Shiga Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiga Bank Bundle

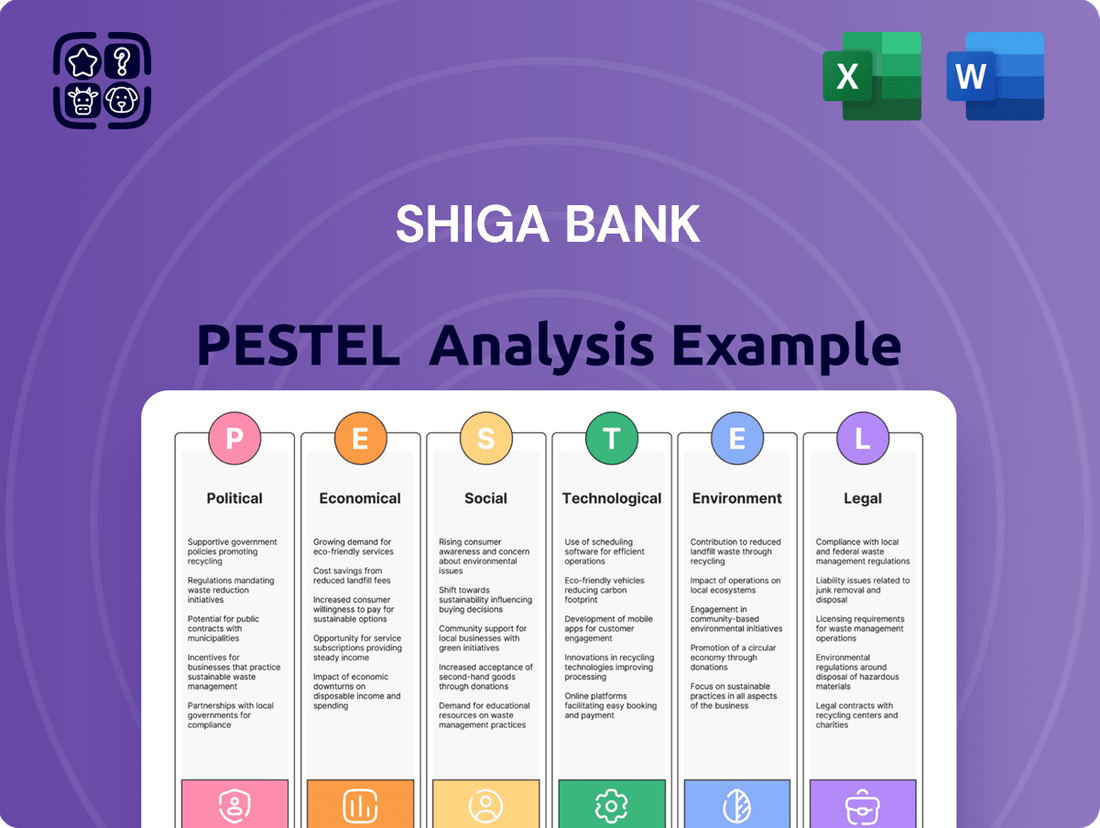

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Shiga Bank's future. This expertly crafted PESTLE analysis provides the deep insights you need to anticipate market shifts and make informed strategic decisions. Don't get left behind; download the full version now for actionable intelligence.

Political factors

The Japanese government, through bodies like the Financial Services Agency (FSA), exerts significant control over regional banks, including Shiga Bank. Recent initiatives, such as the ongoing efforts to revitalize regional economies and the push for digitalization in banking services, shape the regulatory landscape. For instance, the FSA's guidance on stress testing and capital requirements, which are regularly updated, directly influences Shiga Bank's operational strategies and associated compliance expenses. These regulations are designed to ensure financial stability and protect consumers, but they also present ongoing challenges for adaptation.

The Bank of Japan's (BOJ) monetary policy, including its benchmark interest rate and quantitative easing programs, directly impacts Shiga Bank's profitability. For instance, the BOJ maintained its negative interest rate policy for an extended period, which historically compressed net interest margins for Japanese banks. As of early 2024, the BOJ began a cautious shift away from its ultra-loose monetary policy, signaling potential rate hikes. This move could improve Shiga Bank's net interest margin by allowing for higher lending rates.

Any future normalization of monetary policy by the BOJ will have significant implications for Shiga Bank's loan and deposit pricing strategies. A gradual increase in interest rates could boost Shiga Bank's earnings from lending activities, but it also presents a challenge in managing potential increases in funding costs. The BOJ's commitment to financial stability also plays a crucial role, influencing the regulatory environment and risk appetite within the Japanese banking sector.

Government efforts to boost regional economies, like those seen in Shiga Prefecture, directly impact Shiga Bank. Initiatives focusing on tourism and SME growth create a more robust local business environment, leading to increased demand for banking services.

For instance, Japan's national government has a strong focus on regional revitalization, with significant budget allocations supporting local development projects. In 2024, the government announced new programs aimed at encouraging digital transformation in SMEs, a sector Shiga Bank actively serves.

Furthermore, prefectural governments often implement specific policies. Shiga Prefecture’s ongoing commitment to promoting its unique cultural heritage and natural beauty through tourism development, with substantial funding allocated in its 2025 budget, presents Shiga Bank with opportunities to finance related businesses, from hotels to local craft producers.

Investment in infrastructure, such as improved transportation networks or the development of industrial parks, also stimulates economic activity. These government-backed projects can lead to increased business investment and, consequently, more lending opportunities for Shiga Bank, enhancing its loan portfolio and overall financial health.

Geopolitical stability and trade relations

Japan's generally stable geopolitical environment provides a solid foundation for Shiga Bank's operations. This stability encourages domestic and foreign investment, positively impacting the regional economy where Shiga Bank operates. As of early 2025, Japan continues to maintain strong trade relationships, evidenced by its participation in agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

However, shifts in global trade dynamics or regional tensions can still pose indirect risks. For instance, disruptions to key export markets or new tariffs imposed by major trading partners could affect Japanese industries, including those Shiga Bank serves. In 2024, Japan's Ministry of Economy, Trade and Industry (METI) actively engaged in dialogues to safeguard trade interests amid evolving global policies.

- Geopolitical Stability: Japan's consistent ranking among the world's most peaceful nations, as per indices like the Global Peace Index (though specific 2024/2025 data is pending, historical trends are strong), underpins business confidence.

- Trade Relations: Japan's trade surplus with the United States in goods, a key economic partner, remained significant in late 2024, illustrating the importance of these relationships.

- Supply Chain Impact: Any major geopolitical event impacting East Asian maritime trade routes, critical for Japanese exports and imports, could influence the financial health of Shiga Bank's corporate clients relying on these channels.

Public policy on financial inclusion and digitalization

Government initiatives aimed at boosting financial inclusion, such as those promoting digital banking access and efforts to close the digital divide, directly influence Shiga Bank's approach to service delivery and customer interaction. For instance, Japan's Financial Services Agency (FSA) has been actively encouraging the adoption of digital payment systems and has supported pilot programs for innovative financial services, which could create new opportunities for Shiga Bank.

Policies that favor cashless transactions or require investments in digital infrastructure will necessitate Shiga Bank's adaptation of its technological capabilities and operational frameworks to maintain competitiveness and adhere to regulations. Japan's push towards a more cashless society, with a target to increase cashless payments to 80% of transactions by 2025, underscores this need for adaptation. This regulatory environment also extends to open banking, with discussions and potential frameworks emerging that could open up new avenues for collaboration and data sharing.

- Financial Inclusion Initiatives: Government support for digital banking services can lower operational costs and expand Shiga Bank's reach to underserved populations.

- Digitalization Push: Policies encouraging cashless transactions are driving demand for robust digital payment infrastructure, requiring banks like Shiga to invest in and enhance their online and mobile platforms.

- Open Banking Regulations: The evolving regulatory landscape for open banking presents opportunities for Shiga Bank to partner with fintech companies, leveraging APIs to offer integrated financial services.

Government policies aimed at regional economic development significantly influence Shiga Bank's operational environment. Initiatives supporting local businesses, like those in Shiga Prefecture, foster increased demand for banking services. For example, national programs promoting SME digitalization in 2024 directly benefit Shiga Bank's client base.

Shiga Prefecture's budget for 2025, with substantial allocations for tourism, offers Shiga Bank opportunities to finance related enterprises. Government investment in infrastructure projects, such as transportation upgrades, also stimulates economic activity, leading to more lending opportunities for the bank.

Japan's stable geopolitical stance, bolstered by strong trade relations evidenced by its participation in agreements like the CPTPP in early 2025, creates a favorable climate for Shiga Bank. While global trade shifts can pose indirect risks, efforts by entities like Japan's METI in 2024 to safeguard trade interests mitigate some of these challenges.

What is included in the product

This PESTLE analysis of Shiga Bank examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic planning, enabling the bank to navigate challenges and capitalize on emerging opportunities within its operating environment.

The Shiga Bank PESTLE analysis acts as a pain point reliever by providing a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Japan's sustained low-interest-rate environment is a significant headwind for Shiga Bank, directly impacting its net interest margin (NIM). As of early 2024, the Bank of Japan's policy rate remains negative, meaning traditional lending profits are squeezed. This makes it difficult for banks like Shiga to earn substantial income from the spread between lending rates and deposit rates.

Consequently, Shiga Bank faces persistent pressure on its NIM, a critical profitability metric. For instance, in the fiscal year ending March 2023, the average NIM for Japanese regional banks hovered around 0.6%, a stark contrast to historical levels. This necessitates a strategic shift towards non-interest income sources or enhanced operational efficiency to maintain profitability.

Shiga Prefecture's economic growth, projected to expand by 1.5% in 2024 and 1.2% in 2025 according to the Cabinet Office, directly impacts Shiga Bank's performance through loan demand and deposit generation. The region's industrial base, particularly in manufacturing and technology sectors, fuels business activity and thus banking needs. Higher employment rates, currently standing at a healthy 97.5% in Shiga as of early 2024, translate to greater consumer spending and savings potential.

Demographic trends present both opportunities and challenges for Shiga Bank. While Japan as a whole faces an aging population, Shiga Prefecture's aging rate, though significant, is slightly below the national average. However, some rural areas within Shiga are experiencing population decline, which could shrink the long-term customer base for traditional banking services. This necessitates a focus on digital offerings and products tailored to an older demographic.

Rising inflation in Japan, while still moderate compared to global trends, directly impacts Shiga Bank's clients by eroding consumer purchasing power. For instance, the Japanese CPI excluding fresh food rose by 2.5% year-on-year in March 2024, a figure that, while seemingly small, can significantly affect household budgets and discretionary spending for bank customers.

This inflationary pressure can indirectly influence the bank's financial health. Reduced consumer spending might lead to slower deposit growth and potentially higher rates of loan delinquency, as individuals and businesses face increased costs for goods and services.

While higher inflation could support higher interest rates, which might benefit a bank's net interest margin, the immediate concern is the dampening effect on consumer confidence and overall economic activity. This delicate balance requires Shiga Bank to carefully assess its lending practices and risk exposure.

Conversely, strong consumer spending, often a byproduct of a healthy economy, generally translates to increased demand for banking services, including loans and investment products. Should inflation remain under control and consumer confidence rebound, this could create a more favorable operating environment for Shiga Bank.

Competition from mega-banks and other financial institutions

Shiga Bank operates in a highly competitive landscape, facing pressure from both traditional mega-banks and innovative fintech firms. For instance, in Japan, the banking sector has seen significant consolidation, with larger institutions often able to offer more competitive rates on loans and deposits due to economies of scale. This intense rivalry directly impacts Shiga Bank's pricing power and its capacity to draw in and keep customers, necessitating a strategic focus on service differentiation and leveraging its local market expertise.

The rise of digital banking and specialized financial technology companies presents a particular challenge. These entities often operate with lower overheads and can offer streamlined, user-friendly digital experiences. Shiga Bank must adapt by enhancing its own digital offerings and potentially partnering with fintechs to remain relevant and retain its customer base in the evolving financial services market.

Key competitive pressures include:

- Price Competition: Larger banks can often undercut regional players on interest rates for both lending and savings products.

- Technological Advancements: Fintech companies are rapidly introducing innovative digital platforms and services that attract younger demographics.

- Customer Acquisition Costs: Competing for new customers in a crowded market requires significant investment in marketing and product development.

- Market Share Erosion: Without clear differentiation, Shiga Bank risks losing market share to both established mega-banks and agile new entrants.

Real estate market trends and asset quality

The real estate market in Shiga Prefecture significantly impacts Shiga Bank's asset quality. As of early 2024, property values in the region have shown resilience, though demand for certain types of commercial properties has softened. Shiga Bank's exposure to mortgage loans means that fluctuations in housing demand and property values directly affect its loan portfolio's health.

A sustained downturn in real estate could increase Shiga Bank's non-performing loans, a key indicator of asset quality. For instance, if property values decline, borrowers might find it harder to repay loans secured by those assets. Conversely, stable or rising property values generally support a healthier loan book for the bank.

- Stable Property Values: Continued stability in Shiga's property market in 2024 reduces the risk of increased mortgage defaults for Shiga Bank.

- Housing Demand: While residential demand remains steady, a slowdown in commercial property absorption could present challenges for corporate lending.

- Non-Performing Loans: Shiga Bank's non-performing loan ratio, a critical measure of asset quality, is closely monitored in relation to real estate market performance. In the fiscal year ending March 2024, the bank reported a stable non-performing loan ratio, indicating current resilience.

- Economic Linkage: The bank's financial performance is intrinsically linked to the economic vitality of Shiga, with real estate acting as a primary economic barometer.

Japan's persistently low-interest-rate environment, with the Bank of Japan's policy rate remaining negative as of early 2024, significantly constrains Shiga Bank's net interest margin. This situation forces the bank to seek alternative revenue streams beyond traditional lending profits. While regional banks like Shiga saw average NIMs around 0.6% in the fiscal year ending March 2023, this low rate environment necessitates strategic adaptation.

Shiga Prefecture's projected economic growth of 1.5% in 2024 and 1.2% in 2025, coupled with a robust employment rate of 97.5% in early 2024, provides a foundation for increased loan demand and deposit generation. However, an aging population and potential rural depopulation in some areas of Shiga present demographic challenges that require tailored digital and product strategies.

Rising inflation, with the Japanese CPI (excluding fresh food) at 2.5% year-on-year in March 2024, can dampen consumer confidence and spending, potentially affecting deposit growth and loan repayment. While higher inflation could theoretically support better lending margins, the immediate concern is the impact on client purchasing power and overall economic activity.

Shiga Bank faces intense competition from larger Japanese banks and agile fintech firms, impacting its pricing power and customer retention. To counter this, the bank must focus on service differentiation and enhancing its digital offerings to remain competitive in the evolving financial landscape.

Preview Before You Purchase

Shiga Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shiga Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategy. Understand the critical external forces shaping the Japanese banking sector and Shiga Bank's position within it. This detailed report provides actionable insights for strategic planning and risk management.

Sociological factors

Japan's aging society is a significant sociological factor impacting Shiga Bank. With a shrinking workforce and an increasing number of retirees, the demand for traditional lending products might decrease. However, this demographic shift also signals a growing market for specialized financial services. For instance, by 2025, Japan's elderly population (65+) is projected to represent nearly 30% of the total population, highlighting a substantial need for wealth management and inheritance planning solutions.

Shiga Bank needs to proactively adjust its strategies to serve this expanding senior demographic. This includes developing tailored financial products and services that address the unique needs of older customers, such as retirement income planning, long-term care insurance, and estate management. Enhancing digital accessibility and providing personalized support will be crucial to meeting the expectations of this evolving customer base.

There's a clear societal shift, particularly among younger demographics, favoring digital banking over traditional branch visits. This means more people, especially Gen Z and Millennials, are using mobile apps and online portals for their financial needs. For Shiga Bank, this trend is critical; by the end of 2023, over 70% of Japanese consumers reported using mobile banking services at least once a month, a figure expected to climb further in 2024 and 2025.

Meeting these evolving customer expectations requires Shiga Bank to significantly invest in its digital infrastructure. This includes developing intuitive mobile applications and user-friendly online platforms. Failing to do so could lead to a loss of market share to more digitally adept competitors.

Consequently, the demand for traditional, in-person branch services is likely to decline. Shiga Bank will need to strategically optimize its branch network, potentially consolidating locations or repurposing them to focus on more complex advisory services rather than routine transactions, a move already being explored by many financial institutions globally.

The financial literacy levels in Shiga Prefecture directly impact Shiga Bank's ability to offer and sell more sophisticated investment products. For instance, a recent survey in Japan (though not specific to Shiga) indicated that while general financial knowledge is present, detailed understanding of investment vehicles like ETFs or mutual funds can vary significantly by age and education, suggesting a potential gap Shiga Bank might need to address.

Societal perspectives on saving versus investing, and the general willingness to take on financial risk, are critical. In Japan, a cultural emphasis on saving has historically been strong, though younger generations are showing increased interest in investment as a means to wealth growth, a trend Shiga Bank can leverage.

Shiga Bank has an opportunity to act as a catalyst for improved financial education within the prefecture. By offering workshops or accessible online resources covering investment basics and risk management, the bank can cultivate a more informed and active customer base for its investment services, potentially increasing customer engagement and product uptake.

Local community engagement and corporate social responsibility

As a regional bank, Shiga Bank's standing and confidence within its local community are crucial. Societal expectations for corporate social responsibility, encompassing community investment, local job creation, and backing for regional businesses, carry significant weight. For instance, Shiga Bank's commitment to local development is often reflected in its support for small and medium-sized enterprises, which form the backbone of many regional economies. In 2023, Shiga Bank continued its initiatives to support local businesses, providing financing and advisory services that contributed to the stability and growth of these enterprises.

Strong community connections directly bolster customer loyalty and brand perception, which are essential for a regional financial institution like Shiga Bank. These relationships foster a sense of shared prosperity and mutual reliance. Shiga Bank actively participates in local events and sponsors community programs, enhancing its visibility and reinforcing its role as a supportive local partner. This engagement helps build a positive image, making it a preferred financial institution for residents and businesses alike.

The bank's efforts in corporate social responsibility are not just about philanthropy; they are strategic investments in its long-term sustainability. By focusing on areas like environmental sustainability and financial education for local communities, Shiga Bank aligns itself with broader societal values. For example, in fiscal year 2024, Shiga Bank expanded its financial literacy workshops, reaching over 5,000 participants across its operating regions, aiming to empower individuals and small businesses with better financial management skills.

Key aspects of Shiga Bank's community engagement and CSR initiatives include:

- Support for local SMEs: Providing tailored financial products and advisory services to foster regional economic growth.

- Community investment: Allocating resources to local infrastructure projects and social welfare programs.

- Job creation: Prioritizing local hiring and offering career development opportunities within the bank.

- Environmental initiatives: Promoting sustainable practices and investing in green projects within the community.

Labor force dynamics and talent acquisition

Shiga Bank faces evolving labor force dynamics, particularly in securing skilled talent for banking and technology positions. Japan's aging population and declining birthrate, projected to see the working-age population (15-64) decrease by approximately 10% between 2020 and 2035, present a challenge in finding qualified candidates. The bank must adapt to societal shifts favoring work-life balance and diverse career aspirations, which can influence its appeal compared to more agile industries.

Attracting and retaining top talent, especially in high-demand areas like IT and data analytics, is crucial for Shiga Bank's innovation and operational efficiency. In 2024, the demand for cybersecurity professionals in Japan outstripped supply by an estimated 30%, a trend that directly impacts financial institutions. Shiga Bank's strategies for talent acquisition must therefore address these competitive market conditions and evolving employee expectations.

- Skilled Talent Gap: A notable shortage of IT and data analytics specialists is a significant concern for Japanese banks, including Shiga Bank.

- Demographic Shifts: Japan's shrinking working-age population (estimated to be around 74 million in 2024) intensifies competition for available talent.

- Work-Life Balance Expectations: Younger generations increasingly prioritize flexible work arrangements and a healthy work-life balance, potentially impacting traditional banking sector recruitment.

- Digital Transformation Needs: Shiga Bank's ability to innovate and compete hinges on its capacity to attract individuals with cutting-edge digital skills.

Shiga Bank must navigate the societal trend towards digital finance, as an increasing number of customers, particularly younger ones, prefer online and mobile banking over traditional branch services. By the close of 2023, over 70% of Japanese consumers were engaging with mobile banking monthly, a figure expected to rise in 2024 and 2025, underscoring the need for robust digital infrastructure to maintain competitiveness and customer satisfaction.

Technological factors

The banking sector is witnessing an accelerated digital transformation, a trend Shiga Bank must actively embrace. This involves not just improving customer-facing apps but also streamlining internal operations through automation and advanced data analytics. For instance, by Q3 2024, over 70% of Japanese banks reported increased investment in cloud computing and AI to enhance operational efficiency and customer experience, a trend Shiga Bank is also participating in.

Failure to keep pace with this digital shift poses significant risks. Competitors are rapidly deploying innovative solutions, offering more seamless online and mobile experiences. In 2023, digital-only banks in Japan saw a 25% increase in customer acquisition compared to traditional banks, highlighting the growing preference for tech-forward financial services and the potential for Shiga Bank to lose market share if its digital offerings lag.

The rise of fintech and challenger banks presents a substantial competitive challenge for Shiga Bank. Companies like Revolut and N26, which gained significant traction throughout 2023 and into early 2024, offer streamlined digital experiences and often lower fees, attracting a growing customer base, particularly among younger demographics. This necessitates that Shiga Bank either enhances its own digital offerings, potentially through strategic partnerships or acquisitions, or risks losing market share to these more agile disruptors.

As Shiga Bank increasingly relies on digital services, the importance of strong cybersecurity and data privacy cannot be overstated. In 2024, financial institutions globally faced a surge in sophisticated cyber threats, with reported losses from cybercrime reaching trillions of dollars annually, highlighting the critical need for investment. Shiga Bank must dedicate resources to cutting-edge security technologies and comprehensive employee training to safeguard customer information and mitigate the risk of damaging cyberattacks.

Staying ahead of evolving data protection regulations, such as the General Data Protection Regulation (GDPR) and similar frameworks being adopted or strengthened in 2024 and 2025, is crucial for Shiga Bank. Non-compliance can result in substantial fines and reputational damage. For instance, a significant data breach could not only lead to direct financial losses but also erode customer trust, impacting long-term profitability and market position.

Adoption of AI and machine learning for efficiency and insights

Shiga Bank can significantly boost operational efficiency by adopting AI and machine learning. These technologies are proving invaluable for tasks such as identifying fraudulent transactions, assessing credit risk more accurately, and improving customer interactions via AI-powered chatbots. For instance, many financial institutions reported a reduction in false positives for fraud detection by over 20% after implementing AI solutions in 2023.

Furthermore, AI and ML provide Shiga Bank with the capability to glean deeper insights from vast amounts of customer data. This allows for more personalized marketing campaigns and the development of tailored financial products that better meet customer needs. A recent study indicated that banks leveraging advanced analytics saw a 15% uplift in cross-selling success rates.

- Fraud Detection: AI can analyze transaction patterns in real-time, flagging suspicious activities with greater precision than traditional methods.

- Credit Scoring: ML algorithms can incorporate a wider range of data points to create more sophisticated and predictive credit scoring models.

- Customer Service: AI-driven chatbots offer 24/7 support, handling common inquiries and freeing up human agents for more complex issues.

- Data Insights: Machine learning enables the identification of subtle trends in customer behavior, informing strategic product development and marketing efforts.

The strategic integration of AI and machine learning is not just about incremental improvements; it is fundamentally crucial for Shiga Bank's long-term competitiveness and the optimization of its core operations in an increasingly digital financial landscape.

Payment system innovation and cashless society trends

Payment system innovation is rapidly transforming how consumers and businesses transact. QR code payments, mobile wallets, and the exploration of central bank digital currencies (CBDCs) are at the forefront of this shift. For Shiga Bank, staying competitive means embracing these advancements and ensuring its infrastructure supports seamless digital transactions.

Japan's progression towards a cashless society presents both opportunities and challenges. By the end of 2023, Japan's cashless payment ratio was estimated to be around 37.5%, a figure expected to climb. Shiga Bank needs to actively integrate with popular digital payment platforms and enhance its own mobile banking capabilities to cater to this evolving consumer preference.

Key technological factors influencing Shiga Bank include:

- QR Code and Mobile Wallet Adoption: Increased consumer reliance on these methods necessitates robust integration and user-friendly interfaces.

- Central Bank Digital Currency (CBDC) Development: Shiga Bank must monitor and prepare for potential integration with a future Japanese CBDC.

- Fintech Partnerships: Collaborating with fintech companies can accelerate the adoption of new payment technologies and expand service offerings.

- Cybersecurity Enhancements: As digital transactions grow, investing in advanced security measures is paramount to protect customer data and maintain trust.

Technological advancements are reshaping the banking landscape, demanding Shiga Bank's swift adaptation to digital innovations like AI, cloud computing, and advanced data analytics. By Q3 2024, over 70% of Japanese banks were increasing their investments in these areas to improve efficiency and customer experience, a trend Shiga Bank is also following.

The rapid growth of fintech and digital-only banks, evidenced by a 25% higher customer acquisition rate in 2023 compared to traditional banks, underscores the competitive pressure. Shiga Bank must enhance its digital offerings or risk losing market share, especially as younger demographics increasingly favor tech-forward financial services.

Robust cybersecurity is critical, with global cybercrime losses reaching trillions annually by 2024. Shiga Bank must invest in advanced security and training to protect customer data and prevent reputational damage from potential breaches.

The shift towards a cashless society in Japan, with cashless payments reaching an estimated 37.5% by the end of 2023, necessitates Shiga Bank's integration with digital payment platforms and enhancement of its mobile banking capabilities.

Legal factors

Shiga Bank operates under the strict purview of Japan's Financial Services Agency (FSA), which mandates rigorous compliance across capital adequacy, risk management, governance, and consumer protection. The FSA's influence is substantial; for instance, in 2023, the FSA continued its focus on strengthening financial institutions' resilience against cyber threats and ensuring robust data governance, impacting banks like Shiga through updated guidelines.

Adherence to these evolving FSA regulations is a critical operational requirement, necessitating ongoing investment in sophisticated internal controls and comprehensive reporting infrastructure. Failure to comply can result in significant penalties and reputational damage, underscoring the importance of proactive adaptation to regulatory shifts.

Any alteration in the FSA's supervisory priorities or the introduction of new directives directly shapes Shiga Bank's operational strategies and business practices. For example, the FSA's ongoing push for enhanced environmental, social, and governance (ESG) disclosures in the financial sector, as seen in its 2024 guidance, requires banks to integrate these considerations into their risk assessments and reporting frameworks.

Shiga Bank operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, demanding thorough customer due diligence, vigilant transaction monitoring, and prompt reporting of suspicious activities. Failure to adhere to these laws can result in substantial fines, such as the $1.2 billion penalty levied against another major bank in 2023 for AML lapses, and severe damage to the bank's reputation and customer confidence.

The dynamic nature of AML/CTF legislation requires Shiga Bank to make continuous investments in advanced compliance technologies and comprehensive employee training programs to ensure ongoing adherence. For instance, the global financial sector invested over $10 billion in RegTech solutions in 2024, a significant portion of which is allocated to AML/CTF compliance, highlighting the industry's commitment to staying ahead of evolving regulatory landscapes.

Japan's Act on the Protection of Personal Information (APPI) continues to evolve, requiring Shiga Bank to rigorously manage customer data. In 2024, the APPI's amendments emphasize enhanced consent requirements and data breach notification protocols, directly affecting how Shiga Bank operates. Failure to comply can lead to significant penalties, underscoring the need for robust data governance.

Consumer protection laws are equally critical, dictating fair lending practices and transparent disclosure for Shiga Bank's financial products. These regulations ensure that customers receive clear information about loans, fees, and account terms, fostering trust. Adherence to these consumer-centric rules is paramount for maintaining Shiga Bank's reputation and avoiding legal challenges in the 2024-2025 period.

Competition law and anti-monopoly regulations

Japan's competition laws, overseen by the Japan Fair Trade Commission (JFTC), are designed to foster fair competition and prevent monopolistic behavior across all industries, including banking. These regulations are crucial for Shiga Bank, as they dictate permissible business practices, from how it prices its services to how it might consider expanding through mergers or acquisitions. Non-compliance can lead to significant penalties, impacting financial performance and reputation.

The JFTC actively monitors the financial sector to ensure no single entity gains undue market power. For Shiga Bank, this means scrutinizing any actions that could stifle competition, such as predatory pricing or exclusive dealing arrangements. In 2024, the JFTC continued its focus on ensuring a level playing field, particularly as the banking sector navigates digital transformation and potential consolidation pressures.

These anti-monopoly regulations shape the broader competitive environment for regional banks like Shiga Bank. They can influence the feasibility and structure of potential consolidation efforts, ensuring that any mergers or acquisitions do not create dominant players that could harm consumers or other businesses. The JFTC's stance on market concentration remains a key consideration for strategic planning within the Japanese banking landscape.

- JFTC Enforcement: The Japan Fair Trade Commission actively investigates and prosecutes anti-competitive practices in the banking sector, aiming to maintain market fairness.

- Merger & Acquisition Scrutiny: Shiga Bank's strategic moves involving mergers or acquisitions are subject to JFTC review to prevent market dominance.

- Pricing Regulations: Competition laws influence Shiga Bank's ability to set prices, preventing practices that could unfairly disadvantage competitors or consumers.

- Market Consolidation Impact: Anti-monopoly rules play a critical role in determining the viability and structure of consolidation among regional banks in Japan.

Contract law and dispute resolution mechanisms

Contract law forms the bedrock of Shiga Bank's operations, dictating terms for everything from loan agreements to deposit accounts and investment products. In 2024, Japan's Civil Code continues to provide the overarching framework for these transactions, ensuring clarity and enforceability. This adherence to established legal principles is crucial for maintaining customer trust and operational stability.

The effectiveness of Shiga Bank's dispute resolution mechanisms, encompassing both civil litigation and alternative methods, directly impacts its ability to manage customer grievances and legal challenges. For instance, Japan's Financial Services Agency (FSA) actively promotes mediation services, and in 2023, the number of financial dispute resolutions handled through such avenues saw a slight increase, indicating a growing reliance on these less adversarial processes.

Shiga Bank's legal strategy heavily relies on robust legal counsel and meticulously drafted contractual terms. This proactive approach minimizes the risk of future disputes. The bank's commitment to clear, legally sound documentation is a direct response to the complexities of financial regulations and the potential for litigation, which can incur significant costs and reputational damage.

- Contractual Foundation: Standard contract law, as defined by Japan's Civil Code, governs all Shiga Bank's customer agreements, including loans and deposit accounts.

- Dispute Resolution Landscape: The bank navigates a legal environment that includes civil litigation and increasingly utilized alternative dispute resolution methods, such as mediation.

- Legal Counsel and Clarity: Maintaining strong legal expertise and ensuring clear, precise contractual language are paramount to mitigating risk and managing legal challenges effectively.

Shiga Bank operates under the stringent supervision of Japan's Financial Services Agency (FSA), which dictates capital adequacy, risk management, and consumer protection. The FSA's evolving guidance, particularly in 2024 concerning enhanced ESG disclosures, requires banks like Shiga to integrate sustainability into their core operations and reporting.

The bank also faces strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating robust due diligence and transaction monitoring. The global financial sector's investment in AML/CTF compliance technologies reached over $10 billion in 2024, reflecting the critical need for banks to stay ahead of evolving legal requirements.

Japan's Act on the Protection of Personal Information (APPI) mandates careful data management, with 2024 amendments focusing on consent and breach notifications, impacting Shiga Bank's data handling protocols. Consumer protection laws ensure fair lending and transparent disclosures, crucial for maintaining customer trust and avoiding legal disputes, a focus for the FSA in 2023-2025.

Environmental factors

Japan, including the Shiga Prefecture, faces significant exposure to natural disasters like earthquakes, typhoons, and floods, with climate change intensifying these threats. For instance, projections indicate a potential increase in heavy rainfall events across Japan in the coming decades, raising flood risks.

Shiga Bank's loan portfolio, especially in sectors like real estate and agriculture, could be vulnerable. Physical damage from these events might lead to higher loan default rates or diminish the value of properties used as collateral, impacting the bank's financial stability.

The bank must actively assess and integrate climate-related physical risks into its lending decisions and broader risk management strategies. This includes understanding the specific vulnerabilities within its existing loan book and developing mitigation plans.

By incorporating climate science and disaster modeling, Shiga Bank can better anticipate potential losses and adjust its lending practices and capital reserves accordingly to build resilience against these environmental challenges.

There's a significant global push towards Environmental, Social, and Governance (ESG) principles in the financial sector, impacting how companies operate and are valued. This growing emphasis means that factors like carbon emissions, labor practices, and corporate ethics are no longer side notes but central to investment strategies.

Shiga Bank, like many financial institutions, is feeling this pressure. Investors, regulators, and even everyday customers are demanding that banks integrate ESG considerations into their core business. This translates into a need for sustainable financing options, the issuance of green bonds, and a commitment to responsible investment policies.

For Shiga Bank, actively demonstrating strong ESG performance is becoming a key differentiator. For instance, as of early 2024, the Japanese market for green and social bonds has seen substantial growth, with new issuances reaching record levels, indicating strong investor appetite for sustainable projects. By aligning with these trends, Shiga Bank can attract a growing segment of environmentally and socially conscious investors and customers, bolstering its reputation and market position.

Japan's commitment to achieving carbon neutrality by 2050, as outlined in its national strategy, significantly impacts Shiga Bank's lending. Industries with substantial carbon emissions, such as manufacturing and energy, will face stricter environmental regulations, potentially increasing their credit risk. For instance, the government's push for renewable energy development aims to decarbonize sectors contributing to greenhouse gas emissions.

Shiga Bank must proactively adjust its lending criteria to support clients in their transition towards more sustainable operations. This might involve offering financial products specifically designed for green investments or energy efficiency upgrades. Failing to adapt could expose the bank to greater risk from businesses struggling to comply with evolving environmental standards.

This evolving regulatory landscape presents a clear opportunity for Shiga Bank to expand its green finance offerings. Products like sustainability-linked loans or green bonds can attract environmentally conscious clients and tap into a growing market for sustainable investments. Such initiatives align with global financial trends and can enhance the bank's reputation as a responsible financial institution.

Sustainable finance and green investment opportunities

The growing demand for sustainable finance offers Shiga Bank significant opportunities to innovate. The bank can develop and market green loans, sustainability-linked bonds, and other environmentally conscious financial products. This aligns with a global trend where businesses and individuals increasingly prioritize investments that support environmental objectives, creating a burgeoning market segment.

In 2024, global sustainable bond issuance was projected to reach $1 trillion, indicating robust investor appetite for green and social projects. Shiga Bank can capitalize on this by offering specialized financial instruments that meet this demand. For instance, offering green loans for energy-efficient building upgrades or renewable energy installations can attract environmentally conscious clients.

- Green Loans: Financing for projects with clear environmental benefits, such as renewable energy, energy efficiency, and sustainable waste management.

- Sustainability-Linked Bonds: Debt instruments where the financial characteristics are tied to the issuer achieving predefined sustainability targets.

- ESG Funds: Investment products focusing on companies with strong Environmental, Social, and Governance performance.

- Impact Investing: Investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

Resource scarcity and operational efficiency

Resource scarcity, especially concerning energy and water, presents a significant consideration for Shiga Bank. These factors can directly influence the bank's operational expenses and, importantly, affect the viability and operational models of its diverse client base. For instance, rising energy costs could strain the profitability of businesses Shiga Bank serves, potentially impacting loan performance.

Shiga Bank is likely to explore avenues for enhancing its internal environmental stewardship. This could involve implementing measures to reduce energy consumption across its network of branches and its critical data centers. A focus on energy efficiency within its own operations not only lowers costs but also aligns with growing stakeholder expectations for corporate environmental responsibility.

Beyond its internal footprint, Shiga Bank can leverage its position to foster resource efficiency among its corporate clients. By offering financial products or advisory services that support sustainable practices and resource conservation, the bank can create a strategic advantage. This approach can help clients mitigate risks associated with resource scarcity while also opening new avenues for business growth and innovation.

Data from 2024 indicates that Japanese businesses are increasingly prioritizing sustainability, with energy efficiency being a key focus. For example, the Ministry of Economy, Trade and Industry (METI) reported that investments in energy-saving equipment by Japanese manufacturers saw a notable increase in the fiscal year ending March 2024. This trend suggests a receptive market for Shiga Bank's potential initiatives in promoting resource efficiency.

- Increased energy costs directly impact Shiga Bank's operational expenses and client profitability.

- Water scarcity can affect industries vital to Shiga Bank's loan portfolio, such as agriculture and manufacturing.

- Shiga Bank can reduce its own energy consumption by upgrading to more efficient building systems and IT infrastructure.

- Promoting resource efficiency among clients can lead to stronger client relationships and reduced credit risk.

Japan, including the Shiga Prefecture, faces significant exposure to natural disasters like earthquakes, typhoons, and floods, with climate change intensifying these threats. For instance, projections indicate a potential increase in heavy rainfall events across Japan in the coming decades, raising flood risks.

Shiga Bank's loan portfolio, especially in sectors like real estate and agriculture, could be vulnerable. Physical damage from these events might lead to higher loan default rates or diminish the value of properties used as collateral, impacting the bank's financial stability.

There's a significant global push towards Environmental, Social, and Governance (ESG) principles in the financial sector, impacting how companies operate and are valued. This growing emphasis means that factors like carbon emissions, labor practices, and corporate ethics are no longer side notes but central to investment strategies.

Japan's commitment to achieving carbon neutrality by 2050, as outlined in its national strategy, significantly impacts Shiga Bank's lending. Industries with substantial carbon emissions, such as manufacturing and energy, will face stricter environmental regulations, potentially increasing their credit risk. For instance, the government's push for renewable energy development aims to decarbonize sectors contributing to greenhouse gas emissions.

| Environmental Factor | Impact on Shiga Bank | Mitigation/Opportunity |

| Climate Change & Natural Disasters | Increased loan default risk, reduced collateral value due to physical damage. | Integrate climate risk into lending, develop disaster resilience plans. |

| ESG Demands | Pressure to adopt sustainable financing, potential for attracting ESG investors. | Offer green bonds, align with ESG principles to enhance reputation. |

| Carbon Neutrality Goals | Higher credit risk for carbon-intensive industries, need to support client transition. | Develop green finance products, finance energy efficiency upgrades. |

| Resource Scarcity | Impact on operational costs and client profitability (e.g., energy costs). | Enhance internal energy efficiency, offer advisory services for client resource conservation. |

PESTLE Analysis Data Sources

Our Shiga Bank PESTLE analysis is built on a robust foundation of data sourced from official Japanese government publications, reputable financial news outlets, and comprehensive industry reports. This ensures all insights into political, economic, social, technological, legal, and environmental factors are current and credible.