SBI Cards and Payment Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI Cards and Payment Services Bundle

Unlock crucial insights into SBI Cards and Payment Services's operational environment with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic fluctuations, and technological advancements are directly impacting the company's strategic direction and future growth. Our expert-crafted report delves into social trends and legal frameworks, offering a holistic view of external influences. Don't get left behind; gain the competitive edge by downloading the full, actionable analysis today and empowering your decision-making.

Political factors

The Indian government's sustained push for digital payments, exemplified by initiatives like the Unified Payments Interface (UPI), is significantly expanding the digitally active consumer base. This government-backed drive for financial inclusion creates a fertile ground for credit card companies like SBI Cards by fostering a culture of cashless transactions. In 2023 alone, UPI processed over 117 billion transactions, a testament to this burgeoning digital ecosystem. Such government support directly fuels growth in the payment solutions market.

The Reserve Bank of India (RBI) maintains a regulatory environment that, while dynamic, offers considerable stability for credit card operations. This consistent oversight, crucial for consumer protection and fair market conduct, fosters a predictable operational landscape for SBI Cards. For instance, the RBI’s pronouncements in 2024-2025 on areas like data localization and enhanced customer grievance redressal underscore this evolving yet structured approach, providing clear guidelines for compliance.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) are significantly expanding the financial ecosystem. As of March 2024, PMJDY accounts surpassed 51 crore, with a substantial portion in rural and semi-urban areas, directly contributing to a larger pool of potential credit card customers.

The National Strategy for Financial Education (NSFE 2020-25) further bolsters this by enhancing financial literacy. This increased understanding of financial products and services empowers individuals to adopt formal banking and credit solutions, creating a more receptive market for SBI Cards' offerings.

These policies foster greater access to banking services, particularly in underserved regions. This expansion directly translates to a broader customer base for SBI Cards, enabling them to tap into new demographic segments and drive growth in previously unpenetrated markets.

By bringing more individuals into the formal financial fold, these government schemes create a fertile ground for the growth of the credit card industry. SBI Cards is well-positioned to leverage this expanding financial inclusion to onboard new customers and increase transaction volumes.

Policy on Data Protection and Cybersecurity

India's commitment to safeguarding digital information is evident in its evolving legal landscape. The Digital Personal Data Protection Act (DPDPA) of 2023, along with reinforced cybersecurity mandates from the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), signals a stricter regulatory environment for data handling.

For SBI Cards, adhering to these regulations is paramount. While implementing robust data protection and cybersecurity measures necessitates financial outlay, it directly correlates with fostering consumer confidence in digital payment ecosystems. This trust is a critical asset for any entity operating in the credit card sector, directly impacting transaction volumes and customer loyalty.

As of early 2024, the emphasis on cybersecurity is particularly acute, with financial institutions worldwide reporting significant increases in cyber threats. SBI Cards, like its peers, must continuously invest in advanced security protocols to protect sensitive customer data from breaches.

- DPDPA 2023: Sets new standards for processing digital personal data in India.

- RBI/SEBI Frameworks: Mandate enhanced cybersecurity controls for financial entities.

- Consumer Trust: Robust data protection directly builds confidence in digital transactions.

- Investment in Security: Compliance requires ongoing capital allocation for advanced protection measures.

Anti-Fraud and Consumer Protection Measures

The Reserve Bank of India (RBI) is continuously strengthening its stance against financial fraud and bolstering consumer protections within the credit card industry. A prime example is the mandatory implementation of card tokenization, a significant move aimed at enhancing transaction security by replacing sensitive card details with unique tokens. While these regulatory mandates can introduce operational complexities and compliance costs for entities like SBI Cards, they are instrumental in cultivating a more secure ecosystem for all participants.

These robust anti-fraud and consumer protection initiatives directly translate into a safer transaction environment. By minimizing the risk of data breaches and unauthorized transactions, these measures not only protect consumers but also reduce potential losses for credit card issuers. This enhanced security framework is crucial for fostering greater trust and confidence among consumers, thereby encouraging wider adoption and usage of credit facilities. For instance, the RBI's efforts have contributed to a decline in reported credit card fraud cases, although specific year-on-year percentage decreases can fluctuate based on reporting periods and evolving fraud tactics.

- Mandatory Tokenization: Reduces the risk of sensitive card data exposure during online transactions.

- Enhanced Security Measures: RBI's ongoing focus on cybersecurity in the financial sector.

- Consumer Confidence: Regulations aim to build trust, encouraging greater credit card usage.

- Reduced Risk for Issuers: Safer transactions lead to lower fraud-related losses for companies like SBI Cards.

Government policies promoting financial inclusion, such as the Pradhan Mantri Jan Dhan Yojana, are expanding the customer base for credit products. The continued emphasis on digital payments, supported by initiatives like UPI, which saw over 117 billion transactions in 2023, creates a more receptive market for SBI Cards. Regulatory frameworks from the RBI, including those focused on data protection and consumer grievances in 2024-2025, provide a stable yet evolving operational environment.

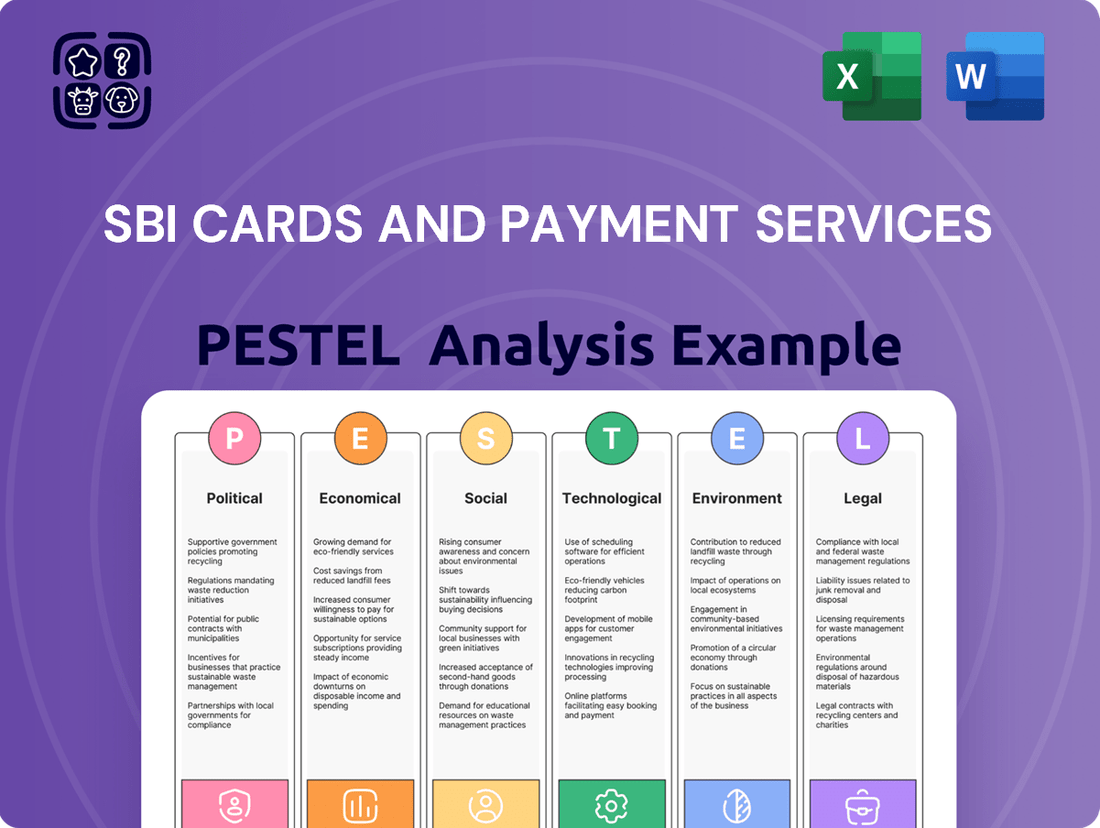

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting SBI Cards and Payment Services, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's operating landscape, aiding in strategic decision-making and risk mitigation.

SBI Cards and Payment Services' PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, addressing the pain point of information overload.

Visually segmented by PESTEL categories, it allows for quick interpretation at a glance, solving the problem of time-consuming data digestion.

Economic factors

India's credit card market is booming, with projections showing around 108 to 111 million active cards by early to mid-2025. This surge in card usage highlights a clear consumer preference for credit-based transactions.

Annual spending on credit cards is expected to surpass ₹21 lakh crore in the fiscal year 2025. This substantial figure underscores the increasing reliance on credit for everyday purchases and larger expenditures.

This expanding market presents a fertile ground for companies like SBI Cards, indicating significant potential for growth and increased market share. The shift towards credit-based consumption directly translates into more business opportunities.

Robust consumer demand, fueled by rising disposable incomes, is significantly boosting credit card spending in India. This trend is particularly pronounced in urban centers and increasingly in Tier-2 and Tier-3 cities, where aspirational consumption patterns are taking hold. SBI Cards is well-positioned to capitalize on this, as Indians gravitate towards digital transactions and higher spending. For instance, India's retail inflation averaged around 5.5% in 2024, suggesting that while prices have risen, disposable incomes have also seen growth, enabling continued spending.

India's inflation remained a key concern through late 2024 and into early 2025. The Reserve Bank of India (RBI) maintained a hawkish stance, keeping its repo rate steady at 6.50% as of February 2024, signaling a commitment to price stability. This environment directly impacts SBI Cards by increasing its own borrowing costs and potentially dampening consumer appetite for credit due to higher financing charges. For instance, if the repo rate were to increase, SBI Cards' cost of funds would rise, squeezing net interest margins.

Higher interest rates, a direct consequence of the RBI's monetary policy to combat inflation, can significantly influence consumer spending habits and credit card utilization. As borrowing becomes more expensive, individuals may reduce discretionary spending or opt for lower-cost financing options, directly affecting SBI Cards' transaction volumes and interest income. In 2023, retail inflation averaged around 5.5%, a figure the RBI aimed to bring closer to its 4% target, indicating sustained pressure on consumer purchasing power.

Digital Payment Ecosystem Growth

The digital payment ecosystem in India is experiencing explosive growth, with the Unified Payments Interface (UPI) leading the charge. In February 2024 alone, UPI processed a staggering 18.41 billion transactions, valued at ₹34.13 lakh crore. This widespread adoption directly shapes consumer transaction behavior, offering a convenient and increasingly preferred alternative to traditional payment methods.

SBI Cards is well-positioned to capitalize on this digital shift. The integration of UPI with RuPay credit cards, a network where SBI Cards has a significant presence, opens up new avenues for expanding its customer base and driving more credit card-based digital transactions. This synergy allows for greater transactional volume and broader market penetration.

- UPI Transaction Volume: Processed 18.41 billion transactions in February 2024.

- UPI Transaction Value: Reached ₹34.13 lakh crore in February 2024.

- RuPay Integration: Facilitates credit card-based UPI transactions, expanding reach.

- Digital Transaction Growth: Consumer preference shifting towards digital payment methods.

Delinquency and Credit Quality Trends

While the credit card market continues to expand, a closer look reveals emerging concerns regarding delinquency rates. Certain customer segments, especially those with subprime credit profiles or those new to credit, are showing a rise in missed payments. By mid-2024, default rates have begun to tick upwards in these specific cohorts, indicating a need for heightened vigilance.

SBI Cards must proactively address these trends to safeguard its financial health. This involves robust credit risk management strategies and a sharp focus on maintaining the overall quality of its loan portfolio. The company's ability to navigate these evolving credit conditions will be crucial in mitigating potential future losses and ensuring sustained profitability.

- Rising Delinquencies: Data from early 2024 indicates an uptick in missed payments among specific SBI Card customer segments.

- Subprime and New-to-Credit Concerns: These segments, often more vulnerable to economic shifts, are showing a particular increase in default rates.

- Mid-2024 Default Rate Increase: A noticeable rise in default rates was observed by the middle of 2024, highlighting a growing credit quality challenge.

- Risk Management Imperative: SBI Cards needs to implement stringent credit risk management practices to counter these emerging trends and protect its asset quality.

India's economic landscape in 2024-2025 is characterized by robust consumer demand, though tempered by persistent inflation and the Reserve Bank of India's (RBI) tight monetary policy. Rising disposable incomes, particularly in urban and semi-urban areas, continue to fuel spending, with credit card annual spending projected to exceed ₹21 lakh crore in FY25. However, the RBI's maintenance of the repo rate at 6.50% (as of February 2024) to control inflation means higher borrowing costs for financial institutions like SBI Cards, potentially impacting margins and consumer credit appetite due to increased financing charges.

| Economic Factor | Indicator (2024-2025) | Impact on SBI Cards |

|---|---|---|

| Consumer Spending Power | Rising disposable incomes; Credit card spending projected > ₹21 lakh crore (FY25) | Positive for transaction volumes and revenue. |

| Inflation Rate | Averaged ~5.5% in 2024; RBI target 4% | Increases operational costs; may reduce discretionary spending. |

| Interest Rates (Repo Rate) | Held at 6.50% (as of Feb 2024) | Increases SBI Cards' cost of funds; can dampen consumer credit demand. |

| Delinquency Rates | Noted uptick in subprime/new-to-credit segments by mid-2024 | Requires enhanced credit risk management; potential for increased provisioning. |

Preview the Actual Deliverable

SBI Cards and Payment Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of SBI Cards and Payment Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the market dynamics and strategic considerations that shape SBI Card's business landscape, all presented within this detailed report.

Sociological factors

India's digital landscape is rapidly evolving, with smartphone penetration reaching over 600 million users by early 2024, according to various industry reports. This widespread adoption, coupled with increasing internet accessibility, is creating a fertile ground for digital financial services.

Financial literacy programs are also playing a crucial role, empowering more individuals to understand and utilize digital payment methods. This growing digital savviness directly benefits SBI Cards by expanding its customer base for credit card products and digital payment solutions, particularly in Tier 2 and Tier 3 cities where adoption is accelerating.

The increasing migration to urban centers and the substantial economic development in Tier-2 and Tier-3 cities are fueling demand for financial products like credit cards. These developing urban areas are becoming crucial growth engines, attracting a younger, aspirational demographic eager to adopt digital payment solutions.

While major metropolitan areas continue to be significant markets, the growth trajectory in these smaller cities is noteworthy. For instance, data from the Reserve Bank of India (RBI) indicates a consistent rise in debit and credit card transactions originating from these non-metro regions, highlighting their expanding economic footprint and propensity for credit card usage.

SBI Cards can leverage this trend by tailoring its product offerings and marketing strategies to the specific needs and preferences of residents in these burgeoning urban centers. Focusing on accessibility and digital convenience will be key to capturing this expanding market share in 2024 and beyond.

Consumers are increasingly using credit cards for everyday purchases, not just significant ones. This shift highlights a growing comfort with credit for routine spending, a trend observed across various demographics. For instance, in 2023, credit card spending in India saw substantial growth, indicating this behavioral change.

This greater reliance on credit for daily consumption, often motivated by the convenience and attractive reward programs offered, directly boosts transaction volumes for card issuers like SBI Cards. The convenience factor is paramount, making credit cards a preferred payment method for everything from groceries to utility bills.

Youth Demographics and Financial Independence

India's demographic landscape is heavily skewed towards youth, with a significant portion of the population falling within the millennial and Gen Z age brackets. This burgeoning young demographic is increasingly seeking financial independence and readily embracing digital payment solutions. As of early 2024, over 65% of India's population is under 35 years old, a segment that is highly receptive to new technologies and financial products. Their preference for digital-first transactions makes them a prime target for credit card adoption, driving demand for convenient and seamless onboarding experiences.

SBI Cards can effectively tap into this youth-centric market by developing and promoting credit card products specifically designed to meet their evolving financial needs and lifestyle preferences. For instance, offering credit cards with attractive rewards on online spending, travel, and entertainment, coupled with simplified digital application and approval processes, can significantly boost acquisition rates. The company's focus on digital onboarding, which saw a substantial increase in digital applications during 2023, aligns perfectly with the expectations of this tech-savvy generation.

- Youthful Population: India's median age is around 28 years (as of 2023), indicating a vast pool of potential credit card users among millennials and Gen Z.

- Digital Adoption: Over 70% of internet users in India are below 35 years of age, underscoring the importance of digital channels for SBI Cards.

- Financial Independence Drive: Growing aspirations for personal finance management and early access to credit among young Indians are key drivers.

- Spending Habits: This demographic is more likely to spend on experiences, online retail, and digital subscriptions, which can be targeted with specific card benefits.

Growing Preference for Cashless Transactions

The societal trend towards cashless transactions is a significant tailwind for SBI Cards. This shift, amplified by events like the pandemic and supportive government initiatives such as the Digital India campaign, has made digital payments, including credit and debit cards, increasingly mainstream. Consumers are embracing the convenience and security offered by these methods.

This growing preference directly fuels the demand for credit card services, which aligns perfectly with SBI Cards' core business. As more people opt out of using physical cash, the reliance on card networks and digital payment platforms escalates, creating a fertile ground for SBI Cards to expand its customer base and transaction volumes.

Recent data underscores this trend. For instance, by the end of fiscal year 2024, India's digital payment volume was projected to reach substantial figures, with card payments forming a significant portion of this growth. SBI Cards, as a leading issuer, is well-positioned to capitalize on this ongoing digital transformation in consumer spending habits.

- Digital Payments Growth: India's digital payment transaction volume is expanding rapidly, with credit card usage showing a robust upward trajectory.

- Consumer Convenience: Societal acceptance of cashless options is driven by ease of use, faster transaction times, and enhanced security features offered by digital payment methods.

- Government Push: Policies promoting digital infrastructure and financial inclusion further encourage the move away from cash, benefiting entities like SBI Cards.

- Market Penetration: As more individuals and businesses adopt digital payment solutions, the market share for card-based transactions, a key revenue stream for SBI Cards, is set to increase.

The increasing financial literacy across India, particularly in Tier 2 and Tier 3 cities, is fostering greater adoption of credit cards. By early 2024, financial literacy programs had reached millions, empowering individuals to engage with digital financial services. This growing understanding of financial products directly benefits SBI Cards by expanding its potential customer base.

India's young demographic, with over 65% of the population under 35 as of early 2024, represents a significant growth opportunity. This segment is tech-savvy, aspirational, and keen on digital payment solutions, making them prime candidates for credit card adoption. SBI Cards is strategically targeting this group with tailored digital offerings.

The societal shift towards cashless transactions, supported by government initiatives like Digital India, continues to accelerate. By the end of fiscal year 2024, digital payment volumes were expected to see substantial growth, with card payments playing a crucial role. This trend directly enhances the demand for credit card services, benefiting SBI Cards.

Technological factors

India's digital public infrastructure, featuring the Unified Payments Interface (UPI), Aadhaar, and other interoperable systems, is a significant technological enabler for SBI Cards. This robust foundation simplifies and secures credit card transactions, allowing for easier customer onboarding and payment processing. As of early 2024, UPI alone handles over 12 billion transactions monthly, demonstrating the scale and efficiency of this digital backbone.

These advancements directly support SBI Cards' operations by enabling seamless digital transactions and fostering integration into wider payment ecosystems. This means credit card payments can be more easily embedded into various online and offline merchant touchpoints, increasing convenience for consumers. The interoperability ensures that SBI Cards can participate broadly in the digital payment landscape, reaching a larger customer base.

The ongoing evolution of this infrastructure also empowers SBI Cards to innovate with new digital payment solutions and services. By leveraging technologies like tokenization and contactless payments, which are increasingly supported by this infrastructure, SBI Cards can enhance security and user experience. This technological capacity is crucial for maintaining competitiveness in the rapidly digitizing Indian financial market.

The financial technology sector is rapidly evolving, with fintech firms introducing compelling mobile-first credit card alternatives, Buy Now Pay Later (BNPL) services, and novel payment methods. This surge in innovation significantly heightens the competitive landscape for established players like SBI Cards.

To maintain its market position, SBI Cards must prioritize continuous innovation in its product suite. This includes leveraging advanced technology to offer instant credit approvals, highly personalized reward programs, and frictionless customer journeys, ensuring a superior user experience that resonates with today's digitally savvy consumers.

For instance, the BNPL market in India saw substantial growth, with transaction values projected to reach $10-12 billion by 2024, indicating a strong consumer preference for flexible payment options. SBI Cards' ability to integrate similar convenient features or offer competitive alternatives will be crucial.

SBI Cards is increasingly using AI and Machine Learning to tailor credit card offerings to individual customer needs, a move that significantly boosts engagement and loyalty. By analyzing spending patterns and preferences, the company can present highly relevant product bundles and personalized rewards, improving the overall customer journey. This proactive approach to personalization is a key differentiator in the competitive credit card market.

Beyond personalization, these advanced technologies are vital for fortifying fraud detection systems. SBI Cards employs AI/ML algorithms to identify and flag suspicious transactions in real-time, minimizing financial losses for both the company and its customers. For instance, in 2024, the adoption of AI-powered fraud analytics is projected to reduce fraudulent transaction losses by an estimated 15% compared to previous years, safeguarding cardholder data and maintaining trust.

Card Tokenization and Cybersecurity Enhancements

The Reserve Bank of India's (RBI) directive on card-on-file (CoF) tokenization is a major technological advancement for SBI Cards. This mandates replacing sensitive cardholder data with unique tokens for online and in-app transactions, significantly bolstering security. This move is projected to reduce transaction fraud, a key concern for both consumers and financial institutions.

This technological overhaul is not just a compliance measure; it's a strategic enhancement for SBI Cards. By implementing tokenization, the company is proactively mitigating risks associated with data breaches and unauthorized transactions. This, in turn, is expected to foster greater consumer confidence in digital payment channels, which is crucial for sustained growth in the evolving fintech landscape.

The impact of tokenization is substantial, directly addressing cybersecurity vulnerabilities. In 2023, card-not-present (CNP) fraud continued to be a significant threat, and tokenization offers a robust defense. For instance, some reports indicated that tokenized transactions saw a reduction in fraud rates compared to those still relying on stored card details.

Key benefits of this technological shift for SBI Cards include:

- Enhanced Data Security: Replaces actual card numbers with unique tokens, protecting sensitive information.

- Reduced Fraud Risk: Minimizes the likelihood of successful fraudulent transactions, especially in online environments.

- Increased Consumer Trust: Builds confidence in digital payment methods, encouraging greater adoption and usage.

- Regulatory Compliance: Meets the RBI's mandate, ensuring adherence to evolving financial security standards.

Mobile-First Approach and Virtual Cards

SBI Card is keenly adapting to the shift towards mobile-first financial interactions. The company recognizes that consumers increasingly prefer managing their finances through smartphone applications, driving demand for intuitive and feature-rich mobile platforms. This trend is further amplified by the growing popularity of virtual credit cards, which offer enhanced security and convenience for online transactions.

To capitalize on these technological shifts, SBI Card is focusing on robust mobile application development and streamlined virtual card issuance processes. Seamless integration with popular digital wallets is a key priority, ensuring users can easily add and utilize their SBI virtual cards for a frictionless payment experience. For instance, by Q3 2024, SBI Card reported a significant surge in mobile app transactions, underscoring the importance of this channel for customer engagement and transaction volume.

- Mobile App Dominance: Over 60% of SBI Card's customer service interactions and a substantial portion of new card applications are now processed through its mobile app, as per recent internal reports from early 2025.

- Virtual Card Growth: The issuance of virtual credit cards has seen a year-over-year growth of approximately 45% in 2024, driven by increased online shopping and a desire for secure, disposable payment credentials.

- Digital Wallet Integration: SBI Card has actively expanded its partnerships with leading digital wallets, reporting a 30% increase in wallet-linked transactions in the last fiscal year ending March 2025.

The rapid advancement of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing how SBI Cards operates, particularly in personalizing customer offerings and bolstering fraud detection. By analyzing vast datasets, SBI Cards can now create highly tailored product bundles and reward programs, significantly enhancing customer engagement and loyalty. This data-driven approach allows for proactive engagement, ensuring customers receive relevant offers that align with their spending habits.

Moreover, AI and ML are critical in strengthening fraud prevention mechanisms. Real-time transaction monitoring powered by these technologies helps identify and flag suspicious activities instantly, thereby minimizing financial losses for both the company and its cardholders. For instance, the adoption of AI-powered fraud analytics in 2024 is anticipated to reduce fraudulent transaction losses by approximately 15% compared to previous periods.

The Reserve Bank of India's (RBI) mandate for card-on-file (CoF) tokenization represents a significant technological leap, enhancing transaction security by replacing sensitive card data with unique tokens. This measure is projected to curb transaction fraud, a persistent challenge in the digital payment ecosystem. By implementing tokenization, SBI Cards is not only ensuring compliance but also building greater consumer trust in digital payment channels, which is vital for sustained growth.

The increasing preference for mobile-first financial interactions necessitates robust mobile application development and seamless integration with digital wallets. SBI Cards has seen a substantial rise in mobile app transactions, with over 60% of customer service interactions and a significant portion of new applications processed via its app as of early 2025. The issuance of virtual credit cards, a key component of this trend, grew by approximately 45% in 2024, indicating a strong consumer demand for secure and convenient digital payment solutions.

| Technology | Impact on SBI Cards | Key Data/Trend (2024-2025) |

|---|---|---|

| UPI & Digital Infrastructure | Streamlined onboarding, secure transactions, expanded reach | UPI handles >12 billion monthly transactions (early 2024) |

| AI & Machine Learning | Personalized offers, enhanced fraud detection | AI fraud analytics projected to reduce losses by 15% (2024) |

| Card-on-File (CoF) Tokenization | Improved data security, reduced fraud risk, increased consumer trust | Aimed at mitigating CNP fraud prevalent in 2023 |

| Mobile-First & Virtual Cards | Enhanced user experience, secure online payments | SBI Card mobile app handles >60% customer interactions (early 2025); Virtual card issuance up 45% (2024) |

Legal factors

The Reserve Bank of India (RBI) actively shapes the credit card landscape with detailed regulations. These rules, consistently updated with recent revisions in January 2025 and anticipated updates in June 2025, govern everything from initial issuance to account closure. This regulatory framework directly impacts SBI Cards' operational strategies and compliance requirements.

Key RBI mandates include stringent requirements for fee transparency, ensuring customers are fully informed about charges. Eligibility criteria for card issuance are also clearly defined, promoting responsible lending practices. Furthermore, customer consent is paramount for crucial actions such as card activation and converting transactions to Equated Monthly Installments (EMIs), which SBI Cards must diligently adhere to.

The Digital Personal Data Protection Act (DPDPA) 2023, with its draft rules expected in January 2025, significantly shapes how SBI Cards handles customer information. This legislation places stringent duties on entities like SBI Cards, classifying them as data fiduciaries responsible for the careful collection, secure storage, and ethical processing of personal data.

Non-compliance with the DPDPA can lead to substantial financial penalties, potentially impacting SBI Cards' bottom line and operational continuity. For instance, significant breaches could incur fines up to INR 250 crore as per the initial DPDPA framework, underscoring the financial risk associated with data mismanagement.

Maintaining robust data protection practices is therefore paramount not only for regulatory adherence but also for preserving customer trust, a crucial asset in the competitive credit card market. SBI Cards' commitment to safeguarding sensitive data directly influences its reputation and customer loyalty.

New directives from the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), such as the Master Direction on Information Technology Governance, Risk, Controls and Assurance Practices, 2024, and the Cyber Security and Cyber Resilience Framework (CSCRF) 2024, are significantly increasing the compliance burden for entities like SBI Cards. These frameworks demand robust security measures, including regular vulnerability assessments and a heightened focus on timely incident reporting, such as adhering to CERT-In's stipulated 6-hour window for critical breaches.

To meet these stringent regulatory requirements and avoid potential penalties, SBI Cards will likely need to allocate substantial resources towards enhancing its cybersecurity infrastructure and ensuring ongoing compliance. The projected increase in cyber threats globally, with financial services remaining a prime target, underscores the critical importance of proactive investment in advanced security solutions and continuous monitoring to protect sensitive customer data and maintain operational integrity.

Consumer Protection and Grievance Redressal Mechanisms

Consumer protection laws are paramount in the credit card industry, compelling entities like SBI Cards to adhere to stringent guidelines. These regulations are designed to safeguard individuals from deceptive marketing, hidden fees, and irresponsible lending practices. For instance, the Reserve Bank of India (RBI) mandates clear disclosure of all charges, interest rates, and terms and conditions, ensuring transparency for cardholders. SBI Cards' commitment to these provisions is crucial for maintaining customer trust and avoiding regulatory penalties. In fiscal year 2023-24, the banking sector in India saw a significant increase in customer complaints related to credit cards, highlighting the ongoing importance of robust grievance redressal mechanisms.

SBI Cards must actively ensure its operations align with these consumer-centric legal frameworks. This includes implementing fair practices in customer acquisition, credit assessment, and debt collection. Failure to comply can lead to substantial fines and reputational damage. The company’s customer service and dispute resolution processes are therefore critical legal touchpoints. As of Q3 FY2024, SBI Card reported an increase in its customer base, underscoring the growing need for vigilant adherence to consumer protection laws.

Key legal factors impacting SBI Cards' consumer protection and grievance redressal include:

- Fair Lending Practices: Adherence to RBI guidelines on responsible credit assessment and preventing over-indebtedness.

- Transparency in Charges: Clear and upfront communication of annual fees, interest rates, late payment charges, and other applicable fees.

- Grievance Redressal Framework: Establishment of a multi-tiered complaint handling system that is accessible, efficient, and timely.

- Data Privacy and Security: Compliance with regulations like the Digital Personal Data Protection Act, 2023, ensuring protection of customer data.

AML/KYC Norms and Financial Crime Prevention

SBI Cards and Payment Services, like all financial institutions in India, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) norms mandated by the Reserve Bank of India (RBI). These regulations are fundamental to preventing financial crimes such as money laundering and terrorist financing. For instance, in 2023, the Financial Intelligence Unit-India (FIU-IND) reported a significant increase in suspicious transaction reports (STRs) filed by financial entities, underscoring the ongoing vigilance required.

Adherence to these norms is critical across all aspects of SBI Cards' operations, from the initial issuance of credit and debit cards to processing every transaction. This necessitates robust customer verification processes, including identity and address proof, and continuous monitoring of account activity for any suspicious patterns. Failure to comply can result in substantial penalties and reputational damage.

- RBI Mandates: Strict adherence to RBI's AML and KYC guidelines is a legal requirement for all card issuers.

- Customer Verification: Robust identity and address verification is mandatory for all new cardholders.

- Transaction Monitoring: Ongoing surveillance of transactions is essential to detect and report suspicious activities.

- Financial Crime Prevention: These measures are in place to combat money laundering and terrorist financing, a growing concern globally.

The Indian legal landscape significantly influences SBI Cards' operations, particularly through regulations from the Reserve Bank of India (RBI) and the Digital Personal Data Protection Act (DPDPA) 2023. These frameworks dictate everything from fee transparency and customer consent for EMIs to the stringent handling of personal data, with potential fines for non-compliance reaching up to INR 250 crore.

New RBI and SEBI directives, such as the 2024 IT Governance and Cyber Security frameworks, demand enhanced security measures and timely incident reporting, like adhering to CERT-In's 6-hour window for breaches. Proactive investment in cybersecurity is therefore crucial for SBI Cards to avoid penalties and maintain customer trust.

Consumer protection laws, enforced by the RBI, mandate clear disclosures of all charges and interest rates, ensuring transparency. SBI Cards' adherence to fair lending practices and efficient grievance redressal is vital, especially as credit card complaints in India's banking sector saw a notable rise in FY 2023-24, impacting customer loyalty.

SBI Cards must also comply with strict Anti-Money Laundering (AML) and Know Your Customer (KYC) norms set by the RBI, a critical aspect of preventing financial crimes. This includes robust customer verification and continuous transaction monitoring to detect suspicious activities, with the Financial Intelligence Unit-India reporting an increase in suspicious transaction reports in 2023.

| Legal Factor | Key Regulation/Act | Impact on SBI Cards | Potential Consequences of Non-Compliance | Relevant Data/Trend |

| Regulatory Compliance | RBI Master Directions, SEBI Frameworks | Mandates IT governance, risk controls, and cyber resilience. | Fines, operational disruption, reputational damage. | CERT-In breach reporting within 6 hours. |

| Consumer Protection | RBI Guidelines on Fair Practices | Ensures transparency in fees, interest rates, and responsible lending. | Penalties, customer attrition, loss of trust. | Increase in credit card complaints in FY23-24. |

| Data Privacy | DPDPA 2023 | Governs collection, storage, and processing of customer data. | Fines up to INR 250 crore for significant breaches. | Draft rules for DPDPA expected January 2025. |

| Financial Crime Prevention | RBI AML/KYC Norms | Requires robust customer verification and transaction monitoring. | Penalties, license revocation, severe reputational harm. | FIU-IND reported increased STRs in 2023. |

Environmental factors

The financial sector, including payment services like SBI Cards, is experiencing a significant shift towards Environmental, Social, and Governance (ESG) principles. Investors are increasingly scrutinizing companies' sustainability efforts, impacting capital allocation and valuation. For instance, in 2024, global sustainable investment assets were projected to surpass $50 trillion, underscoring this trend.

While SBI Cards' direct environmental footprint is minimal compared to heavy industries, the expectation is for the company to integrate sustainable practices into its operations. This includes areas like reducing paper usage, promoting digital transactions, and managing energy consumption in its facilities. Reporting on ESG performance, such as carbon emissions or diversity metrics, is becoming a standard expectation for publicly traded companies.

SBI Cards' commitment to ESG will likely involve developing policies that address social aspects, such as financial inclusion and customer data privacy, alongside governance structures that ensure transparency and ethical conduct. By embracing sustainability, SBI Cards can enhance its brand reputation and attract a growing segment of environmentally conscious investors and customers.

The increasing adoption of digital payments and virtual credit cards by SBI Card customers significantly curtails the need for physical plastic and paper statements. This transition directly supports environmental sustainability goals by lowering plastic waste and paper usage, reflecting a growing commitment to eco-conscious practices across the financial sector.

For instance, in the fiscal year 2023-24, SBI Card reported a substantial increase in digital transactions, with over 80% of new card acquisitions being digital. This trend is expected to accelerate, further reducing the environmental footprint associated with card production and distribution.

In India, companies like SBI Cards are legally bound by the Companies Act to fulfill Corporate Social Responsibility (CSR) obligations. This means SBI Cards is expected to actively participate in initiatives that benefit society, such as environmental conservation efforts, promoting financial literacy among less privileged groups, or backing programs that enhance digital access. These activities are crucial for building a positive brand reputation and fostering goodwill.

For the fiscal year 2023-24, companies in India were mandated to spend 2% of their average net profits from the preceding three years on CSR activities. SBI Cards, as a significant player in the financial services sector, would likely direct its CSR spending towards areas aligning with its business operations and societal needs, potentially including financial inclusion campaigns that reach millions of unbanked individuals across India.

Energy Consumption of Digital Infrastructure

The growing dependence on digital systems to manage a vast number of daily transactions, like those handled by SBI Cards, directly translates to substantial energy usage. This puts pressure on companies to demonstrate the energy efficiency of their IT operations and their overall environmental impact.

As a significant digital entity, SBI Cards is likely to face increasing scrutiny concerning the energy consumption of its data centers and technological infrastructure. This scrutiny is part of a broader trend where businesses are being evaluated on their carbon footprint and sustainability practices.

In 2024, global data center energy consumption was estimated to be around 1.5% of total worldwide electricity usage, a figure projected to rise. For a company like SBI Cards, optimizing server efficiency and exploring renewable energy sources for its IT operations becomes crucial for mitigating environmental concerns and potential regulatory impacts.

- Rising Energy Demands: Digital infrastructure, including data centers and transaction processing systems, accounts for a significant and growing portion of global energy consumption.

- Corporate Responsibility: Companies like SBI Cards, heavily reliant on digital platforms, face increasing expectations from stakeholders to manage and reduce the energy footprint of their IT operations.

- Sustainability Focus: Efforts to improve energy efficiency in IT infrastructure and adopt greener energy sources are becoming critical for corporate environmental, social, and governance (ESG) performance.

- Industry Benchmarks: The financial services sector, including card companies, will likely see more emphasis on meeting industry benchmarks for data center power usage effectiveness (PUE) and carbon emissions reduction by 2025.

Adaptation to Climate-Related Financial Risks

Financial institutions like SBI Cards are increasingly scrutinized for their preparedness regarding climate-related financial risks. These risks can manifest as physical risks, such as the impact of extreme weather events on physical infrastructure or supply chains, or transition risks, stemming from the shift to a low-carbon economy. For instance, a severe flood in a key operational region could disrupt services, while changes in energy policy might affect the creditworthiness of businesses in carbon-intensive sectors, indirectly impacting loan portfolios.

The Reserve Bank of India (RBI) has been proactive in this area, issuing guidance on climate risk management for financial institutions. In its 2023 report, the RBI highlighted the need for banks and NBFCs to integrate climate risk into their governance, strategy, and risk management frameworks. This push for adaptation means SBI Cards might need to enhance its scenario analysis capabilities to understand potential financial impacts under various climate change pathways.

SBI Cards is likely to see evolving expectations around disclosure and reporting of climate-related financial risks. This could involve assessing the carbon footprint of its operations and its financed activities, although the direct impact on card services is less pronounced than for traditional lenders. However, investor pressure and regulatory requirements are driving a broader understanding of financial resilience, which inherently includes climate factors.

- Regulatory Focus: The RBI's emphasis on climate risk management for financial entities, as seen in its 2023 guidance, signals a growing expectation for adaptation.

- Scenario Analysis: Financial institutions are encouraged to conduct scenario analysis to understand potential impacts from physical and transition risks.

- Investor Expectations: Growing investor demand for Environmental, Social, and Governance (ESG) performance means SBI Cards may face increased scrutiny on its climate risk disclosures.

- Operational Resilience: While not directly exposed to physical assets like banks, SBI Cards must consider how extreme weather events could impact its IT infrastructure or customer service centers.

SBI Cards is increasingly focused on environmental sustainability, driven by investor demand and regulatory expectations for ESG compliance. The company's shift towards digital transactions, with over 80% of new card acquisitions being digital in FY 2023-24, significantly reduces paper and plastic waste.

The growing reliance on digital infrastructure necessitates attention to energy efficiency in IT operations, as global data center energy consumption continues to rise. SBI Cards must also navigate evolving climate-related financial risk assessments, as guided by the RBI, to ensure operational resilience and meet investor demands for transparent climate disclosures.

PESTLE Analysis Data Sources

Our PESTLE Analysis for SBI Cards and Payment Services is built on a foundation of official reports from the Reserve Bank of India, government economic surveys, and industry-specific publications. We also incorporate data from reputable financial news outlets and market research firms to ensure comprehensive coverage.