SBI Cards and Payment Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI Cards and Payment Services Bundle

SBI Cards and Payment Services operates in a dynamic sector where intense competition, significant buyer power, and the threat of substitutes shape its landscape. Understanding the influence of suppliers and the barriers to entry is crucial for navigating this market successfully. This brief overview hints at the complexities SBI Cards faces, but it only scratches the surface of the strategic pressures at play.

The complete report reveals the real forces shaping SBI Cards and Payment Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Payment network providers such as Visa, Mastercard, and India's own RuPay wield considerable bargaining power. Their indispensability in processing transactions means SBI Cards, like all issuers, is heavily reliant on their infrastructure and reach.

SBI Cards utilizes these networks to enable its credit card operations and to connect with a vast customer base throughout India. The limited number of major players in this sector creates a situation where SBI Cards faces significant costs and complexities if it were to switch to a different network, given existing infrastructure and established co-branding partnerships.

In 2024, the Indian digital payments market continued its robust growth, with RuPay, a domestic network, playing an increasingly vital role alongside international players. RuPay transactions saw significant volume increases, underscoring its importance in the Indian financial ecosystem and thus reinforcing the bargaining power of the network providers.

Technology and software vendors offering specialized payment processing, cybersecurity, and data analytics tools hold moderate bargaining power over SBI Cards. These services are fundamental for SBI Cards' digital infrastructure and operational integrity, making their disruption costly.

The proprietary nature of some of these advanced solutions, coupled with the specialized knowledge needed for their seamless integration and maintenance, can restrict SBI Cards' ability to switch vendors easily. This dependence, while not absolute, grants these suppliers a degree of leverage.

SBI Cards, despite its strong backing from State Bank of India, still needs to secure funding from other financial institutions. This includes getting lines of credit and various forms of debt to expand its operations and credit card offerings. For instance, in fiscal year 2023, SBI Cards raised significant funds through bond issuances, demonstrating its reliance on the broader debt market.

The terms and availability of this external funding directly affect SBI Cards' bottom line and its capacity to grow its customer base and product portfolio. Higher interest rates or tighter credit conditions from these financial suppliers can squeeze profit margins and slow down expansion plans.

Factors like prevailing interest rates, such as the Reserve Bank of India's repo rate, and the general liquidity within the financial system play a crucial role. When liquidity is abundant, the bargaining power of these financial institutions may be somewhat lessened, potentially leading to more favorable borrowing costs for SBI Cards.

Credit Bureaus and Data Providers

Credit bureaus like CIBIL and Experian are vital suppliers for SBI Cards, providing essential credit information for risk assessment and customer onboarding. The inability to access this data would significantly impede SBI Cards' loan underwriting and default management capabilities. Their specialized data and critical role in the financial ecosystem grant them substantial bargaining power.

- Data Dependency: SBI Cards relies heavily on credit bureaus for accurate scoring and identity verification, making switching suppliers difficult.

- Limited Alternatives: While some alternative data sources exist, the established credit bureaus offer a comprehensive and regulated view of creditworthiness, limiting direct substitutes.

- Data Quality and Regulation: The quality and regulatory compliance of data provided by these bureaus are paramount, reinforcing their position.

- Cost of Data: The fees charged by credit bureaus for accessing this critical data represent a significant operational cost for SBI Cards, highlighting the suppliers' leverage.

Co-branding Partners

Co-branding partners, while benefiting from SBI Card's payment infrastructure, also act as suppliers of their valuable customer base and brand equity. The strength of these partnerships directly impacts the appeal and success of co-branded card offerings. For instance, a popular airline or a major retail chain can leverage its extensive customer loyalty and brand recognition to negotiate more favorable terms with SBI Cards. This dynamic grants these partners significant bargaining power.

The bargaining power of co-branding partners is influenced by their market standing and customer reach. In 2023, SBI Card reported significant growth in its co-branded card portfolio, indicating the importance of these collaborations. For example, partnerships with travel companies or e-commerce platforms allow SBI Card to tap into new customer segments. The revenue share and marketing commitments are often dictated by the partner's ability to deliver a substantial and engaged customer base, thereby enhancing their leverage.

- Partner Brand Strength: The more recognized and trusted a co-branding partner's name, the greater their ability to dictate terms.

- Customer Base Size and Engagement: A large and active customer base directly translates to higher bargaining power for the partner.

- Exclusive Agreements: Partners with exclusive deals often hold more sway in negotiations.

- Market Share of Partner: A partner with a dominant market share in their respective industry has a stronger negotiating position.

Payment network providers like Visa, Mastercard, and RuPay hold substantial bargaining power due to their essential role in transaction processing. SBI Cards' reliance on their infrastructure for broad customer reach and transaction enablement means switching networks is complex and costly, reinforcing the providers' leverage.

In 2024, the increasing adoption and transaction volume of India's RuPay network further solidified the bargaining power of network providers. SBI Cards must adhere to the terms and fees set by these dominant players, impacting operational costs and strategic flexibility.

| Supplier Type | Bargaining Power Assessment | Key Factors |

|---|---|---|

| Payment Networks (Visa, Mastercard, RuPay) | High | Indispensability, extensive reach, high switching costs, network effects. |

| Technology & Software Vendors | Moderate | Proprietary solutions, specialized integration needs, data security reliance. |

| Financial Institutions (Debt Providers) | Moderate to High | Reliance on credit lines, prevailing interest rates, market liquidity. |

| Credit Bureaus (CIBIL, Experian) | High | Critical data dependency for underwriting, limited alternatives, data quality. |

| Co-branding Partners | Moderate to High | Customer base size and engagement, partner brand strength, exclusive agreements. |

What is included in the product

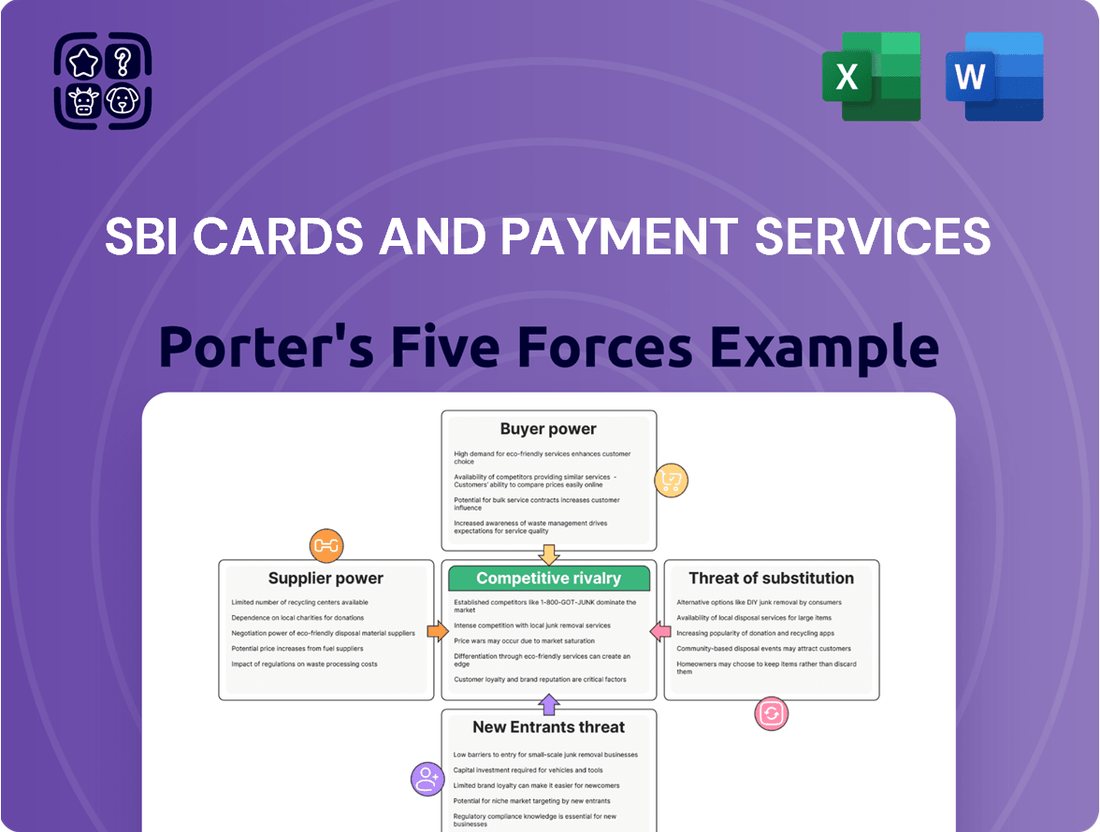

This analysis dissects the competitive forces impacting SBI Cards and Payment Services, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the Indian payments industry.

SBI Cards and Payment Services Porter's Five Forces Analysis acts as a pain point reliever by providing a clear, one-sheet summary of all competitive forces—perfect for quick, informed decision-making.

Customers Bargaining Power

Customers in the Indian credit card market face a landscape brimming with choices. Major banks like HDFC Bank, ICICI Bank, and Axis Bank, alongside numerous other financial institutions, offer a wide spectrum of credit card products. This abundance of alternatives significantly empowers consumers.

The ease with which customers can switch between providers, often with minimal hassle, directly translates to increased bargaining power. For instance, a customer dissatisfied with one card's rewards program can readily explore offerings from competitors, comparing benefits and fees with just a few clicks.

This competitive environment means that card issuers must constantly innovate and offer attractive features to retain their customer base. SBI Card, like its peers, needs to remain competitive on aspects such as annual fees, interest rates, and reward points to avoid losing customers to rivals.

In 2023, the Indian credit card market saw a significant increase in card issuances, with public sector banks and private sector banks both contributing to this growth, indicating a dynamic and competitive market. This continued expansion reinforces the notion that customers have ample options at their disposal.

Indian consumers have become notably more price-sensitive, actively seeking out credit cards that offer compelling rewards, cashback, and discounts. This heightened awareness of value means customers hold significant bargaining power, readily switching to providers that best align with their spending habits and benefit expectations.

SBI Cards, like its competitors, must constantly innovate its benefit structures to attract and retain this discerning customer base. For instance, during 2024, the average annual percentage rate (APR) for credit cards in India remained a key consideration for consumers, with many actively comparing these rates alongside reward point accumulation.

The ability of customers to easily compare offerings and switch providers based on superior rewards or lower fees directly amplifies their bargaining power. This dynamic forces SBI Cards to maintain competitive pricing and attractive loyalty programs, ensuring they meet the evolving demands of the Indian market.

The bargaining power of customers in the credit card industry, particularly concerning digital platforms, is significantly influenced by low switching costs. It's incredibly easy for consumers to apply for new credit cards online, often completing the process in minutes.

This digital ease means customers can readily explore and adopt new payment solutions if better offers or features become available. While loyalty programs exist, the streamlined digital onboarding process by many issuers simplifies the transition for customers seeking improved rewards or lower interest rates.

For instance, in 2024, the average time to approve a new credit card application online was reported to be under 10 minutes for many major issuers, highlighting the low effort involved in switching. This further empowers customers to leverage competition amongst card providers.

Information Transparency

Information transparency significantly boosts the bargaining power of customers for SBI Cards. The widespread availability of data through comparison websites and fintech platforms means consumers can easily scrutinize card features, annual fees, interest rates, and reward programs. For instance, as of early 2024, numerous financial aggregators in India allow users to compare credit card offerings from various issuers side-by-side, highlighting differences in cashback percentages, lounge access benefits, and annual charges. This ease of access to comparative information empowers customers to demand better terms or readily switch to providers offering more attractive value propositions.

The enhanced transparency directly translates to increased customer leverage. Consumers are no longer reliant on limited information provided by issuers. They can actively seek out the best deals, leading to a more competitive market where SBI Cards must continuously innovate and offer compelling benefits to retain and attract customers. This dynamic means that customers are better positioned to negotiate for lower interest rates or fee waivers, knowing that attractive alternatives are just a click away.

- Informed Decision-Making: Customers can easily compare features like reward points, annual fees, and interest rates across different credit card providers.

- Negotiating Power: Access to transparent data empowers customers to negotiate for better terms or switch to competitors offering more favorable conditions.

- Market Competition: The proliferation of comparison platforms fuels competition, forcing card issuers to offer more attractive benefits and competitive pricing.

- Customer Loyalty: Transparency and competitive offerings influence customer loyalty, as consumers are more likely to stay with providers that offer consistent value.

Emergence of Digital-First Payment Options

The swift rise of digital payment solutions like UPI has significantly boosted customer bargaining power against traditional credit card providers. Customers now have readily available alternatives for everyday purchases, lessening their dependence on credit cards and giving them more leverage.

This shift allows consumers to choose the most cost-effective or convenient payment method for each transaction, directly impacting the transaction volumes for credit card companies. For instance, UPI transactions in India saw a massive surge, processing over 10 billion transactions in the financial year 2023-24, demonstrating its widespread adoption and appeal as a no-cost alternative for many consumers.

- Increased Payment Diversification: Customers can easily switch between credit cards, UPI, and other digital wallets, reducing lock-in effects.

- Reduced Reliance on Credit: For many smaller transactions, digital alternatives offer a zero-cost option, decreasing the necessity of credit card usage.

- Price Sensitivity: The availability of free or low-cost digital payment options makes customers more sensitive to any fees or interest charges levied by credit card companies.

Customers in India possess substantial bargaining power within the credit card market due to the sheer volume of competing issuers and the ease of switching between them. This is further amplified by heightened price sensitivity and a demand for superior rewards, forcing providers like SBI Card to continuously offer competitive rates and benefits. The proliferation of digital payment alternatives, such as UPI, also reduces dependence on credit cards, giving consumers more leverage to seek out the best value.

For instance, in 2024, the average annual percentage rate (APR) remained a critical factor for consumers, with many actively comparing these rates alongside reward point accumulation. The ease of online applications, with approval times often under 10 minutes for major issuers, further simplifies the process of switching, empowering customers to leverage competition.

Preview Before You Purchase

SBI Cards and Payment Services Porter's Five Forces Analysis

This preview showcases the precise Porter's Five Forces analysis for SBI Cards and Payment Services that you will receive immediately after purchase, ensuring full transparency and no hidden content. You're looking at the actual, professionally formatted document that details the competitive landscape, including the intensity of rivalry, threat of new entrants, bargaining power of buyers, bargaining power of suppliers, and the threat of substitute products for SBI Cards. This comprehensive analysis is ready for your immediate download and use, providing valuable strategic insights without any placeholders or sample content. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth understanding of SBI Cards' market position.

Rivalry Among Competitors

The Indian credit card landscape is fiercely competitive, with established banking giants like HDFC Bank, ICICI Bank, and Axis Bank holding significant sway. These institutions, alongside SBI Cards, leverage their vast branch networks and substantial customer bases to capture market share.

These major banks boast considerable financial muscle and widespread brand recognition, enabling them to invest heavily in marketing and product innovation. This allows them to aggressively vie for new customers and retain existing ones, intensifying the rivalry for SBI Cards.

For instance, in FY2023, HDFC Bank reported a credit card customer base exceeding 19 million, highlighting the scale of competition SBI Cards faces. Similarly, ICICI Bank and Axis Bank also command millions of credit card customers, making it a constant battle for dominance.

The presence of these formidable players means SBI Cards must continuously differentiate its offerings, focusing on customer loyalty programs, attractive rewards, and seamless digital experiences to stand out in this crowded market.

Competitors in the Indian credit card market, including HDFC Bank and ICICI Bank, are relentlessly introducing innovative card products, such as premium travel cards and co-branded offerings with popular airlines and e-commerce platforms. SBI Card itself reported a 25% year-on-year increase in new customer acquisitions in FY24, driven by these very strategies. This constant stream of new card variants and aggressive marketing campaigns, particularly focusing on digital onboarding and personalized rewards, significantly heightens competitive rivalry.

The competition among credit card companies, including SBI Cards, is intensifying as firms aggressively pursue digital channels for customer acquisition and engagement. This digital-first approach means a strong emphasis on user-friendly mobile applications and streamlined online onboarding processes. SBI Card's FY24 financial results, for instance, show a continued expansion in its customer base, partly driven by these digital initiatives, with digital channels playing a crucial role in reaching new segments.

Investing in personalized digital experiences, such as tailored offers and proactive customer service through apps, has become a key differentiator. Companies are competing to offer the most intuitive and rewarding digital journey to attract and retain customers. This focus is evident in the increasing digital transaction volumes reported by major players in the sector, indicating a strong customer preference for online interactions.

Market Share Dynamics and Growth Rates

The Indian credit card market is experiencing robust growth, but a recent slowdown in new card issuances has intensified rivalry. This means companies are fighting harder for the customers they already have and for a bigger slice of the market. For instance, while the overall credit card market expanded, the pace of new customer acquisition saw some moderation in late 2023 and early 2024, pushing incumbents to focus on retention and cross-selling.

Companies are keenly observing competitor growth figures and adjusting their strategies accordingly to either hold their ground or gain a competitive edge. This dynamic environment requires constant vigilance and strategic agility.

- Market Growth vs. Issuance Slowdown: While the Indian credit card market continues to expand, the rate of new card issuances has moderated, increasing the fight for existing customer bases.

- Intensified Competition: This slowdown in new customer acquisition fuels more aggressive competition among players vying for market share.

- Strategic Adaptations: Financial institutions are closely monitoring each other's performance metrics, such as customer acquisition cost and market share gains, to refine their strategic approaches.

- Focus on Retention: With fewer new customers entering the market, there's a greater emphasis on retaining existing cardholders through enhanced loyalty programs and superior customer service.

Regulatory Impact on Lending Norms

The Reserve Bank of India's (RBI) recent directives, like increasing risk weightage on unsecured loans, directly affect the cost of capital for credit card companies such as SBI Card. This has led to a notable impact on their profitability by raising the expenses associated with extending credit. For instance, a 25% increase in risk weight for unsecured consumer credit could significantly increase the capital required for each rupee lent.

This evolving regulatory landscape forces companies to rethink their competitive strategies. They must adapt their pricing, product offerings, and risk management frameworks to comply with new norms. This continuous adjustment to regulatory changes adds a distinct layer of complexity to the competitive rivalry within the credit card industry.

- RBI's increased risk weightage on unsecured loans impacts borrowing costs for credit card issuers.

- This directly influences the profitability of companies like SBI Card.

- Companies must adjust their business models and compliance strategies.

- The dynamic regulatory environment intensifies competitive pressures.

The competitive rivalry in the Indian credit card market is intense, primarily driven by large public sector banks and private sector banks, alongside emerging fintech players. These competitors, including HDFC Bank, ICICI Bank, and Axis Bank, leverage extensive customer bases and significant financial resources to launch innovative products and aggressive marketing campaigns. For example, HDFC Bank alone reported a credit card customer base exceeding 19 million in FY2023, underscoring the scale of the challenge for SBI Cards. This robust competition necessitates continuous differentiation through superior loyalty programs and digital experiences.

A key aspect of this rivalry is the digital-first approach adopted by most players, focusing on user-friendly mobile applications and streamlined online onboarding. SBI Card's own FY24 performance, showing continued customer base expansion partly due to these digital efforts, highlights this trend. Companies are investing heavily in personalized digital offerings and proactive customer service to attract and retain cardholders, a strategy evident in the increasing digital transaction volumes across the sector.

The market dynamics, particularly a moderation in new card issuances observed in late 2023 and early 2024, have further intensified competition. This scenario pushes companies to focus more on customer retention and cross-selling, leading to a heightened emphasis on loyalty programs and enhanced customer service to maintain and grow their market share. Companies closely monitor each other's growth figures and customer acquisition costs to refine their strategies and maintain a competitive edge.

Regulatory changes, such as the RBI's increased risk weightage on unsecured loans, directly impact the cost of capital for credit card issuers like SBI Card, affecting their profitability and forcing strategic adjustments. This evolving regulatory landscape necessitates continuous adaptation in pricing, product offerings, and risk management, adding another layer of complexity to the competitive rivalry.

| Key Competitors | Customer Base (Approx. FY23) | Key Competitive Strategies |

| HDFC Bank | > 19 million | Premium cards, co-branding, extensive digital offerings, strong rewards programs |

| ICICI Bank | Millions | Innovative product launches, aggressive digital marketing, personalized offers |

| Axis Bank | Millions | Focus on customer acquisition through digital channels, loyalty programs, partnerships |

| SBI Card | ~1.6 crore (as of Dec 2023) | Digital onboarding, customer loyalty, rewards, co-branded cards, adapting to regulatory changes |

SSubstitutes Threaten

The Unified Payments Interface (UPI) presents a significant threat of substitution for SBI Card. UPI's widespread adoption in India, enabling instant and often free transactions directly from bank accounts, makes it a compelling alternative for many everyday purchases. By early 2024, UPI had processed over 100 billion transactions, demonstrating its massive scale and user trust.

For smaller ticket items, UPI's convenience and lack of fees directly compete with credit card usage, potentially reducing the frequency with which customers reach for their SBI Card. This shift is particularly noticeable as UPI continues to integrate more merchants and services, further solidifying its position as a go-to payment method.

Buy Now Pay Later (BNPL) services present a significant threat by offering consumers interest-free short-term credit, directly challenging the revolving credit facility traditionally provided by credit cards like those from SBI Cards. This alternative credit option appeals to a broad consumer base, especially younger demographics and those new to credit, due to its perceived ease of access and often less stringent approval processes.

The growth trajectory of BNPL is substantial, indicating its increasing traction as a payment method. For example, global BNPL transaction volume was projected to reach approximately $1.6 trillion by 2025, a stark increase from earlier years, highlighting the competitive pressure these services exert on established credit card providers.

The attractiveness of BNPL lies in its simple, often integrated checkout experience that can defer payments without immediate interest charges, making it a compelling alternative to traditional credit cards for everyday purchases. This convenience factor, coupled with targeted marketing, allows BNPL providers to capture market share, particularly among consumers who may find traditional credit card application processes more burdensome.

SBI Cards needs to consider how BNPL's appeal, especially its user-friendly interface and flexible payment terms, directly siphons off transaction volume that might otherwise be processed through their credit card products. As BNPL adoption continues to rise, its role as a substitute payment method will likely intensify.

Personal loans from banks and non-banking financial companies (NBFCs) present a significant threat. For substantial expenses or extended repayment terms, these credit products directly compete with credit card Equated Monthly Installments (EMIs) or substantial outstanding balances. In 2023, personal loan disbursals in India saw robust growth, reflecting consumer confidence and a demand for flexible financing options beyond credit cards.

Debit Cards and Digital Wallets

Debit cards represent a significant substitute for credit cards, directly accessing funds from a user's bank account. This eliminates the need for borrowing and associated interest charges, appealing to a broad segment of consumers, particularly those managing their spending tightly. For instance, as of Q4 2023, debit card transactions continued to hold a substantial share of the overall payment landscape in India, reflecting their ingrained usage.

Digital wallets further intensify this threat by offering a streamlined payment experience. These platforms can store debit card information or be pre-loaded with funds, providing a convenient alternative that bypasses the traditional credit card lifecycle. The rapid adoption of digital payment solutions, accelerated by initiatives like UPI, means consumers have readily available, often free, alternatives to credit card spending.

- Debit Card Dominance: Debit cards are a fundamental substitute, especially for budget-conscious consumers.

- Digital Wallet Convenience: Mobile payment solutions offer a frictionless alternative, reducing the need for physical credit cards.

- Cost Avoidance: Both debit cards and digital wallets allow spending without incurring credit card interest or fees.

- Market Trends: The growing penetration of digital payments in India, supported by strong government initiatives, bolsters the threat of substitutes.

Government Push for Digital Transactions

The Indian government's robust promotion of digital transactions significantly intensifies the threat of substitutes for credit cards. Initiatives like the Unified Payments Interface (UPI) and the push for financial inclusion via programs such as Jan Dhan Yojana encourage widespread adoption of alternative digital payment methods. This governmental backing creates a vibrant ecosystem of readily available and often lower-cost payment options, directly challenging the dominance of traditional credit card services.

For instance, UPI transactions in India have seen exponential growth. By April 2024, the total volume of UPI transactions had surpassed 1.3 billion, with a value of over ₹1.8 trillion. This demonstrates a clear shift in consumer behavior towards digital payments beyond cards.

- Government Mandates and Promotions: The government actively promotes digital payment solutions, making them more accessible and appealing to a wider population.

- Rise of UPI: Unified Payments Interface (UPI) offers a seamless and integrated platform for peer-to-peer and merchant payments, directly competing with credit card functionalities.

- Financial Inclusion Focus: Initiatives aimed at bringing more citizens into the formal banking system often prioritize digital payment methods, expanding the base of non-card users.

- Cost-Effectiveness: Many digital alternatives, particularly UPI, often involve lower transaction fees for merchants and consumers compared to credit card processing fees, making them an attractive substitute.

The threat of substitutes for SBI Card is significant, driven by the rise of digital payment platforms and alternative credit solutions. UPI, debit cards, and digital wallets offer increasingly convenient and cost-effective ways for consumers to transact, directly impacting credit card usage for everyday purchases. Furthermore, Buy Now Pay Later (BNPL) services and personal loans provide alternatives for consumers seeking short-term credit or financing for larger expenses, diverting potential business from traditional credit card offerings.

The Indian digital payments landscape is rapidly evolving, with UPI transactions reaching over 1.3 billion in April 2024, demonstrating a clear consumer preference for instant, bank-to-bank transfers. This growth, coupled with the continued prevalence of debit card usage, presents a substantial challenge to credit card providers like SBI Card.

BNPL services are projected to reach approximately $1.6 trillion globally by 2025, indicating a strong consumer uptake for these flexible credit options. This trend highlights a growing segment of the market that may opt for BNPL over traditional credit card revolving credit facilities.

| Substitute Type | Key Features | Impact on SBI Card | Market Trend/Data Point |

| UPI | Instant, direct bank transfers, often free | Reduces credit card usage for small transactions | Over 1.3 billion transactions in April 2024 |

| Debit Cards | Access to existing funds, no interest | Primary alternative for budget-conscious consumers | Substantial share of payment landscape (Q4 2023) |

| Digital Wallets | Streamlined payments, can link to debit/credit cards | Convenient alternative, may bypass direct credit card use | Rapid adoption driven by digital payment push |

| BNPL Services | Interest-free short-term credit | Competes with credit card EMIs and revolving credit | Projected $1.6 trillion global volume by 2025 |

| Personal Loans | Financing for larger expenses, extended terms | Alternative to credit card balance transfers or large purchases | Robust growth in disbursals in 2023 |

Entrants Threaten

The credit card industry in India operates under a strict regulatory framework overseen by the Reserve Bank of India (RBI). This includes substantial capital requirements for new issuers, a rigorous licensing process, and ongoing adherence to complex compliance standards. For instance, in 2024, the RBI continues to emphasize robust risk management and data security protocols for all credit card companies.

These stringent regulatory hurdles significantly elevate the barrier to entry for potential new players. Obtaining the necessary approvals and establishing the infrastructure to meet these compliance demands requires considerable investment and expertise, thereby limiting the number of new entrants looking to compete with established players like SBI Card.

Establishing a credit card business demands significant capital. For instance, in 2023, leading players like SBI Cards invested heavily in technology upgrades and expanding their customer base, requiring billions in capital expenditure to maintain competitiveness. This substantial upfront investment acts as a major barrier for potential new entrants.

The need for robust technology infrastructure, encompassing secure payment processing and data analytics, coupled with extensive customer acquisition costs and sophisticated risk management systems, necessitates a deep financial well. Newcomers must also maintain a strong balance sheet to support lending activities, a hurdle that existing, well-capitalized firms like SBI Cards have already overcome.

Consequently, the sheer scale of capital required to launch and sustain a credit card operation makes it exceedingly difficult for new players to enter and meaningfully challenge established incumbents. This high capital threshold effectively limits the threat of new entrants in the credit card market.

SBI Cards, along with other established players, enjoys significant brand recognition and deep-seated customer trust built over years of reliable service. This is a formidable barrier for any newcomer aiming to penetrate the Indian credit card market.

The process of cultivating such brand loyalty and trust requires substantial time and considerable marketing expenditure, presenting a significant challenge for new entrants. For instance, SBI Cards reported a customer base of over 1.6 crore as of March 2024, a testament to its established market presence.

Economies of Scale and Network Effects

Existing players in the credit card industry, like SBI Card, benefit significantly from economies of scale. This allows them to process a vast number of transactions more efficiently and negotiate better terms with payment networks. For instance, in 2023, SBI Card reported a total income of INR 14,735 crore, demonstrating the scale of their operations.

Network effects create a formidable barrier to entry. A larger customer base and a wider acceptance network among merchants make the service more valuable for everyone. This creates a powerful virtuous cycle that new entrants struggle to match. As of December 2023, SBI Card had over 1.75 crore credit card customers, highlighting the strength of its network.

- Economies of Scale: Lower per-unit costs in transaction processing, data management, and network negotiations for established players.

- Network Effects: Increased value proposition for customers and merchants as the user and acceptance base grows, making it harder for new entrants to gain traction.

- Customer Acquisition Cost: High initial marketing and incentive costs for new entrants to build a comparable customer base and merchant network.

- Brand Loyalty: Established players benefit from existing brand recognition and customer loyalty, which is difficult and expensive for newcomers to overcome.

Fintech Disruption and Niche Entrants

While traditional entry barriers for banks remain high, the threat of new entrants in the credit card space is evolving. Fintech companies and neobanks are carving out niches by leveraging technology for streamlined onboarding processes and innovative credit solutions. For instance, Buy Now Pay Later (BNPL) services have seen significant growth, offering alternative credit models that appeal to specific consumer segments. This digital-first approach allows these entrants to target underserved markets and specific needs, potentially impacting established players like SBI Cards.

The rapid adoption of digital platforms means that new entrants can scale quickly without the legacy infrastructure of traditional banks. Their agility allows them to experiment with new credit scoring methods and customer acquisition strategies. By focusing on user experience and personalized offerings, these fintechs can attract a younger demographic and those seeking alternatives to conventional credit products. This creates a competitive pressure that SBI Cards must continually monitor and respond to through its own digital transformation efforts.

In 2024, the fintech landscape continues to be dynamic. BNPL providers, for example, have demonstrated substantial user growth, with some platforms reporting millions of active users. This indicates a tangible shift in consumer preferences for flexible and easily accessible credit. The ability of these new entrants to integrate seamlessly into e-commerce platforms further amplifies their reach and competitive threat.

- Fintechs focus on niche segments, like BNPL, disrupting traditional credit card models.

- Digital-first players offer faster onboarding and innovative credit solutions.

- Targeting underserved markets and specific consumer needs is a key strategy for new entrants.

- The agility of fintechs allows for rapid scaling and experimentation with credit products.

The threat of new entrants for SBI Card remains moderate due to substantial regulatory hurdles and high capital requirements, with the RBI's stringent licensing and compliance standards acting as significant deterrents. For instance, in 2024, the RBI continues to emphasize robust risk management and data security, demanding considerable investment from any new player.

Established players like SBI Card benefit from strong brand loyalty and economies of scale, exemplified by SBI Card's customer base exceeding 1.6 crore as of March 2024, making it difficult for newcomers to compete on customer acquisition and operational efficiency.

However, the rise of agile fintechs and BNPL services presents an evolving threat, as these digital-first entrants can quickly capture niche markets and offer innovative credit solutions, potentially impacting SBI Card's market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for SBI Cards and Payment Services is built upon a foundation of robust data from primary sources like company investor relations, annual reports, and direct competitor disclosures. We supplement this with insights from reputable secondary sources, including industry research reports from firms like CRISIL and domestic banking sector analyses, to provide a comprehensive view of the competitive landscape.