Sekisui Chemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sekisui Chemical Bundle

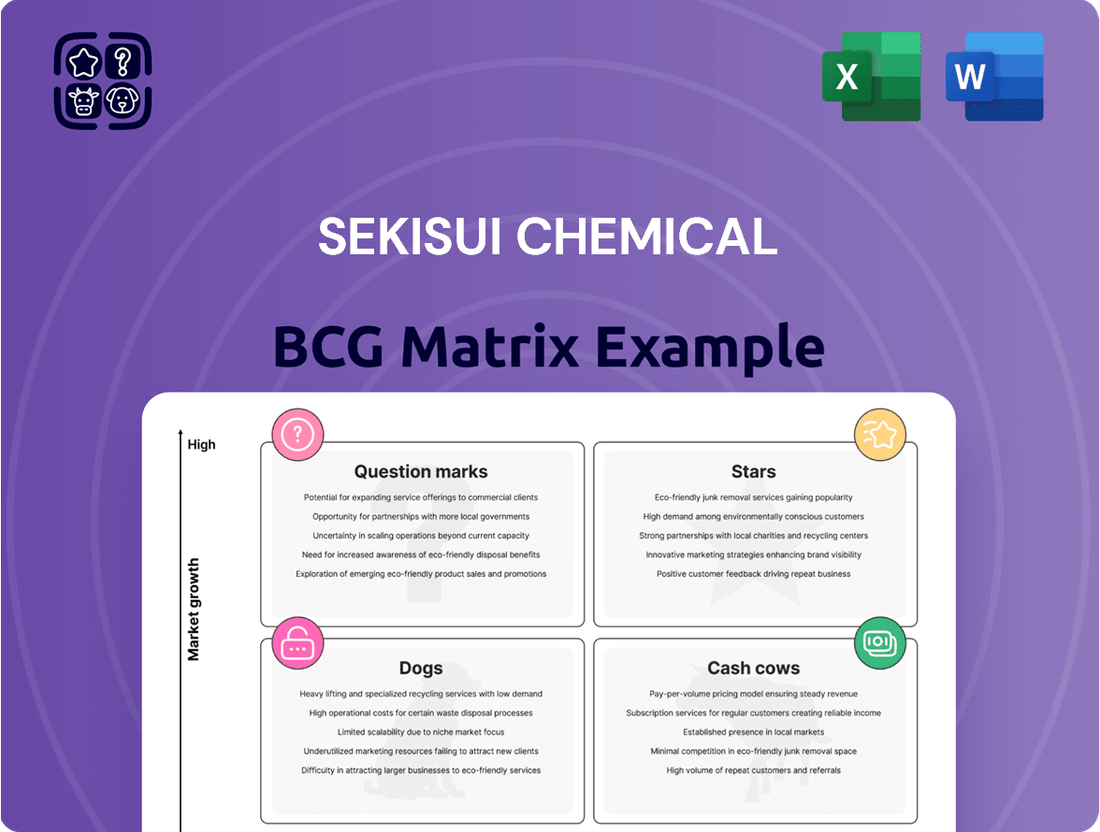

Sekisui Chemical's BCG Matrix highlights its diverse portfolio, from high-growth stars to established cash cows. This preview offers a glimpse into strategic product positioning. Understand which products fuel growth and which need attention.

The full matrix unveils detailed quadrant placements, competitive analysis, and strategic implications. Get the full BCG Matrix report for data-driven recommendations and actionable strategies.

Stars

Sekisui Chemical's interlayer films are a Star, dominating the global market. This segment thrives in the expanding automotive and architectural glass sectors. The company's strong market share, supported by innovations, shows significant growth potential. In 2024, the interlayer film business generated ¥200 billion in revenue, a 7% increase year-over-year.

Sekisui Chemical's foam products represent a star in its BCG matrix, holding a leading global market share. These products cater to various industries, suggesting strong market presence. To sustain this star status, Sekisui should focus on expanding into new applications and geographies. In 2024, the global foam market was valued at approximately $120 billion, with projected growth.

Sekisui Chemical holds a leading global market share in conductive particles. The need for reliable conductive materials is rising with the advancement of electronics. In 2024, the global conductive particles market was valued at approximately $3.5 billion, reflecting steady growth. Focusing on innovative particle tech and expanding into new electronics markets can spur future expansion.

Products to Enhance Sustainability (Premium Framing)

Sekisui Chemical is prioritizing 'Products to Enhance Sustainability,' especially 'Premium Framing' solutions. These offerings aim to solve societal challenges while promising high profitability. The company is heavily investing in these products to fuel growth. In 2024, Sekisui Chemical allocated ¥15 billion for R&D in sustainable materials.

- Focus on sustainable products and premium framing.

- High profit potential and solutions for social issues.

- Aggressive investment for development and expansion.

- ¥15 billion allocated for sustainable material R&D in 2024.

Ultra-Low Loss Build-up Film

Sekisui Chemical shines in the ultra-low loss build-up film market, a segment fueled by the needs of high-frequency communication, automotive electronics, and high-performance computing. This market is set for continued growth, making Sekisui's strong position a key advantage, particularly with ongoing innovation. In 2024, the global market for build-up films was valued at approximately $2.5 billion, with an expected annual growth rate of 8%.

- Sekisui Chemical holds a significant market share in ultra-low loss build-up films.

- The company's innovation in film technology is critical for high-frequency applications.

- Demand from automotive electronics and high-performance computing drives market expansion.

- Sekisui's strategy includes further market penetration and product enhancements.

Sekisui Chemical's Stars include dominant businesses like interlayer films and foam products, holding leading global market shares. These segments, alongside conductive particles and ultra-low loss build-up films, operate in high-growth markets. Strategic investments in sustainable materials, with ¥15 billion allocated for R&D in 2024, further bolster their future potential. In 2024, interlayer films alone generated ¥200 billion in revenue.

| Segment | 2024 Revenue/Market Value | Growth Driver |

|---|---|---|

| Interlayer Films | ¥200 billion (revenue) | Automotive, Architecture |

| Foam Products | ~$120 billion (market) | Diverse Industrial Use |

| Sustainable Materials R&D | ¥15 billion (investment) | Societal Solutions |

What is included in the product

BCG Matrix analysis of Sekisui Chemical reveals strategic investment, hold, or divest decisions.

Simplified analysis: the Sekisui Chemical BCG Matrix helps to swiftly prioritize resource allocation.

Cash Cows

Sekisui Chemical's prefabricated housing in Japan is a cash cow, holding a strong market share. This mature market provides stable cash flow, even with slower growth. In 2024, Japan's construction orders were approximately ¥70 trillion, indicating a substantial market size for Sekisui. The segment benefits from lower investment needs, boosting profitability.

Sekisui Chemical's Urban Infrastructure & Environmental Products segment, including piping systems, is a Cash Cow. These products benefit from consistent demand due to established infrastructure needs. In developed markets, these systems often experience low growth but hold high market share, ensuring steady revenue streams. For example, in 2024, the segment reported approximately ¥400 billion in revenue.

Basic industrial tapes, within Sekisui Chemical's High Performance Plastics segment, are likely cash cows. These products, with a stable market and customer base, generate consistent revenue. Sekisui's established market presence ensures steady cash flow, even without high growth. In 2024, the global industrial tape market was valued at approximately $35 billion. Sekisui's share contributes significantly to its financial stability.

Certain Building Materials

Sekisui Chemical's building materials segment features various products, with some, especially those in established markets, acting as cash cows. These products generate steady revenue with minimal new investment. For example, in 2024, Sekisui's housing-related businesses likely showed stable profitability. Cash cows offer predictable financial stability, essential for funding growth elsewhere.

- Sekisui's building materials include items for traditional construction.

- These materials often operate in mature markets.

- Cash cows generate consistent revenue.

- They need little new investment.

Existing Chemical Solutions for Mature Industries

Sekisui Chemical's extensive portfolio includes chemical solutions for many industries. Some of its established chemical products in mature industries likely fit the cash cow profile. These products, with high market share but low growth, generate steady profits. This is achieved with reduced R&D and market development expenses.

- Sekisui Chemical's net sales for FY2024 were ¥1,447.5 billion.

- Operating income for FY2024 was ¥80.9 billion.

- The company invests in mature businesses to sustain profitability.

Sekisui Chemical’s established chemical solutions, serving diverse industries, act as cash cows. These products hold high market shares in mature sectors, generating steady profits. This stability is achieved with reduced R&D and marketing expenses, bolstering overall company performance. For instance, Sekisui Chemical’s net sales for FY2024 reached ¥1,447.5 billion, with operating income at ¥80.9 billion.

| Segment | Market Share | Growth |

|---|---|---|

| Established Chemical Solutions | High | Low |

| FY2024 Net Sales | ¥1,447.5 Billion | |

| FY2024 Operating Income | ¥80.9 Billion |

Delivered as Shown

Sekisui Chemical BCG Matrix

The Sekisui Chemical BCG Matrix preview is the complete report you'll receive after buying. It’s a fully formatted, ready-to-use document, offering clear strategic insights.

Dogs

Within Sekisui Chemical's housing segment, underperforming prefabricated lines could be "dogs" in the BCG matrix. These products might struggle against stronger competitors or face limited demand. For example, in 2024, certain niche housing products saw only a 2% market share due to shifts in consumer preferences. This low share, coupled with slow growth, indicates limited future potential.

In Sekisui Chemical's Urban Infrastructure segment, outdated renovation materials could be dogs. These materials, facing obsolescence, have low market share. Their contribution to overall revenue is minimal, reflecting stagnant growth. For instance, in 2024, older materials saw a 2% decline in sales, indicating diminishing demand.

Some undifferentiated plastic products in Sekisui Chemical's portfolio, like certain commodity plastics, fit the "dog" category. These face fierce price competition and have low market share, potentially impacting profitability. In 2024, such products likely saw narrow margins. Without innovation, they struggle to gain market share.

Divested or Downsized Business Units

Sekisui Chemical has actively managed its business portfolio through acquisitions and divestitures. Units failing to meet growth or market share targets would be evaluated. In 2024, strategic shifts likely involved divesting underperforming segments. These actions reclassified certain business units as dogs.

- 2024: Sekisui's strategic moves included acquisitions and divestitures.

- Underperforming units were considered dogs before divestment.

- Focus on core businesses for improved performance.

- Divestitures aimed to optimize resource allocation.

Products with Declining Demand in Specific Niches

In Sekisui Chemical's BCG matrix, products in declining niche markets are considered "Dogs." These might be chemical solutions for industries facing contraction. If Sekisui has a small market share in these areas, the products face low growth and profitability.

- Examples could include specialized adhesives or coatings for industries like print media, which saw a revenue decline of approximately 7% in 2024.

- These products often require significant resources for minimal returns.

- The company may consider divesting or discontinuing these lines.

- Focus should shift to areas with higher growth potential and market share.

Sekisui Chemical identifies "Dogs" in its BCG matrix as segments with low market share and growth, such as underperforming prefabricated housing lines that held only a 2% market share in 2024. Outdated urban infrastructure materials, seeing a 2% sales decline in 2024, also fall into this category due to diminishing demand. Similarly, some undifferentiated commodity plastics exhibit narrow margins, struggling to gain market share against fierce competition. Strategic divestitures in 2024 actively reclassified certain business units as "Dogs" to optimize the portfolio.

| Segment | Product/Category | 2024 Performance |

|---|---|---|

| Housing | Underperforming Prefabricated Lines | 2% Market Share |

| Urban Infrastructure | Outdated Renovation Materials | 2% Sales Decline |

| High Performance Plastics | Undifferentiated Commodity Plastics | Narrow Margins |

| Chemical Solutions | Adhesives for Print Media | 7% Revenue Decline |

Question Marks

Sekisui Chemical is heavily investing in film-type perovskite solar cells. This technology is a "Question Mark" in their BCG matrix. The global perovskite solar cell market was valued at $12.7 million in 2023. It's a new product with high growth potential. Sekisui aims to increase its market share, targeting significant growth.

Sekisui Chemical strategically focuses on R&D, especially in advanced materials for automotive and healthcare. These innovations, aiming at high-growth sectors, currently hold a smaller market share. In 2024, Sekisui's R&D spending reached ¥40 billion. The company anticipates significant growth in these areas. This positions these materials as "Question Marks" in its BCG matrix.

Sekisui Chemical aims to grow internationally, targeting higher global sales. New markets with current or custom products are question marks. Although there's growth potential, Sekisui's initial market share is low. In 2024, Sekisui's international sales represented about 30% of total revenue, with plans for further expansion. Investment is crucial to boost market presence and compete effectively.

Epoxy Flux (New Semiconductor Material)

Sekisui Chemical's epoxy flux, a new semiconductor material, is positioned as a "question mark" in its BCG Matrix. This product targets the expanding semiconductor market, which in 2024, saw global revenue exceed $520 billion. As a recent entrant, it likely has a small market share initially. High growth potential exists if the epoxy flux gains traction, possibly due to its process and reliability advantages.

- 2024 global semiconductor market revenue: over $520 billion.

- Sekisui Chemical's epoxy flux is a new product.

- It targets the growing semiconductor market.

- Market share is likely low initially.

New Offerings within the Diagnostics Business

Sekisui Chemical is broadening its Diagnostics business, focusing on coagulation equipment and infectious disease tests. These new offerings enter a competitive market, typically starting with low market share. Success requires substantial investment in research, development, and marketing to gain ground.

- In 2024, the global in-vitro diagnostics market was valued at approximately $85 billion.

- Coagulation testing market is valued at roughly $4 billion.

- New products face challenges in a market where established players have significant market share.

Sekisui Chemical's Question Marks include high-growth potential areas like film-type perovskite solar cells and new advanced materials, requiring significant investment. Their epoxy flux for semiconductors and expanded diagnostics business also represent future growth avenues with low initial market share. International expansion into new markets similarly demands capital to establish presence and compete effectively.

| Area | 2024 Market Data | Sekisui's Position |

|---|---|---|

| Semiconductor Market | Over $520 billion | New epoxy flux product |

| In-Vitro Diagnostics | Approx. $85 billion | Expanding new offerings |

| R&D Investment | ¥40 billion | Supporting new materials |

BCG Matrix Data Sources

This Sekisui Chemical BCG Matrix uses company financial statements, market research, and competitor analysis for data-driven insights.