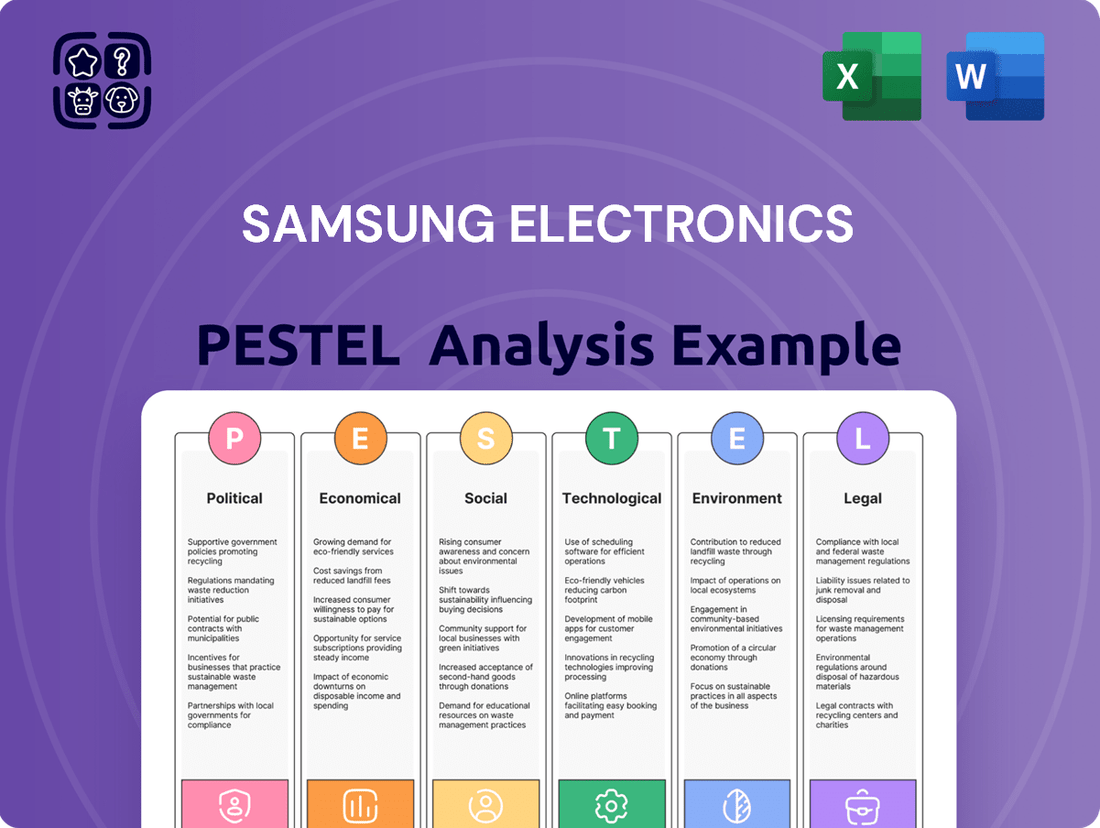

Samsung Electronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

Discover the intricate web of external factors shaping Samsung Electronics's trajectory. From evolving political landscapes and economic fluctuations to societal shifts and technological advancements, our PESTEL Analysis provides a crucial understanding of the forces at play. Learn how regulatory changes and environmental concerns are influencing their operations and innovation strategies. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities within the global electronics market.

Gain a competitive edge by understanding the complete external environment impacting Samsung Electronics. Our professionally researched PESTEL Analysis delivers critical insights into political stability, economic growth, social trends, technological innovation, legal frameworks, and environmental sustainability. Don't just react to change; proactively shape your strategy with this comprehensive report. Download the full version now and unlock the data-driven clarity you need to thrive.

Political factors

The ongoing trade tensions, particularly between the U.S. and China, significantly impact Samsung's global supply chain and market access. U.S. export controls on advanced AI chips to China, reinforced in October 2023, have created operational uncertainties and pressured Samsung's semiconductor sales within that market. These policies contribute to the volatility seen in the memory chip sector, with a projected 2024 revenue growth for Samsung's semiconductor business, potentially reaching 40% for DRAM. Furthermore, potential tariffs and shifting trade agreements in key markets like the U.S. and Europe introduce risks to Samsung's revenue forecasts and long-term investment planning.

Samsung Electronics operates within a deeply intertwined political and regulatory environment in South Korea. The company significantly benefits from government support, including substantial subsidies and tax incentives, particularly for its critical semiconductor initiatives. For example, South Korea's 2024 budget allocated significant R&D tax credits to bolster domestic chip manufacturing and innovation. However, Samsung also faces intense scrutiny under stricter anti-corruption laws and persistent pressure regarding its corporate governance, stemming from high-profile political scandals that have impacted public trust.

Political instability in key manufacturing regions, such as Vietnam or India, poses significant risks to Samsung Electronics' production and raw material sourcing, potentially disrupting its global supply chain operations. To mitigate these geopolitical uncertainties and tariff pressures, Samsung is actively regionalizing its supply chains. For example, the company is expanding appliance production in Mexico and considering further semiconductor packaging investments in the U.S., aiming to reduce reliance on single geographic areas. This strategic shift, including a projected 2025 increase in North American manufacturing capacity, is crucial for maintaining operational stability and ensuring consistent product delivery in an increasingly volatile global market.

International Regulatory Compliance

Operating globally requires Samsung to navigate a complex web of regulations across dozens of countries, covering everything from labor laws to market-specific product standards. For instance, ongoing compliance with data privacy regulations like GDPR in Europe remains critical, impacting product development and service delivery into 2025. Adherence to diverse international laws is crucial for uninterrupted market access and avoiding significant penalties, which can exceed billions of USD for major tech firms in cases of non-compliance.

- Samsung’s global revenue, projected near 300 trillion KRW for 2024, is highly dependent on regulatory compliance.

- Navigating differing international product safety and environmental standards adds compliance costs.

- Legal disputes, such as patent infringement cases, continue to pose significant financial risks.

- Adherence to evolving AI and data governance frameworks is a growing priority for 2025 operations.

Government Incentives for Tech Manufacturing

Governments globally, especially in the U.S. and South Korea, are actively providing substantial incentives to strengthen domestic semiconductor manufacturing capabilities. Samsung Electronics has significantly benefited from these supportive policies, including substantial tax breaks for its advanced chip fabrication plant in Taylor, Texas, where it is investing over $40 billion by 2025.

South Korea is also proposing new legislation by mid-2025 to offer increased tax credits and subsidies for domestic chip producers like Samsung, aiming to counter aggressive international competition. These government incentives are crucial for funding the exceptionally high capital expenditure required for developing and scaling advanced technology, ensuring a competitive edge and supply chain resilience.

- U.S. CHIPS Act support for Samsung's Texas fab, with investments exceeding $40 billion by 2025.

- South Korea's proposed K-Chips Act amendments by mid-2025 to boost domestic incentives.

- Incentives directly offset high capital expenditures for advanced semiconductor R&D and production.

Political factors significantly shape Samsung's global operations, driven by U.S.-China trade tensions impacting semiconductor sales and supply chains. South Korean government support via subsidies and R&D tax credits, like those in 2024, boosts domestic chip manufacturing, while also imposing stricter governance. Geopolitical instability prompts strategic regionalization of production, with a projected 2025 increase in North American capacity to mitigate risks and ensure compliance with diverse international regulations. Substantial government incentives, such as the U.S. CHIPS Act, directly support Samsung's multi-billion dollar investments in advanced chip fabrication.

| Political Factor | Impact on Samsung | Relevant Data (2024/2025) | ||

|---|---|---|---|---|

| U.S.-China Trade Tensions | Supply chain disruption, market access limitations | U.S. export controls on advanced AI chips (reinforced Oct 2023) | Projected 2024 DRAM revenue growth for Samsung's semiconductor business, potentially reaching 40% | |

| South Korean Government Support | Enhanced domestic chip manufacturing capabilities | 2024 R&D tax credits for domestic chip manufacturing | Proposed K-Chips Act amendments by mid-2025 for increased incentives | |

| Global Regulatory Compliance | Operational costs, market access risks | Ongoing GDPR compliance critical for 2025 operations | Potential penalties exceeding billions of USD for non-compliance | |

| Geopolitical Instability / Regionalization | Supply chain resilience, production stability | Projected 2025 increase in North American manufacturing capacity | Expansion of appliance production in Mexico | |

| Government Semiconductor Incentives | Funding for high capital expenditure, competitive edge | U.S. CHIPS Act support for Samsung's Taylor, Texas fab (over $40 billion by 2025) |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Samsung Electronics, providing a comprehensive overview of its external macro-environment.

It is designed to equip stakeholders with actionable insights into market dynamics, regulatory landscapes, and emerging trends to inform strategic decision-making and identify potential opportunities and threats.

A readily digestible PESTLE analysis of Samsung Electronics, presented in a clean, summarized format, serves as a vital pain point reliever for strategic planning, offering quick referencing during high-stakes meetings and presentations.

Economic factors

Samsung's sales are highly sensitive to global economic health, as demand for premium electronics directly ties to consumer purchasing power. High inflation, projected at 5.8% globally for 2024 by the IMF, erodes spending on non-essential goods like smartphones and TVs. Conversely, strong GDP growth in emerging markets, such as India's forecast 6.5% for 2025, significantly boosts sales. Samsung's performance fluctuates directly with these macroeconomic trends, impacting its overall revenue outlook.

As a leading global exporter, Samsung Electronics' profitability is highly sensitive to currency fluctuations, especially the South Korean won against the U.S. dollar. A strong won, for example, a sustained move towards 1,300 KRW per USD in early 2025, makes Samsung's semiconductor chips and consumer electronics more expensive internationally. This directly impacts its competitiveness against rivals and introduces financial risk, potentially reducing revenue reported in its home currency from its 2024 consolidated revenue exceeding 250 trillion KRW.

The semiconductor industry is notoriously cyclical, swinging between high demand and oversupply, profoundly impacting Samsung. Its Device Solutions division, for instance, faced an operating loss of KRW 15.1 trillion in 2023 due to the memory downturn. However, a significant recovery is projected for 2024, with analysts forecasting over KRW 20 trillion in operating profit for DS. This rebound is driven by robust High Bandwidth Memory demand and rising DRAM and NAND prices, a trend expected to continue into 2025, mirroring the global memory market's health.

Inflation and Interest Rates

Rising global inflation and higher interest rates significantly impact Samsung Electronics. In 2024, persistent inflation, with the US CPI at 3.3% in May, pushes up raw material costs for semiconductors and displays, such as silicon wafers and rare earth elements. This directly squeezes Samsung's operating profit margins. Concurrently, elevated interest rates, like the US Federal Funds Rate at 5.25%-5.50% as of June 2024, dampen consumer demand for high-value electronics typically purchased on credit, particularly affecting smartphone and TV sales. Furthermore, these higher borrowing costs increase the expense of financing Samsung's massive capital-intensive projects, which exceeded KRW 53 trillion in 2023.

- Global inflation at 3.3% (US CPI, May 2024) increases Samsung's raw material and operational costs.

- High interest rates (US Fed Funds 5.25%-5.50%, June 2024) reduce consumer demand for electronics.

- Increased borrowing expenses affect Samsung's capital expenditure, which was over KRW 53 trillion in 2023.

Competition from Emerging Economies

Samsung Electronics faces intense economic competition from manufacturers in emerging economies, notably impacting its pricing strategies and global market share. The continuous rise of Chinese brands like Xiaomi and OPPO, alongside other Asian electronics companies, presents a formidable challenge. For instance, in Q1 2024, Chinese vendors collectively held over 60% of the global smartphone market share, a direct pressure point for Samsung. Trade agreements and lower labor costs in competing nations like Vietnam and India are critical economic factors that influence Samsung's strategic decisions regarding production locations and competitive pricing.

- Q1 2024 data shows Chinese smartphone brands collectively dominated over 60% of global market share.

- Companies like Xiaomi, OPPO, and Vivo continue to gain ground, particularly in mid-range segments.

- Lower production costs in emerging markets directly challenge Samsung's profit margins.

- Samsung is strategically shifting some production to countries like India to leverage competitive labor costs.

Samsung's profitability hinges on global economic health, with high inflation (US CPI 3.3% May 2024) increasing costs and dampening consumer spending. Currency fluctuations, like the KRW/USD at 1,300 in early 2025, directly affect international competitiveness. The cyclical semiconductor market is recovering, with DS operating profit projected over KRW 20 trillion for 2024. Intense competition from emerging markets, where Chinese brands held over 60% of Q1 2024 smartphone share, also pressures margins.

| Economic Factor | 2024/2025 Data | Impact on Samsung |

|---|---|---|

| Global Inflation | US CPI 3.3% (May 2024) | Increased raw material costs, reduced consumer demand |

| Currency Volatility | KRW/USD ~1,300 (early 2025) | Affects export competitiveness and reported revenue |

| Semiconductor Cycle | DS Profit >KRW 20T (2024 proj.) | Significant recovery in core business segment |

| Market Competition | Chinese brands >60% (Q1 2024 global smartphone share) | Pressure on pricing and market share |

Same Document Delivered

Samsung Electronics PESTLE Analysis

The Samsung Electronics PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Samsung's global operations. Understand the market dynamics and strategic challenges Samsung faces through this detailed analysis. You'll gain insights into the competitive landscape and potential growth areas for the electronics giant.

Sociological factors

The increasing consumer desire for interconnected devices drives significant demand for Samsung's extensive ecosystem, encompassing smartphones, TVs, and home appliances. The Internet of Things (IoT) and smart home technology represent a substantial growth area, with the global smart home market projected to exceed $200 billion by 2025. Samsung is heavily investing in AI to enhance user experience across its devices and the SmartThings platform, aiming to solidify its position in this integrated lifestyle trend. This focus ensures seamless functionality and continued relevance in modern smart living environments.

Modern consumers are increasingly influenced by a company's brand reputation and its commitment to corporate social responsibility (CSR). Samsung actively invests in CSR initiatives, promoting its brand as a trustworthy global leader, which is crucial as 2024 market data indicates over 65% of consumers prioritize purchasing from brands they trust. The company's past product-related challenges highlight the ongoing importance of maintaining an impeccable corporate image. This focus directly impacts consumer perception and sales in competitive markets.

A significant portion of consumers, notably millennials, are increasingly willing to invest more in sustainable and eco-friendly electronics. This trend is evident as consumer surveys from early 2024 indicate a strong preference for brands demonstrating environmental responsibility. In response, Samsung has committed to integrating more recycled materials, aiming to use recycled resin in 100% of its new mobile phones and home appliances by 2025. This commitment extends to achieving higher energy efficiency across its product lines, with targets for reducing operational greenhouse gas emissions by 2030. The growing desire for green products pressures Samsung to innovate in sustainable technologies and maintain transparent reporting on its environmental progress and material usage.

Demographic Shifts and Market Growth

Global demographic shifts present substantial growth avenues for Samsung Electronics, particularly the burgeoning middle class in emerging economies such as India and Africa. These regions are pivotal, forecasted to contribute significantly to the 2025 global smartphone user base expansion, with projections indicating over 800 million smartphone users in India alone by 2025. Capturing market share demands tailored offerings and competitive price points for these younger, tech-savvy demographics.

- By 2025, over 80% of new smartphone subscriptions are expected from emerging markets.

- Africa's smartphone penetration is projected to exceed 50% by 2025, up from 39% in 2020.

- Samsung's Q1 2024 smartphone shipments reflect strong demand in developing Asian and African markets.

- The average age of smartphone users in India is significantly lower than in developed nations, driving demand for mid-range and budget devices.

High Brand Loyalty

Samsung enjoys significant brand loyalty, especially among its Android user base, which represents a crucial competitive advantage. Customers who invest in Samsung devices often remain committed to the brand for future upgrades, ensuring a stable and predictable revenue stream. This deep-rooted loyalty is a primary objective for marketing and user acquisition campaigns, particularly as Samsung aims to solidify long-term customer relationships and market share. For instance, Samsung consistently holds a leading position in the global smartphone market, capturing 20.8% of shipments in Q1 2024, demonstrating strong customer retention.

- Samsung's global smartphone market share reached 20.8% in Q1 2024, reflecting significant customer retention.

- Repeat purchases contribute substantially to Samsung's consistent market leadership.

- Marketing strategies prioritize fostering enduring customer relationships to capitalize on existing loyalty.

Sociological factors significantly shape Samsung's strategy, driven by consumers' growing demand for interconnected smart devices, with the global smart home market projected to exceed $200 billion by 2025. Brand reputation and corporate social responsibility are paramount, as 2024 data shows over 65% of consumers prioritize trusted brands. A strong preference for sustainable electronics prompts Samsung to integrate recycled materials and enhance energy efficiency by 2025. Furthermore, the burgeoning middle class in emerging markets, notably India with over 800 million smartphone users by 2025, presents substantial growth opportunities.

| Factor | Trend | 2024/2025 Data |

|---|---|---|

| Smart Home Adoption | Interconnected living | Global market > $200B by 2025 |

| Consumer Trust | Brand reputation | 65%+ consumers prioritize trusted brands (2024) |

| Sustainability | Eco-friendly products | 100% recycled resin in new mobile/home appliances by 2025 |

| Emerging Markets | Demographic shifts | India: >800M smartphone users by 2025 |

Technological factors

Samsung Electronics places artificial intelligence at the core of its future strategy, committing substantial investments in R&D to integrate AI across its diverse product portfolio. This includes the prominent 'Galaxy AI' features rolled out in 2024 smartphones, AI-powered upscaling technology in its 2025 TV lineups, and critical operational efficiencies in semiconductor manufacturing. The company is actively investing billions in AI and advanced memory through 2026, anticipating on-device AI proliferation will drive significant demand for its high-performance memory and processor products. Samsung aims to ship over 100 million AI-enabled smartphones in 2024, demonstrating its leadership in this transformative technology.

Samsung Electronics is in a fierce race to develop and mass-produce next-generation semiconductors, targeting 2nm Gate-All-Around (GAA) process mass production by 2025. The company faces significant competition in securing certifications for critical components like HBM3E memory chips for AI servers, with Samsung securing NVIDIA HBM3E certification in Q2 2024. Success in these advanced nodes is fundamental to maintaining its leadership in the high-value-added memory and foundry markets, directly impacting its projected revenue growth for 2024 and 2025.

Samsung Electronics continues to drive innovation in consumer electronics, notably with its foldable smartphone lineup, which is projected to capture a significant portion of the global foldable market expected to exceed 50 million units by 2025. The company is actively expanding its Galaxy Z Fold and Z Flip series, maintaining its estimated 60% market dominance in early 2024, and exploring novel form factors. Furthermore, Samsung is advancing its television technology, enhancing Neo QLED and OLED picture quality with features like AI upscaling and glare-free displays. These continuous technological leaps are crucial for sustaining its competitive edge in the rapidly evolving consumer electronics landscape, especially heading into 2025.

Development of Future Networks (6G)

Samsung Electronics is proactively investing in 6G research and development, positioning itself for the next generation of telecommunications infrastructure even as 5G deployment continues globally through 2024. This forward-looking approach is crucial for maintaining its competitive edge and ensuring it remains a pivotal player in future network evolution. The company’s advanced R&D initiatives aim to define early standards and secure key patents for a technology expected to achieve commercialization around 2030, building on its significant 5G patent portfolio which includes over 4,000 declared patent families as of late 2023.

- Samsung established its Advanced Communications Research Center in 2019 to accelerate 6G development.

- Early 6G research focuses on terahertz (THz) spectrum, AI integration, and new network architectures.

- The global 6G market is projected to reach significant valuation by 2030, indicating substantial future revenue streams.

- This strategic investment ensures Samsung's leadership in future mobile communication standards.

Expansion into New Tech Frontiers (VR/AR/Robotics)

Samsung Electronics is significantly investing in cutting-edge technology sectors to secure future growth. The company is actively developing new ecosystem products with advanced AI and health integration, aiming to lead in categories like Extended Reality (XR) and robotics. Innovations such as the AI-powered home robot Ballie, unveiled in early 2024, highlight Samsung's vision for a more connected and intelligent living environment. This strategic focus is critical for maintaining market leadership and diversifying its revenue streams beyond traditional consumer electronics.

- Samsung’s investment in XR and robotics is a key strategic pillar for 2024-2025.

- The company plans to expand its AI capabilities across its device ecosystem, enhancing user experience.

- Strategic partnerships and acquisitions in AI and robotics are anticipated to accelerate development.

- Ballie represents a tangible step towards smart home robotics and AI-driven personal assistance.

Samsung Electronics is heavily investing in AI integration, with its 2024 Galaxy phones featuring AI capabilities and targeting over 100 million AI-enabled smartphone shipments. The company aims for 2nm Gate-All-Around semiconductor mass production by 2025, securing critical HBM3E memory certifications in Q2 2024. Samsung also maintains an estimated 60% market share in foldable smartphones as of early 2024 and leads 6G research for future connectivity.

| Technological Focus | Key Milestone/Target | Date/Period |

|---|---|---|

| AI-enabled Smartphones | >100 Million Shipments | 2024 |

| Semiconductor Process | 2nm GAA Mass Production | 2025 |

| Foldable Smartphone Market Share | ~60% | Early 2024 |

Legal factors

As a leading global technology firm, Samsung Electronics constantly faces intense antitrust scrutiny from regulators across major markets like the U.S., EU, and India. This ongoing oversight addresses concerns regarding potential anti-competitive practices, including allegations of collusion with retailers or restrictive behavior within its app distribution channels. For instance, in 2023-2024, the European Commission continued monitoring digital market activities closely, impacting dominant players. Such legal challenges can lead to substantial financial penalties, potentially reaching billions of USD, and necessitate significant adjustments to Samsung's business operations and market strategies to ensure compliance.

The technology sector consistently faces intense intellectual property disputes, making patent litigation a significant legal factor for Samsung Electronics. The company is frequently embroiled in high-stakes lawsuits with rivals like Apple, which have historically resulted in multi-billion dollar settlements and ongoing legal costs. Protecting Samsung's extensive patent portfolio, which included over 100,000 active patents globally as of 2023, is crucial. Navigating these complex claims and counterclaims continues to be a substantial financial and strategic challenge into 2024 and 2025.

With the increasing collection of user data through smart devices and AI features, Samsung must comply with stringent data privacy laws like the GDPR in Europe, which can impose fines up to 4% of global annual revenue. The company has faced lawsuits over its handling of biometric data, such as facial recognition scans, with a 2024 class-action suit in the US highlighting ongoing challenges. Ensuring robust privacy protection and transparency is critical to maintaining customer trust and avoiding significant legal penalties, especially as global data regulations continue to tighten through 2025.

Labor Laws and Supply Chain Due Diligence

Samsung Electronics must navigate a complex landscape of diverse labor laws across its global operations, ensuring adherence in every country where it manufactures and sells products. There is increasing pressure to guarantee fair labor practices throughout its intricate supply chain, prompting the implementation of robust due diligence policies to combat forced and child labor. The company’s first-ever labor strike in June 2024, involving the National Samsung Electronics Union, highlighted the critical importance of managing workforce relations effectively and respecting local labor rights.

- Samsung’s 2024 labor strike involved the National Samsung Electronics Union (NSEU) seeking a 6.5% pay raise.

- The company adheres to standards like the Responsible Business Alliance (RBA) Code of Conduct in its supply chain.

- Global operations require compliance with varying national labor regulations, from South Korea to Vietnam.

Environmental and E-Waste Regulations

Governments globally are enacting stricter environmental regulations, including standards for product energy efficiency and the management of electronic waste (e-waste), directly impacting Samsung's operations. The EU's directives, such as the Carbon Border Adjustment Mechanism (CBAM) set to fully apply by 2026, and the new Battery Regulation effective mid-2024, significantly influence Samsung’s product design and supply chain. Compliance requires substantial investment in sustainable practices and circular economy initiatives, with Samsung targeting 100% renewable energy use across all operations globally by 2050.

- Global e-waste generation is projected to reach 74.7 million metric tons by 2030, necessitating robust recycling infrastructure.

- The EU Battery Regulation mandates higher collection targets for portable batteries, reaching 63% by 2027 and 73% by 2030.

- Samsung aims for 50% of its plastic parts to incorporate recycled resin by 2030, increasing to 100% by 2050.

- The company reported recycling 590,000 tons of e-waste globally in 2023, demonstrating ongoing compliance efforts.

Samsung Electronics must also navigate stringent product liability and consumer protection laws across its diverse markets. Past events, like the Galaxy Note 7 recall, underscore the critical financial and reputational risks associated with product safety issues. Upcoming regulations, such as enhanced EU consumer rights expected by 2025, demand greater transparency and repairability, directly influencing Samsung’s product development and warranty strategies.

| Legal Area | Key Impact on Samsung | Relevant Regulation/Trend (2024/2025) |

|---|---|---|

| Product Liability | Risk of recalls, litigation, and brand damage from device failures. | Increased scrutiny on device safety and component sourcing. |

| Consumer Protection | Demands for transparency, repairability, and fair terms for users. | EU's New Deal for Consumers, Right to Repair initiatives. |

| International Trade Law | Compliance with import/export controls and sanctions. | Geopolitical shifts impacting supply chains and market access. |

Environmental factors

Samsung Electronics is significantly advancing its environmental commitment, targeting net-zero carbon emissions for its DX (Device eXperience) division by 2030. The broader corporate goal aims for complete carbon neutrality across all operations by 2050, reflecting a long-term sustainability strategy. This involves a crucial transition to 100% renewable energy for major global manufacturing sites, a key operational shift. The company is actively investing in emission reduction technologies and securing renewable sources through power purchase agreements (PPAs).

Maximizing resource circularity is a core pillar of Samsung's environmental strategy, driven by both regulatory pressure and escalating consumer demand for a circular economy. By 2024, Samsung has significantly increased its use of recycled resins in plastic components, aiming for higher integration across its product lines. The company has also expanded its e-waste collection and recycling programs, now operating in over 70 countries globally. These initiatives underscore a commitment to reducing electronic waste and fostering sustainable product lifecycles.

Samsung Electronics is significantly expanding its environmental and ethical standards across its extensive global supplier network. By 2025, Samsung aims for 100% of its key suppliers to have environmental management system certifications, ensuring compliance with stringent environmental regulations and fostering sustainable practices throughout its value chain. This includes proactive management of hazardous substances, with over 99% of suppliers having hazardous substance management systems in place by early 2024, and promoting resource efficiency among its partners to minimize ecological impact.

Water Management and Pollution Control

Samsung Electronics prioritizes responsible water usage, especially crucial for its water-intensive semiconductor manufacturing processes. The company has achieved high-level certifications, like the AWS (Alliance for Water Stewardship) Platinum certification for its Hwaseong and Pyeongtaek campuses by late 2024, demonstrating its commitment to minimizing water withdrawal and ensuring sustainable practices. Investments continue in advanced facilities to treat process gases and significantly reduce pollution from manufacturing sites, aligning with their environmental goals for 2025. This focus helps mitigate operational risks and enhances brand reputation among environmentally conscious stakeholders.

- By late 2024, Samsung's Hwaseong and Pyeongtaek semiconductor fabs achieved AWS Platinum certification for water stewardship.

- Samsung targets a 20% reduction in water intensity by 2025 compared to 2021 levels for its semiconductor operations.

- Over $1 billion is allocated annually through 2025 for environmental initiatives, including advanced pollution control technologies.

- In 2024, the company reported over 95% of wastewater from its global operations was treated and reused or safely discharged.

Eco-Conscious Product Innovation

Samsung Electronics is significantly advancing eco-conscious product innovation, leveraging its technological expertise to develop more environmentally friendly devices. This includes designing products that consume less power, with a focus on reducing standby power consumption across various appliances. The company is also integrating sustainable materials, such as recycled plastics, into its product lines as highlighted in its 2024 Sustainability Report.

- Samsung aims to achieve 100% recycled plastic in its mobile phones by 2025.

- The company reduced semiconductor process emissions by 20% in 2023 compared to 2021.

- By 2025, Samsung targets net-zero emissions from its Device eXperience (DX) division.

Samsung Electronics aggressively targets net-zero carbon for its DX division by 2025, expanding renewable energy use at major global sites. The company significantly boosted recycled resin integration in 2024, aiming for 100% recycled plastic in mobile phones by 2025. Key fabs achieved AWS Platinum water certification by late 2024, with a 20% water intensity reduction target by 2025 for semiconductors. Over $1 billion is allocated annually through 2025 for these environmental initiatives.

| Metric | Target/Status | Year |

|---|---|---|

| DX Net-Zero Carbon | Achieve | 2025 |

| Mobile Recycled Plastic | 100% | 2025 |

| Water Intensity Reduction | 20% | 2025 |

PESTLE Analysis Data Sources

Our Samsung Electronics PESTLE Analysis is built on a comprehensive review of official government publications, international financial reports, and reputable industry analysis. We meticulously gather data on political stability, economic performance, technological advancements, and socio-cultural trends to ensure a well-rounded perspective.