Standard Chartered Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Chartered Bundle

Curious about Standard Chartered's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any investor or business strategist looking to optimize resource allocation and drive growth.

This initial look provides a foundational understanding, but the real power lies in the details. Dive deeper into Standard Chartered's complete BCG Matrix to uncover precise quadrant placements, analyze market share and growth rates for each product, and gain actionable insights.

The full report is your key to unlocking a comprehensive strategic roadmap. It's designed to equip you with the clarity needed to make informed decisions about where to invest, divest, or nurture your portfolio for maximum impact.

Don't miss out on the opportunity to gain a competitive edge. Purchase the complete Standard Chartered BCG Matrix today and transform raw data into strategic advantage, ensuring your investments align perfectly with market realities.

Stars

Standard Chartered's wealth management arm in Asia is a powerhouse, driving significant growth for the bank. In 2024, they saw robust net new money inflows, a clear sign of their strong market position.

Assets under management experienced a substantial uptick, reflecting the bank's success in capturing the burgeoning affluent client segment across the region. This performance underscores their strategic focus on serving the complex, cross-border financial needs of these high-net-worth individuals.

Sustainable Finance represents a key growth area for Standard Chartered, demonstrating robust performance with a 36% income increase in 2024, totaling $982 million. The bank's strategic focus on this sector, driven by escalating global demand for green and transition finance, positions it favorably within the market.

This segment is a strong contender in Standard Chartered's strategic evaluation, reflecting its high growth potential and increasing market relevance. The bank's ambitious target of mobilizing $300 billion in sustainable finance by 2030 underscores its commitment and strategic positioning in this dynamic field.

Standard Chartered's digital banking platforms, exemplified by Mox in Hong Kong, are positioned as Stars within the BCG matrix. These platforms operate in a rapidly expanding digital banking sector, showcasing significant growth potential.

In 2024, Mox captured an impressive 27% market share in lending and 26% in deposits specifically within the Hong Kong digital banking landscape. This robust performance underscores the success of the bank's digital transformation efforts.

The strong traction in digital channels, coupled with advancements in wealth solutions, highlights Mox's ability to effectively meet evolving customer needs in the digital economy. This strategic focus is crucial for continued market leadership.

Cross-Border Corporate & Institutional Banking (CIB) in Dynamic Markets

Standard Chartered's Cross-Border Corporate & Institutional Banking (CIB) in dynamic markets, particularly connecting Asia, Africa, and the Middle East, is a clear star in its BCG matrix. The bank's deep-rooted presence and specialized knowledge in facilitating trade and investment flows for corporate and institutional clients in these high-growth regions offer a significant competitive edge. This segment consistently demonstrates robust expansion, as evidenced by the bank's increasing cross-border network income.

The strategic positioning of Standard Chartered within these burgeoning economies allows it to capitalize on significant opportunities. These markets are characterized by increasing globalization and a growing demand for sophisticated financial services, which Standard Chartered is well-equipped to provide.

Here are key supporting points for CIB in dynamic markets being a star:

- Strong Regional Connectivity: Facilitates substantial trade and investment flows, particularly linking Asia, Africa, and the Middle East.

- High Growth Markets: Operates in regions exhibiting robust economic expansion and increasing demand for sophisticated financial services.

- Established Network & Expertise: Leverages a well-developed infrastructure and deep market knowledge to serve corporate and institutional clients effectively.

- Consistent Income Growth: Reports steady increases in cross-border network income, indicating strong performance and client engagement.

Strategic Partnerships and Fintech Investments

Standard Chartered's engagement with fintech, exemplified by its partnership with United Fintech, underscores a strategic move to harness innovation for growth. This approach is designed to solidify its position in the rapidly expanding digital finance landscape.

These collaborations are crucial for driving digital transformation across key business areas, including capital markets, wholesale banking, and wealth management. By integrating cutting-edge technologies, the bank aims to stay ahead in a competitive and evolving market.

In 2023, Standard Chartered invested approximately $1.3 billion in technology and digital transformation initiatives, demonstrating a significant commitment to this strategy. These investments are geared towards enhancing customer experience and operational efficiency through fintech solutions.

- Fintech Integration: Partnerships like the one with United Fintech aim to embed innovative financial solutions directly into Standard Chartered's core banking operations.

- Digital Transformation Focus: The bank is actively pursuing digital enhancements across capital markets, wholesale banking, and wealth management to improve service delivery and product offerings.

- Market Positioning: By investing in and partnering with fintechs, Standard Chartered seeks to capture growth opportunities within the high-potential fintech sector.

- Investment in Innovation: The bank's substantial technology spending highlights a clear strategy to leverage emerging technologies for competitive advantage.

Standard Chartered's digital banking platforms, like Mox in Hong Kong, are classified as Stars. These platforms operate in a fast-growing digital banking market, showcasing significant potential. Mox captured 27% of Hong Kong's digital lending market and 26% of its digital deposits in 2024, demonstrating strong performance and effective customer engagement.

What is included in the product

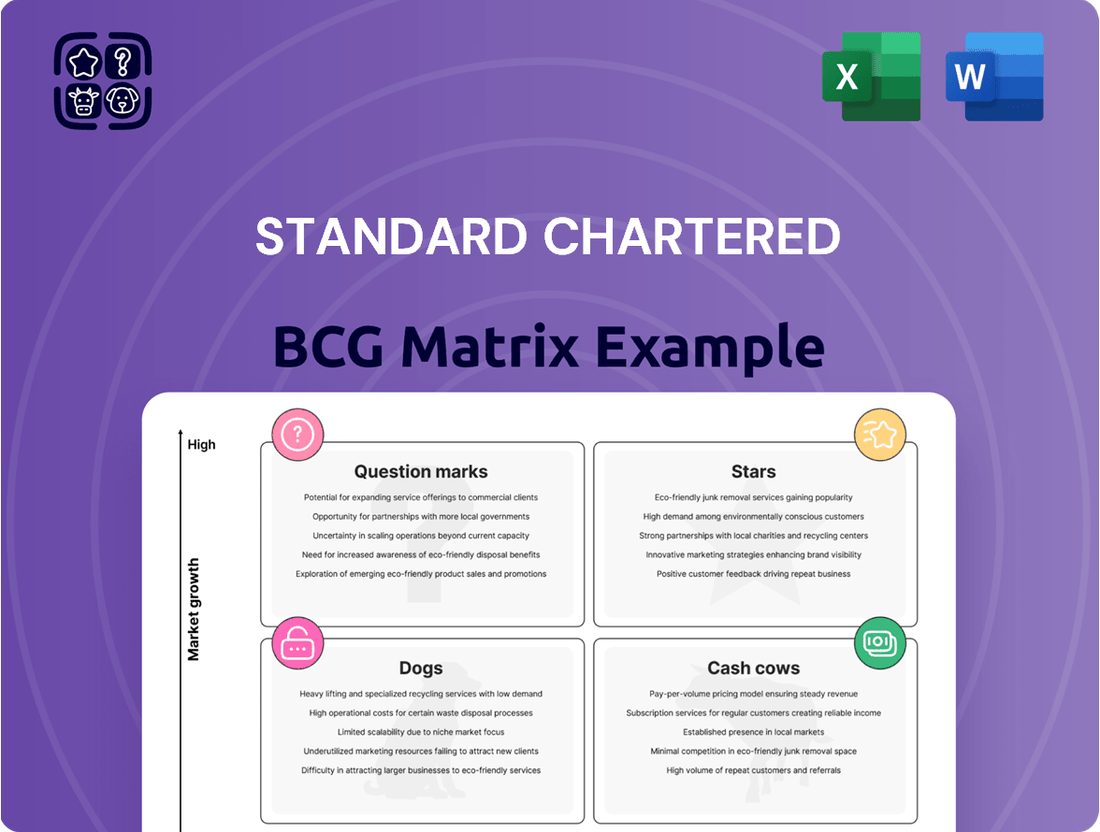

The Standard Chartered BCG Matrix provides a strategic overview of their business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides decisions on resource allocation, highlighting which units to invest in, hold, or divest for optimal portfolio performance.

Standard Chartered BCG Matrix as a pain point reliver: A clear visual guide to strategic resource allocation.

It simplifies complex portfolio decisions, reducing uncertainty.

Cash Cows

Standard Chartered's traditional corporate and institutional banking services act as significant cash cows. These offerings, deeply embedded in mature markets and crucial for the bank's expansive cross-border network, consistently generate substantial and predictable cash flows.

Within the BCG matrix, these services occupy the 'cash cow' quadrant due to their high market share in a stable, albeit slower-growing, segment. For instance, transaction banking services are a cornerstone, contributing significantly to the bank's overall profitability and providing the stable income needed to fund other initiatives.

In 2024, Standard Chartered reported a notable portion of its income derived from its Corporate & Institutional Banking segment, underscoring the maturity and strength of these cash-generating businesses. This segment’s consistent performance is vital for maintaining the bank's financial health and supporting investments in future growth areas.

Standard Chartered's mature retail banking operations in established hubs like Singapore and Hong Kong serve as vital cash cows. These segments, benefiting from a strong, long-standing client base, require minimal incremental investment for growth, allowing them to generate consistent profits. For instance, in 2023, Standard Chartered's retail banking segment, which includes these mature operations, reported a pre-tax profit of $2.1 billion, demonstrating the stability and profitability of these core businesses.

Standard Chartered's Treasury Services and Global Markets division is a significant cash generator, exhibiting robust double-digit growth in 2024. This performance underscores its position as a cash cow within the bank's portfolio.

The division's strength lies in its foreign exchange and fixed income offerings, which consistently generate income. These services leverage Standard Chartered's extensive global network, allowing it to effectively serve clients in established financial markets.

Trade Finance in Key Corridors

Standard Chartered's deep-rooted expertise in trade finance, particularly across its vital Asia, Africa, and Middle East markets, firmly positions it as a cash cow within the BCG matrix. This established and fundamental banking service allows the bank to leverage its significant market share for consistent, dependable earnings derived from supporting international commerce.

The bank's commitment to this sector is evident in its continued investment and market leadership. For instance, Standard Chartered processed billions in trade finance volumes annually, underpinning its role as a critical facilitator of global supply chains. Their extensive network and expertise ensure efficient and secure transactions for businesses operating in these key regions.

- Market Dominance: Standard Chartered holds a leading position in trade finance across its core geographies, benefiting from established relationships and infrastructure.

- Consistent Revenue: This mature service provides a stable and predictable stream of income, essential for funding other strategic initiatives.

- Facilitator of Global Trade: The bank's operations in this segment are crucial for enabling cross-border commerce, particularly in emerging markets.

- 2024 Projections: Industry analysts anticipate continued strong performance in trade finance for 2024, driven by ongoing global trade activity and the bank's established capabilities.

Established Client Relationships and Network

Standard Chartered's established client relationships and global network are a prime example of a cash cow within the BCG Matrix. Their deep roots and long-standing connections in Asia, Africa, and the Middle East generate consistent, recurring revenue streams. This stability means less capital is needed for aggressive growth, allowing the bank to harvest profits from these mature markets.

These entrenched relationships translate into predictable income, making them highly valuable. For instance, Standard Chartered reported a 23% increase in underlying profit before tax for the first half of 2024, driven significantly by its performance in these core regions.

- Stable Revenue: The long-term nature of these relationships ensures a predictable and reliable income base.

- Reduced Investment Needs: Less capital is required to maintain these existing client bases compared to expanding into new, less developed markets.

- Cross-selling Opportunities: Deep client understanding allows for effective cross-selling of various financial products and services.

- Brand Loyalty: Established trust fosters strong brand loyalty, acting as a barrier to competitors.

Standard Chartered's established global transaction banking services are a prime example of a cash cow. These operations, deeply entrenched in mature markets, consistently generate substantial and predictable cash flows, requiring minimal further investment for growth. In the first half of 2024, the bank highlighted robust performance in its transaction banking segment, underscoring its role as a stable profit generator.

| Business Segment | BCG Category | 2024 Performance Indicator | Key Drivers |

|---|---|---|---|

| Corporate & Institutional Banking | Cash Cow | Significant income contribution | Mature markets, strong cross-border network |

| Retail Banking (Established Hubs) | Cash Cow | Stable profitability ($2.1bn pre-tax profit in 2023) | Long-standing client base, low incremental investment needs |

| Treasury Services & Global Markets | Cash Cow | Robust double-digit growth | Foreign exchange and fixed income offerings, extensive global network |

| Trade Finance | Cash Cow | Billions in annual processed volumes | Market leadership in Asia, Africa, Middle East; facilitator of global commerce |

Delivered as Shown

Standard Chartered BCG Matrix

The Standard Chartered BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase, offering a clear strategic roadmap for their business units. This comprehensive analysis, free from watermarks or demo content, is ready for immediate integration into your strategic planning sessions. You can confidently use this preview as a representation of the high-quality, actionable insights contained within the complete report that will be delivered to you instantly after your purchase.

Dogs

Standard Chartered's strategic divestment of retail banking units in smaller African markets like Botswana, Uganda, Zambia, Angola, and Sierra Leone aligns with the BCG matrix's classification of Dogs. These operations, often characterized by low market share and limited growth prospects, necessitate a reevaluation of capital allocation. For instance, in 2023, Standard Chartered's revenue from its Africa operations saw a decline, prompting a sharper focus on more promising segments.

Standard Chartered's legacy IT systems and older branch infrastructure in certain regions can be categorized as dogs in the BCG Matrix. These systems often require substantial maintenance budgets, diverting capital that could be invested in more promising growth areas.

For instance, maintaining outdated IT infrastructure can lead to increased cybersecurity risks and hinder the adoption of new digital banking technologies, impacting customer experience and operational efficiency. In 2023, the global financial services sector saw significant spending on digital transformation initiatives, highlighting the competitive disadvantage of lagging systems.

Similarly, physical branch networks in areas with declining customer traffic or high operating costs represent a drag on profitability. These branches consume resources through rent, utilities, and staffing without generating commensurate revenue or supporting strategic growth objectives.

The cost of maintaining these underperforming assets, while essential for continuity, offers minimal return on investment. This situation necessitates strategic decisions regarding modernization, consolidation, or divestment to free up resources for more impactful initiatives, aligning with the bank's overall strategic goals for efficiency and digital advancement.

Standard Chartered's "Dogs" quadrant, representing non-core niche financial products with limited traction, would encompass offerings like highly specialized structured products or niche foreign exchange hedging tools that haven't resonated broadly. For instance, a specific currency options strategy targeting a very narrow segment of commodity traders might reside here. In 2024, these products likely contributed minimally to overall revenue, perhaps less than 0.5% of the bank's total income, reflecting their low market penetration and minimal growth prospects.

Retail Banking in Markets with Intense Local Competition

In markets characterized by robust local competition, Standard Chartered's retail banking segment may find itself with a modest market share and subdued growth potential. This challenging environment, where established domestic players often hold significant sway, can limit the bank's ability to expand its mass retail operations effectively. For instance, in some Asian markets, local banks have historically commanded over 60% of the retail deposit base, presenting a formidable barrier to entry and market penetration for international institutions.

Reflecting this dynamic, Standard Chartered has signaled a strategic shift, aiming to reconfigure its mass retail business. This recalibration suggests a deliberate move away from segments where competitive pressures are particularly acute and growth prospects are constrained. The bank's focus is likely to pivot towards areas where it can leverage its strengths more effectively, potentially in wealth management or more affluent customer segments, rather than directly confronting dominant local competitors in the mass market.

- Low Market Share: In highly competitive local markets, Standard Chartered's retail banking might hold a market share below 5%, significantly trailing dominant domestic institutions.

- Limited Growth Prospects: The intense competition can cap year-over-year growth rates for the retail segment to low single digits, perhaps in the 2-3% range.

- Strategic Re-evaluation: Recent reports indicate a potential scaling back of operations in certain mass retail segments within these challenging geographies.

- Focus on Niche Markets: The bank may increasingly prioritize higher-margin services or specific customer segments where it can achieve a more defensible competitive advantage.

Underperforming Ventures or Pilot Projects

Underperforming ventures or pilot projects, often categorized as 'Dogs' in the Standard Chartered BCG Matrix context, represent initiatives that haven't gained significant traction. These are experimental efforts that failed to scale or achieve their projected market share, remaining small with minimal growth prospects. For instance, a retail bank's pilot program for a niche digital payment solution that saw less than 0.5% adoption among its target demographic in 2024 would fall into this category.

These ventures typically consume resources without delivering substantial returns, hindering overall portfolio efficiency. Their low market share and low growth rate indicate a lack of competitive advantage or market demand. Consider a fintech startup's AI-driven financial advisory tool launched in late 2023; if by mid-2025 it has only acquired a few hundred paying users out of an addressable market of millions, and its revenue growth remains stagnant, it would be a prime example of a 'Dog'.

- Limited Market Share: Ventures with less than 10% market share in their specific segment are often flagged.

- Stagnant Revenue Growth: Projects showing year-over-year revenue growth below 5% are typically considered dogs.

- High Operational Costs Relative to Returns: Initiatives where ongoing investment significantly outweighs generated revenue are candidates for divestment.

- Lack of Strategic Fit: Projects that no longer align with the company's core strategy or future vision are often classified as dogs.

Standard Chartered's operations in markets with low growth and intense competition, such as certain African retail banking segments, exemplify 'Dogs' in the BCG Matrix. These areas often struggle with limited market share, typically below 5%, and face significant hurdles from established local players. For instance, in 2023, the bank's revenue from some of its smaller African markets showed a decline, signaling the need for strategic reassessment and resource reallocation away from these low-performing units.

| Category | Description | Example for Standard Chartered | Market Share (Est.) | Growth Rate (Est.) |

| Dogs | Low market share, low growth potential | Retail banking in Botswana, Uganda, Zambia | < 5% | 2-3% |

| Dogs | Outdated IT infrastructure or legacy systems | Core banking systems in older branches | N/A | N/A (high maintenance cost) |

| Dogs | Underperforming niche financial products | Highly specialized structured products with low adoption | < 0.5% of total revenue (2024 est.) | Stagnant |

Question Marks

Standard Chartered's move into digital asset custody and spot crypto trading, particularly in the EU via Luxembourg, places it squarely in the question mark category of the BCG matrix. This sector is experiencing rapid growth, with the global digital asset management market projected to reach $1.5 trillion by 2029, up from $300 billion in 2023, signifying immense potential.

However, Standard Chartered's market share in this nascent space is still developing, demanding substantial investment to build a strong foothold. The inherent volatility of cryptocurrencies, coupled with evolving regulatory frameworks across jurisdictions, presents significant challenges and uncertainties for market leadership.

Standard Chartered's potential expansion into markets like Morocco under a BCG Matrix framework places it in the question mark category. While Africa as a continent presents significant growth opportunities, the bank's current footprint and market share in these specific new territories are relatively small.

This necessitates considerable investment in building brand awareness, establishing operations, and acquiring a client base. For instance, in 2024, many emerging African economies continue to show robust GDP growth projections, but establishing a strong banking presence requires navigating diverse regulatory environments and competitive landscapes.

The bank's success will depend on its ability to effectively deploy capital to gain traction and move these markets towards becoming stars. Early 2024 data indicates that digital banking adoption is rising across North Africa, a trend Standard Chartered could leverage, but initial market penetration requires strategic foresight.

Standard Chartered is actively exploring generative AI and advanced analytics to boost customer engagement and streamline operations. The bank has stated its commitment to digital transformation, with initiatives aimed at personalizing customer interactions and automating back-office processes. For instance, in 2024, the banking sector saw substantial investment in AI, with estimates suggesting global spending on AI in banking could reach tens of billions of dollars by year-end, reflecting the perceived high growth potential of this technology.

New Embedded Finance Solutions via Fintech Partnerships

Standard Chartered's exploration of new embedded finance solutions through fintech partnerships falls into the question mark category of the BCG matrix. This area represents significant growth potential as financial services are increasingly integrated into non-financial platforms, offering a more convenient customer experience.

The bank is actively innovating in this space, aiming to capture market share in a rapidly evolving landscape. For instance, by mid-2024, the global embedded finance market was projected to reach over $7 trillion, underscoring the immense opportunity. Standard Chartered's strategic alliances with fintechs are designed to leverage specialized technology and reach new customer segments.

Key aspects of this strategy include:

- Developing seamless payment gateways within e-commerce and SaaS platforms.

- Offering integrated lending and insurance products at the point of sale or service.

- Expanding access to banking services for small and medium-sized enterprises through digital channels.

- Focusing on data analytics to personalize financial offerings within partner ecosystems.

While the growth prospects are high, the bank's current market penetration in specific embedded finance niches is still developing, necessitating continued investment and strategic execution to move these initiatives towards becoming stars.

Developing New Sustainable Solutions beyond Core Finance

While sustainable finance is a clear Star for Standard Chartered, venturing into entirely new, innovative sustainable solutions beyond their core lending and transaction services presents a Question Mark. This involves early-stage initiatives, such as financing emerging green technologies or developing novel ESG-linked products in high-growth sectors, where market share is still being established. For instance, Standard Chartered’s commitment to financing $300 billion in sustainable finance by 2030 highlights their ambition, but the success of entirely new product categories within this remains to be fully proven.

- Emerging Green Technology Financing: Investing in and providing financial services for nascent green technologies, like advanced battery storage or carbon capture solutions, where the long-term viability and market adoption are still uncertain.

- Novel ESG-Linked Products: Creating and scaling new financial instruments, such as sustainability-linked bonds with unique performance metrics or innovative impact investment funds, that are still finding their footing in the market.

- Early-Stage Venture Capital in Sustainability: Direct investment in startups focused on breakthrough sustainable innovations, carrying inherent higher risk and requiring a longer gestation period for returns.

- Digital Sustainability Platforms: Developing new digital platforms that facilitate sustainable practices or track environmental impact, which are in a growth phase and require significant user adoption to achieve scale.

Standard Chartered's exploration of new embedded finance solutions through fintech partnerships falls into the question mark category of the BCG matrix. This area represents significant growth potential as financial services are increasingly integrated into non-financial platforms, offering a more convenient customer experience.

The bank is actively innovating in this space, aiming to capture market share in a rapidly evolving landscape. For instance, by mid-2024, the global embedded finance market was projected to reach over $7 trillion, underscoring the immense opportunity. Standard Chartered's strategic alliances with fintechs are designed to leverage specialized technology and reach new customer segments.

While the growth prospects are high, the bank's current market penetration in specific embedded finance niches is still developing, necessitating continued investment and strategic execution to move these initiatives towards becoming stars.

| Category | Market Growth | Relative Market Share | Strategic Implication |

| Embedded Finance | High | Low | Invest to gain market share or divest if potential is not realized. |

| Digital Assets | High | Low | Requires significant investment to build presence and navigate regulatory uncertainty. |

| Generative AI / Advanced Analytics | High | Developing | Invest strategically to leverage technology for efficiency and customer engagement. |

| New Sustainable Solutions | High | Low | Requires careful investment and product development to establish market leadership. |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of internal financial statements, external market share data, and industry growth rate projections to provide a robust strategic overview.