Sana Biotechnology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sana Biotechnology Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Sana Biotechnology. Discover how political shifts, economic volatility, and evolving social attitudes are shaping the company’s future. Understand the technological advancements and regulatory landscapes that present both opportunities and challenges. Download the full version now and get actionable intelligence at your fingertips to strengthen your own market strategy.

Political factors

Government healthcare policies are a major force shaping the biotechnology industry. These policies, which include research and development grants, tax breaks for innovation, and direct funding for public health programs, can significantly boost or slow down the progress of new medical treatments. For Sana Biotechnology, shifts in these government initiatives directly affect their ability to develop and bring therapies to market, influencing their strategic decisions and the availability of investment capital. For example, the U.S. government's commitment to advancing cancer research through the National Institutes of Health (NIH) provides crucial funding that can support early-stage biotech projects.

The stringency and efficiency of regulatory bodies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) significantly impact the timeline and cost for bringing engineered cell therapies to market. For instance, the FDA's accelerated approval pathway, while offering speed, still involves rigorous data collection and review, a process that can take years and considerable investment. In 2023, the FDA continued to refine its processes for cell and gene therapies, aiming for both speed and safety, a balance that directly influences Sana Biotechnology's ability to launch its products.

Political discourse surrounding unmet medical needs often pushes for faster drug approvals, creating a dynamic environment for companies like Sana Biotechnology. However, this is often counterbalanced by increased scrutiny on long-term safety and efficacy. This push-and-pull can lead to shifts in regulatory expectations, requiring significant resource allocation and strategic adaptability from biotechnology firms navigating these complex pathways to market.

Global political stability and evolving trade agreements are critical for Sana Biotechnology. These factors directly influence the company's ability to secure vital raw materials, conduct crucial international clinical trials, and gain access to diverse global markets. For instance, in 2024, the World Trade Organization reported ongoing discussions around new trade pacts that could streamline cross-border movement of goods and services, potentially benefiting biopharmaceutical companies like Sana.

Geopolitical tensions and trade disputes present significant operational risks. Such conflicts can disrupt complex supply chains, leading to increased costs for essential components and finished products. Furthermore, these tensions can erect barriers to market entry, hindering Sana Biotechnology's strategic expansion plans into promising new regions. The ongoing trade friction between major economic blocs in 2024 has already demonstrated how swiftly these disruptions can materialize.

International collaboration, a cornerstone of scientific advancement, is also heavily shaped by the political landscape. Favorable diplomatic relations foster an environment conducive to research partnerships and the sharing of scientific knowledge. Equally important is robust intellectual property protection; strong international agreements ensure that Sana Biotechnology’s innovations are safeguarded as it operates and expands globally.

Intellectual Property Protection Policies

Intellectual property protection is paramount for Sana Biotechnology, as its core business relies on innovative therapies stemming from patented research. Strong patent laws and rigorous enforcement are essential for safeguarding these innovations and maintaining market exclusivity, a crucial factor in recouping substantial R&D investments. For instance, in 2024, the global biotechnology sector saw continued robust investment in IP, with patent filings remaining a key indicator of innovation pipeline strength. Government policies regarding patent duration, compulsory licensing provisions, and measures against IP theft directly impact Sana's competitive positioning and future revenue streams. The company's ability to secure and defend its intellectual property underpins its valuation and its capacity to attract further investment.

Key aspects of intellectual property protection relevant to Sana Biotechnology include:

- Patent Duration: The length of patent protection directly influences the period of market exclusivity for Sana's therapeutic innovations.

- Compulsory Licensing: Government policies allowing compulsory licensing can impact Sana's ability to maintain exclusive rights to its patented technologies.

- IP Theft Enforcement: The effectiveness of legal frameworks in preventing and prosecuting intellectual property theft is vital for protecting Sana's research and development investments.

- International IP Treaties: Adherence to and alignment with international intellectual property agreements affect Sana's global market access and protection of its innovations abroad.

Public Health Priorities and Biodefense Initiatives

Government focus on public health challenges, such as the ongoing efforts to combat cancer and diabetes, directly influences research funding and can expedite regulatory processes for new treatments. Sana Biotechnology's work in cell and gene therapies aligns with these critical areas. For instance, the US National Institutes of Health (NIH) allocated approximately $47.7 billion to biomedical research in fiscal year 2023, with a significant portion directed towards disease-specific initiatives that could benefit companies like Sana.

Biodefense initiatives present another avenue for companies possessing advanced cell engineering expertise. The increasing awareness of potential biological threats has led to heightened government investment in preparedness and countermeasures. Sana Biotechnology's platform technology for engineered cells could be highly relevant to developing novel therapies for biodefense applications. In 2024, the US Department of Health and Human Services (HHS) announced plans to invest further in biodefense research and development, signaling a supportive environment for innovative biotech solutions.

- Government funding for public health research, like that provided by the NIH, directly supports the development of novel therapies.

- Sana Biotechnology's focus on cell and gene therapies positions it to benefit from increased investment in areas like oncology and immunology.

- Biodefense initiatives create market opportunities for companies with advanced cell engineering capabilities to develop countermeasures.

- The US government's commitment to biodefense research in 2024 suggests a favorable landscape for companies contributing to national health security.

Government policies significantly influence Sana Biotechnology's operational landscape, particularly concerning research grants and tax incentives aimed at fostering innovation in the life sciences sector. Favorable government policies, such as those supporting advanced therapy development, can accelerate Sana's progress and market entry. For instance, the U.S. Inflation Reduction Act of 2022 includes provisions that could impact drug pricing and R&D investment, a factor Sana must monitor closely.

Regulatory frameworks established by agencies like the FDA and EMA are critical for the approval and commercialization of Sana Biotechnology's engineered cell therapies. The FDA’s ongoing efforts to streamline the review process for cell and gene therapies, as seen in its 2024 guidance updates, can reduce time-to-market. However, the stringent data requirements for demonstrating safety and efficacy remain a significant hurdle, necessitating substantial investment in clinical trials.

Geopolitical stability and international trade agreements directly affect Sana Biotechnology's ability to source raw materials and access global markets for its innovative therapies. In 2024, ongoing trade dialogues between major economic blocs aim to facilitate cross-border commerce, potentially easing supply chain logistics for biopharmaceutical companies. Conversely, trade disputes can introduce volatility, impacting material costs and market access.

Intellectual property protection is fundamental to Sana Biotechnology's business model, safeguarding its proprietary cell engineering technologies. Robust patent laws and enforcement mechanisms are vital for ensuring market exclusivity and recouping R&D expenditures. Global patent filings in the biotechnology sector remained strong in 2023 and early 2024, underscoring the importance of IP for innovation and investment.

What is included in the product

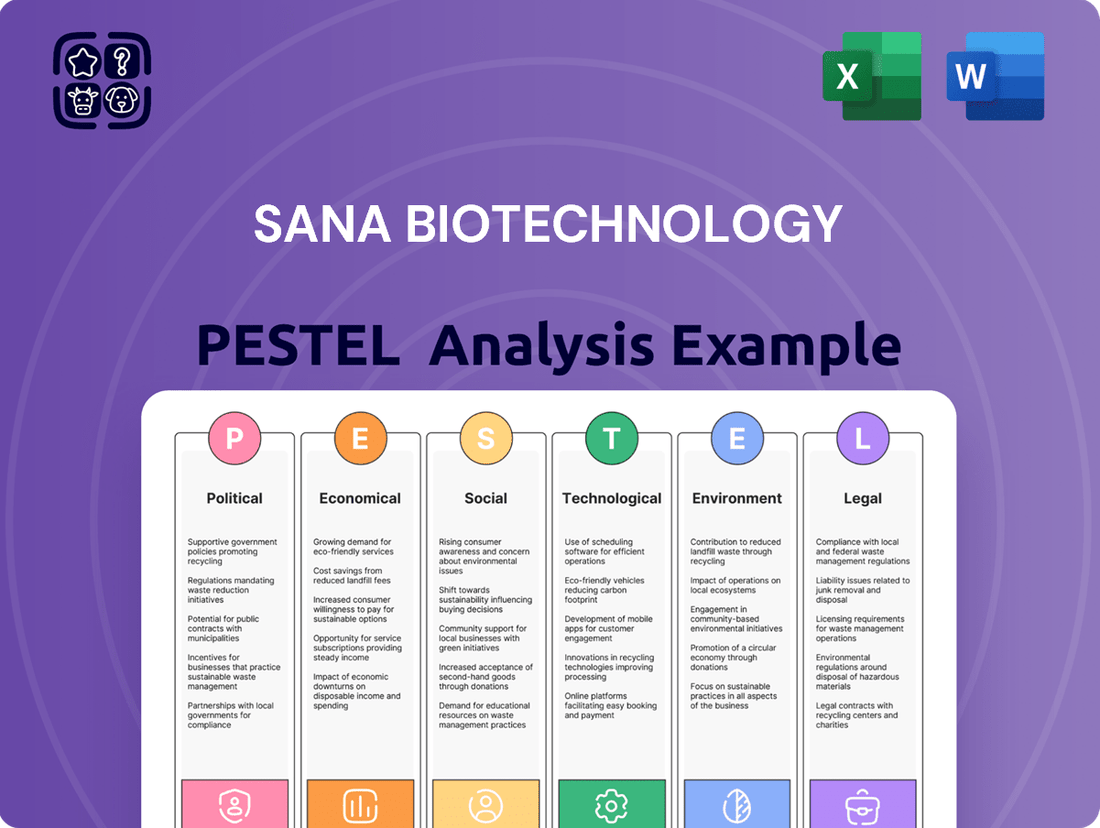

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Sana Biotechnology, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for Sana Biotechnology.

This PESTLE analysis for Sana Biotechnology offers a streamlined approach to identifying and mitigating external challenges, acting as a pain point reliever by proactively addressing potential market disruptions and regulatory hurdles.

Economic factors

Sana Biotechnology's research and development hinges on the flow of capital from venture capital, private equity, and public markets. For instance, the global venture capital funding for life sciences, including biotech, saw significant activity in 2024, with major rounds continuing to fuel innovation, though some sectors experienced a slight recalibration compared to peak years. This availability directly influences Sana's capacity to fund its ambitious R&D pipeline, from early-stage discovery to late-stage clinical trials.

Economic downturns or shifts in investor sentiment can significantly impact this funding landscape. A contraction in the broader economy or a more cautious approach from investors towards the biotech sector can lead to reduced capital availability, potentially slowing down Sana's critical drug development processes. For example, while overall IPO markets have shown some recovery in 2024, the biotech sector faced specific challenges impacting its access to public funding compared to prior periods.

A strong and stable investment climate is therefore paramount for Sana Biotechnology's long-term growth and its ability to drive innovation. When capital is readily accessible and investors are confident, it enables sustained investment in cutting-edge research and the progression of promising therapeutic candidates through the complex development pathway.

Healthcare spending trends and government reimbursement policies are crucial for Sana Biotechnology. In 2024, global healthcare spending is projected to reach approximately $10 trillion, with a significant portion allocated to pharmaceuticals and advanced therapies. Favorable reimbursement rates for cell and gene therapies, such as those implemented for CAR-T therapies, directly impact market access and revenue potential for companies like Sana Biotechnology. However, rising healthcare costs and budgetary constraints on governments can create hurdles for widespread patient adoption of high-cost treatments.

Inflationary pressures directly impact Sana Biotechnology by increasing the cost of crucial raw materials, specialized manufacturing, and skilled labor needed for cell therapy development. For instance, the U.S. Producer Price Index (PPI) for chemicals, a key input for many biotechnologies, saw significant increases in 2023, impacting supply chain costs. This rise in operational expenses can compress profit margins, forcing companies like Sana to consider price hikes for their advanced therapies, which could affect patient access and market penetration.

Global Economic Growth and Market Access

The general health of the global economy significantly impacts consumer spending and the capacity of healthcare systems to embrace novel, costly treatments. In 2024, projections for global economic growth, while varied, generally anticipate a moderate expansion. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that influences the disposable income available for healthcare advancements.

Economic expansion in crucial markets directly correlates with Sana Biotechnology's potential to broaden its patient reach and increase revenue. Strong economic performance in regions like North America and Europe, where healthcare spending is typically robust, offers a more receptive environment for innovative therapies. Conversely, economic downturns or recessions in these key areas can hinder market penetration and dampen sales volumes.

For Sana Biotechnology, this means that periods of robust global economic activity, such as the anticipated growth in emerging markets in 2025, could translate into increased adoption of its gene therapies. However, if major economies experience a slowdown, such as a potential dip in European GDP growth below 1% in late 2024, it could constrain the market's ability to absorb new, high-value treatments, impacting Sana's revenue projections.

- Global economic growth projections for 2024 hover around 3.2%, according to the IMF, influencing healthcare investment.

- Economic expansion in developed markets like the US and EU provides greater capacity for adopting advanced therapies.

- Conversely, economic stagnation or recession in target regions can limit market access and sales for new biotechnologies.

- Emerging markets are expected to contribute to global growth in 2025, potentially opening new avenues for market penetration.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Sana Biotechnology, particularly as it navigates international markets or sources materials globally. Changes in exchange rates can directly affect the reported value of revenue earned from sales in foreign currencies and increase the cost of imported goods and services. For instance, a strengthening US dollar against other major currencies could reduce the dollar-equivalent value of Sana Biotechnology's overseas earnings.

This volatility introduces a layer of financial risk, making it more challenging to forecast profits and manage budgets effectively on a global scale. For example, if Sana Biotechnology has significant research and development expenses denominated in Euros, a depreciation of the Euro against the dollar would increase those costs in dollar terms. The company’s financial planning must account for these potential swings to maintain financial stability and achieve its strategic objectives.

To counter these risks, Sana Biotechnology may implement hedging strategies. These can include forward contracts, options, or other financial instruments designed to lock in exchange rates for future transactions. Such measures are crucial for protecting profit margins and ensuring predictable financial outcomes in an unpredictable global economic landscape.

- Impact on Revenue: A stronger USD can decrease the reported value of foreign sales for Sana Biotechnology.

- Cost of Imports: Fluctuations affect the dollar cost of materials and services sourced internationally.

- Financial Risk: Significant currency volatility complicates global financial planning and can introduce unforeseen costs.

- Hedging Necessity: Strategies like forward contracts are vital for mitigating exchange rate-related financial risks.

Interest rate movements directly influence Sana Biotechnology's cost of capital and the attractiveness of its future revenue streams. Higher interest rates, such as those seen in 2023 and continuing into 2024 as central banks manage inflation, increase the cost of borrowing for R&D and expansion. This can make it more expensive for Sana to fund its operations through debt, potentially impacting investment decisions. Conversely, lower interest rates can reduce borrowing costs and make the company's long-term growth prospects more appealing to investors.

The interplay of economic growth, inflation, and interest rates shapes the overall investment climate for biotechnology firms like Sana. For example, a robust economy with moderate inflation might support higher interest rates that still allow for investment in innovation. However, high inflation coupled with rising rates, as experienced in late 2022 and through much of 2023, can create a more challenging environment, increasing operational costs and potentially dampening investor enthusiasm for riskier, long-term biotech ventures.

Understanding these macroeconomic trends is vital for Sana Biotechnology's strategic financial planning and its ability to secure necessary funding. The company must monitor economic indicators closely to adapt its capital structure and investment strategies to prevailing interest rate environments and their impact on overall market sentiment.

| Economic Factor | Impact on Sana Biotechnology | 2024/2025 Outlook/Data |

|---|---|---|

| Interest Rates | Affects cost of borrowing and investor valuations. Higher rates increase debt costs. | Federal Reserve rates remained elevated through early 2024, influencing borrowing costs. Projections suggest a gradual easing, but uncertainty persists. |

| Inflation | Increases operational costs (materials, labor) and can pressure pricing strategies. | Inflationary pressures continued in 2024, though moderating from 2023 peaks. Supply chain costs remain a consideration. |

| Economic Growth | Influences healthcare spending and investor confidence. Strong growth supports investment. | Global growth projected around 3.2% for 2024 (IMF), with varied regional performance impacting market receptiveness to new therapies. |

What You See Is What You Get

Sana Biotechnology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Sana Biotechnology delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain insights into market trends, regulatory landscapes, and competitive pressures shaping Sana Biotechnology's strategic decisions. What you’re previewing here is the actual file—fully formatted and professionally structured, providing a complete picture of the company's external environment.

Sociological factors

Societal attitudes toward genetic and cell therapies are a major factor for Sana Biotechnology. Public acceptance directly impacts how readily patients will adopt these innovative treatments and how much overall support exists for the research and development in this area. For instance, a 2024 survey indicated that while over 60% of respondents expressed optimism about gene therapies for rare diseases, a significant portion still harbored concerns about potential unknown long-term effects.

Concerns regarding the ethical dimensions of genetic modification, coupled with worries about the long-term safety and the often-high cost of these advanced therapies, can indeed create resistance. Conversely, growing awareness of the potential for these treatments to offer cures for previously untreatable or debilitating conditions is a powerful driver of demand. Reports in early 2025 highlighted patient advocacy groups actively lobbying for greater access to cell therapies for conditions like ALS, showcasing this rising demand.

For Sana Biotechnology, fostering public education and maintaining transparent communication is absolutely critical. This helps to address anxieties and build trust. As of mid-2025, several public forums and educational campaigns focused on gene therapy safety and efficacy have seen increased participation, suggesting a growing public appetite for understanding these complex medical advancements.

The creation of engineered cells as therapies brings up significant ethical debates, particularly concerning genetic modification and ensuring fair access for all patients. For instance, ongoing discussions about the ethical implications of gene editing technologies, like CRISPR, continue to shape public opinion and regulatory approaches, impacting companies like Sana Biotechnology.

Patient autonomy is another critical ethical consideration, as individuals must have a clear understanding and control over decisions regarding advanced therapies. Surveys in late 2024 and early 2025 indicate a growing public interest in understanding the long-term effects and consent processes for cell-based treatments.

Societal values deeply influence how these groundbreaking medical advancements are perceived and regulated. As of mid-2025, public sentiment analysis shows a cautious optimism towards engineered cell therapies, but with strong emphasis on safety and equitable distribution, which directly affects Sana Biotechnology's market acceptance and potential funding avenues.

Maintaining rigorous ethical standards is not just a moral imperative but a strategic necessity for Sana Biotechnology. Regulatory bodies worldwide, including the FDA and EMA, are increasingly scrutinizing the ethical frameworks of companies developing novel cell therapies, with compliance being a key factor in drug approval processes throughout 2024 and into 2025.

Patient advocacy groups are powerful forces, shaping research and treatment landscapes. For instance, the American Cancer Society, a prominent cancer advocacy organization, raised over $1.4 billion in 2023, directly influencing research funding and patient support services. Similarly, the Juvenile Diabetes Research Foundation (JDRF) has been instrumental in driving advancements in diabetes care and prevention, contributing to a significant increase in clinical trial participation for new therapies.

The growing strength of these organizations means they can effectively lobby for policy changes, such as accelerated drug approval pathways or increased government funding for rare diseases. This advocacy directly benefits companies like Sana Biotechnology, as it can create a more favorable environment for bringing novel treatments to market, especially in areas like oncology and neurology where patient voices are particularly strong.

By raising public awareness, these groups also stimulate demand for innovative treatments. For example, campaigns by neurological disorder advocacy groups have led to increased patient inquiries about advanced therapies. Sana Biotechnology can leverage this by engaging with these communities, understanding their needs, and demonstrating how its pipeline directly addresses unmet medical needs, potentially accelerating patient access to its therapies.

Demographic Shifts and Disease Prevalence

Global demographic shifts, particularly the aging population, directly impact the market for biotechnology companies like Sana Biotechnology. For instance, the World Health Organization projects that by 2030, one in six people globally will be 65 years or older. This aging trend is intrinsically linked to an increased prevalence of age-related diseases, such as Alzheimer's, Parkinson's, and various forms of cancer, which are key areas of focus for therapeutic development.

Understanding these evolving demographic patterns is crucial for Sana Biotechnology to accurately forecast market demand and strategically allocate resources for research and development. For example, the increasing incidence of neurodegenerative diseases in aging populations could signal a significant growth opportunity for therapies targeting these conditions. Furthermore, lifestyle changes, such as shifts in diet and activity levels, also contribute to altered disease patterns, creating dynamic market landscapes that require constant analysis.

- Aging Population Growth: By 2050, the number of people aged 65 and over is projected to reach 1.6 billion, a substantial increase from 703 million in 2019.

- Chronic Disease Burden: Chronic diseases, often associated with aging and lifestyle, are major drivers of healthcare expenditure and demand for advanced therapies.

- Disease Prevalence Shifts: For example, cancer incidence rates vary significantly by age group, with a higher proportion of diagnoses occurring in older adults, impacting the potential market size for oncology treatments.

Healthcare Accessibility and Equity

Societal values increasingly champion equitable access to advanced medical treatments, irrespective of an individual's socioeconomic standing. This can significantly shape healthcare policy and public sentiment towards high-cost therapies. Sana Biotechnology, therefore, might encounter pressure to make its potentially life-altering treatments available to a wider patient base. This could involve strategic pricing models or robust patient assistance programs.

The growing emphasis on social responsibility also plays a crucial role. Companies like Sana are expected to demonstrate a commitment to broader societal well-being, not just profit. For instance, in 2024, a significant portion of Americans reported concerns about the affordability of prescription drugs, with roughly 29% stating they did not fill a prescription due to cost. This sentiment underscores the public’s expectation for fairness in healthcare access.

- Equitable Access: Public opinion increasingly favors making advanced medical innovations accessible to all, regardless of income.

- Pricing Pressures: Societal expectations may compel Sana Biotechnology to adopt flexible pricing or support programs to ensure broad patient reach for its therapies.

- Social Responsibility: Demonstrating a commitment to social good is becoming a key factor in public perception and regulatory scrutiny for biotech firms.

- Affordability Concerns: Widespread concerns about prescription drug costs, particularly in 2024, highlight the need for accessible pricing strategies in the biopharmaceutical sector.

Public perception of genetic and cell therapies is a critical sociopolitical factor for Sana Biotechnology. Growing awareness of potential cures for previously untreatable diseases fosters demand, as seen with patient advocacy groups lobbying for cell therapy access in early 2025. However, concerns about long-term safety, ethical implications of genetic modification, and high costs, as highlighted in a 2024 survey where over 60% of respondents were optimistic about gene therapy but still had concerns, can create resistance.

Societal values increasingly emphasize equitable access to advanced medical treatments, putting pressure on companies like Sana Biotechnology to develop accessible pricing models or patient assistance programs. This aligns with public sentiment in 2024, where approximately 29% of Americans did not fill a prescription due to cost, underscoring the importance of affordability.

The aging global population, projected to reach 1.6 billion people aged 65 and over by 2050, directly influences the market for biotechnology companies like Sana by increasing the prevalence of age-related diseases. This demographic shift presents significant growth opportunities for therapies targeting conditions such as Alzheimer's and various cancers.

Patient advocacy groups wield considerable influence, impacting research funding and policy. Organizations like the American Cancer Society, which raised $1.4 billion in 2023, and the JDRF actively shape treatment landscapes and can accelerate market access for companies like Sana Biotechnology by advocating for favorable regulatory pathways and increased research funding.

Technological factors

The rapid advancements in gene editing technologies, such as CRISPR-Cas9, base editing, and prime editing, are fundamentally reshaping the landscape for companies like Sana Biotechnology. These innovations offer increasingly precise and efficient ways to modify cellular genetics, directly impacting Sana's ability to develop novel cell therapies. For instance, the development of more sophisticated CRISPR systems in 2024 continues to enhance target specificity and reduce off-target effects, a critical factor for therapeutic safety and efficacy.

Continuous innovation in these gene editing platforms provides Sana Biotechnology with opportunities to expand its therapeutic pipeline. More efficient and safer editing techniques can unlock the potential to treat a broader spectrum of diseases, from genetic disorders to complex cancers, by enabling better control over cellular functions. The ongoing research and development in this field, with significant investment flowing into biotech startups focused on these technologies, suggest a dynamic environment where precision medicine is becoming increasingly attainable.

Maintaining a leading position in gene editing and cell engineering is paramount for Sana Biotechnology's competitive edge. Companies that can effectively leverage and innovate upon these technologies are poised to gain significant market advantage. The increasing number of clinical trials utilizing gene-edited cells, many of which have shown promising results in 2024 and early 2025, underscores the real-world impact and commercial potential of these scientific breakthroughs.

Breakthroughs in both in vivo and ex vivo technologies are significantly boosting the potential of companies like Sana Biotechnology. For in vivo delivery, advancements in viral vectors and non-viral methods are making it easier and safer to get therapeutic agents directly into the body. This is critical for the broad application of gene therapies.

Concurrently, ex vivo cell modification techniques are becoming more sophisticated, allowing for precise genetic alterations outside the body before reintroduction. This precision is vital for creating effective and reliable cell-based therapies. Sana Biotechnology's focus on these platform technologies underscores their commitment to innovation in this space.

The ongoing development of delivery systems that are both highly targeted and less likely to provoke an immune response is paramount. This is because such improvements directly translate to a wider therapeutic window and enhanced patient safety, key considerations for regulatory approval and widespread adoption. For instance, in 2024, the gene therapy market was valued at approximately $10.6 billion and is projected to grow substantially, highlighting the importance of these technological advancements.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing drug discovery by speeding up the identification of potential drug targets and optimizing cell engineering. For Sana Biotechnology, this means faster R&D cycles and potentially lower costs. These technologies can predict clinical trial success rates, which is crucial for efficient resource allocation.

The ability to analyze vast datasets with AI/ML is becoming a competitive advantage. For instance, in 2024, the AI in drug discovery market was valued at approximately $2.5 billion, with projections to reach over $10 billion by 2030, highlighting its growing importance. This trend supports Sana Biotechnology's efforts in personalized medicine by enabling more precise patient stratification and treatment design.

Manufacturing Scalability and Automation

The ability to scale up manufacturing for complex cell therapies like those developed by Sana Biotechnology presents a significant technological hurdle. Moving from lab-scale production to commercial volumes requires sophisticated processes that can maintain product integrity and efficacy. This is crucial for meeting market demand and ensuring patient access.

Advancements in bioreactor technology, automated manufacturing systems, and rigorous quality control are essential for Sana Biotechnology to increase production, lower per-unit costs, and guarantee consistent product quality. These innovations are directly linked to the company's ability to deliver its therapies reliably.

Efficient and cost-effective manufacturing is a key competitive advantage in the biopharmaceutical industry. For Sana Biotechnology, mastering these processes will directly impact its market position and its capacity to bring life-changing treatments to patients at a sustainable cost.

- Bioreactor Innovation: Expect continued development in single-use bioreactors and perfusion systems for higher cell densities and continuous processing, potentially reducing capital expenditure and improving efficiency for companies like Sana Biotechnology.

- Automation in Cell Therapy Manufacturing: The global cell and gene therapy manufacturing market is projected to reach over $20 billion by 2028, with automation playing a significant role in achieving this growth by enhancing reproducibility and reducing manual labor.

- Quality Control Advancements: Technologies like real-time biosensors and advanced analytics are becoming critical for in-process monitoring, ensuring the safety and efficacy of engineered cell therapies, a vital area for Sana Biotechnology.

Data Integration and Bioinformatics

Technological advancements in data integration and bioinformatics are reshaping the landscape for companies like Sana Biotechnology. The sheer volume of biological data generated from genomics, proteomics, and clinical trials necessitates advanced bioinformatics tools and integrated platforms for efficient analysis and interpretation. For instance, by 2024, the global big data market in healthcare was projected to reach over $77 billion, highlighting the critical need for robust data management. Sana Biotechnology's success hinges on its ability to leverage these technologies to identify novel biomarkers, unravel complex disease mechanisms, and accelerate therapeutic development.

Effective data management and analysis are not just beneficial but absolutely crucial for Sana Biotechnology's pipeline. This includes ensuring the cybersecurity of sensitive patient and research data, a growing concern as data breaches in the healthcare sector continue to rise. A report from IBM Security in 2023 indicated that the average cost of a healthcare data breach reached $10.1 million, underscoring the financial and reputational risks involved.

- Genomic Data Growth: The output from genomic sequencing is expanding exponentially, requiring advanced computational infrastructure for processing and analysis.

- Proteomic Analysis: Sophisticated tools are needed to interpret complex protein interactions and their roles in disease, driving innovation in drug discovery.

- Clinical Trial Data: Integrating and analyzing diverse data streams from clinical trials is essential for validating therapeutic efficacy and safety.

- Cybersecurity Imperative: Protecting vast datasets from cyber threats is paramount to maintaining data integrity and patient privacy.

Technological advancements, particularly in gene editing and delivery systems, are central to Sana Biotechnology's progress. Innovations like CRISPR-Cas9 continue to offer greater precision, reducing off-target effects and enhancing therapeutic safety. By 2024, the gene therapy market was valued at approximately $10.6 billion, underscoring the significant commercial potential driven by these technological leaps.

The integration of AI and machine learning is accelerating drug discovery and optimizing cell engineering processes for Sana. In 2024, the AI in drug discovery market was valued at around $2.5 billion, demonstrating its growing impact on R&D efficiency. Furthermore, scaling up manufacturing for complex cell therapies remains a key technological challenge, with automation and advanced bioreactor technology being critical for commercial viability.

| Technological Area | Key Advancements | Impact on Sana Biotechnology | Market Data/Projections |

| Gene Editing | CRISPR-Cas9, Base Editing, Prime Editing | Enhanced precision, reduced off-target effects, broader therapeutic applications | Gene therapy market valued at ~$10.6B (2024) |

| Delivery Systems | Improved viral vectors, non-viral methods | Safer and more targeted delivery of therapeutic agents | Continued investment in delivery platform R&D |

| AI/ML in R&D | Accelerated target identification, optimized cell engineering | Faster R&D cycles, improved prediction of clinical trial success | AI in drug discovery market ~$2.5B (2024), projected to exceed $10B by 2030 |

| Manufacturing | Bioreactor automation, single-use systems, quality control | Increased production capacity, reduced costs, consistent product quality | Cell and gene therapy manufacturing market projected >$20B by 2028 |

Legal factors

The legal landscape for cell and gene therapies is complex and constantly shifting, presenting both challenges and opportunities for companies like Sana Biotechnology. Specific pathways, such as the Regenerative Medicine Advanced Therapy (RMAT) designation, can expedite the review process for promising treatments, potentially shortening the time to market. For instance, in 2023, the FDA continued to see a steady stream of RMAT applications, reflecting ongoing innovation in the field.

Navigating these evolving regulatory frameworks demands significant expertise and resources. Sana Biotechnology must invest heavily in its regulatory affairs team to ensure meticulous adherence to guidelines set by bodies like the FDA and EMA. Failure to comply can result in costly delays or even outright rejection of therapeutic candidates.

The Orphan Drug Act, which incentivizes the development of treatments for rare diseases, can also play a crucial role. Securing Orphan Drug status can provide market exclusivity and tax credits, significantly impacting the economic viability of a therapy. Many novel cell and gene therapies target conditions that, by definition, affect smaller patient populations, making this designation highly relevant.

Ultimately, compliance with these stringent legal and regulatory requirements is paramount. It is not merely a procedural hurdle but a fundamental aspect of ensuring patient safety and the ultimate success of any cell or gene therapy product developed by Sana Biotechnology.

Intellectual property laws are crucial for Sana Biotechnology, protecting its substantial investments in research and development through patents and trade secrets. For instance, in 2024, the global biotechnology patent landscape saw continued activity, with significant filings in areas like cell and gene therapies, directly relevant to Sana's focus.

Legal disputes, such as patent infringement lawsuits or validity challenges, can incur substantial financial and operational costs, potentially impacting R&D timelines and market entry. In 2023, the average cost of patent litigation in the biotech sector could run into millions of dollars, a significant consideration for companies like Sana.

The legal framework governing gene editing technologies, a core area for Sana Biotechnology, is particularly dynamic. Keeping abreast of these changes, including new regulations and court decisions impacting CRISPR and other novel editing techniques, is essential for strategic planning and risk mitigation throughout 2024 and into 2025.

Clinical trials for new therapies are heavily regulated, with laws dictating everything from how trials are designed and managed to how patient safety is monitored. These regulations, enforced by bodies like the FDA in the United States, are paramount for protecting participants and ensuring the integrity of research data. For instance, the FDA's Code of Federal Regulations (21 CFR Part 312) outlines extensive requirements for investigational new drugs.

Sana Biotechnology must meticulously adhere to these legal frameworks, which cover critical aspects like obtaining informed consent from every patient, safeguarding their personal health information through laws such as HIPAA, and promptly reporting any unexpected or serious adverse events. Failure to comply can result in significant consequences, including hefty fines, the suspension of ongoing studies, and damage to the company's reputation, potentially delaying or preventing the approval of life-saving treatments.

Data Privacy and Security Laws

Data privacy and security laws, like HIPAA in the US and GDPR in Europe, significantly impact biotechs like Sana Biotechnology. These regulations mandate strict protocols for handling patient health information and clinical trial data, requiring robust security measures and vigilant compliance to prevent breaches. Failing to adhere can result in severe legal penalties and reputational damage.

For Sana Biotechnology, navigating these legal frameworks is crucial. The potential fines for non-compliance are substantial; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher. Ensuring the secure and private handling of sensitive patient data is therefore not just a legal obligation but a critical business imperative.

- HIPAA compliance is mandatory for handling Protected Health Information (PHI) in the US.

- GDPR imposes strict rules on data processing and consent for individuals in the European Union.

- Data breaches can lead to significant financial penalties and loss of public trust.

- Sana Biotechnology must invest in **advanced cybersecurity infrastructure** and employee training.

Product Liability and Consumer Protection Laws

Sana Biotechnology, as a developer of advanced medical therapies, faces stringent product liability laws. These regulations make manufacturers accountable for any harm or defects stemming from their products. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued its focus on post-market surveillance, investigating potential product issues across various therapeutic areas, a trend expected to persist through 2025.

Ensuring the safety, efficacy, and accurate labeling of its gene therapies is not just good practice but a legal imperative for Sana. Failure to meet these standards can lead to costly lawsuits and damage patient trust. The U.S. has seen an increase in product liability claims against biotechnology firms in recent years, with settlements often reaching millions of dollars for patient harm.

Furthermore, Sana must adhere to consumer protection acts in its marketing and promotional efforts. This means all claims made about its therapies must be truthful and substantiated, avoiding misleading statements that could attract regulatory scrutiny or legal challenges. In 2024, regulatory bodies like the Federal Trade Commission (FTC) have been actively monitoring health and wellness advertising, particularly for novel treatments.

- Product Safety Mandates: Sana must rigorously test and validate its therapies to meet FDA standards for safety and efficacy before market approval.

- Labeling Requirements: Accurate and comprehensive labeling detailing intended use, dosage, potential side effects, and contraindications is legally required.

- Marketing Integrity: All promotional materials must be factual, avoiding exaggerated claims or misleading information to comply with consumer protection laws.

- Liability Exposure: Non-compliance or product-related harm can result in significant financial penalties and reputational damage through product liability lawsuits.

Sana Biotechnology operates within a highly regulated environment, necessitating strict adherence to laws governing clinical trials, data privacy, and product safety. The company must navigate the complexities of obtaining approvals from agencies like the FDA, which involves rigorous scientific evidence and meticulous documentation. Failure to comply with these regulations, including those concerning patient consent and adverse event reporting, can lead to severe penalties, impacting timelines and market access.

Intellectual property law is also a critical legal factor, safeguarding Sana's innovations through patents and trade secrets. The company must actively protect its research and development investments, as patent disputes can be costly and time-consuming. In 2024, the biotechnology sector continued to see robust patent activity, underscoring the importance of IP protection for companies like Sana.

Product liability laws hold Sana accountable for the safety and efficacy of its gene therapies. This requires stringent quality control throughout the development and manufacturing processes. Misleading marketing claims are also prohibited under consumer protection laws, necessitating truthful and substantiated communication about its products, a focus for regulatory bodies in 2024.

| Legal Area | Key Considerations for Sana Biotechnology | Regulatory Bodies/Examples | Potential Impact of Non-Compliance |

|---|---|---|---|

| Clinical Trial Regulation | Adherence to protocols for patient safety, informed consent, and data integrity. | FDA (21 CFR Part 312) | Study suspension, fines, reputational damage. |

| Data Privacy & Security | Robust protection of patient health information and clinical trial data. | HIPAA (US), GDPR (EU) | Significant financial penalties (e.g., up to 4% of global revenue for GDPR), loss of trust. |

| Intellectual Property | Protecting R&D investments through patents and trade secrets. | USPTO (US), EPO (EU) | Loss of competitive advantage, litigation costs. |

| Product Liability & Consumer Protection | Ensuring product safety, efficacy, and truthful marketing. | FDA, FTC (US) | Lawsuits, costly settlements, brand damage, market withdrawal. |

Environmental factors

Sana Biotechnology's production of engineered cell therapies generates unique waste streams, including biological materials and specialized reagents. Proper disposal is paramount, necessitating strict adherence to regulations governing hazardous and biological waste. For instance, the US Environmental Protection Agency (EPA) sets standards for medical waste, which often apply to biotech operations, ensuring environmental safety and public health.

Compliance with these stringent regulations is non-negotiable for Sana Biotechnology. Failure to manage and dispose of waste responsibly could result in significant fines and reputational damage. The company must invest in specialized waste management protocols and partners to ensure all biological byproducts are handled according to the latest environmental standards, as dictated by bodies like the EPA.

Beyond regulatory mandates, there's a growing expectation from investors, partners, and the public for companies like Sana Biotechnology to adopt sustainable waste management practices. This includes minimizing waste generation where possible and exploring innovative disposal methods that reduce environmental impact. By prioritizing eco-friendly approaches, Sana can enhance its corporate social responsibility profile.

Biotechnology manufacturing, particularly processes like cell culture and maintaining sterile, controlled environments, demands significant energy. This inherent energy intensity contributes to a substantial carbon footprint for companies like Sana Biotechnology.

Sana Biotechnology is under increasing pressure to curb its energy usage and environmental impact. This involves exploring and implementing renewable energy solutions and refining its manufacturing processes for greater efficiency.

For example, the global pharmaceutical industry's energy consumption is a growing concern, with some estimates suggesting it accounts for a significant portion of the manufacturing sector's overall emissions. Companies are increasingly looking at on-site solar or wind power, and optimizing HVAC systems in their facilities.

Beyond regulatory compliance, prioritizing sustainability can bolster Sana Biotechnology's public image and appeal to a growing segment of investors who favor environmentally responsible businesses. This focus on green initiatives is becoming a key differentiator in the market.

The availability and sustainable sourcing of critical raw materials are significant environmental considerations for Sana Biotechnology. This includes specialized growth media, reagents, and single-use plastics essential for their cell and gene therapy development. Dependence on finite resources or those with substantial environmental footprints can introduce considerable supply chain risks.

For instance, the global demand for biologics manufacturing inputs, including cell culture media components, has seen steady growth, potentially straining sourcing. Sana Biotechnology is likely exploring sustainable alternatives and engaging in responsible sourcing practices to mitigate these environmental and operational risks, aiming to secure a reliable and ethically produced supply chain.

Biosecurity and Containment Measures

Sana Biotechnology's operations involving genetically modified organisms (GMOs) and live cells necessitate robust biosecurity and containment protocols. These measures are critical to prevent any unintended release into the environment, safeguarding both ecosystems and public health. For example, regulatory bodies like the FDA and USDA impose strict guidelines on handling such materials, with penalties for non-compliance.

Adherence to biosafety level (BSL) standards, ranging from BSL-1 to BSL-4, is fundamental. Sana Biotechnology must ensure its facilities and operational procedures align with the specific BSL requirements for the organisms it handles. This investment in specialized infrastructure and rigorous training is essential for risk mitigation.

- Regulatory Compliance: Sana Biotechnology must comply with evolving biosafety regulations globally, which can vary significantly between regions.

- Facility Investment: Costs associated with maintaining high-containment facilities and specialized equipment can be substantial, impacting operational expenses.

- Risk Management: Implementing comprehensive risk assessments and mitigation strategies for potential biological breaches is an ongoing necessity.

- Public Perception: Maintaining strong biosecurity builds public trust, which is vital for a company working with advanced biological technologies.

Climate Change Impact on Operations and Supply Chain

Climate change presents significant operational and supply chain challenges for Sana Biotechnology. Extreme weather events, like the increased frequency of hurricanes and wildfires observed in recent years, can directly disrupt manufacturing processes, damage facilities, and impede the timely distribution of critical biological materials. For instance, the severe winter storms in Texas in early 2021 caused widespread power outages, impacting numerous businesses including those in the biotech sector that rely on consistent energy for operations. Sana Biotechnology must proactively assess and build resilience against these climate-related risks to maintain uninterrupted operations and ensure the integrity of its product pipelines.

Adapting to a changing climate is no longer a distant concern but an immediate operational imperative. The company needs to develop robust contingency plans that account for potential disruptions. This includes diversifying suppliers across different geographic regions less prone to extreme weather, investing in resilient infrastructure, and exploring alternative transportation routes. The economic impact of climate-related disruptions is substantial; a 2023 report estimated that supply chain disruptions cost the global economy billions annually. Sana Biotechnology’s preparedness in this area will be crucial for its long-term stability and success.

- Supply Chain Vulnerability: Extreme weather events, such as floods and droughts, directly threaten the sourcing of raw materials and the transportation of finished goods.

- Operational Disruption: Manufacturing facilities may face downtime due to power outages or damage caused by severe weather, impacting production schedules.

- Regulatory Landscape: Evolving climate regulations may impose new operational requirements or carbon footprint reporting mandates.

- Increased Costs: Climate-related risks can lead to higher insurance premiums, increased logistics costs, and potential investments in adaptation measures.

Sana Biotechnology's reliance on specialized biological materials and sterile environments means careful waste management is crucial to prevent environmental contamination. Adhering to regulations set by bodies like the Environmental Protection Agency (EPA) ensures safe disposal of biological and chemical byproducts, with non-compliance carrying significant financial and reputational risks.

The energy-intensive nature of biotechnology manufacturing, including cell culture and maintaining controlled environments, contributes to a notable carbon footprint. As global pressure mounts for sustainable practices, Sana Biotechnology faces increasing scrutiny to reduce energy consumption and explore renewable energy sources, mirroring trends seen across the wider pharmaceutical industry.

Sana Biotechnology's operations involving genetically modified organisms (GMOs) and live cells demand stringent biosecurity and containment protocols to prevent environmental release, aligning with guidelines from agencies like the FDA and USDA. Maintaining appropriate biosafety levels (BSLs) requires substantial investment in specialized facilities and rigorous training to manage potential biological risks effectively.

| Environmental Factor | Impact on Sana Biotechnology | Data/Example (2024/2025) |

|---|---|---|

| Waste Management | Disposal of biological and chemical waste, regulatory compliance | EPA regulations on medical waste; potential fines for non-compliance. |

| Energy Consumption & Carbon Footprint | High energy use in manufacturing, need for sustainable solutions | Global pharma energy consumption is a growing concern; exploration of on-site solar. |

| Biosecurity & Containment | Handling GMOs and live cells, preventing environmental release | Adherence to BSL standards; FDA/USDA oversight. |

| Climate Change Resilience | Disruption from extreme weather, supply chain vulnerability | Increased frequency of extreme weather events impacting operations; 2023 estimate of billions lost annually due to supply chain disruptions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Sana Biotechnology is informed by a diverse range of data, including scientific journals, regulatory filings, and market research reports from leading biotechnology industry analysts. We also incorporate information from government health agencies and patent databases to ensure a comprehensive view.