RWE Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RWE Group Bundle

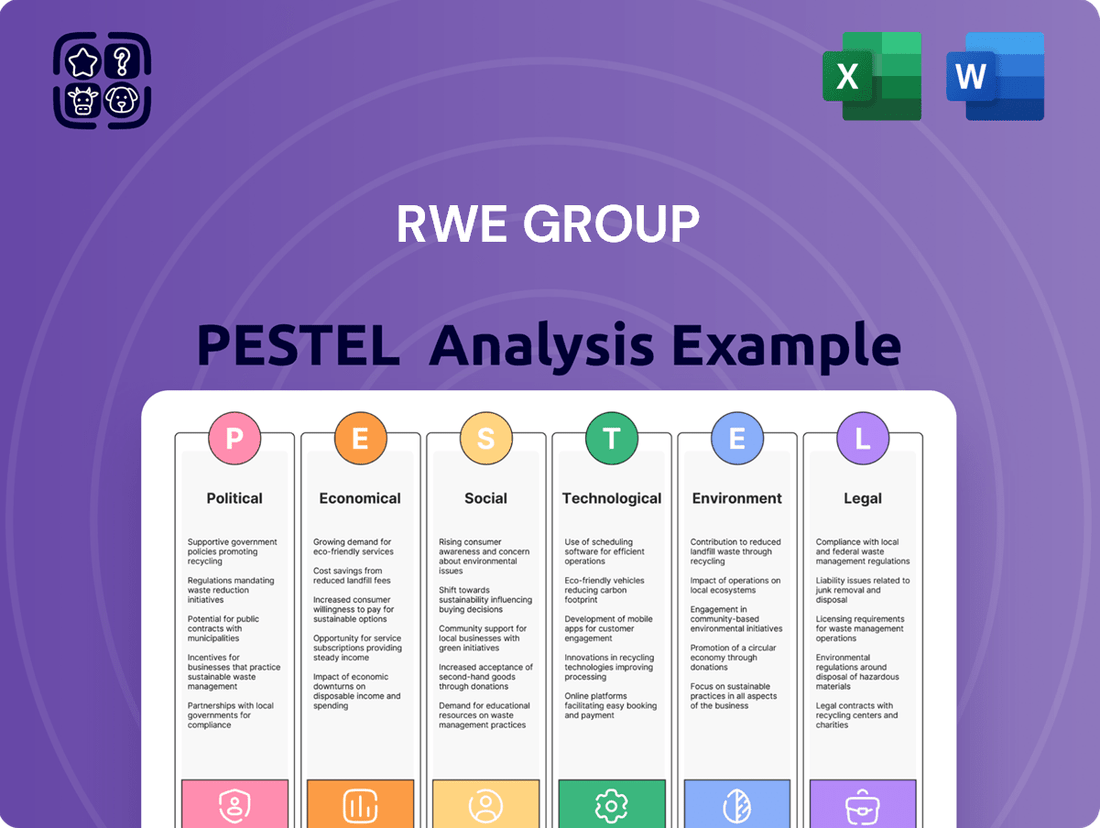

Navigate the complex global landscape affecting RWE Group with our comprehensive PESTLE analysis. Understand the crucial political, economic, social, technological, legal, and environmental factors that are shaping its future. This analysis provides a clear roadmap to identify opportunities and mitigate risks. Download the full version now and gain the strategic foresight needed to excel.

Political factors

RWE's strategic pivot towards renewables is strongly supported by governmental initiatives in Germany and the European Union, which are pushing for substantial decarbonization efforts. This backing includes targeted policies for offshore wind, solar power, and the emerging hydrogen sector, all vital components of RWE's 'Growing Green' strategy.

The German government's ambitious target of sourcing at least 80% of its electricity from renewable sources by 2030 directly bolsters RWE's primary business operations. For instance, Germany's Renewable Energy Sources Act (EEG) continues to provide a stable framework for renewable energy development, with ongoing auctions for wind and solar projects.

The EU's Green Deal and its associated funding mechanisms, such as the Just Transition Fund, also provide significant financial and regulatory impetus for RWE's renewable energy expansion plans across the continent. As of early 2024, the EU has committed substantial funds to accelerate the rollout of renewable energy infrastructure, recognizing its critical role in energy security and climate goals.

The stability and predictability of regulatory frameworks are critical for RWE's substantial long-term investments in energy infrastructure. Shifts in energy policy, particularly concerning renewable energy subsidies, carbon pricing, and grid expansion, directly influence RWE's financial performance and strategic investment choices.

RWE has demonstrably adjusted its investment plans, citing growing uncertainties in markets such as the United States, underscoring the imperative for consistent and reliable policy environments to foster growth and secure capital.

Geopolitical tensions and evolving trade policies present a significant challenge for RWE. Potential tariffs or escalating trade wars could disrupt RWE's supply chains for crucial components in renewable energy projects, directly impacting project costs and timelines. Furthermore, these tensions can limit access to key international markets.

The company's CEO has explicitly identified global political instability and its ripple effects on supply chains as a major risk for new investment decisions. For instance, in 2024, the global energy sector faced increased uncertainty due to ongoing conflicts in Eastern Europe, affecting commodity prices and investment sentiment.

Phase-out of Fossil Fuels

Germany's firm commitment to phasing out coal by 2030 and achieving net-zero emissions by 2040 significantly shapes RWE Group's strategic direction. This political imperative is a key catalyst for RWE's ongoing transformation towards a greener energy portfolio. The company is actively capitalizing on this policy shift by expanding its renewable energy capacity while simultaneously managing the retirement of its legacy fossil fuel assets.

RWE's proactive approach is evident in its operational adjustments. For instance, the company has already completed the closure of six lignite-fired power plant units in 2024, a tangible step towards fulfilling its 2030 coal phase-out obligation. This aligns RWE with national climate targets and positions it to benefit from the growing demand for sustainable energy solutions.

- German Coal Phase-out: Aiming for closure by 2030.

- Net-Zero Target: Germany's commitment by 2040.

- RWE's Renewable Expansion: Strategic growth in green energy.

- Asset Decommissioning: Managing the transition from conventional power.

- 2024 Closures: Six lignite power plant units already shut down.

Climate Litigation and Liability

Political factors significantly impact RWE Group through the growing trend of climate litigation and associated liability. Recent legal precedents, like the Lliuya v. RWE case in Germany, demonstrate mounting political and legal pressure on major emitters. While this specific case was dismissed, the court’s acknowledgment of potential corporate liability for climate damages is a crucial development.

This legal acknowledgment, even in dismissal, influences corporate responsibility and risk management strategies for RWE. It signals a shift where companies may be held accountable for their contribution to climate change impacts, necessitating proactive adaptation and mitigation planning.

- Legal Precedent: The Lliuya v. RWE case, though dismissed, established the principle that large emitters could be liable for climate damages.

- Corporate Responsibility: This trend pushes companies like RWE to integrate climate risk into their core business and liability assessments.

- Regulatory Scrutiny: Increased litigation fuels demand for stricter environmental regulations and corporate accountability measures.

Governmental support for renewables, especially in Germany and the EU, is a major driver for RWE. Policies like the German Renewable Energy Sources Act (EEG) and the EU Green Deal, backed by substantial funding as of early 2024, create a favorable investment climate for RWE's green energy expansion.

Germany's commitment to phasing out coal by 2030 and achieving net-zero by 2040 directly influences RWE's strategic shift towards renewables, with the company already closing lignite power units in 2024 to meet these targets.

Political stability and predictable energy policies are crucial for RWE's long-term investments, as demonstrated by the company's adjustments in response to perceived uncertainties in markets like the US in 2024.

Geopolitical tensions pose risks to RWE's supply chains and market access, with global political instability cited as a significant concern for new investments, particularly in light of ongoing international conflicts affecting energy markets in 2024.

| Political Factor | Impact on RWE | Supporting Data/Observation |

|---|---|---|

| Renewable Energy Support | Drives RWE's growth strategy | EU Green Deal funding for renewables accelerating in 2024. German EEG provides stable framework. |

| National Climate Targets | Accelerates RWE's transition | Germany's 2030 coal phase-out target; RWE closed 6 lignite units in 2024. |

| Policy Stability | Influences investment decisions | RWE cited US market uncertainties in 2024 as a reason for strategic adjustments. |

| Geopolitical Risk | Threatens supply chains and market access | CEO identified global political instability as a major risk for investment in 2024. |

What is included in the product

This PESTLE analysis of RWE Group thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic planning.

It provides actionable insights into how these macro-environmental forces present both challenges and opportunities for RWE's future growth and market positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting key external factors impacting RWE Group's strategy and mitigating potential disruptions.

Economic factors

RWE's substantial commitment to renewable energy, with a planned net investment of €35 billion for 2025-2030, signals a strong response to economic trends favoring decarbonization and energy security. This investment, initially projected at €55 billion, underpins the group's strategic shift towards a green portfolio.

The focus areas for RWE's capital allocation include offshore and onshore wind, solar power, battery storage, and hydrogen, reflecting the economic viability and growing market demand for these technologies. These investments are crucial for meeting global climate targets and capitalizing on the transition to a low-carbon economy.

In 2024, RWE demonstrated its commitment by investing a significant €10 billion net and bringing 2 GW of new renewable capacity online. This aggressive expansion highlights the economic opportunities RWE sees in the burgeoning renewable energy sector, driven by supportive government policies and increasing investor appetite.

Fluctuations in wholesale electricity and gas prices are a major factor for RWE, directly impacting its earnings, particularly within the energy trading operations. For instance, RWE's 2024 outlook indicated that while renewables offer cost stability, the broader market volatility can still sway short-term profitability and the financial performance of its flexible power plants.

Despite the inherent price swings in conventional energy markets, RWE is projecting a stronger financial year. The company anticipates normalized earnings in its Supply & Trading segment for 2025, suggesting a degree of confidence in managing market volatility and leveraging trading opportunities.

Rising inflation and interest rates present a significant challenge for RWE Group. The increasing cost of capital directly impacts the feasibility and projected returns of RWE's substantial infrastructure investments. This economic shift necessitates a recalibration of investment strategies to maintain profitability in a higher-cost environment.

RWE's proactive response to these market dynamics is evident in its adjusted return expectations. The company has already revised its target returns for new projects upwards, moving from an average of 8% to over 8.5%. This adjustment reflects the heightened investment uncertainties and the need to compensate for increased financial risks.

Access to Green Financing

RWE's transition to renewables hinges on its ability to secure funding for green initiatives. Access to green financing, such as green bonds and sustainability-linked loans, is crucial for this transformation.

The company actively utilizes these instruments, as evidenced by its issuance of a $2 billion green bond in the U.S. in April 2024. This capital raise specifically targets the financing of renewable energy projects, underscoring RWE's strategy to tap into the growing market for sustainable investments.

This demonstrates RWE's strong capacity to attract capital dedicated to environmentally friendly projects. The availability and cost-effectiveness of such financing directly impact the pace and scale of RWE's green transformation.

- Green Bond Issuance: RWE issued a $2 billion green bond in April 2024.

- Purpose: Funds are earmarked for renewable energy projects.

- Market Access: Highlights RWE's ability to access sustainable finance markets.

- Impact: Facilitates the funding of the company's green transformation strategy.

Economic Growth and Energy Demand

Global economic growth is a powerful driver of energy demand. As economies expand, so does the need for electricity to power industries, businesses, and homes. This presents a clear opportunity for RWE, a major energy company, to grow its generation and supply operations.

The International Energy Agency (IEA) projects a substantial rise in global electricity demand in the coming years. This surge is largely attributed to the widespread electrification of transport and heating, as well as the burgeoning energy requirements of data centers supporting artificial intelligence (AI) advancements. For instance, the IEA’s 2024 forecast suggests global electricity demand could grow by over 3% annually through 2026, with developing economies, particularly in Asia, leading the charge. RWE’s diversified portfolio, encompassing renewables, conventional power generation, and energy trading, is well-positioned to capitalize on this increasing demand.

- Growing Demand: Global electricity demand is expected to rise significantly, fueled by electrification and AI.

- Opportunity for RWE: Increased energy needs translate directly into opportunities for RWE's generation and supply businesses.

- IEA Projections: The IEA anticipates robust annual growth in global electricity demand through 2026.

- AI's Impact: The energy consumption of data centers supporting AI is a key factor in the demand forecast.

RWE's strategic investment of €35 billion for 2025-2030, with €10 billion invested in 2024 to add 2 GW of renewables, underscores the economic shift towards decarbonization and energy security.

While wholesale price volatility in conventional energy markets impacts RWE's earnings, the company anticipates normalized earnings in its Supply & Trading segment for 2025, indicating confidence in managing market swings.

Rising inflation and interest rates are increasing capital costs, prompting RWE to adjust its target returns for new projects upwards to over 8.5% to compensate for heightened investment risks.

Global economic growth, particularly driven by electrification and AI-powered data centers, is projected to boost electricity demand, creating opportunities for RWE's diverse energy portfolio, with the IEA forecasting over 3% annual growth through 2026.

Same Document Delivered

RWE Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of RWE Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the energy giant. Understand the key drivers shaping RWE's strategic landscape, from government regulations and market volatility to societal shifts and technological advancements. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Public perception and community acceptance are absolutely key for RWE’s renewable energy projects, like wind farms and solar installations. Without local buy-in, projects can face significant hurdles, leading to delays and increased costs.

To navigate this, RWE actively engages with communities, making sure local concerns are heard and addressed. This proactive approach helps build trust and minimize potential opposition, which is crucial for smooth project development and ongoing operations.

In the United States alone, RWE's dedicated community engagement team conducted 92 social risk and community assessments during 2024. This highlights their commitment to understanding and mitigating local impacts before they become major issues.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products and services. This shift is directly impacting the energy sector, pushing demand towards renewable and carbon-neutral options. RWE’s strategic investments in offshore wind and solar power, for example, directly cater to this growing consumer conscience.

The growing demand for green energy is not just a consumer trend; it's also influencing corporate purchasing. Large technology firms, in particular, are actively seeking Power Purchase Agreements (PPAs) with renewable energy providers to meet their own sustainability targets. RWE’s successful PPAs with companies like Google in 2023, securing significant renewable energy capacity, highlight this trend, demonstrating how consumer preference for sustainability translates into tangible business opportunities for RWE.

RWE's significant investment in renewable energy, projected to reach €15 billion by 2030, directly influences its workforce. This transition necessitates a substantial upskilling of employees, particularly in areas like offshore wind maintenance, solar panel installation, and grid modernization. The company is actively investing in training programs to equip its existing staff with these new competencies, aiming to retain talent and manage job shifts from its conventional power generation activities.

The company’s commitment to employment and skills development is crucial for navigating the energy transition smoothly. RWE is actively engaging in partnerships with educational institutions and vocational training centers to cultivate a pipeline of skilled workers for the renewable sector. This proactive approach ensures that as their operational focus shifts, their human capital remains aligned with future business needs, supporting their ambitious growth targets in green energy.

Diversity, Equity, and Inclusion

RWE is actively fostering an inclusive workplace, a key driver for attracting and keeping skilled employees in the competitive energy sector. The company is specifically working to boost the number of women in management roles and broaden its diversity, equity, and inclusion (DE&I) training programs globally.

In 2024, RWE saw significant expansion in its internal diversity networks, demonstrating a tangible commitment to these principles. This focus on DE&I is not just a social imperative but a strategic advantage.

- Increased Focus on DE&I: RWE is prioritizing DE&I to enhance its employer brand.

- Women in Management: Efforts are underway to increase the representation of women in leadership positions.

- Global Training Expansion: DE&I training is being rolled out across RWE's international operations.

- Network Growth in 2024: RWE's diversity networks experienced substantial growth during the year.

Corporate Social Responsibility and Community Engagement

RWE Group places significant emphasis on its role within the communities where it operates, recognizing that strong social ties are crucial for its long-term success. This commitment manifests through active engagement and substantial investment in local development.

The company's dedication to Corporate Social Responsibility (CSR) isn't just about compliance; it's a strategic imperative that bolsters its social license to operate and cultivates essential trust among its diverse stakeholders. This proactive approach helps to mitigate potential social risks and fosters a more collaborative operating environment.

A prime example of this commitment is the RWE Foundation. In 2024 alone, the foundation provided funding for 29 distinct projects. These initiatives are specifically designed to promote equal opportunities for children and young people, addressing key societal needs and investing in future generations.

RWE's community engagement strategy involves more than just financial contributions. It includes tangible investments in local infrastructure and active support for local organizations, directly contributing to the well-being and development of the areas in which RWE has a presence.

- Community Investment: RWE actively invests in local infrastructure and supports local organizations in its operational areas.

- CSR Commitment: The company's dedication to CSR enhances its social license to operate and builds stakeholder trust.

- Foundation Impact: The RWE Foundation funded 29 projects in 2024, focusing on equal opportunities for children and young people.

- Stakeholder Relations: Strong community ties are viewed as essential for RWE's long-term success and operational stability.

Sociological factors significantly influence RWE's operations, particularly in community acceptance of renewable projects. RWE's proactive engagement, including 92 social risk assessments in the US in 2024, aims to address local concerns and build trust, crucial for project success.

Consumer demand for sustainability is a major driver, with customers willing to pay more for eco-friendly options, pushing RWE's investments in offshore wind and solar power. This trend extends to corporate clients, evidenced by RWE's 2023 PPAs with major tech firms seeking renewable energy capacity.

RWE's workforce is adapting to the energy transition, with a €15 billion investment in renewables by 2030 necessitating upskilling in areas like offshore wind maintenance and solar installation. Partnerships with educational institutions are key to developing a skilled workforce.

Diversity, Equity, and Inclusion (DE&I) are strategic priorities for RWE to attract and retain talent. The company expanded internal diversity networks in 2024 and is focused on increasing women in management roles through global training programs.

RWE's commitment to Corporate Social Responsibility (CSR) and community investment, like the RWE Foundation funding 29 projects in 2024 focused on youth opportunities, is vital for its social license to operate and fosters strong stakeholder relationships.

| Sociological Factor | RWE's Approach | Key Data/Initiative |

| Community Acceptance | Proactive engagement and addressing local concerns | 92 social risk assessments in the US (2024) |

| Consumer Demand for Sustainability | Investing in renewable energy projects | PPAs with tech firms (2023) |

| Workforce Development | Upskilling for energy transition | €15 billion investment in renewables by 2030 |

| Diversity, Equity, and Inclusion (DE&I) | Enhancing employer brand and inclusivity | Expansion of diversity networks (2024) |

| Corporate Social Responsibility (CSR) | Community investment and social impact | RWE Foundation funded 29 projects (2024) |

Technological factors

Continuous innovation in wind turbine design, solar panel efficiency, and hydropower generation directly improves the output and cost-effectiveness of RWE's core assets. For instance, advances in turbine aerodynamics and materials have pushed offshore wind capacity factors higher, contributing to RWE's growing renewable portfolio. By 2024, global solar PV capacity reached over 1,300 GW, a significant increase driven by efficiency gains.

RWE is actively involved in developing cutting-edge renewable projects, such as floating offshore wind farms, which unlock new geographical areas for wind power. They are also pioneering advanced solar projects, including installations on repurposed mine lands, demonstrating a commitment to utilizing diverse landscapes for clean energy generation. This strategic focus on innovation is crucial for RWE to maintain its competitive edge in the rapidly evolving energy sector.

Technological advancements in energy storage are paramount for integrating variable renewables like wind and solar into the power grid and maintaining its stability. RWE is actively pursuing this, with significant investments in battery storage solutions. For instance, RWE commissioned a 100 MW battery storage facility in the US in early 2024, and is further expanding its battery storage capacity across the United States, aiming to add hundreds of megawatts by the end of 2025 to support grid reliability.

RWE is actively investing in green hydrogen production, aiming to be a key player in this emerging sector. Their 14 MW electrolyzer pilot plant in Lingen is a testament to this commitment, showcasing their technological advancements.

The company has ambitious plans for scaling up green hydrogen production, recognizing its critical role in decarbonizing heavy industries like steel and chemicals. This transition is essential for meeting climate goals and creating more resilient energy systems.

By 2030, RWE aims to have a green hydrogen production capacity of 1 gigawatt (GW), signaling a significant expansion of their capabilities in this area. This growth is driven by increasing demand for clean energy alternatives and supportive government policies.

Smart Grid and Digitalization

RWE is significantly leveraging digitalization, including smart grid technologies, to boost the efficiency and reliability of its energy systems. This focus on advanced data analytics and artificial intelligence is crucial for optimizing operations and managing complex energy infrastructures.

The company's commitment to digitalization is evident across its operations, from advanced visualization and virtual representation of assets to streamlining human resources and enhancing energy production processes. For instance, RWE's investments in digital solutions are aimed at improving grid management and customer service.

- Smart Grid Deployment: RWE is actively involved in rolling out smart grid technologies to enable better monitoring, control, and automation of its electricity distribution networks.

- AI in Operations: The group utilizes artificial intelligence for predictive maintenance of power plants and for optimizing energy trading strategies, aiming to reduce costs and improve performance.

- Data Analytics for Efficiency: Advanced data analytics are employed to gain insights into energy consumption patterns and network performance, leading to more efficient resource allocation and service delivery.

- Digital Transformation Investment: RWE has allocated substantial resources towards its digital transformation, recognizing it as a key enabler for future growth and operational excellence in the evolving energy landscape.

Carbon Capture and Utilization

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) present a developing area for RWE, even as the company prioritizes renewable energy. While RWE's core strategy leans heavily into renewables, CCUS technologies could provide future solutions for managing emissions from any remaining conventional power generation or supporting industrial clients with their own hard-to-abate emissions. This aligns with RWE's stated innovation focus on CO2 utilization and environmental engineering, exploring how captured carbon can be repurposed or stored safely.

The global CCUS market is projected for significant growth. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that CCUS projects under development could capture over 700 million tonnes of CO2 annually by 2030, a substantial increase from current levels. RWE's involvement in this space, even in its nascent stages, positions them to potentially leverage these emerging technologies.

- Technological Development: RWE's innovation efforts are exploring CO2 utilization and environmental engineering, which are key components of CCUS.

- Market Growth: The CCUS sector is experiencing rapid expansion, with projections indicating substantial growth in capture capacity by 2030.

- Strategic Relevance: CCUS offers a potential avenue for RWE to address residual emissions from conventional assets or to partner with industries facing decarbonization challenges.

- Future Pathways: While not RWE's primary focus, CCUS represents a technological factor that could shape future emission management strategies.

Technological advancements are reshaping RWE's operational landscape, driving efficiency and enabling new energy solutions. Innovations in turbine design, like improved aerodynamics, boost the performance of offshore wind farms, a key growth area for RWE. By 2024, global solar PV capacity exceeded 1,300 GW, underscoring the impact of solar efficiency gains.

Legal factors

Securing the necessary environmental permits and approvals for new renewable energy projects, particularly extensive offshore wind farms, represents a legally intricate and lengthy procedure. These approvals are crucial for RWE's development pipeline.

RWE's UK offshore wind farm extension project, Five Estuaries, is currently undergoing a rigorous examination process. A final decision on its planning is anticipated in the summer of 2025, highlighting the extended timeline involved in obtaining regulatory consent for major infrastructure.

RWE navigates a stringent regulatory landscape shaped by EU and national energy laws. These include mandates for renewable energy expansion, such as the EU's target of at least 42.5% renewable energy by 2030, and directives promoting energy efficiency. The company also operates within frameworks for market liberalization, influencing how it competes and structures its operations.

The implementation of the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) starting in 2024 significantly alters RWE's disclosure requirements. This means RWE must provide detailed and standardized reporting on its environmental, social, and governance (ESG) performance, impacting transparency and investor relations.

RWE faces significant legal hurdles with land use and siting regulations for its onshore wind and solar projects. Navigating the patchwork of diverse local and regional planning laws is crucial, especially when facing opposition driven by environmental concerns or aesthetic objections. For instance, in 2023, Germany's Federal Network Agency reported that permitting processes for new wind turbines frequently faced delays due to complex land-use zoning and environmental impact assessments, impacting the pace of renewable energy deployment.

Contractual Obligations and Power Purchase Agreements

RWE Group's operations are heavily influenced by contractual obligations, particularly through its Power Purchase Agreements (PPAs). These long-term contracts with customers involve complex legal negotiations and create significant commitments for both parties. Such agreements are crucial for ensuring predictable revenue streams but simultaneously introduce contractual risks that RWE must actively manage.

In 2024 and into 2025, RWE has been actively securing major PPAs, demonstrating the ongoing importance of this legal framework. For instance, the company finalized substantial long-term PPAs with tech giants Meta and Microsoft. These agreements underscore the company's strategy to lock in demand for its renewable energy output, providing a stable foundation for future investments and operations.

- RWE's PPAs are legally binding, outlining terms for electricity supply and pricing over extended periods.

- These agreements are vital for RWE's revenue stability, reducing exposure to volatile market prices.

- Contractual risks include potential breaches, changes in regulatory environments affecting contract enforceability, and counterparty financial health.

- Notable 2024/2025 PPAs with Meta and Microsoft highlight the scale of RWE's long-term commitments and its role in supplying large corporate energy needs.

Climate Change Litigation Risk

The increasing frequency of climate change litigation poses a significant legal risk for RWE. Even when individual lawsuits are dismissed, the underlying trend of holding major emitters accountable for climate damages persists.

Courts are increasingly examining the concept of liability for large carbon emitters, which could translate into future claims seeking compensation for climate-related impacts or funding for adaptation measures. This evolving legal landscape means RWE must remain vigilant regarding potential litigation stemming from its historical and ongoing emissions.

- Growing Legal Precedent: Courts globally are grappling with cases that could establish precedents for holding companies liable for climate change contributions.

- Adaptation and Compensation Claims: Future litigation could focus on seeking funds for communities to adapt to climate impacts or for direct compensation for damages.

- Reputational and Financial Exposure: Beyond direct legal costs, successful litigation could lead to substantial financial penalties and reputational damage for RWE.

- Regulatory Scrutiny: Climate litigation often goes hand-in-hand with increased regulatory scrutiny, potentially leading to new compliance requirements and operational changes.

RWE must adhere to evolving environmental regulations, with the EU targeting 42.5% renewables by 2030, impacting project development and operational compliance.

The Corporate Sustainability Reporting Directive (CSRD) and ESRS, implemented in 2024, mandate detailed ESG disclosures, increasing transparency and potential investor scrutiny.

Complex land-use and siting laws in Germany, as seen in 2023 permitting delays for wind turbines, create legal challenges for RWE's onshore projects.

The company's significant Power Purchase Agreements (PPAs) with entities like Meta and Microsoft in 2024/2025 highlight the critical role of legally binding contracts in securing revenue and managing counterparty risk.

| Legal Factor | Impact on RWE | 2024/2025 Relevance |

| Environmental Permits | Lengthy and intricate approval processes for new projects, especially offshore wind. | Five Estuaries offshore wind extension decision expected summer 2025. |

| EU & National Energy Law | Compliance with renewable energy targets and energy efficiency directives. | Navigating market liberalization frameworks. |

| Sustainability Reporting | Mandatory detailed ESG disclosures under CSRD/ESRS. | Increased transparency and investor relations management. |

| Land Use & Siting | Navigating diverse local and regional planning laws for onshore projects. | 2023 German wind turbine permitting delays due to zoning and EIA. |

| Power Purchase Agreements (PPAs) | Legally binding contracts for electricity supply and pricing. | Major 2024/2025 PPAs with Meta and Microsoft for revenue stability. |

| Climate Change Litigation | Potential liability for carbon emissions and climate damages. | Increasing global litigation trends holding emitters accountable. |

Environmental factors

RWE Group is deeply invested in climate change mitigation, aiming for net-zero emissions by 2040. This ambitious goal involves a significant shift away from fossil fuels, with plans to cut Scope 1 and 2 emissions by over 70% per MWh of electricity produced by 2030, a target validated by the Science Based Targets initiative (SBTi).

This commitment to decarbonization is central to RWE's strategy, driving substantial investments in renewable energy infrastructure. The company is actively expanding its renewable portfolio, particularly in offshore wind and solar power, which are key pillars in its transition away from coal and gas-fired power generation.

The global push for decarbonization, driven by international agreements and national policies, creates both challenges and opportunities for RWE. While regulatory pressures to reduce emissions intensify, the increasing demand for clean energy solutions offers significant growth potential for the company's renewable energy business.

RWE is actively working to protect and enhance biodiversity, particularly around its renewable energy projects. The company aims for new assets to have a positive net impact on biodiversity, going beyond simply minimizing harm.

For instance, RWE implements practical measures such as releasing lobsters at its offshore wind farm sites, contributing to marine ecosystem health. This initiative is part of a broader strategy to foster the co-existence of marine life and wind energy infrastructure.

In 2023, RWE continued its commitment to biodiversity conservation. While specific lobster release numbers are part of ongoing monitoring, the company’s broader environmental efforts in 2024 focus on integrating biodiversity considerations into every stage of project development and operation, aiming for measurable ecological improvements.

RWE Group places significant emphasis on sustainable resource management, recognizing water as a critical element in its operations and post-mining land restoration. This commitment is evident in their proactive planning for infrastructure designed to manage water resources responsibly.

A prime example is RWE's commencement of planning for an approval procedure to construct a pipeline. This pipeline is specifically designed to fill pits at closed opencast mines, a crucial step in stabilizing groundwater levels and ensuring the long-term environmental health of these former operational sites.

For context, RWE's lignite mining activities, while transitioning, have historically involved significant water usage and potential impacts on local hydrology. The company’s investment in such projects underscores a strategic response to environmental regulations and a dedication to minimizing its ecological footprint.

Circular Economy Principles

RWE is actively integrating circular economy principles, particularly as it navigates the complexities of decommissioning assets like wind turbine blades. This strategic shift focuses on finding innovative ways to reuse and recycle materials, minimizing waste and maximizing resource value within the energy industry.

The company is exploring solutions for end-of-life management of renewable energy components, such as developing advanced recycling processes for composite materials used in wind turbine blades. This commitment aligns with the growing global emphasis on sustainable resource management and reducing the environmental footprint of energy production.

- Recycling Innovations RWE is investing in research and development for advanced recycling technologies to recover valuable materials from decommissioned wind turbine blades, aiming for high material recovery rates.

- Circular Supply Chains The group is working to establish circular supply chains, seeking partnerships to create closed-loop systems for materials and components throughout the lifecycle of its energy infrastructure.

- Waste Reduction Targets RWE has set ambitious targets for waste reduction across its operations, with a specific focus on minimizing landfill waste from its renewable energy projects.

- Material Innovation The company is exploring the use of more sustainable and recyclable materials in the design and manufacturing of new renewable energy technologies to support circularity from the outset.

Environmental Impact Assessments for Projects

RWE Group mandates thorough environmental impact assessments for all new projects. This is crucial for adhering to stringent environmental regulations and actively reducing ecological footprints. For instance, in 2024, RWE committed to investing €50 billion in green growth by 2030, with a significant portion dedicated to ensuring sustainable development practices are integrated from the project inception phase. These assessments are foundational to managing impacts related to pollution control and maintaining air quality standards.

These assessments directly inform strategies for pollution control. By evaluating potential emissions and waste streams early on, RWE can implement preventative measures. For example, their 2024 sustainability report highlighted a 15% reduction in CO2 emissions intensity from their power generation portfolio compared to 2023, a testament to proactive environmental management informed by impact assessments.

- Regulatory Compliance: Environmental Impact Assessments (EIAs) are mandatory for all new RWE projects, ensuring adherence to national and international environmental laws.

- Ecological Footprint Reduction: EIAs identify potential environmental risks, enabling RWE to implement measures to minimize harm to biodiversity and natural resources.

- Pollution Control & Air Quality: Assessments specifically evaluate the project's impact on air quality and potential pollution, guiding the adoption of best available techniques for emission reduction.

- Sustainable Investment: RWE's €50 billion green growth investment by 2030 underscores the integration of environmental considerations, stemming from thorough EIAs, into their core business strategy.

RWE Group's environmental strategy is deeply intertwined with climate action, targeting net-zero emissions by 2040 and a significant reduction in emissions intensity by 2030, validated by SBTi. This focus drives substantial investment in renewables like offshore wind and solar, as global decarbonization efforts create both regulatory pressures and growth opportunities. The company also prioritizes biodiversity, aiming for new assets to have a positive net impact, exemplified by initiatives like releasing lobsters at offshore wind farm sites to enhance marine ecosystems.

Sustainable resource management is critical, with RWE planning infrastructure like pipelines to manage water resources at closed opencast mines, addressing historical impacts and ensuring ecological health. Furthermore, RWE is embedding circular economy principles, particularly in decommissioning wind turbine blades, by investing in advanced recycling technologies and aiming for high material recovery rates. This commitment is supported by waste reduction targets and the exploration of more sustainable materials in new renewable energy technologies.

Environmental Impact Assessments are mandatory for all new RWE projects, ensuring regulatory compliance and guiding pollution control strategies. RWE's commitment to green growth, with a €50 billion investment by 2030, highlights the integration of environmental considerations from project inception, leading to tangible improvements like a 15% reduction in CO2 emissions intensity in 2024 compared to the previous year.

| Environmental Factor | RWE's Action/Commitment | Data/Target |

| Climate Change & Emissions | Net-zero emissions target | By 2040 |

| Climate Change & Emissions | Scope 1 & 2 emissions reduction | Over 70% per MWh by 2030 (SBTi validated) |

| Biodiversity | Positive net impact goal for new assets | Ongoing (e.g., lobster releases) |

| Resource Management | Water management at former mining sites | Pipeline construction planned |

| Circular Economy | Recycling of wind turbine blades | Focus on advanced recycling technologies |

| Environmental Impact Assessment | Mandatory for all new projects | Informs pollution control and sustainability |

| Green Investment | Investment in green growth | €50 billion by 2030 |

| CO2 Emissions Intensity | Reduction in power generation | 15% decrease in 2024 vs. 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for RWE Group is informed by a robust blend of data, including recent government policy documents, international energy market reports, and reputable economic indicators. We meticulously gather information on regulatory changes, technological advancements, and socio-economic trends to provide a comprehensive overview.