SiteOne Landscape Supply Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SiteOne Landscape Supply Bundle

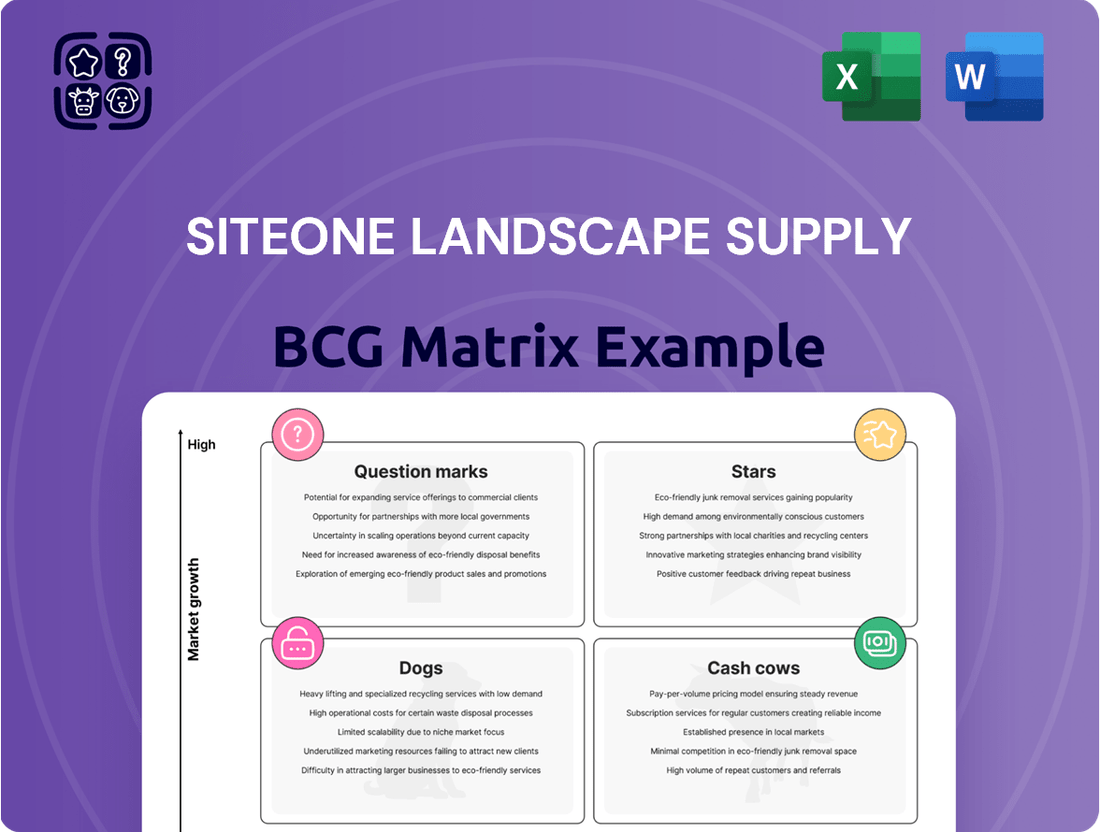

Curious about SiteOne Landscape Supply's product portfolio performance? This preview offers a glimpse into how their offerings might stack up on the BCG Matrix, potentially identifying their Stars, Cash Cows, Dogs, and Question Marks.

However, to truly unlock strategic advantage and make informed decisions about resource allocation and future investments, a deeper dive is essential.

Purchase the full SiteOne Landscape Supply BCG Matrix report to gain a comprehensive understanding of each product's market share and growth rate.

You'll receive detailed quadrant placements, expert analysis, and actionable recommendations tailored to their specific market position.

Don't miss out on the opportunity to refine your strategy and drive growth – get the complete picture today!

Stars

SiteOne's Digital Commerce Platform is a clear star in its BCG matrix. The company has experienced a remarkable surge in digital sales, with year-to-date online sales up over 170% by Q3 2024. This rapid expansion highlights a high-growth segment where SiteOne is effectively capturing market share.

Further solidifying its star status, digital sales continued their impressive trajectory, surging 140% year-over-year in Q1 2025. This sustained growth underscores the platform's success in attracting and retaining customers through enhanced digital engagement and simplified ordering experiences.

Investments in digital tools such as siteone.com and integration with solutions like DispatchTrack are pivotal. These initiatives not only boost customer connectivity but also significantly streamline operational efficiencies, reinforcing the platform's position as a key growth driver.

SiteOne Landscape Supply actively utilizes strategic acquisitions to broaden its market reach and product selection. In 2024 alone, the company completed seven acquisitions, with an additional two in the first quarter of 2025. This aggressive inorganic growth strategy is designed to strengthen SiteOne's presence in the fragmented $25 billion landscaping supply market.

Acquisitions like Millican Nurseries and Pacific Nurseries are key examples of this expansion. These moves not only bring in new geographic markets but also diversify SiteOne's product offerings, incorporating essential categories such as nursery goods and hardscapes. Furthermore, these acquisitions integrate skilled teams, reinforcing SiteOne's management capabilities.

This approach allows SiteOne to leverage its existing product portfolio by introducing it to the customer base of newly acquired companies. It also serves to enhance local market leadership by consolidating smaller players and improving operational efficiencies.

Sustainable & Eco-Friendly Landscape Products are emerging as a star in SiteOne Landscape Supply's portfolio. This growth is fueled by increasing consumer preference and stricter regulations favoring environmentally conscious landscaping. Products such as LESCO Moisture Manager, a range of drought-tolerant plants, permeable pavers, and efficient drip irrigation systems are key contributors, promoting water conservation and ecological well-being.

SiteOne's dedication to this segment is evident in their 2024 Impact Report, which emphasizes their expanding selection of sustainable options designed to cater to a shifting market demand. For instance, the company is actively increasing its offerings of recycled content in hardscape materials and promoting organic fertilizer options, reflecting a tangible commitment to environmental stewardship and market leadership in green solutions.

Advanced & Smart Irrigation Systems

The market for advanced irrigation systems is booming, driven by a strong demand for water efficiency and automation in landscaping. SiteOne Landscape Supply's smart irrigation and drip irrigation technologies are perfectly positioned to capitalize on this trend, addressing the growing need for better water management.

These innovative solutions offer significant benefits to customers by directly reducing water consumption and minimizing labor costs. This dual advantage makes SiteOne's advanced irrigation products highly desirable, marking them as key drivers of growth within the company's portfolio.

- Market Growth: The global smart irrigation market was valued at approximately $2.8 billion in 2023 and is projected to reach over $7.5 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 15%.

- Customer Benefits: Smart irrigation systems can reduce water usage by up to 50% compared to traditional methods, leading to substantial cost savings for end-users.

- SiteOne's Position: SiteOne's focus on smart and drip irrigation aligns with increasing environmental regulations and customer preferences for sustainable landscaping practices.

Premium Outdoor Living & Hardscape Solutions

Premium Outdoor Living & Hardscape Solutions represent a significant growth area for SiteOne Landscape Supply, aligning with the 'Star' category in a BCG Matrix analysis. Homeowners are increasingly prioritizing their outdoor spaces, driving demand for sophisticated hardscape materials like natural stone and advanced outdoor lighting systems. SiteOne's strategic expansion of its product lines, including the introduction of the Solstice brand for premium imported natural stone and improvements to its Pro-Trade offerings, positions the company to capitalize on this trend.

This segment exhibits strong growth potential and allows SiteOne to capture a larger market share. The market for outdoor living products saw robust growth in 2023, with many segments experiencing double-digit increases. For example, the natural stone segment, a key component of hardscaping, continued to show resilience and demand from consumers seeking durable and aesthetically pleasing outdoor features. SiteOne's investment in these premium offerings reflects a strategic move to lead in a high-value market.

- Market Trend: Increasing homeowner investment in outdoor living spaces.

- SiteOne's Strategy: Expansion of premium hardscape and lighting offerings, including Solstice natural stone and enhanced Pro-Trade lines.

- Growth Potential: High-growth segment with strong opportunities for market share expansion.

- Financial Implication: Represents a key driver for future revenue and profitability within SiteOne's portfolio.

SiteOne's Digital Commerce Platform is a clear star, with year-to-date online sales up over 170% by Q3 2024, and a continued surge of 140% year-over-year in Q1 2025. Investments in digital tools like siteone.com and integrations, such as DispatchTrack, are crucial for customer engagement and operational efficiency.

SiteOne Landscape Supply is strategically expanding its market presence through acquisitions, completing seven in 2024 and two in Q1 2025 to strengthen its position in the fragmented landscaping supply market. Acquisitions like Millican Nurseries and Pacific Nurseries broaden geographic reach and product offerings, integrating skilled teams and enhancing local market leadership.

Sustainable & Eco-Friendly Landscape Products are a growing star for SiteOne, driven by consumer preference and regulations. Products like LESCO Moisture Manager and drought-tolerant plants, along with increased offerings of recycled content in hardscapes, reflect a commitment to environmental stewardship and market leadership.

Advanced irrigation systems, including smart and drip technologies, are a star segment for SiteOne, capitalizing on the demand for water efficiency and automation. These solutions reduce water consumption by up to 50%, lowering costs for customers and aligning with environmental regulations.

Premium Outdoor Living & Hardscape Solutions are a star, with homeowners increasingly investing in outdoor spaces. SiteOne's expansion of premium lines, like Solstice natural stone and enhanced Pro-Trade offerings, positions them to capture market share in this high-growth segment.

| Category | Market Position | Growth Rate | SiteOne's Performance | Key Products/Initiatives |

| Digital Commerce | Star | High | Online sales +170% YTD Q3 2024; +140% YoY Q1 2025 | siteone.com, DispatchTrack integration |

| Acquisitions | Star | High | 7 acquisitions in 2024, 2 in Q1 2025 | Millican Nurseries, Pacific Nurseries |

| Sustainable Products | Star | High | Expanding selection of eco-friendly options | LESCO Moisture Manager, drought-tolerant plants, permeable pavers |

| Advanced Irrigation | Star | High | Capitalizing on water efficiency demand | Smart irrigation, drip irrigation systems |

| Premium Hardscapes | Star | High | Robust growth in outdoor living segment | Solstice natural stone, Pro-Trade enhancements |

What is included in the product

This BCG Matrix overview details SiteOne's product portfolio, categorizing them by market growth and share to guide strategic decisions.

A clear BCG Matrix visualizes SiteOne's business units, alleviating the pain of not knowing where to invest or divest.

Cash Cows

Core Irrigation Supplies, encompassing pipes, valves, and standard sprinklers, are SiteOne Landscape Supply's established cash cows. As the largest wholesale distributor in the industry, SiteOne commands a significant market share in these foundational products. The demand for these items remains consistently high for both new landscape projects and ongoing maintenance, creating a reliable and substantial revenue stream.

This segment benefits from a mature market where SiteOne's dominance translates into predictable and robust profitability. The essential nature of these supplies means less need for heavy marketing spend, allowing SiteOne to leverage its scale for efficient operations and sustained earnings. For instance, in 2024, SiteOne reported strong performance in its established product lines, reflecting the consistent demand for core irrigation components.

Standard fertilizers and control products represent SiteOne Landscape Supply's cash cows. These essential items, including basic fertilizers and herbicides, are the backbone of routine landscape maintenance and turf care, driving consistent sales volume. Their high-volume, recurring nature, particularly for landscape professionals, solidifies their position as significant cash flow generators for SiteOne due to their well-established market presence and substantial market share.

SiteOne's own LESCO brand exemplifies this strength, offering key products like PolyPlus-Opti, which focuses on efficient nutrient delivery, a critical factor for their customer base. For the fiscal year ending December 29, 2023, SiteOne reported net sales of $4.0 billion, with a significant portion attributed to these foundational product categories that professionals rely on season after season.

SiteOne Landscape Supply's traditional hardscape materials, like standard pavers and retaining wall blocks, are foundational to many construction and renovation projects. These products are essential for driveways, patios, and garden walls, making them consistently in demand across the country.

The company boasts a significant market share in this segment, thanks to its expansive distribution network and deep supplier partnerships. This allows SiteOne to efficiently supply these widely used materials to a broad customer base, ensuring steady sales and predictable revenue streams.

In 2024, the residential construction sector continued to show resilience, with hardscape projects remaining a popular choice for homeowners looking to enhance their outdoor living spaces. Data from the National Association of Home Builders indicated ongoing strength in single-family housing starts, which directly benefits demand for these core hardscape products.

These traditional hardscape items represent a mature but stable market, generating consistent cash flow for SiteOne. Their predictable demand and SiteOne's established position make them a reliable component of the company's overall portfolio, functioning as classic cash cows.

Extensive Branch Network & Distribution

SiteOne Landscape Supply's extensive branch network, boasting over 690 locations across North America, is a cornerstone of its success and a prime example of a cash cow. This vast physical footprint translates directly into superior local access for customers and highly efficient distribution of landscape supplies.

This significant competitive advantage in a fragmented market allows SiteOne to maintain a dominant market share and generate consistent revenue. The logistical efficiency and customer convenience offered by this widespread network are key drivers of their financial strength.

- Over 690 branch locations: This density ensures proximity and accessibility for a broad customer base.

- North American presence: SiteOne operates across the United States and Canada, providing broad market coverage.

- Logistical efficiency: The network facilitates streamlined inventory management and timely product delivery, reducing operational costs and enhancing customer satisfaction.

- Market share dominance: The extensive network supports SiteOne's position as a leading distributor in the landscape supply industry.

Maintenance End Market Products

Maintenance end market products represent a significant portion of SiteOne Landscape Supply's business, accounting for roughly 35% of total sales. This segment is characterized by its stability and resilience, driven by recurring purchases for essential lawn care, seasonal supplies, and general property upkeep. These products consistently enjoy high market share due to their steady demand, proving reliable even when the broader market experiences downturns.

In 2024, SiteOne demonstrated its strength in this area by successfully growing its market share within the maintenance segment. This growth underscores the company's ability to capture a larger piece of a dependable revenue stream.

- Stable Revenue Stream: Products for the maintenance end market, making up about 35% of SiteOne's sales, provide a consistent and dependable income source.

- Recurring Purchases: This includes items like lawn fertilizers, seasonal flower bulbs, and basic gardening tools, which customers buy repeatedly throughout the year.

- High Market Share: SiteOne holds a strong position in this segment, benefiting from consistent demand that remains steady regardless of economic fluctuations.

- 2024 Market Share Gains: The company actively increased its market share in the maintenance sector during 2024, reinforcing its leadership in this stable product category.

SiteOne's core irrigation supplies, including pipes, valves, and standard sprinklers, are definitive cash cows. As the industry's largest wholesale distributor, SiteOne maintains a commanding market share in these essential products. Their demand remains consistently robust for both new installations and ongoing upkeep, generating a dependable and substantial revenue stream.

These established product lines are characterized by a mature market, where SiteOne's dominance ensures predictable and strong profitability. The inherent necessity of these supplies minimizes the need for extensive marketing, allowing SiteOne to capitalize on its scale for operational efficiency and sustained earnings. For fiscal year 2024, SiteOne reported impressive performance in these foundational categories, reflecting sustained demand.

| Product Category | Market Position | Revenue Driver | 2024 Data Insight |

|---|---|---|---|

| Core Irrigation Supplies | Market Leader | Consistent, high-volume demand for new projects and maintenance | Strong 2024 performance in established lines |

| Standard Fertilizers & Control Products | Dominant Share | Recurring purchases for routine landscape care | LESCO brand strength (PolyPlus-Opti) |

| Traditional Hardscape Materials | Significant Share | Essential for residential and commercial outdoor construction | Benefited from resilient 2024 housing starts |

| Extensive Branch Network | Competitive Advantage | Customer accessibility and logistical efficiency | Over 690 North American locations |

| Maintenance End Market Products | High Share | Stable, recurring sales (approx. 35% of total sales) | Gained market share in 2024 |

What You’re Viewing Is Included

SiteOne Landscape Supply BCG Matrix

The SiteOne Landscape Supply BCG Matrix you're previewing is the definitive, final document you will receive immediately after purchase. This means no altered content or watermarks; you get the complete, professionally formatted analysis ready for immediate strategic application.

Rest assured, the BCG Matrix preview you're currently viewing is the identical, fully unlocked file you'll download upon completing your purchase. It’s meticulously prepared with actionable insights, ensuring you receive a comprehensive tool for evaluating SiteOne's product portfolio without any hidden surprises or additional steps.

Dogs

Outdated product SKUs represent SiteOne Landscape Supply's potential 'Dogs' in the BCG Matrix. These are typically older items, perhaps less efficient or superseded by newer technologies, that have seen sales volumes decline significantly. For instance, if a specific type of irrigation controller from a few years ago is no longer the industry standard, its sales might be very low.

Products in this category generally exhibit low market growth and low relative market share. This means they aren't attracting new customers, and SiteOne's share of the remaining market is also small. By the end of 2023, SiteOne managed inventory valued at $1.9 billion, and identifying and phasing out these 'Dog' SKUs is crucial for freeing up capital and warehouse space.

Tying up valuable shelf space and inventory with these underperforming items directly impacts profitability. For example, a product that generated less than $10,000 in sales in 2024, while requiring storage and management, is a clear candidate for review. SiteOne's strategic approach would involve systematically identifying these SKUs and implementing a plan to discontinue them.

Even with a vast network, some SiteOne Landscape Supply branches operate in markets with sluggish growth or face fierce local competition. This often results in a smaller market share and reduced profitability for these specific locations.

To address this, SiteOne actively manages underperforming assets. In the fourth quarter of 2024, the company took decisive action by consolidating or closing 16 branches. This strategic move aims to reallocate resources from locations that are not generating sufficient returns.

SiteOne Landscape Supply's highly niche products, those catering to very specific customer needs, often exhibit limited market demand. This translates to low sales volumes and, consequently, a small market share for these items within the broader landscape supply industry. For example, specialized irrigation components for rare plant species might only appeal to a handful of horticulturalists, keeping their sales figures modest.

These specialized offerings can be classified as Dogs in the BCG matrix if their low turnover and the associated high carrying costs surpass any strategic benefit they provide. Consider a line of custom-designed stone pavers for a particular architectural style; if these generate minimal sales and tie up significant inventory capital, their value proposition weakens considerably. A thorough assessment of their actual contribution versus their cost is crucial for deciding whether to retain, divest, or discontinue them. In 2023, the specialty horticultural supplies segment, which includes many such niche products, saw a global market size of approximately $1.5 billion, but with a growth rate of only 3%, indicating the limited scale these products often operate within.

Legacy Manual Operational Processes

Legacy manual operational processes at SiteOne Landscape Supply represent a potential drag on efficiency and profitability. These lingering analog workflows, which haven't been fully digitized or streamlined, can lead to increased operational expenses and diminished productivity. Without a clear avenue for high growth or significant market share expansion, these processes are prime candidates for modernization or outright elimination as SiteOne continues its digital transformation efforts.

These manual processes can manifest in several ways across the business:

- Inventory Management: Relying on paper-based tracking or outdated systems for stock levels can result in inaccuracies, leading to stockouts or overstocking, impacting sales and carrying costs.

- Order Processing: Manual entry of customer orders, especially for a large volume business like SiteOne, is prone to errors and delays, affecting customer satisfaction and order fulfillment speed.

- Employee Time Tracking: Traditional methods of recording employee hours can be cumbersome and less accurate than integrated digital solutions, potentially leading to payroll discrepancies and administrative overhead.

Commodity Products with Persistent Deflation

Certain commodity products within SiteOne's portfolio, like PVC pipe and grass seed, have faced persistent price deflation. For instance, PVC pipe saw a notable 21% price decrease in Q1 2025, while grass seed experienced a 10% drop during the same period. This trend directly impacts gross margins, as lower selling prices squeeze profitability.

These products remain integral to SiteOne's core offerings, but their future classification hinges on the company's ability to innovate. Without differentiation or added value, these commodities risk becoming "cash cows" that generate minimal returns due to sustained low profitability and a lack of growth in their underlying value.

- PVC Pipe Deflation: experienced a 21% price decrease in Q1 2025.

- Grass Seed Deflation: saw a 10% price reduction in Q1 2025.

- Margin Impact: These price drops directly compress gross margins.

- Potential Classification: Risk becoming cash cows if value-add strategies are not implemented.

SiteOne Landscape Supply's 'Dogs' in the BCG Matrix encompass outdated product SKUs, niche offerings with limited demand, and legacy manual operational processes. These elements typically exhibit low market growth and a low relative market share, hindering overall profitability and efficient capital allocation. Identifying and phasing out these underperformers is key to optimizing inventory and operational focus.

For example, a specific line of older, less efficient irrigation controllers might represent a 'Dog' if its sales have significantly declined and it no longer aligns with current industry standards. Similarly, highly specialized horticultural supplies, while serving a specific need, may have modest sales volumes and low growth, placing them in this category. By the end of 2023, SiteOne managed $1.9 billion in inventory, underscoring the importance of pruning such underperforming assets.

These 'Dogs' tie up valuable resources, including shelf space and capital, that could be better utilized elsewhere. For instance, a product generating less than $10,000 in sales in 2024, while incurring storage and management costs, is a prime candidate for discontinuation. SiteOne's strategic pruning, such as the consolidation or closure of 16 branches in Q4 2024, reflects an effort to reallocate resources from underperforming areas.

The global market for specialty horticultural supplies, where niche products reside, was valued at roughly $1.5 billion in 2023 with a modest 3% growth rate. This limited market scale can make niche items 'Dogs' if their carrying costs outweigh their strategic benefits, especially when compared to the potential returns from higher-growth categories.

Question Marks

The market for robotic and autonomous equipment in landscape maintenance is rapidly expanding, fueled by persistent labor shortages and a growing demand for efficiency. This burgeoning sector presents a significant opportunity for distributors. For instance, the global robotic lawn mower market alone was valued at approximately $1.7 billion in 2023 and is projected to reach over $4.4 billion by 2030, indicating a strong growth trajectory.

SiteOne Landscape Supply, while a dominant player in traditional landscape supplies, likely holds a nascent position in the distribution of these advanced autonomous solutions. Establishing a strong foothold requires substantial investment in new product lines, specialized training for sales and service teams, and the development of robust logistical support for these technologically advanced machines. Capturing a meaningful share of this high-growth segment will be crucial for future market leadership.

SiteOne Landscape Supply's focus on digital commerce is a strong foundation, but the true game-changer for market expansion lies in advanced digital design and planning software. Think of AI-powered tools that can streamline complex projects, optimize material usage, and even predict plant growth. This area is a classic high-growth, low-market-share opportunity, ripe for disruption.

The landscape industry is increasingly reliant on sophisticated software to stay competitive. Professionals need tools that go beyond basic visualization, offering features like automated irrigation design, cost estimation, and 3D rendering. SiteOne could significantly differentiate itself by offering or partnering to provide these cutting-edge solutions.

Developing or acquiring such advanced software requires a substantial investment, but the potential return is immense. Market research from 2024 indicates a growing demand for integrated design-build platforms within the green industry. Early adopters of AI in landscape design are already reporting increased efficiency and client satisfaction, signaling a clear trend.

Gaining significant market adoption will necessitate not only robust technology but also effective training and support for landscapers. SiteOne can leverage its existing distribution network to introduce and champion these new tools, fostering a loyal customer base that values innovation and efficiency.

SiteOne Landscape Supply could position specialized consulting for green infrastructure as a potential star in its BCG Matrix. This segment, focusing on large-scale stormwater management and sustainable landscape solutions, represents a high-growth market. While SiteOne’s direct involvement might be developing, the demand for expert guidance in this area is significant.

The green infrastructure market is projected for substantial growth, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 10% through 2030. SiteOne’s existing strong relationships within the landscape and construction sectors provide a solid foundation for building a consulting arm. By offering expertise in complex project design, permitting, and execution, SiteOne can capture a larger share of this lucrative, high-margin business.

Expansion into New, Untapped Geographic Markets

SiteOne Landscape Supply's expansion into new, untapped geographic markets positions these ventures as Stars within its BCG Matrix. While these markets offer substantial growth opportunities, SiteOne's initial presence is characterized by a low market share, necessitating significant capital infusion. For instance, in 2024, SiteOne continued its acquisition-led growth strategy, targeting regions where it had minimal or no prior presence, aiming to capture nascent market demand.

These new markets demand considerable investment in building out distribution networks, stocking appropriate inventory, and cultivating local talent to effectively serve customers. The company’s approach involves acquiring established local players to gain immediate market entry and leverage existing customer bases and operational efficiencies. This strategy is designed to accelerate market penetration and build a strong foundation for future growth in these high-potential areas.

- High Growth Potential: Emerging markets offer SiteOne opportunities to establish a dominant position in a rapidly expanding landscape supply sector.

- Low Initial Market Share: SiteOne enters these markets with limited brand recognition and customer penetration, requiring strategic efforts to build share.

- Significant Investment Required: Capital is allocated for infrastructure development, inventory expansion, and local team building to support growth.

- Acquisition-Driven Strategy: The company actively pursues acquisitions to gain immediate market access and operational capabilities in new territories.

Cutting-Edge Water Harvesting & Reuse Systems

The demand for advanced water harvesting and reuse systems, moving beyond simple drip irrigation, is on the rise. This growth is fueled by stricter environmental rules and growing water shortages, pushing the market towards more sophisticated solutions.

SiteOne Landscape Supply may currently hold a smaller market share in these specialized, high-investment systems. However, these represent a significant growth opportunity, aligning perfectly with the increasing focus on sustainability and the substantial capital required for their development.

The global smart water management market, which encompasses these advanced systems, was valued at approximately $17.7 billion in 2023 and is projected to reach around $37.3 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 11.2% during that period. This indicates a strong upward trend in demand for innovative water solutions.

- Market Growth Drivers: Increasing regulatory pressure for water conservation and the rising cost of potable water are key factors driving adoption of advanced systems.

- SiteOne's Potential: While market share might be nascent, the high-growth nature of this segment presents a strategic opportunity for SiteOne to invest and capture future market leadership.

- Investment Landscape: These systems are capital-intensive, requiring significant R&D and infrastructure, which can create barriers to entry but also offer substantial rewards for early movers.

- Sustainability Alignment: The focus on water reuse and harvesting directly supports environmental, social, and governance (ESG) initiatives, enhancing brand reputation and attracting socially conscious investors.

The market for advanced water harvesting and reuse systems is experiencing strong growth, driven by environmental concerns and regulations. SiteOne Landscape Supply has a potential opportunity in this high-growth but currently low-market-share segment, requiring significant capital investment.

This segment aligns with sustainability trends and offers substantial returns for early investors. The global smart water management market, a proxy for these systems, was valued at approximately $17.7 billion in 2023, with projections to reach $37.3 billion by 2030, reflecting an 11.2% CAGR.

SiteOne’s existing relationships in the industry provide a foundation, but success hinges on investing in specialized technologies and expertise to capture this expanding market.

These systems are capital-intensive, creating barriers to entry but also offering rewards for those who invest strategically.

| Segment | Market Growth | SiteOne's Market Share | Investment Required | BCG Classification |

|---|---|---|---|---|

| Advanced Water Harvesting & Reuse | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our SiteOne Landscape Supply BCG Matrix leverages a blend of internal financial statements, supplier sales data, and market research reports. This data is augmented by industry trend analysis and competitor performance metrics.