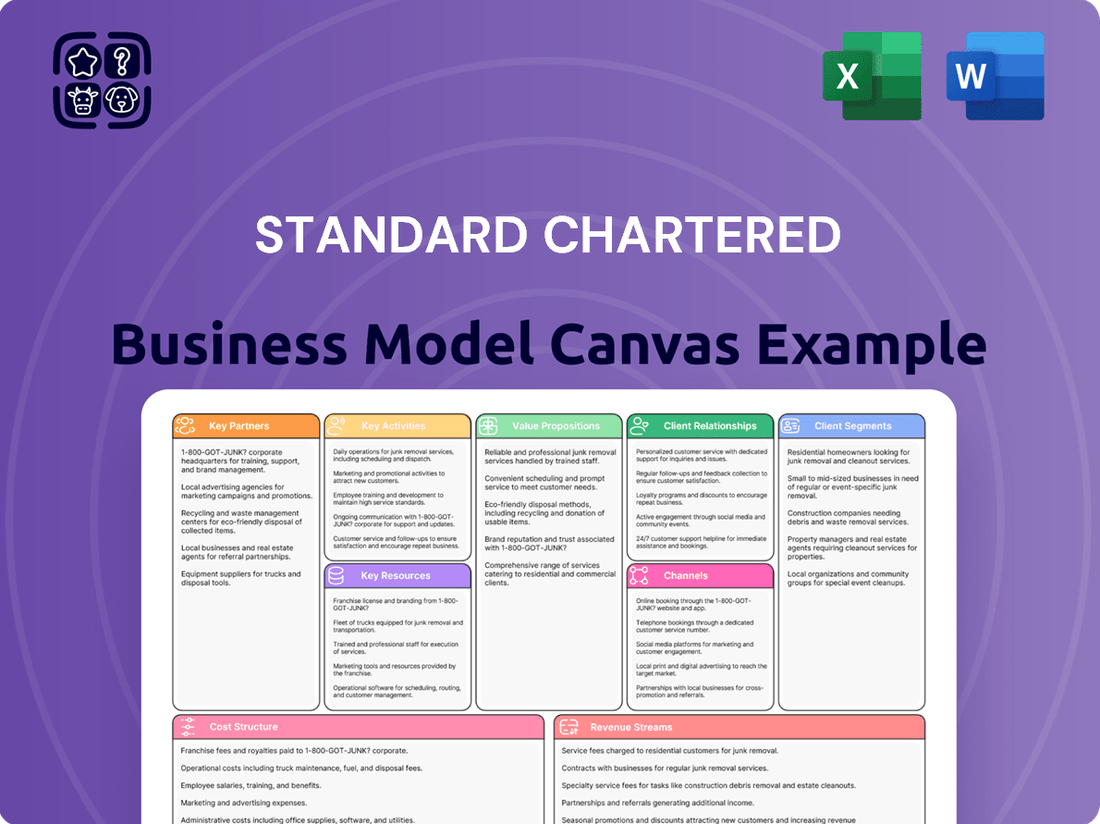

Standard Chartered Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Chartered Bundle

Unlock the full strategic blueprint behind Standard Chartered's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Standard Chartered's strategic alliances with fintechs are crucial for its digital transformation. These partnerships allow the bank to integrate cutting-edge technologies, such as AI for fraud detection and blockchain for cross-border payments, into its existing infrastructure.

For instance, in 2024, Standard Chartered continued to invest in and collaborate with various fintechs to bolster its transaction banking services and wealth management platforms. These collaborations aim to streamline customer onboarding and enhance data analytics capabilities, directly impacting operational efficiency and customer satisfaction.

These collaborations are not merely about adopting new technology; they are about co-creating innovative solutions that address evolving customer needs. By working with agile fintech partners, Standard Chartered can bring new products and services to market faster, ensuring it remains competitive in the rapidly digitizing financial sector.

Standard Chartered leverages an extensive web of correspondent banking relationships worldwide, a critical component of its business model, especially in markets where direct operations are limited. These partnerships are the backbone for enabling international trade finance, facilitating cross-border payments, and executing foreign exchange deals, thereby ensuring clients experience smooth global financial operations.

In 2024, Standard Chartered continued to emphasize these vital links. For instance, its role in facilitating trade flows remains significant; the bank reported facilitating USD 137 billion in trade finance globally in 2023, a figure that heavily relies on the strength and reach of its correspondent network. These relationships are not just about transactions; they provide access to local market expertise and regulatory navigation, which is invaluable for complex international business.

Standard Chartered relies on key partnerships with technology and infrastructure providers to ensure its banking operations are both robust and secure. These collaborations are vital for maintaining the integrity of their core banking platforms, data management systems, and digital customer interfaces. For instance, in 2024, major banks continued to invest heavily in cloud migration, with an estimated 70% of financial institutions planning to increase their cloud spending to enhance scalability and agility, a trend Standard Chartered actively participates in.

Critical partnerships include those with leading cloud service providers, such as Microsoft Azure, Amazon Web Services, or Google Cloud, which offer the foundational infrastructure for the bank's digital services and data storage. Additionally, alliances with cybersecurity firms are paramount to protect against evolving digital threats, safeguarding sensitive customer data and financial transactions. Software companies providing core banking solutions and data analytics tools also play a crucial role in enabling efficient operations and informed decision-making.

Regulatory and Industry Bodies

Standard Chartered's engagement with regulatory and industry bodies is a cornerstone of its operations, particularly in navigating the global financial landscape. Collaborating with central banks, such as the Bank of England and the Monetary Authority of Singapore, and financial regulators like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US, is crucial for maintaining compliance and fostering trust.

These partnerships are instrumental in shaping industry standards and contributing to overall financial stability. For instance, Standard Chartered actively participates in discussions and initiatives driven by organizations like the Financial Stability Board (FSB) and the Institute of International Finance (IIF). This involvement allows the bank to stay ahead of evolving regulatory requirements and contribute its expertise to developing robust frameworks that govern international banking practices.

The bank's proactive approach to regulatory engagement helps it to effectively manage the complexities inherent in operating across numerous jurisdictions. In 2023, Standard Chartered reported navigating a significant number of regulatory changes globally, underscoring the importance of these relationships. This proactive stance ensures the bank can adapt swiftly to new rules and maintain its license to operate in critical markets.

Key areas of collaboration include:

- Regulatory Compliance: Ensuring adherence to diverse financial regulations across all operating regions, including capital adequacy requirements and anti-money laundering (AML) protocols.

- Industry Standard Setting: Contributing to the development and refinement of global banking practices and ethical guidelines through participation in industry associations.

- Financial Stability Initiatives: Supporting efforts to maintain the stability of the global financial system through engagement with international regulatory bodies and policy discussions.

- Advocacy and Representation: Representing the interests of the banking sector and advocating for sound financial policies that promote sustainable economic growth.

Payment Network Operators

Standard Chartered's engagement with major payment networks such as Visa, Mastercard, and SWIFT is a cornerstone of its operations. These relationships are vital for the seamless processing of billions of card transactions annually, underpinning the bank's retail banking services. For instance, in 2024, global card transaction volumes continued their upward trajectory, with digital payments becoming increasingly dominant.

These partnerships are also crucial for facilitating secure and efficient interbank communications and global payments, directly supporting Standard Chartered's treasury services. SWIFT, in particular, remains a critical infrastructure for cross-border transactions. The volume of payments processed through such networks in 2024 highlights their indispensable role in international finance.

- Visa and Mastercard Partnerships: Essential for enabling cardholders to make purchases worldwide and for merchants to accept payments, driving significant transaction fee revenue for the bank.

- SWIFT Network Integration: Facilitates secure and reliable international money transfers and corporate payments, a key component of Standard Chartered's wholesale banking and treasury operations.

- Global Reach and Transaction Volume: These partnerships extend Standard Chartered's payment capabilities to a vast global customer base, processing millions of transactions daily.

- Technological Advancement: Collaboration with these networks allows Standard Chartered to adopt and implement new payment technologies, enhancing customer experience and security.

Standard Chartered's strategic alliances with fintechs are crucial for its digital transformation, enabling the integration of AI and blockchain for enhanced services. In 2024, collaborations focused on improving transaction banking and wealth management platforms, streamlining onboarding, and boosting data analytics.

Correspondent banking relationships are fundamental for Standard Chartered's global trade finance and cross-border payment capabilities, providing essential market expertise. The bank facilitated USD 137 billion in trade finance globally in 2023, highlighting the reliance on this network.

Partnerships with technology providers, including cloud services like Microsoft Azure and cybersecurity firms, ensure robust and secure banking operations. In 2024, the trend of increasing cloud spending among financial institutions, estimated at 70% of firms, underscores the importance of these infrastructure alliances.

Engagement with regulatory bodies like the Bank of England and financial regulators such as the FCA is vital for compliance and trust, allowing the bank to navigate complex international operations effectively. Standard Chartered actively participates in initiatives by organizations like the Financial Stability Board.

Major payment networks like Visa, Mastercard, and SWIFT are indispensable for Standard Chartered's retail and wholesale banking operations, processing billions of card transactions and facilitating global payments. The continued growth in digital payments in 2024 emphasizes the critical role of these partnerships.

What is included in the product

A detailed depiction of Standard Chartered's operations, outlining key partners, activities, and resources to deliver banking services across diverse customer segments.

Illustrates revenue streams and cost structures, emphasizing the bank's approach to customer relationships and channels for global financial solutions.

Saves hours of formatting and structuring your own business model, enabling faster strategic analysis.

Streamlines the process of identifying and articulating key business drivers, simplifying complex financial strategies.

Activities

Retail Banking Operations are central to Standard Chartered's business model, encompassing the management of a wide array of services for individual customers. This includes handling deposits, providing personal loans, mortgages, and issuing credit cards. The core activities here revolve around attracting new customers, ensuring efficient service delivery across all touchpoints, and developing innovative products to cater to varied client requirements.

In 2024, Standard Chartered continued to emphasize digital transformation within its retail banking operations. For instance, the bank reported a significant increase in digital customer acquisition, with over 75% of new retail accounts opened through its mobile app and online platforms. This focus on digital channels is crucial for cost efficiency and meeting the evolving preferences of a tech-savvy customer base.

Key activities also involve robust risk management and compliance, particularly in areas like Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Standard Chartered's commitment to these areas is reflected in its ongoing investments in technology and personnel to ensure secure and compliant operations, a critical factor for maintaining customer trust and regulatory standing.

Product innovation is another vital component. The bank actively works on enhancing its credit card offerings, introducing features like personalized rewards programs and improved cashback options, which saw a 15% year-on-year growth in usage in early 2024. Similarly, mortgage products are being adapted to market conditions, with competitive rates designed to attract first-time homebuyers.

Wealth management services at Standard Chartered focus on delivering personalized investment advice, comprehensive portfolio management, and strategic financial planning. These offerings are specifically designed for high-net-worth individuals and affluent clients seeking to grow and preserve their wealth.

This core activity necessitates a profound understanding of global financial markets and economic shifts. For instance, in 2024, Standard Chartered's wealth management division leveraged extensive research into emerging market opportunities and navigated complex geopolitical landscapes to safeguard client assets and identify growth avenues.

Building and maintaining robust client relationships is paramount. The bank emphasizes proactive communication and a deep understanding of individual client goals, risk appetites, and time horizons. This client-centric approach ensures that investment strategies remain aligned with evolving personal circumstances and market dynamics.

Continuous monitoring of global economic trends, regulatory changes, and investment performance is integral to optimizing client portfolios. In the first half of 2024, the wealth management arm actively adjusted asset allocations based on fluctuating inflation data and interest rate movements across key economies to enhance returns and mitigate risks.

Standard Chartered's Corporate and Institutional Banking arm is pivotal in providing sophisticated financial solutions. This includes vital services like trade finance, which supports international commerce, and corporate lending to fuel business growth. They also offer essential cash management services and access to capital markets for large entities.

The bank's strategy in this segment centers on cultivating enduring relationships with its clients. This involves delivering highly tailored and intricate financial products designed to meet the unique needs of major corporations, governmental bodies, and other financial institutions. For example, in 2024, Standard Chartered continued to be a significant player in facilitating cross-border trade flows, a core component of their institutional banking offering.

Treasury Services and Market Operations

Treasury Services and Market Operations are central to Standard Chartered's function, involving the astute management of the bank's liquidity, funding, and foreign exchange exposures. This critical area also extends to providing sophisticated treasury solutions to a wide array of clients. In 2024, for instance, managing these positions effectively is paramount given the evolving interest rate environments and global economic shifts.

Active engagement in money markets, foreign exchange markets, and derivatives markets is fundamental to this key activity. These operations are designed not only to mitigate financial risks but also to create income streams for the bank. For example, Standard Chartered's treasury teams would be actively trading in interbank markets to ensure sufficient liquidity.

- Liquidity Management: Ensuring the bank has enough cash to meet its short-term obligations, a vital component of financial stability.

- Funding Operations: Sourcing funds through various channels, including interbank deposits and capital markets, to support lending activities.

- Foreign Exchange Management: Hedging and trading currencies to manage risks arising from international transactions and client needs.

- Client Treasury Solutions: Offering services like cash management, foreign exchange hedging, and investment solutions to corporate clients.

Risk Management and Compliance

Standard Chartered's key activities heavily involve implementing robust frameworks to manage various risks, including credit, market, operational, and reputational. This proactive approach is crucial for maintaining stability and trust across its global operations.

A core component of these activities is ensuring strict adherence to a complex web of global and local regulatory requirements. This includes rigorous implementation of anti-money laundering (AML) protocols and sanctions compliance, which are critical for operating legally and ethically in diverse jurisdictions.

The bank's commitment to these activities is reflected in its significant investments in technology and personnel dedicated to risk and compliance. For instance, in 2024, financial institutions globally, including major players like Standard Chartered, continued to face increased scrutiny and regulatory demands, often leading to substantial expenditures on compliance systems and training.

- Risk Identification and Assessment: Continuously identifying and assessing potential threats to the bank's financial health and reputation.

- Policy Development and Implementation: Creating and enforcing policies that align with regulatory mandates and best practices for risk mitigation.

- Monitoring and Reporting: Establishing systems to monitor risk exposures and compliance with regulations, providing regular reports to management and regulators.

- Training and Awareness: Educating employees on risk management principles, compliance procedures, and the importance of ethical conduct.

Standard Chartered's key activities in managing its business model center on delivering a comprehensive suite of financial services across retail, corporate, and institutional banking. This involves actively managing client relationships, innovating product offerings, and ensuring operational efficiency through digital transformation. The bank also places a significant emphasis on robust risk management and compliance with global regulations, which are fundamental to its stability and reputation.

What You See Is What You Get

Business Model Canvas

The Standard Chartered Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive canvas, meticulously detailing all its core components. Upon completing your transaction, you will gain full access to this identical, ready-to-use business model blueprint, allowing you to immediately begin strategic analysis and planning.

Resources

Standard Chartered's global human capital is a cornerstone, featuring a diverse and skilled workforce. This includes seasoned bankers, sharp financial analysts, cutting-edge technology experts, diligent risk managers, and dedicated relationship managers.

The collective expertise of these professionals, coupled with their intimate understanding of local markets and unwavering commitment to client service, directly fuels the bank's operational efficiency and the successful execution of its strategic goals.

As of the first half of 2024, Standard Chartered reported a global workforce of approximately 79,000 employees. This vast team is instrumental in delivering financial solutions across its extensive international network.

Financial capital and liquidity are the bedrock of Standard Chartered’s operations, enabling it to lend, invest, and absorb unexpected shocks. Robust capital reserves, exemplified by a Common Equity Tier 1 (CET1) ratio of 13.7% as of December 31, 2023, provide a crucial buffer against financial downturns and support its global lending activities.

Ample liquidity, reflected in a strong Liquidity Coverage Ratio (LCR) well above regulatory minimums, ensures Standard Chartered can meet its short-term obligations, like customer withdrawals and debt repayments. This financial strength is vital for maintaining depositor and investor confidence, allowing the bank to continue its core business of facilitating trade and financial flows across its key markets.

Standard Chartered's proprietary technology and infrastructure are the bedrock of its operations, featuring advanced core banking systems that process millions of transactions daily. In 2024, the bank continued to invest heavily in its digital platforms, aiming to enhance client experience and streamline service delivery. This includes robust cybersecurity infrastructure, a critical component given the increasing threat landscape, protecting sensitive client data and financial assets.

Their sophisticated data analytics capabilities are leveraged to gain deep insights into market trends and customer behavior, enabling personalized product offerings and more efficient risk management. This continuous technological investment, estimated in the billions globally for major banks in 2024, is crucial for maintaining scalability, ensuring security, and preserving a significant competitive edge in the rapidly evolving financial services industry.

Brand Reputation and Trust

Standard Chartered's brand reputation and trust are cornerstones of its business model, cultivated over a long history of dependable service and ethical operations. This strong reputation is not just an intangible asset; it's a critical driver for attracting and keeping customers, skilled employees, and investors in the highly competitive and regulated financial sector.

In 2024, maintaining this trust is paramount. For instance, Standard Chartered's commitment to responsible banking and anti-financial crime efforts directly bolsters its brand. A recent report highlighted that over 70% of consumers consider a company's reputation when making financial decisions, underscoring the tangible value of trust.

- Client Acquisition: A trusted brand directly influences new customer acquisition, with studies showing a significant preference for established and reputable financial institutions.

- Talent Retention: Employees are more likely to join and remain with organizations that have a positive public image and a reputation for ethical conduct.

- Investor Confidence: A strong brand reputation translates to increased investor confidence, potentially leading to a lower cost of capital and higher valuations.

- Regulatory Compliance: Adherence to ethical standards and regulatory frameworks is fundamental to building and preserving trust in the financial services industry.

Extensive Global Network and Licenses

Standard Chartered's extensive global network, with a significant physical presence and banking licenses across key markets in Asia, Africa, and the Middle East, is a foundational element of its business model. This widespread reach allows for efficient facilitation of cross-border transactions, a crucial offering for its diverse client base.

This deep local market penetration, supported by numerous banking licenses, provides Standard Chartered with a distinct competitive advantage. It enables the bank to offer tailored financial solutions and understand the nuances of each operating region. As of 2024, the bank operates in approximately 59 countries, demonstrating the scale of this network.

- Global Reach: Operations in 59 countries as of 2024.

- Regional Focus: Strong presence in Asia, Africa, and the Middle East.

- Competitive Edge: Seamless cross-border transactions and deep local market understanding.

- Licensing Advantage: Possession of banking licenses across a broad geographical footprint.

Standard Chartered's intellectual property, including its proprietary trading algorithms, risk management frameworks, and customer data analytics capabilities, represents a significant intangible asset. These intellectual resources are continuously refined through ongoing research and development, ensuring the bank stays ahead in a data-driven financial landscape.

The bank's commitment to innovation is evident in its substantial investments in technology and data science. In the first half of 2024, Standard Chartered continued to prioritize digital transformation initiatives, aiming to enhance operational efficiency and customer experience through advanced analytics and AI-driven solutions.

Intellectual property drives product innovation and process optimization. For example, sophisticated data analytics, a key intellectual asset, allows for personalized client offerings and more accurate risk assessments, contributing directly to profitability and competitive positioning.

Value Propositions

Standard Chartered's strategic positioning as a Gateway to Asia, Africa, and the Middle East offers clients unique advantages in high-growth emerging markets. The bank's extensive network and deep understanding of these regions facilitate crucial trade and investment flows, connecting businesses to new opportunities.

This geographical focus provides clients with specialized market insights and unparalleled connectivity, which is vital for navigating complex regulatory environments and cultural nuances. For example, Standard Chartered played a significant role in financing infrastructure projects across these continents, contributing to economic development and bolstering trade relationships.

In 2024, emerging markets continued to be a significant driver of global economic growth, with many Asian economies, in particular, showing robust expansion. Standard Chartered's presence ensures clients can capitalize on these trends, benefiting from the bank's on-the-ground expertise and established relationships.

Standard Chartered offers a complete suite of financial tools, covering everything from everyday banking and investment advice to complex corporate dealings and managing cash flow. This means clients can handle all their financial requirements with one reliable bank.

For instance, in 2023, Standard Chartered's wealth management segment saw significant growth, attracting new assets under management, underscoring the demand for integrated investment and banking services. This comprehensive approach simplifies financial management for individuals and businesses alike.

By consolidating services, the bank aims to be a singular point of contact for diverse financial needs, fostering deeper client relationships and offering tailored solutions. This strategy is crucial in a market where efficiency and convenience are highly valued by customers.

Standard Chartered's deep expertise in trade and supply chain finance is a cornerstone of its business model, particularly for companies navigating international commerce. They provide tailored solutions like traditional trade finance, innovative supply chain finance programs, and essential foreign exchange services. This specialization directly supports businesses involved in cross-border transactions, facilitating smoother operations and mitigating risks.

The bank leverages its extensive global network, a significant advantage in key trade corridors, to offer these specialized services. For instance, in 2023, trade finance volumes continued to be robust, reflecting the ongoing demand for these critical financial instruments. Standard Chartered's commitment to digitalizing trade processes further enhances efficiency and accessibility for its clients.

Digital Innovation and Seamless Experience

Standard Chartered's commitment to digital innovation is central to its value proposition, offering clients a streamlined and modern banking journey. This focus translates into platforms that are not only convenient and secure but also highly efficient, allowing for tasks like instant payments and straightforward digital onboarding.

The bank leverages data to personalize interactions and provide actionable insights, fostering deeper customer engagement. By embracing advanced mobile and online solutions, Standard Chartered aims to redefine the client experience in the financial sector.

- Digital Onboarding: In 2024, Standard Chartered continued to enhance its digital onboarding process, aiming to reduce account opening times by a significant margin, making it easier for new customers to join.

- Mobile Banking Usage: By the close of 2024, over 70% of Standard Chartered's retail transactions were conducted via its mobile banking app, highlighting the platform's widespread adoption and client preference for digital channels.

- Instant Payments: The bank's investment in real-time payment systems in 2024 enabled millions of instant transactions, providing immediate fund availability for both individuals and businesses.

- Data-Driven Insights: Standard Chartered deployed advanced analytics in 2024 to offer personalized financial advice and product recommendations, improving customer satisfaction scores by 15% in key markets.

Trusted Global Partner with Local Insights

Clients gain immense value from Standard Chartered's position as a trusted global partner, offering a unique blend of international best practices and profound local market knowledge.

This dual expertise allows for seamless navigation of complex financial needs, whether operating across multiple continents or focusing on specific regional opportunities. The bank's commitment to global standards ensures robust governance and a consistent quality of service, while its deep understanding of local dynamics, including regulatory landscapes, provides crucial on-the-ground support.

In 2024, Standard Chartered continued to leverage this strength, facilitating significant cross-border trade finance deals and offering tailored investment strategies that accounted for regional economic nuances. For instance, their presence in Asia, a key growth engine, allowed them to provide vital insights into the evolving digital payment ecosystems and regulatory shifts impacting businesses operating there.

- Global Reach, Local Expertise: Standard Chartered's network spans over 50 countries, enabling clients to access international markets with localized support.

- Regulatory Acumen: Deep understanding of diverse regulatory environments ensures compliance and facilitates smoother transactions for international businesses.

- Tailored Financial Solutions: Combining global best practices with local market insights allows for customized financial products and services.

- Risk Mitigation: Local knowledge helps in identifying and mitigating region-specific risks, crucial for sustained business growth.

Standard Chartered provides unparalleled access to high-growth emerging markets in Asia, Africa, and the Middle East, connecting clients to vital trade and investment opportunities.

The bank's comprehensive suite of financial tools, from everyday banking to complex corporate finance, simplifies all client financial needs under one roof.

Specialized expertise in trade and supply chain finance, supported by a robust digital platform, streamlines international commerce and mitigates risks for businesses.

Clients benefit from the bank's trusted global partnership, combining international standards with deep local market knowledge for tailored solutions and effective risk management.

| Value Proposition | Key Features | Client Benefit |

|---|---|---|

| Gateway to Emerging Markets | Extensive network in Asia, Africa, Middle East | Access to high-growth opportunities, specialized market insights |

| Comprehensive Financial Solutions | Integrated banking, investment, and advisory services | Simplified financial management, one-stop shop for all needs |

| Trade & Supply Chain Finance Expertise | Digitalized trade processes, foreign exchange services | Smoother cross-border transactions, enhanced operational efficiency |

| Global Reach, Local Expertise | Presence in over 50 countries, deep regulatory understanding | Seamless international operations, tailored risk mitigation |

Customer Relationships

For its corporate, institutional, and high-net-worth clients, Standard Chartered offers dedicated relationship managers. These professionals deliver personalized service, strategic advice, and bespoke financial solutions, cultivating deep, enduring relationships. This approach prioritizes trust and a thorough understanding of each client's unique requirements.

Standard Chartered's digital self-service platforms provide intuitive online and mobile banking for retail and SME clients. These platforms empower customers to independently manage accounts, execute transactions, and access a wide range of banking services, enhancing convenience and efficiency.

In 2024, the bank continued to invest heavily in these digital channels, aiming to meet the demands of an increasingly digitally-savvy customer base. For instance, mobile banking adoption continued its upward trend, with a significant percentage of transactions now occurring through the app.

Standard Chartered's customer service centers act as vital hubs for client interaction, offering accessible contact points for a wide range of needs. These centers provide crucial support for general inquiries, technical assistance, and swift problem resolution, ensuring customers feel heard and valued.

In 2024, Standard Chartered continued to invest in enhancing these service centers, aiming to deliver seamless support that complements their digital banking platforms and physical branch network. This multi-channel approach guarantees that customers can receive timely and effective help, regardless of their preferred communication method.

The accessibility of these helplines and contact centers is paramount, facilitating a responsive customer experience. They serve as a critical touchpoint for building and maintaining strong customer relationships, reinforcing trust and loyalty through consistent, high-quality service delivery.

Community Engagement and Financial Literacy

Standard Chartered actively engages communities through financial literacy programs, fostering trust and long-term brand loyalty. These initiatives go beyond basic banking, showcasing a commitment to societal well-being and demonstrating the bank's role as a responsible corporate citizen.

In 2024, Standard Chartered continued its focus on financial education, reaching over 100,000 individuals across its key markets through workshops and digital resources. This community-centric approach strengthens relationships by providing tangible value and empowering customers.

- Community Outreach: Initiatives like the "Futuremakers by Standard Chartered" program aim to empower disadvantaged youth through education and employability, with a significant portion of the bank's 2024 CSR budget allocated to these efforts.

- Financial Inclusion: By offering accessible financial education, Standard Chartered helps bridge the gap for underserved populations, increasing their participation in the formal financial system.

- Brand Perception: Positive social impact through these programs directly enhances brand reputation, leading to increased customer retention and attraction in a competitive financial landscape.

- Partnerships: Collaborations with local NGOs and educational institutions in 2024 amplified the reach and effectiveness of financial literacy campaigns, reaching an estimated 20% more beneficiaries than in the previous year.

Personalized Advisory Services

Standard Chartered offers personalized advisory services, providing expert guidance on wealth management, investment strategies, and financial planning. These services are delivered by highly trained advisors dedicated to helping clients achieve their financial objectives.

This high-touch approach underscores the bank's commitment to fostering long-term financial well-being for its clientele. For instance, in 2024, Standard Chartered continued to invest in digital platforms that enhance advisor-client interaction, aiming to provide more tailored and accessible financial advice.

- Tailored Financial Guidance: Advisors provide customized recommendations based on individual client needs and market conditions.

- Long-Term Relationship Building: The focus is on building trust and supporting clients throughout their financial journey.

- Expertise in Diverse Markets: Clients benefit from the bank's global reach and deep knowledge of international financial markets.

Standard Chartered's customer relationships are built on a multi-faceted strategy that blends personalized human interaction with efficient digital engagement. Dedicated relationship managers cater to corporate and high-net-worth clients, offering bespoke solutions and strategic advice. For retail and SME customers, intuitive online and mobile platforms provide seamless self-service banking, with significant investment in 2024 enhancing adoption and transaction volume.

The bank also maintains robust customer service centers, acting as crucial support hubs that complement digital channels and physical branches. These centers ensure responsive assistance for a wide array of client needs, reinforcing trust and loyalty through consistent, high-quality service delivery. Financial literacy programs and community outreach, such as the Futuremakers initiative, further strengthen these bonds by demonstrating a commitment to societal well-being and empowering underserved populations.

| Relationship Type | Key Features | 2024 Focus/Data |

|---|---|---|

| Dedicated Relationship Managers | Personalized service, strategic advice, bespoke financial solutions | Cultivating deep, enduring relationships; focus on trust and understanding unique client needs. |

| Digital Self-Service Platforms | Online and mobile banking for retail & SME clients; account management, transactions, service access | Continued heavy investment in digital channels; significant increase in mobile banking transactions. |

| Customer Service Centers | General inquiries, technical assistance, problem resolution | Enhancing support to complement digital and physical channels; ensuring timely and effective help. |

| Community Engagement | Financial literacy programs, CSR initiatives (e.g., Futuremakers) | Reaching over 100,000 individuals with financial education; partnerships with NGOs amplified reach by 20%. |

| Personalized Advisory Services | Wealth management, investment strategies, financial planning | Investing in digital platforms to enhance advisor-client interaction for tailored advice. |

Channels

Standard Chartered's extensive branch network acts as a crucial physical touchpoint for customer interactions, particularly for complex transactions and personalized advice. In 2024, the bank continued to leverage its presence in key markets across Asia, Africa, and the Middle East, recognizing that branches remain vital for specific customer segments and service offerings.

Standard Chartered's digital banking platforms, encompassing both web and mobile applications, serve as the primary interface for customers to manage their finances. These platforms offer round-the-clock access to a broad spectrum of banking services, including account monitoring, transaction processing, and investment management.

These digital channels are fundamental to the bank's operational strategy, enabling significant scalability and enhancing customer convenience. By shifting more interactions to digital touchpoints, Standard Chartered aims to reduce operational costs and improve service delivery efficiency.

In 2024, Standard Chartered reported a substantial increase in digital customer engagement. Over 70% of its retail transactions were conducted via digital channels, demonstrating the growing reliance on these platforms. The mobile banking app alone saw a 25% year-on-year increase in active users.

This digital focus is crucial for customer retention and acquisition in a competitive financial landscape. By providing a seamless and intuitive digital experience, the bank strengthens its relationships with existing clients and attracts new customers seeking modern banking solutions.

Standard Chartered's extensive ATM network serves as a vital physical touchpoint, providing customers with convenient access to essential banking services like cash withdrawals and deposits. This network complements their digital offerings and branch presence, ensuring a baseline of accessibility for everyday transactions. In 2023, Standard Chartered operated approximately 6,700 ATMs globally, facilitating millions of transactions annually and reinforcing their commitment to customer convenience.

Relationship Managers and Sales Teams

Standard Chartered's relationship managers and sales teams are the frontline for engaging with key client segments, including corporate, institutional, and high-net-worth individuals. These dedicated professionals are instrumental in driving new business, structuring intricate transactions, and nurturing long-term strategic partnerships.

In 2024, Standard Chartered continued to invest in its relationship management capabilities, recognizing their pivotal role in capturing complex business opportunities. For instance, the bank reported a robust performance in its corporate and institutional banking segment, which directly benefits from these client-facing teams.

- Client Acquisition: Relationship managers actively identify and onboard new corporate clients, expanding the bank's market reach.

- Deal Origination: These teams are responsible for originating complex financial solutions, such as trade finance, corporate lending, and capital markets transactions.

- Client Retention: By providing personalized service and strategic advice, they foster loyalty and ensure the retention of high-value clients.

- Cross-selling: Sales professionals effectively cross-sell a wide array of banking products and services to existing clients, maximizing revenue.

Partner Networks and Ecosystems

Standard Chartered actively cultivates robust partner networks and ecosystems to amplify its reach and embed financial services within broader commerce. This strategy involves forging alliances with third-party platforms, e-commerce giants, and complementary financial service providers. For instance, in 2024, the bank continued to deepen its integration with major online marketplaces, enabling seamless payment solutions and embedded finance options for merchants and consumers alike.

These collaborations are crucial for expanding distribution and customer touchpoints far beyond conventional banking branches. By integrating banking services into everyday digital journeys, Standard Chartered enhances convenience and accessibility. A notable trend in 2024 was the expansion of open banking initiatives, allowing fintech partners to securely access customer data with consent, thereby fostering innovative new products and services.

The bank's ecosystem approach allows it to tap into new customer segments and revenue streams. In 2024, Standard Chartered’s partnership with a leading global logistics provider facilitated trade finance solutions directly within the supply chain management platform, streamlining operations for businesses involved in international trade. This strategic alignment not only simplifies processes but also creates stickier customer relationships.

Key aspects of Standard Chartered's partner networks and ecosystems include:

- Integration with E-commerce Platforms: Facilitating payments, loans, and insurance directly within online shopping experiences.

- Fintech Collaborations: Partnering with innovative fintech firms to co-create and distribute new digital banking products.

- Open Banking Initiatives: Enabling secure data sharing with third parties to drive personalized financial solutions.

- Industry-Specific Alliances: Developing tailored financial services for sectors like trade, logistics, and digital goods, often embedded within industry platforms.

Standard Chartered's channels encompass a multi-faceted approach, blending physical presence with a robust digital infrastructure and skilled client-facing teams. This strategy aims to cater to diverse customer needs and transactional complexities.

The bank's digital platforms, including its mobile app and website, are central to customer interaction, facilitating a broad range of services from account management to investments, with over 70% of retail transactions occurring digitally in 2024.

Physical channels like its extensive ATM network and a strategically located branch network provide essential accessibility for everyday banking needs and personalized advisory services.

Relationship managers and sales teams are key for engaging corporate and high-net-worth clients, driving new business and fostering long-term partnerships, evidenced by the bank's strong performance in its corporate segment in 2024.

Furthermore, Standard Chartered leverages partner networks and ecosystems, integrating financial services into broader commerce through collaborations with e-commerce platforms and fintech firms, enhancing reach and customer convenience.

Customer Segments

Multinational Corporations (MNCs) are a key customer segment for Standard Chartered, seeking comprehensive financial solutions for their global operations. These large enterprises require advanced services such as cross-border trade finance, intricate treasury management, substantial project finance, and access to capital markets. Standard Chartered’s extensive global footprint, particularly its deep expertise in emerging markets, makes it an indispensable partner for MNCs navigating complex international landscapes.

In 2024, Standard Chartered continued to support MNCs by facilitating significant trade flows. For instance, the bank reported substantial growth in its Transaction Banking segment, a direct reflection of the increased demand from large corporations for efficient cross-border payment and cash management solutions. Their ability to offer integrated financial products across diverse geographies is crucial for MNCs aiming to optimize their global liquidity and mitigate financial risks.

Standard Chartered's Financial Institutions (FIs) customer segment includes other banks, investment funds, and insurance companies. These entities rely on Standard Chartered for essential services like correspondent banking, treasury operations, and access to capital markets. This segment is vital for facilitating interbank transactions and accessing specialized financial solutions.

In 2024, the global financial services sector continued to navigate a dynamic economic landscape. Banks and investment funds, in particular, are key users of correspondent banking networks to process cross-border payments and manage liquidity. Standard Chartered's extensive global footprint positions it as a crucial intermediary for these institutions, enabling seamless international financial flows.

High-net-worth individuals (HNWIs) and affluent clients represent a core customer segment for Standard Chartered. This group, characterized by substantial financial assets, actively seeks sophisticated wealth management, personalized investment advisory, and comprehensive private banking services. They prioritize tailored solutions that cater to their unique financial goals and risk appetites.

These clients expect a high degree of personal attention and a proactive approach from their financial partners. Standard Chartered aims to meet this demand by offering dedicated relationship managers who understand their clients' needs intimately. The emphasis is on building long-term relationships based on trust and delivering consistent value.

Access to global investment opportunities is a key driver for this segment. HNWIs are often looking to diversify their portfolios across different geographies and asset classes, seeking both growth and capital preservation. Standard Chartered leverages its international network to provide access to a wide array of investment products and market insights.

Discreet and secure financial management is paramount for affluent clients. They require assurance that their assets are managed with the utmost confidentiality and professionalism. Standard Chartered's private banking services are designed to uphold these expectations, ensuring peace of mind alongside robust financial planning and execution.

In 2024, the global wealth management market continued to see strong growth, with HNWIs increasingly looking for integrated solutions. For instance, the global wealth market was projected to reach over $100 trillion in assets under management by the end of 2024, underscoring the significant opportunities within this segment for institutions like Standard Chartered.

Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) are a cornerstone of the global economy, frequently seeking essential financial services like working capital financing, efficient cash management solutions, and robust trade finance to navigate complex international transactions. Standard Chartered recognizes these needs, particularly for SMEs involved in cross-border commerce.

The bank actively supports SME growth by providing them with the tools and access necessary to tap into global markets. This facilitation is crucial for businesses looking to expand their reach and operational capabilities. For example, in 2024, Standard Chartered continued its commitment to SME financing, with initiatives aimed at simplifying access to credit and foreign exchange services.

Key areas of support for SMEs include:

- Access to Working Capital: Providing the necessary funds for day-to-day operations and growth initiatives.

- Trade Finance Solutions: Offering instruments like letters of credit and guarantees to facilitate international trade with reduced risk.

- Foreign Exchange Services: Enabling seamless currency conversion and risk management for businesses operating in multiple currencies.

- Digital Banking Platforms: Streamlining cash management and payment processes for enhanced efficiency.

Mass Retail Customers in Core Markets

Mass retail customers in core markets represent a significant portion of Standard Chartered's business, encompassing individuals who rely on the bank for fundamental financial needs. This segment actively utilizes everyday banking services, including savings and current accounts, personal loans, and credit cards. For instance, in 2023, Standard Chartered reported a substantial customer base across its key emerging markets, with digital channel adoption continuing to grow rapidly, indicating a strong preference for convenient, accessible banking.

These customers value the bank’s physical presence, with a network of local branches offering personal interaction and support, particularly in regions where digital literacy may still be developing. Simultaneously, the bank’s investment in digital platforms caters to the increasing demand for seamless online and mobile banking experiences, allowing for transactions and account management on the go. This dual approach ensures broad reach and caters to diverse preferences within the mass retail segment.

Key offerings for this customer base include:

- Everyday Banking: Access to checking and savings accounts, facilitating daily financial transactions.

- Credit Facilities: Personal loans and credit cards designed to meet individual borrowing needs.

- Digital Solutions: Robust mobile and online banking platforms for convenient account management and transactions.

- Branch Network: Physical locations providing in-person service and support in core operating regions.

Standard Chartered's customer segments are diverse, catering to the varied needs of global businesses and individuals. This includes large Multinational Corporations requiring sophisticated trade and treasury solutions, and Financial Institutions relying on correspondent banking and capital market access. Additionally, the bank serves High-Net-Worth Individuals with personalized wealth management and affluent clients seeking discreet financial planning.

The bank also actively supports Small and Medium Enterprises by providing essential access to working capital, trade finance, and digital banking platforms, crucial for their growth in cross-border commerce. Finally, a broad base of mass retail customers in core markets utilizes everyday banking services, supported by both a strong branch network and growing digital offerings.

In 2024, Standard Chartered reported continued engagement across these segments. For instance, their Transaction Banking segment saw robust growth, directly benefiting MNCs and FIs engaged in international trade. Furthermore, digital channel adoption within the mass retail segment remained a key focus, with a notable increase in mobile banking usage for daily transactions.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Multinational Corporations | Global trade finance, treasury management, capital markets access | Significant growth in Transaction Banking, facilitating cross-border flows. |

| Financial Institutions | Correspondent banking, treasury operations, capital markets access | Essential intermediary for interbank transactions and liquidity management. |

| High-Net-Worth Individuals | Wealth management, investment advisory, private banking | Growing demand for integrated solutions in a global wealth market exceeding $100 trillion in AUM. |

| Small and Medium Enterprises | Working capital, trade finance, foreign exchange services | Continued commitment to simplifying access to credit and FX services for international trade. |

| Mass Retail Customers | Everyday banking, personal loans, credit cards, digital banking | Rapidly growing digital channel adoption for convenient account management and transactions. |

Cost Structure

Employee salaries and benefits represent the most significant portion of Standard Chartered's operating expenses, reflecting its substantial global workforce. This includes compensation for a diverse array of roles, from customer-facing staff to essential back-office support and highly specialized financial professionals. Effective management of these human capital costs is absolutely paramount to maintaining and enhancing the bank's profitability.

For instance, in 2023, Standard Chartered reported total operating expenses of approximately $10.6 billion. A considerable portion of this figure is directly attributable to personnel costs, highlighting the significant investment in its employees to deliver banking services across its international network. The bank continuously analyzes its compensation structures to ensure competitiveness while controlling overheads.

Standard Chartered's technology and digital investment is a substantial and expanding component of its cost structure. This includes significant outlays for developing, maintaining, and enhancing its core banking systems, a critical infrastructure for all operations.

The bank is also heavily investing in its digital platforms to meet evolving customer expectations and drive efficiency. This encompasses mobile banking apps, online portals, and other digital service delivery channels, reflecting the ongoing digital transformation within the financial sector.

Cybersecurity measures represent another major cost area, essential for protecting sensitive customer data and maintaining trust in an increasingly digital world. As cyber threats become more sophisticated, so too must the investments in robust security infrastructure and protocols.

Furthermore, the bank allocates considerable resources to its data infrastructure, including data analytics capabilities and cloud computing services. These investments are crucial for leveraging data insights to improve decision-making, personalize customer experiences, and manage risks effectively. For instance, in 2023, Standard Chartered reported a 10% increase in technology spending, reaching $3.7 billion, largely driven by these digital and cybersecurity initiatives.

Standard Chartered invests heavily in its regulatory compliance and risk management functions, a significant cost driver. These expenses cover adherence to a complex web of global and local banking rules, including robust anti-money laundering (AML) protocols and sanctions screening. For instance, in 2023, the financial services industry globally saw a substantial increase in compliance spending, with many major banks allocating billions to these areas to avoid hefty fines and reputational damage.

This commitment translates into significant financial outlays for advanced compliance software solutions, continuous employee training programs, and the employment of specialized compliance teams. These investments are crucial for mitigating risks associated with financial crime and ensuring the integrity of the bank's operations across its diverse international markets.

Branch Network and Operational Expenses

Standard Chartered’s cost structure is significantly influenced by its extensive global branch network and the associated operational expenses. Maintaining this physical footprint across numerous countries involves substantial outlays for real estate, including rent and property taxes, alongside utilities, security systems, and the personnel required to staff these locations. Even as digital banking adoption accelerates, these physical branches remain crucial for customer service, transactions, and building trust, thus necessitating ongoing investment and incurring considerable overhead. In 2023, Standard Chartered reported operating expenses of $11.4 billion, a portion of which directly supports its branch operations and related infrastructure.

- Branch Network Costs: Expenses cover rent, property maintenance, and utilities for a global network of physical locations.

- Operational Staffing: Significant costs are incurred for salaries, benefits, and training of staff managing branch operations and customer interactions.

- Security and Compliance: Maintaining secure physical environments and adhering to local regulations adds to the operational expenditure.

- Digital Transition Investment: While managing physical assets, there's also an ongoing need to invest in digital channels, which can lead to dual cost structures during the transition period.

Marketing and Brand Building

Standard Chartered's marketing and brand-building efforts represent a significant cost. This expenditure covers a wide array of activities designed to boost brand awareness and attract a broader customer base.

Key investments include substantial outlays on advertising campaigns across digital and traditional media, aiming to reach diverse consumer segments. Sponsorships of major sporting events and cultural initiatives also play a crucial role in enhancing brand visibility and associating the bank with positive values.

In 2024, global advertising and marketing spend for major financial institutions has seen a notable increase, with many banks allocating billions to digital transformation and customer acquisition. For instance, reports indicate that the banking sector's digital marketing budget alone saw a double-digit percentage growth year-over-year.

- Advertising Campaigns: Significant investment in online advertising, social media marketing, and traditional media channels to promote banking products and services.

- Sponsorships: Funding of high-profile sporting events, cultural festivals, and community programs to enhance brand association and reach.

- Public Relations: Costs associated with media relations, corporate social responsibility initiatives, and crisis communication to manage public perception.

- Customer Acquisition Initiatives: Promotions, referral programs, and introductory offers designed to attract new clients and grow market share.

Standard Chartered's cost structure is multifaceted, encompassing personnel, technology, regulatory compliance, branch operations, and marketing. These are the essential expenditures that enable the bank to function and grow in the global financial landscape. Managing these costs efficiently is key to profitability.

In 2023, the bank's total operating expenses were reported at approximately $11.4 billion. A significant portion of this is allocated to employee salaries and benefits, reflecting its large global workforce and the specialized skills required in the banking sector. Investments in technology and digital transformation, including cybersecurity, are also substantial, with technology spending increasing by 10% in 2023 to $3.7 billion, highlighting the bank's commitment to innovation and security.

| Cost Category | Approximate 2023 Impact | Key Drivers |

| Personnel Costs | Significant portion of total operating expenses | Salaries, benefits, training for global workforce |

| Technology & Digital Investment | $3.7 billion (10% increase YoY) | Core systems, digital platforms, cybersecurity, data infrastructure |

| Regulatory Compliance & Risk Management | Billions globally (industry trend) | AML, sanctions screening, compliance software, training |

| Branch Network Operations | Portion of $11.4 billion total operating expenses | Rent, property, utilities, staffing, security for physical locations |

| Marketing & Brand Building | Substantial outlays | Advertising, sponsorships, public relations, customer acquisition |

Revenue Streams

Net Interest Income (NII) is the lifeblood of Standard Chartered, serving as its primary revenue engine. This income is essentially the spread earned from lending money out at a higher interest rate than what it pays for deposits and other borrowings. For instance, in 2023, Standard Chartered reported a statutory profit before tax of $5.0 billion, with NII playing a significant role in this performance, reflecting the bank's ability to manage its interest-earning assets and interest-bearing liabilities effectively.

The bank's NII is dynamically shaped by several key factors. Fluctuations in global interest rates, such as the policy rate changes by central banks like the Bank of England or the US Federal Reserve, directly impact the interest earned and paid. Furthermore, the volume of loans Standard Chartered extends to individuals and businesses, alongside the composition of its deposit base – whether it's more checking accounts or higher-interest savings accounts – all contribute to the final NII figure.

In 2024, the banking environment continued to see interest rate volatility. Standard Chartered's strategy focused on optimizing its balance sheet to capture favorable interest rate differentials. The bank's ability to maintain a strong deposit franchise and grow its loan book, particularly in key markets across Asia, Africa, and the Middle East, was crucial for robust NII growth throughout the year.

Standard Chartered generates substantial income from trade finance fees and commissions, a core component of its business model, especially given its strategic focus on emerging markets and trade corridors. This revenue stream includes charges for facilitating international transactions through instruments like letters of credit, bank guarantees, and various supply chain financing solutions. For instance, in 2023, the bank reported significant contributions from its corporate and institutional banking segment, which heavily relies on trade finance services, underscoring its importance as a revenue driver.

Standard Chartered generates significant revenue through wealth management and investment advisory fees. These fees are earned by managing client assets, offering tailored investment advice, and facilitating brokerage services, primarily for their high-net-worth and affluent customer base. This non-interest income is a crucial and expanding part of the bank's business model as they continue to invest in and grow their wealth management capabilities.

In 2023, Standard Chartered reported a substantial increase in its wealth management income. For instance, the bank saw its wealth management revenues climb by 13% year-on-year in the first half of 2023, reaching $1.1 billion. This growth underscores the increasing importance of these fee-based services as a driver of profitability and a key component of their strategy to diversify income streams beyond traditional lending.

Foreign Exchange (FX) and Treasury Income

Standard Chartered generates significant revenue through foreign exchange (FX) and treasury activities. This includes income from trading FX for clients and the bank's own accounts, as well as fees for currency conversion services. The bank also earns from its involvement in money markets and derivatives trading.

The volatility in global currency markets in 2024 directly benefits this revenue stream, as increased trading volumes and wider bid-ask spreads often accompany such conditions. Cross-border transactions, a core component of Standard Chartered's global operations, further bolster this income.

- FX Trading and Conversion: Revenue from facilitating client FX transactions and currency exchange services.

- Treasury Income: Earnings from proprietary trading in money markets, bonds, and derivatives.

- Market Conditions Impact: Volatile FX markets typically increase trading volumes and profit opportunities.

- Cross-Border Transactions: A key driver, leveraging the bank's extensive international network.

Corporate and Institutional Banking Fees

Standard Chartered generates significant revenue from fees charged to its corporate and institutional clients for a broad spectrum of financial services. These fees are a direct reflection of the value-added solutions provided to large businesses and financial institutions.

Key revenue-generating fee categories include cash management, which helps businesses manage their daily financial transactions efficiently. Payment processing fees are also a substantial component, stemming from facilitating domestic and international payments for these clients. Additionally, fees are earned from loan syndication, where the bank arranges and manages large loans for multiple borrowers, and from various advisory services, offering strategic financial guidance.

- Cash Management Fees: Revenue from services like liquidity management, account services, and digital banking solutions for corporations.

- Transaction Banking Fees: Income derived from facilitating trade finance, payments, and cash clearing for institutional clients.

- Advisory and Structuring Fees: Earnings from providing expertise in areas such as mergers and acquisitions, capital markets, and debt restructuring.

- Loan and Syndication Fees: Fees associated with originating, underwriting, and distributing syndicated loans.

In 2023, Standard Chartered reported strong performance in its Transaction Banking segment, highlighting the importance of these fee-based services. For instance, client income from Transaction Banking grew, underscoring the demand for efficient cash management and payment solutions in the global market. This segment continues to be a cornerstone of the bank's revenue diversification strategy.

Standard Chartered earns significant income from various fee-based services, diversifying its revenue beyond net interest income. These fee streams are crucial for profitability, especially in dynamic market conditions.

In 2023, the bank highlighted strong growth in its Transaction Banking and Wealth Management segments. For instance, Wealth Management revenues increased by 13% year-on-year in the first half of 2023, demonstrating the growing importance of these fee-driven services. This focus on fee income aligns with the bank's strategy to build a more resilient and diversified earnings profile.

| Revenue Stream | Description | 2023 Highlight |

| Net Interest Income (NII) | Profit from lending versus deposit costs. | Key driver of $5.0 billion statutory profit before tax. |

| Trade Finance Fees | Charges for facilitating international trade transactions. | Significant contribution from Corporate & Institutional Banking. |

| Wealth Management Fees | Income from asset management and advisory services. | 13% year-on-year revenue growth in H1 2023. |

| FX and Treasury Income | Earnings from currency trading and market activities. | Benefits from volatile currency markets and cross-border transactions. |

| Corporate & Institutional Fees | Fees for cash management, payments, and advisory. | Strong performance in Transaction Banking services. |

Business Model Canvas Data Sources

The Standard Chartered Business Model Canvas is underpinned by a robust blend of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of the bank's operational and strategic landscape.