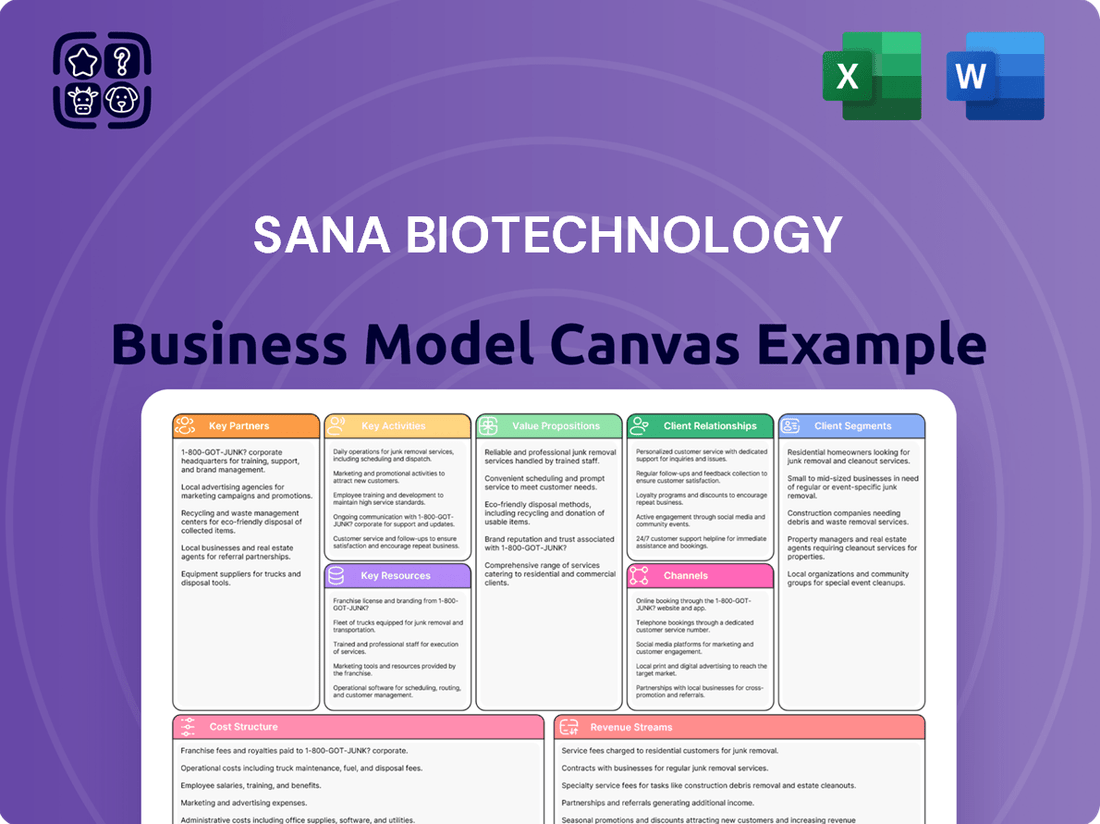

Sana Biotechnology Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sana Biotechnology Bundle

Unlock the strategic blueprint behind Sana Biotechnology's innovative approach. This comprehensive Business Model Canvas details their unique value propositions, target customer segments, and key revenue streams, offering a clear view into their operational success.

Discover how Sana Biotechnology leverages strategic partnerships and key resources to deliver groundbreaking therapies. Understand their cost structure and key activities that drive their competitive advantage.

Want to see exactly how Sana Biotechnology operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Sana Biotechnology’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Download the full Business Model Canvas for Sana Biotechnology and get a complete strategic snapshot—from core activities to value creation. Available now to accelerate your own business thinking and strategic planning.

Partnerships

Sana Biotechnology actively partners with academic and research institutions like Uppsala University Hospital. These collaborations are vital for conducting early-stage clinical trials, often referred to as investigator-sponsored trials, which help validate their innovative cell therapies. For instance, in 2024, Sana continued to deepen its ties with key academic centers to explore novel applications and refine its therapeutic platforms.

Sana Biotechnology's strategic alliances with other biopharmaceutical firms are crucial, particularly for programs slated for out-licensing or co-development. These partnerships are designed to accelerate therapy development, share the inherent risks in the biotech sector, and leverage the commercialization expertise of established players. For instance, Sana has strategically deprioritized certain oncology programs for internal investment, creating opportunities for external collaborations that could bring these potential therapies to market.

Sana Biotechnology strategically partners with leading technology firms, notably Beam Therapeutics Inc., to integrate advanced gene editing capabilities. This collaboration grants Sana access to proprietary CRISPR Cas12b nuclease editing, a crucial component for their innovative cell therapies.

These alliances are vital for enhancing Sana's core platforms, including their hypoimmune (HIP) and fusogen technologies. By embedding cutting-edge gene editing tools, Sana significantly boosts its capacity for precise cell modification and efficient delivery mechanisms, ensuring a competitive edge.

For instance, access to Beam's gene editing technology allows Sana to refine the immunogenicity of its engineered cells, a critical factor for successful allogeneic cell therapies. This focus on immune evasion is paramount for broad patient applicability.

These technology collaborations are fundamental to Sana's business model, enabling them to push the boundaries of cell engineering and develop potentially groundbreaking treatments for a range of diseases.

Contract Research Organizations (CROs)

Sana Biotechnology likely partners with Contract Research Organizations (CROs) to navigate the intricate landscape of cell therapy development. Given the specialized nature and regulatory demands of clinical trials in this field, CROs offer crucial expertise in trial design, patient recruitment, and data management, freeing Sana to concentrate on its core innovation.

These collaborations are essential for efficiently executing preclinical and clinical studies, ensuring adherence to stringent regulatory requirements. For instance, the global CRO market was valued at over $50 billion in 2023 and is projected to grow significantly, underscoring the vital role these organizations play in the biopharmaceutical industry. Sana's engagement with CROs would likely encompass:

- Clinical Trial Management: Overseeing all phases from protocol development to site selection and monitoring.

- Regulatory Affairs Support: Assisting with submissions to regulatory bodies like the FDA.

- Data Analysis and Biostatistics: Ensuring robust interpretation of trial outcomes.

- Specialized Scientific Expertise: Providing deep knowledge in cell and gene therapy research.

Manufacturing and Supply Chain Partners

As Sana Biotechnology moves its therapies closer to market, forming strong relationships with specialized contract development and manufacturing organizations (CDMOs) is paramount. These partnerships will be the backbone for scaling up the production of its innovative engineered cell therapies, ensuring they can reach a wider patient population.

Securing reliable supply chain partners is equally vital. This involves experts adept at managing the intricate logistics required for cell therapies, including specialized handling, temperature control, and timely delivery to treatment centers. For Sana's ‘off-the-shelf’ cell therapies, a seamless and compliant supply chain is non-negotiable for consistent product quality and patient safety.

- CDMO Selection: Sana will need to partner with CDMOs possessing expertise in cell therapy manufacturing, adhering to current Good Manufacturing Practices (cGMP).

- Supply Chain Expertise: Partnerships will focus on logistics providers experienced in cold chain management and the specialized handling of biological materials.

- Regulatory Compliance: Key partners must demonstrate a strong track record in navigating regulatory hurdles for cell and gene therapies, ensuring all manufacturing and distribution processes meet FDA and other global health authority standards.

- Scalability: The chosen manufacturing partners must have the capacity and flexibility to scale production as demand for Sana's therapies grows, potentially supporting hundreds to thousands of patient doses annually by 2026.

Sana Biotechnology's key partnerships extend to academic and research institutions for early-stage clinical validation, crucial for their cell therapy platforms. Collaborations with biopharmaceutical firms are strategic for out-licensing and co-development, sharing risk and leveraging commercialization expertise. Furthermore, alliances with technology leaders like Beam Therapeutics provide access to essential gene editing tools, enhancing Sana's core cell engineering capabilities.

These collaborations are critical for advancing Sana's proprietary technologies, such as hypoimmune (HIP) and fusogen platforms, enabling precise cell modification. The company also relies on Contract Research Organizations (CROs) for specialized expertise in clinical trial management and regulatory affairs, a vital support given the complex nature of cell therapy development. The global CRO market surpassed $50 billion in 2023, highlighting their indispensable role.

Looking ahead, partnerships with Contract Development and Manufacturing Organizations (CDMOs) and specialized supply chain firms are paramount for scaling production and ensuring the efficient, compliant delivery of Sana's therapies. This includes CDMOs with current Good Manufacturing Practices (cGMP) expertise and logistics partners experienced in cold chain management for biological materials.

| Partner Type | Purpose | Example/Focus Area | Strategic Importance |

|---|---|---|---|

| Academic/Research Institutions | Early-stage clinical validation, novel application exploration | Uppsala University Hospital | Validating cell therapies, refining platforms |

| Biopharmaceutical Firms | Co-development, out-licensing | Deprioritized oncology programs | Accelerating therapy development, sharing risk |

| Technology Firms | Access to advanced gene editing | Beam Therapeutics Inc. (CRISPR Cas12b) | Enhancing cell engineering, immune evasion |

| CROs | Clinical trial management, regulatory support | Specialized expertise in cell therapy trials | Efficient study execution, regulatory adherence |

| CDMOs/Supply Chain Partners | Manufacturing scale-up, logistics | cGMP manufacturing, cold chain management | Scaling production, ensuring product quality and patient safety |

What is included in the product

A detailed, strategically aligned business model canvas for Sana Biotechnology, outlining its customer segments, value propositions, and channels to address unmet medical needs in gene and cell therapy.

This BMC reflects Sana's operational plans and competitive advantages, offering insights for informed decision-making and stakeholder discussions.

Sana Biotechnology's Business Model Canvas offers a clear, concise snapshot of their innovative approach to gene therapy, simplifying complex strategies for quick understanding and discussion.

Activities

Sana Biotechnology's core strength lies in its robust research and development efforts, specifically targeting gene and cell engineering to pioneer new cell therapies. This commitment is evident in their continuous investment in preclinical studies and the advancement of their proprietary hypoimmune platform, or HIP, alongside their fusogen technology.

The company's significant allocation of resources to R&D underscores a dedication to innovation across various therapeutic areas, with a particular focus on conditions like type 1 diabetes and other autoimmune diseases. For instance, in 2023, Sana reported R&D expenses of $233.3 million, highlighting the substantial financial commitment to these cutting-edge scientific endeavors and the development of their therapeutic candidates.

Sana Biotechnology's key activities revolve around the meticulous management and execution of clinical trials for its innovative cell and gene therapies. This crucial phase involves navigating the complex landscape of patient recruitment, ensuring rigorous data collection, and maintaining vigilant safety monitoring throughout the trial process. For instance, Sana is actively progressing its gene therapy candidate, UP421, through clinical development, a process that demands precise oversight.

The company's commitment extends to the thorough reporting of clinical results to regulatory authorities like the FDA. This transparent communication is vital for gaining approval to advance their therapies, such as SC291 and SC262, to subsequent clinical phases. The successful validation of these therapies through clinical trials is paramount to their business strategy and market potential.

Sana Biotechnology's core activities revolve around developing and safeguarding a strong intellectual property (IP) portfolio. This includes patents covering their innovative cell engineering platforms, specific gene modifications, and their promising therapeutic candidates.

This strategic IP development is vital for protecting their unique technologies and establishing a significant competitive edge within the specialized biotechnology sector. Their foundational IP, particularly around the HIP platform, underpins their entire approach.

By securing these rights, Sana Biotechnology creates a barrier to entry for competitors and ensures they can exclusively leverage their advancements. This focus on IP protection is a cornerstone of their business model, enabling long-term value creation.

Regulatory Affairs and Submissions

Engaging with regulatory bodies such as the U.S. Food and Drug Administration (FDA) is a cornerstone activity for Sana Biotechnology. This involves meticulously preparing and submitting essential documentation, including Investigational New Drug (IND) applications, to demonstrate the safety and efficacy of their novel therapies. These submissions are critical for advancing their drug candidates through the rigorous development pipeline towards potential market approval.

Sana Biotechnology is strategically focused on preparing IND filings for its advanced candidates, SC451 and SG299. The company anticipates submitting these crucial applications as early as 2026. This timeline underscores their commitment to a structured and compliant approach to drug development, aiming to meet all regulatory prerequisites for future clinical trials and eventual commercialization.

- Regulatory Engagement: Direct interaction and communication with agencies like the FDA are fundamental.

- Submission Preparation: Developing and filing comprehensive Investigational New Drug (IND) applications and other required regulatory documents.

- Compliance Assurance: Ensuring all therapies adhere to stringent safety and efficacy standards mandated by regulatory authorities.

- Strategic Filing Timeline: Planning to submit INDs for SC451 and SG299 in 2026, marking a significant milestone in their development process.

Manufacturing and Quality Control

Sana Biotechnology's key activities revolve around establishing and refining manufacturing processes for their engineered cell therapies. This is crucial for ensuring both the scalability of their treatments and the consistent quality of their products. They are focused on developing robust methods for producing cells both outside the body (ex vivo) and directly within the body (in vivo).

A significant hurdle and a core focus for Sana is the development of production methods that can be scaled up effectively. This involves intricate processes to ensure that each batch of cell medicine meets rigorous safety and efficacy standards. For instance, in 2024, the cell and gene therapy market continued its rapid expansion, with companies like Sana investing heavily in manufacturing capabilities to meet projected demand. The complexity of these biological manufacturing processes necessitates advanced quality control measures at every stage.

- Process Optimization: Continuously improving the methods used to grow and engineer cells to enhance yield and reduce costs.

- Quality Assurance: Implementing comprehensive testing and validation protocols to guarantee product safety, potency, and purity.

- Scalability Solutions: Designing and building manufacturing infrastructure capable of meeting future market demands.

- Regulatory Compliance: Adhering to strict Good Manufacturing Practices (GMP) to ensure all products meet regulatory agency requirements.

Sana Biotechnology's key activities extend to the strategic formation of partnerships and collaborations. These alliances are crucial for accessing complementary expertise, co-developing technologies, and navigating the complex path to market. For example, collaborations can accelerate clinical development or broaden the therapeutic reach of their innovative platforms.

Delivered as Displayed

Business Model Canvas

This preview showcases the actual Sana Biotechnology Business Model Canvas you will receive upon purchase. It's a direct, unedited view of the comprehensive document, ensuring exactly what you see is what you get. Upon completing your order, you will gain full access to this meticulously crafted Business Model Canvas, ready for immediate application and strategic planning.

Resources

Sana Biotechnology's core assets lie in its proprietary Hypoimmune (HIP) platform, designed for immune evasion, and its Fusogen technology, crucial for in vivo gene delivery.

These advanced platforms are the bedrock of Sana's strategy to create 'off-the-shelf' allogeneic cell therapies. This means patients can receive treatments without the need for complex immunosuppression protocols.

The HIP platform specifically allows engineered cells to evade the body's immune response, a significant hurdle in transplant and cell therapy development. This innovation is key to making these therapies more broadly accessible and effective.

Fusogen technology, on the other hand, facilitates the direct delivery of genetic material into cells within the body. This capability is vital for gene therapy applications, opening doors for treating a wide range of genetic diseases.

Sana Biotechnology’s business model hinges on its access to highly specialized scientific and clinical talent. This includes experts in cell and gene therapy, immunology, and the intricate process of clinical development. Their deep knowledge is the engine driving Sana’s innovative pipeline forward.

This skilled workforce is not just for research; it’s equally vital for the practical execution of clinical trials and ongoing operations. The ability to attract and retain these professionals is therefore a cornerstone of Sana’s ability to translate scientific breakthroughs into viable therapeutic products.

As of early 2024, Sana Biotechnology reported a dedicated team of over 300 employees, with a significant portion holding advanced scientific degrees. This concentration of expertise in areas like CAR-T cell therapy and gene editing underscores the company's commitment to building a robust scientific foundation.

Sana Biotechnology's intellectual property portfolio is a cornerstone of its business model, encompassing a robust collection of patents, licenses, and trade secrets. These assets are specifically tied to their advanced gene editing techniques, sophisticated cell engineering processes, and the unique therapeutic candidates they are developing.

This dense intellectual property acts as a critical competitive moat, safeguarding their innovations and providing a solid foundation for both direct commercialization and lucrative future licensing agreements. Sana's strategic focus has yielded foundational intellectual property in the highly promising hypoimmune space.

Clinical Pipeline and Data

The clinical pipeline and the data generated are Sana Biotechnology's most critical resources. Their portfolio of investigational new drugs (INDs) and the ongoing preclinical and clinical data from trials like UP421, SC291, and SC262 are invaluable assets. Positive clinical outcomes, especially in areas like type 1 diabetes, showcase the potential of their foundational platforms and significantly de-risk the development of subsequent programs.

This accumulating data is fundamental for attracting crucial investment and navigating the rigorous path toward regulatory approval. For instance, as of early 2024, Sana Biotechnology has been advancing multiple cell therapy candidates, with early data suggesting promising therapeutic potential. This evidence base is what fuels investor confidence and underpins the company's valuation.

- IND Portfolio: Sana holds multiple Investigational New Drug applications, representing a diverse range of potential therapies.

- Clinical Trial Data: Accumulated data from trials such as UP421, SC291, and SC262 provide early efficacy and safety signals.

- Type 1 Diabetes Progress: Positive results in type 1 diabetes programs are particularly significant, validating platform technology.

- De-risking Future Programs: Successful clinical data reduces the perceived risk for subsequent pipeline candidates.

- Investor and Regulatory Value: This robust data is a key driver for attracting capital and securing regulatory endorsements.

Financial Capital and Funding

Sana Biotechnology relies heavily on significant financial capital, primarily sourced from equity financings and strong investor backing. These funds are critical for powering their ambitious research and development initiatives, including the expensive and lengthy process of clinical trials for their novel cell therapies.

A core element of their financial resource management is extending their cash runway. As of their recent filings, Sana Biotechnology anticipates its cash and cash equivalents will be sufficient to fund operating expenses and capital expenditures into 2026. This strategic runway allows them to continue advancing their pipeline without immediate funding concerns.

- Equity Financings: Sana has successfully raised substantial capital through multiple equity rounds, demonstrating investor confidence in their technology and therapeutic approach.

- Investor Backing: A strong base of institutional and individual investors provides the financial stability needed for long-term R&D.

- Cash Runway: The company's financial planning aims to ensure operational continuity and pipeline progression, with a projected runway extending into 2026.

- Funding for R&D: Significant financial resources are allocated to the demanding research, development, and clinical testing phases inherent in biotechnology.

Sana Biotechnology's key resources are its proprietary technologies, skilled personnel, intellectual property, clinical pipeline, and robust financial backing.

The Hypoimmune (HIP) and Fusogen platforms are central, enabling immune-evasive and in vivo gene delivery for allogeneic cell therapies. A team exceeding 300 employees, many with advanced degrees, drives innovation and execution. A strong intellectual property portfolio protects these advancements.

Crucially, the clinical pipeline, including data from trials like UP421 and SC291, validates their platforms and de-risks future development, attracting investor confidence. Significant capital raised through equity financings fuels R&D, with a projected cash runway extending into 2026, ensuring continued progress.

| Key Resource | Description | Significance | As of Early 2024 Data |

|---|---|---|---|

| Proprietary Platforms | Hypoimmune (HIP) & Fusogen | Enable immune evasion and in vivo gene delivery for off-the-shelf therapies. | Core technology for allogeneic cell therapy development. |

| Human Capital | Skilled scientific and clinical talent | Drives research, development, and clinical trial execution. | Over 300 employees, many with advanced scientific degrees. |

| Intellectual Property | Patents, licenses, trade secrets | Safeguards innovations and provides a competitive moat. | Foundational IP in the hypoimmune space. |

| Clinical Pipeline & Data | INDs, preclinical and clinical data | Validates platforms, de-risks programs, attracts investment. | Progress in type 1 diabetes, data from UP421, SC291, SC262. |

| Financial Capital | Equity financings, investor backing | Funds R&D and clinical trials, extends cash runway. | Projected cash runway into 2026. |

Value Propositions

Sana Biotechnology's value proposition centers on its innovative immune-evasive allogeneic cell therapies, offering a revolutionary 'off-the-shelf' solution. This means patients can receive therapies derived from healthy donors, rather than needing their own cells, which are then genetically modified to avoid rejection. This bypasses the need for the intense, lifelong immunosuppression typically required after transplants, which can lead to serious infections and other complications.

The core of this innovation is Sana's proprietary hypoimmune platform (HIP). This platform is designed to cloak the transplanted cells, making them invisible to the patient's immune system. For instance, by expressing specific proteins, these cells can effectively shut down the immune response that would normally attack foreign tissue.

This approach significantly enhances patient quality of life by reducing the severe side effects associated with current immunosuppressive regimens. Imagine a world where a cell therapy, like one for diabetes, doesn't require daily potent drugs that weaken your entire body. This is the transformative potential Sana is pursuing.

The implications are vast, potentially making cell therapies more accessible and safer for a broader range of conditions. By overcoming immune rejection, Sana aims to unlock the full therapeutic potential of allogeneic cell therapies, offering a more convenient and less burdensome treatment option for patients worldwide.

Sana Biotechnology is focused on developing therapies that tackle the fundamental causes of serious chronic illnesses. Their approach moves beyond simply managing symptoms for conditions like type 1 diabetes, cancer, and autoimmune diseases. This means aiming for treatments that could offer a lasting impact rather than ongoing care.

For type 1 diabetes, a key objective is a one-time treatment that restores normal blood glucose levels, eliminating the need for daily insulin injections. This represents a significant shift towards a potentially curative option for patients. This focus on addressing the root cause is central to their value proposition.

Sana Biotechnology's core cell engineering platforms, like HIP and fusogen, aren't limited to just one disease. They're built for broad use, meaning they can tackle issues in oncology, autoimmune diseases, and even neurological disorders. This flexibility is key to building a diverse pipeline of potential treatments.

This versatility is crucial because it allows Sana to address a wide spectrum of significant unmet medical needs. By not being confined to a single therapeutic area, the company can potentially impact many different patient populations, expanding its overall market opportunity.

For instance, in 2024, the global market for cell and gene therapies was projected to reach tens of billions of dollars, highlighting the immense potential for platforms with broad applicability. Sana's approach positions it to capture a significant portion of this growing market.

Reduced Treatment Burden and Improved Patient Outcomes

Sana Biotechnology's gene therapies are designed to lessen the treatment burden for patients by potentially eliminating the need for ongoing immunosuppressive medications. This means fewer doctor visits and a simpler, less demanding treatment regimen.

The goal is to improve a patient's overall quality of life and long-term health. By addressing the root cause of diseases, Sana aims for more durable and effective results.

This approach is supported by promising clinical data. For example, their type 1 diabetes program showed positive 12-week results without requiring immunosuppression, demonstrating the feasibility of this less burdensome treatment model.

- Reduced Treatment Burden: Eliminates need for immunosuppressive drugs, simplifying patient care.

- Improved Patient Outcomes: Aims for better long-term health and quality of life.

- Fewer Hospital Visits: Less reliance on frequent medical interventions.

- Single-Treatment Potential: Offers the possibility of a one-time curative therapy.

Scalable and Accessible Cell Therapies

Sana Biotechnology is focused on developing cell therapies that are both scalable and accessible, a key differentiator from traditional autologous treatments. Their allogeneic approach, using donor cells, is designed for ‘off-the-shelf’ production. This manufacturing strategy aims to significantly reduce the logistical hurdles and high costs typically associated with therapies derived from a patient’s own cells. By streamlining production, Sana intends to make these advanced treatments available to a much broader patient base, potentially revolutionizing access to cellular medicine.

- Scalable Manufacturing: Sana's allogeneic cell therapy platform is built for large-scale production, a critical step towards widespread availability.

- Reduced Costs: The ‘off-the-shelf’ model is projected to lower manufacturing expenses compared to personalized autologous therapies.

- Broader Patient Access: By overcoming logistical and cost barriers, Sana aims to serve a significantly larger patient population.

- Overcoming Challenges: This approach addresses key limitations of current cell therapies, including manufacturing complexity and patient-specific variability.

Sana Biotechnology's value proposition revolves around providing innovative, immune-evasive allogeneic cell therapies that are essentially 'off-the-shelf'. This means patients receive treatments from healthy donors, genetically modified to avoid immune rejection, thereby eliminating the need for lifelong, debilitating immunosuppression common with transplants.

The core of this innovation is Sana's proprietary hypoimmune platform (HIP). This platform effectively cloaks the transplanted cells, rendering them invisible to the patient's immune system. This approach significantly enhances patient quality of life by mitigating the severe side effects associated with current immunosuppressive regimens, potentially offering a less burdensome treatment option for a wide range of chronic illnesses.

Sana's platforms are designed for broad applicability across oncology, autoimmune diseases, and neurological disorders, aiming to address significant unmet medical needs. In 2024, the global cell and gene therapy market was projected to reach tens of billions of dollars, underscoring the substantial market opportunity for companies with versatile platforms like Sana's.

The company's allogeneic, 'off-the-shelf' manufacturing strategy aims to significantly reduce the logistical hurdles and high costs typically associated with personalized autologous therapies, making advanced treatments more accessible to a broader patient base.

| Value Proposition | Description | Key Benefit |

| Immune-Evading Therapies | Genetically modified donor cells that evade patient immune rejection. | Eliminates need for immunosuppression, reducing side effects and complications. |

| Broad Platform Applicability | Proprietary platforms (HIP) applicable across multiple disease areas (oncology, autoimmune, etc.). | Addresses diverse unmet medical needs and expands market reach. |

| Reduced Treatment Burden | Simplifies treatment regimens by minimizing ongoing medical interventions. | Improves patient quality of life and long-term health outcomes. |

| Scalable & Accessible Manufacturing | 'Off-the-shelf' allogeneic production model. | Lowers costs and logistical complexity, increasing patient access to advanced therapies. |

Customer Relationships

Sana Biotechnology cultivates direct relationships with the clinicians and research hubs that are pivotal to their ongoing studies. This hands-on approach ensures trials are run smoothly and data is captured accurately.

By actively engaging with key opinion leaders and the medical centers conducting their trials, Sana builds a strong foundation of trust and collaboration within the scientific community. This is crucial for moving their innovative therapies forward.

These partnerships are instrumental in efficiently executing clinical trials and gathering the essential insights needed to progress Sana's diverse pipeline of gene and cell therapies.

Sana Biotechnology prioritizes investor relations and transparency to build and maintain market confidence, essential for securing ongoing funding. This involves proactive and regular communication through financial reports, earnings calls, and participation in industry conferences. For instance, in their Q1 2024 earnings call, Sana highlighted progress on key pipeline programs and provided updated financial projections.

The company actively engages with financial analysts and stakeholders, ensuring they have access to timely information regarding financial performance and strategic developments. Sana’s commitment to transparency aims to foster a strong understanding of their business, thereby supporting their valuation and access to capital markets.

Sana Biotechnology actively partners with patient advocacy groups and disease-specific foundations, especially those focused on conditions like type 1 diabetes and various autoimmune diseases. These collaborations are crucial for gaining a deep understanding of patient needs and fostering vital community support for their innovative therapies.

These essential relationships also play a significant role in facilitating patient recruitment for clinical trials. By working closely with advocacy organizations, Sana can more effectively raise awareness about its novel therapeutic approaches, ensuring that those who could benefit most are informed and able to participate.

Biotech and Pharmaceutical Industry Collaborations

Sana Biotechnology actively builds strategic alliances within the biotech and pharmaceutical landscape. These collaborations are designed to explore partnerships, secure licensing deals, and pursue joint development projects.

These business-to-business relationships are vital for broadening Sana's market presence, tapping into specialized knowledge from other firms, and potentially divesting assets that aren't central to their core operations.

- Strategic Partnerships: Sana seeks alliances to accelerate drug development and commercialization.

- Licensing Agreements: These allow Sana to access or out-license specific technologies or drug candidates.

- Co-Development: Collaborating on the development of new therapies can share risk and reward.

- Market Expansion: Partnerships can provide access to new geographic regions or patient populations.

Regulatory Agency Interactions

Sana Biotechnology places significant emphasis on cultivating robust relationships with regulatory agencies, most notably the U.S. Food and Drug Administration (FDA). This proactive approach is critical for successfully navigating the intricate pathway to drug approval. By fostering consistent and transparent communication, Sana Biotechnology aims to ensure adherence to regulatory standards and expedite the review of its investigational new drug applications.

These interactions are characterized by ongoing dialogue and the meticulous submission of comprehensive data packages. For instance, in 2024, companies in the biotechnology sector have increasingly focused on pre-submission meetings to align with FDA expectations early in the development process. This strategy aims to de-risk the later stages of clinical trials and marketing authorization applications. Sana Biotechnology’s commitment to this open communication channel is a cornerstone of its operational strategy.

- FDA Engagement: Maintaining open channels with the FDA is paramount for regulatory pathway clarity.

- Compliance Assurance: Consistent dialogue supports adherence to evolving regulatory requirements.

- Data Submission: Thorough and timely submission of data packages facilitates efficient review cycles.

- Strategic Alignment: Pre-submission meetings in 2024 highlight a trend towards proactive regulatory alignment.

Sana Biotechnology fosters deep relationships with clinical trial sites and key opinion leaders, ensuring high-quality data and smooth trial execution. This direct engagement is crucial for advancing their gene and cell therapies.

The company also prioritizes investor relations, maintaining transparency through regular financial reporting and calls, as evidenced by their Q1 2024 updates on pipeline progress and financial outlook, which supports market confidence.

Furthermore, Sana collaborates with patient advocacy groups to understand patient needs and facilitate trial recruitment, demonstrating a commitment to community engagement.

Strategic alliances with other biotech and pharmaceutical firms are pursued to expand market reach and expertise, while close communication with regulatory bodies like the FDA in 2024 is key to navigating the drug approval process efficiently.

| Relationship Type | Key Activities | Strategic Importance | 2024 Focus/Data Point |

|---|---|---|---|

| Clinical & Research Hubs | Direct engagement, data collaboration | Trial execution, data accuracy | Facilitating ongoing studies |

| Investors & Financial Analysts | Financial reports, earnings calls, proactive communication | Market confidence, capital access | Q1 2024 earnings call highlighted pipeline progress |

| Patient Advocacy Groups | Collaboration on needs assessment, trial recruitment support | Community engagement, patient access | Focus on type 1 diabetes and autoimmune diseases |

| Biotech/Pharma Alliances | Partnerships, licensing, co-development | Market expansion, knowledge sharing | Exploring joint development projects |

| Regulatory Agencies (FDA) | Consistent dialogue, data submission, pre-submission meetings | Navigating approval pathways, compliance | Emphasis on early alignment with FDA expectations |

Channels

Sana Biotechnology's primary channel for delivering its novel therapies to patients is through a carefully curated network of clinical trial sites. These sites are typically leading academic medical centers and specialized hospitals with the expertise to administer and monitor investigational treatments.

These clinical trial sites serve as the direct interface with patients participating in Sana's studies, facilitating the administration of experimental therapies and the collection of crucial safety and efficacy data. This direct patient engagement is vital during the drug development process.

As of early 2024, Sana Biotechnology has engaged with numerous clinical trial sites across the United States and potentially other regions as their pipeline advances. The specific number of active sites can fluctuate based on the stage and enrollment needs of ongoing clinical trials.

The effectiveness of these sites is paramount, as they directly influence the speed and success of clinical development. Sana strategically selects sites based on their patient populations, research infrastructure, and experience with similar therapeutic modalities.

Sana Biotechnology shares its cutting-edge research and clinical trial results through presentations at prestigious scientific and medical conferences, as well as in peer-reviewed publications. This strategy is vital for informing the broader scientific community, establishing trust, and drawing in potential partners and skilled professionals. For instance, during 2023, Sana presented data from its ongoing clinical programs at key industry events, highlighting advancements in their gene therapy pipeline.

Sana Biotechnology engages its financial stakeholders through a dedicated investor relations website, which serves as a central hub for financial reports, news releases, and corporate presentations. This platform ensures transparency and accessibility for current and potential investors seeking information on the company's performance and strategic direction.

Beyond its website, Sana leverages financial news outlets to disseminate important company updates and achievements to a broader audience. This strategic use of media keeps the financial community informed about key developments, fostering a better understanding of Sana's progress and market position.

Participation in investor conferences and roadshows is a critical component of Sana's outreach strategy. These events offer direct engagement opportunities, allowing the company to present its vision and financial outlook to a concentrated group of investors, analysts, and financial professionals.

In 2024, Sana Biotechnology continued to actively participate in investor conferences, providing updates on its clinical trials and pipeline advancements. For instance, during its first quarter 2024 earnings call, the company highlighted progress in its gene therapy programs, aiming to attract and retain investor confidence through clear communication of milestones and future potential.

Corporate Website and Digital Presence

Sana Biotechnology's corporate website acts as a vital information nexus, delivering critical updates on their scientific pipeline, investor relations, and available career paths. This digital cornerstone ensures stakeholders have access to the latest developments.

Their robust digital presence extends beyond the website, leveraging social media platforms to effectively broadcast their core mission, overarching vision, and groundbreaking scientific progress to a wide and diverse audience. This approach facilitates the widespread distribution of company news and essential information, fostering transparency and engagement.

- Corporate Website: Serves as the primary source for official company information, including pipeline progress, investor materials, and employment opportunities.

- Digital Presence: Utilizes social media and other digital channels to communicate mission, vision, and scientific advancements broadly.

- Information Dissemination: Enables efficient and widespread sharing of company news and updates to the public and stakeholders.

- Brand Building: Contributes to building brand awareness and communicating the company's innovative approach in the biotechnology sector.

Strategic Partnerships for Commercialization (Future)

Upon receiving regulatory approval, Sana Biotechnology plans to collaborate with established pharmaceutical giants to bring its innovative therapies to market. These alliances are crucial for effective commercialization, encompassing marketing strategies and ensuring broad distribution across various regions.

These strategic partnerships will grant Sana access to the extensive sales forces and established distribution channels of larger companies. This significantly accelerates market penetration and patient access to potentially life-changing treatments.

Furthermore, these collaborations will tap into the invaluable market access expertise of their partners. This includes navigating complex reimbursement landscapes and securing favorable pricing, which is critical for the financial viability of advanced therapies.

For instance, in 2024, the global pharmaceutical market was valued at over $1.5 trillion, highlighting the immense scale and potential of these commercialization efforts. Sana’s ability to secure partnerships within this vast market is a key determinant of its future success.

- Access to Established Sales Forces: Leveraging existing relationships and trained personnel to promote therapies.

- Extensive Distribution Networks: Utilizing established logistics and supply chains for broad market reach.

- Market Access Expertise: Navigating regulatory hurdles, reimbursement, and payer negotiations.

- Shared Commercialization Costs: Mitigating the financial burden of launching novel therapeutics.

Sana Biotechnology's channels are multifaceted, beginning with its direct engagement through clinical trial sites for its investigational therapies. Post-approval, the company anticipates leveraging strategic partnerships with established pharmaceutical companies to access their extensive sales forces and distribution networks, thereby ensuring broad market penetration and patient access.

These collaborations are crucial for navigating complex market access landscapes and securing favorable reimbursement, vital for the financial viability of advanced therapies. In 2024, the global pharmaceutical market exceeded $1.5 trillion, underscoring the significant commercial potential Sana aims to tap into through these alliances.

Sana also maintains a robust digital presence, using its corporate website and social media to disseminate information about its pipeline, research, and investor relations, fostering transparency and engagement with a broad audience.

Customer Segments

Patients with Type 1 Diabetes represent a core customer segment for Sana Biotechnology. These individuals currently manage their condition through daily insulin injections, a regimen that can be burdensome and imperfectly controls blood sugar levels. The long-term complications of poorly managed diabetes, such as nerve damage, kidney disease, and cardiovascular issues, significantly impact quality of life and healthcare costs.

A key unmet need within this segment is the desire for a functional cure. While islet cell transplantation offers hope, it typically requires lifelong immunosuppression to prevent graft rejection. This immunosuppression carries its own set of serious risks, including increased susceptibility to infections and certain cancers, making it a less than ideal solution for many. Sana's innovative cell therapies aim to overcome these limitations.

Sana’s approach is designed to potentially offer a curative treatment for Type 1 Diabetes without the necessity of chronic immunosuppressive drugs. This would be a transformative advancement for patients. For context, in 2024, it’s estimated that over 1.4 million Americans are living with Type 1 Diabetes, with approximately 64,000 new diagnoses annually, highlighting the vast market potential for effective, long-term solutions.

This segment encompasses individuals battling severe autoimmune diseases like refractory systemic lupus erythematosus and ANCA-associated vasculitis. In these conditions, B-cells are central players, driving the disease process. For many, existing treatments have proven insufficient, leaving them with few viable therapeutic avenues.

Sana Biotechnology's SC291 program is specifically designed to address the unmet needs of these patients. It offers a novel allogeneic CAR T cell therapy, a cutting-edge approach targeting the problematic B-cells.

The market for such advanced therapies is significant, driven by the persistent and often debilitating nature of these diseases. For instance, the global prevalence of lupus alone affects millions worldwide, with a substantial portion experiencing severe or refractory disease.

This customer segment focuses on patients diagnosed with B-cell malignancies, specifically those whose cancer has returned (relapsed) or no longer responds to existing treatments (refractory). Sana Biotechnology’s SC262 program is designed to offer these individuals a novel therapeutic avenue. This addresses a critical area of high unmet need within the oncology landscape, aiming to provide hope where other treatments have failed.

Physicians and Transplant Centers

Physicians, particularly endocrinologists, oncologists, immunologists, and transplant specialists, are the primary decision-makers and prescribers for Sana Biotechnology's cell therapies. These healthcare providers act as gatekeepers, controlling patient access to innovative treatments. Educating them on the safety, efficacy, and unique benefits of Sana's therapies is paramount for market penetration and successful adoption.

Transplant centers, as specialized hubs for organ and stem cell transplantation, represent a critical segment for Sana. Their established patient populations and expertise in managing complex immune conditions make them ideal partners for introducing novel cell-based approaches. Sana's success hinges on demonstrating clear clinical advantages that align with the goals of these advanced medical facilities.

- Key Prescribers: Endocrinologists, oncologists, immunologists, and transplant specialists hold significant influence in patient treatment pathways.

- Gatekeepers to Access: Physician adoption directly correlates with patient access to Sana's novel cell therapies.

- Market Penetration Drivers: Their understanding and acceptance of the technology are crucial for initial market entry and widespread use.

- Specialized Centers: Transplant centers are vital for reaching specific patient populations and leveraging existing expertise in cell-based treatments.

Payers and Healthcare Systems

Health insurance companies, government healthcare programs, and hospital systems are critical payers that Sana Biotechnology must engage. These entities control reimbursement policies and formulary access, directly impacting the commercial viability of Sana's innovative therapies. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine payment models for novel cell and gene therapies, highlighting the need for clear value propositions.

Securing favorable coverage and pricing for Sana's high-value therapies is paramount for achieving widespread market access and commercial success. The ability of these payers to negotiate prices can significantly influence patient access and overall revenue. In 2023, the average price for a gene therapy treatment exceeded $2 million, underscoring the sensitivity of payers to cost-effectiveness.

Sana's planned value-based pricing strategy is designed to resonate with these stakeholders by aligning payment with demonstrated patient outcomes. This approach aims to mitigate payer concerns regarding the high upfront costs of advanced therapies. Companies employing such models are increasingly being evaluated on long-term efficacy and reduction in overall healthcare utilization.

- Health Insurers: They determine which treatments are covered and at what level, influencing patient out-of-pocket costs.

- Government Programs: Medicare and Medicaid, for example, set reimbursement rates and coverage policies for millions of beneficiaries.

- Hospital Systems: These institutions manage the administration of therapies and negotiate contracts with manufacturers, influencing adoption.

- Value-Based Agreements: Sana's strategy will likely involve contracts tied to patient response or long-term health improvements, a trend gaining traction in the pharmaceutical industry.

Sana Biotechnology is targeting patients with Type 1 Diabetes, a chronic autoimmune condition affecting millions. These individuals require lifelong insulin management, facing significant risks of long-term complications. The development of a functional cure, eliminating the need for daily insulin and offering improved quality of life, represents a primary goal for this segment.

Another key group comprises patients with severe autoimmune diseases, such as refractory lupus and vasculitis, where B-cells play a critical role. For these individuals, existing treatments often fall short, creating a substantial unmet need for more effective therapies.

Finally, Sana is also focused on patients with relapsed or refractory B-cell malignancies. This oncology segment represents a critical area where novel approaches are desperately needed to combat difficult-to-treat cancers.

Cost Structure

Research and Development (R&D) represents Sana Biotechnology's most significant cost. This expenditure covers critical stages like preclinical studies, the intricate process of drug discovery, and the extensive costs associated with clinical trials. These investments are essential for bringing novel therapies to market and directly impact future revenue streams.

The R&D budget includes substantial outlays for highly skilled scientific personnel, vital laboratory supplies, and the strategic outsourcing of specialized tasks to contract research organizations (CROs). These elements are fundamental to the scientific advancement and validation required in the biotechnology sector.

Sana Biotechnology's commitment to innovation is clearly demonstrated by its financial figures. In the first quarter of 2025, the company reported R&D expenses totaling $37.2 million. This substantial figure underscores the ongoing, significant investment Sana is making to advance its therapeutic pipeline.

Clinical trials are a significant expense for biotechnology companies like Sana Biotechnology. These costs encompass a wide range of activities, from finding and enrolling patients to meticulously monitoring their progress and analyzing the resulting data. Furthermore, ensuring strict adherence to regulatory requirements adds another layer of expense.

The financial outlay for these trials is not static; it fluctuates based on several factors. The phase of the trial, the sheer number of participants involved, and how long the trial runs all play a crucial role in determining the overall cost. For instance, later-stage trials with more patients naturally incur higher expenses.

Sana Biotechnology is anticipating key clinical data readouts in 2025. This upcoming information will be vital for understanding the efficacy and safety of their therapeutic candidates, directly impacting future development costs and strategic decisions.

Developing and scaling up manufacturing processes for engineered cell therapies is a significant undertaking, demanding substantial investment in facility costs, specialized equipment, high-quality raw materials, and rigorous quality control measures. These expenses are inherently high due to the need for sterile environments and the precision required for cell handling.

Sana Biotechnology's commitment to this area is evident in its Bothell facility, which represents a considerable capital expenditure. This investment is crucial for establishing the infrastructure necessary to produce its innovative cell therapies efficiently and reliably.

General and Administrative Expenses

General and administrative expenses are the backbone of Sana Biotechnology's operational support, covering essential corporate functions. These costs encompass a range of activities, from executive compensation and legal counsel to the salaries of administrative personnel and the maintenance of vital IT infrastructure. Investor relations also falls under this umbrella, ensuring clear communication with stakeholders.

For the first quarter of 2025, Sana Biotechnology reported general and administrative expenses totaling $11.5 million. This figure highlights the significant investment in maintaining the company's corporate structure and facilitating its ongoing operations and strategic initiatives.

- Executive Salaries: Compensation for senior leadership driving the company's direction.

- Legal and Compliance: Costs associated with regulatory adherence and legal matters.

- Administrative Staff: Salaries for personnel supporting day-to-day corporate functions.

- IT Infrastructure: Expenses for technology systems and support.

- Investor Relations: Costs for communicating with shareholders and the investment community.

Intellectual Property and Legal Costs

Sana Biotechnology allocates significant resources to securing and defending its intellectual property. These costs are crucial for safeguarding its innovative gene therapy platforms.

Key expenditures include patent application fees, international filings, and ongoing maintenance charges to preserve patent rights globally. In 2024, companies in the biotech sector, like Sana, often spend hundreds of thousands to millions of dollars annually on IP protection, depending on the breadth of their patent portfolio and geographic coverage.

- Patent Filings and Maintenance: Essential for protecting novel therapeutic approaches and platform technologies.

- Legal Defense: Costs associated with enforcing patents and defending against potential infringement claims.

- Regulatory Compliance: Expenses incurred to navigate the complex legal and regulatory frameworks governing biotechnology products.

- Licensing Agreements: Fees related to in-licensing or out-licensing technologies, which often involve upfront payments and royalties.

Sana Biotechnology's cost structure is heavily weighted towards research and development, reflecting the innovative nature of its engineered cell therapies.

Manufacturing, general administrative expenses, and intellectual property protection also represent significant cost drivers for the company.

These investments are critical for advancing its therapeutic pipeline and ensuring long-term competitive advantage.

| Cost Category | Q1 2025 Expense (Millions USD) | Key Components | Significance |

|---|---|---|---|

| Research & Development (R&D) | $37.2 | Preclinical studies, drug discovery, clinical trials, scientific personnel, lab supplies, CRO outsourcing | Primary driver of innovation and future revenue potential |

| Manufacturing | N/A (Capital Expenditure on Bothell Facility) | Facility costs, specialized equipment, raw materials, quality control | Essential for producing engineered cell therapies |

| General & Administrative (G&A) | $11.5 | Executive salaries, legal counsel, administrative staff, IT infrastructure, investor relations | Supports core operations and corporate functions |

| Intellectual Property (IP) Protection | (Hundreds of thousands to millions annually in biotech sector for 2024) | Patent filings, international filings, legal defense, licensing agreements | Safeguards innovative platforms and therapeutic approaches |

Revenue Streams

Sana Biotechnology's core future revenue will stem from selling its advanced cell therapies once they gain regulatory green lights. This is the ultimate aim of their extensive research and development.

The company plans to generate income by directly commercializing treatments for specific conditions like type 1 diabetes, various autoimmune diseases that affect B-cells, and certain B-cell cancers. These therapeutic areas represent significant unmet medical needs.

As of their latest filings in early 2024, Sana Biotechnology continues to advance its pipeline, with significant investment allocated to clinical trials and manufacturing capabilities in preparation for these future product sales. The success of these therapies in clinical trials is crucial for unlocking this primary revenue stream.

Sana Biotechnology generates revenue through licensing and collaboration agreements, a key part of its business model. This involves upfront payments, milestone payments, and royalties from partners who license Sana's innovative technologies, like its HIP platform or fusogen technology. The company is actively pursuing these partnerships, particularly for its oncology programs, to leverage its scientific advancements.

In 2024, Sana Biotechnology continued to focus on strategic collaborations to advance its pipeline. For instance, the company has highlighted its interest in partnering for its oncology-focused gene therapies. These agreements are structured to provide Sana with non-dilutive capital through initial payments and further funding tied to the achievement of specific development milestones, demonstrating the financial viability of its licensing strategy.

Sana Biotechnology leverages research grants and non-dilutive funding as crucial early-stage capital. While not a permanent revenue source, these funds are vital for advancing foundational research and de-risking initial development phases. For instance, the Leona M. and Harry B. Hemsley Charitable Trust has provided support for Sana's type 1 diabetes research, a testament to the value placed on their scientific endeavors by external bodies.

Partnerships for Co-development and Commercialization

Sana Biotechnology's strategy includes co-development and commercialization partnerships, going beyond simple licensing. These agreements allow Sana to share the significant costs associated with research and development, a crucial aspect of their recent strategic realignment. In return for contributing to R&D, partners typically share in future profits or pay royalties on successful products.

This collaborative approach is designed to expedite the path to market and broaden Sana's commercial reach. By leveraging a partner's established infrastructure for manufacturing, marketing, and sales, Sana can effectively scale its innovative therapies. For instance, in their 2024 efforts, Sana has been actively seeking such alliances to advance their pipeline candidates.

- Shared R&D Investment: Partners contribute financially to the development of Sana's novel cell and gene therapies, mitigating Sana's individual expenditure.

- Profit and Royalty Sharing: Revenue is generated through a pre-agreed split of profits or ongoing royalty payments from commercialized products.

- Leveraged Commercialization: Sana benefits from partners' existing sales forces, distribution networks, and market access capabilities, enhancing market penetration.

- Strategic Realignment: These partnerships are a key component of Sana's broader strategy to focus resources and accelerate the delivery of its therapeutic platforms.

Strategic Asset Sales/Divestitures (Less Core Programs)

Sana Biotechnology could generate revenue through the strategic sale or divestiture of specific programs that no longer fit its primary strategic direction. For instance, the company might choose to monetize its oncology program, which is developing SC291, or its glial progenitor cell program, SC379. This approach allows Sana to convert non-core assets into capital, freeing up resources to concentrate on its most promising pipeline candidates.

This strategy is particularly relevant as companies in the biotech sector often refine their focus. By divesting less central programs, Sana can avoid diluting its efforts and ensure that its investment is directed towards areas with the highest potential for clinical and commercial success. This also presents an opportunity for other entities to acquire and develop these assets, potentially bringing them to market more efficiently.

- Monetization of Non-Core Assets: Selling off programs like SC291 (oncology) or SC379 (glial progenitor cells) generates immediate cash flow.

- Resource Reallocation: Divestitures allow Sana to redirect capital and personnel towards its prioritized pipeline candidates.

- Strategic Focus: Shedding less aligned programs sharpens the company's overall strategic direction and operational efficiency.

- Potential for Partnerships: These divestitures can also open avenues for future partnerships or collaborations with companies better suited to develop the divested assets.

Sana Biotechnology's primary revenue driver will be the successful commercialization of its advanced cell therapies, pending regulatory approval. The company is actively advancing its pipeline, with significant investments in clinical trials and manufacturing, particularly for its treatments targeting type 1 diabetes, autoimmune diseases, and B-cell cancers.

In 2024, Sana Biotechnology continued to solidify its revenue streams through licensing and collaboration agreements. These partnerships leverage Sana's innovative technologies, such as its HIP platform, and are structured to provide upfront payments, milestone achievements, and royalties, especially from its oncology programs.

The company also utilizes co-development and commercialization partnerships to share R&D costs and accelerate market entry. These alliances allow Sana to leverage partners' established infrastructure for manufacturing and sales, enhancing the scalability of its therapeutic offerings, with ongoing efforts in 2024 to secure such strategic alliances.

Additionally, Sana Biotechnology may generate capital through the strategic divestiture of specific programs, such as its oncology (SC291) or glial progenitor cell (SC379) programs, to focus resources on its most promising pipeline candidates.

| Revenue Stream | Description | 2024 Focus/Activity | Potential Impact |

| Product Sales (Cell Therapies) | Commercialization of approved cell therapies. | Advancing clinical trials for diabetes, autoimmune, and cancer therapies. | Primary long-term revenue source. |

| Licensing & Collaboration Agreements | Upfront payments, milestones, and royalties from partners. | Pursuing partnerships for oncology programs and HIP platform. | Provides non-dilutive capital and validates technology. |

| Co-development & Commercialization Partnerships | Sharing R&D costs and future profit/royalty splits. | Seeking alliances to expedite market entry and scale therapies. | Mitigates financial risk and expands commercial reach. |

| Program Divestitures | Sale of non-core R&D programs. | Potential monetization of oncology or glial progenitor cell programs. | Generates capital and sharpens strategic focus. |

Business Model Canvas Data Sources

The Sana Biotechnology Business Model Canvas is built using a blend of robust scientific literature, clinical trial data, and market analysis of the biotechnology sector. These foundational sources ensure the accurate definition of our value proposition and target customer segments.