Shiga Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiga Bank Bundle

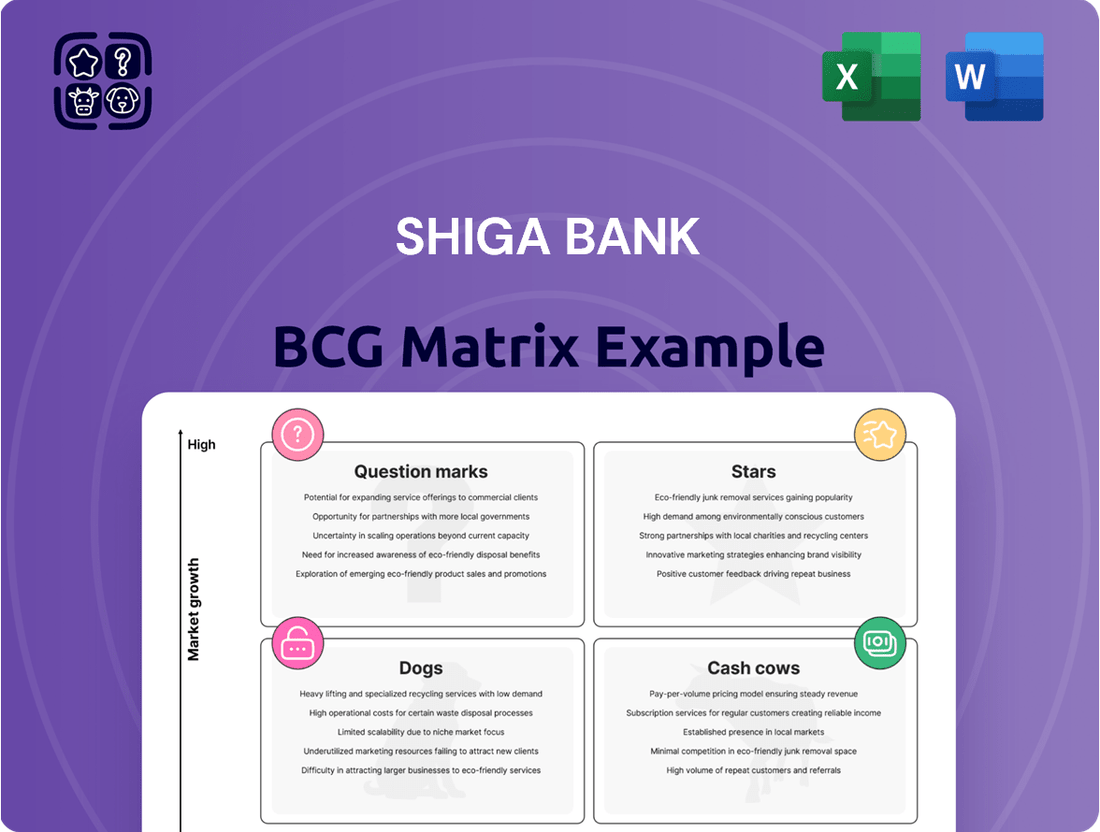

Curious about Shiga Bank's strategic positioning? This preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

But to truly understand their competitive landscape and make informed decisions, you need the full picture.

Dive deeper into Shiga Bank's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Shiga Bank is heavily investing in digital transformation, aiming to lead in the evolving banking sector. They are exploring cutting-edge core-banking systems, such as 'BankVision on Azure,' and significantly boosting the use of their smartphone application. This strategic push is designed to improve customer service and streamline operations, positioning Shiga Bank for substantial growth. Their commitment to integrating physical and digital experiences, what they call 'real x digital' hybrid services, underscores their ambition to be a frontrunner in contemporary banking. For instance, by the end of fiscal year 2024, Shiga Bank reported a 15% increase in active users for their mobile banking app, reflecting the success of these digital outreach efforts.

Shiga Bank's commitment to sustainable finance is evident through products like the 'Shigagin Sustainable Assessment Loan.' This initiative, alongside investments in crucial areas such as bio-healthcare, climate, and nature transition funds, positions the bank in a high-growth sector.

The increasing global and local focus on environmental, social, and governance (ESG) principles means these sustainable products are well-placed to attract a larger market share from both individuals and businesses prioritizing sustainability. For instance, as of the first half of fiscal year 2024, Shiga Bank reported a significant increase in its ESG-related loan balances, reflecting strong customer demand.

This strategic direction directly supports the bank's 8th Medium-Term Business Plan, which outlines a vision for Shiga Bank to become a 'Sustainability Design Company.' This ambition is backed by concrete actions that integrate sustainability into its core business operations and offerings, aiming for long-term value creation.

The Shigagin Business Succession Fund, launched in January 2025, positions Shiga Bank squarely within a burgeoning market driven by Japan's aging demographics. This initiative directly addresses the critical need for business succession planning among small and medium-sized enterprises (SMEs), a challenge particularly acute in regional economies like Shiga Prefecture.

With an estimated 2.4 million SME owners in Japan expected to retire in the coming decade, the demand for succession solutions is immense. Shiga Bank's fund aims to capture a significant portion of this market by providing specialized financial products and advisory services, thereby supporting the continuity of local businesses and fostering economic stability.

Targeted SME Lending in Growth Sectors

Shiga Bank can cultivate a strong position in targeted SME lending by focusing on growth sectors within Shiga Prefecture and its surrounding areas. This strategy moves beyond general loans to actively seek out and support innovative, expanding small and medium-sized enterprises. By identifying local businesses with high growth potential, the bank can build specialized loan portfolios that offer significant returns.

This approach aligns with Shiga Bank's existing corporate customer acquisition strategy, which emphasizes business support finance through its financial intermediary functions. For instance, in 2024, the Japanese government continued its push for SME digitalization and green transformation, creating opportunities for specialized lending programs. Shiga Bank could tap into these trends by offering tailored financial products.

- Focus on high-growth sectors: Identifying industries like advanced manufacturing, IT services, and sustainable agriculture within Shiga Prefecture for targeted lending.

- Develop specialized loan products: Creating programs with flexible terms and potentially lower initial collateral requirements for innovative SMEs.

- Leverage local economic data: Utilizing 2024 regional economic reports and SME surveys to pinpoint promising businesses and sectors.

- Partnerships for innovation: Collaborating with local chambers of commerce, universities, and startup incubators to identify and vet potential borrowers.

Wealth Management for High-Net-Worth Individuals

Shiga Bank's strategy for high-net-worth individuals centers on trust products and inheritance tax mitigation, tapping into a growing demand for specialized financial planning. As wealth concentration increases, particularly with the aging population, sophisticated services are becoming essential. For instance, in Japan, the total value of assets held by individuals aged 65 and over was estimated to be around ¥1,000 trillion as of late 2023, highlighting a significant market for inheritance services.

This focus allows Shiga Bank to target a lucrative niche, aiming for substantial growth and market share by offering expert advice and tailored financial solutions. The bank's approach is designed to build long-term relationships and cater to the complex needs of affluent clients.

- Focus on Trust Products: Shiga Bank is prioritizing trust products to manage and preserve wealth for its high-net-worth clients.

- Inheritance Tax Mitigation: A key strategy involves offering solutions to reduce the burden of inheritance taxes, a critical concern for wealthy families.

- Growing Demand: The demographic shift towards an older, wealthier population in Japan fuels the increasing need for sophisticated wealth management and estate planning.

- Market Opportunity: By specializing in this segment, Shiga Bank aims to capture significant market share in a profitable area of financial services.

Shiga Bank's digital transformation initiatives, including the expansion of its smartphone app and exploration of new core-banking systems, position it as a potential 'Star' in the BCG matrix. The reported 15% increase in active mobile users by the end of fiscal year 2024 demonstrates strong customer adoption of their digital offerings. This focus on innovation and enhanced customer experience is crucial for capturing market share in the rapidly evolving financial technology landscape.

What is included in the product

This BCG Matrix overview analyzes Shiga Bank's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs for strategic allocation.

The Shiga Bank BCG Matrix provides a clear, one-page overview placing each business unit in a quadrant, alleviating the pain of scattered portfolio data.

Cash Cows

Traditional retail deposit accounts, encompassing savings and time deposits, represent Shiga Bank's core cash cows. These foundational products contribute a substantial and stable funding base, with individual deposits making up around 72% of the bank's total deposits.

Shiga Bank enjoys a dominant market share for these offerings within Shiga Prefecture, ensuring a consistent flow of low-cost funds. This established presence means they require minimal marketing expenditure to maintain their position.

The predictable nature and widespread customer reliance on these accounts solidify their role as reliable cash generators for the bank. Their maturity in the market allows for efficient management and a steady contribution to overall profitability.

Shiga Bank's established corporate loans to local businesses are a prime example of a Cash Cow within its BCG Matrix. These loans generate a steady, predictable stream of interest income, thanks to long-standing relationships with stable corporate clients in Shiga Prefecture.

The bank holds a high market share in the mature segment of traditional lending, particularly with 'loans on deeds,' which form the vast majority of its loan portfolio. For instance, as of March 2024, Shiga Bank's total loan balance stood at approximately ¥2,827 billion, with corporate loans forming a substantial portion. This segment provides a reliable foundation for the bank's core profitability.

Shiga Bank's mortgage and housing loan portfolio is a classic cash cow. Given their deep focus on individual customers within Shiga Prefecture, these loans represent a substantial and reliable income source. The long tenures and consistent repayment schedules of these established loans provide a steady cash flow with minimal growth prospects but strong market dominance in their core region.

Bancassurance Products

Shiga Bank's bancassurance products, encompassing personal life, medical, and corporate life insurance, represent a significant Cash Cow within its BCG Matrix.

These offerings capitalize on the bank's established customer relationships and extensive branch network, creating a reliable stream of fee income. In 2024, bancassurance continued to be a cornerstone of Shiga Bank's revenue diversification strategy, with insurance premiums contributing a substantial portion to non-interest income.

The mature nature of the insurance market in Shiga Prefecture, coupled with the low incremental marketing expenditure required due to the bank's existing infrastructure, ensures consistent profitability. This stability makes bancassurance a dependable source of funds for the bank.

Key aspects of Shiga Bank's bancassurance Cash Cows:

- Stable Fee Income: Bancassurance products generate predictable fee income, benefiting from cross-selling opportunities to the bank's existing customer base.

- Low Marketing Costs: Leveraging the bank's branch network minimizes the need for extensive, costly marketing campaigns for these products.

- Profitability Driver: These products consistently contribute to Shiga Bank's overall profitability, particularly in a mature financial services landscape.

- Diversification: Bancassurance effectively diversifies Shiga Bank's revenue streams beyond traditional lending activities.

ATM and Basic Payment Services

Shiga Bank's ATM and basic payment services function as cash cows within its portfolio. These offerings hold a substantial market share in a mature, low-growth sector, reflecting their essential nature for both individual and corporate clients.

These foundational banking services are critical for maintaining customer relationships and generate consistent, albeit modest, revenue through transaction fees. This stability solidifies Shiga Bank's standing as a key financial provider in its service areas.

Consider these points regarding these cash cow services:

- High Market Share: ATMs and basic payment processing are deeply integrated into the daily financial lives of Shiga Bank's customers, giving it a dominant position in these essential services.

- Low Market Growth: The market for these fundamental banking services is largely saturated, with minimal expansion expected.

- Steady Fee Generation: Transaction fees from ATM usage and payment processing provide a reliable, predictable income stream for the bank.

- Customer Retention: Offering convenient and ubiquitous access to these basic services is vital for retaining existing customers and attracting new ones, even in a competitive landscape.

Shiga Bank's retail deposit accounts, including savings and time deposits, are its primary cash cows. These products, representing about 72% of total deposits, provide a stable, low-cost funding base due to Shiga Bank's strong market share in Shiga Prefecture. Their predictable revenue and minimal marketing needs solidify their role as consistent profit generators.

What You’re Viewing Is Included

Shiga Bank BCG Matrix

The Shiga Bank BCG Matrix document you are currently previewing is the precise, unwatermarked, and fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, showcases the same industry-standard layout and data you will utilize for your business planning. Rest assured, what you see is exactly what you get—a ready-to-use, professionally crafted tool for evaluating Shiga Bank's product portfolio.

Dogs

Shiga Bank's physical branch locations in areas with declining populations or shifting demographics, particularly those experiencing very low transaction volumes, are candidates for re-evaluation. These once vital hubs now represent a significant cost in terms of rent and staffing, often without generating commensurate revenue or offering strategic advantages as digital banking adoption accelerates. For instance, in 2024, many regional banks are reporting a continued decline in in-branch transactions, with some seeing as much as a 20% year-over-year drop in foot traffic for routine services.

Legacy IT systems at Shiga Bank, like many financial institutions, fall into the Dogs category of the BCG Matrix. These are the outdated or inefficient systems that demand substantial maintenance budgets, often consuming a significant portion of the IT spending without delivering commensurate value. For instance, in 2024, Shiga Bank, like its peers, likely faced the challenge of maintaining older core banking systems that are costly to update and slow to integrate with modern digital solutions.

These legacy systems are characterized by their low return on investment and their tendency to hinder digital transformation efforts. They can slow down customer service, impede the adoption of new fintech solutions, and create operational inefficiencies. The bank’s investment in maintaining these systems provides minimal competitive advantage and often represents a drain on resources that could be better allocated to growth initiatives.

The continued reliance on these aging technologies means Shiga Bank may struggle to compete with more agile, digitally native competitors. The cost of upkeep for systems that are no longer fit for purpose is a key indicator of their ‘Dog’ status. For example, reports from industry analysts in 2024 indicated that financial institutions spend upwards of 60% of their IT budget on maintaining legacy systems, a figure likely applicable to Shiga Bank’s situation.

Niche, underperforming investment products often find themselves in the Dogs quadrant of the Shiga Bank BCG Matrix. These are products that have struggled to gain traction, perhaps due to a lack of clear market demand or an inability to compete effectively. For instance, a specialized emerging market bond fund launched in 2023 by a smaller bank might have seen very low subscription rates, with initial assets under management (AUM) barely reaching $5 million against a target of $50 million.

The consequence is a drain on resources without commensurate returns. Consider a scenario where a bank invested heavily in developing a unique ESG-focused cryptocurrency fund, anticipating strong investor interest. However, by mid-2024, this fund had only attracted $2 million in AUM and was consistently trailing the performance of major cryptocurrency indices by over 15%.

Such products tie up valuable capital and human resources in product development, marketing, and ongoing sales support. This can lead to low profitability, as the operational costs outweigh the meager revenue generated. For example, a proprietary structured product designed for a very specific, small client segment might have incurred $200,000 in development and regulatory approval costs, yet by the end of 2024, it had only generated $50,000 in fees, resulting in a net loss.

The core issue is their failure to attract significant customer interest or consistently outperform market benchmarks. This results in low uptake and, consequently, low profitability. A bank's internal analysis in early 2024 might reveal that a particular suite of actively managed, sector-specific ETFs, despite extensive marketing campaigns, collectively held less than 1% of the bank's total investment product AUM, while consuming 5% of the product management team's time.

High-Cost, Low-Volume Specialized Corporate Advisory Services

High-cost, low-volume specialized corporate advisory services often find themselves in the question mark quadrant of the BCG matrix. These services demand significant expert input, driving up costs, yet cater to a niche market with limited client acquisition. For instance, highly bespoke M&A advisory for unique distressed asset situations might fit this description.

The challenge lies in the inherent inefficiency: the high price point necessary to cover intensive resource allocation doesn't translate to substantial revenue due to the small client base. This can lead to profitability concerns if not managed strategically.

- High Cost of Delivery: Intensive expert hours and specialized knowledge drive up operational expenses significantly.

- Low Market Demand: These services cater to very specific, infrequent needs, limiting the potential client pool.

- Low Overall Revenue: The combination of high cost and low volume results in minimal top-line contribution.

- Potential for Low Profitability: Without careful cost management and client targeting, these services can become a drag on overall performance.

Paper-Based Transaction Processes

Shiga Bank's paper-based transaction processes are a clear example of a Dog in the BCG Matrix. This means they require significant cash to maintain but generate low returns. The continued reliance on paper, instead of digital workflows, makes these operations inherently slow and expensive.

These outdated methods are not only inefficient but also create a competitive disadvantage. In 2024, as digital transformation accelerates across the financial sector, services still heavily dependent on paper are falling behind. For instance, manual processing of loan applications or account openings can take days, compared to hours or even minutes for digitally-native competitors.

The costs associated with paper-based systems are substantial, including printing, mailing, storage, and the labor involved in manual data entry. These operational expenses eat into profitability.

- Slow Processing Times: Manual handling of documents leads to significant delays in customer service and transaction completion.

- High Operational Costs: Expenses related to paper, printing, postage, and manual labor are considerably higher than digital alternatives.

- Increased Error Rates: Manual data entry and handling are prone to human errors, leading to potential financial losses and customer dissatisfaction.

- Lack of Scalability: Paper-based systems are difficult to scale efficiently to meet growing customer demand or transaction volumes.

Shiga Bank's physical branch locations in declining population areas, especially those with minimal transaction activity, are prime examples of 'Dogs' in the BCG Matrix. These branches are costly to maintain through rent and staffing but yield little revenue, particularly as digital banking gains traction. By 2024, many regional banks saw significant drops in branch traffic, with some experiencing up to a 20% decrease in customer visits for routine services year-over-year.

Legacy IT systems at Shiga Bank, much like those in other financial institutions, fall into the 'Dog' category. These are the outdated, inefficient systems that consume substantial maintenance budgets without offering proportionate value. In 2024, Shiga Bank likely grappled with maintaining older core banking systems that are expensive to upgrade and slow to integrate with modern digital solutions, a common challenge across the industry where institutions might spend over 60% of their IT budget on maintaining these legacy systems.

Niche, underperforming investment products are also classified as 'Dogs' within Shiga Bank's BCG Matrix. These products struggle to attract significant customer interest or consistently outperform market benchmarks, leading to low uptake and profitability. For instance, a specialized fund launched in 2023 might have only garnered a fraction of its initial AUM target by mid-2024, while tying up capital and resources in development and marketing.

Shiga Bank's paper-based transaction processes represent another clear 'Dog'. The continued reliance on paper, instead of digital workflows, makes these operations inherently slow and expensive, creating a significant competitive disadvantage. By 2024, manual processing of loan applications or account openings could take days, compared to the hours or minutes offered by digitally-native competitors, with high operational costs for paper, printing, and manual labor contributing to low profitability.

| Category | Description | Challenges | 2024 Data/Example |

|---|---|---|---|

| Physical Branches (Low Activity) | Locations in declining populations/low transaction volumes. | High operating costs (rent, staff), low revenue, declining foot traffic. | Up to 20% year-over-year drop in in-branch transactions for routine services reported by regional banks. |

| Legacy IT Systems | Outdated or inefficient core banking and operational systems. | High maintenance costs, hinder digital transformation, slow customer service, integration difficulties. | Financial institutions may spend over 60% of IT budget on legacy system maintenance. |

| Underperforming Investment Products | Niche products with low market traction or poor performance. | Low AUM, tie up capital and resources, low profitability, fail to attract customer interest. | A specialized fund launched in 2023 might have only achieved 10% of its $50M AUM target by mid-2024. |

| Paper-Based Processes | Manual, paper-reliant transaction workflows. | Slow processing times, high operational costs (paper, labor), increased error rates, lack of scalability. | Manual loan processing can take days vs. hours for digital competitors. |

Question Marks

Shiga Bank's representative office in Hong Kong signifies a strategic move into international waters. This expansion positions them in what is considered a high-growth market, particularly for financial services, yet Shiga Bank, as a regional Japanese institution, likely holds a low initial market share there.

Establishing a presence in Hong Kong requires substantial investment. This capital is crucial for building brand recognition, understanding local regulations, and developing the necessary infrastructure to compete effectively. The goal is to transform this "Question Mark" into a "Star" within the BCG matrix.

As of early 2024, Hong Kong remains a significant financial hub in Asia, though global economic conditions and geopolitical factors are continuously influencing its growth trajectory. Data from the Hong Kong Monetary Authority indicates a robust financial sector, with total assets of authorized institutions reaching HKD 20.5 trillion (approximately USD 2.6 trillion) by the end of 2023, highlighting the scale of the opportunity.

Shiga Bank's commitment to this region will be a determining factor in its success. If they can effectively capture market share and leverage Hong Kong's position as a gateway to mainland China and Southeast Asia, this venture could become a significant contributor to their overall growth, mirroring the potential seen in other regional banks that have successfully expanded internationally.

Shiga Bank's embrace of advanced fintech partnerships and AI integration, including generative AI, positions it firmly within the question marks of the BCG Matrix. This strategy reflects a forward-thinking approach to data-driven operations and enhanced efficiency. For instance, in 2024, many banks globally are investing heavily in AI, with projections suggesting the AI in banking market could reach over $20 billion by 2026, indicating substantial growth potential.

These initiatives, while holding high promise for future value creation and operational improvements, currently represent nascent or experimental stages for Shiga Bank. Their market share in terms of direct customer-facing AI-powered products or services is likely still developing, requiring significant upfront investment and careful execution to achieve widespread adoption and tangible returns.

Developing specialized digital lending platforms for new segments, such as gig economy workers or niche startups, aligns with the Question Mark quadrant. These ventures target markets with significant growth potential, but Shiga Bank's current penetration is minimal. For instance, the gig economy in Japan is projected to grow substantially, with estimates suggesting it could account for over 10% of the workforce by 2025, presenting a large, untapped market for tailored financial products.

These initiatives require substantial upfront investment in technology and marketing to build brand awareness and customer trust within these new demographics. Shiga Bank would need to innovate its underwriting processes to accurately assess risk for non-traditional income streams. The success hinges on effectively reaching and serving these segments, which often have unique financial needs not met by conventional banking services.

Innovative Green Bonds or Sustainability-Linked Loans for New Industries

Shiga Bank could pioneer innovative green bonds or sustainability-linked loans for emerging green industries in Japan, such as renewable energy startups and environmental technology firms. These sectors represent high-growth potential but currently see low market share for the bank, necessitating strategic investment to build leadership.

For example, by offering tailored financial instruments, Shiga Bank can tap into the burgeoning sustainable finance market, which saw global green bond issuance reach an estimated $700 billion in 2023.

- Targeted Green Financing: Develop specific green bond frameworks or sustainability-linked loan structures for sectors like offshore wind development or carbon capture technology startups.

- Market Share Expansion: Aim to capture a significant portion of the niche market for financing early-stage green technology companies, where existing financial products may not be perfectly aligned.

- Risk Mitigation and Innovation: Structure these products to mitigate risks associated with nascent industries while encouraging innovation through performance-linked incentives in sustainability-linked loans.

- Strategic Partnership: Collaborate with industry associations and government agencies to identify and support promising new green ventures, thereby enhancing Shiga Bank's reputation as an enabler of sustainable growth.

Regional Revitalization Investment Funds

Regional Revitalization Investment Funds, when viewed through the lens of Shiga Bank's potential BCG Matrix, would likely be positioned as Stars or Question Marks. These funds represent a strategic move into areas with high societal growth potential, aiming to stimulate specific local economies. For instance, a 2024 initiative might involve partnering with local governments to create venture capital funds focused on sustainable agriculture or tourism in underdeveloped prefectures.

The uncertainty surrounding direct financial returns and market share for Shiga Bank in these new ventures requires careful consideration. While the societal impact is high, the immediate profitability is not guaranteed, placing them in a category that demands strategic capital allocation. This could involve pilot programs or smaller investment tranches to test market viability before committing larger sums.

- Shiga Bank's potential investment in regional revitalization aligns with national trends; for example, Japan's government allocated approximately ¥1 trillion (around $7 billion USD as of mid-2024) to regional revitalization initiatives in its 2024 budget.

- These funds aim to address demographic shifts and economic stagnation in rural areas, often focusing on sectors like advanced manufacturing, renewable energy, and digital transformation.

- The success metrics for such funds often extend beyond pure financial ROI to include job creation, population retention, and increased local economic activity, making their classification complex.

- By investing in these areas, Shiga Bank could foster new business ecosystems, potentially leading to future profitable relationships and market expansion, albeit with a longer-term outlook.

Shiga Bank's ventures into international markets, such as its Hong Kong representative office, and its embrace of advanced fintech, including AI and specialized digital lending platforms, firmly place these initiatives within the Question Mark quadrant of the BCG matrix. These areas represent significant growth potential but currently have a low market share for the bank, necessitating substantial investment and strategic execution.

BCG Matrix Data Sources

The Shiga Bank BCG Matrix is constructed using comprehensive financial disclosures, internal performance metrics, and extensive market research to provide a clear strategic overview.