fertilizers to power equipment. Failure to do so could result in costly lawsuits and damage to their reputation. For instance, in 2024, the landscape industry continued to see increased scrutiny on the safety of chemical-based products, with regulatory bodies like the EPA actively enforcing compliance.

Environmental compliance is another critical legal factor for SiteOne. This covers the responsible storage, transportation, and disposal of various materials, including potentially hazardous chemicals and waste generated from hardscape installations. Staying abreast of evolving environmental regulations, such as those concerning water runoff and chemical containment, is paramount to avoid substantial fines and operational disruptions. As of early 2025, many states are enhancing their regulations on stormwater management and the disposal of construction debris, directly impacting landscape supply businesses.

- Product Safety Standards: Adherence to national and international product safety certifications is non-negotiable for SiteOne's extensive product catalog.

- Chemical Handling Regulations: Strict compliance with laws governing the storage, labeling, and transportation of fertilizers, pesticides, and other chemicals is essential.

- Waste Disposal Mandates: SiteOne must follow regulations concerning the proper disposal of materials like concrete washout, excess soil, and packaging waste from projects.

- Environmental Protection Agency (EPA) Oversight: Continuous monitoring and adherence to EPA guidelines on emissions, water quality, and hazardous material management are critical.

SiteOne Landscape Supply must navigate complex product liability laws, ensuring the safety and quality of its diverse inventory, from chemicals to equipment. For instance, in 2024, the EPA continued to enforce stringent regulations on pesticides and fertilizers, with potential fines for non-compliance reaching substantial figures, impacting distributor liability.

Environmental compliance is also crucial, covering the responsible handling and disposal of materials, including hazardous substances and construction waste. As of early 2025, updated stormwater management regulations in several states are increasing scrutiny on how landscape businesses manage runoff and debris, directly affecting SiteOne's operational requirements and potential liabilities.

The company's adherence to labor laws, including minimum wage and worker safety, is non-negotiable, with significant penalties for violations. With many states increasing minimum wages in 2024, labor costs are a key legal consideration, and OSHA fines can quickly escalate, affecting budgetary planning.

Changes in building codes and safety standards for hardscape materials, such as updated seismic requirements in regions like California, necessitate constant product adaptation and compliance checks for SiteOne's offerings.

| Legal Factor | Impact on SiteOne | Relevant 2024/2025 Data |

| Water Conservation Regulations | Drives demand for drought-tolerant products and smart irrigation. | California continues to implement strict water use mandates. |

| Pesticide/Fertilizer Use | Necessitates a shift to organic and environmentally friendly alternatives. | Several states considered or implemented bans on neonicotinoids in 2024. |

| Labor Laws | Affects direct labor costs and hiring strategies. | Numerous US states increased minimum wage in 2024; average landscaping wages hover around $18-$19/hr. |

| Product Liability | Requires rigorous product safety and quality control. | EPA continued enforcement on chemical safety in 2024. |

| Environmental Compliance | Governs storage, transport, and disposal of materials. | Enhanced stormwater management regulations enacted in early 2025 in multiple states. |

Environmental factors

The increasing prevalence of prolonged droughts and water scarcity across many regions is significantly reshaping the landscaping industry, directly benefiting companies like SiteOne Landscape Supply. This environmental shift is compelling a stronger demand for water-wise solutions, influencing the very products SiteOne distributes.

Specifically, there's a growing market for drought-tolerant plants, xeriscaping materials, and advanced smart irrigation systems. These offerings align perfectly with the need for water efficiency, driving sales and shaping SiteOne's product mix. For instance, in California, a state frequently battling drought, water restrictions have spurred a surge in demand for low-water landscaping, a trend SiteOne is well-positioned to capitalize on.

Changing climate patterns are significantly altering plant hardiness zones, with some regions experiencing warmer winters and hotter summers. This shift directly impacts which plants can thrive, potentially making previously unsuitable species viable and stressing traditional favorites. For instance, the USDA Plant Hardiness Zone Map, last updated in 2012, is widely expected to be revised in 2024/2025 to reflect these warming trends, with many areas potentially moving up a zone.

SiteOne Landscape Supply needs to proactively adapt its inventory to include plant and turf varieties that demonstrate resilience to these evolving local climates. This involves sourcing or developing cultivars better suited to increased heat, altered rainfall patterns, and potential drought conditions. Furthermore, the prevalence of certain pests and diseases is changing; warmer winters can allow more insects to survive, necessitating a focus on pest and disease management solutions that address these new threats.

For example, regions historically prone to specific fungal diseases might see a reduction, while others could face new insect infestations. SiteOne’s strategic response must include offering products and advice that help landscapers manage these dynamic environmental challenges, ensuring successful project outcomes for their clients. This adaptability is crucial for maintaining market leadership and customer satisfaction in a climate-impacted industry.

Consumers and businesses are increasingly prioritizing sustainability, driving a significant demand for eco-friendly landscaping. This translates to a growing market for organic fertilizers, water-wise native plants, and permeable paving solutions, all designed to minimize environmental impact.

SiteOne Landscape Supply is actively responding to this trend by expanding its portfolio of sustainable product offerings and refining its supply chain to support these greener alternatives. For instance, the demand for drought-tolerant plants has surged, with some regions reporting over a 20% increase in sales of such varieties in recent years.

The company's commitment to sourcing and promoting products with lower environmental footprints, such as recycled materials for hardscaping and biodegradable mulches, aligns directly with this evolving consumer preference. This strategic pivot is crucial for maintaining market relevance and capturing growth in the landscaping sector.

Waste Management and Recycling Regulations

Environmental regulations on waste disposal from landscaping projects, covering green waste, soil, and hardscape debris, directly affect contractor operational costs. This can influence how SiteOne Landscape Supply manages its material handling and product offerings. For instance, stricter landfill regulations in many regions, including California's organics diversion mandates aiming for 75% diversion by 2025, increase disposal fees for contractors, potentially impacting their purchasing decisions.

These evolving regulations create opportunities for SiteOne to bolster its service offerings by facilitating or directly providing recycling solutions for materials like concrete, asphalt, and wood waste. By embracing circular economy principles, SiteOne can reduce its own environmental footprint and offer value-added services that resonate with environmentally conscious clients. The U.S. EPA reported that in 2018, over 94 million tons of construction and demolition debris were generated, highlighting the scale of potential recycling efforts.

- Regulatory Impact: Increased disposal costs for landscaping debris due to landfill restrictions and diversion mandates.

- Market Trend: Growing demand for sustainable practices and waste reduction in the landscaping sector.

- SiteOne Opportunity: Potential to offer or partner for recycling services for green waste, soil, and hardscape materials.

- Data Point: California's goal to divert 75% of organic waste from landfills by 2025 exemplifies tightening environmental controls.

Energy Efficiency and Emissions Standards for Equipment

The increasing global emphasis on sustainability and the reduction of carbon footprints is directly influencing the landscaping industry. Stricter regulations and growing customer demand for environmentally friendly practices are pushing for a transition away from traditional gasoline-powered equipment towards more energy-efficient alternatives.

This shift presents both challenges and opportunities for companies like SiteOne Landscape Supply. The company's distribution network will need to adapt to accommodate a rising demand for electric or low-emission landscaping tools. For instance, the global electric lawn mower market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly, reaching an estimated $9.8 billion by 2030, showcasing a clear market trend towards greener equipment.

- Regulatory Push: Governments worldwide are implementing or strengthening emissions standards for off-road engines, impacting the availability and cost of traditional equipment.

- Consumer Demand: End-users, including professional landscapers and homeowners, are increasingly seeking out quieter, more efficient, and environmentally responsible equipment options.

- Technological Advancements: Battery technology and electric motor efficiency are rapidly improving, making electric landscaping tools more viable and powerful for professional use.

- SiteOne's Role: SiteOne is positioned to be a key facilitator in this transition by stocking and promoting these new technologies, potentially offering training and support for their adoption.

Climate change is directly impacting landscaping needs, driving demand for drought-tolerant plants and water-saving irrigation systems, areas where SiteOne Landscape Supply excels. Evolving plant hardiness zones, with warmer winters and hotter summers becoming more common, necessitate a shift in plant varieties, a trend highlighted by expected revisions to the USDA Plant Hardiness Zone Map in 2024/2025.

SiteOne must adapt its inventory to resilient cultivars, addressing new pest and disease patterns brought on by altered weather. The company is also responding to a growing consumer preference for sustainability by expanding its offerings of organic fertilizers and native plants, with sales of drought-tolerant varieties seeing significant increases in certain regions.

Environmental regulations, such as California's 2025 goal to divert 75% of organic waste, are increasing contractor costs for debris disposal, creating an opportunity for SiteOne to offer recycling solutions. Furthermore, the global push for reduced carbon footprints is fueling demand for electric landscaping equipment, with the electric lawn mower market projected for substantial growth, a trend SiteOne is poised to support.

PESTLE Analysis Data Sources

Our SiteOne Landscape Supply PESTLE Analysis is built on a foundation of credible data, drawing from official government reports, reputable industry publications, and economic trend forecasts. This comprehensive approach ensures that each factor—political, economic, social, technological, legal, and environmental—is informed by current and relevant information.