Samsung Electronics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

Samsung Electronics masterfully leverages its diverse product portfolio, from cutting-edge smartphones to home appliances, to meet a wide spectrum of consumer needs. Their strategic pricing, balancing premium innovation with accessible options, ensures broad market appeal.

Samsung's extensive distribution network, encompassing online channels, retail partnerships, and direct sales, guarantees widespread availability of their innovative products.

The brand's dynamic promotional strategies, including impactful advertising campaigns, sponsorships, and digital engagement, consistently build brand loyalty and drive consumer desire.

Understanding how these elements intertwine is crucial for any business aiming for market leadership. Dive deeper into Samsung's winning formula.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Samsung Electronics boasts an extensive product portfolio, spanning consumer electronics like the Galaxy S24 series, which continued its strong market position into 2024, and Neo QLED TVs. This includes innovative Bespoke home appliances and critical B2B components such as advanced DRAM and NAND flash memory, pivotal for global tech supply chains through 2025.

This broad diversification across smartphones, TVs, and semiconductors, where Samsung remains a top player, significantly mitigates risks associated with reliance on any single market segment. The strategy positions Samsung as a comprehensive technology provider, embedding its brand across diverse consumer and enterprise landscapes.

Samsung Electronics heavily invests in research and development, with expenditures reaching approximately KRW 28.34 trillion in 2023, fueling innovations like the latest Galaxy Z Fold 6 and Z Flip 6 series expected in mid-2024. This commitment drives groundbreaking technologies such as on-device Galaxy AI, introduced with the S24 series, and advanced 3nm semiconductor processes, with 2nm expected by 2025. By leading in innovation, Samsung cultivates a premium brand image, attracting early adopters and setting market trends. This strategy is crucial for maintaining a competitive edge and justifying premium price points for flagship products, which can exceed $1,800 USD.

Samsung’s Integrated Ecosystem, powered by SmartThings, offers a seamless interconnected experience across its diverse product portfolio, from 2024 model smartphones to home appliances and TVs. This strategy enhances user convenience and builds strong brand loyalty by ensuring devices work harmoniously together. As of early 2024, SmartThings connected over 280 million devices, significantly increasing switching costs for consumers. This interconnectedness encourages the purchase of multiple Samsung products, maximizing utility and strengthening the company's market position.

Focus on Sustainability and Eco-Conscious Design

Samsung Electronics prioritizes sustainability in its product design, reflecting a strong commitment to environmental responsibility crucial for modern consumers and investors. This focus includes integrating recycled materials into products like the Galaxy S24 series, which uses recycled cobalt and rare earth elements, along with packaging made from 100% recycled paper. The company aims for 100% renewable energy use across its global operations by 2050 and zero waste to landfill for its global operations by 2025, enhancing its brand reputation and appealing to eco-conscious market segments.

- Samsung targets 100% renewable energy across global operations by 2050.

- The company aims for zero waste to landfill in global operations by 2025.

- Galaxy S24 series incorporates recycled cobalt and rare earth elements.

- Packaging utilizes 100% recycled paper, reducing environmental impact.

B2B Component Dominance (Semiconductors & Displays)

Samsung’s Device Solutions (DS) Division is a global leader in B2B component supply, manufacturing essential semiconductors and displays. This includes advanced memory chips like HBM and DRAM, alongside cutting-edge OLED panels, critical for data centers, AI hardware, and mobile devices worldwide. This B2B dominance provides significant revenue, with the DS division contributing over 40% of Samsung Electronics’ operating profit in Q1 2024, solidifying its market influence beyond consumer products.

- Samsung held over 49% of the global DRAM market share and nearly 35% of the NAND flash market as of Q1 2024.

- The company controls over 60% of the small and medium-sized OLED panel market, supplying major smartphone brands.

- HBM sales are projected to significantly boost DS division revenue, with strong demand into 2025.

Samsung Electronics maintains a robust product strategy, integrating consumer electronics like the 2024 Galaxy S24 series with critical B2B components such as advanced DRAM for 2025. This diversification across semiconductors, TVs, and mobile devices, including new foldable models in mid-2024, mitigates market risks. Significant R&D investments, approximately KRW 28.34 trillion in 2023, drive innovations like on-device AI and 3nm chip processes. The SmartThings ecosystem, connecting over 280 million devices in early 2024, enhances user loyalty and strengthens market position.

| Product Segment | Key Offerings (2024-2025) | Market Position (Q1 2024) |

|---|---|---|

| Mobile & IT | Galaxy S24, Z Fold/Flip 6, Tablets | Global #1 Smartphone (20% share) |

| Device Solutions (DS) | DRAM, NAND, HBM, OLED Panels | DRAM >49%, NAND ~35% |

| Consumer Electronics | Neo QLED TVs, Bespoke Appliances | Global #1 TV (18 consecutive years) |

What is included in the product

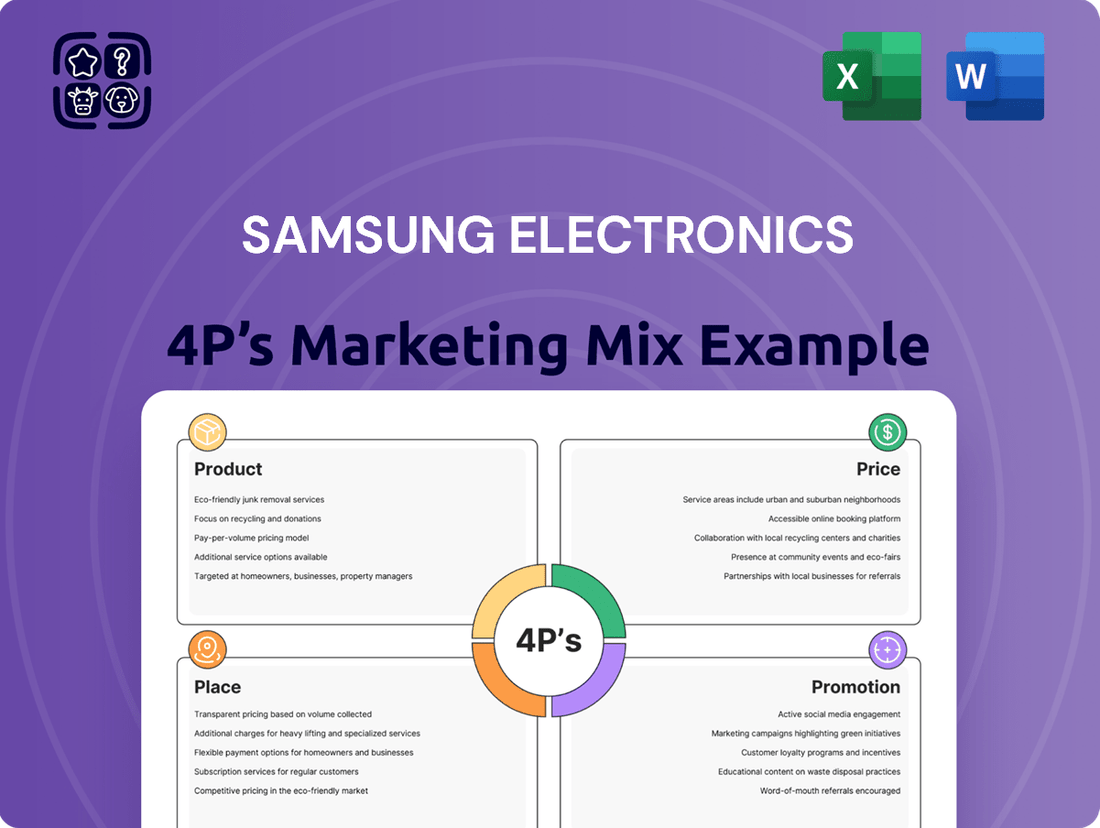

This analysis provides a comprehensive breakdown of Samsung Electronics' marketing mix, examining their innovative product development, competitive pricing strategies, extensive global distribution channels, and impactful promotional campaigns.

It's designed for professionals seeking to understand Samsung's market positioning and leverage real-world examples for their own strategic planning.

Simplifies complex Samsung Electronics 4Ps analysis into actionable marketing strategies, easing the burden of fragmented planning.

Provides a clear, structured overview of Samsung's 4Ps, removing the pain of understanding diverse product, price, place, and promotion elements.

Place

Samsung Electronics employs a robust omnichannel global retail network, blending physical and digital touchpoints to ensure widespread product accessibility. This strategy includes over 300 Samsung Experience Stores worldwide by early 2025, offering immersive hands-on experiences for devices like the Galaxy S25. Beyond its own stores, Samsung leverages strong partnerships with major electronics retailers such as Best Buy in North America and MediaMarktSaturn in Europe. This extensive network, encompassing hypermarkets and local shops globally, aims to meet customers wherever they prefer to shop, facilitating easy access and broad availability of Samsung's diverse product portfolio.

Samsung Electronics significantly leverages its robust e-commerce ecosystem, including Samsung.com, which saw a 15% year-over-year increase in direct online sales volume in Q1 2024.

This direct-to-consumer (D2C) channel offers superior control over branding and customer data, contributing to higher profit margins, estimated to be 5-10% greater than traditional retail channels.

Strategic partnerships with major platforms like Amazon and Alibaba further expand reach, capturing the growing digital shopping trend where online electronics sales are projected to exceed $1.2 trillion globally by 2025.

This comprehensive online presence is crucial for offering exclusive deals and products, enhancing market penetration and consumer engagement.

Samsung Electronics leverages deep strategic partnerships with global mobile carriers, including major players like SKT and KT in South Korea, and large retail chains to ensure widespread product availability. These collaborations are crucial for smartphone distribution, enabling devices to be offered seamlessly with carrier plans, and securing prominent in-store placement. For instance, Samsung’s market share in the global smartphone market reached approximately 20.8% in Q1 2024, largely supported by this extensive distribution network. This strategy maximizes market penetration and makes their latest innovations, like the Galaxy S25 series, readily accessible at the point of sale.

Global Manufacturing and Logistics Network

Samsung Electronics leverages an expansive global manufacturing and logistics network, boasting over 30 production sites and R&D centers worldwide across regions like Vietnam, India, and the Americas as of early 2025. This vertically integrated supply chain, including key facilities such as the Noida plant in India producing 120 million units annually, enables significant cost efficiencies and faster time-to-market. The strategy supports localized product development, exemplified by the Make for India initiative, and enhances resilience against regional disruptions, ensuring timely product availability globally.

- Samsung operates a vast network with key manufacturing hubs in Vietnam and India, optimizing global distribution.

- The Noida, India plant alone has an annual production capacity exceeding 120 million mobile units as of 2024.

- This integrated system reduces logistics costs and accelerates product launches by up to 20% compared to fragmented supply chains.

- Strategic diversification across continents enhances supply chain resilience against geopolitical or natural disruptions.

Experience-Based Retail Marketing

Samsung's marketing strategy heavily leverages experience-based retail, crafting immersive environments where customers directly interact with its cutting-edge technology. Dedicated Samsung Experience Stores and specialized zones within retail partners, like those found in over 1,000 Best Buy locations in North America, serve as hubs for innovation. Consumers engage with hands-on demonstrations of product ecosystems, such as AI-powered Bespoke appliances connected via SmartThings, showcasing tangible benefits. This approach educates customers, drives engagement, and highlights the integrated value of Samsung's interconnected device world, influencing purchase decisions.

- Samsung's global retail footprint includes hundreds of dedicated stores and significant presence in partner retail spaces.

- The SmartThings platform, central to these experiences, connects over 280 million registered users globally as of early 2025, demonstrating ecosystem growth.

- Experiential retail contributes to higher customer satisfaction scores and brand loyalty, with interactive demos increasing product understanding by an estimated 20-30%.

Samsung Electronics ensures widespread product availability through an extensive omnichannel network, combining over 300 Samsung Experience Stores globally by early 2025 with strong partnerships across major retailers and mobile carriers. Its robust e-commerce platform, Samsung.com, saw a 15% surge in Q1 2024 direct online sales, complementing strategic alliances with Amazon. A vast global manufacturing and logistics footprint, including the Noida plant producing 120 million units annually, underpins this distribution. This integrated approach, supporting a 20.8% Q1 2024 global smartphone market share, maximizes market reach and customer accessibility.

| Channel | 2024/2025 Data | Impact |

|---|---|---|

| Samsung Experience Stores | 300+ worldwide (early 2025) | Enhances customer engagement |

| Samsung.com Direct Sales | +15% YOY in Q1 2024 | Higher profit margins (5-10%) |

| Global Smartphone Share | 20.8% (Q1 2024) | Leverages carrier partnerships |

| Noida Plant Production | 120M units annually | Ensures timely supply globally |

What You Preview Is What You Download

Samsung Electronics 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Samsung Electronics 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain detailed insights into how Samsung leverages these elements to maintain its market leadership and customer loyalty. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with actionable intelligence.

Promotion

Samsung Electronics commits substantial resources to high-impact global advertising campaigns, leveraging both traditional channels like television and print, alongside extensive digital media presence on platforms such as YouTube and various social networks. The company consistently allocates billions annually, with marketing expenses reaching approximately 10 trillion KRW (around 7.5 billion USD) in 2023, projected similarly for 2024/2025. This massive investment ensures high brand visibility and cultivates a premium image for its diverse product portfolio. These broad-spectrum campaigns continuously reinforce Samsung's position as a leading global technology innovator in the public eye.

Samsung’s Galaxy Unpacked events are pivotal promotional showcases, generating immense global media attention and consumer excitement for flagship products like the Galaxy S24 series or upcoming foldable devices. These highly publicized launches are a cornerstone of their strategy, effectively highlighting innovations such as advanced AI features in 2024 models, driving significant initial sales momentum. For instance, the Galaxy S24 series saw over 1.21 million units sold in Korea within its first 28 days in early 2024, demonstrating the events' direct impact. They function as critical PR and marketing platforms, engaging a vast audience of tech enthusiasts, media, and potential customers worldwide.

Samsung leverages high-profile strategic sponsorships, such as its ongoing Worldwide Olympic Partner role extending through the LA28 Games, to enhance its global brand image. These alliances position Samsung alongside excellence and reach hundreds of millions of viewers worldwide. Collaborations with global music sensations like BTS further amplify brand reach, tapping into a massive youth demographic and cultural influence. Such partnerships build immense brand credibility and open unique marketing channels, supporting Samsung's premium perception and market presence in 2024-2025.

Comprehensive Digital and Social Media Marketing

Samsung Electronics employs sophisticated digital and social media strategies, leveraging platforms for targeted and interactive marketing. The company consistently utilizes social media for community engagement, notably with over 160 million followers across key platforms as of Q1 2025, fostering direct communication. Personalized campaigns, driven by data analytics, ensure relevant content reaches specific consumer segments, enhancing brand loyalty.

Influencer collaborations, a core component, amplify reach, with campaigns often generating billions of impressions. This comprehensive digital approach builds a robust brand community, driving conversations and product interest globally.

- Samsung's global digital ad spend for 2024 is projected to exceed $3 billion.

- Social media engagement rates for Samsung's flagship product launches averaged over 5% in late 2024.

- Over 70% of Samsung's marketing budget is allocated to digital channels by 2025.

- Influencer marketing campaigns contributed to a 15% increase in online sales conversion rates in early 2025.

Sales s and Channel Marketing

Samsung Electronics employs robust sales and channel marketing to drive immediate purchases, leveraging tactics like trade-in programs and bundling offers. These promotions, including strategic discounts and point-of-sale marketing, are often executed in close collaboration with retail partners such as Best Buy and carrier networks like Verizon. For instance, during early 2024, Samsung’s Galaxy S24 series launch benefited from aggressive trade-in values and carrier financing, contributing to its strong initial sales performance. These efforts are crucial for stimulating demand, maintaining competitiveness against rivals like Apple, and encouraging customer upgrades and loyalty within a dynamic market.

- Samsung’s Q1 2024 global smartphone market share reached 20.8%, partly due to aggressive promotional strategies.

- Financing options and trade-in deals significantly boost flagship device sales, with some reports indicating up to 40% of premium phone sales involve trade-ins.

- Channel partnerships with major retailers and mobile operators are central to Samsung’s promotional reach, driving in-store engagement and sales conversions.

Samsung’s promotion strategy is multifaceted, combining massive global advertising campaigns with pivotal Galaxy Unpacked events, which drove over 1.21 million S24 unit sales in Korea by early 2024. Digital channels, including influencer collaborations, are central, projected to receive over 70% of the marketing budget by 2025. Strategic sponsorships and aggressive sales promotions, like trade-in offers, significantly boost market share, contributing to Samsung’s 20.8% global smartphone share in Q1 2024.

| Promotional Tactic | Key Data (2024/2025) | Impact |

|---|---|---|

| Global Ad Spend | ~10 Trillion KRW (~$7.5B) | High brand visibility, premium image |

| Digital Channel Allocation | >70% of marketing budget | Targeted reach, community engagement |

| Galaxy Unpacked S24 Sales (Korea) | 1.21M units (first 28 days) | Significant initial sales momentum |

| Global Smartphone Market Share | 20.8% (Q1 2024) | Competitive positioning, sales growth |

Price

Samsung utilizes price skimming for its groundbreaking innovations, like the Galaxy S24 Ultra, launched in January 2024 starting at $1,299.99. This approach targets early adopters willing to pay a premium, allowing Samsung to maximize initial revenue and quickly recoup significant R&D investments, which totaled approximately $21 billion USD in 2023. By setting a high initial price, the company captures the most eager segment. As the product matures and competition emerges, the price is gradually lowered, expanding market reach.

Samsung sets its premium smartphone prices, like the Galaxy S24 Ultra at $1,299, to directly compete with Apple's iPhone 15 Pro Max. For its mid-range Galaxy A series and budget-friendly Galaxy M series, prices are aggressively set below $500 to counter brands such as Xiaomi and Vivo. This aggressive strategy ensures broad market competitiveness, especially in key emerging markets like India where Samsung maintains a strong presence as of Q1 2024. This approach optimizes market share across all consumer segments.

Samsung employs a multi-tiered pricing strategy, offering distinct product lines to capture a broad consumer base. The premium Galaxy S24 and Z Fold5 series target high-end segments, with the S24 Ultra launching in early 2024 often exceeding $1,200. Conversely, the value-focused Galaxy A55 and M35 series, released in 2024, cater to mid-range and entry-level markets, typically priced between $200-$500. This segmentation maximizes Samsung's market share, ensuring a product for nearly every budget and contributing to robust revenue streams. This approach helps Samsung maintain its global smartphone market leadership, holding approximately 20.8% share as of Q1 2024.

Value-Based and Psychological Pricing

Samsung Electronics employs value-based pricing, meticulously setting prices according to the perceived worth to diverse customer segments, a strategy supported by extensive market research insights from 2024 consumer trends.

For instance, their flagship Galaxy S24 Ultra, priced around $1,299, targets premium users valuing cutting-edge AI features and camera technology, while the Galaxy A series, starting near $299, caters to budget-conscious consumers seeking essential smartphone functionality.

The company also skillfully uses psychological pricing, such as listing a new foldable phone at $1,799 instead of $1,800, making the price appear significantly lower and more appealing to potential buyers.

This dual approach ensures Samsung captures various market segments while maximizing perceived value.

- Samsung’s global smartphone market share was approximately 20% in Q1 2024, demonstrating strong segment penetration.

- The Galaxy S24 series, launched in early 2024, saw a notable increase in pre-orders compared to its predecessors, partly due to perceived value.

- Value-based pricing allows Samsung to maintain premium margins on high-end devices, with mobile division operating profit reaching 3.51 trillion KRW in Q1 2024.

- Pricing strategies are continually refined based on competitive landscape analysis and consumer purchasing power in key markets like North America and Europe.

Promotional Pricing and Bundling

Samsung Electronics leverages promotional pricing and bundling to enhance its value proposition and drive sales. This includes frequent trade-in programs, such as those for new Galaxy S24 series devices in early 2024, alongside seasonal discounts during peak shopping periods. Cashback offers, often in partnership with financial institutions, and strategic product bundles, like a new smartphone paired with discounted Galaxy Buds, make products more accessible. These tactics encourage upgrades and stimulate demand, contributing to Samsung's strong market presence, with its mobile division reporting significant operating profit in Q1 2024.

- Samsung's Q1 2024 mobile division operating profit reached approximately KRW 3.51 trillion (around USD 2.5 billion).

- Trade-in programs for the Galaxy S24 series were prominent in early 2024, offering significant value to consumers.

- Bundling deals, such as those combining phones with wearables, are a consistent strategy, increasing average transaction value.

- Seasonal sales, like Black Friday or holiday promotions in late 2024, are critical for driving high-volume purchases.

Samsung strategically employs price skimming for new flagships like the Galaxy S24 Ultra, launched at $1,299.99 in January 2024, maximizing initial revenue.

Its multi-tiered approach ensures competitive pricing across premium ($1,200+), mid-range ($200-$500), and budget segments, maintaining a 20.8% global smartphone share in Q1 2024.

Value-based pricing, supported by 2024 consumer trends, and psychological pricing tactics enhance perceived value, with the mobile division's Q1 2024 operating profit reaching KRW 3.51 trillion.

Promotional pricing, including Q1 2024 trade-in programs for the S24 series, and bundling, further drive sales and market penetration.

| Product Line | Launch Price (USD) | Strategy |

|---|---|---|

| Galaxy S24 Ultra (Jan 2024) | $1,299.99 | Price Skimming |

| Galaxy A55 (2024) | $479 | Competitive Mid-Range |

| Mobile Division (Q1 2024) | KRW 3.51T Operating Profit | Value-Based |

4P's Marketing Mix Analysis Data Sources

Our Samsung Electronics 4P's Marketing Mix Analysis is constructed using a robust blend of primary and secondary data. We leverage official company disclosures, including annual reports and investor presentations, alongside real-time market data from retail channels and e-commerce platforms.

We meticulously gather information on Samsung's product portfolio, pricing strategies, distribution networks, and promotional activities. This includes analyzing industry reports, competitive benchmarks, and official brand communications to ensure a comprehensive and accurate assessment of their marketing mix.