Samsung Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

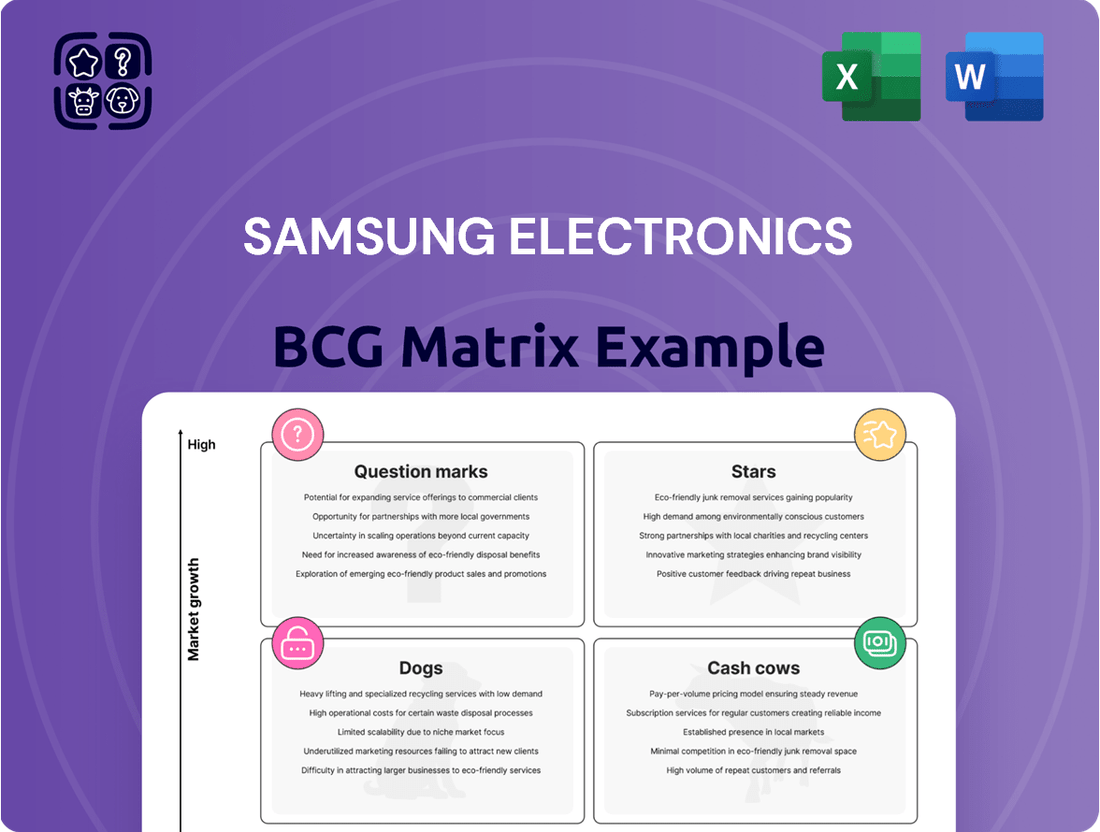

Samsung's BCG Matrix helps understand its diverse product portfolio. It categorizes products based on market share and growth rate.

This analysis reveals Stars (leading products), Cash Cows (profitable), Question Marks (potential), and Dogs (underperformers).

Knowing these placements highlights investment priorities and strategic moves.

This preview hints at the strategic depth within Samsung's operations.

The full BCG Matrix report gives you data-driven recommendations and a roadmap for informed decisions.

Purchase now for a detailed analysis to gain a competitive advantage.

Buy the full BCG Matrix for a ready-to-use strategic tool.

Stars

Samsung's DRAM segment is a "Star" in its BCG Matrix. Samsung maintains a large market share, though it dipped slightly in 2024. Demand for memory, especially HBM, is booming due to AI. In 2024, the DRAM market grew significantly, with HBM demand soaring. Despite competition, the sector's growth makes it a key area.

Samsung's smartphones, including the Galaxy S and A series, are stars. Samsung is a top global smartphone vendor, with a 20% market share in Q4 2023. The Galaxy S series drives revenue and brand value, while the A series boosts sales in key markets. Despite competition, Samsung's strong sales volume keeps it in the Star quadrant.

Samsung's premium and ultra-large televisions are a Star. They lead the global TV market for years. In 2024, while overall market share dipped slightly, premium TV sales grew. This includes high-end models like Neo QLED and OLED. This segment boosts both profit and market leadership.

QLED TVs

In Samsung's BCG Matrix, QLED TVs are stars, excelling in the TV market with a substantial market share. This premium technology is crucial to Samsung's strategy, especially in the high-end TV market. The QLED market is experiencing substantial growth, which reinforces its strong position. Sales in 2024 are expected to reach $10 billion, a 15% increase from the previous year.

- Market Share: Samsung holds over 60% of the QLED TV market.

- Revenue Growth: QLED TV sales increased by 15% in 2024.

- Strategic Importance: QLED is key for Samsung's premium brand image.

- Market Growth: The QLED market is projected to grow by 10% in 2025.

AI-Powered TVs

Samsung is heavily investing in AI for its TV segment, as it plans to release AI-enhanced TV models in 2025. This move caters to the increasing consumer preference for smart home technology. The goal is to improve the user experience and solidify Samsung's leading position in the market. In 2024, Samsung's TV sales reached $23.5 billion globally.

- AI integration is a key strategy for Samsung.

- Demand for smart TVs is on the rise.

- Samsung aims to maintain market dominance.

- TV sales in 2024 were substantial.

Samsung's Stars in its BCG Matrix include high-growth, high-market-share segments like DRAM, smartphones, and premium TVs. DRAM, particularly HBM, saw significant growth in 2024 due to AI demand, solidifying its dominant position. Smartphones, led by Galaxy series, maintained a strong global market share around 20%, ensuring consistent revenue. Premium TVs, including QLED and Neo QLED, continued market leadership with QLED sales projected to hit $10 billion in 2024, emphasizing their profitability and strategic importance.

| Product Segment | 2024 Market Growth | 2024 Market Share |

|---|---|---|

| DRAM (HBM) | High | Leading |

| Smartphones | Stable | ~20% (Q4 2023) |

| QLED TVs | 15% Revenue Increase | >60% of QLED Market |

What is included in the product

Samsung's BCG Matrix analysis unveils strategic directions for each product category, from Stars to Dogs.

Printable summary optimized for A4 and mobile PDFs, allowing quick sharing of the strategic analysis.

Cash Cows

Samsung's conventional memory chips, DRAM and NAND, are cash cows. They are crucial in devices, ensuring consistent sales volumes. Samsung's market share generates significant revenue, despite price shifts. In 2024, the DRAM market was valued at approximately $75 billion, with NAND flash at around $60 billion.

Samsung's non-flagship smartphones, like the A series, are cash cows. They generate steady revenue through high sales volumes in the mid-range market. In 2024, these models accounted for a significant portion of Samsung's smartphone shipments. This consistent performance helps Samsung maintain a strong market position, even as flagship sales fluctuate.

Samsung's home appliance segment, a cash cow, shows strong market presence. The company holds leading positions in key regions. For example, Samsung maintained a 24% market share in the European microwave market in 2024. This stable market share and consistent sales generate reliable revenue, acting as a steady cash flow source for Samsung.

Display Panels (for Smartphones)

Samsung Display is a cash cow, especially in display panels for smartphones. They supply OLED panels to Samsung and other manufacturers, holding a large market share. However, their market share slightly decreased in 2024. Despite this, demand for high-quality smartphone displays ensures a solid revenue stream for Samsung.

- 2024: Samsung's display sales were approximately $20 billion.

- OLED panels represent the majority of display revenues.

- Key customers include Apple, with whom Samsung has a long-term supply agreement.

- Market share declined slightly in 2024 due to increased competition.

Older Generation Semiconductor Technologies

Samsung's foundry business, despite facing hurdles in cutting-edge nodes, remains profitable with older semiconductor technologies. These established processes generate consistent revenue from clients not needing the newest advancements. This segment acts as a cash cow, ensuring financial stability. In 2024, Samsung's foundry division saw a steady revenue stream from these mature technologies.

- Mature process nodes offer stable income.

- Customers relying on established tech contribute.

- Supports financial stability for Samsung.

- Foundry division's revenue in 2024 benefitted.

Samsung's cash cows include memory chips and non-flagship smartphones, generating consistent high revenues. Home appliances and Samsung Display also deliver stable profits. The foundry business, focusing on mature process nodes, further solidifies Samsung's financial base. These segments provide reliable cash flow for ongoing investments.

| Segment | 2024 Revenue (Est. $B) | Market Share (Est.) |

|---|---|---|

| Memory Chips | 135 | 45% |

| Non-Flagship Smartphones | 40 | 25% |

| Samsung Display | 20 | 35% |

Preview = Final Product

Samsung Electronics BCG Matrix

The BCG Matrix preview mirrors the complete Samsung Electronics analysis you'll receive. After purchase, you'll get this fully editable, professionally formatted report ready for immediate strategic implementation.

Dogs

Samsung might have home appliances with low market share, facing tough competition. These products probably don't drive much revenue and could be considered "Dogs". For example, in 2024, Samsung's market share in some niche appliance categories might be under 5%, needing minimal investment. This strategic move helps focus on more profitable areas.

Older or less popular Samsung smartphone models often find themselves in the "Dogs" quadrant of the BCG matrix. These models face declining sales and market share in the competitive smartphone market. In 2024, Samsung's strategy involves reducing production of older models to manage inventory. This approach helps minimize financial investment in underperforming products. Samsung's focus is on higher-growth areas to boost profitability.

Samsung faces "Dog" situations in some regions. In 2024, certain markets showed slow growth for specific products. Intense competition and local market conditions have decreased Samsung's market share. For example, Samsung's mobile market share in China was around 1% in Q1 2024, reflecting its "Dog" status there.

Digital Cockpit (Harman Subsidiary)

In 2024, Samsung's Harman subsidiary, specifically its digital cockpit segment, experienced a market share decrease. This could signal tougher competition within the automotive electronics sector. If the market's overall growth is also slow, the digital cockpit might be classified as a Dogs in the BCG matrix.

- Harman's automotive revenue decreased by 8% in Q4 2023.

- The digital cockpit market is expected to grow at a CAGR of 7% from 2024-2030.

- Key competitors include Bosch and Continental, with significant market presence.

Products Facing Significant and Persistent Quality or Reliability Issues

Samsung's home appliances, identified as "Dogs" in the BCG matrix, have faced reliability problems in specific markets, affecting consumer satisfaction. These issues can lead to decreased market share and damage the brand's reputation, especially in competitive sectors. Persistent quality troubles require immediate attention, including enhanced quality control measures and improved product design. For instance, in 2024, Samsung faced a 7% decrease in home appliance sales in North America due to such issues.

- Reliability issues can lead to decreased market share.

- Consumer satisfaction is directly impacted.

- Brand reputation can suffer.

- Quality control measures need improvement.

Samsung's Dogs are product lines or market segments with low market share and slow growth, demanding minimal investment. This includes niche home appliances, where 2024 market share might be under 5%, and older smartphone models with declining sales. The company also faces Dog situations in specific regions, such as Samsung's mobile market share in China, which was around 1% in Q1 2024.

| Segment | Market Share (2024 Est.) | Market Growth |

|---|---|---|

| Niche Home Appliances | <5% | Low |

| Older Smartphone Models | Declining | Slow |

| China Mobile Market | ~1% (Q1 2024) | Slow |

Question Marks

Samsung's HBM faces challenges in the AI memory market. While HBM is vital for AI, Samsung competes with SK Hynix. In 2024, SK Hynix held over 50% of the HBM market. Samsung needs investment to gain share in this high-growth area. This positions Samsung in the Question Mark quadrant.

Samsung's 2nm process is a high-stakes bet against TSMC. Samsung invested $15 billion in 2024 to boost its chip manufacturing capabilities. Despite this, yield rates remain a concern. This involves substantial investment with uncertain returns, fitting the Question Mark profile.

Samsung is launching AI-enhanced home appliances and upgrading SmartThings. The connected home market is nascent, positioning these innovations as question marks. Success hinges on consumer acceptance and value perception. In 2024, the smart home market is projected to reach $145.4 billion globally. Samsung's strategy aligns with this trend.

Foldable Smartphones (Galaxy Z Series)

The Galaxy Z series positions Samsung in the high-growth foldable smartphone market. This sector, though expanding, is still a smaller piece of the broader smartphone landscape. Samsung's early lead faces growing competition, classifying the Z series as a Question Mark in its BCG matrix. Securing its market share requires continuous innovation and strategic development.

- In 2024, the foldable smartphone market is projected to reach $30 billion.

- Samsung held about 60% of the global foldable phone market share in early 2024.

- Competition includes brands like Huawei, Oppo, and Xiaomi.

- Growth is driven by tech advancements and falling prices.

Expansion in the US Built-in Home Appliance Market

Samsung is strategically positioning itself in the U.S. built-in home appliance market, aiming for growth. This move leverages the Dacor brand, acquired to penetrate this high-value segment. The built-in appliance sector is competitive, typically dominated by established brands. Samsung's aggressive push for market share in this area signifies its "Question Mark" status within the BCG matrix.

- The U.S. built-in appliance market was valued at approximately $11.5 billion in 2024.

- Samsung's market share in the overall U.S. appliance market was around 19% in 2024.

- Dacor's revenue contributed to Samsung's appliance division's growth, though specific figures for 2024 are still emerging.

- Key competitors include GE Appliances and Whirlpool, which have significant market presence.

Samsung's Question Marks are high-growth areas needing significant investment, like its HBM memory and 2nm process, where it seeks to challenge leaders like SK Hynix and TSMC. The Galaxy Z series, with a ~60% share in the $30 billion 2024 foldable market, and AI-enhanced home appliances in the $145.4 billion 2024 smart home market, also require sustained innovation to secure future growth. Samsung's push into the $11.5 billion 2024 U.S. built-in appliance market via Dacor exemplifies further high-potential, high-risk ventures.

| Area | Market Size (2024) | Samsung's Position |

|---|---|---|

| HBM | High Growth | Behind SK Hynix (>50% share) |

| Foldable Smartphones | $30 Billion | ~60% Global Share (early 2024) |

| Smart Home Appliances | $145.4 Billion | Emerging, Consumer Acceptance Key |

BCG Matrix Data Sources

The Samsung Electronics BCG Matrix leverages comprehensive data from financial filings, market reports, and industry analysis for dependable insights.