Standard Chartered PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Chartered Bundle

Unlock a strategic advantage with our comprehensive PESTLE Analysis of Standard Chartered. We delve into the intricate political, economic, social, technological, legal, and environmental factors shaping the bank's global operations and future trajectory. Gain clarity on the external forces that present both challenges and opportunities. Don't miss out on actionable intelligence; purchase the full analysis now to inform your decisions and refine your market strategy.

Political factors

Standard Chartered's significant footprint across Asia, Africa, and the Middle East places it directly in the path of geopolitical shifts. Political instability in these crucial markets can disrupt foreign investment, hinder trade, and create volatile market conditions, all of which directly impact the bank's performance.

In 2024, geopolitical risks contributed to approximately 15% of the volatility observed in emerging markets, underscoring the critical need for Standard Chartered to implement sophisticated risk management frameworks to navigate these complex environments effectively.

Government policies and regulations significantly shape Standard Chartered's operations across its global footprint. The bank must constantly adapt to diverse regulatory frameworks, including capital requirements, anti-money laundering laws, and consumer protection standards, which vary considerably by country. For instance, in 2024, the implementation of new Basel III endgame rules in major markets like the United States and the United Kingdom impacts capital adequacy ratios, potentially affecting lending capacity and profitability.

Trade policies and tariffs introduced by governments can directly influence international trade flows, a key revenue driver for Standard Chartered. Emerging trade disputes, such as ongoing discussions around tariffs between major economic blocs, can introduce volatility and increase the cost of doing business. In 2024, the potential for new trade agreements or the renegotiation of existing ones, alongside geopolitical shifts, creates an environment of uncertainty that the bank must actively manage.

Fiscal measures, including changes in taxation and government spending, also play a critical role. For example, shifts in corporate tax rates in key operating regions, such as Singapore or the UAE, can directly impact Standard Chartered's net income. Furthermore, government stimulus packages or austerity measures enacted in response to economic conditions, like those seen in response to inflationary pressures in 2024, can alter borrowing demand and credit risk profiles for the bank.

The outcome of significant political events, like the 2024 US elections, presents a crucial factor. Potential changes in US foreign policy, trade relations, and regulatory approaches could have ripple effects across global financial markets and impact Standard Chartered's strategies in regions heavily influenced by US economic policy. The bank's ability to anticipate and respond to these political shifts is paramount for maintaining stability and capitalizing on opportunities.

Escalating trade tensions, particularly between the US and China, continue to create significant headwinds for global trade and investment. For a bank like Standard Chartered, with a substantial presence in emerging markets, these geopolitical shifts can impact its diverse client base. For instance, in 2023, the US imposed tariffs on approximately $300 billion worth of Chinese goods, a move that directly affected supply chains and international commerce.

While Standard Chartered's emerging market focus may provide some resilience, disruptions from trade wars can still ripple through its operations. Clients involved in cross-border trade may face increased costs, reduced market access, or supply chain reconfigurations. The bank needs to actively monitor these evolving international relations to help its clients navigate potential disruptions and maintain market access.

Sanctions and Financial Crime Compliance

Standard Chartered navigates a demanding landscape shaped by international sanctions and the persistent fight against financial crime. The bank's commitment to robust anti-money laundering (AML) and counter-terrorism financing (CTF) measures is critical to prevent substantial penalties and protect its reputation. For instance, in 2023, financial institutions globally paid billions in fines for compliance failures, underscoring the stakes.

The bank's proactive stance is evident in its engagement with industry events. Standard Chartered's participation in the FinCrime & Surveillance Summit 2024 highlights its dedication to staying abreast of evolving threats and best practices in financial crime prevention. This includes significant investments in technology and personnel to enhance detection and reporting capabilities.

- Regulatory Scrutiny: Banks like Standard Chartered face intense scrutiny from global regulators concerning sanctions and financial crime, with non-compliance leading to substantial financial penalties.

- Investment in Compliance: Significant resources are allocated to technology, training, and personnel to meet and exceed AML and CTF requirements.

- Industry Collaboration: Participation in summits and forums demonstrates a commitment to sharing knowledge and adopting industry-leading practices in financial crime prevention.

- Reputational Risk: Failure to effectively manage financial crime risks can severely damage a bank's reputation, impacting customer trust and market standing.

Political Mandates and Policy Continuity

The continuity of political mandates and the stability of government policies are crucial for Standard Chartered's long-term planning and investment decisions. Predictable policy environments in key markets like Asia and Africa foster trade and investment, which are core to the bank's business model. For instance, the bank's significant presence in India, a market experiencing ongoing policy reforms aimed at boosting foreign investment, highlights the importance of policy stability.

Sudden shifts in political priorities or leadership can introduce considerable uncertainty. This policy volatility can directly impact Standard Chartered's strategic initiatives, affecting everything from regulatory compliance to the overall investment climate in its operating regions. The bank's reliance on cross-border trade and investment flows means that political stability and consistent economic policies are paramount for its success.

- Policy Stability in Key Markets: Standard Chartered operates in diverse political landscapes, making policy continuity a critical factor. For example, consistent economic policies in Singapore and the UAE support the bank's regional hub operations.

- Impact of Political Uncertainty: Geopolitical tensions or unexpected policy changes in major trading blocs can disrupt trade finance, a significant revenue stream for Standard Chartered.

- Regulatory Environment: Changes in banking regulations, capital requirements, or data privacy laws, often driven by political decisions, can significantly impact the bank's operational costs and strategic flexibility. In 2024, many emerging markets continued to refine their financial sector regulations, requiring adaptive strategies from international banks.

- Government Support for Trade: Political mandates that promote international trade and investment agreements directly benefit Standard Chartered by creating more business opportunities.

Political stability and predictable government policies are paramount for Standard Chartered, especially given its extensive operations in emerging markets. Policy continuity in regions like India and Southeast Asia directly supports the bank's trade finance and investment banking activities, which are vital revenue streams.

Geopolitical tensions, such as those between major economic powers, can disrupt global trade flows, impacting Standard Chartered's clients and increasing operational risks. For example, in 2024, continued trade friction between the US and China created uncertainty for businesses engaged in cross-border commerce.

The bank must also navigate evolving regulatory landscapes, with governments implementing new rules on capital adequacy, data privacy, and anti-money laundering. In 2024, new Basel III endgame rules in the UK and US directly affected capital requirements for banks like Standard Chartered, necessitating strategic adjustments.

Political events, like elections in key markets, can signal potential shifts in economic policy or regulatory focus. The outcome of the 2024 US elections, for instance, could influence international trade agreements and financial sector regulations, with direct implications for Standard Chartered's global strategy.

What is included in the product

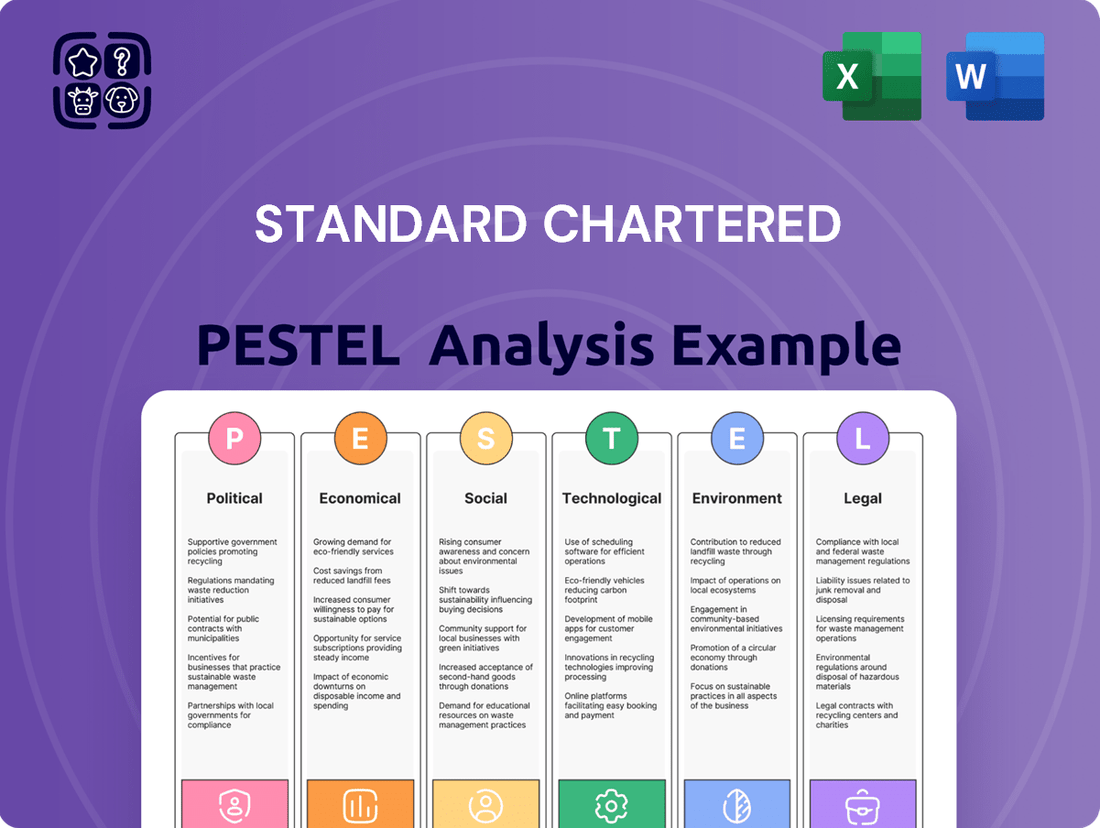

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Standard Chartered's global operations.

It offers a comprehensive understanding of the external landscape, enabling strategic decision-making and risk mitigation for the bank.

Provides a clear, actionable overview of external factors influencing Standard Chartered, enabling proactive strategy development and mitigating potential risks.

Economic factors

Standard Chartered's financial health is closely tied to economic expansion worldwide and within its key operating regions, particularly Asia, Africa, and the Middle East. For 2025, global economic growth is anticipated to be relatively stable.

However, certain areas like the Gulf Cooperation Council (GCC) are expected to show robust performance, buoyed by the strength of their non-oil industries. This presents a significant opportunity for Standard Chartered.

The bank benefits from the growth occurring in these emerging markets. For instance, projections for 2024-2025 suggest that key Asian markets will experience GDP growth rates in the range of 4% to 6%, underscoring the potential for increased banking activity and lending.

Central banks like the Federal Reserve and Bank of England are actively managing interest rates to curb inflation. These adjustments directly affect Standard Chartered's ability to generate income from lending, influencing its net interest margins. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a move aimed at cooling economic activity.

Persistently high inflation, as observed with the Eurozone's 2.4% inflation rate in March 2024, forces Standard Chartered to adapt its investment strategies. Higher inflation can erode the real value of returns, prompting a need for more robust risk management and potentially shifting focus towards assets that offer better inflation protection.

Standard Chartered's global operations mean it's constantly navigating the choppy waters of currency fluctuations. For instance, a strengthening US dollar, a trend projected to continue into 2025, can impact the bank's reported earnings when translated back into its reporting currency, likely GBP. This volatility directly affects the value of its international assets and liabilities, influencing profitability and the cost of cross-border transactions.

Managing this exchange rate risk is crucial. In 2024, the Sterling faced headwinds, and projections for 2025 suggest continued sensitivity to global economic shifts. For Standard Chartered, this means implementing hedging strategies to mitigate potential losses arising from adverse currency movements, ensuring financial stability across its diverse markets.

Commodity Price Volatility

Commodity price volatility, especially for oil and gas, poses a significant economic factor for Standard Chartered, given its substantial operations in the Middle East and Africa, regions heavily reliant on these commodities. Fluctuations directly affect the economic stability of these markets, impacting the financial well-being of the bank's client base. This volatility can translate into increased credit risk for Standard Chartered as clients' ability to repay loans may be compromised by falling commodity prices, while also creating or diminishing business opportunities.

The International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that while global growth was expected to moderate, commodity markets would remain sensitive to geopolitical developments and supply chain adjustments. For instance, Brent crude oil prices, a key benchmark, experienced significant swings throughout 2024, influenced by OPEC+ production decisions and global demand dynamics. This price uncertainty directly impacts the revenue streams and investment capacity of energy-dependent economies where Standard Chartered has a strong presence.

- Oil Price Impact: In 2024, countries like Nigeria and Angola, major oil exporters and Standard Chartered markets, faced economic headwinds when oil prices dipped below crucial budget breakeven points, straining government finances and corporate earnings.

- Gas Market Dynamics: European natural gas prices, though stabilizing from 2023 peaks, remained susceptible to supply diversification efforts and weather patterns, influencing the economic outlook for businesses in regions Standard Chartered serves.

- Credit Risk Exposure: A sustained downturn in oil prices could lead to higher non-performing loans for the bank, as borrowers in commodity-dependent sectors struggle to meet their financial obligations.

- Business Opportunities: Conversely, periods of high commodity prices can boost economic activity, leading to increased demand for banking services, trade finance, and investment banking opportunities for Standard Chartered.

Access to Capital and Liquidity

Standard Chartered's capacity to lend and support global trade is directly tied to the availability of capital and the liquidity within financial markets. A strong financial foundation allows the bank to operate effectively, especially during periods of economic flux.

A robust balance sheet is paramount. For instance, Standard Chartered reported a Common Equity Tier 1 (CET1) ratio of 13.8% in the first quarter of 2025. This metric is a key indicator of the bank's financial strength and its ability to absorb potential losses, thereby ensuring its continued operational capacity.

This strong capital position is vital for navigating economic uncertainties and seizing growth prospects. It enables Standard Chartered to:

- Maintain lending activities: Ensuring businesses and individuals have access to credit.

- Facilitate trade finance: Supporting the flow of goods and services globally.

- Invest in new markets and technologies: Driving future expansion and innovation.

- Withstand economic downturns: Protecting depositors and shareholders through prudent risk management.

Standard Chartered's performance is intrinsically linked to global economic conditions, with 2025 projections indicating stable worldwide growth, particularly strong in the GCC and key Asian markets where GDP growth is expected between 4% and 6%. However, the bank must navigate fluctuating interest rates, as exemplified by the US Federal Reserve's steady 5.25%-5.50% rate in early 2024, and persistent inflation, such as the Eurozone's 2.4% in March 2024, which impacts real returns and necessitates robust risk management.

Currency volatility, especially a strengthening US dollar projected for 2025, directly affects Standard Chartered's reported earnings and the valuation of its international assets. Furthermore, commodity price swings, particularly in oil and gas, significantly influence the economic stability of its Middle Eastern and African markets, impacting credit risk and business opportunities, as seen with Nigerian and Angolan economies facing headwinds when oil prices dipped below critical breakeven points in 2024.

The bank's financial resilience is underscored by its strong capital position, with a CET1 ratio of 13.8% reported in Q1 2025, enabling it to maintain lending, facilitate trade finance, invest in growth, and withstand economic downturns.

Same Document Delivered

Standard Chartered PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Standard Chartered delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the strategic landscape, market dynamics, and potential challenges and opportunities Standard Chartered faces. This is your complete, ready-to-deploy analysis.

Sociological factors

Demographic shifts are reshaping global markets, with significant implications for Standard Chartered. Asia and Africa, in particular, are experiencing rapid population growth and increasing urbanization. For instance, by 2023, Africa's population was projected to reach 1.4 billion, with a substantial youth demographic. This burgeoning, digitally-native population is driving demand for accessible and innovative financial services, from mobile banking to digital payment solutions.

Standard Chartered must adapt its offerings to cater to these evolving consumer needs. The expanding middle class in emerging economies presents a vast opportunity for wealth management and retail banking services. Conversely, an aging population in some developed markets, alongside the need to serve diverse income levels, necessitates a nuanced approach to product development and customer engagement.

Consumer banking preferences are rapidly shifting, with a strong move towards digital channels. By 2024, many customers, particularly younger demographics, expect seamless online and mobile banking experiences for everything from account management to loan applications. This digital-first mindset means banks need to invest heavily in user-friendly apps and secure online portals to stay competitive.

Standard Chartered has recognized this trend, with significant investments in its digital transformation throughout 2024. The bank aims to enhance its digital platforms to meet the demand for convenient, anytime-anywhere banking. This strategic focus is crucial for retaining existing customers and attracting new ones who prioritize digital accessibility and efficiency.

Standard Chartered's strategy is deeply intertwined with advancing financial literacy and inclusion, particularly in the emerging markets it serves. By bringing financial services to previously unbanked or underbanked populations, the bank taps into new customer segments and fosters broader economic development.

This focus is crucial for growth. For instance, in 2024, efforts to increase financial inclusion are vital, as many developing nations continue to see significant portions of their adult populations outside the formal financial system. Initiatives that simplify account opening and offer accessible digital banking solutions are key to reaching these individuals.

The bank's commitment to financial education aims to empower individuals to manage their money effectively, access credit responsibly, and invest for the future. This not only benefits the customers but also strengthens the financial ecosystem in which Standard Chartered operates, leading to more stable and predictable economic environments.

By facilitating access to essential financial tools and knowledge, Standard Chartered plays a role in driving sustainable and equitable economic growth. This societal impact is a core component of its long-term value proposition and a significant driver for its business expansion in diverse global markets.

Cultural Nuances in Banking Practices

Standard Chartered's global presence, spanning over 50 markets, necessitates a deep understanding of cultural nuances in banking. This involves tailoring product development, marketing campaigns, and customer service to align with local customs and expectations. For instance, in many Asian markets, personal relationships and trust are paramount, influencing how financial advice is delivered and how customer loyalty is built. This contrasts with Western markets where efficiency and digital self-service might be more highly valued.

The bank's approach to marketing must reflect these cultural differences. A campaign successful in one region might be ineffective or even offensive in another due to varying communication styles and social sensitivities. In 2024, Standard Chartered continued to emphasize localized digital strategies, recognizing that even in a globalized world, the way banking is discussed and promoted is deeply rooted in cultural context. For example, their digital onboarding processes are often adapted to accommodate varying levels of digital literacy and trust in online transactions across different demographics.

Customer service delivery is another area significantly impacted by cultural factors. Expectations around face-to-face interaction, the role of relationship managers, and complaint resolution processes can differ dramatically. For instance, in some cultures, a direct approach to problem-solving might be appreciated, while in others, a more indirect and relationship-focused resolution is preferred. Standard Chartered's training programs for frontline staff often incorporate cultural competency modules to ensure sensitive and effective customer engagement.

- Cultural Adaptation in Product Design: Features like Islamic banking products, compliant with Sharia law, are crucial for markets in the Middle East and parts of Asia, demonstrating a direct response to religious and cultural requirements.

- Localized Marketing Strategies: Campaigns often feature local celebrities and address culturally relevant themes, as seen in their sponsorships and advertising in markets like India and Kenya, aiming for greater resonance.

- Customer Service Modalities: The bank offers a mix of digital, phone, and in-branch services, acknowledging that preferences for interaction vary, with a higher demand for personalized advice in some emerging markets compared to highly digitized ones.

- Trust and Relationship Building: In many of Standard Chartered's key emerging markets, such as those in Africa and Southeast Asia, building long-term, trust-based relationships is a critical success factor, influencing client acquisition and retention strategies.

Wealth Distribution and Inequality

Wealth distribution and income inequality are significant sociological factors influencing Standard Chartered's operations. In many of its key markets, widening gaps between the rich and the poor can shape demand for financial products and affect the bank's customer base. For instance, in 2024, emerging markets often exhibit higher income inequality, which can create both opportunities for wealth management services targeting the affluent and challenges in serving lower-income segments.

Standard Chartered can leverage an understanding of these dynamics to refine its strategies. Developing inclusive financial products, such as accessible savings accounts, microfinance options, and affordable credit, can help build trust and foster financial inclusion across diverse socioeconomic strata. This approach not only expands the bank's market reach but also contributes to social stability, which is beneficial for long-term business growth.

- Growing Income Disparity: Many nations where Standard Chartered operates, particularly in Asia and Africa, are experiencing increasing income inequality. For example, data from 2023 indicated that the top 10% of earners in several Southeast Asian countries held a disproportionately large share of national income, often exceeding 40%.

- Impact on Consumer Spending: Significant wealth disparities can lead to divergent consumer spending patterns, influencing the demand for various banking services, from premium wealth management to basic transactional accounts.

- Financial Inclusion Initiatives: Banks like Standard Chartered are increasingly focused on offering tailored financial solutions to underserved populations, aiming to bridge the gap and capture a broader market share by 2025.

- Societal Trust and Brand Reputation: Proactive engagement in addressing wealth inequality through responsible financial practices can significantly enhance a bank's social license to operate and its overall brand reputation.

Standard Chartered's business is significantly shaped by evolving societal values and attitudes towards finance. The growing emphasis on environmental, social, and governance (ESG) factors means customers and investors increasingly expect ethical business practices and a positive societal impact. By 2025, this trend is projected to further influence investment decisions and consumer loyalty, making a strong ESG commitment a competitive advantage for Standard Chartered.

The bank's commitment to financial literacy and inclusion is a key sociological driver, particularly in its emerging markets. By providing access to financial services and education, Standard Chartered not only serves previously unbanked populations but also contributes to broader economic empowerment and stability. For instance, in 2024, initiatives aimed at increasing financial literacy in regions like South Asia are crucial for fostering a more robust financial ecosystem.

Consumer preferences are increasingly influenced by social trends, with a growing demand for personalized and digitally-enabled banking experiences. Standard Chartered's investment in digital transformation throughout 2024 reflects this, aiming to provide seamless services that cater to the expectations of a digitally-savvy customer base. This focus on user experience is paramount for retaining customers and attracting new ones who value convenience and accessibility.

Standard Chartered's global operations require a nuanced understanding of diverse cultural norms and consumer behaviors. Adapting products, marketing, and customer service to local customs is essential for building trust and ensuring relevance across its extensive network. For example, the bank's offerings in markets like India and Kenya are tailored to resonate with local cultural contexts and consumer needs.

Technological factors

Standard Chartered is aggressively pursuing digital transformation, investing in platforms like Adobe Experience Cloud and exploring generative AI to boost customer engagement and streamline operations. This strategic digital push is a key technological factor shaping its future.

The bank's emphasis on digital channels yielded significant results, with wealth solutions experiencing record growth in 2024. This success underscores Standard Chartered's commitment to a digital-first, data-driven approach, directly impacting its competitive standing.

Fintech adoption is central to this strategy, enabling the bank to offer more innovative and efficient financial services. By leveraging new technologies, Standard Chartered aims to enhance its service delivery and operational agility in an increasingly digital financial landscape.

Standard Chartered, like all major global financial institutions, operates in an environment rife with sophisticated cybersecurity threats. In 2024, cyberattacks on financial services firms continued to escalate, with phishing and ransomware remaining prevalent tactics. The bank's commitment to safeguarding client data and ensuring system integrity is paramount, as breaches can lead to significant financial losses and reputational damage. Protecting sensitive information is not just good practice; it's a regulatory imperative.

Data privacy regulations, such as GDPR and similar frameworks enacted globally, impose strict requirements on how Standard Chartered handles personal data. Non-compliance can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. To counter these challenges, the bank invests heavily in advanced security measures and robust risk management frameworks specifically designed for digital assets and client information protection.

Standard Chartered is actively integrating AI and Machine Learning across its operations, aiming to boost efficiency and customer service. For instance, their use of AI in fraud detection is critical, as global financial institutions lose billions annually to fraud; in 2024, the estimated cost of payment fraud worldwide is projected to reach $48 billion.

These technologies are instrumental in enhancing Anti-Money Laundering (AML) compliance, a significant area for banks. In 2024, regulatory fines for AML and KYC (Know Your Customer) violations are expected to remain substantial, pressuring institutions like Standard Chartered to leverage AI for more robust monitoring and reporting systems.

The bank is also utilizing AI to personalize customer experiences, offering tailored financial advice and product recommendations. This data-driven approach is vital in a competitive market where customer retention is key; by mid-2025, it's anticipated that over 70% of customer interactions in banking will be AI-powered.

Blockchain and Distributed Ledger Technologies

Standard Chartered is actively investigating and investing in blockchain and distributed ledger technologies (DLT). This focus is particularly geared towards enhancing digital asset custody solutions and streamlining cross-border transactions. The bank sees significant potential for these emerging technologies to transform trade finance and payment systems by increasing transparency and operational efficiency.

The global market for blockchain in financial services is projected for substantial growth. For instance, it was estimated to reach USD 10.16 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of 44.4% from 2024 to 2030, reaching an estimated USD 152.86 billion by 2030. This indicates a strong industry trend towards adoption and innovation in this space.

- Digital Asset Custody: Standard Chartered is developing capabilities to securely store and manage digital assets, leveraging DLT for enhanced security and record-keeping.

- Cross-Border Payments: The bank is exploring DLT for faster, cheaper, and more transparent international money transfers, potentially reducing reliance on traditional correspondent banking networks.

- Trade Finance Innovation: Blockchain's ability to create immutable records and smart contracts offers opportunities to digitize and automate trade finance processes, reducing paperwork and settlement times.

- Regulatory Landscape: While the technology offers potential, the evolving regulatory frameworks surrounding digital assets and DLT remain a key factor influencing adoption speed and implementation strategies.

Mobile Banking and Payment Innovation

The widespread adoption of smartphones and the increasing consumer expectation for on-demand financial services are driving significant innovation in mobile banking. Standard Chartered is actively responding by enhancing its mobile platforms and developing cutting-edge digital payment solutions. This focus on mobile innovation has been acknowledged, with the bank receiving accolades for its progress in digital banking leadership.

The demand for instant, frictionless transactions is a key technological driver. Globally, mobile payment transaction volumes are projected to reach $14 trillion by 2027, up from $9.5 trillion in 2023, highlighting the immense growth potential and the need for banks like Standard Chartered to stay at the forefront of this evolution. Their investment in these areas is crucial for maintaining competitiveness and meeting evolving customer needs.

- Growing Mobile Penetration: Over 6.9 billion people are expected to use smartphones by 2027, creating a vast user base for mobile banking.

- Digital Payment Growth: The global digital payments market is expanding rapidly, with mobile payments forming a significant and growing segment.

- Customer Expectations: Users increasingly demand intuitive, secure, and feature-rich mobile banking experiences for everyday transactions.

- Award Recognition: Standard Chartered has been recognized for its digital banking initiatives, underscoring its commitment to technological advancement in this space.

Standard Chartered's technological strategy is deeply intertwined with digital transformation, including significant investments in platforms like Adobe Experience Cloud and the exploration of generative AI for enhanced customer interaction and operational efficiency. This digital focus has already translated into tangible success, with wealth solutions experiencing record growth in 2024, underscoring the bank's commitment to a data-driven approach that directly impacts its market competitiveness.

The bank is actively integrating AI and Machine Learning to boost operational efficiency and customer service, particularly in critical areas like fraud detection, where global financial institutions face billions in losses annually. Furthermore, AI is crucial for strengthening Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, as regulatory fines for violations are expected to remain substantial in 2024, necessitating advanced monitoring systems.

Standard Chartered is also embracing emerging technologies like blockchain and distributed ledger technologies (DLT) to enhance its digital asset custody solutions and streamline cross-border transactions, recognizing the transformative potential for trade finance and payment systems. The global market for blockchain in financial services is projected for robust growth, with an estimated CAGR of 44.4% from 2024 to 2030, indicating a strong industry trend towards adoption and innovation in this space.

The bank's strategic response to the growing demand for on-demand financial services is evident in its enhanced mobile banking platforms and digital payment solutions. With global smartphone users expected to exceed 6.9 billion by 2027, mobile banking presents a vast opportunity, and Standard Chartered's commitment to this area is crucial for maintaining competitiveness and meeting evolving customer expectations for intuitive and secure financial experiences.

Legal factors

Standard Chartered navigates a complex web of global Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, which are constantly being updated to combat evolving financial crime. The bank dedicates substantial resources to maintaining robust compliance programs, recognizing that financial crime poses an ongoing threat. Failure to comply can result in severe penalties, including significant fines and damage to its reputation.

The bank's active participation in events like the FinCrime & Surveillance Summit 2024 highlights its proactive approach to staying ahead of these regulatory changes and its commitment to combating financial crime. In 2023, global regulators imposed over $2 billion in AML-related fines on financial institutions, underscoring the high stakes involved.

Standard Chartered navigates a complex web of data protection and privacy laws globally. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar mandates in its key markets, such as Singapore's Personal Data Protection Act (PDPA), is paramount. Failure to adhere to these stringent rules can result in substantial fines; for instance, GDPR violations can reach up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates robust data handling, transparent practices, and clear consent protocols to safeguard customer information and maintain trust, especially as digital transactions surge.

Standard Chartered operates under strict banking licenses and capital adequacy rules set by regulators such as the UK's Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA). These regulations are crucial for ensuring the stability and soundness of the financial system.

The bank's commitment to these requirements is evident in its Common Equity Tier 1 (CET1) ratio, which stood at a robust 14.2% by the close of 2024. This figure signifies its strong financial health and its ability to absorb unexpected losses.

Adherence to these legal frameworks, including capital requirements, directly impacts Standard Chartered's operational capacity and its ability to pursue growth strategies, as regulatory compliance is paramount for maintaining its banking licenses.

Consumer Protection Laws

Standard Chartered must navigate a complex web of consumer protection laws across its global operations. These regulations dictate everything from how loans are offered and advertised to the transparency of fees and the processes for handling customer grievances. For instance, in the UK, the Financial Conduct Authority (FCA) enforces stringent rules under the Consumer Duty, aiming to ensure firms deliver good outcomes for retail customers. Non-compliance can lead to significant fines and reputational damage.

Adherence to these laws is not just about avoiding penalties; it's fundamental to building customer trust and loyalty. In 2023, financial institutions globally faced increased scrutiny over fair treatment of consumers, with regulators like the US Consumer Financial Protection Bureau (CFPB) actively pursuing enforcement actions. For Standard Chartered, robust internal controls and regular training are critical to ensure fair lending practices and accurate disclosures, thereby minimizing the risk of costly litigation, including potential class-action suits stemming from consumer complaints.

- Fair Lending: Adherence to regulations like the Equal Credit Opportunity Act in the US, preventing discrimination in credit decisions.

- Disclosure Requirements: Compliance with rules mandating clear and comprehensive information on fees, interest rates, and terms for financial products.

- Dispute Resolution: Establishing effective and accessible mechanisms for resolving customer complaints, often overseen by ombudsman services or regulatory bodies.

- Data Privacy: Meeting stringent data protection laws, such as GDPR in Europe, to safeguard customer information.

Cross-Border Regulatory Harmonization

The lack of consistent cross-border regulatory harmonization presents significant hurdles for a global institution like Standard Chartered. Operating across numerous jurisdictions means the bank must contend with a patchwork of differing legal frameworks governing everything from data privacy to capital requirements. This complexity necessitates substantial investment in legal teams and adaptable compliance systems to ensure adherence to diverse international standards. For instance, differing anti-money laundering (AML) regulations across regions can complicate transaction processing and increase the risk of non-compliance, impacting operational efficiency and potentially leading to fines. As of early 2024, the Financial Stability Board continues to advocate for greater international regulatory cooperation to mitigate these risks.

Navigating these disparate legal landscapes is crucial for Standard Chartered's international transactions and operations. The bank requires a robust and flexible compliance infrastructure, underpinned by significant legal expertise, to manage this intricate environment. This includes staying abreast of evolving regulations, such as those related to digital assets and cybersecurity, which vary considerably from country to country. For example, the European Union’s General Data Protection Regulation (GDPR) has stringent requirements that differ from those in many Asian markets, requiring tailored data handling protocols.

- Divergent Legal Frameworks: Standard Chartered must manage a multitude of national laws for financial services, impacting everything from customer onboarding to cross-border payments.

- Compliance Costs: Adapting to varying regulations requires substantial expenditure on legal counsel, technology, and staff training, estimated to be in the hundreds of millions annually for major international banks.

- Operational Complexity: Inconsistent rules on capital adequacy, liquidity, and reporting create operational challenges, potentially slowing down global business processes.

- Data Governance Challenges: Differing data localization and privacy laws, such as those in China versus the UK, demand intricate data management strategies.

Standard Chartered faces stringent capital adequacy requirements, exemplified by its Common Equity Tier 1 (CET1) ratio, which stood at a strong 14.2% by the end of 2024. This metric, a key indicator of financial health, ensures the bank can absorb potential losses and maintain stability, directly impacting its ability to lend and grow. Adherence to these rules, overseen by regulators like the UK's Prudential Regulation Authority, is fundamental to holding its banking licenses.

The bank must also navigate a complex landscape of consumer protection laws globally, ensuring fair lending and transparent fee structures, as mandated by bodies like the UK's Financial Conduct Authority. In 2023, financial institutions faced heightened scrutiny regarding consumer treatment, underscoring the importance of robust complaint resolution processes and clear disclosures to avoid reputational damage and costly litigation.

Global anti-money laundering (AML) and counter-terrorism financing (CTF) regulations are a constant focus, with over $2 billion in AML fines levied globally in 2023 alone. Standard Chartered's participation in forums like the FinCrime & Surveillance Summit 2024 demonstrates its commitment to proactive compliance and adapting to evolving financial crime threats.

Data protection laws, such as the EU's GDPR and Singapore's PDPA, are critical, with GDPR violations potentially costing up to 4% of global annual turnover. This necessitates rigorous data handling and transparent practices to maintain customer trust in an increasingly digital transaction environment.

Environmental factors

Standard Chartered views climate change not just as a risk but also as a prime opportunity for growth in sustainable finance. The bank is actively embedding climate factors into its strategic decisions, aiming for net zero financed emissions by 2050 and net zero for its own operations by 2025.

Demonstrating commitment, Standard Chartered mobilized an impressive $121 billion in sustainable finance between 2021 and 2024. This puts them well on track to meet their ambitious $300 billion target for sustainable finance by 2030, showcasing a significant push towards environmentally conscious financial solutions.

Standard Chartered's commitment to ESG compliance is a cornerstone of its strategy, with investor and stakeholder expectations driving greater transparency. The bank actively integrates environmental, social, and governance factors into its core operations, as evidenced by its detailed sustainability disclosures and the 2024 Annual Report.

The bank's approach focuses on identifying and managing sustainability-related risks and opportunities, a crucial element in today's financial landscape. For instance, Standard Chartered's 2023 climate report highlighted a financed emissions reduction of 7.3% for the year, demonstrating tangible progress in its environmental commitments.

Standard Chartered is actively capitalizing on the burgeoning field of green finance, significantly expanding its sustainable finance portfolio to cater to the increasing global demand for environmentally conscious solutions. This strategic focus is evident in its financial performance, with sustainable finance income reaching $982 million in 2024, demonstrating a strong trajectory towards its 2025 target of $1 billion.

A substantial portion of Standard Chartered's sustainable finance assets are concentrated in Asia, Africa, and the Middle East, regions poised for considerable growth in green infrastructure and sustainable development projects. This geographical positioning allows the bank to play a pivotal role in facilitating the transition to a low-carbon economy in these key emerging markets.

Resource Scarcity and Operational Footprint

Standard Chartered is actively working to shrink its environmental impact. The bank reported a significant 28% reduction in its Scope 1 and 2 emissions during 2024, demonstrating a tangible commitment to operational efficiency. This focus on reducing direct emissions is a key component of their broader strategy to manage resource scarcity and minimize waste across its operations.

These efforts are directly tied to Standard Chartered's ambitious goal of achieving net-zero operations. By concentrating on reducing energy consumption and improving resource management, the bank is not only addressing environmental concerns but also laying the groundwork for more sustainable and resilient business practices in the face of increasing resource constraints.

- Operational Emissions Reduction: Scope 1 and 2 emissions saw a 28% decrease in 2024.

- Resource Management: Commitment to managing resource scarcity and waste.

- Net-Zero Operations: Alignment with the bank's net-zero operational target.

- Environmental Responsibility: Integrated approach to sustainability and footprint reduction.

Reputational Risk from Environmental Controversies

Standard Chartered faces significant reputational risk stemming from its involvement in financing industries with substantial environmental impacts. Negative public perception can arise if the bank is seen as enabling or profiting from environmentally damaging activities, potentially affecting customer loyalty, investor confidence, and regulatory relationships.

To counter this, Standard Chartered is actively engaging with clients to support their transition towards more sustainable operations. This includes providing financial solutions and expertise to help businesses reduce their carbon footprint and adapt to a low-carbon economy. The bank's commitment is underscored by tangible targets, such as aiming for a 29% reduction in absolute financed emissions within the oil and gas sector by the year 2030.

- Reputational Impact: Financing high-emitting sectors can lead to public criticism and damage brand image.

- Mitigation Strategy: Supporting clients' transition plans to greener operations is a key defensive measure.

- Emission Reduction Target: A 29% reduction in absolute financed emissions for the oil and gas sector by 2030 demonstrates concrete action.

- Stakeholder Expectations: Investors and customers increasingly demand that financial institutions align their portfolios with environmental goals.

Standard Chartered is actively addressing environmental concerns by setting ambitious net-zero targets, aiming for its own operations to be net-zero by 2025 and financed emissions by 2050. The bank has made substantial progress, mobilizing $121 billion in sustainable finance between 2021 and 2024, putting it on track to meet its $300 billion goal by 2030.

The bank also reported a significant 28% reduction in its Scope 1 and 2 emissions in 2024, demonstrating a commitment to operational efficiency and resource management. This focus is crucial for managing resource scarcity and minimizing waste, aligning with their broader sustainability objectives.

Financially, sustainable finance income reached $982 million in 2024, moving towards a 2025 target of $1 billion, showcasing the financial viability of their green initiatives. Furthermore, the bank aims for a 29% reduction in financed emissions within the oil and gas sector by 2030, actively managing reputational risks associated with financing high-emitting industries.

PESTLE Analysis Data Sources

Our Standard Chartered PESTLE analysis draws from a comprehensive range of data, including reports from international financial institutions, governmental economic surveys, and reputable industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the global financial landscape.