Sekisui Chemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sekisui Chemical Bundle

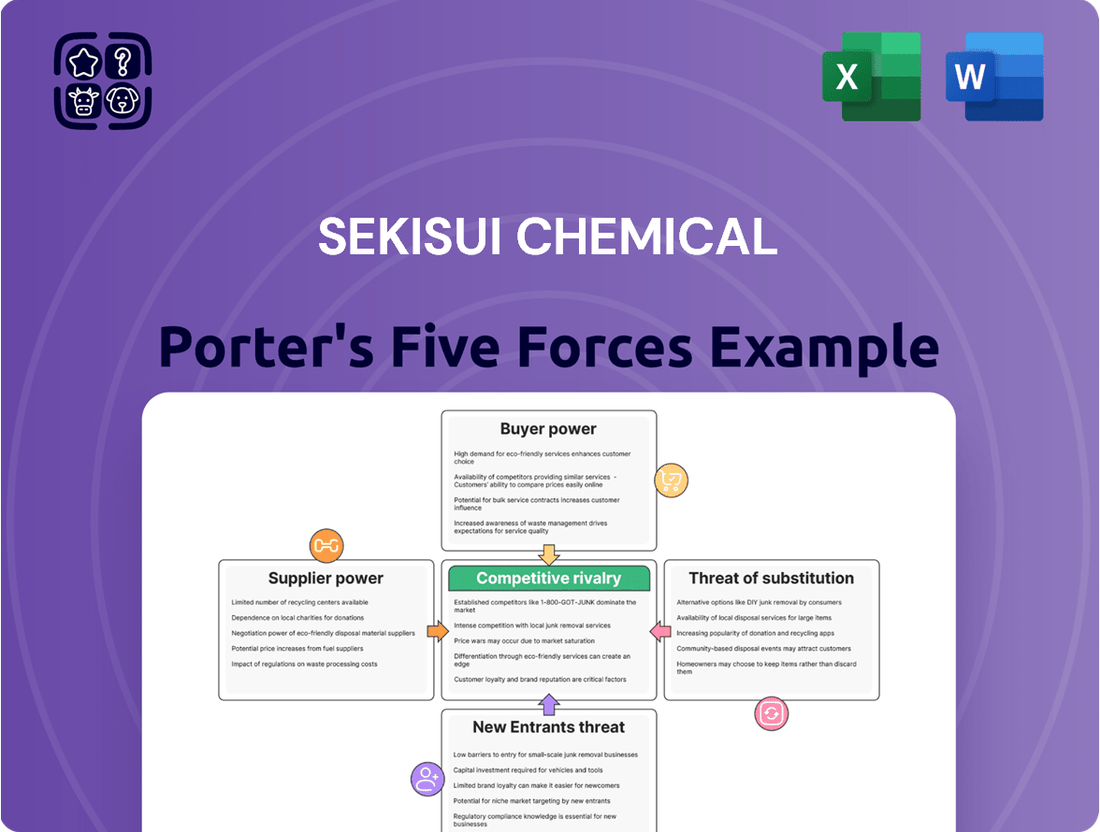

Sekisui Chemical navigates a landscape shaped by formidable competitive forces. Understanding the intensity of buyer power and the threat of substitutes is crucial for grasping its market position.

The threat of new entrants and the bargaining power of suppliers also play significant roles in defining Sekisui Chemical's strategic options.

Our full Porter's Five Forces analysis delves into each of these pressures, providing a comprehensive view of Sekisui Chemical's competitive environment.

This detailed report offers actionable insights into how these forces impact Sekisui Chemical's profitability and long-term sustainability.

Ready to uncover the full strategic picture? Unlock the complete Porter's Five Forces Analysis for Sekisui Chemical to gain a deeper understanding of its industry dynamics and competitive advantages.

Suppliers Bargaining Power

Sekisui Chemical relies on a concentrated base of suppliers for specialized raw materials like high-performance resins and advanced chemicals crucial for its diverse product segments, including its 2024 focus on environmental solutions. This limited number of key suppliers can exert significant influence over pricing and supply terms due to the unique nature of their offerings. For example, the global specialty chemicals market for certain polymers vital to Sekisui’s operations remains highly consolidated. Sekisui mitigates this by cultivating strong, long-term relationships with its suppliers, ensuring a more stable and predictable procurement pipeline.

Switching suppliers for highly specialized or customized materials, particularly in Sekisui Chemical's High Performance Plastics segment, involves significant costs related to qualification and process adjustments. The critical material specifications for end-product performance in industries like automotive and electronics make these inputs indispensable. Sekisui Chemical's focus on quality and innovation necessitates close collaboration, increasing dependency on these key suppliers. For instance, the company's 2024 focus on advanced materials for mobility and electronics reinforces this reliance, as their performance directly impacts final product integration and market competitiveness.

The chemical industry, including Sekisui Chemical, remains highly susceptible to the volatility of raw material prices, often tied to global commodities like crude oil and natural gas. These fluctuations directly impact Sekisui's manufacturing costs and overall profitability across its diverse business segments. For instance, while crude oil prices saw significant shifts in early 2024, averaging around $80-85 per barrel for Brent, these changes can quickly erode margins on products derived from petrochemicals. Sekisui's broad portfolio in housing, infrastructure, and high-performance plastics may offer some mitigation, spreading the risk across various input markets.

Emphasis on Sustainable and Responsible Procurement

Sekisui Chemical’s strong emphasis on responsible procurement, mandating adherence to a Supplier Code of Conduct covering human rights and ethical practices, significantly influences supplier bargaining power. This commitment to sustainability, highlighted in their 2024 sustainability initiatives, enhances brand image and supply chain resilience. However, it also narrows the eligible supplier pool, potentially increasing procurement costs as fewer suppliers meet the stringent criteria.

- Sekisui Chemical's 2024 procurement strategy prioritized suppliers aligning with their updated Code of Conduct, focusing on ethical sourcing.

- This selective approach strengthens the company's environmental, social, and governance (ESG) profile.

- The heightened requirements can limit supplier options, potentially increasing input costs for specialized materials.

- Supplier adherence to the Code ensures long-term supply stability and reduces reputational risks.

Supplier Integration and Collaboration

Sekisui Chemical engages in significant collaborative initiatives with its partners, such as the ongoing development of a marketplace system for recycled materials with Hitachi. These partnerships foster innovation and a circular economy, crucial for Sekisui's environmental goals in 2024. While beneficial, such deep integration creates a degree of interdependence, potentially increasing the bargaining power of these strategic partners. This collaboration highlights a shift from transactional supplier relationships to more integrated ecosystems.

- Sekisui's strategic partnerships, like the one with Hitachi, enhance its circular economy initiatives.

- These collaborations, while innovative, can lead to increased interdependence with key suppliers.

- The development of a marketplace for recycled materials signifies a move towards integrated supply chains.

- Such integration can subtly elevate the bargaining leverage of critical collaborative partners over time.

Sekisui Chemical faces substantial supplier bargaining power due to reliance on a concentrated base for specialized materials with high switching costs, impacting its 2024 operations. Volatile raw material prices, like Brent crude averaging $80-85/barrel in early 2024, directly influence manufacturing expenses. Additionally, stringent ethical sourcing requirements, though strengthening ESG, narrow the eligible supplier pool, potentially elevating input costs. Strategic collaborations also create interdependence, subtly increasing partner leverage.

| Factor | 2024 Impact | Leverage |

|---|---|---|

| Specialized Material Suppliers | Concentrated base | High |

| Switching Costs | Qualification & Process | High |

| Raw Material Volatility | Crude Oil ($80-85/barrel) | Moderate-High |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Sekisui Chemical, detailing the interplay of industry rivalry, buyer and supplier power, new entrant threats, and substitute products.

Instantly visualize competitive intensity and strategic positioning with a dynamic, interactive Five Forces dashboard.

Effortlessly adapt to market shifts by swapping in real-time data for a continuously relevant analysis.

Customers Bargaining Power

Sekisui Chemical benefits from a highly diversified customer base spanning critical sectors like automotive, electronics, construction, and healthcare. This broad reach, complemented by operations across major global regions including North America, Europe, and Asia, significantly diminishes the bargaining power of any single customer. For instance, their High Performance Plastics segment, crucial for automotive and electronics, contributed substantially to fiscal year 2024 revenues, illustrating robust demand across multiple industries. This strategic diversification ensures the company is not overly reliant on a limited number of buyers, enhancing its market position.

Sekisui Chemical’s High Performance Plastics segment delivers highly specialized products crucial to customer end-products, such as advanced films and foams used in automotive and electronics. These unique performance characteristics and stringent quality requirements create significant switching costs for customers. For example, their high-performance films, contributing to the segment's roughly 42% share of Sekisui's total sales in fiscal year 2024, are often custom-engineered. This technical dependency and the high cost of qualifying new suppliers reduce customer bargaining power, as evidenced by stable demand for these critical components.

Sekisui Chemical, while broadly diversified, faces concentrated customer power within specific business units, particularly for large corporate clients in the automotive and electronics industries. These high-volume buyers, such as major vehicle manufacturers, can exert significant pressure on pricing and contract terms due to their purchasing scale. For example, Sekisui’s High Performance Plastics segment, a key contributor to its 2024 outlook, serves these demanding sectors. To counter this, Sekisui prioritizes delivering high-quality, innovative products and solutions, supported by continued R&D investments, to maintain customer loyalty and reduce substitutability. This strategy aims to strengthen its position against buyer demands.

Availability of Alternative Suppliers

The global specialty chemicals and plastics markets are highly competitive, with a vast array of companies offering diverse products. This competitive landscape means customers, particularly for more commoditized offerings, often have multiple alternative suppliers available, significantly increasing their bargaining power. Sekisui Chemical counters this by prioritizing strong product differentiation and superior quality, aiming to create unique value propositions that reduce customer willingness to switch. Despite this, the threat remains, as evidenced by the intense competition from firms globally.

- The global specialty chemicals market was valued at approximately USD 1.2 trillion in 2023, projected to grow to over USD 1.3 trillion by 2024, highlighting its vast and competitive nature.

- Customers in segments like commodity plastics can easily compare prices and switch suppliers, leveraging the high number of producers.

- Sekisui Chemical's 2024 focus on high-performance materials and medical solutions aims to lock in customers through specialized, difficult-to-replicate products.

- The ability to switch suppliers keeps pricing pressure on manufacturers, necessitating continuous innovation.

Customer's Potential for Backward Integration

Customers, especially large industrial clients in sectors like pharmaceuticals or advanced manufacturing, possess the latent ability to produce some chemical inputs themselves. This potential for backward integration significantly enhances their bargaining power with suppliers like Sekisui Chemical, as it provides a credible alternative to purchasing. However, the substantial capital outlay and specialized technical knowledge required for chemical production, often exceeding 2024 average R&D intensity of 2.5% for manufacturing, act as strong deterrents. For instance, setting up a new chemical plant can cost hundreds of millions of USD, making it a less viable option for most.

- Significant capital investment deters most customers from in-house production.

- High technical expertise in specialized chemical processes is a major barrier.

- Threat of backward integration enhances customer negotiation leverage.

- Only large, resource-rich customers in specific sectors might consider it.

Sekisui Chemical’s broad customer diversification and highly specialized products, like high-performance films contributing significantly to its fiscal year 2024 sales, generally limit individual customer bargaining power by creating high switching costs. However, large clients in sectors such as automotive and electronics can exert pressure due to their purchasing volume. The competitive global specialty chemicals market, projected over USD 1.3 trillion in 2024, offers customers alternatives for more commoditized offerings. The threat of customer backward integration is largely mitigated by the substantial capital and technical expertise required.

| Factor | Impact | 2024 Context |

|---|---|---|

| Diversification | Lowers buyer power | Broad customer base |

| Specialized Products | Increases switching costs | High-performance films (42% of FY24 sales) |

| Market Size | Increases buyer options | Global market >$1.3T |

What You See Is What You Get

Sekisui Chemical Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Sekisui Chemical provides an in-depth examination of industry competition, buyer and supplier power, the threat of new entrants, and the availability of substitutes. You'll gain valuable insights into the strategic landscape influencing Sekisui Chemical's operations and market position. This detailed report is fully formatted and ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The specialty chemicals and high-performance plastics sectors, where Sekisui Chemical operates, face intense competitive rivalry from a multitude of global and regional players. Companies like Asahi Kasei, with a net sales forecast of ¥2,780 billion for fiscal year 2024, Nissan Chemical, and Resonac Corporation are significant competitors. This fragmented landscape, characterized by many strong players, consistently puts downward pressure on product pricing. Such high competition directly impacts profitability margins across the industry.

Sekisui Chemical’s competitive rivalry often hinges on product innovation, quality, and performance, especially within its high-performance materials sector. The company prioritizes substantial investment in research and development to create highly differentiated products and sustainable solutions. For instance, Sekisui Chemical budgeted approximately JPY 60.0 billion for R&D in the fiscal year ending March 2024, demonstrating its commitment to maintaining a competitive edge through advanced offerings like high-efficiency films and advanced medical materials. This focus on unique, value-added products, rather than just price, helps them navigate intense market competition.

Sekisui Chemical navigates intense competitive rivalry within the prefabricated housing segment from major Japanese players such as Daiwa House Industry and Panasonic Homes. This competition, which saw Daiwa House report net sales exceeding ¥5 trillion in FY2023, is driven by factors including innovative design and construction technology. Furthermore, international companies contribute to this dynamic landscape, where cost-efficiency and brand reputation are crucial differentiators. As of 2024, market positioning hinges on these elements, necessitating continuous innovation to maintain share.

Competition in Urban Infrastructure

The urban infrastructure and environmental products segment faces intense competition from diverse companies offering solutions for pipes, pipeline renewal, and other construction materials. This competitive landscape includes specialized pipe manufacturers like Kubota Corporation and diversified construction material suppliers such as Saint-Gobain. The global pipe market, projected to reach over $100 billion in 2024, sees strong rivalry in both new construction and rehabilitation projects. Companies differentiate through material innovation and sustainable solutions.

- Global pipe market value: Over $100 billion (2024 projection).

- Key competitors: Kubota Corporation, Saint-Gobain, Sekisui Chemical.

- Market drivers: Urbanization, aging infrastructure, sustainability demands.

- Competitive pressure: Focus on advanced materials and cost-efficiency.

Strategic Acquisitions and Partnerships

Many chemical and materials companies pursue strategic acquisitions and partnerships to expand their product portfolios and global reach. Sekisui Chemical actively engages in such initiatives, enhancing its competitiveness and market entry capabilities. For instance, in 2024, Sekisui continued to focus on areas like high-performance plastics and medical solutions, leveraging external collaborations.

- Sekisui Chemical's 2024 M&A strategy targets growth in housing and infrastructure, as well as high-performance plastics.

- The company actively seeks partnerships for advanced materials development and sustainable technologies.

- Strategic alliances bolster Sekisui's position against rivals through expanded intellectual property and market access.

- These moves directly impact market share and technological leadership in key segments.

Sekisui Chemical faces intense competitive rivalry across its diverse segments, from specialty chemicals to prefabricated housing. Key competitors like Asahi Kasei (projected ¥2,780 billion sales, FY2024) and Daiwa House Industry drive innovation and cost-efficiency. Sekisui invests significantly in R&D, budgeting JPY 60.0 billion for FY2024, and leverages strategic alliances to differentiate its high-performance products and sustain market leadership.

| Segment | Rivalry Drivers | 2024 Focus |

|---|---|---|

| Chemicals | Innovation, Quality | R&D (JPY 60B) |

| Housing | Design, Cost | Strategic M&A |

| Infrastructure | Materials, Sustainability | Global Market |

SSubstitutes Threaten

The high-performance plastics sector faces a continuous threat from the evolution of alternative materials. New developments in lightweight metals, advanced composites, and even other specialized polymers offer comparable or superior performance, particularly driven by the automotive industry's push for lightweighting. For instance, the demand for lighter EV components in 2024 has accelerated the adoption of aluminum alloys and carbon fiber composites, directly competing with high-performance plastics. This innovation across material types necessitates Sekisui Chemical to continuously innovate to maintain its competitive edge.

The primary substitute for Sekisui Chemical's prefabricated housing is traditional on-site construction, which still dominates a significant portion of the global housing market. The choice between these methods hinges on factors like initial cost, construction speed, design flexibility, and prevailing customer perceptions of quality and durability. While traditional methods offer perceived customization, Sekisui's unit construction method, including its Heim series, offers advantages in stringent factory quality control and significantly reduced on-site labor, often completing homes in a fraction of the time, typically within days for assembly, compared to months for conventional builds in 2024.

The increasing focus on sustainability presents a significant threat from substitute building materials like mass timber and recycled composites. The global green building materials market, valued at over $330 billion in 2023, is projected for substantial growth through 2024. These eco-friendly alternatives could replace Sekisui Chemical's plastic-based construction products if they achieve comparable performance and cost-effectiveness. This trend is driven by regulatory pushes and consumer demand for greener solutions in construction. As such, Sekisui must innovate to maintain competitiveness against these evolving threats.

Bio-Based and Recycled Plastics

The increasing global emphasis on sustainability is accelerating the development of bio-based plastics and advanced recycling technologies. While Sekisui Chemical is actively investing in sustainable solutions, such as its cellulose-based plastic for packaging, the broader market availability of these alternative feedstocks could empower competitors to introduce new substitute products. For instance, the global bio-plastic market is projected to reach significant growth by 2024, indicating a rising competitive landscape. This shift poses a notable threat as customers increasingly prioritize environmentally friendly materials.

- Global bioplastics production capacity is expected to increase from approximately 2.18 million tonnes in 2023 to 2.95 million tonnes in 2028.

- Sekisui Chemical aims to expand its sustainable products, targeting 50% of total sales from environmental contributions by 2030.

- Advanced recycling methods are projected to process over 1.5 million metric tons of plastic waste annually by 2025 in Europe alone.

- Companies like Avantium and TotalEnergies are advancing plant-based plastics, intensifying market competition.

Innovations in Interlayer Film and Tapes

The market for interlayer films and industrial tapes faces a constant threat from substitute products. New adhesive technologies, like advanced structural adhesives for automotive lightweighting, or alternative material joining methods continuously emerge. Sekisui Chemical must innovate to maintain the performance advantages of its existing products, as evidenced by the projected 2024 growth in alternative bonding solutions.

- Global adhesive and sealant market expected to reach over 75 billion USD by 2025.

- UV-curable adhesives are gaining traction for faster processing in 2024.

- Bio-based alternatives are attracting increased R&D investment in 2024.

- Mechanical fasteners remain a strong alternative in some industrial applications.

Sekisui Chemical faces a broad threat from substitutes across its diverse operations. New lightweight materials like advanced composites and aluminum alloys are challenging high-performance plastics, especially with increased EV production in 2024. Traditional construction methods remain a strong alternative to prefabricated housing, despite Sekisui's efficiency advantages.

Moreover, the push for sustainability introduces competition from bio-based plastics and eco-friendly building materials such as mass timber. Emerging adhesive technologies also threaten Sekisui's films and tapes segments, requiring continuous innovation to maintain competitiveness. These evolving market dynamics necessitate strategic adaptation.

| Substitute Category | Key Threat | 2024 Market Impact |

|---|---|---|

| Advanced Materials | Lightweight metals, composites | Increased EV component adoption |

| Construction Methods | Traditional on-site building | Dominant market share, perceived customization |

| Sustainable Materials | Bio-based plastics, mass timber | Global green building market projected growth |

| Adhesive Technologies | UV-curable, bio-based adhesives | Faster processing, increased R&D investment |

Entrants Threaten

The chemical industry, particularly for specialized products like those Sekisui Chemical produces, demands immense capital investment for advanced manufacturing facilities. Establishing such operations can cost billions, creating a substantial barrier for new entrants. Furthermore, the extensive research and development required for high-performance materials, like Sekisui Chemical's focus on new energy solutions, involves significant ongoing expenditure. For instance, major chemical companies often allocate over 3% of their revenue to R&D, with Sekisui Chemical reporting R&D expenses of JPY 57.5 billion in fiscal year 2023, underscoring the high financial commitment. This combination of high fixed costs and continuous innovation outlays makes large-scale competition extremely challenging for any aspiring new company.

New entrants struggle against established players like Sekisui Chemical, which boasts deep technological expertise and proprietary processes. Sekisui's extensive patent portfolio, including over 18,000 patents globally as of early 2024, creates significant intellectual property hurdles for any aspiring competitor. This robust defense makes the required R&D investment and time-to-market for newcomers prohibitively high. For instance, Sekisui Chemical recently allocated 3.8% of its net sales to R&D in its latest fiscal year, a substantial barrier for new companies lacking comparable resources.

Established players like Sekisui Chemical benefit from substantial economies of scale, achieving cost advantages in procurement, manufacturing, and distribution. With fiscal year 2024 net sales around JPY 1,290.7 billion, Sekisui’s size allows for efficient resource allocation, making it difficult for new entrants to compete on price. Developing a comparable global distribution network, essential for reaching diverse markets, demands significant capital and time. New market participants face high barriers in replicating these extensive, efficient supply chains and distribution channels, limiting their competitive viability.

Stringent Regulatory and Environmental Standards

The chemical and construction sectors, where Sekisui Chemical operates, face extensive regulatory and environmental hurdles globally. Adhering to these stringent safety, quality, and environmental standards demands substantial capital outlay and specialized technical knowledge, creating a formidable barrier for potential new entrants.

- In 2024, the global chemical industry continues to navigate evolving REACH regulations and tightening emissions standards.

- Compliance costs for new chemical plants can exceed 10% of total project investment.

- The Japanese construction sector, for instance, requires strict building code adherence and environmental impact assessments.

- Sekisui Chemical’s long-standing compliance expertise provides a significant competitive advantage.

Brand Recognition and Customer Relationships

Sekisui Chemical has cultivated a robust brand reputation and strong customer relationships over decades, particularly in critical sectors like high-performance plastics and housing. This established trust acts as a significant barrier for new entrants, who struggle to replicate such deep-seated loyalty and perceived reliability. For instance, in 2024, Sekisui Chemical continues to leverage its long-standing partnerships, making market penetration arduous for newcomers.

- Sekisui Chemical's brand value has been built over 75+ years, making immediate replication by new entrants highly improbable.

- Customer relationships in sectors like infrastructure and medical solutions demand rigorous product validation and a proven track record.

- The company's global revenue, exceeding ¥1.2 trillion in fiscal year 2023, reflects its established market dominance.

- New companies face substantial R&D investment and certification hurdles to compete on product reliability.

New entrants face significant barriers due to Sekisui Chemical's immense capital requirements for R&D and advanced facilities. Its vast patent portfolio, established economies of scale, and stringent regulatory compliance further deter competition. Sekisui's strong brand reputation, built over decades, also makes market penetration exceptionally difficult for aspiring companies.

| Barrier Type | 2024 Data Point | Impact on New Entrants |

|---|---|---|

| Capital Costs | R&D Expense: JPY 59B (est.) | High initial investment. |

| IP & Expertise | 18,000+ Global Patents | Difficult to replicate tech. |

| Economies of Scale | Net Sales: JPY 1.3T (est.) | Cost disadvantage. |

Porter's Five Forces Analysis Data Sources

Our Sekisui Chemical Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research, and competitor disclosures. We also leverage data from reputable financial news outlets and economic indicator databases to capture the full competitive landscape.