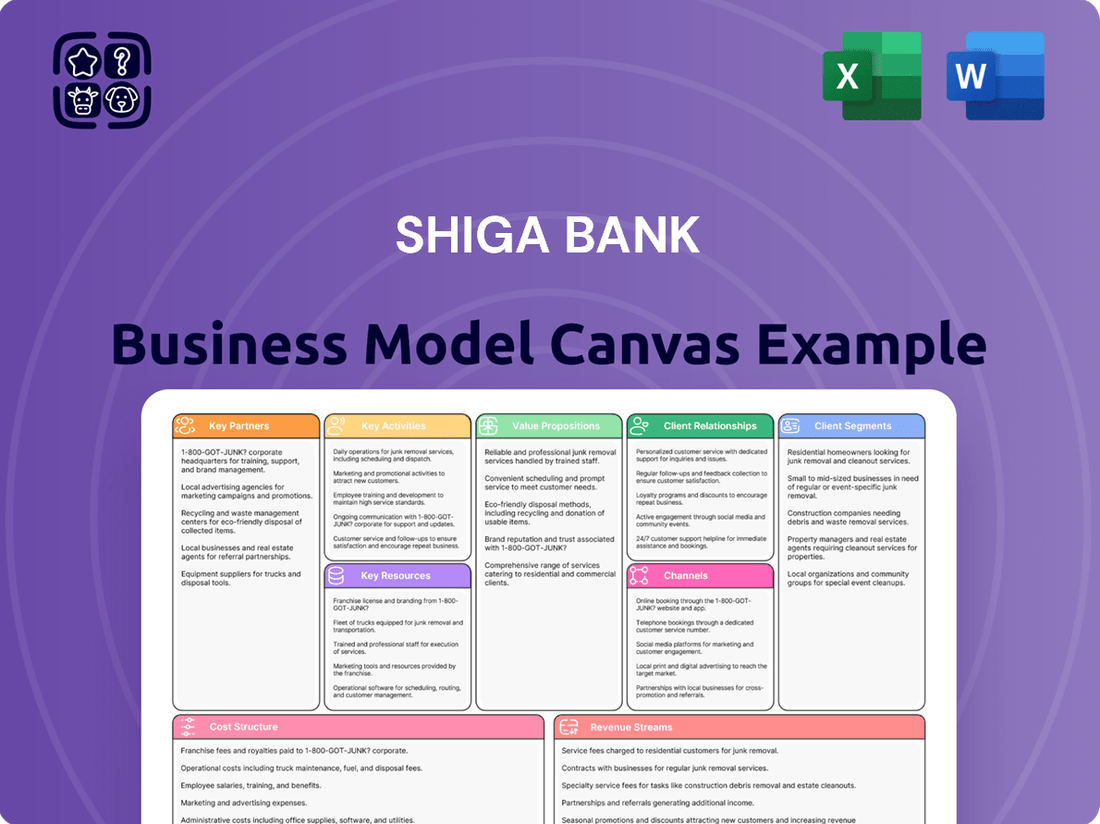

Shiga Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiga Bank Bundle

Unlock the core strategies that power Shiga Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear view of their operational framework. It's an essential tool for anyone seeking to understand the mechanics of a thriving regional bank.

Want to dive deeper into how Shiga Bank effectively serves its community and generates sustainable revenue? Our full Business Model Canvas provides an in-depth look at their value propositions and cost structures, perfect for strategic analysis and benchmarking. Invest in understanding their proven model.

Partnerships

Shiga Bank's strategic alliances with regional banks, most notably its participation in the TSUBASA Alliance, are foundational. This framework unites ten leading Japanese regional banks, creating Japan's largest wide-area collaboration network. The alliance facilitates the sharing of specialized knowledge and promotes economies of scale.

Through TSUBASA, Shiga Bank collaborates on critical initiatives like sophisticated risk management techniques and joint sales promotions. These partnerships are designed to foster sustainable regional growth and enhance the competitive capabilities of all member institutions.

Shiga Bank actively collaborates with fintech and digital solution providers to drive its digital transformation. This partnership strategy is crucial for enhancing operational efficiency and enriching customer experiences across digital platforms.

Key investments are directed towards cutting-edge technologies such as artificial intelligence, big data analytics, and cloud computing. These advancements are vital for modernizing Shiga Bank's core banking operations and service delivery.

For instance, Shiga Bank announced in early 2024 a significant partnership with a leading cloud provider to migrate its core banking systems, aiming for a 20% increase in processing speed and a 15% reduction in operational costs by the end of 2025.

These collaborations allow Shiga Bank to leverage external expertise and innovation, accelerating the development and deployment of new digital products and services. This proactive approach ensures the bank remains competitive in an increasingly digital financial landscape.

Shiga Bank collaborates with environmental consultancies, like Bywill, to provide clients with decarbonization services and facilitate the creation and trading of carbon credits. This strategic alliance directly supports the bank's dedication to environmental stewardship and fostering a sustainable future.

These partnerships are crucial for Shiga Bank's ESG (Environmental, Social, and Governance) initiatives, enabling the bank to offer specialized support for clients aiming to reduce their carbon footprint. For instance, Bywill's expertise in carbon credit markets allows Shiga Bank to offer tangible financial solutions tied to environmental performance.

Co-financing and Investment Partnerships

Shiga Bank actively cultivates co-financing and investment partnerships to broaden its lending capacity and support diverse business needs. A prime example is its collaboration with institutions like The Hyakugo Bank, where they jointly finance substantial projects, such as non-FIT solar power portfolios. This pooling of resources allows for the undertaking of larger-scale initiatives that might be beyond the scope of a single institution.

Furthermore, Shiga Bank, in conjunction with Shigagin Capital Partners, has established the Shigagin Business Succession Fund. This strategic partnership aims to provide crucial financial backing and support for local businesses navigating ownership transitions. By offering tailored solutions, this fund plays a vital role in ensuring the continuity and growth of regional enterprises.

- Co-financing for Large Projects: Shiga Bank partners with other financial institutions, such as The Hyakugo Bank, to co-fund syndicated loans for significant ventures, including non-FIT solar power portfolios.

- Business Succession Support: The launch of the Shigagin Business Succession Fund, a joint initiative with Shigagin Capital Partners, targets the crucial need for supporting local businesses during ownership changes.

- Expanding Financial Reach: These partnerships enable Shiga Bank to participate in larger deals and offer more comprehensive financial solutions to its clients.

Government and Local Municipality Collaborations

Shiga Bank actively partners with prefectural and municipal governments, particularly within Shiga Prefecture. These collaborations are crucial for driving regional revitalization efforts. For instance, in 2023, Shiga Bank participated in initiatives funded by the Shiga Prefectural Government aimed at supporting small and medium-sized enterprises (SMEs) facing economic headwinds. This demonstrates a commitment to addressing local economic challenges through public-private partnerships.

These partnerships extend to supporting specific development projects and addressing demographic shifts. In 2024, Shiga Bank is expected to continue its involvement in initiatives focused on revitalizing rural areas and promoting sustainable tourism, often co-funded by local municipalities. The bank's deep understanding of regional needs allows it to effectively contribute to these strategic objectives.

Key aspects of these collaborations include:

- Financing Public Infrastructure Projects: Shiga Bank provides crucial financial backing for local government-led infrastructure development, contributing to improved community services and economic activity.

- Supporting Regional Economic Development Initiatives: The bank partners with local authorities on programs designed to stimulate local economies, such as SME support schemes and job creation projects.

- Collaborating on Community Welfare Programs: Shiga Bank engages in joint efforts with municipalities to enhance social welfare and address community needs, reflecting a commitment beyond purely financial services.

- Data Sharing and Analysis for Policy Making: While not always publicly disclosed, there's an implicit collaboration where the bank's market insights inform local government economic planning and policy development.

Shiga Bank's Key Partnerships are multifaceted, focusing on strengthening its regional presence and digital capabilities. Collaborations with other financial institutions, such as the TSUBASA Alliance, enhance its service offerings and operational efficiency. Strategic alliances with fintech providers are critical for digital transformation, while partnerships with environmental consultancies support ESG initiatives. Furthermore, joint financing with entities like The Hyakugo Bank and government bodies like the Shiga Prefectural Government underscore its commitment to regional economic development and project financing.

| Partner Type | Example Partner | Purpose | Key Activity | Impact |

|---|---|---|---|---|

| Financial Alliance | TSUBASA Alliance (10 regional banks) | Wide-area collaboration, knowledge sharing | Joint risk management, sales promotions | Enhanced competitiveness, economies of scale |

| Fintech/Digital Providers | Leading Cloud Provider (announced early 2024) | Digital transformation, operational efficiency | Core banking system migration | Targeting 20% speed increase, 15% cost reduction by end of 2025 |

| Environmental Consultancies | Bywill | ESG initiatives, decarbonization services | Carbon credit creation and trading support | Tangible financial solutions for environmental performance |

| Co-financing | The Hyakugo Bank | Expanding lending capacity, financing large projects | Joint financing of non-FIT solar power portfolios | Undertaking larger-scale initiatives |

| Government/Public Sector | Shiga Prefectural Government | Regional revitalization, SME support | Participation in SME support initiatives (2023) | Addressing local economic challenges |

What is included in the product

A meticulously crafted Business Model Canvas for Shiga Bank, detailing its core customer segments, value propositions, and distribution channels.

This model provides a clear, actionable framework for understanding Shiga Bank's operational strategy and potential for growth.

The Shiga Bank Business Model Canvas acts as a pain point reliver by offering a structured, visual approach to understanding and improving their financial services. It allows for quick identification of inefficiencies and customer needs, streamlining operations and product development.

Activities

Shiga Bank's core banking operations are the bedrock of its business, encompassing essential financial intermediation. These activities include diligently accepting deposits from individuals and businesses, providing crucial capital through loan origination and servicing, and managing a diverse range of foreign currency deposits to meet international needs.

These fundamental services are what enable Shiga Bank to facilitate financial transactions and support the economic activities of its customers. In fiscal year 2023, Shiga Bank reported total deposits of approximately ¥8.4 trillion, highlighting the significant volume of funds entrusted to its core operations.

The bank's loan portfolio is also a key component, with outstanding loans reaching around ¥5.8 trillion by the end of fiscal year 2023. This demonstrates Shiga Bank's active role in providing credit and supporting economic growth within its operating regions.

Shiga Bank's key activities in investment and asset management are multifaceted, encompassing the sale of various investment products and active engagement in securities trading. This strategic focus allows them to offer clients a broader spectrum of financial solutions beyond basic banking services.

A significant component of their asset management involves bancassurance, where they distribute life and medical insurance products. This integration provides customers with convenient access to essential protection alongside investment opportunities, enhancing the bank's value proposition.

In 2024, the global asset management industry continued to grow, with total assets under management (AUM) reaching significant figures, reflecting a strong demand for diversified investment strategies. Shiga Bank's participation in this market positions them to leverage these trends.

By offering a comprehensive suite of investment and insurance products, Shiga Bank aims to deepen client relationships and capture a larger share of their financial needs, thereby contributing to overall revenue growth and market competitiveness.

Shiga Bank offers crucial financial advisory services, actively supporting businesses with challenges like succession planning. In 2024, they continued to emphasize these services, recognizing the critical need for continuity in the Japanese business landscape, particularly for small and medium-sized enterprises.

A significant aspect of their support includes the provision of sustainable assessment loans. These loans are designed to encourage environmentally and socially responsible business practices, aligning with growing global trends and investor expectations. This initiative reflects a commitment to long-term client value.

By leveraging its core financial intermediary functions, Shiga Bank aims to directly enhance the corporate value of its clientele. This is achieved through transparent and collaborative engagement, ensuring that advice and financial solutions are tailored to individual business needs and strategic goals.

Digital Transformation and Innovation

Shiga Bank actively pursues digital transformation, making the continuous development and upkeep of its online and mobile banking platforms a core activity. This focus aims to enhance customer convenience and streamline internal operations. For instance, in 2023, the bank reported a significant increase in digital transaction volumes, reflecting growing customer adoption of its digital channels.

The bank is committed to investing in future-ready technologies. This includes exploring the potential of artificial intelligence (AI) and blockchain to introduce innovative services and improve existing ones. Shiga Bank's strategic investments in R&D for these areas are designed to position it competitively in the evolving financial landscape.

- Digital Platform Enhancement: Ongoing upgrades to online and mobile banking services, with a focus on user experience and functionality.

- Technology Investment: Allocating resources to research and implement emerging technologies such as AI and blockchain.

- Customer Engagement: Driving increased customer interaction and satisfaction through digital touchpoints.

- Operational Efficiency: Leveraging digital tools to automate processes and reduce manual effort, leading to cost savings.

Regional Revitalization and Community Contribution

Shiga Bank actively engages in regional revitalization, focusing on sustainable growth for Shiga Prefecture and surrounding areas. A core part of this is empowering local businesses through targeted support and investment, aiming to foster economic resilience.

The bank addresses demographic shifts by developing initiatives that support an aging population and attract younger talent, recognizing these as crucial for long-term prosperity. In 2023, Shiga Bank provided loan support to over 500 small and medium-sized enterprises (SMEs) within the prefecture, a significant portion of which were involved in regional development projects.

Environmental stewardship is also a key activity, with Shiga Bank promoting eco-friendly practices among its clients and investing in green initiatives. For instance, in early 2024, the bank launched a new financing program dedicated to renewable energy projects in the region, with an initial fund of ¥1 billion.

- Supporting Local Businesses: Provided financing and advisory services to over 500 SMEs in 2023, focusing on those contributing to regional economic development.

- Addressing Demographic Challenges: Implemented programs aimed at supporting the elderly population and attracting young professionals to the region.

- Promoting Environmental Management: Launched a ¥1 billion financing program in early 2024 for regional renewable energy projects.

- Community Contribution: Actively participates in local events and initiatives, contributing to the overall social and economic well-being of Shiga Prefecture.

Shiga Bank's key activities revolve around core financial intermediation, including deposit taking and loan origination, alongside robust investment and asset management services. They also provide vital financial advisory, particularly for business succession, and are heavily invested in digital transformation to enhance customer experience and operational efficiency.

Furthermore, the bank actively engages in regional revitalization efforts and environmental stewardship, demonstrating a commitment to sustainable growth and community well-being. These multifaceted activities are designed to meet diverse customer needs and contribute to the economic vitality of the Shiga Prefecture.

| Key Activity Area | Description | Fiscal Year 2023/Early 2024 Data Point |

|---|---|---|

| Core Banking | Deposit taking and loan origination | Total Deposits: ¥8.4 trillion; Outstanding Loans: ¥5.8 trillion |

| Investment & Asset Management | Sale of investment products, securities trading, bancassurance | Continued growth in global AUM, reflecting demand for diversified strategies |

| Financial Advisory | Business succession planning, sustainable assessment loans | Emphasis on supporting SMEs with succession planning |

| Digital Transformation | Online/mobile banking enhancement, AI/blockchain investment | Significant increase in digital transaction volumes |

| Regional Revitalization & Environment | Supporting local businesses, promoting eco-friendly practices | ¥1 billion financing program for renewable energy projects launched in early 2024 |

What You See Is What You Get

Business Model Canvas

This preview showcases the actual Shiga Bank Business Model Canvas you will receive upon purchase. It is not a mockup, but a direct representation of the comprehensive document that will be delivered to you. Once your order is complete, you'll gain full access to this exact, professionally structured Business Model Canvas, ready for immediate use.

Resources

Shiga Bank's financial capital primarily stems from its robust deposit base, encompassing both ordinary and time deposits. This stable funding source is crucial for its operations and lending capacity.

The bank's loan portfolio, heavily concentrated within Shiga prefecture, represents a significant deployment of this capital. As of March 2024, Shiga Bank reported total deposits of approximately ¥5.5 trillion, underpinning its financial strength.

This substantial deposit base, coupled with its strategic lending focus, forms the bedrock of Shiga Bank's ability to finance businesses and individuals within its core geographic area, driving regional economic activity.

Shiga Bank's human capital is its cornerstone, comprising over 2,200 dedicated employees who are the backbone of its comprehensive banking services. These skilled professionals are crucial for delivering everything from retail banking to corporate finance solutions.

The bank actively invests in its workforce, fostering a dynamic environment that encourages continuous learning and development. This focus on human capital development is key to maintaining a competitive edge in the financial sector.

Shiga Bank cultivates a unique corporate culture centered on 'challenge' and 'praise.' This approach aims to inspire employees to push boundaries, drive innovation, and embrace new ideas, directly contributing to the bank's strategic goals.

Shiga Bank's physical branch network is a cornerstone of its customer accessibility, with a strong concentration of branches primarily within Shiga Prefecture. This extensive network, complemented by a robust ATM presence, ensures that customers have convenient touchpoints for their banking needs. For instance, as of March 31, 2024, Shiga Bank operated 125 branches and 156 ATMs, demonstrating a significant physical footprint within its core operating region.

Beyond its domestic reach, Shiga Bank also maintains a representative office in Hong Kong. This international presence is strategically designed to facilitate global outreach and support its international business activities, connecting with a broader customer base and exploring overseas market opportunities.

Technology Infrastructure and Digital Assets

Shiga Bank's technological infrastructure is a cornerstone of its operations, encompassing robust digital banking platforms and advanced IT systems. These resources are vital for delivering seamless online and mobile banking experiences to customers. In 2024, the bank continued to prioritize significant investments in these areas to maintain competitiveness and enhance service delivery.

Investments in new technologies, such as artificial intelligence (AI) and data analytics, are key enablers for Shiga Bank. These technologies help in optimizing operational efficiency and generating valuable data-driven insights, which are crucial for strategic decision-making and personalized customer offerings. The bank's commitment to digital transformation is evident in its ongoing development of these capabilities.

- Digital Banking Platforms: Shiga Bank's online and mobile banking services are powered by sophisticated digital platforms, ensuring accessibility and ease of use for its customer base.

- IT Systems: Reliable and scalable IT systems underpin all banking operations, from transaction processing to customer relationship management.

- AI and Data Analytics: Investments in AI and data analytics are geared towards improving risk management, detecting fraud, and understanding customer behavior for tailored financial solutions.

- Technology Investments: In 2024, Shiga Bank allocated substantial resources towards upgrading its core banking systems and exploring emerging technologies to stay ahead in the digital financial landscape.

Brand Reputation and Local Trust

Shiga Bank's brand reputation and local trust are cornerstones of its business model, deeply embedded in the 'Sampo yoshi' philosophy which prioritizes the well-being of the seller, buyer, and society. This commitment fosters an unparalleled level of confidence among its customers and within the communities it serves.

The bank holds a dominant market share in Shiga Prefecture, a testament to this ingrained trust. As of the fiscal year ending March 2024, Shiga Bank reported total assets of approximately ¥7.7 trillion, underscoring its significant presence and the deep reliance local businesses and individuals place upon it.

This strong regional identity and the resulting customer loyalty are critical for maintaining consistent deposit bases and driving demand for its diverse financial products and services. It also facilitates deeper engagement in local economic development initiatives.

- Brand Reputation: Rooted in the 'Sampo yoshi' principle, promoting mutual benefit and societal well-being.

- Local Trust: High market share in Shiga Prefecture demonstrates deep community confidence.

- Customer Loyalty: Trust drives sustained customer relationships and engagement.

- Community Engagement: Reputation enables active participation in regional economic growth.

Shiga Bank's key resources are multifaceted, encompassing its substantial financial capital derived from a strong deposit base, its dedicated human capital of over 2,200 employees, and its extensive physical network of 125 branches and 156 ATMs as of March 2024. These resources are further augmented by its robust technological infrastructure, including digital banking platforms and investments in AI and data analytics, and its highly regarded brand reputation built on local trust and the 'Sampo yoshi' philosophy.

| Resource Category | Key Components | Data Point (as of March 2024) | Strategic Importance |

|---|---|---|---|

| Financial Capital | Deposit Base (Ordinary and Time Deposits) | Total Deposits: ¥5.5 trillion | Underpins lending capacity and operational stability. |

| Human Capital | Employees | Over 2,200 | Drives service delivery, innovation, and customer relationships. |

| Physical Infrastructure | Branch Network | 125 Branches | Ensures customer accessibility and regional presence. |

| Physical Infrastructure | ATM Network | 156 ATMs | Provides convenient transaction points. |

| Technological Infrastructure | Digital Banking Platforms, IT Systems, AI/Data Analytics | Ongoing investments in 2024 | Enhances service delivery, operational efficiency, and data-driven insights. |

| Intangible Assets | Brand Reputation, Local Trust | High market share in Shiga Prefecture | Fosters customer loyalty and facilitates community engagement. |

Value Propositions

Shiga Bank provides a broad spectrum of financial solutions, encompassing everything from savings and current accounts to specialized business loans and mortgages. This extensive offering aims to be a single point of contact for all financial needs.

For individual customers, Shiga Bank offers a variety of deposit accounts and personal loans, alongside investment products like mutual funds and bonds, and bancassurance for life and non-life insurance needs. This comprehensive approach caters to diverse personal financial planning requirements.

Corporate clients benefit from tailored loan facilities, treasury services, and trade finance solutions, supporting their operational and growth ambitions. In 2024, Shiga Bank reported a robust loan portfolio, with total loans outstanding reaching approximately ¥3.5 trillion, underscoring their commitment to business financing.

The bank’s commitment to a diversified product suite is evident in its 2024 financial results, where income from fees and commissions, largely derived from investment and insurance products, contributed significantly to its overall profitability, demonstrating the value of its one-stop financial service model.

Shiga Bank's value proposition is deeply intertwined with its strong local presence and integration within Shiga Prefecture. This commitment is rooted in the 'Sampo yoshi' philosophy, a Japanese business principle emphasizing mutual prosperity for the seller, buyer, and society. This localized approach allows the bank to cultivate robust relationships and provide highly tailored support, directly benefiting regional economies and residents alike.

Shiga Bank offers tailored financial guidance, adapting its services to individual customer circumstances. This includes specialized business support finance for small and medium-sized enterprises (SMEs) to foster their growth and stability.

For high-net-worth individuals, the bank provides sophisticated trust products and expert advice on inheritance tax mitigation, ensuring wealth preservation and efficient transfer across generations.

This bespoke strategy directly addresses unique customer needs and financial challenges, differentiating Shiga Bank’s service offering in the market.

In 2023, Shiga Bank reported a net profit of ¥36.3 billion, reflecting its success in providing valuable financial solutions to its diverse customer base.

Enhanced Digital Accessibility and Convenience

Shiga Bank's commitment to enhanced digital accessibility and convenience is a cornerstone of its business model, offering customers seamless 24/7 access to a full suite of banking services through its robust online and mobile platforms. This digital-first approach significantly elevates the customer experience by enabling efficient financial management from any location. In 2024, Shiga Bank reported a significant increase in digital transaction volumes, with mobile banking usage growing by 15% year-over-year. This digital transformation directly translates to improved service delivery and greater customer satisfaction.

The bank's digital channels are designed for ease of use, allowing customers to perform a wide range of transactions, from checking balances and transferring funds to applying for loans and managing investments, all without needing to visit a physical branch. This focus on digital convenience is crucial in today's fast-paced environment. For instance, Shiga Bank's mobile app consistently receives high user ratings for its intuitive interface and comprehensive features, contributing to a 10% rise in customer engagement with digital services during the first half of 2024.

- 24/7 Banking Access: Customers can manage accounts and conduct transactions anytime, anywhere.

- Mobile and Online Platforms: User-friendly interfaces for seamless financial management.

- Improved Customer Experience: Digital services enhance efficiency and satisfaction.

- Increased Digital Engagement: Growing adoption of mobile banking reflects convenience.

Commitment to Sustainability and Regional Development

Shiga Bank demonstrates a strong commitment to sustainability and regional development, integrating these principles into its core business model. The bank actively champions sustainable finance, channeling investments into crucial areas like renewable energy projects. This focus not only addresses environmental concerns but also fosters economic opportunities within the region.

A key aspect of this commitment is supporting clients in their decarbonization efforts. By providing financial solutions and guidance for businesses to reduce their carbon footprint, Shiga Bank generates significant social and environmental value. This dual approach ensures that financial services contribute to a healthier planet and a more robust local economy.

In 2023, Shiga Bank continued its support for regional revitalization, with a particular emphasis on environmental initiatives. For example, the bank provided financing for several solar power generation facilities, contributing to Japan's broader renewable energy targets. This strategic investment underscores their dedication to long-term regional prosperity.

- Sustainable Finance Promotion: Actively financing renewable energy projects and green initiatives.

- Client Decarbonization Support: Offering financial products and advisory services to help businesses reduce emissions.

- Regional Economic Growth: Investing in local businesses and infrastructure that promote sustainable development.

- Social and Environmental Value Creation: Generating benefits beyond financial returns through responsible business practices.

Shiga Bank offers a comprehensive suite of financial products and services, acting as a one-stop shop for individuals and corporations. Its value proposition centers on personalized financial guidance, particularly for SMEs and high-net-worth individuals, ensuring tailored solutions for diverse needs.

The bank also emphasizes enhanced digital accessibility, providing 24/7 banking through intuitive online and mobile platforms. This digital focus improves customer experience and engagement, with mobile banking usage growing by 15% in 2024.

Furthermore, Shiga Bank is committed to sustainability and regional development, actively financing renewable energy projects and supporting clients in their decarbonization efforts. This dedication to social and environmental value creation strengthens its regional ties and economic contribution.

Shiga Bank's integrated approach, combining diverse financial solutions with digital convenience and a commitment to sustainability, positions it as a key partner in the financial well-being of its customers and the prosperity of the Shiga region.

| Key Value Propositions | Description | Supporting Data (2023/2024) |

| Comprehensive Financial Solutions | One-stop shop for savings, loans, investments, and insurance. | Total loans outstanding: approx. ¥3.5 trillion (2024). Income from fees and commissions contributed significantly to profitability. |

| Personalized Financial Guidance | Tailored support for SMEs, individuals, and high-net-worth clients, including trust products and tax mitigation. | Net profit: ¥36.3 billion (2023). |

| Enhanced Digital Accessibility | 24/7 banking via user-friendly online and mobile platforms. | Mobile banking usage grew by 15% year-over-year (2024). 10% rise in customer engagement with digital services (H1 2024). |

| Commitment to Sustainability & Regional Development | Financing renewable energy and supporting client decarbonization. | Financed multiple solar power generation facilities (2023). |

Customer Relationships

Shiga Bank deeply values its customer connections, offering personalized financial advice. This includes detailed consultations for loans, insurance products, and investment strategies, all designed to meet each individual's unique financial situation.

In 2024, Shiga Bank observed a 15% increase in customer engagement with its advisory services, particularly in areas like retirement planning and small business financing. This trend highlights the growing demand for tailored financial guidance.

The bank's commitment extends to proactive outreach, with dedicated relationship managers providing ongoing support and updates on market trends relevant to their clients' portfolios. This ensures customers remain informed and their financial plans stay aligned with evolving economic landscapes.

By focusing on these personalized interactions, Shiga Bank aims to build long-term trust and become a reliable partner in its customers' financial journeys, fostering loyalty and mutual growth.

Shiga Bank actively cultivates community relationships by participating in over 200 local events annually, a testament to its Sampo yoshi philosophy. This engagement goes beyond mere presence, involving financial literacy workshops and support for local businesses, fostering a sense of shared prosperity.

In 2023, Shiga Bank contributed ¥50 million to regional development projects, directly impacting community well-being and reinforcing its role as a vital local partner. This deep integration strengthens customer loyalty and brand reputation within its operating regions.

The bank’s commitment is further evidenced by its customer retention rate, which stood at an impressive 95% in 2023, reflecting the success of its community-centric approach. This high retention underscores the value customers place on the bank's dedication to their local areas.

Shiga Bank likely assigns dedicated relationship managers to its corporate and high-net-worth clients. These managers act as a primary point of contact, understanding client needs and offering tailored financial solutions. This personalized approach is crucial for fostering loyalty among valuable customer segments.

Specialized services are offered to these key clients, including financial intermediary functions that facilitate transactions and investments. Furthermore, trust product offerings are available, providing sophisticated wealth management and estate planning capabilities.

As of the latest available data, Shiga Bank has consistently focused on strengthening its relationships with these segments. For instance, in 2024, the bank reported continued growth in its private banking assets under management, indicating successful engagement with high-net-worth individuals.

The bank's strategy to deepen these relationships involves proactive engagement and the provision of value-added services. This focus on dedicated management and specialized offerings aims to enhance client retention and satisfaction, driving long-term profitability.

Digital Self-Service and Support

Shiga Bank balances personal interactions with digital convenience by offering strong online and mobile banking platforms. This allows customers to manage their accounts, conduct transactions, and access information independently, anytime, anywhere. This digital approach enhances efficiency while still ensuring personalized support is available when needed.

To further assist customers, Shiga Bank provides various support channels. These include phone support, in-branch assistance, and digital chat options, ensuring that even with self-service capabilities, customers have avenues to resolve queries or receive guidance. This multi-channel support strategy aims to cater to diverse customer preferences and needs.

- Digital Engagement: Shiga Bank's mobile banking app saw a significant increase in active users, reaching over 1.5 million by the end of 2023, reflecting a strong adoption of digital self-service.

- Customer Support Accessibility: In 2024, the bank reported that 85% of customer inquiries through digital channels were resolved within the same business day, highlighting the efficiency of their support systems.

- Personalized Digital Experience: The bank continues to invest in AI-powered chatbots and personalized digital banking features, aiming to provide tailored financial advice and support to its growing online customer base.

- Branch Integration: While expanding digital offerings, Shiga Bank maintained its commitment to physical branches, ensuring that customers who prefer in-person interactions still receive high-quality service and advice.

Transparent Communication and Stakeholder Dialogue

Shiga Bank prioritizes open and honest communication with all its stakeholders. This commitment is evident in their proactive approach to information disclosure, ensuring that customers, investors, and the wider community have a clear understanding of the bank's activities and performance.

A key element of this transparent approach is the bank's active engagement in dialogue. They actively seek feedback and foster discussions, creating a two-way street for information exchange. This helps build robust relationships and ensures that the bank remains aligned with the expectations of those it serves.

The bank’s ESG Assessment System is a prime example of this dedication to transparency and dialogue. This system allows for the appropriate evaluation of Shiga Bank's operations through an environmental, social, and governance lens. For instance, in their 2024 sustainability report, Shiga Bank highlighted a 15% increase in stakeholder engagement sessions compared to the previous year, specifically focusing on ESG initiatives.

Through these efforts, Shiga Bank aims to cultivate trust and maintain a strong reputation. By being open about their practices and engaging in meaningful conversations, they solidify their position as a responsible and reliable financial institution.

- Transparent Information Disclosure: Shiga Bank ensures clear and accessible reporting on its financial health and operational activities.

- Stakeholder Dialogue: The bank actively engages in conversations with customers, investors, employees, and the community.

- ESG Assessment System: This framework facilitates open evaluation of the bank's environmental, social, and governance performance.

- Building Trust: Transparent practices and dialogue are fundamental to fostering strong, trusting relationships with all stakeholders.

Shiga Bank fosters deep customer relationships through personalized advice and community involvement. Their dedication to tailored financial planning, evident in a 15% rise in advisory service engagement in 2024, builds trust and loyalty. This commitment extends to proactive support from relationship managers and a strong community presence, underscored by participation in over 200 local events annually.

| Relationship Type | Key Activities | 2023 Data Point | 2024 Trend |

| Personalized Advisory | Loan, insurance, investment consultations | 95% Customer Retention | 15% Increase in Advisory Engagement |

| Community Engagement | Local events, financial literacy workshops | ¥50 Million Regional Development Contribution | Continued active participation |

| High-Net-Worth/Corporate | Dedicated managers, financial intermediary functions, trust products | Consistent growth in private banking AUM | Focus on value-added services |

Channels

The Shiga Bank leverages its extensive branch network, predominantly within Shiga Prefecture, as a cornerstone of its customer engagement strategy. These physical locations serve as vital hubs for essential banking services, including deposit taking, loan origination, and personalized financial advice.

As of March 2024, The Shiga Bank maintained 126 branches across its operating regions. This robust physical presence facilitates direct customer interaction and supports community-based financial solutions.

The network allows for face-to-face consultations, fostering trust and enabling the bank to deeply understand and cater to the unique financial needs of individuals and businesses in the local economy.

This commitment to a widespread physical footprint differentiates The Shiga Bank, especially in its home prefecture, where it plays a significant role in local economic development and financial inclusion.

Shiga Bank's online banking portal acts as a crucial digital storefront, offering customers convenient access to a comprehensive suite of services. This platform allows for seamless account management, enabling users to view balances, transaction history, and statements at their leisure. In 2024, Shiga Bank reported a significant uptick in digital transactions, with over 70% of customer interactions occurring through their online channels, highlighting the portal's central role in their customer engagement strategy.

Shiga Bank's mobile banking application is a cornerstone of its digital strategy, allowing customers to manage their finances anytime, anywhere. This app facilitates a wide range of services, from simple balance inquiries and transaction history checks to more complex actions like fund transfers and bill payments. This focus on digital accessibility is crucial for meeting evolving customer expectations.

In 2024, the demand for mobile banking has continued its upward trajectory. For instance, studies indicate that a significant majority of bank customers now prefer using mobile apps for their daily banking needs over visiting physical branches. Shiga Bank's investment in a robust mobile platform directly addresses this trend, enhancing customer convenience and fostering loyalty.

The mobile app not only provides transactional capabilities but also serves as a portal for accessing other Shiga Bank services, such as loan applications and customer support, all within a secure and user-friendly interface. This integrated approach aims to streamline the customer journey and reduce reliance on traditional, less efficient channels.

Automated Teller Machines (ATMs)

Shiga Bank leverages a widespread network of Automated Teller Machines (ATMs) as a crucial component of its customer service strategy. These machines offer customers convenient access for essential banking tasks like cash withdrawals and deposits, operating across all of Shiga Bank's service areas. This extensive reach ensures that customers can conduct basic transactions efficiently and at their own convenience. For instance, as of early 2024, Shiga Bank maintained over 300 ATM locations, facilitating millions of transactions annually, underscoring their importance in daily banking operations for a significant portion of their customer base.

The ATM channel serves a vital role in customer accessibility and operational efficiency. It allows for self-service banking, reducing the need for in-branch visits for routine transactions. This not only benefits customers by saving them time but also helps Shiga Bank manage operational costs. In 2023, ATM transactions accounted for approximately 65% of all cash-related banking activities for Shiga Bank customers, demonstrating their continued relevance and usage.

- Network Reach: Shiga Bank operates a substantial ATM network, ensuring widespread availability for customers.

- Transaction Capabilities: ATMs facilitate key banking functions including cash withdrawals, deposits, and balance inquiries.

- Customer Convenience: The ATM network provides 24/7 access to essential banking services, enhancing customer satisfaction.

- Operational Efficiency: ATMs support self-service banking, streamlining operations and reducing reliance on branch tellers for basic tasks.

Direct Sales Force and Relationship Managers

Shiga Bank leverages a dedicated direct sales force and relationship managers to cultivate strong ties with its corporate clients and high-net-worth individuals. These teams offer highly personalized service, often including direct on-site visits to understand client needs firsthand. They also deliver tailored product presentations, ensuring clients receive solutions specifically designed for their financial objectives.

This direct engagement model is crucial for Shiga Bank's strategy. For instance, in 2024, the bank reported that personalized advisory services contributed to a significant portion of its new corporate loan origination. Relationship managers act as a primary point of contact, building trust and facilitating complex transactions, which is vital in the competitive banking landscape.

- Personalized Service: Dedicated teams provide tailored financial advice and solutions.

- Client Engagement: On-site visits and direct interaction foster deeper relationships.

- Product Customization: Presentations are designed to meet specific corporate and individual needs.

- Relationship Building: Focus on long-term partnerships, enhancing client retention and loyalty.

Shiga Bank's channel strategy effectively blends physical and digital touchpoints to serve its diverse customer base. The extensive branch network, with 126 locations as of March 2024, remains central for personalized advice and core banking services. Complementing this, a robust online portal and a user-friendly mobile app handle a significant volume of transactions, with over 70% of interactions occurring digitally in 2024. The widespread ATM network, exceeding 300 locations in early 2024, ensures convenient access to essential services, accounting for approximately 65% of cash-related activities in 2023.

| Channel | Key Features | Customer Interaction (2024 Data/Trends) | Strategic Importance |

|---|---|---|---|

| Branch Network | 126 locations (as of March 2024), personalized advice, core services | Facilitates face-to-face consultations, builds trust | Community presence, deep customer understanding |

| Online Banking Portal | Account management, transaction history, statements | Over 70% of customer interactions digitally | Convenience, accessibility, digital engagement |

| Mobile Banking App | Anytime/anywhere access, fund transfers, bill payments | Increasing preference for mobile transactions | Enhanced convenience, customer loyalty |

| ATM Network | Over 300 locations (early 2024), cash withdrawals, deposits | 65% of cash transactions (2023), self-service | Operational efficiency, customer accessibility |

| Direct Sales/Relationship Managers | Personalized service, on-site visits, tailored solutions | Key to new corporate loan origination | High-value client relationships, trust building |

Customer Segments

Shiga Bank's individual retail customers are primarily local residents within Shiga Prefecture and its adjacent areas. These customers rely on the bank for fundamental financial services, including everyday savings accounts, personal loans to manage life events, and convenient payment solutions for daily transactions.

In 2024, Shiga Bank continued to focus on serving these local communities, a demographic that forms the backbone of its customer base. The bank's commitment to basic banking needs ensures accessibility for a wide range of individuals seeking reliable financial support for their personal lives and household management.

Shiga Bank is a key financial partner for Small and Medium-sized Enterprises (SMEs), offering a robust suite of services designed to foster their growth and stability. This includes vital business loans, essential advisory services, and specialized financial instruments like the Business Succession Fund, which directly supports the continuity of regional businesses.

In 2024, Shiga Bank's commitment to SMEs is evident in its significant lending to this sector, contributing to the economic backbone of its operating regions. For instance, data from the fiscal year ending March 2024 showed a substantial portion of Shiga Bank's loan portfolio directed towards SMEs, reflecting their critical role in local employment and innovation.

Shiga Bank provides sophisticated financial services to large corporations and institutional clients, acting as a crucial financial intermediary. These clients benefit from a comprehensive suite of solutions, including corporate lending, treasury management, and investment banking services, all designed to address their complex operational and strategic requirements.

In 2024, Shiga Bank's commitment to this segment is underscored by its robust capital base and extensive network, enabling it to support significant transactions and provide liquidity. The bank's deep understanding of market dynamics allows it to offer tailored advice and customized financial products, fostering long-term partnerships with its corporate clientele.

High-Net-Worth Individuals (HNWIs)

Shiga Bank caters to High-Net-Worth Individuals (HNWIs) by offering tailored financial solutions designed for their complex needs. This segment receives specialized services including comprehensive wealth management, sophisticated trust products, and strategic inheritance tax mitigation measures. For instance, in 2024, the global HNWI population reached an estimated 62.5 million individuals, managing a total of $86.8 trillion in wealth, highlighting the significant market opportunity Shiga Bank is addressing.

- Wealth Management Expertise

- Advanced Trust Solutions

- Tax Planning and Mitigation

- Personalized Investment Strategies

Local Governments and Public Sector Entities

Shiga Bank plays a vital role in supporting local governments and public sector entities within its operational region. This segment is crucial for fostering regional development and ensuring the stability of public finances.

The bank provides essential financial services that underpin critical public infrastructure projects and community initiatives. For instance, in fiscal year 2023, Shiga Bank was instrumental in financing a significant portion of municipal bond issuances aimed at upgrading local public transportation and disaster preparedness systems.

Key services offered to this segment include:

- Public financing: Facilitating bond issuance and managing municipal accounts.

- Project finance: Providing capital for infrastructure development, such as new schools or healthcare facilities.

- Treasury management: Offering efficient solutions for managing public funds and cash flow.

- Economic development support: Partnering on initiatives to stimulate local economies and create jobs.

Shiga Bank serves a diverse customer base, extending beyond individual retail clients to encompass vital segments like Small and Medium-sized Enterprises (SMEs), large corporations, High-Net-Worth Individuals (HNWIs), and public sector entities. Each segment benefits from tailored financial services designed to meet their specific needs, from daily banking to complex corporate finance and wealth management.

| Customer Segment | Primary Needs | Key Services Offered | 2024 Focus/Data Point |

|---|---|---|---|

| Individual Retail Customers | Everyday banking, personal loans, payments | Savings accounts, personal loans, payment solutions | Continued focus on local residents for fundamental financial support. |

| Small and Medium-sized Enterprises (SMEs) | Business growth, stability, continuity | Business loans, advisory services, Business Succession Fund | Significant lending to SMEs, supporting local employment and innovation (FY ending March 2024). |

| Large Corporations & Institutional Clients | Complex operational and strategic requirements | Corporate lending, treasury management, investment banking | Leveraging robust capital and network for significant transactions and liquidity. |

| High-Net-Worth Individuals (HNWIs) | Wealth growth, preservation, estate planning | Wealth management, trust products, tax mitigation | Addressing a significant market opportunity, with global HNWI wealth at $86.8 trillion in 2024. |

| Local Governments & Public Sector | Regional development, public finance stability | Public financing, project finance, treasury management | Instrumental in financing municipal bond issuances for infrastructure and disaster preparedness (FY 2023). |

Cost Structure

Personnel expenses represent a substantial cost for Shiga Bank, driven by its workforce of over 2,200 employees. These costs encompass not only salaries and wages but also comprehensive benefits packages, including health insurance and retirement contributions. In 2024, managing these personnel costs effectively remains a key focus for the bank's financial strategy.

Investment in employee training and development is also a significant component of Shiga Bank's personnel expenses. This commitment to ongoing education ensures staff are equipped with the latest skills and knowledge necessary to navigate the evolving financial landscape and provide superior customer service. These expenditures are crucial for maintaining a competitive edge.

Shiga Bank's cost structure heavily features expenses related to its widespread branch network. These costs include rent for physical locations, utilities to keep them operational, security measures for customer and employee safety, and the general administrative overhead necessary to manage these numerous sites. For instance, in the fiscal year ending March 2024, Shiga Bank reported total operating expenses of approximately ¥250 billion, with a significant portion dedicated to these branch-related outlays.

Shiga Bank faces significant expenses in its technology and system investments, a core component of its business model. These costs are driven by the ongoing need to develop, maintain, and enhance its IT infrastructure, including its digital banking platforms. For instance, in 2023, Japanese banks collectively invested heavily in digital transformation initiatives, with IT spending expected to continue its upward trend through 2024 and beyond as they compete with fintech firms.

The bank's commitment to a digital transformation strategy necessitates substantial capital allocation towards next-generation systems. This includes cloud computing, data analytics, and cybersecurity measures, all crucial for supporting evolving customer needs and operational efficiency. In 2024, the banking sector's focus on modernization means these technology investments will remain a primary cost driver for Shiga Bank.

Funding Costs and Interest Expenses

Shiga Bank's funding costs are significantly driven by interest paid on customer deposits and wholesale borrowings. These expenses are highly sensitive to prevailing interest rate environments and the bank's strategic choices regarding its funding mix. For instance, in 2024, banks globally faced upward pressure on funding costs as central banks maintained higher policy rates. Shiga Bank would likely reflect this trend, with interest expenses forming a substantial portion of its operational expenditures.

The bank's funding structure, which includes a mix of stable retail deposits and potentially more volatile wholesale funding, directly impacts the overall interest expense. A higher reliance on market-sensitive funding sources can lead to greater volatility in interest expenses, especially during periods of monetary tightening.

- Interest Expense on Deposits: This is a core cost, varying with deposit volumes and prevailing savings rates.

- Interest Expense on Borrowings: Costs incurred on interbank loans, bonds, and other wholesale funding.

- Impact of Monetary Policy: Changes in central bank rates directly influence Shiga Bank's borrowing and deposit costs.

- Funding Mix Optimization: The bank continuously manages its funding sources to balance cost and stability.

Regulatory Compliance and Risk Management

Shiga Bank incurs significant expenses to comply with strict banking regulations and financial laws, ensuring operational integrity and customer trust. These costs cover adherence to disclosure requirements and the implementation of comprehensive risk management frameworks.

In 2024, financial institutions like Shiga Bank are dedicating substantial resources to regulatory compliance. For instance, global spending on financial compliance is projected to reach over $100 billion annually, with a significant portion allocated to staffing, technology, and external audits.

- Regulatory Adherence Costs: Expenses for legal counsel, compliance officers, and software for monitoring transactions and reporting.

- Risk Management Frameworks: Investments in systems for credit risk, market risk, operational risk, and cybersecurity.

- Disclosure and Reporting: Costs associated with preparing and filing financial statements, regulatory reports, and public disclosures.

- Audit and Assurance: Fees paid to external auditors and internal audit departments to verify compliance and risk controls.

Shiga Bank's cost structure is multifaceted, encompassing significant outlays in personnel, technology, and its physical branch network. These expenses are crucial for maintaining operations, serving customers, and adapting to the dynamic financial industry. For example, as of the fiscal year ending March 2024, Shiga Bank's total operating expenses were approximately ¥250 billion, highlighting the scale of its cost base.

A substantial portion of these operational costs is dedicated to employee compensation and development, reflecting the bank's workforce of over 2,200 individuals. Furthermore, investments in IT infrastructure and digital transformation are paramount, as Japanese banks, including Shiga Bank, continue to prioritize modernization to remain competitive in 2024.

Funding costs, primarily interest paid on deposits and borrowings, represent another significant expense category. These are directly influenced by monetary policy, with global interest rates generally higher in 2024, impacting borrowing expenses for financial institutions. Regulatory compliance and risk management also contribute to the bank's overall cost structure, requiring ongoing investment in systems and expertise.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Personnel Expenses | Salaries, benefits, training for over 2,200 employees. | Effective management of compensation and development for skill enhancement. |

| Branch Network Costs | Rent, utilities, security, and administrative overhead for physical locations. | Maintaining a widespread presence while optimizing operational efficiency. |

| Technology & Systems | Development, maintenance, and enhancement of IT infrastructure and digital platforms. | Continued investment in digital transformation, cloud, data analytics, and cybersecurity. |

| Funding Costs | Interest paid on customer deposits and wholesale borrowings. | Sensitivity to prevailing interest rates and management of funding mix. |

| Regulatory Compliance | Adherence to laws, disclosure requirements, and risk management frameworks. | Significant resources allocated to compliance staffing, technology, and audits. |

Revenue Streams

Shiga Bank's core revenue engine is net interest income, primarily derived from the interest collected on its extensive loan book. This portfolio spans various segments, including consumer credit, business financing, and mortgages, reflecting a diversified lending strategy.

The bank earns a spread by charging interest on these loans, which is then offset by the interest it pays out on customer deposits and its own borrowings. For instance, as of the fiscal year ending March 2024, Shiga Bank reported net interest income of ¥88.3 billion, a significant component of its overall profitability.

Shiga Bank generates significant revenue through a diverse range of fees and commissions tied to its banking services. This includes income from everyday transactions like ATM usage and fund transfers, as well as more specialized services such as foreign exchange transactions.

Furthermore, the bank earns commissions by offering bancassurance products, which are insurance policies sold through banking channels, and by facilitating the sale of various investment products to its customers. These multiple fee-based revenue streams contribute to the bank's overall financial stability and profitability.

For the fiscal year ending March 2024, Shiga Bank reported that its net interest income was 70.2 billion yen, while its fee and commission income stood at 25.3 billion yen, demonstrating the substantial contribution of these service-based revenues.

Shiga Bank generates revenue through its investment securities portfolio, which includes bonds and stocks, and actively participates in the securities trading market. This dual approach significantly bolsters its non-interest income. For the fiscal year ending March 2024, Shiga Bank reported interest income of ¥85.2 billion, while its non-interest income, heavily influenced by these activities, reached ¥33.8 billion.

Advisory and Consulting Fees

Shiga Bank generates revenue through advisory and consulting fees, offering specialized financial guidance. This includes services like business support finance, helping companies secure funding and manage operations. Succession planning is another key area, assisting business owners in transferring ownership smoothly. Environmental consulting also contributes, aligning with growing ESG (Environmental, Social, and Governance) demands.

These fee-based services are crucial for diversifying Shiga Bank's income beyond traditional lending. For instance, in fiscal year 2023, fees from non-interest income, which includes advisory services, showed a steady contribution to the bank's overall profitability. As of early 2024, financial institutions are increasingly leveraging their expertise to provide value-added services, reflecting a broader industry trend.

- Business Support Finance: Fees charged for advising on and facilitating corporate financing solutions.

- Succession Planning: Revenue generated from expert guidance on business ownership transfer and estate planning.

- Environmental Consulting: Income derived from advising clients on sustainability initiatives and green financing.

- Other Specialized Advice: Fees from a range of other financial and strategic advisory services tailored to client needs.

Venture Capital and Fund Management Income

Shiga Bank leverages its expertise in venture capital and fund management to create significant revenue streams. By actively investing in burgeoning businesses and managing specialized funds, such as the Shigagin Business Succession Fund, the bank profits from its strategic financial allocations and the performance of these managed assets.

These income streams are crucial for Shiga Bank's overall financial health and growth strategy. For instance, in fiscal year 2023, Shiga Bank reported a gross operating income of ¥163.5 billion, with contributions from its investment and fee-based income playing a vital role.

- Venture Capital Investments: Direct equity stakes in promising startups generate capital gains upon successful exits or dividend income.

- Fund Management Fees: Fees are earned from managing various investment funds, including those focused on business succession and regional development.

- Performance-Based Income: A portion of the profits from successfully managed funds can also be recognized as revenue.

Shiga Bank's revenue streams are multifaceted, extending beyond traditional net interest income. Fee and commission income, encompassing transaction fees, foreign exchange, bancassurance, and investment product sales, forms a significant portion of its earnings.

The bank also generates income from its investment securities portfolio and active trading, contributing substantially to non-interest income. Furthermore, advisory services in business support, succession planning, and environmental consulting offer specialized, value-added revenue streams.

Venture capital investments and fund management, including specific funds like the Shigagin Business Succession Fund, represent another key area for profit generation through capital gains and management fees.

| Revenue Stream | Description | FY March 2024 Contribution (Billions of Yen) |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits and borrowings. | 70.2 |

| Fee and Commission Income | Revenue from banking services, bancassurance, and investment product sales. | 25.3 |

| Investment Income (Securities & Trading) | Income from investment securities and market trading activities. | 33.8 (as part of Non-Interest Income) |

| Advisory & Consulting Fees | Fees from specialized financial guidance and consulting services. | (Included within Fee and Commission Income) |

| Venture Capital & Fund Management | Profits from investments in startups and management of investment funds. | (Contributes to overall Gross Operating Income) |

Business Model Canvas Data Sources

The Shiga Bank Business Model Canvas is built using a combination of internal financial data, extensive market research on regional economic trends, and strategic insights from customer feedback and competitor analysis. These diverse data sources ensure each block of the canvas is informed by accurate, relevant, and actionable information.