Sekisui Chemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sekisui Chemical Bundle

Sekisui Chemical operates within a dynamic global environment, shaped by political shifts, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and identifying both opportunities and threats. Our PESTLE analysis delves into these critical areas, offering a clear picture of the landscape Sekisui Chemical navigates.

Discover how technological advancements, environmental regulations, and legal frameworks are directly impacting Sekisui Chemical's operations and future growth. This comprehensive analysis provides actionable intelligence for stakeholders seeking to gain a competitive edge.

Don't get left behind; equip yourself with the knowledge to anticipate market changes and make informed decisions. Our expertly crafted PESTLE analysis of Sekisui Chemical is your key to unlocking strategic foresight.

Download the full PESTLE analysis now and gain the in-depth insights needed to navigate the complexities of Sekisui Chemical's external environment and strengthen your own market strategy.

Political factors

Sekisui Chemical's extensive global footprint makes it highly sensitive to shifts in international trade agreements and potential tariff implementations through 2025. Policy changes from major markets like the U.S., Europe, and key Asian nations could directly influence raw material procurement costs and the competitive pricing of its exported finished goods. For instance, new tariffs on specialty polymers could reduce the profitability of its High Performance Plastics segment, which generated 2024 operating income of ¥28.9 billion, impacting sales to the automotive and electronics sectors in those regions.

Sekisui Chemical's Urban Infrastructure & Environmental Products segment heavily relies on public investment. Government budgets and stimulus packages, especially in Japan, directly influence demand for the company's pipes and rehabilitation materials for water and sewage systems. For instance, Japan's FY2024 budget includes significant allocations for infrastructure maintenance, driving steady demand. A global push for sustainable infrastructure, like the anticipated 5% increase in global water infrastructure spending by 2025, presents a strong growth opportunity for Sekisui's specialized products.

Sekisui Chemical operates in over 30 countries, making its global supply chains and manufacturing operations susceptible to political instability. Geopolitical shifts, like evolving trade policies in key regions during 2024, can disrupt material flow and alter market demand for products like high-performance plastics. For instance, changes in government or foreign policy in a major market could impact revenue streams. However, Sekisui's diversified global footprint, with significant operations across Asia, Europe, and North America, helps mitigate the impact of instability in any single country.

International Relations and Partnerships

International relations significantly influence Sekisui Chemical’s global expansion and innovation efforts. Collaborative agreements with foreign governments and entities are crucial, as exemplified by a 2024 memorandum of understanding with Slovakia to potentially produce perovskite solar panels.

Furthermore, an agreement with entities in the Netherlands for a similar factory highlights the importance of positive diplomatic and business relations. These partnerships, like the projected €100 million investment in European facilities by 2025, are essential for establishing new manufacturing capabilities and securing market access.

- Slovakia MoU: Potential perovskite solar panel production.

- Netherlands Agreement: Similar factory development.

- Strategic Partnerships: Crucial for market access and global expansion.

- Investment: Over €100 million projected for European facilities by 2025.

Donations to Political Organizations

Sekisui Chemical discloses its donations to political organizations, asserting these contributions support public policies beneficial to society. While managed for compliance, this practice can attract public scrutiny and raise perceptions of influencing policy-making, impacting brand reputation. The company maintains transparency in reporting these contributions as part of its corporate governance, reflecting a commitment to ethical conduct. For fiscal year 2024, such disclosures are integral to investor relations and sustainability reporting.

- Public disclosure of political donations is a key governance aspect for Sekisui Chemical.

- Donations aim to support policies beneficial to societal progress.

- The practice faces scrutiny regarding potential influence on policy-making.

- Transparency in reporting is crucial for maintaining public trust and corporate reputation.

Sekisui Chemical's global operations are significantly shaped by international trade policies and geopolitical shifts, impacting its supply chains and market access. Public infrastructure spending, notably Japan's FY2024 budget, drives demand for its environmental products. Strategic international partnerships, like the 2024 Slovakia MoU for solar panels, are vital for new market entry and innovation. The company's transparency regarding political donations also influences its corporate reputation.

| Political Factor | Impact on Sekisui Chemical | Relevant Data (2024/2025) |

|---|---|---|

| Trade Policies & Tariffs | Influences raw material costs and product pricing. | High Performance Plastics 2024 operating income: ¥28.9 billion. |

| Public Infrastructure Spending | Drives demand for Urban Infrastructure & Environmental Products. | Japan's FY2024 budget allocations; 5% global water infrastructure spending increase by 2025. |

| International Relations & Partnerships | Crucial for global expansion and innovation. | 2024 Slovakia MoU; €100 million projected investment in European facilities by 2025. |

What is included in the product

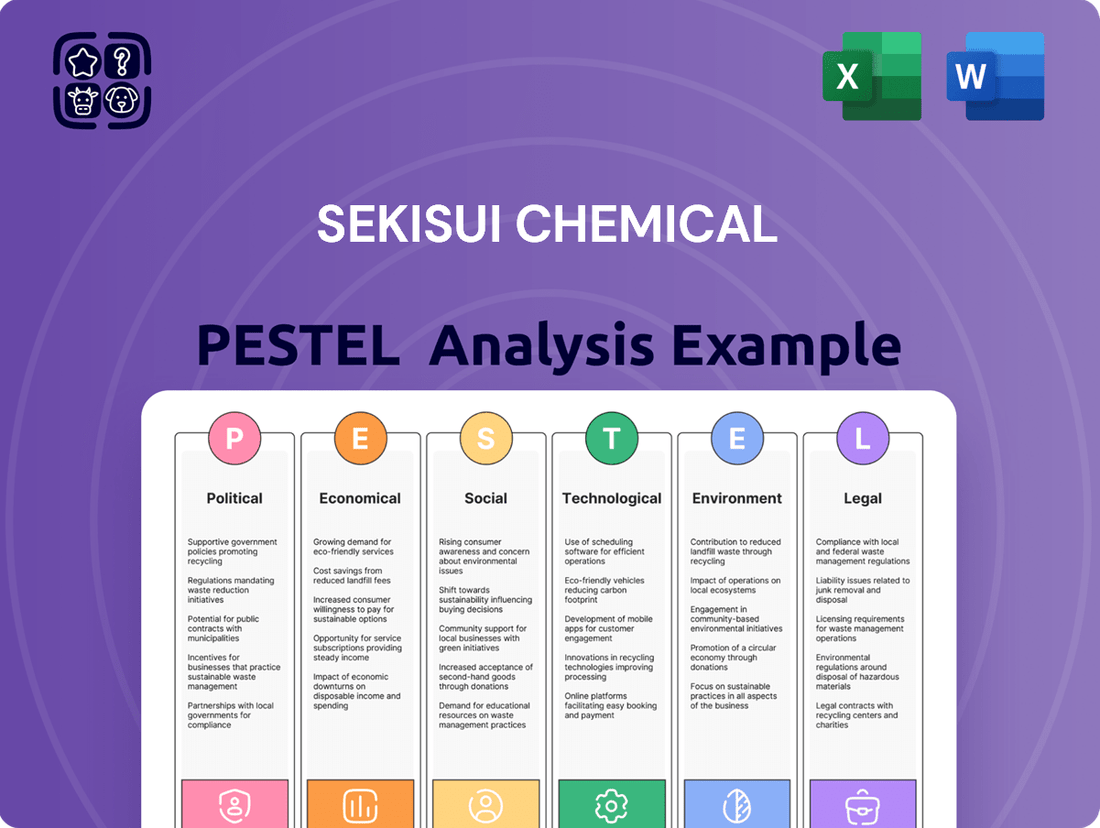

Sekisui Chemical's PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its global operations, offering a comprehensive view of its external landscape.

This analysis provides actionable insights by detailing how these macro-environmental factors create both challenges and strategic advantages for Sekisui Chemical, guiding informed decision-making.

Sekisui Chemical's PESTLE analysis offers a structured framework to proactively identify and mitigate external threats and opportunities, thereby easing the burden of navigating complex global markets.

Economic factors

Sekisui Chemical, a global entity, sees its performance intrinsically linked to the economic vitality of key markets including Japan, North America, Europe, and Asia. A projected global GDP growth slowdown to around 2.7% in 2024 (IMF data) could decrease demand across its housing, automotive, and electronics segments. Conversely, anticipated stronger growth, such as 2.8% global GDP in 2025, would fuel demand for Sekisui's diverse product portfolio. For instance, a resilient US market with an expected 2.1% GDP growth in 2024 supports demand for its high-performance plastics. However, continued inflation pressures and interest rate policies in regions like Europe, where 2024 growth is modest at 1.5%, could still temper consumer and industrial spending.

Sekisui Chemical's profitability is highly sensitive to the volatile prices of key raw materials like steel, timber, and petroleum-based products such as polyvinyl chloride and olefin. Significant increases in these costs directly elevate production expenses, impacting segments like Urban Infrastructure and High Performance Plastics. For example, the sustained high energy prices observed into early 2024 continue to pressure input costs for petro-chemical derivatives. While Sekisui Chemical endeavors to pass these increased costs onto customers, this strategy can compress profit margins, especially in competitive markets. Effective raw material procurement and hedging strategies remain crucial to mitigate these economic pressures through 2025.

Sekisui Chemical's significant international operations mean its earnings are highly susceptible to foreign currency exchange rate fluctuations. A weaker Japanese Yen, observed at levels around ¥155-¥160 per US Dollar in early 2024, favorably impacts the translation of overseas profits into its home currency, boosting reported revenue. However, a strengthening Yen, if it were to appreciate significantly in late 2024 or 2025, would have the opposite effect, making Sekisui's products more expensive for foreign buyers and reducing the value of repatriated profits.

Housing Market Trends in Japan

The Japanese housing market significantly influences Sekisui Chemical's Housing segment, with conditions like interest rates and consumer confidence directly affecting demand. As of early 2024, the Bank of Japan's shift away from negative interest rates could modestly impact mortgage affordability, potentially slowing housing starts. A decline in new housing construction, which saw around 860,000 starts in 2023, or shifts towards smaller, more sustainable units, directly affects sales of prefabricated homes. Sekisui Chemical's strategic pricing and cost management, particularly with fluctuating material costs, are crucial for maintaining profitability in this evolving landscape.

- Japanese housing starts are projected to stabilize around 850,000-880,000 units in 2024.

- Consumer confidence in Japan, while recovering, remains sensitive to economic outlook and inflation pressures.

- Government policies encouraging renovation and energy-efficient homes are shaping new construction trends.

- Sekisui Chemical's prefabricated housing sales are directly tied to these market dynamics.

Growth in Emerging Markets

Rapid urbanization and infrastructure development in emerging economies, particularly in Asia, present significant growth opportunities for Sekisui Chemical. The rising demand for modern housing and commercial buildings in regions like Southeast Asia, projected to see construction market growth of around 6.5% annually through 2025, drives the need for Sekisui’s construction plastics and pipes. Sekisui Chemical is actively expanding, with its new factory in India enhancing capacity to meet this burgeoning demand. This strategic positioning allows the company to capitalize on the robust economic expansion in these key markets.

- Asia's emerging construction market is forecast for approximately 6.5% annual growth through 2025.

- Sekisui Chemical has invested in new production facilities in India to boost regional supply.

- Demand for modern housing and infrastructure in these regions remains a primary driver.

Global economic growth, projected at 2.7% for 2024, directly influences Sekisui Chemical's diverse market demand. Fluctuating raw material costs, particularly petroleum-based products, and a weaker Japanese Yen (around ¥155-¥160/USD in early 2024) significantly impact profitability and international earnings. The Japanese housing market, with 2024 starts stabilizing around 850,000-880,000 units, and Asia's 6.5% annual construction growth through 2025, shape key segment performance.

| Economic Factor | 2024 Outlook | 2025 Outlook |

|---|---|---|

| Global GDP Growth | ~2.7% | ~2.8% |

| Yen Exchange Rate (USD/JPY) | ¥155-¥160 (early 2024) | Volatile |

| Japanese Housing Starts | 850,000-880,000 units | Stable |

| Asia Construction Market Growth | ~6.5% | ~6.5% |

Full Version Awaits

Sekisui Chemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Sekisui Chemical PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination of the external forces shaping Sekisui Chemical's strategic landscape. Understanding these elements is crucial for stakeholders to navigate current challenges and capitalize on future opportunities.

Sociological factors

Japan's accelerating aging population, with over 30% projected to be 65 or older by 2025, and a declining birthrate present a dual challenge and opportunity for Sekisui Chemical. While a shrinking overall population might temper long-term demand for new, large family housing, there is a growing need for specialized, barrier-free housing solutions tailored for elderly residents and smaller households. This demographic shift directly influences product development within Sekisui Chemical's Housing segment, driving innovation in renovations and compact designs. The company is actively adapting its offerings to cater to the evolving needs of an older, more diverse household structure in Japan.

There is increasing consumer and societal pressure for environmentally friendly and sustainable products, directly influencing Sekisui Chemical's market. This trend impacts all Sekisui's business segments, driving demand for green construction materials, recyclable plastics, and products that contribute to a circular economy. For instance, the global market for sustainable packaging is projected to exceed $400 billion by 2025. Sekisui's focus on Products to Enhance Sustainability, aiming for a 2025 sales ratio of 60% from these offerings, is a direct response to this significant societal shift.

Heightened public awareness regarding health and safety significantly influences Sekisui Chemical's product development, particularly within its Housing and Medical business segments. There is a growing demand for materials that improve indoor air quality, such as advanced anti-allergen agents, reflecting a societal shift towards healthier living environments. This trend also drives the need for safe and reliable medical diagnostic products, critical for global healthcare infrastructure. Sekisui Chemical's commitment to these areas aligns with its focus on contributing to improved health, with its Medical business segment contributing JPY 108.9 billion in sales during fiscal year 2023, showcasing its strong position in this vital market.

Corporate Social Responsibility (CSR) and ESG Expectations

Stakeholders, including customers, investors, and the public, increasingly expect companies like Sekisui Chemical to demonstrate strong Environmental, Social, and Governance (ESG) performance. Sekisui Chemical's commitment to ESG is central to its management strategy, crucial for maintaining brand reputation and attracting investment, especially given the rising focus on sustainable finance in 2024. The company's human rights policies and community engagement are key components of its social responsibility efforts, aligning with global standards for ethical business conduct.

- Sekisui Chemical targets a 30% reduction in CO2 emissions by FY2030 (compared to FY2013) as part of its ESG goals.

- The company achieved an A- score in the CDP Climate Change 2023 assessment, reflecting strong environmental management.

- Sekisui Chemical has been included in the Dow Jones Sustainability Asia Pacific Index for 11 consecutive years through 2023.

- Their human rights due diligence process covers suppliers, ensuring ethical supply chains in 2024.

Labor Shortages and Workforce Dynamics

Like many Japanese manufacturers, Sekisui Chemical navigates significant challenges from Japan's shrinking domestic workforce, impacting production capacity and increasing labor costs. The nation's working-age population declined by over 600,000 in 2023, intensifying labor market tightness. Sekisui Chemical's focus on human resource management, including fostering a culture of challenge and ensuring workplace safety, is crucial for attracting and retaining talent amidst these demographic shifts. This strategic approach helps mitigate the risks posed by the country's persistent labor shortages.

- Japan's working-age population decreased by 0.9% in 2023.

- The unemployment rate in Japan remained low at 2.6% in early 2024, indicating a tight labor market.

Societal shifts in Japan, including an aging population and declining birthrate, drive demand for specialized housing and renovations. Growing global awareness of sustainability and health fuels demand for green products and advanced medical solutions, with the sustainable packaging market projected to exceed $400 billion by 2025. Stakeholder pressure for strong ESG performance and challenges from Japan's shrinking workforce, with the working-age population declining by 0.9% in 2023, shape Sekisui Chemical's strategic priorities.

| Sociological Trend | Impact on Sekisui Chemical | Relevant Data (2024/2025) |

|---|---|---|

| Aging Population (Japan) | Demand for barrier-free, renovated housing | 30%+ of Japan's population 65+ by 2025 |

| Sustainability Demand | Focus on green materials, circular economy | Sustainable packaging market >$400B by 2025 |

| Health & Safety Awareness | Growth in indoor air quality, medical products | Medical business sales JPY 108.9B (FY2023) |

| ESG Expectations | Enhanced reputation, investment appeal | CDP Climate Change A- score (2023) |

| Workforce Shrinkage (Japan) | Increased labor costs, talent retention focus | Japan's working-age population decreased 0.9% (2023) |

Technological factors

Sekisui Chemical's competitive edge hinges on its continuous innovation in high-performance materials. The company significantly invests in research and development, with its R&D expenses projected around JPY 60 billion for the fiscal year ending March 2025, to create advanced plastics and eco-friendly construction solutions. This focus also extends to developing specialized materials for the automotive and healthcare sectors, such as high-functional films and medical devices. This deep commitment to R&D remains a core pillar of Sekisui Chemical's strategic growth, driving new product commercialization and market leadership.

Sekisui Chemical is at the forefront of developing and commercializing film-type perovskite solar cells, a key technological advancement. This innovation offers lightweight and flexible alternatives to traditional solar panels, expanding application possibilities. The company is actively engaged in demonstration projects, including a 2024 installation on a building in Tokyo. Sekisui plans for mass production by 2025, targeting efficiencies exceeding 15% for its film-type cells, aiming to capture a significant share of the evolving renewable energy market.

The chemical manufacturing industry is undergoing a significant transformation driven by the adoption of digital technologies, including artificial intelligence (AI) and the Internet of Things (IoT). Sekisui Chemical is actively leveraging these advancements to enhance operational efficiency, streamline processes, and foster innovation across its production facilities. The company's strategic integration of AI and IoT is a core component of its goal to fuse internal technological expertise with external collaborations for sustained growth. By fiscal year 2024, such digitalization efforts aim to optimize resource allocation and accelerate new product development cycles.

Development of Sustainable Technologies

Sekisui Chemical significantly invests in research and development for sustainable technologies, directing efforts toward a circular economy and bio-based plastics. The company aims to reduce greenhouse gas emissions in its production processes, targeting a 26% reduction in Scope 1 and 2 emissions by fiscal year 2030 compared to 2019 levels. Achieving ISCC PLUS certification for various products, including polyolefin resins, further underscores Sekisui's commitment to sustainable polymer production methods as of early 2024.

- Targeted a 26% reduction in Scope 1 and 2 GHG emissions by FY2030 (vs. 2019).

- Achieved ISCC PLUS certification for key sustainable polymer offerings in 2024.

Intellectual Property and Technological Platforms

Sekisui Chemical's competitive edge relies heavily on protecting its innovations through robust intellectual property rights, including patents. The company's future product development and market expansion are fundamentally supported by its 26 distinct technological platforms. These platforms, ranging across residential, environmental, and chemical solutions, are central to Sekisui's value creation process and strategic growth into 2025.

- Sekisui Chemical reported over 5,000 active patents globally as of March 2024.

- These 26 platforms underpin new product launches, contributing to a projected 3% revenue growth in fiscal year 2025.

- Investment in R&D for these core technologies is expected to exceed ¥40 billion in fiscal year 2024.

- Strategic focus areas, like advanced materials, leverage multiple platforms for synergistic innovation.

Sekisui Chemical drives innovation through significant R&D investments, projecting around JPY 60 billion for fiscal year 2025, focusing on high-performance materials and sustainable solutions. The company is poised for mass production of film-type perovskite solar cells by 2025, targeting efficiencies over 15%. Digitalization efforts, including AI and IoT integration by fiscal year 2024, enhance operational efficiency and product development. Robust intellectual property protection, with over 5,000 active patents in March 2024, safeguards its 26 core technological platforms.

| Technological Focus | Key Initiative | 2024/2025 Data Point |

|---|---|---|

| R&D Investment | High-performance materials | JPY 60 billion R&D expenses (FY2025 projection) |

| Renewable Energy | Perovskite solar cells | Mass production by 2025 (targeting >15% efficiency) |

| Digital Transformation | AI and IoT integration | Operational optimization by FY2024 |

| Intellectual Property | Patent portfolio | Over 5,000 active patents (March 2024) |

| Sustainability | GHG emissions reduction | 26% reduction in Scope 1 and 2 by FY2030 (vs. 2019) |

Legal factors

Sekisui Chemical must navigate Japan's stringent chemical substance regulations, including the Chemical Substance Control Law (CSCL) and the Industrial Safety and Health Law (ISHL).

These laws mandate rigorous testing and registration of new chemicals, directly influencing the company's product development and innovation pipeline for 2024-2025.

The management of hazardous materials in manufacturing processes also requires strict adherence, increasing operational complexity and oversight.

Compliance costs for such regulations can be substantial, with Japanese chemical companies potentially allocating several million yen annually towards testing, registration, and safety protocols, impacting Sekisui's expenditures.

Sekisui Chemical operates globally, necessitating strict adherence to diverse environmental laws concerning greenhouse gas emissions, waste management, and pollution prevention across all regions. The company targets a 46% reduction in Scope 1 and 2 GHG emissions by fiscal year 2030 (compared to FY2013), aligning with international climate goals. Continuous investment in eco-friendly technologies, such as their 2024 development of high-performance materials for hydrogen infrastructure, helps mitigate environmental risks and avoid significant legal penalties or reputational damage. Compliance efforts are critical to maintaining their strong ESG ratings and market confidence into 2025.

Sekisui Chemical's Housing and Urban Infrastructure segments must strictly comply with national and local building codes, which are regularly updated. These regulations dictate precise specifications for housing units and materials, including pipes and insulation, crucial for product development. For instance, the ongoing push for higher energy efficiency standards, such as Japan's Net Zero Energy House (ZEH) targets aiming for widespread adoption by 2030, directly impacts Sekisui's Sekisui House operations. Compliance often necessitates modifications to existing product designs and manufacturing processes, requiring significant R&D investment to meet evolving safety and environmental mandates in 2024 and 2025.

Intellectual Property Law

As a company deeply committed to innovation, Sekisui Chemical prioritizes robust intellectual property protection, particularly for its patents and trademarks, which are crucial for market competitiveness. The company is actively engaged in legal proceedings to defend its technological advancements, such as the ongoing patent infringement lawsuits in Germany and Korea concerning its advanced PVB interlayer films. For instance, in fiscal year 2024, Sekisui Chemical allocated a significant portion of its R&D budget, approximately 3.5% of net sales, towards developing and securing new patents. These proactive legal efforts are essential for safeguarding its proprietary technologies and maintaining its leadership in specialized material markets.

- Sekisui Chemical’s R&D expenditure for fiscal year 2024 was approximately 3.5% of its net sales, underscoring its innovation focus.

- The company holds over 10,000 active patents globally as of early 2025, protecting core technologies.

- Legal costs related to patent defense in Europe and Asia are projected to increase by 8-10% in fiscal year 2025.

Labor and Employment Laws

Sekisui Chemical must rigorously adhere to labor and employment laws across all its operational countries, covering crucial aspects such as working hours, minimum wages, and comprehensive workplace safety standards. In Japan, compliance with the Industrial Safety and Health Law is paramount, mandating specific measures to protect employees from chemical hazards and other occupational risks, especially vital for a chemical manufacturer. Non-compliance could result in significant fines, potentially impacting Sekisui Chemical’s 2024 financial performance, and lead to legal disputes and reputational damage. Ensuring employee welfare through strict adherence remains a top priority.

- Global adherence to labor laws, including working hours and wages, is critical for Sekisui Chemical.

- Japan’s Industrial Safety and Health Law mandates specific measures against chemical hazards.

- Compliance mitigates legal risks and protects employee welfare, impacting 2024-2025 operational stability.

Sekisui Chemical must rigorously comply with diverse legal frameworks, including stringent chemical substance regulations and evolving environmental laws globally. Robust intellectual property protection, with over 10,000 active patents, is crucial for safeguarding its technological leadership. Adherence to building codes and labor laws also significantly impacts operational costs and strategy, particularly in 2024-2025.

| Legal Factor | Key Metric | 2024 Data |

|---|---|---|

| R&D IP Investment | % of Net Sales | 3.5% |

| Active Patents | Global Count | >10,000 |

| Projected Patent Legal Costs | FY2025 Increase | 8-10% |

Environmental factors

Sekisui Chemical identifies climate change as a critical business risk and social issue, actively working to mitigate its environmental impact. The company aims for carbon neutrality by 2050, a target consistent with global climate goals. This involves substantial investment in renewable energy sources and the development of advanced low-carbon production processes. For instance, Sekisui Chemical has committed to reducing its Scope 1 and 2 GHG emissions by 30% by fiscal year 2030, compared to a 2013 baseline. Such initiatives are crucial for long-term operational resilience and market positioning in the evolving 2024-2025 regulatory landscape.

Sekisui Chemical is actively advancing its commitment to a circular economy, crucial for its plastics and chemicals sectors.

The company aims to increase the use of non-fossil-derived and recycled materials, minimizing finite resource consumption and waste generation. For instance, Sekisui Chemical is targeting a 20% reduction in CO2 emissions from its value chain by fiscal year 2025 compared to 2013 levels, partly through these circular initiatives. Their focus on resource efficiency supports the long-term viability of their product lines, aligning with global sustainability trends and regulations.

Sekisui Chemical deeply commits to sustainable water resource management, essential for its global operations. Their policies ensure access to clean water, integral to their environmental strategy, particularly within the Urban Infrastructure & Environmental Products segment. The company targets a 40% reduction in water usage per unit of sales by fiscal year 2030 compared to fiscal year 2013, with significant progress noted as of fiscal year 2023. This focus supports operational resilience and aligns with growing global demands for responsible resource stewardship in 2024 and 2025.

Waste Management and Zero Emissions Goal

Sekisui Chemical is proactively addressing environmental impact through a robust zero emissions goal, aiming for total recycling of all waste generated from its workplaces, encompassing both industrial and office waste. This ambitious target seeks to eliminate landfill use and incineration without thermal recycling by fiscal year 2024, building on significant progress. For instance, the company achieved a 99.4 percent recycling rate for industrial waste in fiscal year 2023, demonstrating strong commitment to circular economy principles.

- Zero emissions defined as 100 percent waste recycling from all Sekisui Chemical workplaces.

- Target includes both industrial and office waste streams.

- Goal is to eliminate landfill disposal and non-thermal recycling incineration by FY2024.

- Industrial waste recycling rate reached 99.4 percent in fiscal year 2023.

Development of Environmentally Conscious Products

Sekisui Chemical prioritizes developing environmentally conscious products as a core part of its sustainability strategy, aiming to contribute through its product portfolio. The company focuses on creating solutions that enhance sustainability across the entire product lifecycle, from initial research and production to their use and eventual disposal. For instance, Sekisui produces materials that significantly improve energy efficiency in buildings, supporting global decarbonization efforts. Their innovations also reduce the environmental footprint across various industrial sectors, aligning with projected market demands for green technologies in 2024 and 2025.

- Sekisui Chemical aims for 2030 net sales of Environment-contributing Products to reach 1,800 billion JPY.

- The company is developing advanced materials for Zero Energy Houses (ZEH) and Zero Energy Buildings (ZEB), critical for reducing energy consumption by 2025.

- Sekisui's products contribute to reducing CO2 emissions, with a 2023 reported contribution of 5.09 million tons for the entire product lifecycle.

- Efforts include developing products for a circular economy, such as high-performance resins enabling resource recycling.

Sekisui Chemical prioritizes environmental sustainability, targeting carbon neutrality by 2050 and reducing Scope 1 & 2 GHG emissions by 30% by FY2030. The company aims for zero emissions by FY2024, achieving a 99.4% industrial waste recycling rate in FY2023. This focus extends to developing environmentally conscious products, with a goal of 1,800 billion JPY in net sales from such products by 2030, aligning with 2024-2025 market demands for green solutions.

| Metric | Target | FY2023 Progress |

|---|---|---|

| GHG Reduction (Scope 1 & 2) | 30% by FY2030 (vs. 2013) | On track |

| Industrial Waste Recycling | 100% by FY2024 | 99.4% |

| Env. Products Sales | ¥1,800B by 2030 | Growing |

PESTLE Analysis Data Sources

Our Sekisui Chemical PESTLE analysis is built on a robust foundation of data sourced from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. We also incorporate insights from industry-specific reports and reputable news outlets to ensure comprehensive coverage of all macro-environmental factors.