Shiga Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiga Bank Bundle

The Shiga Bank's competitive landscape is shaped by several key forces, including the bargaining power of its customers and the intensity of rivalry among existing banks. Understanding these dynamics is crucial for strategic planning.

The threat of new entrants, while potentially moderated by regulatory hurdles, still presents a consideration for Shiga Bank's market position. Furthermore, the availability of substitute financial products can influence customer loyalty and pricing power.

The bargaining power of suppliers, though perhaps less pronounced in the banking sector, can still impact operational costs and service delivery for Shiga Bank.

The complete report reveals the real forces shaping Shiga Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Shiga Bank, like many Japanese regional banks, utilizes a variety of IT vendors for its essential banking systems and digital services. While the IT vendor market itself is generally fragmented, meaning no single supplier dominates, the intricate nature of integrating these diverse systems can create significant switching costs for Shiga Bank. This vendor lock-in makes it challenging and expensive to change providers if dissatisfaction arises.

The push for digital transformation across Japan's banking sector is increasing the demand for specialized fintech solutions. This heightened demand can empower smaller, niche technology suppliers who offer unique capabilities. For instance, the global fintech market was projected to reach over $1.5 trillion by 2024, indicating strong growth and potential leverage for specialized providers.

The increasing prevalence of cloud and Software-as-a-Service (SaaS) solutions within Japan's financial sector is gradually shifting the balance of power away from traditional IT infrastructure suppliers. These modern solutions frequently provide more standardized service offerings, leading to reduced upfront capital expenditures and a more manageable transition process when considering alternative providers compared to legacy on-premise systems.

For instance, as of early 2024, a significant portion of Japanese financial institutions have been actively exploring or implementing cloud-based core banking systems, aiming for enhanced agility and cost efficiency. This growing adoption suggests a potential long-term reduction in the bargaining power of specialized, proprietary software vendors who previously held considerable sway due to high switching costs.

However, it's crucial to acknowledge that data security and stringent regulatory compliance requirements in Japan continue to be paramount concerns for Shiga Bank when evaluating any cloud or SaaS supplier. These factors can still grant significant leverage to providers who demonstrate robust compliance and security protocols, particularly those with a proven track record within the Japanese financial regulatory landscape.

The availability of skilled talent, especially in rapidly evolving fields like IT, cybersecurity, and fintech, presents a critical aspect of supplier bargaining power for Shiga Bank. These professionals are essentially suppliers of essential human capital. A scarcity of these specialized skills within Japan, particularly in regional markets where Shiga Bank operates, can significantly amplify employee and consultant leverage, potentially leading to increased salary demands and hindering the bank's capacity for technological advancement.

In 2023, Japan faced a notable IT talent shortage, with estimates suggesting a deficit of over 200,000 professionals. This scarcity directly translates to higher recruitment costs and retention challenges for companies like Shiga Bank. Consequently, banks are compelled to consider substantial investments in internal training programs or engage in more aggressive competition for seasoned IT and financial technology experts, impacting operational budgets and strategic flexibility.

Regulatory and Compliance Service Providers

The bargaining power of specialized regulatory and compliance service providers for Shiga Bank is significant, particularly in Japan's dynamic financial landscape. As regulations surrounding Anti-Money Laundering/Counter-Financing of Terrorism (AML/CFT) and data privacy, such as the updated Act on the Protection of Personal Information effective in 2024, become more stringent, banks like Shiga Bank must rely heavily on these external experts. This dependence elevates the leverage of compliance firms, as the penalties for non-compliance can be substantial, impacting reputation and financial stability. The specialized knowledge required means few providers can meet these complex needs, further concentrating power.

The increasing complexity of financial regulations, coupled with a growing emphasis on cybersecurity and data governance following incidents in other regions, necessitates deep expertise. For instance, the Financial Services Agency (FSA) of Japan continues to update its guidelines, requiring constant adaptation from banks. This environment creates a scenario where Shiga Bank has limited alternatives for obtaining up-to-date, expert advice, thereby increasing the bargaining power of these specialized service providers. Their ability to navigate these intricate legal and operational frameworks is crucial for the bank's continued operation and risk management.

Key factors contributing to the bargaining power of regulatory and compliance service providers include:

- Specialized Expertise: Providers possess niche knowledge of evolving Japanese financial regulations, which is difficult for banks to replicate internally.

- High Switching Costs: Migrating to a new compliance provider or building in-house capabilities involves significant time, cost, and potential disruption.

- Risk of Non-Compliance: The severe financial and reputational damage associated with regulatory breaches strengthens the hand of providers who ensure adherence.

- Limited Supplier Pool: The number of firms offering comprehensive and up-to-date regulatory services in Japan is relatively small, reducing Shiga Bank's negotiation leverage.

Access to Capital Markets and Funding Sources

Shiga Bank's access to capital markets, beyond its core deposit base, significantly influences its bargaining power as a supplier of financial services. While deposits form the bedrock, the bank also taps into interbank lending, bond markets, and other wholesale funding avenues. These sources represent a form of 'supply' of capital that fuels its operations and lending activities.

The Bank of Japan's monetary policy plays a crucial role here. As of early 2024, the BoJ has begun a cautious normalization of its ultra-loose monetary policy, moving away from negative interest rates and yield curve control. This shift directly impacts the cost and availability of these wholesale funds. For Shiga Bank, this means potentially higher borrowing costs, which can compress its net interest margins and affect its overall financial flexibility.

- Impact of BoJ Policy: The Bank of Japan's interest rate adjustments in 2024 are increasing the cost of borrowed funds for banks like Shiga Bank.

- Wholesale Funding Costs: Rising interbank lending rates and bond yields mean Shiga Bank faces higher expenses for capital acquired through these channels.

- Profitability Squeeze: Increased funding costs, if not fully passed on to borrowers, can lead to reduced profitability for the bank.

- Financial Flexibility: The availability and cost of wholesale funding directly influence Shiga Bank's capacity to lend and invest, impacting its strategic options.

The bargaining power of Shiga Bank's suppliers, particularly in IT and specialized services, is influenced by several factors. Vendor lock-in due to system integration complexity can make switching providers costly, giving established suppliers leverage. However, the increasing adoption of cloud and SaaS solutions is democratizing access to technology, potentially reducing reliance on traditional, high-cost infrastructure providers.

Japan's IT talent shortage, estimated at over 200,000 professionals in 2023, significantly amplifies the bargaining power of skilled IT and fintech experts, driving up recruitment costs for Shiga Bank. Similarly, the specialized nature of regulatory and compliance services, coupled with the severe penalties for non-compliance with evolving Japanese regulations, grants considerable power to firms that can ensure adherence, as evidenced by the updated Act on the Protection of Personal Information in 2024.

The Bank of Japan's monetary policy adjustments throughout 2024 are increasing wholesale funding costs for banks like Shiga Bank. This means higher expenses for capital acquired through interbank lending and bond markets, potentially squeezing profit margins if these costs cannot be fully passed on to borrowers, thereby impacting the bank's financial flexibility.

What is included in the product

This analysis provides a comprehensive evaluation of the competitive forces impacting Shiga Bank, detailing the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes.

Quickly identify and neutralize competitive threats with a visual breakdown of industry power dynamics, allowing for proactive strategic adjustments.

Customers Bargaining Power

Customers in Japan, even in regional areas like those served by Shiga Bank, benefit from a wide selection of banking providers. This includes major megabanks, other regional institutions, credit unions, and a growing number of online-only financial services. For instance, as of early 2024, Japan boasts over 200 licensed banks, creating a competitive landscape.

This abundance of choice significantly empowers customers, allowing them to easily switch to a competitor if they find better rates, services, or digital offerings. The Japanese government's continued emphasis on digital transformation in finance further amplifies these options, pushing traditional banks to innovate and improve their customer value propositions.

The growing digitalization of banking, from online account opening to mobile payments, significantly lowers the effort customers need to switch providers. This ease of transition, amplified by user-friendly digital interfaces, empowers customers by making it simpler to manage finances across different banks.

Fintech advancements, such as account aggregation services, further streamline the switching process. For example, in 2024, a significant portion of banking customers reported using at least one digital channel for their banking needs, indicating a strong digital adoption that facilitates easier comparison and movement between institutions.

As the Bank of Japan shifts away from negative interest rates, depositors are paying closer attention to the returns offered on their savings. This increased sensitivity means Shiga Bank must offer competitive deposit rates. For instance, if Shiga Bank's savings account yields only 0.02%, a customer might easily find 0.1% or higher at a larger institution or through alternative investments, leading to fund outflows.

Regional banks like Shiga Bank might find it harder to match the rate increases offered by megabanks. Megabanks often have greater financial flexibility and can absorb higher funding costs more readily. This disparity could put Shiga Bank at a disadvantage, potentially losing customers to institutions offering more attractive yields on time deposits.

Aging and Shrinking Population in Regional Areas

Japan's demographic shift, with an aging and shrinking population, particularly in regions like Shiga Prefecture, directly impacts the customer base for regional banks. This trend means fewer potential new customers and a greater reliance on existing ones. As of 2023, Japan's total population was estimated to be around 123.3 million, and projections indicate a continued decline. This diminishing pool of customers increases the leverage of the remaining segments, as banks compete more fiercely for their business.

The decreasing number of individuals and businesses in regional areas amplifies the bargaining power of customers. When the customer base shrinks, each customer becomes more valuable, and their demands for better services, more favorable terms, and competitive pricing carry greater weight. For Shiga Bank, this translates to existing customers having more options and the ability to negotiate more effectively for loans, deposits, and other financial products.

- Declining Customer Pool: Regional areas like Shiga face a shrinking population, reducing the overall customer base for banks.

- Increased Customer Value: Fewer customers mean each individual or business holds more significance for the bank.

- Enhanced Negotiation Power: Customers can leverage their importance to demand better terms and pricing.

- Competitive Pressure: Banks must work harder to retain existing customers, giving those customers more bargaining leverage.

Corporate Clients' Sophistication and Diversification

Corporate clients, particularly larger enterprises, exhibit a heightened level of financial sophistication and often maintain multifaceted banking relationships. This sophistication allows them to effectively leverage their existing connections with multiple financial institutions, including major global banks, to secure more favorable terms. For instance, in 2023, large Japanese corporations frequently diversified their banking partners, with many engaging at least three major financial institutions for their core lending and treasury needs, thereby increasing their negotiating leverage.

The capacity of these corporate clients to tap into a wide array of funding avenues and specialized financial advisory services directly curtails Shiga Bank's individual bargaining power. As of early 2024, access to alternative financing, such as private credit markets and corporate bond issuance, has become more prevalent for many established businesses, presenting Shiga Bank with a more competitive landscape where clients can readily compare and demand better pricing and service packages.

- Sophisticated Needs: Large corporate clients require complex financial solutions, driving them to seek multiple banking partners.

- Diversified Relationships: Businesses maintain relationships with various banks, including megabanks, to enhance their negotiating position.

- Leveraging Competition: Clients can use offers from one bank to negotiate better terms with another, including Shiga Bank.

- Access to Alternative Funding: The availability of diverse funding sources outside traditional banking reduces reliance on any single institution.

Customers in Japan, including those served by Shiga Bank, face a highly competitive banking environment with numerous providers. This choice, amplified by digital banking trends and fintech advancements, significantly enhances customer bargaining power. As of early 2024, Japan had over 200 licensed banks, creating a landscape where customers can easily switch for better rates or services, a trend facilitated by digital platforms that simplify comparison and account management.

| Factor | Impact on Shiga Bank | Customer Leverage |

|---|---|---|

| Abundance of Choice | Increased competition for deposits and loans. | Customers can easily compare and switch for better terms. |

| Digitalization & Fintech | Lowered switching costs for customers. | Customers can leverage user-friendly digital tools to manage multiple banking relationships. |

| Demographic Shifts | Shrinking customer pool in regional areas. | Existing customers in regions like Shiga hold more value and negotiating power. |

| Corporate Sophistication | Large businesses diversify banking relationships. | Corporates use offers from multiple institutions to negotiate better pricing and services. |

Preview Before You Purchase

Shiga Bank Porter's Five Forces Analysis

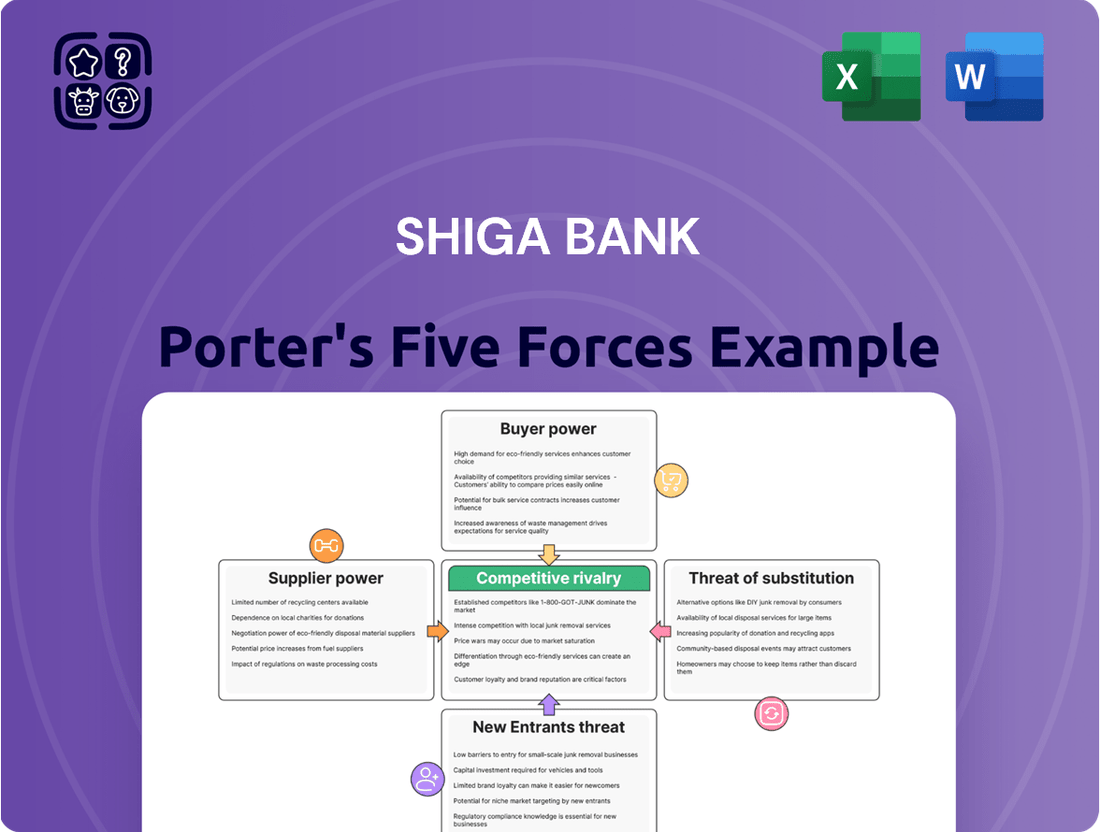

This preview showcases the comprehensive Shiga Bank Porter's Five Forces Analysis, detailing the competitive landscape within its industry. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the forces shaping Shiga Bank's strategic environment. This includes a thorough examination of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

Shiga Bank contends with formidable competition from Japan's dominant megabanks, such as Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group. These national players boast extensive branch networks, advanced digital platforms, and a wider array of financial products, allowing them to capture a significant market share and exert considerable pricing pressure. For instance, as of March 2024, the combined assets of these three megabanks exceeded ¥450 trillion, dwarfing the scale of regional institutions.

Beyond the megabanks, Shiga Bank faces a crowded field of regional banks operating within its primary service areas. These include institutions like Kyoto Bank and Hokuriku Bank, which also vie for local depositors and borrowers. This intense rivalry among regional players often results in aggressive pricing strategies for loans and deposits, and a constant drive to differentiate through customer service and specialized offerings to attract and retain customers.

The Japanese regional banking landscape is marked by increasing consolidation and strategic alliances. This trend is fueled by the persistent need for greater scale and enhanced profitability, particularly within a low-growth economic environment. Recent years have seen several regional banks merging or forming partnerships, creating larger, more formidable competitors. For instance, in 2023, the merger of Iyo Bank and Shikoku Bank into Iyo-Shikoku Holdings created a significant regional player. This consolidation pressure compels Shiga Bank to continually improve its services and operational efficiency to remain competitive.

Competitive rivalry in the banking sector is intensifying, significantly fueled by digital transformation and the rapid adoption of fintech solutions. Banks that prioritize and heavily invest in areas like mobile banking, artificial intelligence for personalized services, and streamlined digital platforms are clearly differentiating themselves and gaining a crucial competitive advantage.

Shiga Bank faces the imperative to not only match but also anticipate these technological shifts. Failure to keep pace risks alienating customers who are increasingly drawn to the convenience and innovation offered by more digitally agile competitors, including nimble non-bank fintech companies that often specialize in specific financial services.

For instance, in 2023, global fintech investment reached an estimated $150 billion, underscoring the vast resources being poured into digital innovation within the financial services industry. This trend highlights the pressure on traditional banks like Shiga Bank to innovate or risk losing market share to these tech-forward disruptors.

Demographic Pressures and Regional Revitalization Efforts

Japan's demographic shifts, characterized by a declining and aging population, are intensifying competitive rivalry for regional banks like Shiga Bank. This shrinking customer base forces banks to vie more aggressively for market share. For instance, in 2023, Japan's total fertility rate was reported to be 1.20, a figure well below the replacement level, indicating a sustained population decline.

To counter these pressures, regional banks are increasingly engaging in revitalization efforts within their local communities. This strategic focus means competition extends beyond traditional financial services to encompass community engagement, support for local businesses, and tailored regional products. Banks are essentially competing on their ability to foster local economic growth and maintain community relevance.

- Shrinking Customer Base: Japan's aging population and low birth rates directly reduce the pool of potential customers for regional banks.

- Intensified Competition: Banks are forced to compete more fiercely for a smaller number of clients, driving down margins on core products.

- Focus on Regional Revitalization: Differentiation is sought through active participation in local economic development and community support initiatives.

- Competition Beyond Financial Products: Success hinges on building loyalty through community involvement and unique, locally relevant offerings.

Interest Rate Environment and Profitability Pressures

The Bank of Japan's move away from negative interest rates and its subsequent gradual rate increases directly impact the net interest margins for all financial institutions, including Shiga Bank.

Regional banks like Shiga Bank might struggle to capitalize fully on these rising rates. This is partly due to the composition of their existing loan portfolios and the intense competition for customer deposits, which can limit their ability to pass on higher costs. Consequently, profitability faces pressure, making it even more crucial for these banks to explore new avenues for revenue generation and identify opportunities for cost savings.

- Bank of Japan Policy Shift: The BOJ began exiting its negative interest rate policy in March 2024, a significant change after years of ultra-loose monetary policy.

- Net Interest Margin Impact: While rising rates can theoretically boost margins, regional banks' ability to benefit is constrained by loan structures and deposit competition.

- Profitability Pressures: Increased funding costs and the need to remain competitive on deposit rates can squeeze profitability for banks like Shiga Bank.

- Strategic Imperative: This environment necessitates a focus on non-interest income and operational efficiency to maintain healthy financial performance.

Shiga Bank faces intense rivalry from large national banks, other regional institutions, and emerging fintech players, all vying for market share in a consolidating and digitally transforming Japanese banking sector.

The pressure is amplified by Japan's demographic trends, which are shrinking the customer base and forcing banks to compete more aggressively on price and service innovation to retain clients.

As of March 2024, the three largest Japanese megabanks held over ¥450 trillion in assets, demonstrating their scale advantage over regional players like Shiga Bank.

The Bank of Japan's policy shift away from negative interest rates in March 2024 adds further complexity, potentially squeezing net interest margins for regional banks less able to adapt quickly to rising funding costs.

| Competitor Type | Key Characteristics | Impact on Shiga Bank |

|---|---|---|

| Megabanks (e.g., MUFG, SMBC, Mizuho) | Vast branch networks, advanced digital platforms, broad product offerings, significant asset base (over ¥450 trillion combined as of March 2024). | Market share dominance, pricing pressure, ability to invest heavily in technology. |

| Regional Banks (e.g., Kyoto Bank, Hokuriku Bank) | Local focus, compete on customer service and specialized offerings, often engage in consolidation. | Intense local competition, aggressive pricing for loans and deposits. |

| Fintech Companies | Agile, digital-first, specialized services, high investment in innovation (global fintech investment ~$150 billion in 2023). | Disruptive potential, attract digitally savvy customers, pressure to adopt new technologies. |

SSubstitutes Threaten

Fintech companies are increasingly offering services that directly compete with Shiga Bank's traditional offerings. Think peer-to-peer lending platforms, digital wallets, and online investment tools. These digital alternatives are gaining traction, especially among younger demographics.

The digital payment market in Japan has seen robust growth, with mobile payments alone projected to reach ¥10.7 trillion in transaction value by 2025, according to Statista. This rapid adoption of convenient, often lower-cost digital solutions presents a significant threat to traditional banking models.

For instance, QR code payment systems, widely adopted across Japan, bypass traditional card networks and bank infrastructure, offering a streamlined experience for consumers and merchants alike. This convenience factor makes them a strong substitute for many in-branch or card-based transactions.

Non-bank financial institutions and credit unions represent a significant threat of substitutes for Shiga Bank. These entities, including shinkin banks and local credit unions, offer comparable deposit and lending services, particularly appealing to individuals and small businesses with strong local connections or a preference for community-focused financial solutions. For instance, Japan's credit union sector, as of March 2024, managed over ¥100 trillion in assets, demonstrating their substantial presence and capacity to serve as viable alternatives to traditional banks like Shiga Bank.

Larger corporate clients, especially those with strong credit ratings, increasingly bypass traditional bank lending by directly accessing capital markets. In 2024, the global debt capital markets saw robust activity, with corporations raising substantial funds through bond issuances, offering a direct alternative to bank loans. This trend diminishes Shiga Bank's reliance on corporate lending as a primary revenue source, as companies can secure financing more efficiently through these channels.

Investment Products and Asset Management Firms

Customers looking to grow their wealth have a vast array of options beyond traditional bank deposits. Asset management firms, brokerage houses, and online investment platforms offer mutual funds, stocks, bonds, and real estate, all competing for Shiga Bank's deposit base. This competitive landscape is further intensified by the prevailing low-interest-rate environment in Japan, which historically pushed consumers to seek higher yields elsewhere. For instance, in early 2024, the Bank of Japan maintained its ultra-loose monetary policy, with deposit rates remaining near zero, making alternative investments significantly more attractive.

The threat of substitutes is substantial for Shiga Bank. Consider the growth in Japan's investment trust market; by the end of fiscal year 2023, the total net assets of investment trusts reached approximately ¥233 trillion, a significant increase from previous years. This indicates a strong consumer preference for diversified investment products over simple bank savings.

- Mutual Funds: Offer diversification and professional management, appealing to investors seeking less risk than individual stocks.

- Stocks and Bonds: Direct investment in equities and debt instruments provide potential for higher returns, albeit with greater volatility.

- Real Estate: Direct property ownership or real estate investment trusts (REITs) represent tangible assets that can generate rental income and capital appreciation.

- Online Investment Platforms: Robo-advisors and digital brokerage services lower the barrier to entry for sophisticated investment strategies, attracting younger demographics.

Cryptocurrencies and Stablecoins

Cryptocurrencies and stablecoins represent a looming threat of substitution for Shiga Bank's core services. While still developing, regulatory clarity in Japan, particularly for stablecoins, is increasing, suggesting potential for broader adoption. This digital shift could see customers opting for these assets over traditional bank deposits and payment systems.

The impact could be significant; if cryptocurrencies and stablecoins become mainstream for daily transactions, they directly substitute for Shiga Bank's deposit-taking and payment processing functions. This substitution could lead to a reduction in transaction fees and a shrinking deposit base, directly affecting revenue streams.

For instance, while precise figures for cryptocurrency transaction substitution impacting Japanese banks are still emerging, global trends show increasing interest. In 2023, the global value of cryptocurrency transactions reached trillions of dollars, indicating a significant alternative financial ecosystem already in play.

- Regulatory developments in Japan are creating a more defined landscape for digital currencies.

- Wider adoption of stablecoins could directly compete with traditional bank deposits.

- The potential for reduced transaction volumes for banks is a key concern.

- Global transaction volumes in crypto highlight the scale of potential substitution.

The threat of substitutes for Shiga Bank is considerable, stemming from diverse non-traditional financial service providers and evolving customer preferences. These substitutes offer convenience, potentially lower costs, and alternative avenues for wealth accumulation and transactions.

Fintech innovations, such as P2P lending and digital payment systems, directly challenge Shiga Bank's core services. Japan's digital payment market is a prime example of this substitution, with mobile payments projected to reach ¥10.7 trillion by 2025, according to Statista, bypassing traditional banking infrastructure.

Furthermore, the availability of mutual funds, stocks, bonds, and real estate investment opportunities, fueled by Japan's persistently low interest rates in early 2024, encourages customers to seek higher yields away from traditional bank deposits. The investment trust market alone saw total net assets reach approximately ¥233 trillion by the end of fiscal year 2023, underscoring this shift.

| Substitute Category | Examples | Key Features | Impact on Shiga Bank |

|---|---|---|---|

| Fintech & Digital Payments | P2P lending, digital wallets, QR code payments | Convenience, lower fees, speed | Reduced transaction volume, disintermediation |

| Investment Products | Mutual funds, stocks, bonds, REITs | Higher potential returns, diversification | Shrinking deposit base, loss of wealth management revenue |

| Alternative Lenders | Credit unions, shinkin banks | Community focus, tailored services | Competition for retail and SME deposits/loans |

| Capital Markets | Bond issuances, direct financing | Efficient access to capital for corporates | Reduced corporate lending opportunities |

| Digital Currencies | Cryptocurrencies, stablecoins | Decentralization, alternative payment rails | Potential disruption of payment systems and deposits |

Entrants Threaten

The banking sector in Japan is characterized by substantial regulatory hurdles. Aspiring financial institutions must navigate rigorous licensing procedures, stringent compliance mandates, and demanding capital adequacy ratios. These requirements, overseen by the Financial Services Agency (FSA), significantly elevate the cost and complexity of establishing a new bank.

In 2024, the FSA continued to emphasize robust capital frameworks, with many Japanese banks maintaining Common Equity Tier 1 (CET1) ratios well above the Basel III minimums, often exceeding 10%. This commitment to strong capital buffers, while ensuring stability, inherently raises the capital investment needed for new entrants, thereby dampening the threat of new competition.

Establishing a new bank, akin to Shiga Bank, necessitates immense capital. For instance, in 2024, regulatory capital requirements for new banks in Japan, depending on their business model and scale, can easily run into billions of yen, a significant barrier for potential entrants.

New players must also achieve considerable scale to match the operational efficiencies of established institutions. Shiga Bank, with its extensive branch network and digital infrastructure, benefits from economies of scale, reducing per-unit costs in areas like IT systems and marketing. Replicating this scale would demand substantial upfront investment and time.

Shiga Bank benefits from deeply entrenched customer loyalty and strong brand recognition within its home region of Shiga Prefecture. This long-standing trust, built over decades, creates a significant barrier for any new financial institution looking to enter the market. In 2024, Shiga Bank reported a customer satisfaction score of 85%, a testament to their sustained relationship-building efforts.

Access to Funding and Deposit Bases

New banks entering the market would find it difficult to secure a reliable and varied deposit base, which is essential for funding their lending operations. Established institutions like Shiga Bank have cultivated extensive depositor relationships over many years, providing them with a substantial edge in funding costs and stability.

For instance, as of the fiscal year ending March 2024, major Japanese banks, including those in Shiga Prefecture's sphere of influence, reported substantial deposit volumes. Shiga Bank itself maintained a strong deposit base, reflecting the trust and loyalty of its long-standing customers. This deep well of funding allows them to offer competitive loan rates and weather economic fluctuations more effectively than a newcomer could initially.

The barriers to entry related to accessing funding and deposit bases are significant:

- Established Trust and Brand Recognition: Decades of operation have built deep trust and brand loyalty for banks like Shiga Bank, making it hard for new entrants to attract a comparable deposit base quickly.

- Economies of Scale in Funding: Larger banks benefit from economies of scale in managing their deposit liabilities, leading to lower average funding costs compared to smaller or newer operations.

- Regulatory Hurdles: While not directly about deposits, the capital requirements and compliance associated with banking licenses can indirectly impact a new entrant's ability to build a robust funding structure.

- Network Effects: Existing banks have established branch networks and digital platforms that attract and retain customers, creating a virtuous cycle that is challenging for new players to replicate.

Fintech-led Entrants and Regulatory Sandboxes

While the hurdles for establishing a traditional bank remain substantial, the real threat of new entrants in Japan's financial sector increasingly stems from fintech firms. These companies are adept at utilizing technology to deliver specialized financial services, often targeting underserved market segments or offering more streamlined user experiences.

The Japanese government actively supports fintech advancement, notably through its regulatory sandbox initiatives. These programs allow innovative financial services to be tested in a controlled environment, lowering the barrier to market entry for new players. For instance, by mid-2024, Japan had seen numerous applications for sandbox participation, indicating a vibrant ecosystem of aspiring fintech innovators.

This environment fosters the rise of niche competitors and entirely new digital banks. While these entities may not immediately challenge established institutions like Shiga Bank across the full spectrum of services, they can gain significant traction by focusing on specific areas. Often, these fintech newcomers collaborate with or are acquired by incumbent banks, integrating their innovative solutions rather than purely competing head-on.

- Fintech Innovation: Fintech companies are leveraging technology to offer specialized financial services, posing a threat to traditional banks.

- Regulatory Support: Japan's government is encouraging fintech growth through regulatory sandboxes, facilitating the testing of new financial services.

- Market Impact: Niche players and digital banks emerging from these sandboxes can gain market share, sometimes in partnership with existing financial institutions.

The threat of new entrants for Shiga Bank is currently moderate, primarily due to significant regulatory capital requirements and the need for substantial scale to compete effectively. Established trust and extensive deposit bases are strong deterrents.

However, the rise of fintech presents a more dynamic threat, with regulatory sandboxes in Japan actively encouraging innovation. These agile new players can carve out niche markets, potentially impacting Shiga Bank's customer base in specific service areas.

| Barrier Type | Impact on New Entrants (Shiga Bank Context) | 2024 Data/Observation |

|---|---|---|

| Capital Requirements | High - Significant investment needed for licensing and operations. | CET1 ratios for Japanese banks remained strong, often exceeding 10%, requiring substantial capital for new entrants. |

| Economies of Scale | High - New entrants must match established networks and IT infrastructure. | Shiga Bank's existing infrastructure provides cost efficiencies difficult for newcomers to replicate quickly. |

| Brand Loyalty & Trust | High - Decades of customer relationships are hard to overcome. | Shiga Bank reported an 85% customer satisfaction score in 2024, reflecting deep-seated trust. |

| Fintech Innovation | Moderate to High - Disruptive potential in niche services. | Numerous fintech firms applied for Japan's regulatory sandbox in mid-2024, indicating a growing competitive landscape. |

Porter's Five Forces Analysis Data Sources

Our Shiga Bank Porter's Five Forces analysis is built upon a foundation of reliable data, drawing from the bank's annual reports, financial statements, and investor relations disclosures. We also incorporate industry-specific data from financial news outlets and reports from Japanese financial regulatory bodies to ensure a comprehensive understanding of the competitive landscape.