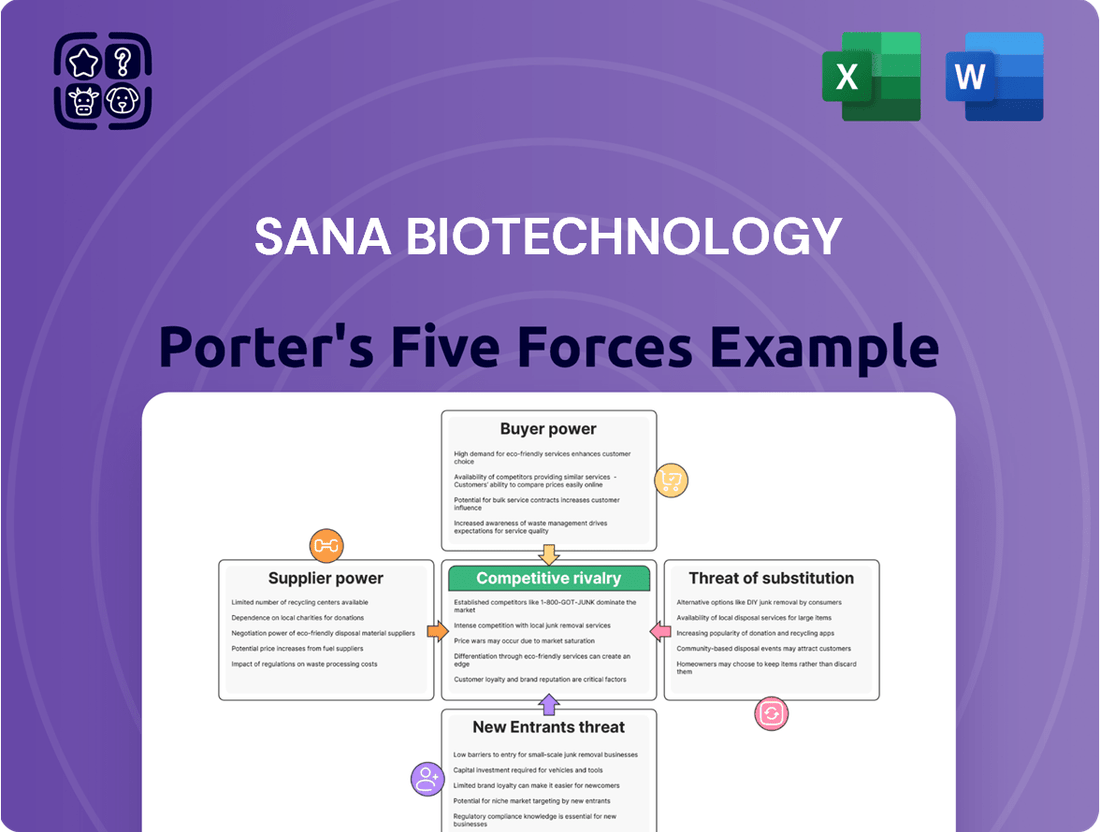

Sana Biotechnology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sana Biotechnology Bundle

Sana Biotechnology operates within a dynamic biotech landscape where novel therapies face intense scrutiny and rapid scientific advancement. Understanding the bargaining power of buyers, be they large pharmaceutical partners or regulatory bodies, is crucial for Sana's market access and pricing strategies. The threat of substitutes, while evolving, remains a constant consideration as new treatment modalities emerge.

The competitive rivalry among biotechnology firms is fierce, with innovation and intellectual property being key battlegrounds. Furthermore, the influence of suppliers, particularly for specialized reagents and manufacturing capabilities, can significantly impact Sana's operational costs and timelines. The threat of new entrants, though high in capital requirements, looms as scientific breakthroughs can democratize access to certain technologies.

The complete report reveals the real forces shaping Sana Biotechnology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Sana Biotechnology's reliance on highly specialized raw materials, reagents, and cell culture media is a critical factor in the bargaining power of its suppliers. The very nature of engineered cell and gene therapies demands unique inputs, often with few alternative sources available. This limited supplier pool naturally shifts power towards those providing these essential components.

For instance, the cutting-edge components necessary for Sana Biotechnology's in vivo delivery systems and ex vivo cell modification technologies are typically developed and supplied by a select few companies. This exclusivity means Sana's ability to secure these vital materials at favorable terms is significantly influenced by the suppliers' pricing and availability strategies. The market for these specialized biotech inputs is not as commoditized as many other industries, further concentrating supplier influence.

Sana Biotechnology's reliance on suppliers with proprietary technologies, such as advanced gene editing tools and viral vectors, significantly bolsters supplier bargaining power. These suppliers often hold patents protecting their innovations, making them unique and difficult to substitute.

The intellectual property held by these key suppliers creates high switching costs for Sana. If Sana were to seek alternative suppliers, they would likely face substantial investments in re-validating new technologies and processes, potentially delaying critical research and development timelines.

This dependency means suppliers can dictate terms, including pricing, which can directly impact Sana's cost of goods and overall profitability. For instance, the market for CRISPR-Cas9 gene editing components, a foundational technology for many biotech firms, has seen price fluctuations influenced by key patent holders.

The biotechnology sector, particularly in advanced areas like cell and gene therapy, frequently encounters bottlenecks due to restricted specialized manufacturing capabilities for intricate biological products. Companies like Sana Biotechnology must navigate this landscape where a limited number of Contract Development and Manufacturing Organizations (CDMOs) possess the requisite expertise and facilities for scaling up the production of engineered cells.

This scarcity of specialized manufacturing capacity grants significant leverage to these CDMOs. For Sana, this translates into fewer viable partners for large-scale production, which can directly impact operational costs and extend production timelines. For instance, the global biopharmaceutical contract manufacturing market was valued at approximately $17.9 billion in 2023 and is projected to grow substantially, yet the specialized segment for cell and gene therapies remains a critical constraint.

Specialized Talent Pool

The availability of highly skilled scientists, researchers, and manufacturing personnel is absolutely critical for Sana Biotechnology’s success. In 2024, the demand for professionals with expertise in cell and gene therapies continued to outstrip supply. This scarcity directly translates to increased bargaining power for these specialized individuals and the agencies that represent them.

This tight labor market means Sana Biotechnology, like many in the biotech sector, faces potentially higher labor costs and significant hurdles in both attracting and retaining top talent. For instance, a report from BioPharma Dive in early 2024 highlighted that average salaries for gene therapy researchers had seen double-digit percentage increases year-over-year, a direct consequence of this specialized talent crunch.

- High Demand, Low Supply: The specialized nature of cell and gene engineering creates a limited pool of qualified professionals.

- Increased Labor Costs: Competition for this talent drives up compensation, impacting Sana's operational expenses.

- Recruitment and Retention Challenges: Attracting and keeping these in-demand employees requires competitive offers and a strong organizational appeal.

- Impact on Innovation: Difficulty in securing and retaining key personnel can slow down research and development timelines.

Regulatory Requirements and Quality Standards

The stringent regulatory landscape, including requirements from bodies like the FDA and EMA for pharmaceutical-grade materials, significantly bolsters the bargaining power of suppliers. Meeting these exacting standards necessitates specialized manufacturing processes and quality control, limiting the pool of qualified vendors. This scarcity means Sana Biotechnology must often work with a smaller group of suppliers capable of delivering compliant products.

Compliance is non-negotiable for Sana, directly translating into increased leverage for suppliers who can consistently meet these rigorous demands. The necessity of adhering to these quality standards means Sana has limited alternatives if a key supplier falters on compliance, further concentrating power in the hands of those who can navigate this complex environment. For example, the cost of ensuring Good Manufacturing Practices (GMP) compliance for raw materials can be substantial, making it a barrier to entry for new suppliers and strengthening the position of established ones.

- Regulatory Hurdles: Suppliers must meet stringent FDA and EMA standards for pharmaceutical-grade materials.

- Limited Supplier Pool: High compliance costs restrict the number of qualified suppliers, concentrating power.

- Non-Negotiable Compliance: Sana's reliance on compliant materials enhances supplier leverage.

- Increased Costs: Adhering to quality standards adds complexity and expense for both Sana and its suppliers.

Sana Biotechnology faces significant supplier bargaining power due to its reliance on highly specialized, patented inputs for its cell and gene therapies. This limited supplier base, coupled with high switching costs stemming from proprietary technologies, grants suppliers considerable leverage over pricing and terms.

The scarcity of specialized manufacturing capacity, particularly for cell and gene therapies, further empowers a limited number of Contract Development and Manufacturing Organizations (CDMOs). This bottleneck impacts Sana's production scalability and costs. For instance, the specialized biopharmaceutical contract manufacturing market, while growing, faces capacity constraints.

Furthermore, the intense demand for highly skilled professionals in cell and gene therapy in 2024 has driven up labor costs and intensified recruitment challenges for companies like Sana. This talent scarcity directly boosts the bargaining power of specialized personnel and their representatives, impacting operational expenses.

Stringent regulatory requirements, such as Good Manufacturing Practices (GMP), significantly narrow the pool of qualified suppliers, increasing the leverage of those who can meet these exacting standards and thus impacting Sana's material costs.

| Factor | Impact on Sana Biotechnology | Supporting Data/Context |

|---|---|---|

| Specialized Inputs | High dependence on few suppliers for proprietary materials. | Limited alternative sources for engineered cell and gene therapy components. |

| Proprietary Technologies | High switching costs due to patents and re-validation needs. | Suppliers with unique gene editing tools and viral vectors dictate terms. |

| Manufacturing Capacity | Limited CDMO availability for specialized cell and gene therapy production. | Bottlenecks in scaling up complex biological products. |

| Skilled Labor | Increased labor costs and recruitment challenges for specialized talent. | Double-digit percentage increases in gene therapy researcher salaries in early 2024. |

| Regulatory Compliance | Concentrated power among suppliers meeting stringent FDA/EMA standards. | High costs for GMP compliance create barriers to entry for new suppliers. |

What is included in the product

This analysis delves into the competitive forces impacting Sana Biotechnology, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the biotech sector.

Instantly assess competitive pressures and identify strategic opportunities with a dynamic Porter's Five Forces analysis for Sana Biotechnology, built for clear, actionable insights.

Customers Bargaining Power

The high cost of cell and gene therapies, like those developed by Sana Biotechnology, grants considerable leverage to customers. These advanced treatments can range from hundreds of thousands to millions of dollars per patient, creating significant pressure on healthcare systems. In 2024, the average cost for a one-time gene therapy treatment continued to be in the high six figures, prompting intense scrutiny from payers.

Healthcare systems, insurance providers, and government payers possess substantial bargaining power due to these exorbitant prices. They actively negotiate reimbursement rates and demand evidence of long-term efficacy and cost-effectiveness to manage their budgets. This financial pressure means payers can dictate terms, influencing market access and adoption of new therapies.

For rare diseases, the limited patient pool can amplify customer bargaining power. While Sana Biotechnology seeks wide application, initial targets for advanced therapies are often small, ultra-rare disease groups. This scarcity means each patient or healthcare provider represents a more significant portion of the market, potentially giving them greater leverage, particularly if alternative treatments are available or patient advocacy groups are influential.

The complex and evolving reimbursement landscape for cell and gene therapies presents a significant challenge for companies like Sana Biotechnology, directly impacting the bargaining power of customers, primarily payers. Payers are increasingly scrutinizing the value and cost-effectiveness of these novel treatments.

Payers often delay or deny coverage for advanced therapies, demanding extensive clinical data and compelling evidence of long-term benefits to justify high price points. This creates leverage for them, as Sana must invest heavily in generating this data to gain market access for its products.

For instance, the average cost of a cell and gene therapy can range from hundreds of thousands to over a million dollars, making payers exceptionally cautious. Sana's ability to demonstrate clear value propositions, including improved patient outcomes and reduced long-term healthcare costs, is crucial for negotiating favorable reimbursement terms and mitigating the impact of this customer bargaining power.

Availability of Alternative Treatments

The availability of alternative treatments significantly impacts Sana Biotechnology's customer bargaining power. For many rare diseases or complex conditions Sana aims to address, established therapies like traditional pharmaceuticals, surgical interventions, or even supportive care can act as substitutes, even if they don't offer a cure. For instance, in oncology, while Sana might be developing novel cell therapies, patients still have access to chemotherapy, radiation, and immunotherapy, which represent existing treatment pathways.

This presence of alternatives, even if imperfect, grants customers leverage. They can compare Sana's proposed treatments with existing options, influencing pricing expectations and demanding demonstrable efficacy. If Sana's novel therapy is significantly more expensive or offers only marginal benefits over standard care, patients and their insurers may opt for the more familiar and potentially less costly alternatives. For example, the market penetration of existing treatments for autoimmune diseases, such as biologics like adalimumab, sets a benchmark for newer entrants.

- Existing therapies like pharmaceuticals and surgeries offer alternative options for patients.

- The effectiveness and cost of these alternatives pressure Sana on pricing and efficacy demands.

- In 2023, the global pharmaceutical market was valued at approximately $1.57 trillion, indicating a large and established market for alternative treatments.

- The presence of multiple established treatment pathways for conditions like diabetes or cardiovascular disease strengthens customer bargaining power against novel therapeutic approaches.

Physician and Hospital Influence

Healthcare providers, especially major academic medical centers and highly specialized hospitals, hold significant sway in the adoption and delivery of advanced therapies like those Sana Biotechnology develops. Their specialized knowledge and existing infrastructure are crucial for successfully administering these treatments. This makes their willingness to integrate Sana's innovations a key factor for market acceptance.

The bargaining power of these healthcare institutions stems from their ability to influence patient decisions and their control over treatment pathways. Without their buy-in and established protocols, reaching a broad patient base becomes challenging. For instance, by 2024, many leading U.S. hospitals were actively evaluating and integrating new cell and gene therapies into their service lines, often demanding favorable terms due to the high cost and complexity of these treatments.

- Critical Infrastructure: Hospitals provide the necessary facilities and trained personnel for complex therapy administration.

- Expertise and Influence: Leading physicians and institutions guide patient treatment choices.

- Market Access Gatekeepers: Their adoption is essential for widespread patient access and market penetration.

- Negotiating Leverage: The high cost and specialized nature of these therapies give providers significant bargaining power.

The bargaining power of customers, particularly payers like insurance companies and healthcare systems, is substantial for companies like Sana Biotechnology due to the high cost of cell and gene therapies. These therapies can cost hundreds of thousands to over a million dollars per patient, leading payers to demand rigorous evidence of efficacy and cost-effectiveness. In 2024, payer scrutiny intensified as they sought to manage budgets against these high-priced treatments.

| Customer Type | Source of Bargaining Power | Impact on Sana Biotechnology | Supporting Data (2024/2023) |

|---|---|---|---|

| Payers (Insurers, Governments) | High therapy costs, demand for value demonstration | Negotiate reimbursement, influence market access | Average gene therapy cost: $600,000 - $1,000,000+ |

| Healthcare Providers (Hospitals) | Control treatment pathways, specialized infrastructure | Gatekeepers for adoption, demand favorable terms | Major hospitals actively integrating new therapies |

| Patients/Advocacy Groups | Limited patient pools for rare diseases, influence | Amplify leverage, especially with few alternatives | N/A (Qualitative impact) |

Same Document Delivered

Sana Biotechnology Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Sana Biotechnology, offering a comprehensive examination of its competitive landscape. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, which details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the biotechnology sector. This professionally written analysis is ready for your immediate use.

Rivalry Among Competitors

The biotechnology sector, particularly in cell and gene therapy, is a hotbed of innovation. Numerous companies are locked in a race to develop groundbreaking treatments, making competitive rivalry intense. Sana Biotechnology operates within this dynamic environment, facing off against both large, established pharmaceutical companies and agile, emerging biotech firms.

This intense competition means that being first to market with a safe and effective engineered cell medicine can provide a significant advantage. Companies are investing heavily in research and development to achieve these breakthroughs. For instance, the global biotechnology market was valued at approximately $1.77 trillion in 2023 and is projected to grow significantly, underscoring the high stakes involved in this innovation race.

The biotechnology sector’s competitive intensity is significantly fueled by substantial investments in research and development (R&D). Companies are channeling vast resources into advancing their therapeutic pipelines, creating a dynamic and innovation-driven landscape. This high R&D spending directly translates into a fierce competition where the ability to develop novel treatments and secure intellectual property is paramount.

Sana Biotechnology's strategic focus on type 1 diabetes and B-cell mediated autoimmune diseases places it squarely in highly competitive arenas. Success in these fields hinges on robust clinical trial outcomes and timely data readouts, which serve as critical differentiators. For instance, in the competitive type 1 diabetes space, companies like Vertex Pharmaceuticals have also made significant strides, highlighting the intense race for effective therapies.

Intellectual property battles are a significant factor in the biotechnology sector, including for companies like Sana Biotechnology. The landscape is dense with complex patents, creating fertile ground for disputes and requiring careful navigation of licensing agreements. Companies fiercely guard their unique technologies, understanding that a robust IP portfolio is fundamental to maintaining a competitive edge, which frequently escalates into costly legal confrontations.

Strategic Partnerships and M&A Activity

The competitive landscape in biotechnology is heavily influenced by strategic alliances and mergers and acquisitions (M&A). Companies forge partnerships to consolidate cutting-edge technologies, broaden their drug development pipelines, and ultimately capture a larger share of the market. Sana Biotechnology's own strategic collaborations, including those with Beam Therapeutics and Harvard College, underscore the importance of leveraging external expertise and resources to accelerate innovation and development.

These partnerships are crucial for accessing specialized knowledge, sharing development costs, and de-risking the often lengthy and expensive process of bringing new therapies to market. For instance, in 2024, the biotechnology sector saw significant M&A activity, with companies actively seeking to acquire innovative platforms or promising preclinical and clinical-stage assets. This trend is expected to continue as firms aim to strengthen their competitive positions and address unmet medical needs through synergistic combinations.

- Strategic Alliances: Sana Biotechnology's partnerships, like the one with Beam Therapeutics, facilitate access to gene editing technologies, enhancing its product development capabilities.

- M&A Drivers: Companies pursue mergers and acquisitions to consolidate research, expand therapeutic areas, and achieve economies of scale in a highly competitive industry.

- Market Share Growth: Collaborations and acquisitions are key strategies for established players and emerging companies alike to increase their market presence and revenue streams.

- Innovation Acceleration: By pooling resources and expertise, these strategic moves aim to speed up the discovery and commercialization of novel treatments.

Global Market Growth and New Entrants

The cell and gene therapy market is booming, with projections indicating substantial growth, which naturally draws in new players. This increasing competition means companies like Sana Biotechnology face intense rivalry. The allure of addressing significant unmet medical needs is a powerful magnet for investment, creating a crowded landscape where standing out is crucial.

In 2024, the global cell and gene therapy market was valued at approximately $20.9 billion, with forecasts suggesting it could reach over $50 billion by 2030, demonstrating the rapid expansion and attractiveness of the sector. This growth trajectory signals a fertile ground for both established biotechs and emerging startups, intensifying the competitive environment.

- Intensifying Rivalry: Rapid market growth attracts numerous new entrants, increasing competition.

- Differentiation is Key: Companies must differentiate through unique technologies and clinical outcomes.

- Investment Fuel: The promise of transformative therapies drives significant investment, further populating the market.

- Clinical Success Paramount: Achieving strong clinical trial results is vital for market differentiation and survival.

Competitive rivalry in the biotechnology sector, particularly for companies like Sana Biotechnology focusing on cell and gene therapies, is exceptionally fierce. This intensity is driven by the sector's high growth potential and the significant unmet medical needs these therapies aim to address, attracting substantial investment and a multitude of players. Companies are in a race to innovate, develop novel treatments, and secure intellectual property, making differentiation through strong clinical outcomes and unique technologies paramount.

| Key Player | Focus Area | Recent Development/Strategy |

|---|---|---|

| Sana Biotechnology | Cell and Gene Therapy (e.g., T1D, Autoimmune) | Strategic partnerships, R&D investment in novel platforms |

| Vertex Pharmaceuticals | Type 1 Diabetes Treatments | Advancing clinical trials for potential curative therapies |

| Beam Therapeutics | Gene Editing (Base & Prime Editing) | Collaborations to leverage editing technologies in therapeutic development |

SSubstitutes Threaten

For the conditions Sana Biotechnology targets, traditional small molecule drugs and biologics are readily available and often come with a lower price tag, making them strong substitutes. These established therapies, while not offering the potential cures of cell and gene therapies, can effectively manage symptoms or control diseases, directly impacting patient and insurance provider decisions. For instance, in oncology, where Sana is active, chemotherapy and targeted therapies remain the standard of care, with global oncology drug sales expected to reach over $250 billion by 2024.

Many diseases, like specific cancers or failing organs, already have tried-and-true surgical or medical treatments. These established procedures, while sometimes invasive or not perfectly curative, are widely understood and typically covered by health insurance. For example, in 2024, organ transplants, a significant surgical intervention, continued to be a primary treatment for end-stage organ failure, with over 40,000 transplants performed in the U.S. alone.

This familiarity and insurance coverage present a practical hurdle for new cell therapies. Patients and healthcare providers are often more comfortable with, and have established reimbursement pathways for, existing surgical and medical options. The Centers for Medicare & Medicaid Services (CMS) in the U.S. continues to reimburse for a vast array of surgical procedures, creating a strong financial incentive to stick with known methods.

For chronic conditions such as diabetes, lifestyle modifications like dietary adjustments and regular self-monitoring can serve as viable substitutes for more advanced, and often costly, cell-based therapies. These foundational approaches represent the initial and most accessible management strategies for many patients.

The economic burden of chronic disease management is significant; in 2024, the global diabetes care market was valued in the hundreds of billions of dollars, with a substantial portion attributed to lifestyle support and monitoring tools. This highlights the widespread adoption and perceived effectiveness of less intensive interventions.

Furthermore, the increasing availability and affordability of wearable health trackers and digital health platforms provide accessible alternatives for disease management, potentially reducing the perceived necessity for expensive, cutting-edge treatments for a broad patient demographic.

Emerging Therapies from Other Modalities

Advances in other therapeutic modalities represent a significant threat of substitutes for Sana Biotechnology's cell-based therapies. For instance, the rapid development and adoption of mRNA-based vaccines and therapeutics, like those from Moderna and Pfizer, demonstrate the potential for alternative delivery systems to gain market traction. These platforms, which saw substantial investment and clinical validation through 2024, could offer comparable or even superior efficacy for certain indications, potentially with different safety profiles or manufacturing efficiencies.

Precision medicine and novel gene editing techniques, such as advancements beyond CRISPR-Cas9, also pose a substitution risk. Companies focusing on targeted therapies that address specific genetic mutations or cellular pathways might provide outcomes that are competitive with cell-based treatments. The market for precision medicine is projected to continue its robust growth, with analysts anticipating the global market to reach hundreds of billions of dollars by the late 2020s, indicating a significant competitive landscape.

- mRNA Therapies: The success of COVID-19 mRNA vaccines validated the platform, opening doors for their application in other diseases, potentially competing with cell therapies in areas like oncology and infectious diseases.

- Precision Medicine: Targeted therapies that address specific genetic markers or molecular pathways can offer alternatives with potentially lower systemic toxicity compared to some cell-based approaches.

- Alternative Gene Editing: While CRISPR is prominent, emerging gene editing technologies could offer different delivery mechanisms or editing efficiencies, creating substitute treatment options.

- Risk-Benefit Profiles: Competitors offering therapies with perceived lower risks or simpler administration routes could draw patients and healthcare providers away from more complex cell therapy protocols.

Cost-Effectiveness and Accessibility

The high cost and intricate logistics associated with cell and gene therapies significantly limit their accessibility compared to many alternative treatments. For instance, while specific cost data for Sana Biotechnology’s pipeline is proprietary, the general market trend for advanced therapies often involves millions of dollars per treatment. If alternative, albeit less advanced, therapeutic options are substantially more affordable and broadly available, they represent a significant threat by attracting a wider patient base who may prioritize cost and convenience over the cutting-edge nature of cell and gene therapies.

This cost-and-accessibility dynamic can be a critical factor in patient and physician decision-making. Consider the broader pharmaceutical market in 2024, where established treatments with lower price points continue to hold significant market share, even when newer, more expensive options emerge. The threat of substitutes is amplified when these alternatives provide a reasonable level of efficacy, even if not superior, at a fraction of the cost. This forces companies like Sana Biotechnology to not only demonstrate clinical superiority but also to address the economic barriers to widespread adoption.

- High Cost Barrier: Cell and gene therapies often carry price tags in the hundreds of thousands to millions of dollars, making them inaccessible to a large portion of the population.

- Logistical Complexity: The specialized handling, manufacturing, and administration required for these advanced therapies add further costs and logistical hurdles.

- Affordability of Alternatives: Many established treatments, while potentially less effective, are significantly more affordable and easier to administer, posing a direct competitive threat.

- Patient Preference for Cost-Effectiveness: A substantial patient population may opt for less ideal but more affordable and accessible treatments, impacting market penetration for higher-cost therapies.

The threat of substitutes for Sana Biotechnology's cell and gene therapies is substantial, driven by existing, more affordable, and widely adopted treatments. Traditional small molecule drugs and biologics, while not offering potential cures, effectively manage symptoms, making them strong contenders, especially in areas like oncology where global drug sales are projected to exceed $250 billion by 2024.

Established surgical and medical treatments, often covered by insurance, also present a challenge. For instance, organ transplants, a primary treatment for end-stage organ failure, saw over 40,000 procedures in the U.S. in 2024. Furthermore, lifestyle modifications and accessible digital health platforms serve as viable substitutes for chronic conditions like diabetes, with the global diabetes care market valued in the hundreds of billions in 2024.

| Therapeutic Area | Sana's Approach | Key Substitutes | 2024 Market Data/Projections |

|---|---|---|---|

| Oncology | Cell and Gene Therapies | Chemotherapy, Targeted Therapies | Global oncology drug sales > $250 billion |

| Organ Failure | Cell and Gene Therapies | Organ Transplants | Over 40,000 U.S. transplants |

| Chronic Disease (e.g., Diabetes) | Cell and Gene Therapies | Lifestyle Modifications, Digital Health Platforms | Global diabetes care market (hundreds of billions) |

Entrants Threaten

Developing engineered cell therapies like those Sana Biotechnology focuses on requires enormous financial backing. The journey from initial research and development to preclinical testing, extensive clinical trials, and setting up specialized manufacturing facilities represents a significant capital outlay. This is a major hurdle for any potential new competitor wanting to enter the space.

Sana Biotechnology's own financial statements underscore this reality, reporting substantial net losses. For instance, in 2023, the company reported a net loss of $176.6 million. This demonstrates the sheer scale of investment needed, effectively acting as a formidable barrier to entry for new players who may not have access to such extensive funding.

Complex regulatory hurdles significantly deter new entrants in the biotechnology sector, particularly for innovative therapies. Navigating the intricate and stringent approval processes, such as those managed by the FDA and EMA, for novel cell and gene therapies is a formidable barrier. New entrants face lengthy and costly clinical trials, demanding extensive data on safety and efficacy, which can take years to achieve and cost hundreds of millions of dollars. For instance, the average cost to develop a new drug can exceed $2 billion, with a significant portion allocated to regulatory compliance and clinical testing.

The cell and gene therapy sector, where Sana Biotechnology operates, is a complex web of intellectual property. Patents are prevalent, covering everything from specific genes and the viral vectors used to deliver them, to the intricate manufacturing processes required. This creates a significant barrier for any new entrant.

To enter this market, newcomers must either innovate with entirely new intellectual property, a costly and time-consuming endeavor, or secure licenses for existing technologies. Without either, they risk substantial legal battles that can cripple a nascent business. For instance, in 2023, the total patent filings in the biotechnology sector, which includes cell and gene therapies, saw a notable increase, underscoring the intense IP competition.

Need for Specialized Expertise and Infrastructure

The development and manufacturing of engineered cells, crucial for companies like Sana Biotechnology, demand exceptionally specialized scientific and technical knowledge, alongside purpose-built infrastructure. This high barrier significantly deters new entrants lacking established biotech foundations.

Establishing the necessary advanced laboratories, sophisticated manufacturing facilities, and rigorous quality control systems represents a substantial capital investment. For instance, setting up a cGMP (current Good Manufacturing Practice) facility for cell therapy production can cost tens of millions of dollars, making it a formidable hurdle.

The need for specialized expertise extends to areas such as gene editing, cell culture optimization, and regulatory compliance, all of which require highly trained personnel. A shortage of skilled professionals in these niche fields further complicates market entry.

- High Capital Investment: Building advanced cell therapy manufacturing facilities can easily exceed $50 million.

- Specialized Talent Pool: Access to experienced scientists in gene editing and cell biology is limited.

- Regulatory Hurdles: Navigating complex FDA approvals for cell-based therapies requires significant regulatory expertise and resources.

- Intellectual Property: Existing patents in gene editing and cell engineering can block new market participants.

Brand Reputation and Clinical Validation

The threat of new entrants for a company like Sana Biotechnology is significantly influenced by the formidable barriers erected by established brand reputation and the rigorous process of clinical validation. Even as an emerging player, Sana's progress in clinical trials, coupled with its data readouts, is actively cultivating a reputation for reliability and scientific rigor. This is a crucial differentiator.

New entrants, by contrast, often find themselves at a disadvantage due to a lack of this hard-won clinical validation. Building trust with medical professionals, securing essential partnerships, and attracting the necessary investment and top-tier talent are considerably more challenging without a proven track record. This absence of established credibility can impede patient enrollment in trials, a vital component for any biotechnology firm's success.

- Clinical Trial Milestones: Sana Biotechnology's ongoing clinical trials, such as those for its gene therapies, represent significant investments and milestones that build credibility. For example, successful Phase 1 trial results, which were anticipated in late 2024, would serve as a critical validation point.

- Investor Confidence: A strong pipeline and positive clinical data directly impact investor confidence. As of mid-2024, Sana had secured substantial funding rounds, reflecting investor belief in its platform and early-stage results.

- Regulatory Hurdles: The lengthy and expensive process of gaining regulatory approval for new therapies acts as a substantial barrier. New entrants must replicate this complex journey without the benefit of Sana's existing regulatory interactions and data packages.

- Talent Acquisition: Experienced scientists and clinicians are drawn to companies with demonstrated progress. Sana's reputation for innovative research makes it an attractive destination for talent, a resource scarce for newcomers.

The threat of new entrants in the engineered cell therapy space, where Sana Biotechnology operates, is severely limited by immense capital requirements, stringent regulatory pathways, and deeply entrenched intellectual property. These factors collectively create a high barrier to entry, making it exceptionally difficult for new companies to challenge established players.

Companies like Sana need substantial funding for R&D, clinical trials, and specialized manufacturing, with 2023 net losses of $176.6 million highlighting this reality. Furthermore, navigating complex FDA and EMA approvals, which can cost over $2 billion per drug, and overcoming extensive patent portfolios in gene editing and cell engineering demand resources and expertise that new entrants often lack. For instance, patent filings in biotech continue to rise, intensifying IP competition.

The need for specialized scientific talent and advanced manufacturing facilities, costing tens of millions for cGMP compliance, further deters newcomers. Sana's own progress in clinical trials, such as anticipated late 2024 Phase 1 results, builds critical credibility, a hurdle new entrants must overcome without established validation or access to scarce, experienced talent in gene editing and cell biology.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sana Biotechnology is built on a foundation of comprehensive data, including SEC filings, investor presentations, and reputable industry research reports.

We leverage insights from clinical trial databases, patent filings, and market intelligence platforms to assess the competitive landscape, supplier power, and buyer bargaining in the biotechnology sector.