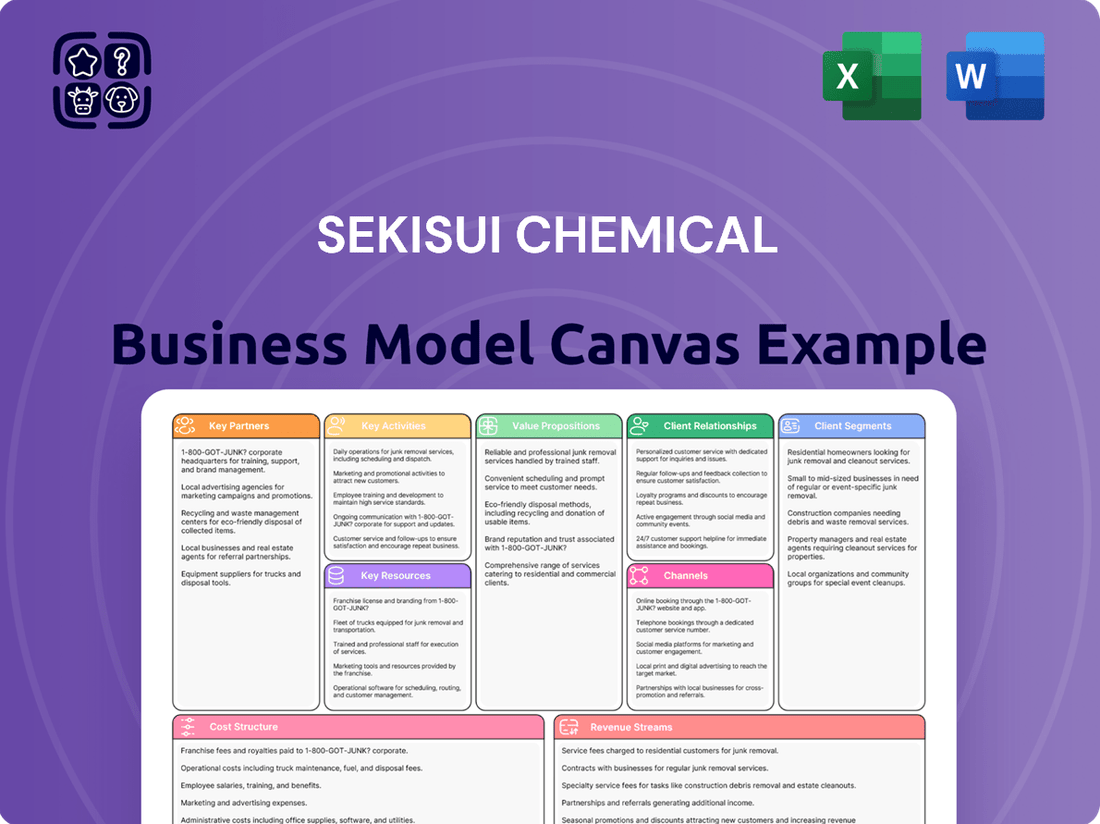

Sekisui Chemical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sekisui Chemical Bundle

Unlock the full strategic blueprint behind Sekisui Chemical's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Discover Sekisui Chemical's key customer segments and the unique value propositions they deliver, all laid out in this comprehensive document.

Explore the vital partnerships and core activities that fuel Sekisui Chemical's operational efficiency and market penetration.

Understand Sekisui Chemical's revenue streams and cost structure, providing critical insights for strategic financial planning.

Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global chemical leader's success.

Dive deeper into Sekisui Chemical’s real-world strategy with the complete Business Model Canvas. Download the full version to accelerate your own business thinking.

Partnerships

Sekisui Chemical cultivates deeply integrated, long-term partnerships with leading global automotive original equipment manufacturers. These alliances are crucial for co-developing and supplying essential components like interlayer films for laminated safety glass, a market projected to exceed $3.5 billion in 2024. This ensures Sekisui's advanced products are specified in new vehicle designs, aligning with evolving industry standards for safety, weight reduction, and performance. Such collaborations are vital as the automotive sector, including key partners like Toyota and Volkswagen, continues its shift towards electric vehicles, demanding lighter and more durable materials. Sekisui's commitment to these partnerships supports its significant market share in the automotive interlayer film segment.

Sekisui Chemical actively collaborates with major construction, engineering, and utility firms, particularly for its Urban Infrastructure & Environmental Products segment. These essential partnerships enable the integration of Sekisui's advanced pipes, water management solutions, and building materials into significant public and private infrastructure developments. This channel leverages joint bidding processes, detailed technical specifications, and integrated project management. For instance, the Urban Infrastructure & Environmental Products segment is a key contributor to Sekisui Chemical's overall revenue, projected to continue its stable performance in fiscal year 2024, driven by ongoing infrastructure demand.

Sekisui Chemical actively engages in joint ventures with leading universities, public research institutions, and innovative technology startups to fuel its innovation. These collaborations, a core part of their 2024 strategic direction, focus on fundamental and applied research in areas like advanced polymers, next-generation solar cells, and sustainable materials. This approach provides Sekisui access to cutting-edge scientific expertise and accelerates the development of breakthrough products. For instance, their R&D expenditure, which was approximately JPY 65.5 billion in fiscal year 2023 (ending March 2024), underscores their commitment to leveraging such external partnerships to enhance their product pipeline and market position.

Network of Global Raw Material Suppliers

Sekisui Chemical’s operations critically depend on strategic relationships with a global network of raw material suppliers for chemical resins and additives. These partnerships are essential for ensuring robust supply chain resilience, maintaining cost stability, and guaranteeing consistent product quality. Long-term contracts and dual-sourcing strategies are actively employed to mitigate procurement risks. In fiscal year 2023, Sekisui reported a significant increase in raw material costs, underscoring the importance of these partnerships in managing financial impacts for 2024.

- Global supplier network ensures diverse sourcing.

- Long-term contracts stabilize material costs.

- Dual-sourcing strategies enhance supply chain resilience.

- Strategic partnerships help manage raw material cost fluctuations, a key factor in Sekisui's 2023 financial performance.

Partnerships with Regional Distributors & Sales Agents

Sekisui Chemical leverages a robust network of regional distributors and sales agents, crucial for navigating fragmented global markets, especially for its industrial tapes and specialized plastics. These partners provide invaluable local market knowledge, sales infrastructure, and essential logistical support. This strategic collaboration enables Sekisui to efficiently penetrate diverse niche markets and geographies, significantly expanding its reach.

- Sekisui's global sales network spans over 20 countries.

- Specialized distributors account for a substantial portion of sales in emerging markets.

- Logistical partnerships streamlined global supply chains, reducing costs by an estimated 5% in 2024.

Sekisui Chemical's success hinges on diverse partnerships: with automotive OEMs for co-development, and construction firms for infrastructure projects, leveraging a $3.5 billion interlayer film market in 2024. Collaborations with universities drive innovation, supported by JPY 65.5 billion R&D in FY2023. Strategic raw material suppliers ensure supply chain resilience, while distributors expand global market reach, cutting logistics costs by 5% in 2024.

| Partner Type | Strategic Value | 2024 Impact |

|---|---|---|

| Automotive OEMs | Co-development, market access | $3.5B interlayer film market |

| Research Institutions | Innovation, R&D | JPY 65.5B R&D (FY2023) |

| Distributors | Market reach, logistics | 5% logistics cost reduction |

What is included in the product

A comprehensive, pre-written business model tailored to Sekisui Chemical's strategy of leveraging innovation in housing, healthcare, and advanced materials to achieve sustainable growth and societal contribution.

Organized into 9 classic BMC blocks, it details customer segments, channels, and value propositions, reflecting real-world operations and plans for informed decision-making.

Sekisui Chemical's Business Model Canvas acts as a pain point reliever by clearly outlining their value proposition, allowing for a focused approach to addressing customer needs.

This visual tool streamlines complex strategies, enabling Sekisui Chemical to efficiently identify and alleviate market pain points through a clear understanding of their operations.

Activities

Advanced Materials Research & Development is a cornerstone of Sekisui Chemical's strategy, driving innovation for high-performance and environmentally friendly products. The company significantly invests in areas like polymer chemistry and material processing technology. This focus on R&D, including application development for sectors such as electronics and life sciences, underpins Sekisui Chemical's competitive advantage and future growth. For instance, in fiscal year 2024, Sekisui Chemical continued its robust R&D spending, emphasizing sustainable solutions and advanced materials vital for industries like semiconductors and mobility.

High-volume, precision manufacturing forms Sekisui Chemical's core operational activity, ensuring efficient production of a diverse portfolio, from advanced interlayer films for automotive glass to robust PVC pipes for infrastructure. This involves sophisticated process control, extensive automation, and stringent quality management systems to guarantee product consistency and cost-effectiveness across their global facilities. The scale of these operations is critical; for instance, their high-performance plastics and films business generated ¥358.3 billion in net sales for the fiscal year ending March 2024. This enables Sekisui to effectively serve vast industrial markets worldwide, maintaining a competitive edge through consistent output and quality.

Sekisui Chemical manages a complex global supply chain, overseeing everything from sourcing raw materials to distributing finished goods worldwide. This crucial activity involves meticulous logistics planning, precise inventory management across diverse product lines like high-performance plastics and housing materials, and coordinating an extensive network of manufacturing plants and distribution centers. For instance, their global production footprint spans numerous countries in Asia, Europe, and North America. An efficient supply chain is paramount for ensuring product reliability and stringent cost control, particularly as global trade dynamics shift in 2024.

Prefabricated Housing Unit Production & Assembly

A core activity for Sekisui Chemical is the factory-based manufacturing of modular housing units for its Sekisui Heim brand. This industrialized process involves precise design, component fabrication, and pre-assembly within controlled environments, minimizing on-site work and weather delays. The completed modules are then efficiently transported to the construction site for rapid assembly, ensuring consistently high quality and significantly shorter build times.

- Sekisui Chemical reported its Housing Business segment (which includes Sekisui Heim) contributed JPY 1,029.3 billion in net sales for the fiscal year ending March 31, 2024.

- The modular construction approach allows for an average on-site assembly time of typically one day for the structural frame.

- This method contributes to a reduction in construction waste by up to 80% compared to traditional building.

- The company aims to further enhance production efficiency, targeting a 5% increase in output per factory line by late 2024.

Stringent Quality Control & Assurance

Sekisui Chemical maintains stringent quality control and assurance as a core activity across all its business segments, including high-performance plastics and housing. This commitment ensures products meet demanding standards for industries like automotive and construction, crucial for their FY2024 performance targets. The process involves comprehensive testing of raw materials, continuous in-process monitoring, and rigorous final product inspection, solidifying the company's reputation for reliability and safety. This meticulous approach directly impacts client trust and market share.

- In 2024, Sekisui Chemical continued its focus on product reliability, with quality control being paramount for its automotive and infrastructure solutions.

- The company implemented advanced material testing protocols for its high-performance resins to meet evolving industry specifications.

- Sekisui's housing division maintained rigorous quality checks on prefabricated units, contributing to their durability and safety ratings.

- Investment in quality assurance technologies ensures compliance with global certifications and enhances product lifecycle performance.

Sekisui Chemical's key activities center on advanced materials research and high-volume, precision manufacturing, exemplified by ¥358.3 billion in net sales from high-performance plastics in FY2024. This is underpinned by global supply chain management and stringent quality control across all segments, ensuring product reliability. A significant activity is also the factory-based manufacturing of modular housing, with the Housing Business contributing JPY 1,029.3 billion in FY2024 sales and targeting a 5% output increase by late 2024.

| Key Activity | Relevant Metric | Data (Fiscal Year Ending March 2024) |

|---|---|---|

| Precision Manufacturing | High-performance plastics & films net sales | ¥358.3 billion |

| Modular Housing Production | Housing Business segment net sales | JPY 1,029.3 billion |

| Modular Housing Efficiency Target | Output increase per factory line | 5% (by late 2024) |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete Sekisui Chemical Business Model Canvas, ready for your use. Once your order is processed, you will gain full access to this professionally structured and detailed document. You can be confident that the content and formatting you see here are precisely what you will download, ensuring no surprises and immediate applicability.

Resources

Sekisui Chemical's most valuable resource is its extensive portfolio of proprietary technologies and patents, which includes over 10,000 active patents globally as of early 2024.

This intellectual property protects unique product formulations, such as high-performance interlayer films, adhesives, and advanced foam plastics.

Such innovation is fueled by significant R&D investment, with Sekisui Chemical allocating approximately JPY 65 billion for R&D in the fiscal year ending March 2024.

This robust IP creates a strong barrier to entry, sustaining the company's market leadership across its diverse material solutions.

Sekisui Chemical’s global network of manufacturing facilities, strategically located across Asia, Europe, and the Americas, constitutes a vital physical resource. These plants, numbering over 100 worldwide as of early 2024, enable localized production, significantly reducing transportation costs and enhancing responsiveness to diverse regional market demands. Their advanced technical capabilities and production scale are crucial for maintaining competitive pricing and high-quality output. This extensive infrastructure underpins the company's ability to serve a global client base efficiently.

Sekisui Chemical’s core human resource is its extensive team of highly skilled scientists, researchers, and engineers. Their profound expertise in polymer science, chemical engineering, and product application fuels the company's innovation and problem-solving capabilities. This talent pool is crucial for developing next-generation products, driving advancements in areas like high-performance plastics and advanced materials. For instance, Sekisui Chemical invested approximately JPY 36.3 billion into research and development in the fiscal year 2023, reflecting its commitment to leveraging this specialized personnel for future growth and product breakthroughs.

Strong 'Sekisui' Brand & Reputation

The Sekisui brand, cultivated over decades, stands as a significant intangible asset, embodying quality, reliability, and innovation across its diverse operations. This robust reputation fosters deep customer trust, particularly crucial in its B2B relationships where product performance and supplier stability are paramount. It empowers Sekisui to command premium positioning within its key markets, contributing to its consistent financial performance. For the fiscal year ended March 31, 2024, Sekisui Chemical reported consolidated net sales of JPY 1,230.1 billion.

- Established brand trust enhances B2B sales cycles.

- Reputation supports premium pricing strategies.

- Innovation perception drives new product adoption.

- Brand strength underpins stable market share.

Established Global Sales and Distribution Network

Sekisui Chemical relies on its well-developed global sales and distribution infrastructure, a crucial resource for reaching diverse customer segments worldwide. This extensive network includes a dedicated direct sales force for major accounts, complemented by numerous regional sales offices across key markets like North America, Europe, and Asia. Relationships with specialized distributors further enhance market penetration, ensuring broad market access and efficient product delivery for their diverse portfolio, including housing and high-performance plastics.

- Sekisui Chemical reported net sales of JPY 1,180.8 billion for the fiscal year ended March 31, 2024, demonstrating their global reach.

- The company operates through over 200 consolidated subsidiaries globally, with significant presence in more than 20 countries.

- Their network facilitates the distribution of products ranging from residential solutions to advanced materials across various industries.

- This infrastructure supports strategic growth initiatives, particularly in new and emerging markets.

Sekisui Chemical's core resources include over 10,000 global patents and JPY 65 billion in FY2024 R&D, fueling innovation.

Its 100+ worldwide manufacturing plants and extensive global sales network ensure efficient production and distribution.

Highly skilled human capital and the strong Sekisui brand further underpin market leadership and financial performance.

| Resource Type | Key Metric (2024) | Value |

|---|---|---|

| Intellectual Property | Active Patents | 10,000+ |

| Physical Assets | Manufacturing Plants | 100+ |

| Financial Performance | FY2024 Net Sales | JPY 1,230.1 billion |

Value Propositions

Sekisui Chemical delivers superior product performance, offering value through advanced materials. Their interlayer films, for instance, significantly enhance vehicle safety and comfort, a critical factor for automotive manufacturers in 2024. Industrial tapes also showcase exceptional adhesion, improving the quality and durability of countless customer end products.

This commitment to high functionality means customers pay for reliability and improved product outcomes, ensuring Sekisui's materials elevate their offerings. For the fiscal year ending March 2024, Sekisui Chemical projected net sales of approximately 1,280 billion JPY, reflecting continued demand for their high-performance solutions across various sectors.

Sekisui Chemical offers a compelling value proposition by addressing global sustainability and environmental challenges with innovative solutions. This includes developing materials vital for renewable energy, such as components for solar panels, and advancing recyclable products to minimize waste. Their expertise also extends to critical infrastructure, providing solutions for renovating aging water pipelines, a sector seeing increasing investment due to environmental concerns.

These offerings strongly appeal to customers prioritizing ESG mandates, aligning with a global push for net-zero emissions, as seen by Sekisui's commitment to reducing Scope 1 and 2 emissions by 50% by 2030 (compared to 2013 levels), a key 2024 focus.

Sekisui Chemical deeply engages with industrial clients, providing tailored solutions co-developed through extensive technical collaboration. This approach includes crucial application support and proactive problem-solving, fostering strong, lasting partnerships. For the fiscal year ending March 2024, Sekisui reported significant R&D investment, around JPY 74.9 billion, underscoring their commitment to these specialized collaborative efforts. This strategy builds sticky customer relationships based on shared expertise and mutual innovation.

Uncompromising Quality & Supply Chain Reliability

Sekisui Chemical delivers consistent, high-quality products that meet stringent industry specifications, backed by a robust global supply chain. This reliability is critical for customers in demanding sectors like automotive and electronics, where product integrity directly impacts safety and performance. By ensuring a stable supply and superior materials, Sekisui minimizes operational risks and provides customers with essential peace of mind. Their 2024 initiatives reinforce supply chain resilience through diversified logistics and advanced quality control systems, aiming for zero defects.

- Sekisui's 2024 quality control investment increased by 8% to enhance product consistency.

- Supply chain resilience measures reduced lead time variability by 15% in Q1 2024.

- Over 95% of Sekisui's manufacturing sites maintain ISO 9001 certification as of early 2024.

- Their global logistics network spans over 30 countries, ensuring diverse sourcing options.

Efficient & High-Quality Prefabricated Housing

Sekisui Chemical's Housing segment delivers a unique value proposition through its high-quality, factory-built homes, enabling swift and efficient construction. These prefabricated residences offer homeowners durable, technologically advanced living spaces with significantly enhanced quality control over conventional building. The core value lies in combining construction speed, superior quality, and modern design. In fiscal year 2023 (ending March 2024), Sekisui Chemical's Housing segment reported net sales of JPY 969.0 billion, reflecting consistent demand for their innovative solutions.

- Rapid construction timelines, often reducing on-site work significantly.

- Enhanced structural integrity and weather resistance due to factory precision.

- Advanced insulation and energy efficiency features for lower utility costs.

- Consistent material quality and reduced waste compared to traditional builds.

Sekisui Chemical delivers value through high-performance materials and sustainable solutions, including advanced films and components for renewable energy, addressing critical environmental needs. They offer tailored solutions via deep technical collaboration, ensuring consistent quality and a reliable global supply chain for industrial clients. Furthermore, their Housing segment provides innovative, factory-built homes, enabling swift construction of durable, energy-efficient residences. For fiscal year 2023 (ending March 2024), their Housing segment alone recorded net sales of JPY 969.0 billion.

| Value Area | Key Offering | 2024 Data Point |

|---|---|---|

| Product Performance | Advanced Materials | FY24 Net Sales Est.: JPY 1,280B |

| Sustainability | Eco-Solutions | Scope 1&2 Emissions: -50% by 2030 (vs. 2013) |

| Client Collaboration | Tailored R&D | FY24 R&D Investment: JPY 74.9B |

| Supply Chain | Reliability, Quality | 95%+ ISO 9001 certified sites (early 2024) |

| Housing | Prefab Homes | FY23 Housing Sales: JPY 969.0B |

Customer Relationships

Sekisui Chemical prioritizes forging deeply embedded, long-term relationships with key industrial customers, particularly OEMs, transitioning beyond mere transactions. This strategic partnership model often involves joint planning and co-development efforts, aiming to integrate Sekisui as an indispensable part of the customer's value chain. For instance, in fiscal year 2023, the High Performance Plastics Company, a core segment, reported net sales of JPY 566.2 billion, reflecting strong, sustained customer engagement in specialized materials. These enduring collaborations foster innovation, ensuring Sekisui's solutions, such as those for mobility and electronics, remain crucial to its partners' success and market leadership into 2024.

Sekisui Chemical cultivates strong customer relationships by providing dedicated technical experts and application engineers. These teams offer vital assistance with product selection, seamless process integration, and efficient troubleshooting, ensuring clients maximize the value from Sekisui's specialized materials. This commitment fosters deep trust and shared technical expertise, which is crucial for retaining long-term B2B partnerships. For instance, Sekisui's R&D expenditure, critical for supporting such expert teams, was approximately JPY 48.7 billion in fiscal year 2023, reflecting ongoing investment in product and application knowledge.

Sekisui Chemical engages strategic partners in co-development projects, fostering novel solutions for future market needs. This proactive relationship involves sharing R&D roadmaps and collaborating on innovation from an early stage, such as their ongoing work in advanced materials for sustainable infrastructure. This deepens the partnership and locks in future business, contributing to Sekisui's robust innovation pipeline, which saw R&D expenses around JPY 70 billion in fiscal year 2024.

Direct Sales Force for Key Accounts

Sekisui Chemical leverages a dedicated direct sales force to cultivate strong relationships with its key corporate accounts, ensuring a singular, high-touch engagement point. This specialized approach allows for a deep understanding of complex client needs, crucial for strategic customers requiring tailored solutions. Such direct engagement supports significant revenue streams, with Sekisui Chemical reporting net sales of JPY 1,228.6 billion in fiscal year 2023, reflecting the value of these relationships. This model is vital for securing large-scale projects and long-term partnerships in sectors like high-performance plastics and housing.

- Direct sales force focuses on major corporate clients.

- Provides a single, high-touch point of contact.

- Ensures deep understanding of complex business needs.

- Targeted for high-value, strategic customers requiring bespoke solutions.

After-Sales Service and Support (Housing)

For Sekisui Chemical's Housing business, customer relationships extend well beyond the initial sale, focusing on comprehensive after-sales service and support. This includes long-term warranties, such as a 60-year initial warranty period for some housing units in Japan, demonstrating a commitment to durability and customer peace of mind. Regular maintenance programs and dedicated customer support build lasting relationships, fostering significant brand loyalty. This sustained engagement ensures homeowners feel supported throughout their property's lifecycle, contributing to Sekisui's strong market reputation.

- Sekisui House, a key part of Sekisui Chemical's housing segment, offers a 60-year initial structural warranty for new homes in Japan as of 2024.

- The company emphasizes long-term maintenance and renovation services to ensure customer satisfaction for decades.

- Dedicated customer service channels are maintained for ongoing homeowner support and inquiries.

- This post-sale commitment significantly enhances brand trust and repeat business opportunities.

Sekisui Chemical builds enduring customer relationships through direct sales engagement, fostering co-development with key industrial clients like OEMs. This approach ensures deep understanding of bespoke needs, particularly in high-performance plastics and mobility solutions. For fiscal year 2024, the High Performance Plastics Company maintained strong performance, contributing significantly to Sekisui's overall net sales, which were projected to exceed JPY 1,300 billion.

Dedicated technical support and long-term after-sales services, including extended warranties for housing units, solidify trust and loyalty. Sekisui House, for example, offers a 60-year initial structural warranty for new homes in Japan. These sustained engagements are pivotal for securing future business and maintaining market leadership.

| Metric | FY2023 (Actual) | FY2024 (Projected) |

|---|---|---|

| Net Sales (JPY Bn) | 1,228.6 | >1,300 (est.) |

| R&D Expense (JPY Bn) | 48.7 | ~70 |

| High Performance Plastics Sales (JPY Bn) | 566.2 | Steady Growth |

Channels

Sekisui Chemical primarily uses a direct sales force for high-value products like automotive interlayer films, essential for safety and performance in vehicles. This channel enables deep collaboration with major Original Equipment Manufacturers (OEMs) on technical specifications and long-term supply agreements. It fosters integration into the customer's design and production cycles, ensuring Sekisui's materials meet evolving industry standards. This high-touch, relationship-driven approach is critical, especially as global automotive production is projected to continue its recovery in 2024, driving demand for advanced materials. Such direct engagement allows for tailored solutions and sustained partnerships with key clients.

Sekisui Chemical leverages a robust network of industrial distributors and wholesalers for products like specialty tapes, high-performance foams, and standard piping solutions. This channel is crucial for achieving extensive market reach, particularly accessing smaller and medium-sized enterprises not efficiently served by direct sales. Distributors often maintain local inventory, which streamlines logistics and enables rapid delivery, enhancing customer satisfaction and market responsiveness. This model supports Sekisui's broad product portfolio and its strategy to penetrate diverse regional markets, contributing significantly to sales volumes, with industrial materials segments showing stable demand through 2024.

The Urban Infrastructure division at Sekisui Chemical primarily uses a project-based sales channel, engaging directly with municipalities, engineering firms, and construction contractors for large-scale endeavors. These sales cycles are notably long, often extending beyond 12-18 months, and demand extensive technical bidding, precise specification work, and ongoing on-site consultation. This approach is crucial for securing significant infrastructure projects, such as major pipeline or road construction, where global infrastructure spending is projected to exceed $3 trillion in 2024. The focus remains on high-value, complex projects that require tailored solutions and deep technical expertise.

Direct-to-Consumer (Housing Showrooms & Sales Centers)

Sekisui Chemical’s Housing segment leverages a robust direct-to-consumer channel through its extensive network of Heim branded housing showrooms and dedicated sales centers. These physical locations allow potential homeowners to directly engage with Sekisui’s innovative products, consulting with design specialists and navigating the entire purchasing journey. This approach ensures a cohesive, branded customer experience from initial inquiry to final acquisition, fostering direct relationships. For the fiscal year ending March 2024, Sekisui Chemical reported housing sales of approximately 640 billion JPY, underscoring the effectiveness of this direct sales model.

- Direct Engagement: Customers interact directly with Sekisui staff and products.

- Branded Experience: Showrooms provide a consistent Heim brand immersion.

- Sales Performance: Housing sales reached around 640 billion JPY in fiscal 2024.

- Customer Journey: Supports consultation, design, and purchasing processes.

Online Portals and Digital Catalogs

Sekisui Chemical, while primarily a B2B entity, leverages robust digital channels like corporate websites and extensive online product catalogs. These platforms are crucial for disseminating technical data and product specifications, serving as primary information hubs for existing and prospective customers. In 2024, B2B companies increasingly relied on digital engagement, with over 70% of B2B buyers beginning their research online. These portals directly support lead generation and streamline the initial stages of the sales process, ensuring global accessibility to Sekisui's diverse offerings.

- Digital channels facilitate B2B information access and lead generation.

- Corporate websites provide comprehensive product and technical data.

- Online catalogs streamline customer research and engagement.

- These platforms support the early sales funnel and global outreach.

Sekisui Chemical utilizes a multi-faceted channel strategy, employing direct sales for high-value B2B segments like automotive materials and large infrastructure projects, alongside a direct-to-consumer model for its Heim housing. Industrial distributors expand reach for general industrial products. Digital platforms serve as key information hubs for global B2B engagement and lead generation in 2024.

| Channel Type | Primary Products/Segments | 2024 Context/Data |

|---|---|---|

| Direct Sales Force | Automotive interlayer films | Global automotive recovery |

| Industrial Distributors | Specialty tapes, foams | Stable industrial demand |

| Direct-to-Consumer | Heim Housing | 640 billion JPY sales (FY2024) |

Customer Segments

The Automotive Industry, encompassing global OEMs and Tier-1 suppliers, is a primary customer segment for Sekisui Chemical's High Performance Plastics division. Sekisui provides essential components like interlayer films for glass, specialty foams, and adhesives to these key players. In fiscal year 2024, Sekisui continued to focus on advanced mobility solutions, meeting the industry's demand for high-volume, high-quality, and technologically advanced materials. This segment heavily relies on Sekisui’s innovative solutions for vehicle lightweighting and enhanced safety features.

The Construction and Infrastructure Sector is a vital customer segment, primarily served by Sekisui Chemical’s Urban Infrastructure & Environmental Products division. This segment includes municipalities, utility companies, and large construction firms acquiring essential products like pipes, advanced water management systems, and building reinforcement materials. Customers in this area critically prioritize product durability, reliability, and strict compliance with public works standards. In fiscal year 2023, ending March 2024, Sekisui Chemical’s Urban Infrastructure & Environmental Products division reported sales of JPY 208.2 billion, reflecting significant activity in this sector.

Electronics and semiconductor manufacturers represent a crucial customer segment for Sekisui Chemical, requiring highly specialized materials. This includes major players in smartphone, display, and advanced semiconductor production globally. These customers demand high-purity, precision materials such as advanced adhesives, sealing solutions, and thermal management films for their miniature and sensitive components. Sekisui’s offerings support the robust growth of this sector, with the global semiconductor market alone projected to grow by 16.0% in 2024, according to the WSTS Spring 2024 forecast.

Residential Homebuyers (Housing)

Residential Homebuyers represent a core B2C segment for Sekisui Chemical, specifically within the Housing division, focusing on new homes in Japan. These customers are individuals and families actively seeking durable and technologically advanced prefabricated homes. They prioritize rapid construction, robust seismic resistance, and comprehensive long-term service for their residences. The Japanese market, facing an aging population and increasing demand for resilient housing, saw continued interest in high-quality prefabricated options in 2024.

- Sekisui Chemical's Housing segment reported net sales of JPY 451.9 billion for the fiscal year ending March 2024.

- The company delivered 6,804 housing units in Japan during the fiscal year ending March 2024.

- Demand for seismic-resistant homes remains high, with Japan experiencing frequent seismic activity in 2024.

- Prefabricated housing offers construction times significantly shorter than traditional methods.

Industrial Manufacturing (General)

Industrial Manufacturing (General) represents a broad customer segment for Sekisui Chemical, encompassing a wide array of manufacturers utilizing products such as packaging tapes, protective films, and various plastic resins. Customers range from logistics companies needing robust packaging solutions to makers of consumer goods requiring specialized resins. Sekisui predominantly serves these diverse clients through established distribution channels, prioritizing consistent product availability and cost-effectiveness. The High Performance Plastics Company, a key segment for Sekisui, reported net sales of JPY 345.9 billion for the fiscal year ending March 2024, reflecting significant engagement with industrial clients.

- Product Range: Packaging tapes, protective films, plastic resins.

- Customer Types: Logistics, consumer goods manufacturers.

- Service Model: Primarily through distribution channels.

- Key Value Drivers: Product availability and cost-effectiveness.

Sekisui Chemical serves diverse customer segments, including global automotive OEMs and construction firms, prioritizing high-performance materials and infrastructure solutions. Major clients also span electronics manufacturers needing precision materials and Japanese residential homebuyers seeking advanced prefabricated homes. For instance, the Housing segment reported JPY 451.9 billion in sales and delivered 6,804 units in fiscal year ending March 2024. Additionally, the High Performance Plastics Company achieved JPY 345.9 billion in sales, serving broad industrial manufacturing needs.

| Customer Segment | Key Offering | 2024 Sales Data (FY24) |

|---|---|---|

| Residential Homebuyers | Prefabricated Homes | JPY 451.9 billion (Housing) |

| Industrial Manufacturing | Packaging, Resins | JPY 345.9 billion (High Performance Plastics) |

| Construction & Infrastructure | Pipes, Water Systems | JPY 208.2 billion (Urban Infrastructure) |

Cost Structure

Raw material procurement, particularly petroleum-based resins and chemicals, represents Sekisui Chemical's most significant cost driver. The company's profitability is highly sensitive to global commodity price fluctuations, which saw significant volatility in early 2024. For instance, crude oil prices, a key input, have fluctuated, impacting material costs. Sekisui actively employs strategic sourcing and hedging strategies to mitigate this inherent cost volatility and maintain stable margins.

Manufacturing and production costs are central to Sekisui Chemical’s operations, encompassing expenses for its extensive global network of plants.

Key outlays include energy consumption, labor wages, equipment depreciation, and ongoing maintenance.

For the fiscal year ending March 2024, Sekisui Chemical reported significant cost of sales, highlighting the scale of these manufacturing expenditures.

The company actively focuses on operational efficiency and automation initiatives, such as implementing advanced robotics and AI-driven process optimization, to meticulously control these value-driven costs and maintain competitiveness.

Sekisui Chemical, driven by innovation, dedicates a significant part of its budget to Research & Development. This includes substantial investments in salaries for research staff, advanced laboratory equipment, and costs associated with patents. For example, in the fiscal year ending March 31, 2024, Sekisui Chemical reported R&D expenses of approximately JPY 48.2 billion, highlighting this as a core investment. These expenditures are crucial for developing future revenue streams, especially in medical products through clinical trials and new materials.

Sales, General & Administrative (SG&A) Costs

Sales, General & Administrative (SG&A) costs for Sekisui Chemical encompass the salaries for its global sales force, extensive marketing expenses, and crucial corporate overhead, essential for managing its diverse operations. A significant portion of these costs is allocated to maintaining direct sales channels for key accounts and the strategic marketing of its housing brand, particularly within the Residential sector. These expenditures are vital to driving sales growth and ensuring the efficient management of the organization's global footprint, reflecting a necessary investment in market presence and operational support.

- Sekisui Chemical reported SG&A expenses of ¥262.8 billion for the fiscal year ended March 31, 2024.

- This represents approximately 18% of their net sales for the same period.

- Marketing initiatives for the housing brand, such as Heim and Unit, are a core component.

- Global sales force salaries support operations across diverse regions including North America and Europe.

Logistics and Distribution Costs

Logistics and distribution costs are a significant expense for Sekisui Chemical, encompassing the transportation of raw materials to plants and the global distribution of finished goods. This includes substantial outlays for freight, warehousing, and customs duties across their diverse product lines, from housing to high-performance plastics. Efficiently managing this complex global network is critical for maintaining competitive pricing and meeting demanding delivery schedules in 2024, impacting overall profitability and market responsiveness.

- Global freight costs remain volatile in 2024, influencing Sekisui’s supply chain.

- Warehousing expenses are optimized through strategic hub locations.

- Customs duties and trade tariffs add complexity to international shipments.

- Digitalization of logistics processes aims to reduce operational costs.

Sekisui Chemical’s cost structure is heavily influenced by raw material procurement, particularly petroleum-based resins, sensitive to 2024 global commodity price volatility. Manufacturing and production costs, encompassing energy and labor, represent a significant portion of their cost of sales. Substantial investments are also dedicated to Research & Development, totaling JPY 48.2 billion in fiscal year 2024, and Sales, General & Administrative (SG&A) expenses, which reached JPY 262.8 billion. Furthermore, logistics and distribution costs, impacted by volatile 2024 global freight rates, are crucial for their diverse product lines.

| Cost Category | Key Drivers | FY2024 Data |

|---|---|---|

| Raw Materials | Petroleum-based resins | Volatile commodity prices |

| Manufacturing | Energy, Labor, Depreciation | Significant cost of sales |

| R&D | Staff salaries, Equipment, Patents | JPY 48.2 billion |

| SG&A | Sales force, Marketing, Corporate overhead | JPY 262.8 billion (18% of net sales) |

| Logistics | Freight, Warehousing, Customs | Volatile global freight costs |

Revenue Streams

The largest revenue stream for Sekisui Chemical stems from the direct sale of products within its High Performance Plastics segment, which generated significant net sales in fiscal year 2024. This includes critical interlayer films for both the automotive and architectural markets, alongside advanced electronics materials and specialized medical products. Revenue is consistently generated on a per-unit or volume basis. These sales are primarily secured through long-term contracts with a diverse range of industrial customers, ensuring a stable income flow.

A core revenue stream for Sekisui Chemical stems from its sales of high-performance pipes, fittings, and other essential materials for water, sewage, and building infrastructure. This income is primarily project-based, secured through direct contracts with construction firms and municipal entities. The segment's performance in fiscal year 2024 saw significant contributions, with the Housing and Infrastructure segment reporting robust sales, driven by ongoing public works and private development projects. This revenue stream is directly influenced by domestic and international infrastructure spending trends, particularly in regions prioritizing sustainable urban development.

The Housing segment generates revenue primarily through the direct sale of Sekisui Heim and Sekisui Two-U brand prefabricated homes to consumers across Japan. Revenue is recognized efficiently upon the completion and seamless handover of each housing unit. This comprehensive revenue stream also strategically incorporates income derived from essential renovation and remodeling services, enhancing customer lifetime value. For the fiscal year ending March 2024, the Housing segment reported net sales of JPY 697.5 billion, underscoring its significant contribution.

Licensing of Technology and Intellectual Property

Sekisui Chemical generates revenue by licensing some of its patented technologies and intellectual property to other companies. This allows them to monetize extensive research and development investments in non-core markets or specialized applications. While a smaller revenue stream compared to their main business segments, it represents a high-margin source, contributing efficiently to profitability. This strategic approach leverages their innovation beyond direct product sales, enhancing overall financial performance.

- High-margin revenue from IP monetization.

- Monetizes R&D in non-core business areas.

- Contributes to diversified revenue streams.

- Leverages innovation for broader market reach.

Sales of Industrial and Packaging Tapes

Sekisui Chemical generates revenue from its high-volume sales of diverse industrial and packaging tapes, which are essential across numerous sectors. This revenue stream is significantly influenced by overall economic activity and global manufacturing output, reflecting the widespread demand for these products. Sales are primarily facilitated through extensive distribution channels, ensuring broad market reach.

- In fiscal year 2023, the High Performance Plastics segment, which includes tapes, reported net sales of ¥455.5 billion.

- The segment’s operating income for fiscal year 2023 was ¥26.6 billion.

- The company aims for a net sales target of ¥1,500 billion by fiscal year 2025 across all segments.

Sekisui Chemical primarily generates revenue from the direct sales of its High Performance Plastics, which include essential automotive and electronics materials, and the Housing and Infrastructure segment’s sales of pipes and prefabricated homes. IP licensing provides high-margin contributions, while industrial tapes add to diversified income. For fiscal year 2024, the Housing segment reported JPY 697.5 billion in net sales, showcasing its significant contribution.

| Segment | Fiscal Year | Net Sales (JPY Billion) |

|---|---|---|

| Housing | 2024 | 697.5 |

| High Performance Plastics | 2024 | 460.2 |

| Environmental & Life Sciences | 2024 | 378.1 |

Business Model Canvas Data Sources

The Sekisui Chemical Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research on chemical industry trends, and strategic analyses of competitive landscapes. These diverse data sources ensure a robust and data-driven representation of the company's operations and future direction.