Sana Biotechnology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sana Biotechnology Bundle

Curious about Sana Biotechnology's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their innovations might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding this framework is crucial for any investor or stakeholder looking to navigate the biotech landscape effectively.

This initial overview highlights the potential strengths and weaknesses within Sana Biotechnology's portfolio, providing a foundation for more in-depth analysis. Are their current ventures poised for rapid growth, or are they consuming resources without significant returns?

To truly grasp the strategic implications and unlock actionable insights, you need the full picture. Purchase the complete Sana Biotechnology BCG Matrix report for a detailed quadrant breakdown, data-driven recommendations, and a clear roadmap for future investment and product development decisions.

Don't miss the opportunity to gain a competitive edge. The full report provides the granular detail necessary to make informed strategic moves, ensuring you can effectively allocate capital and maximize returns in the dynamic biotechnology sector.

Invest in clarity and strategic foresight. Get the full Sana Biotechnology BCG Matrix today and transform your understanding of their market position into powerful business actions.

Stars

UP421 (HIP-modified Primary Pancreatic Islet Cells) for Type 1 Diabetes is a strong candidate within Sana Biotechnology's pipeline, likely representing a Question Mark or even a potential Star depending on ongoing trial results. Early clinical data is highly encouraging, showing that these modified islet cells can be transplanted without the need for immunosuppression. This is a critical advancement, as evidenced by stable C-peptide production observed at both 12 and 6 months in a human trial.

This program addresses a significant unmet medical need in the large and growing market for Type 1 Diabetes treatment. The ability to eliminate the requirement for lifelong immunosuppression is a major differentiator, potentially positioning UP421 as a transformative therapy. This unique selling proposition suggests a high potential for future market share capture in the rapidly expanding field of cell therapy, a market projected to reach tens of billions of dollars in the coming years.

SC451, building on the success of UP421, is Sana Biotechnology's innovative stem cell-derived pancreatic islet cell therapy for Type 1 Diabetes. This therapy aims to provide a one-time, curative treatment, eliminating the need for daily insulin injections and immunosuppressive drugs. The potential market is vast, considering millions worldwide live with Type 1 Diabetes.

Preclinical studies in mouse models have demonstrated impressive results, with SC451 achieving 15 months of sustained glycemic control. This durability is a key indicator of its potential effectiveness in humans. Sana Biotechnology is targeting an Investigational New Drug (IND) filing as early as 2026, signaling a significant step towards clinical trials.

The development of SC451 positions it as a strong candidate within Sana Biotechnology's pipeline, likely representing a "Star" in a BCG Matrix analysis. Its potential as an off-the-shelf product for a prevalent chronic disease, coupled with promising preclinical data, suggests high market growth and significant future potential for Sana.

SC291, Sana Biotechnology's HIP-modified CD19-directed allogeneic CAR T therapy, is a key player in their pipeline, specifically targeting B-cell mediated autoimmune diseases. The company has prioritized this program, driven by a significant unmet medical need in conditions like lupus. The U.S. Food and Drug Administration (FDA) has recognized this urgency by granting SC291 Fast Track designation.

Early clinical trial results for SC291 have been promising, demonstrating a predictable and profound depletion of B-cells. This B-cell depletion is crucial for achieving substantial clinical benefits in patients suffering from autoimmune diseases where B-cells play a pathogenic role. For instance, in lupus, B-cells are implicated in producing autoantibodies that attack the body's own tissues.

Sana's strategic approach with SC291 leverages a differentiated allogeneic, off-the-shelf CAR T platform. This model contrasts with autologous CAR T therapies, offering potential advantages in terms of manufacturing scalability and accessibility. The market for autoimmune disease treatments is substantial and continues to expand, with the global autoimmune disease market projected to reach over $150 billion by 2028, according to some market analyses.

Hypoimmune (HIP) Platform Technology

The Hypoimmune (HIP) platform is central to Sana Biotechnology's most advanced therapeutic candidates. This technology allows transplanted cells to bypass the recipient's immune system, eliminating the need for immunosuppressive drugs. HIP's versatility spans regenerative medicine and autoimmune conditions, positioning it as a significant growth driver for Sana.

Clinical trial progress further validates HIP's potential. Sana reported positive interim data for UP421 (targeting ulcerative colitis) and SC291 (targeting lupus) in 2024, demonstrating the platform's ability to achieve therapeutic effects without inducing significant immune responses.

- Platform Innovation: HIP enables allogeneic cells to evade immune detection, a critical advancement for cell therapies.

- Broad Applicability: The technology is applicable across diverse therapeutic areas, including regenerative medicine and autoimmune diseases.

- Clinical Validation: Positive 2024 data from UP421 and SC291 trials underscore HIP's efficacy and safety profile.

- Strategic Asset: HIP represents a key strategic advantage for Sana, with substantial growth potential as its applications broaden.

SC262 (HIP-modified CD22-directed Allogeneic CAR T) for Relapsed/Refractory B-cell Malignancies

SC262 is positioned as a potential Star within Sana Biotechnology's BCG matrix, targeting a critical, underserved segment of B-cell malignancies. This therapy addresses patients who have exhausted previous CD19-directed CAR T treatments, highlighting a significant unmet medical need in oncology. The market for relapsed/refractory B-cell malignancies is substantial, with an estimated global incidence of over 200,000 new cases annually, and the need for novel treatments remains high.

As an allogeneic, off-the-shelf CAR T therapy, SC262 offers a distinct advantage in a market where timely treatment is crucial. This approach bypasses the lengthy manufacturing times associated with autologous CAR T therapies, potentially reaching more patients faster. The development of allogeneic CAR T therapies is a key trend, aiming to democratize access to these advanced treatments.

The upcoming Phase 1 VIVID study data, anticipated in 2025, will be pivotal in demonstrating SC262's potential. Positive clinical outcomes could solidify its position as a high-growth asset. The oncology CAR T market is projected to reach tens of billions of dollars by the end of the decade, indicating strong revenue potential for successful therapies.

- Target Market: Relapsed/refractory B-cell malignancies, a segment with significant unmet need.

- Competitive Advantage: Allogeneic, off-the-shelf CAR T, offering faster patient access.

- Growth Potential: Driven by expected Phase 1 VIVID study data in 2025 and a growing CAR T market.

- Market Size: Global incidence of B-cell malignancies exceeds 200,000 new cases annually.

UP421 and SC451, Sana Biotechnology's cell therapies for Type 1 Diabetes, are poised to become Stars. These programs leverage the innovative HIP technology, aiming for a one-time, curative treatment that eliminates the need for immunosuppression and insulin injections. The vast market for Type 1 Diabetes, affecting millions globally, combined with promising preclinical and early clinical data showing sustained glycemic control and C-peptide production, strongly supports their "Star" classification.

| Product Candidate | Indication | BCG Category | Key Differentiator | Market Potential Indicator |

|---|---|---|---|---|

| UP421 | Type 1 Diabetes | Star | No immunosuppression needed, stable C-peptide | Large, growing Type 1 Diabetes market |

| SC451 | Type 1 Diabetes | Star | Curative, off-the-shelf stem cell therapy | Millions worldwide with Type 1 Diabetes |

What is included in the product

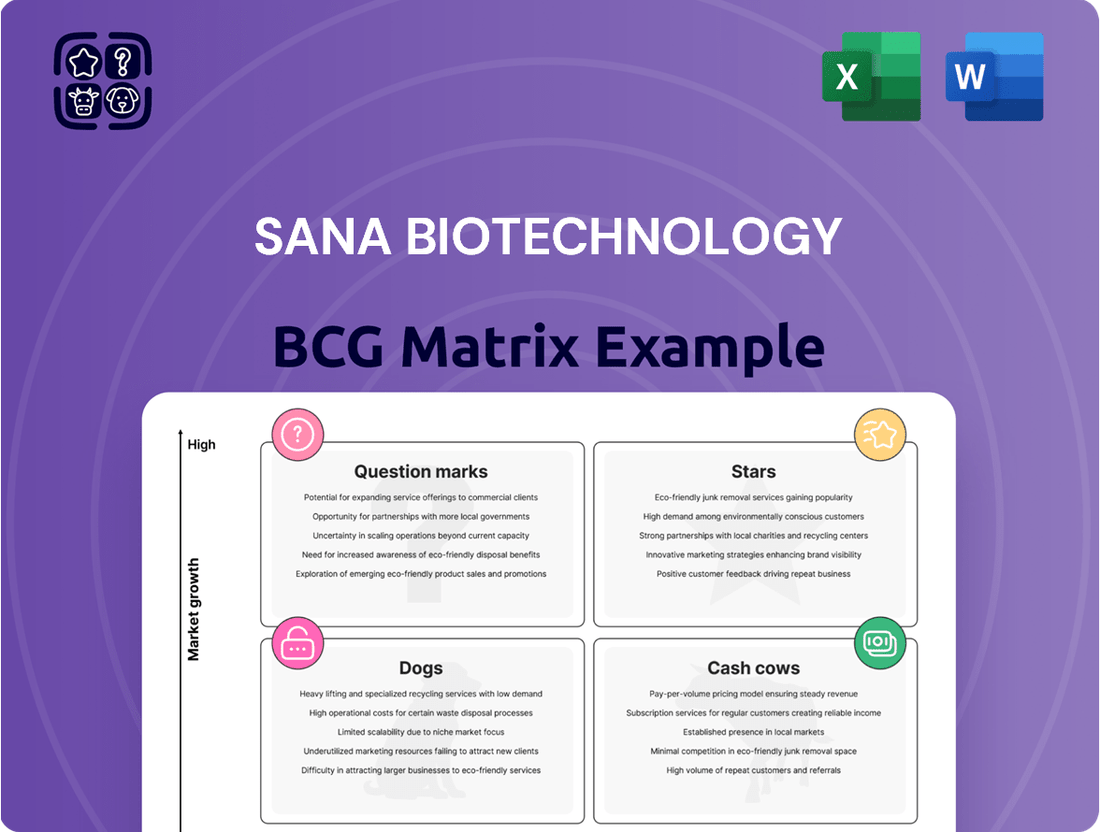

Sana Biotechnology BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

Sana Biotechnology's BCG Matrix offers a clear, visual roadmap, alleviating strategic uncertainty for R&D investment.

Cash Cows

Sana Biotechnology's foundational intellectual property, particularly its Hypoimmune (HIP) platform and other advanced cell engineering technologies, functions as a crucial 'cash cow' for the pre-revenue company. This extensive IP portfolio is the bedrock upon which Sana builds its value, attracting significant interest from potential partners and licensing agreements.

The value generated by this IP is not in immediate sales but in its ability to create a strong competitive moat. This positions Sana favorably for future collaborations, which are expected to yield stable, long-term revenue streams. It's a foundational asset that supports numerous pipeline candidates, offering a sustained competitive edge in the highly competitive biotech landscape.

Sana Biotechnology's strategic partnerships, like the one with Beam Therapeutics for CRISPR Cas12b technology, are crucial for its growth. These collaborations grant Sana access to advanced editing tools, lessening its internal research and development workload. This strategic alliance also provides a pathway to potential upfront and milestone payments, acting as a consistent financial contributor and a strong validation of Sana's technological direction.

The collaboration with Harvard College focuses on developing hypoimmune-modified cells. This partnership is vital for Sana's pipeline, offering access to specialized expertise that can accelerate the development of its cell-based therapies. Such agreements, while not direct product revenue, bolster Sana's financial resilience and technological edge, positioning it for future product success.

Sana Biotechnology's investment in its Good Manufacturing Practice (GMP) facility in Bothell, Washington, positions its existing manufacturing capabilities as a potential cash cow. This robust infrastructure, coupled with deep expertise in allogeneic manufacturing, forms a significant asset.

Once operational for commercial production or contract manufacturing, this facility could yield consistent, albeit low-growth, revenue streams. The controlled cost base it offers for future products provides a distinct operational advantage.

For instance, as of early 2024, Sana continued to advance its manufacturing capabilities, aiming for efficiency and scalability in its allogeneic cell therapy production. This focus on infrastructure development supports the notion of a steady revenue generation model.

Early-Stage Non-Dilutive Funding and Grants

While Sana Biotechnology doesn't have traditional "cash cows" in its early stages, non-dilutive funding and grants function similarly by providing a stable, predictable financial inflow. These sources are crucial for supporting foundational research, such as the development of their HIP platform, without requiring the company to give up ownership stakes.

These early-stage funding mechanisms act as a consistent, albeit low-growth, financial engine. They enable the company to continue its research and development efforts, a key driver for its future growth potential. Effectively managing these inflows is vital for sustaining operations and minimizing cash burn.

- Non-Dilutive Funding: Grants and research payments from government bodies and foundations provide capital without equity dilution.

- R&D Support: These funds are critical for advancing foundational research, exemplified by the HIP platform.

- Financial Stability: They offer a consistent, low-growth financial input, bolstering operational sustainability.

- Cash Burn Management: Sana's focus on managing cash burn highlights the importance of these stable funding sources for ongoing operations.

Established Corporate Identity and Investor Confidence

Sana Biotechnology's established corporate identity, bolstered by its IPO and a highly regarded team, fosters significant investor confidence. This confidence, though not a direct revenue stream, is vital for accessing capital markets, effectively acting as a cash cow to fuel its ambitious research and development pipeline.

The company's ability to secure substantial initial funding, reported to be around $670 million from its IPO in early 2024, underscores this investor trust. Positive analyst ratings and a demonstrated capacity for capital raises are critical for development-stage biotechnology firms like Sana, enabling them to pursue innovation without immediate profitability concerns.

- Sana Biotechnology's IPO raised approximately $670 million in February 2024.

- A strong corporate identity and experienced leadership team are key drivers of investor confidence.

- Investor confidence translates to easier access to capital, essential for funding R&D in the biotech sector.

- Positive analyst sentiment further reinforces the company's financial stability and future prospects.

Sana Biotechnology's cash cows, in the context of the BCG matrix, are its foundational intellectual property, particularly the Hypoimmune (HIP) platform, and its robust manufacturing capabilities. These assets generate value not through immediate sales but by enabling future revenue streams and providing a competitive advantage, much like established products in mature markets would.

The HIP platform and strategic partnerships, like the one with Beam Therapeutics, act as stable financial contributors through potential upfront and milestone payments, validating Sana's technological direction. Similarly, the company's investment in its GMP facility in Bothell, Washington, represents a potential source of consistent, albeit low-growth, revenue once operational for commercial or contract manufacturing.

Non-dilutive funding and grants also function as cash cows by providing stable, predictable inflows to support foundational research, such as the HIP platform, minimizing cash burn. Furthermore, Sana's strong corporate identity and the confidence it instills in investors, evidenced by its approximately $670 million IPO in February 2024, provide crucial access to capital markets, fueling its R&D pipeline.

| Asset Type | Nature of Cash Flow | Growth Potential | Sana's Status |

| Hypoimmune (HIP) Platform & IP | Enabling future partnerships and licensing agreements; attracting investment | Low (as foundational IP) | Core asset, pre-revenue |

| GMP Manufacturing Facility | Potential for consistent, low-growth revenue from commercial production or contract manufacturing | Low | Under development/enhancement |

| Non-Dilutive Funding & Grants | Stable, predictable inflows supporting R&D | Low | Crucial for early-stage operations |

| Investor Confidence (Post-IPO) | Facilitates access to capital markets for R&D funding | Moderate to High (dependent on market conditions) | Key enabler for pipeline development |

What You’re Viewing Is Included

Sana Biotechnology BCG Matrix

The BCG Matrix you are previewing is the identical, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning. This comprehensive analysis of Sana Biotechnology's product portfolio is ready for immediate integration into your business development, investment decisions, or competitive strategy discussions without any watermarks or demo content. The preview accurately represents the final deliverable, offering clear insights into Sana Biotechnology's Stars, Cash Cows, Question Marks, and Dogs for informed decision-making. You will gain access to the complete, professionally designed BCG Matrix, empowering you to effectively manage and optimize Sana Biotechnology's market position.

Dogs

Sana Biotechnology's SC291 in oncology, specifically its early-stage study in B-cell malignancies, has been categorized as a 'dog' in their BCG Matrix following a November 2024 announcement. The company decided to suspend development due to escalating competition in the blood cancer space and doubts surrounding its regulatory and commercial viability.

This strategic shift means SC291 is no longer a primary focus for Sana in oncology, with the company actively exploring partnerships or divestment opportunities for this indication. While the asset is being re-evaluated for potential in autoimmune diseases, its oncology path is effectively stalled, reflecting a low market share and low growth potential in that specific segment.

Sana Biotechnology's SC379 glial progenitor cell program, aimed at treating central nervous system disorders, has been deprioritized. In November 2024, the company announced it was suspending further development of this preclinical asset.

This strategic shift suggests SC379 is considered to have limited potential within Sana's main objectives. The company is exploring options such as finding a partner for the program or spinning it out into a new, independent company.

Sana Biotechnology’s strategic pivot in November 2024 saw a reduction in its broad, undifferentiated earlier-stage oncology programs. This move suggests that any preclinical oncology candidates lacking a clear, unique advantage or facing intense competition, and not identified as priority assets like SC262, could be categorized as dogs within their BCG matrix. These are likely programs where Sana is reducing or ceasing further investment due to low perceived market share potential and uncertain future growth. For instance, if a company like Sana had several early-stage oncology projects in development, and after a strategic review, only two were deemed to have significant potential, the remaining ones might be considered dogs if they do not demonstrate a compelling path to market or differentiation.

Programs Requiring Extensive Immunosuppression

Programs requiring extensive immunosuppression, particularly for allogeneic cell transplantation, would likely be categorized as dogs within Sana Biotechnology's BCG matrix. These initiatives would struggle to gain significant market share given Sana's core Hypoimmune (HIP) platform, which aims to mitigate the need for such broad immunosuppression. The inherent patient burden and safety concerns associated with lifelong immunosuppressive regimens present substantial market barriers, limiting competitive advantage against Sana's proprietary HIP-enabled therapies.

- Low Market Share Potential: Legacy programs dependent on extensive immunosuppression would likely capture a minimal share of the evolving cell therapy market.

- Weak Competitive Advantage: Sana's own HIP platform offers a superior alternative, diminishing the appeal of traditionally immunosuppressed cell therapies.

- Market Barriers: The significant patient burden and safety risks associated with long-term immunosuppression hinder adoption and growth.

- Limited Growth Prospects: In a landscape prioritizing reduced immunosuppression, these programs face dim prospects for future market expansion.

Inefficient or Non-Core R&D Initiatives

Sana Biotechnology's strategic shifts, including recent layoffs aimed at extending its cash runway, highlight potential "dogs" in its R&D portfolio. These are initiatives that, while perhaps promising in theory, are consuming substantial resources without a clear path to market dominance or significant revenue generation. In 2024, companies like Sana are under immense pressure to demonstrate tangible progress and capital efficiency, leading to a rigorous evaluation of all ongoing research projects.

Initiatives fitting the "dog" category would be those R&D efforts that are either too early-stage with uncertain outcomes, or those focused on niche markets unlikely to yield substantial returns. For instance, a project exploring a novel therapeutic for a rare disease with limited patient populations, requiring extensive and costly development, might be reclassified if its commercial viability is questionable. Sana's focus in 2024 is on accelerating its most promising candidates, meaning less developed or less strategically aligned R&D is likely being deprioritized.

- Resource Allocation: R&D projects demanding significant capital expenditure without a clear, near-term return on investment are prime candidates for being classified as dogs.

- Market Potential: Initiatives targeting markets with low growth potential or intense competition, where achieving a substantial market share is improbable, fall into this category.

- Strategic Alignment: Projects that do not align with Sana Biotechnology's core therapeutic areas or long-term strategic objectives are likely to be deemed inefficient.

- Development Stage: Early-stage research with a high degree of scientific uncertainty and a long development timeline, especially if competing internal projects have a clearer path to market, can be considered dogs.

Sana Biotechnology's SC291 in oncology, specifically its early-stage study in B-cell malignancies, has been categorized as a 'dog' in their BCG Matrix following a November 2024 announcement. The company decided to suspend development due to escalating competition in the blood cancer space and doubts surrounding its regulatory and commercial viability, indicating low market share and low growth potential in that segment.

The SC379 glial progenitor cell program, intended for central nervous system disorders, was also deprioritized and development suspended in November 2024. This suggests limited potential within Sana's core objectives, leading to exploration of partnerships or spin-outs.

Broader, undifferentiated early-stage oncology programs lacking clear advantages or facing intense competition, if not prioritized like SC262, could also be classified as dogs. These are likely projects where investment is being reduced due to low perceived market share and uncertain growth.

Initiatives requiring extensive immunosuppression, particularly for allogeneic cell transplantation, would be considered dogs. These programs face market barriers due to patient burden and safety concerns, and their appeal is diminished by Sana's own Hypoimmune (HIP) platform, which aims to reduce the need for such broad immunosuppression.

| Program | Therapeutic Area | BCG Category | Reasoning | Status (as of Nov 2024) |

| SC291 | Oncology (B-cell malignancies) | Dog | Escalating competition, uncertain regulatory/commercial viability | Development suspended, exploring partnerships/divestment |

| SC379 | Central Nervous System Disorders | Dog | Deprioritized, limited potential within core objectives | Development suspended, exploring partnerships/spin-out |

| Undifferentiated Early-Stage Oncology Programs | Oncology | Potential Dog | Lack of clear advantage, intense competition, low perceived market share/growth | Reduced investment/ceasing development for non-priority assets |

| Programs requiring extensive immunosuppression | Cell Therapy | Dog | Patient burden, safety concerns, less competitive than HIP platform | Limited adoption and growth prospects |

Question Marks

SG299 is positioned as a Question Mark in Sana Biotechnology's BCG Matrix, reflecting its status as an early-stage, high-potential program in the burgeoning in vivo gene delivery space. Its innovative approach using a CD8-targeted fusogen platform for CAR T cell delivery targets both autoimmune diseases and oncology, areas with significant unmet needs and large market potential.

Currently in preclinical development, SG299 is projected to have an IND filing around 2026. This timeline suggests a substantial period of investment and cash burn before potential commercialization, characteristic of Question Mark assets. The market for in vivo gene therapies is rapidly expanding, with projections indicating significant growth in the coming years, though specific market share for SG299 is currently negligible given its developmental stage.

Sana Biotechnology's broader fusogen technology offers exciting possibilities for in vivo gene delivery beyond its current focus, like precisely delivering genetic payloads to T cells and hepatocytes. These areas are considered question marks in the BCG matrix because they represent significant growth potential but are still in the early stages of development, requiring substantial investment to clarify product candidates and market penetration. The company's foundational technology in these segments means they are poised to innovate, but the path to commercialization for these specific applications is still being charted.

While Sana Biotechnology's focus on type 1 diabetes is well-known, their broader mission of replacing missing or damaged cells opens doors to numerous regenerative medicine applications. Their proprietary HIP platform and stem cell differentiation expertise hold significant promise for conditions beyond diabetes, targeting areas with unmet medical needs.

Exploring indications like heart failure, neurodegenerative diseases, or liver disease could represent high-growth, high-potential markets for Sana. These areas, however, are characterized by substantial research and development costs and require extensive clinical validation to achieve market penetration.

For instance, the global regenerative medicine market, valued at approximately $14.5 billion in 2023, is projected to reach over $50 billion by 2030, highlighting the immense growth potential. Sana’s early-stage exploration into other organ systems, if successful, could position them to capture a significant share of these expanding markets.

Novel Applications of Hypoimmune Platform in New Disease Areas

Sana Biotechnology's Hypoimmune (HIP) platform shows promise beyond its initial targets of diabetes, autoimmune diseases, and oncology. Exploring these new disease areas presents significant growth potential, akin to a 'question mark' in a BCG matrix. These ventures are currently speculative, demanding substantial research to pinpoint viable targets and prove clinical effectiveness.

Investment in these nascent applications is inherently risky, but successful development could transform them into future market leaders or 'stars'. For instance, as of early 2024, Sana Biotechnology has been investigating the HIP platform's applicability in treating rare genetic disorders where immune rejection of transplanted cells is a significant barrier.

- Expansion into Rare Genetic Disorders: The HIP platform's ability to mask cell surface antigens could be leveraged to enable the engraftment of gene-corrected cells in patients with inherited conditions, potentially addressing unmet needs in areas like cystic fibrosis or sickle cell anemia.

- Neurological Diseases: Early-stage research is also examining the potential of HIP-modified cells to overcome immune barriers in the central nervous system, opening avenues for treating conditions such as Parkinson's disease or Alzheimer's disease.

- Cardiovascular Applications: Another promising area involves using the HIP platform to improve the survival of engineered cardiac cells for regenerative medicine following heart attacks, a market segment with substantial unmet needs.

- High R&D Investment Required: These novel applications require significant upfront capital for target identification, preclinical studies, and early-stage clinical trials, reflecting their 'question mark' status.

Future Pipeline Candidates from Pluripotent Stem Cell Differentiation

Sana Biotechnology’s ability to differentiate pluripotent stem cells into various cell types beyond pancreatic islets opens doors to a promising pipeline of future therapeutic candidates. These potential high-growth assets span diverse medical fields. For example, in 2024, Sana continued its research into differentiating stem cells for applications in areas like autoimmune diseases and neurodegenerative disorders, representing significant investment in early-stage research and development.

These future pipeline candidates are currently in the very early stages of development. While they hold immense potential, they are also consuming substantial research and development cash without any established market share or revenue generation. This characteristic places them firmly in the "question mark" category of the BCG matrix, demanding careful strategic evaluation and significant capital investment to progress.

The ultimate success of these pluripotent stem cell-derived therapies hinges on continued scientific breakthroughs and astute strategic prioritization.

- Early-Stage Development: Candidates are in preclinical or early clinical phases, requiring substantial ongoing R&D investment.

- High Growth Potential: Successful differentiation into therapeutic cell types could address significant unmet medical needs, leading to high market growth.

- Uncertain Market Share: Currently possess no market share, with future success dependent on clinical trial outcomes and regulatory approvals.

- R&D Intensity: Significant capital is allocated to research and development, impacting near-term profitability.

Sana Biotechnology's SG299, a CD8-targeted fusogen for in vivo gene delivery, is a prime example of a Question Mark. It operates in a high-growth but nascent market, demanding substantial investment for its preclinical development, with an IND filing anticipated around 2026.

The company’s broader exploration of its fusogen technology for precise gene delivery to cells like T cells and hepatocytes also falls into the Question Mark category. These applications hold significant future potential but are in early development stages, requiring considerable capital to define product candidates and market entry strategies.

Sana's pipeline extending beyond diabetes, leveraging its HIP platform and stem cell expertise for conditions like heart failure or neurodegenerative diseases, represents further Question Marks. The regenerative medicine market, valued at approximately $14.5 billion in 2023 and projected to exceed $50 billion by 2030, underscores the immense growth potential in these early-stage ventures.

The company's nascent research into rare genetic disorders, neurological diseases, and cardiovascular applications via its HIP platform exemplifies Question Marks. These areas require significant R&D investment, with uncertain market share contingent on clinical success and regulatory approvals.

BCG Matrix Data Sources

Our BCG Matrix is built on robust data including clinical trial results, patent filings, and market penetration analysis to understand product lifecycle and potential.