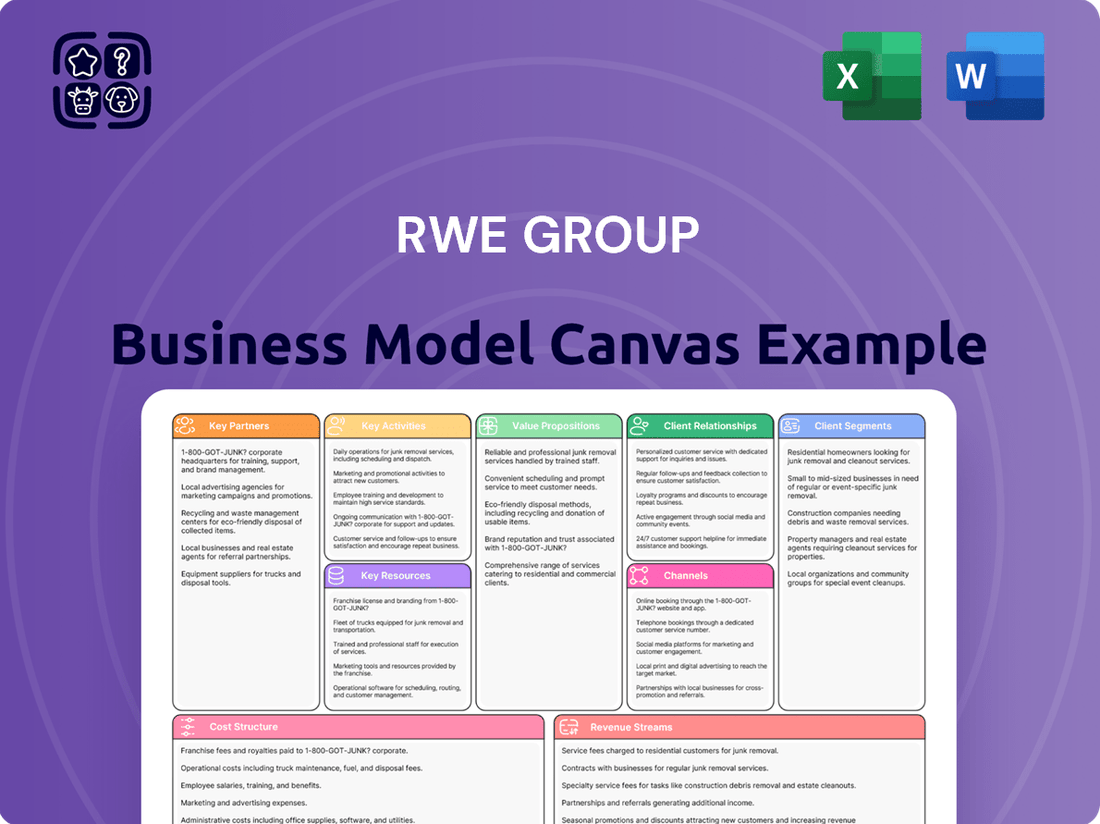

RWE Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RWE Group Bundle

Unlock the full strategic blueprint behind RWE Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

RWE actively seeks strategic alliances with other energy firms and developers to jointly develop and finance significant renewable energy projects. These collaborations span offshore and onshore wind farms, solar power installations, and battery storage solutions, pooling expertise and financial resources.

In 2024, RWE continued to solidify these partnerships, for instance, its joint venture with TotalEnergies for offshore wind development in France is a prime example of leveraging shared capabilities. Such alliances are instrumental in accelerating RWE's ambitious 'Growing Green' strategy and broadening its international presence in the clean energy sector.

RWE actively cultivates partnerships with technology providers and equipment suppliers to bolster its renewable energy portfolio. These collaborations are crucial for incorporating advanced solutions, like Tesla's battery energy storage systems, which RWE is utilizing in its Australian projects. This strategic approach ensures RWE stays at the forefront of technological innovation, thereby enhancing the efficiency and performance of its expanding renewable energy infrastructure.

RWE actively engages in Corporate Power Purchase Agreements (PPAs) with major corporations, notably securing long-term deals with tech leaders like Meta and Microsoft. These partnerships are crucial, offering RWE predictable revenue for its renewable energy generation and enabling these corporate giants to achieve their ambitious sustainability targets.

These PPAs underscore a significant market trend: large industrial and technology consumers are increasingly prioritizing and securing direct access to green energy. For instance, in 2023, RWE announced a substantial PPA with Meta, powering its data centers in Europe with renewable electricity, demonstrating the tangible impact of these collaborations.

Research and Development Collaborations

RWE actively pursues research and development collaborations with leading universities, research institutions, and other industry players. These partnerships are crucial for driving innovation in critical energy transition technologies.

The focus areas for these collaborations include groundbreaking solutions for green hydrogen production, efficient carbon capture and utilization, and the development of advanced battery storage systems. For instance, RWE is involved in numerous EU-funded projects aimed at scaling up hydrogen technologies, with significant investments anticipated in the coming years. In 2024, RWE announced a new partnership with a leading German technical university to accelerate research into next-generation electrolyzer technologies.

A key element of these joint ventures is the robust protection of intellectual property, ensuring that the innovations developed through these partnerships are effectively managed and leveraged by RWE.

Key R&D Collaboration Facets:

- Innovation in Green Technologies: Jointly developing solutions for energy transition challenges.

- Focus Areas: Green hydrogen, CO2 utilization, advanced battery storage.

- Intellectual Property Management: Protecting and leveraging IP from collaborative efforts.

- Knowledge Transfer: Bridging academic research with industrial application.

Industry Associations and Advocacy Groups

RWE actively engages with industry associations and advocacy groups, demonstrating a commitment to shaping a sustainable energy future. By participating in initiatives like Climate Action 100+, RWE contributes to policy discussions and champions the shift towards carbon neutrality. These collaborations are crucial for navigating complex regulatory frameworks and fostering an environment conducive to renewable energy development.

These partnerships are instrumental in driving best practices and advocating for policies that support the growth of clean energy. For instance, RWE's involvement in the European energy sector's dialogue influences the regulatory landscape, impacting investment decisions and project development timelines. In 2023, the renewable energy sector in Europe saw significant growth, with RWE playing a key role in expanding wind and solar capacity.

- Industry Collaboration: RWE joins forces with over 700 global investors through Climate Action 100+ to encourage the world's largest corporate greenhouse gas emitters to take necessary action for a net-zero future.

- Policy Influence: Participation in groups like Eurelectric allows RWE to contribute to the development of European energy policy, advocating for frameworks that support decarbonization.

- Sustainable Practices: These alliances promote the adoption of sustainable practices across the energy sector, ensuring a more responsible approach to resource management and environmental protection.

- Renewable Investment Support: By advocating for supportive policies, RWE helps create a stable and attractive environment for continued investment in renewable energy technologies.

RWE's key partnerships are vital for its renewable energy expansion and innovation. These include joint ventures with other energy firms like TotalEnergies for offshore wind projects and collaborations with technology providers such as Tesla for battery storage. Furthermore, RWE secures long-term Corporate Power Purchase Agreements (PPAs) with major corporations like Meta, ensuring stable revenue and supporting corporate sustainability goals.

In 2024, RWE continued to strengthen these alliances, underscoring their strategic importance in achieving its 'Growing Green' agenda and expanding its global clean energy footprint. These partnerships are essential for pooling expertise, sharing financial burdens, and accessing cutting-edge technologies, thereby accelerating the energy transition.

RWE also actively collaborates with universities and research institutions on green hydrogen and carbon capture technologies, with a new partnership announced in 2024 with a German technical university to advance electrolyzer research.

| Partner Type | Example Partner | Focus Area | 2024 Significance |

|---|---|---|---|

| Energy Firms/Developers | TotalEnergies | Offshore wind development | Joint venture in France |

| Technology Providers | Tesla | Battery energy storage systems | Integration in Australian projects |

| Corporate Offtakers | Meta | Renewable energy supply for data centers | Long-term PPA in Europe |

| Research Institutions | German Technical University | Next-generation electrolyzer technologies | New R&D collaboration announced |

What is included in the product

A comprehensive, pre-written business model tailored to RWE Group's strategy as a leading European energy company, focusing on decarbonization and sustainable energy generation.

Reflects RWE's real-world operations and plans, covering customer segments, channels, and value propositions in full detail for their diverse energy offerings.

The RWE Group Business Model Canvas effectively addresses the pain point of complex energy transition strategies by providing a clear, visual roadmap. It simplifies the multifaceted challenges of decarbonization and digitalization into actionable segments, making strategic planning more manageable.

Activities

RWE's primary business revolves around generating electricity from a broad range of renewable sources. This includes significant investments and operations in onshore and offshore wind farms, solar power installations, and hydropower facilities.

The company is actively growing its renewable energy capacity. In 2024 alone, RWE successfully commissioned roughly 2 gigawatts (GW) of new green power capacity, underscoring its commitment to expansion.

This strategic emphasis on green electricity generation is fundamental to RWE's overarching goal of reaching net-zero emissions. By increasing its renewable output, RWE directly contributes to decarbonization efforts.

RWE's energy trading and optimization is a core activity, managing electricity, gas, commodities, and CO2 certificates globally. This trading division is crucial for connecting RWE's generation capacity with customer demand and market opportunities, effectively managing price volatility and ensuring efficient power plant operations.

In 2023, RWE's Supply & Production segment, which includes trading and optimization, delivered strong results. The Adjusted EBITDA for this segment reached €3.4 billion in 2023, demonstrating its significant contribution to RWE's overall profitability. This highlights the importance of their strategic market positioning and risk management capabilities.

The company's trading activities are essential for optimizing the dispatch of its diverse generation portfolio, including renewables and conventional power plants. By actively participating in energy markets, RWE aims to maximize the value of its assets and secure reliable energy supply for its customers, while also hedging against potential market downturns.

RWE is actively engaged in the global development, planning, and construction of new renewable energy infrastructure. This encompasses significant investments in large-scale wind and solar farms, alongside the creation of advanced battery storage systems and electrolysers crucial for green hydrogen production.

In 2024, RWE maintained a robust pipeline with over 12 gigawatts (GW) of projects actively under construction. This substantial development portfolio underscores the company's commitment to an aggressive growth strategy in the clean energy sector.

Supply of Electricity and Gas to Customers

RWE's core activity involves supplying electricity and gas to a wide array of customers. This includes households, businesses of all sizes, and major industrial players. In 2023, RWE served approximately 15 million residential and business customers across Europe, demonstrating its significant market reach.

To achieve this, RWE utilizes its robust infrastructure and a diverse mix of generation sources. This ensures a consistent and dependable energy flow to meet demand. The company's commitment to a secure energy supply is paramount to its operational success and customer satisfaction.

- Customer Reach: Serves over 15 million residential and business customers across Europe as of 2023.

- Energy Sources: Leverages a diversified generation portfolio, including renewables and conventional power plants, for supply.

- Infrastructure Reliance: Employs extensive transmission and distribution networks to deliver electricity and gas efficiently.

- Revenue Generation: This supply activity is a primary driver of RWE's revenue, contributing significantly to its financial performance.

Decarbonization and Coal Phase-out

RWE is actively pursuing a strategic decarbonization, with a key focus on the responsible phase-out of coal-fired power generation. This commitment is central to their business model, aiming to create a sustainable energy future.

The company demonstrated tangible progress in 2024, achieving a substantial 13% reduction in CO2 emissions from its power production activities. This significant decrease highlights RWE's dedication to climate protection and its efforts to align with the ambitious targets set forth by the Paris Agreement.

- Strategic Commitment: RWE is dedicated to a carbon-neutral energy system, including the responsible phase-out of coal.

- 2024 Emission Reduction: Achieved a 13% reduction in CO2 emissions from power production.

- Climate Protection: This activity directly supports RWE's climate protection goals.

- Paris Agreement Alignment: Demonstrates adherence to the objectives of the Paris Agreement.

RWE's key activities are centered on developing, building, and operating renewable energy infrastructure like wind and solar farms. They are also heavily involved in energy trading and optimization, managing electricity and gas markets to ensure efficient supply and demand matching. Furthermore, RWE actively supplies energy to millions of customers across Europe while simultaneously focusing on decarbonization efforts, including phasing out coal power. These interconnected activities form the backbone of RWE's strategy to become a leader in sustainable energy.

| Key Activity | Description | 2023/2024 Data/Facts |

|---|---|---|

| Renewable Energy Development & Operation | Building and operating wind, solar, and hydro power plants. | Commissioned ~2 GW new green capacity in 2024; over 12 GW projects under construction in 2024. |

| Energy Trading & Optimization | Global trading of electricity, gas, commodities, and CO2 certificates. | Supply & Production segment Adjusted EBITDA was €3.4 billion in 2023. |

| Energy Supply | Providing electricity and gas to residential and business customers. | Served ~15 million customers across Europe in 2023. |

| Decarbonization | Phasing out coal power and reducing emissions. | Achieved a 13% CO2 emission reduction from power production in 2024. |

Full Version Awaits

Business Model Canvas

The RWE Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic template or a sample, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your transaction, you will instantly download this same, fully detailed Business Model Canvas for RWE Group.

Resources

RWE's core strength lies in its diverse and expanding fleet of renewable energy generation assets. This includes a substantial number of onshore and offshore wind farms, solar parks, and hydropower plants, forming the backbone of its green energy strategy.

By the close of 2024, RWE's renewable capacity surpassed 19 gigawatts (GW). This impressive scale is supported by a strong geographical footprint, with significant operations in key markets like the United States, the United Kingdom, and Germany.

These renewable energy assets are not just infrastructure; they are the primary source of RWE's clean energy production. They directly contribute to the company's mission of providing sustainable power and achieving its ambitious growth targets in the green energy sector.

RWE Group's financial capital is a cornerstone of its business model, fueling its aggressive 'Growing Green' strategy. The company has earmarked a significant €35 billion in net investments for the period between 2025 and 2030, demonstrating a clear commitment to expanding its renewable energy portfolio.

To finance this ambitious clean energy expansion, RWE actively leverages a diverse range of financial instruments. This includes the issuance of green bonds, which are specifically designated to fund environmentally friendly projects, and other innovative financing solutions tailored to support its buildout of sustainable infrastructure.

This robust financial capacity is not merely about funding current operations; it is the bedrock upon which RWE's future growth and market leadership in the renewable energy sector are built. It empowers the company to pursue large-scale projects and capitalize on emerging opportunities in the global energy transition.

RWE Group’s foundation rests on its extensive global workforce, numbering over 20,000 individuals. This team brings a wealth of technical and operational know-how across the entire energy sector spectrum.

This deep well of human capital is absolutely essential for RWE. It fuels the successful development, construction, and ongoing operation and maintenance of their sophisticated energy infrastructure projects.

The collective expertise of these employees is a direct driver of innovation within the company. It also underpins RWE's commitment to achieving and maintaining operational excellence in a rapidly evolving industry.

Intellectual Property and Innovation Capabilities

RWE Group leverages a robust portfolio of intellectual property, encompassing patents crucial for microgrids, solar energy advancements, and climate change mitigation strategies. This IP forms a bedrock for its competitive positioning in the energy sector.

The company's commitment to innovation is further demonstrated through its dedicated innovation centers and ongoing research and development initiatives. These efforts are instrumental in creating cutting-edge technologies and refining processes essential for driving the energy transition.

This strategic focus on innovation is not just about creating new products; it's about securing RWE's competitive advantage in a market landscape that is constantly being reshaped by technological progress and evolving energy demands.

- Patented Technologies: RWE holds patents in areas like advanced solar PV, energy storage integration for grid stability, and smart grid management systems.

- R&D Investment: In 2023, RWE significantly increased its investment in research and development, focusing on areas such as green hydrogen production and offshore wind technology optimization.

- Innovation Hubs: RWE operates several global innovation hubs dedicated to exploring and scaling new energy solutions, fostering collaboration with research institutions and startups.

- Digitalization in Energy: A key innovation area for RWE involves digitalizing energy infrastructure, including AI-driven grid management and predictive maintenance for renewable assets.

Global Market Access and Infrastructure

RWE Group leverages its extensive global market access and robust infrastructure to secure its position in diverse energy markets. This includes significant operational footprints across Europe, North America, and key Asia-Pacific countries, enabling a broad spectrum of project development and energy trading activities. In 2023, RWE reported a substantial adjusted EBITDA of €8.4 billion, underscoring the financial strength derived from its global operations and diversified portfolio.

The company’s infrastructure is a critical enabler of its business model, featuring extensive grid connections and numerous operational sites. These assets are fundamental to reliably supplying energy to a wide customer base across various geographies. For instance, RWE's significant presence in renewable energy, with a portfolio of over 10 GW of offshore wind capacity operational or under construction as of the end of 2023, relies heavily on this integrated infrastructure for effective deployment and operation.

- Global Reach: Operates in over 20 countries, providing diversified revenue streams and mitigating regional risks.

- Infrastructure Network: Owns and operates a vast network of power plants, transmission lines, and renewable energy facilities.

- Market Integration: Facilitates efficient energy trading and supply by connecting generation assets to key demand centers.

- Strategic Partnerships: Collaborates with local partners to navigate regulatory environments and optimize market penetration.

RWE’s renewable energy generation assets are its primary physical key resource. This includes a substantial and growing portfolio of onshore and offshore wind farms, solar parks, and hydropower plants. By the end of 2024, RWE's renewable capacity exceeded 19 GW, with a strong presence in markets like the US, UK, and Germany.

The company's financial capital is a vital resource, supporting its aggressive 'Growing Green' strategy. RWE plans net investments of €35 billion between 2025 and 2030 to expand its renewable energy capabilities, financed through instruments like green bonds.

RWE's workforce of over 20,000 employees is a critical human resource, possessing essential technical and operational expertise for developing, constructing, and maintaining its complex energy infrastructure.

Intellectual property, including patents for microgrids, solar advancements, and climate mitigation, forms another key resource, bolstering RWE's competitive edge. The company also invests in innovation centers and R&D, as seen in its increased R&D spending in 2023 focused on green hydrogen and offshore wind optimization.

RWE's extensive global market access and infrastructure network are crucial. This network, encompassing power plants and transmission lines, facilitates efficient energy trading and reliable supply across its operational footprint in over 20 countries. As of late 2023, RWE had over 10 GW of offshore wind capacity operational or under construction.

| Key Resource Category | Specific Examples/Data | Significance |

| Physical Assets | 19 GW+ renewable capacity (end of 2024); Portfolio includes wind, solar, hydro. | Core for clean energy generation and supply. |

| Financial Capital | €35 billion net investment (2025-2030); Green bond issuance. | Enables strategic growth and expansion of renewable portfolio. |

| Human Capital | 20,000+ employees; Expertise in development, construction, O&M. | Drives innovation and operational excellence. |

| Intellectual Property | Patents in microgrids, solar, climate mitigation; R&D investment in 2023. | Secures competitive advantage and drives technological advancement. |

| Market Access & Infrastructure | Operations in 20+ countries; 10 GW+ offshore wind capacity (end of 2023). | Facilitates diversified revenue streams and efficient energy delivery. |

Value Propositions

RWE Group's core value proposition centers on delivering sustainable and clean energy. They achieve this by generating electricity predominantly from renewable sources, such as wind and solar power. This focus directly caters to the increasing global demand for environmentally friendly energy alternatives from both households and businesses.

Their commitment to a cleaner future is underscored by aggressive CO2 emission reduction targets. For instance, RWE aims to be carbon neutral by 2040, a significant undertaking in the energy sector. This strong environmental stance makes them an attractive partner for stakeholders prioritizing sustainability.

RWE is a cornerstone in the global shift towards sustainable energy, offering unparalleled reliability and security. As of early 2024, RWE's significant investments in renewable energy, including wind and solar farms, are crucial for maintaining a stable power supply during this complex transition. Their commitment ensures that decarbonization goals are met without compromising energy availability.

With a robust portfolio encompassing renewables, battery storage, and flexible generation, RWE actively supports grid stability. This integrated approach, evidenced by their substantial operational capacity in offshore wind, for example, makes them a dependable partner for nations and corporations committed to achieving their net-zero targets. Businesses can rely on RWE for consistent energy solutions throughout their decarbonization journey.

RWE is at the forefront of developing innovative energy solutions, including advanced battery storage systems crucial for grid stability and green hydrogen projects that offer a pathway to decarbonizing heavy industry and transport. These offerings directly tackle the intermittency of renewable sources like wind and solar, enabling a more robust integration of clean energy into the grid.

The company's commitment to research and development fuels these cutting-edge propositions. For example, by the end of 2023, RWE had a global pipeline of over 15 GW of battery storage projects, underscoring its significant investment in this critical technology to manage renewable energy fluctuations.

Smart grid technologies are another key component, allowing for more efficient distribution and consumption of electricity. RWE's focus on these areas not only addresses current energy challenges but also positions the company as a leader in the transition towards a sustainable energy future.

Contribution to Climate Targets and Decarbonization

RWE’s unwavering commitment to net-zero emissions by 2040 and its ambitious plan to exit coal by 2030 directly addresses the pressing need for climate action. This strategic direction positions RWE as a key player in achieving global decarbonization targets. For instance, in 2024, RWE continued its substantial investments in renewable energy, aiming to grow its green portfolio significantly.

This dedication to sustainability resonates deeply with stakeholders who prioritize environmental responsibility. By actively expanding its renewable energy capacity, RWE not only reduces its own carbon footprint but also enables its customers to lower theirs. This creates a powerful alignment with the sustainability goals of both corporate clients and individual investors alike.

- Net-Zero by 2040: RWE’s clear target to reach net-zero emissions by 2040 provides a tangible contribution to global climate efforts.

- Coal Phase-Out by 2030: The accelerated exit from coal power generation by 2030 demonstrates a concrete commitment to cleaner energy sources.

- Renewable Energy Investment: Significant capital deployment into wind, solar, and battery storage projects in 2024 underscores the practical implementation of its decarbonization strategy.

- Enabling Customer Sustainability: RWE's transition facilitates its customers' own decarbonization journeys, creating shared value.

Economic and Social Value Creation

RWE's commitment extends beyond simply providing energy. In 2024, the company's substantial investments in renewable energy infrastructure not only drive the energy transition but also foster significant economic growth. These investments translate into tangible benefits for local regions through job creation, both directly within RWE and indirectly through its supply chains and project development. For instance, large-scale offshore wind projects often require substantial local labor for construction and maintenance.

Furthermore, RWE actively contributes to the social fabric of the communities where it operates. This includes direct financial support for local initiatives and ensuring that projects provide long-term economic advantages. A prime example is the property tax revenue generated by RWE's operational assets, which directly funds essential public services like schools and infrastructure in surrounding municipalities. This dual focus on economic stimulation and community well-being underscores RWE's holistic value creation strategy.

The economic and social value RWE creates is multifaceted, benefiting a wide array of stakeholders:

- Economic Stimulus: RWE's capital expenditures, particularly in renewable energy development, inject significant funds into regional economies, supporting local businesses and employment.

- Job Creation: The company's operations and projects generate direct and indirect employment opportunities, contributing to local workforce development.

- Community Investment: RWE's engagement often includes direct financial contributions to community projects and initiatives, enhancing local quality of life.

- Fiscal Contributions: Property taxes and other levies paid by RWE's assets provide crucial revenue streams for local governments, supporting public services.

RWE Group's value proposition is deeply rooted in its role as a reliable provider of sustainable energy solutions. They are committed to a net-zero future, evidenced by their ambition to be carbon neutral by 2040 and their accelerated coal phase-out by 2030. This clear environmental strategy, backed by substantial investments in renewables in 2024, makes them a crucial partner for entities aiming to decarbonize.

The company offers integrated energy solutions, combining renewable generation with battery storage and flexible capacity to ensure grid stability. This comprehensive approach, visible in their extensive offshore wind operations, provides dependable energy supply for nations and businesses pursuing net-zero goals.

RWE actively drives innovation in energy technology, focusing on advanced battery storage and green hydrogen. These developments are vital for managing renewable energy intermittency and decarbonizing hard-to-abate sectors. By the end of 2023, RWE had a pipeline of over 15 GW of battery storage projects, highlighting their commitment to this critical area.

The economic and social impact of RWE's operations is significant. Their investments in renewable energy infrastructure in 2024 not only advance the energy transition but also stimulate local economies through job creation and community support. Property taxes from RWE's assets also contribute vital revenue to local governments, funding essential public services.

| Value Proposition | Description | Key Metric/Data Point | Impact |

|---|---|---|---|

| Sustainable Energy Provider | Delivering clean electricity primarily from renewables. | Aiming for net-zero by 2040. | Supports global climate action and customer sustainability goals. |

| Grid Stability Solutions | Integrating renewables with battery storage and flexible generation. | Over 15 GW battery storage project pipeline (end of 2023). | Ensures reliable energy supply during the energy transition. |

| Energy Innovation | Developing advanced battery storage and green hydrogen. | Significant investments in R&D for clean technologies. | Enables decarbonization of industry and transport. |

| Economic & Social Contribution | Stimulating local economies through investments and community support. | Job creation in renewable energy projects; property tax revenue for local governments. | Fosters regional growth and enhances community well-being. |

Customer Relationships

RWE Group's approach to customer relationships, particularly with large corporate and industrial clients, centers on dedicated corporate account management. These specialized teams act as a direct liaison, ensuring a deep understanding of each client's unique operational demands and sustainability aspirations.

These account managers collaborate closely with customers to design bespoke renewable energy solutions. This often involves structuring long-term Power Purchase Agreements (PPAs) that provide price stability and guarantee supply, crucial for industrial operations. For example, RWE has been actively expanding its PPA portfolio, signing agreements with major companies across various sectors to secure their green energy supply.

This highly personalized engagement model is key to meeting specific energy needs and ambitious sustainability targets. By understanding a client's energy consumption patterns and environmental goals, RWE can offer tailored solutions, whether it's solar, wind, or a combination, contributing to decarbonization efforts. RWE's commitment to these partnerships was underscored in 2024 by significant investments in new renewable projects designed to serve these corporate clients directly.

RWE Group prioritizes forging enduring partnerships with key stakeholders, especially large-scale energy users and co-investors in renewable projects. These collaborations are foundational for the capital-intensive nature of offshore wind and other large renewable ventures, ensuring project viability and long-term success.

Trust and shared objectives in driving the energy transition form the bedrock of these long-term relationships. For instance, RWE's ongoing development of offshore wind farms, like those in the North Sea, often involves joint ventures and agreements with industrial clients seeking stable, green energy sources.

In 2024, RWE continued to expand its portfolio of long-term power purchase agreements (PPAs) with corporate clients, securing predictable revenue streams and solidifying these crucial customer relationships. These agreements are vital for financing and developing projects that contribute significantly to decarbonization goals.

RWE actively cultivates transparent relationships with investors, offering regular financial updates and detailed insights into its strategic direction. This commitment to open communication fosters trust and encourages investment.

The company's investor relations efforts include comprehensive financial reports, accessible via its website, and participation in key industry events. For instance, RWE's 2023 financial results highlighted significant investments in renewable energy, a key strategic pillar.

Furthermore, RWE publishes detailed sustainability reports, aligning with growing investor demand for Environmental, Social, and Governance (ESG) information. These reports, alongside annual general meetings, provide a platform for dialogue and accountability.

By consistently sharing performance data and strategic plans, RWE aims to attract and retain a robust investor base. In 2024, RWE announced plans to invest €15 billion in its green portfolio by 2030, demonstrating its clear commitment to sustainable growth.

Community Engagement and Local Stakeholder Management

RWE actively cultivates strong ties with local communities and stakeholders surrounding its energy infrastructure. This commitment translates into open communication channels designed to address concerns and foster mutual understanding, ultimately paving the way for smoother project development and operation.

The company's approach includes tangible contributions to local economies, such as direct investments and the creation of employment opportunities, thereby enhancing the positive impact of its projects. For instance, RWE's investments in renewable energy projects often prioritize local sourcing and employment, as seen in its offshore wind developments where significant portions of construction and maintenance contracts are awarded to regional businesses.

- Community Dialogue: RWE regularly holds public consultations and information events to keep local residents informed about project progress and to gather feedback.

- Local Investment: In 2023, RWE's renewable energy projects across Europe generated an estimated €2 billion in local economic impact through supply chains and job creation.

- Job Creation: The development and operation of RWE's wind farms, for example, create hundreds of skilled jobs, many of which are filled by local talent.

- Stakeholder Partnerships: Collaborations with local authorities and community groups are established to ensure projects align with local development goals.

Digital Customer Service and Information Platforms

RWE leverages digital customer service and information platforms to enhance engagement and provide accessible data. These platforms are crucial for managing customer interactions efficiently and disseminating important information across various stakeholder groups.

While not always explicitly detailed, RWE likely utilizes digital channels such as dedicated customer portals, mobile applications, and informative websites. These serve as primary touchpoints for inquiries, account management, and accessing real-time energy consumption data.

- Digital Portals and Apps: RWE likely offers online portals and mobile applications for customers to manage their accounts, view bills, track energy usage, and report issues.

- Information Dissemination: Websites and social media channels are used to share updates on services, new offerings, and important industry news.

- Efficiency Gains: Digital platforms streamline customer service, reducing response times and operational costs by automating routine inquiries and tasks.

- Data Access: Customers can gain direct access to their energy consumption data, empowering them to make informed decisions about their usage and costs.

RWE Group nurtures deep, long-term relationships with its corporate clients through dedicated account management, focusing on bespoke renewable energy solutions and long-term Power Purchase Agreements (PPAs). This personalized approach ensures alignment with clients' operational needs and sustainability targets, as evidenced by RWE's continued expansion of its PPA portfolio in 2024 to secure green energy supply for major companies.

| Customer Segment | Relationship Focus | Key Engagement Tools | 2024 Focus/Data Point |

|---|---|---|---|

| Large Corporate & Industrial Clients | Bespoke Solutions, Long-Term Partnerships | Dedicated Account Management, Power Purchase Agreements (PPAs) | Expanded PPA portfolio to secure green energy supply. |

| Investors | Transparency, Strategic Alignment | Regular Financial Updates, Sustainability Reports, Investor Events | Announced €15 billion investment in green portfolio by 2030. |

| Local Communities & Stakeholders | Open Communication, Local Economic Benefit | Public Consultations, Local Investment, Job Creation | €2 billion estimated local economic impact from projects in 2023. |

| General Customer Base | Digital Engagement, Information Access | Customer Portals, Mobile Apps, Informative Websites | Streamlining customer service and data access. |

Channels

RWE primarily leverages direct sales channels and bilateral contracts, particularly for its substantial corporate and industrial client base. This approach is most evident through their engagement in long-term Power Purchase Agreements (PPAs).

These direct relationships are crucial as they enable RWE to offer highly customized energy solutions, tailored to the specific needs of each large client. It also facilitates direct negotiation of contract terms, fostering strong, enduring partnerships.

This direct engagement is a foundational element for RWE, serving as a key channel for securing significant and stable revenue streams. For instance, in 2024, RWE continued to expand its PPA portfolio across Europe, signing numerous agreements with major industrial players for renewable energy supply, underscoring the importance of this channel for consistent income.

RWE actively participates in wholesale energy markets, buying and selling electricity, gas, and other energy commodities through advanced trading platforms. This is a core function for managing their diverse generation assets.

Their trading operations are pivotal in optimizing the dispatch of RWE's power plants and capitalizing on short-term price movements. For instance, in 2023, RWE's wholesale and trading segment reported significant contributions to the group's profitability, reflecting their expertise in navigating volatile market conditions.

These platforms allow RWE to efficiently balance supply and demand, secure fuel for their operations, and monetize excess generation capacity. The company leverages sophisticated risk management tools to mitigate exposure in these dynamic markets.

RWE utilizes extensive national and international electricity and gas transmission and distribution networks as critical channels to move energy from its power plants to customers. These established infrastructures are the physical pathways essential for delivering energy reliably.

While RWE's core business revolves around energy generation and trading, its operational success is fundamentally dependent on secure and efficient access to these transmission and distribution grids. This access is the backbone of its delivery strategy.

In 2023, RWE's gross electricity production reached 232.5 billion kilowatt-hours, highlighting the sheer volume of energy that relies on these grid systems for distribution. The company operates across 11 European countries, underscoring the international reach of the grid infrastructure it accesses.

Investor Relations and Corporate Communication Platforms

RWE Group leverages investor relations websites, annual reports, sustainability reports, and financial presentations as primary channels to engage its financial stakeholders. These platforms are vital for disseminating crucial information regarding the company's financial performance, strategic objectives, and commitment to sustainability. For instance, RWE's 2023 Annual Report detailed a significant increase in adjusted EBITDA to €8.4 billion, underscoring its robust operational performance.

This consistent transparency is fundamental in building trust and attracting ongoing investment. RWE's commitment to clear communication is further evidenced by its active participation in investor conferences and roadshows, facilitating direct dialogue with shareholders and analysts.

Key communication outputs include:

- Investor Relations Website: A central hub for financial news, reports, and presentations.

- Annual Reports: Comprehensive overview of financial results and strategic developments, such as the reported €1.7 billion net profit for 2023.

- Sustainability Reports: Detailing environmental, social, and governance (ESG) performance, a growing focus for many investors.

- Financial Presentations: Providing in-depth analysis of quarterly and annual financial results and outlook.

Partnership Networks and Joint Ventures

RWE Group leverages its extensive partnership networks and joint ventures as crucial channels for both project development and market entry. These collaborations are instrumental in expanding RWE's operational footprint and accessing new geographical regions or technological advancements. For instance, in 2024, RWE announced a significant joint venture with a leading offshore wind developer to build a new wind farm in the North Sea, aiming to significantly boost renewable energy capacity.

By teaming up with other developers, technology providers, and financial institutions, RWE can share risks, pool resources, and gain access to specialized expertise. This strategy allows the company to undertake larger and more complex renewable energy projects that might be beyond its solo capacity. These alliances act as vital conduits for RWE’s growth trajectory, enabling faster market penetration and the efficient execution of ambitious energy transition goals.

- Project Development Acceleration: Joint ventures allow RWE to co-develop large-scale renewable projects, sharing development costs and expertise.

- Market Entry Facilitation: Partnerships provide access to local market knowledge, regulatory understanding, and established networks for new market entries.

- Risk Mitigation: Collaborating with partners helps distribute financial and operational risks associated with major infrastructure projects.

- Technology Advancement: Joint ventures with technology providers enable RWE to integrate cutting-edge solutions and stay at the forefront of the energy transition.

RWE utilizes direct sales and bilateral contracts, especially for its large corporate clients through Power Purchase Agreements (PPAs). These direct relationships allow for customized energy solutions and direct negotiation, fostering strong partnerships and securing stable revenue. In 2024, RWE continued to expand its European PPA portfolio with industrial clients, highlighting the channel's importance for consistent income.

Customer Segments

Large corporate and industrial consumers, especially those in energy-intensive sectors like technology and manufacturing, represent a key customer segment for RWE. These businesses often have substantial energy needs and are increasingly driven by ambitious sustainability goals, seeking to reduce their carbon footprint and meet environmental, social, and governance (ESG) targets. RWE addresses these needs by offering customized renewable energy solutions and long-term Power Purchase Agreements (PPAs), providing price stability and a reliable supply of clean energy.

Notable clients within this segment include major global players such as Meta, Microsoft, and Rivian. For instance, RWE has secured significant PPAs with companies like Meta, contributing to their renewable energy procurement strategies. In 2023, RWE announced it would supply renewable electricity to Microsoft, further underscoring its commitment to serving large tech companies aiming for carbon neutrality. These partnerships highlight the growing demand for large-scale renewable energy projects and the crucial role RWE plays in enabling corporate decarbonization efforts.

The Wholesale Energy Market Participants segment includes other energy utilities, independent traders, and transmission system operators who actively engage in buying and selling electricity, natural gas, and related commodities on large-scale exchanges. RWE interacts with these players for crucial energy trading, balancing services, and optimizing its diverse energy portfolio. In 2024, the European wholesale electricity market, for instance, saw significant price volatility driven by factors like renewable energy generation fluctuations and geopolitical events, underscoring the importance of these participants for market liquidity.

These entities are vital for ensuring the smooth functioning and efficiency of the overall energy system by providing the necessary liquidity and facilitating the allocation of resources. Their participation allows RWE to manage supply and demand imbalances effectively, a critical aspect of operating a large-scale energy generation and trading business. For example, RWE's trading activities in 2024 were heavily influenced by the need to secure supply and manage price risks in an increasingly interconnected European energy landscape.

RWE Group extends its reach to a vast array of residential households and smaller commercial enterprises, supplying them with essential electricity and gas. This direct customer supply, while not the core focus on renewable generation and trading, remains a crucial element in specific markets, ensuring a steady and diversified revenue stream for the company.

In 2024, RWE's supply business continued to be a significant contributor, serving millions of customers across Europe. This segment provides a stable income, balancing the more volatile trading and generation aspects of the business. For instance, RWE's retail operations in Germany alone cater to a substantial portion of the country's households, demonstrating the scale and importance of this customer segment.

Governments and Regulatory Bodies

Governments and regulatory bodies are crucial stakeholders for RWE, influencing the energy landscape through policy and targets. RWE actively supports national and international energy transition goals, aligning its operations with public policy objectives. For instance, RWE committed to phasing out coal power in Germany by 2030, a decade earlier than previously planned, demonstrating its responsiveness to climate policy. In 2023, RWE invested €5.4 billion in its green portfolio, a significant portion of which supports infrastructure development aligned with governmental energy strategies.

Their influence is substantial, shaping RWE's operational framework and investment decisions. Regulatory frameworks dictate market access, environmental standards, and subsidies, directly impacting RWE's business model. For example, the European Union's Green Deal and Fit for 55 package set ambitious emissions reduction targets that RWE actively contributes to achieving through its renewable energy expansion. RWE's consistent reporting on its emissions reduction progress underscores its commitment to meeting these governmental mandates.

- Policy Alignment: RWE's strategy directly supports government energy transition objectives, such as Germany's Renewable Energy Sources Act (EEG).

- Infrastructure Development: RWE's investments in offshore wind farms and battery storage facilities contribute to national energy security and decarbonization goals.

- Regulatory Compliance: Adherence to stringent environmental regulations and emissions standards is fundamental to RWE's operations.

- Stakeholder Engagement: RWE actively engages with governments and regulatory bodies to shape future energy policies and market frameworks.

Institutional and Individual Investors

RWE Group's customer segments include both institutional and individual investors. This encompasses a broad spectrum, from massive pension funds and asset managers to everyday people who invest in the stock market. These investors are essential for RWE to secure the significant capital required to fund its ambitious 'Growing Green' strategy, which focuses on expanding renewable energy sources.

For these investors, RWE is committed to delivering compelling financial returns and maintaining a high level of transparency in its reporting. The company's ability to attract and retain investor confidence directly impacts its financial stability and capacity for growth. For instance, in 2023, RWE's adjusted EBITDA reached €8.3 billion, demonstrating its operational strength and ability to generate value for shareholders.

- Institutional Investors: Large entities like pension funds, insurance companies, and investment banks that manage substantial assets.

- Individual Investors: Retail investors who own RWE shares directly or through mutual funds and ETFs.

- Capital Provision: Both groups provide the necessary financial backing for RWE's capital-intensive investments in green energy infrastructure.

- Confidence and Returns: Investor confidence is directly linked to RWE's performance and its ability to deliver on its strategic objectives, including dividend payouts and share price appreciation.

RWE caters to a diverse customer base, ranging from large industrial consumers seeking renewable energy solutions to residential households needing reliable power. The company also engages with wholesale market participants and relies on both institutional and individual investors for capital.

Key customer segments include major corporations like Meta and Microsoft, who are focused on decarbonization and securing long-term renewable energy. Furthermore, RWE serves millions of residential customers across Europe, providing essential electricity and gas, which offers a stable revenue stream.

| Customer Segment | Key Characteristics | RWE's Offering | 2023/2024 Relevance/Data |

|---|---|---|---|

| Large Corporate & Industrial | High energy needs, sustainability goals | Customized renewable solutions, PPAs | Secured major PPAs with tech firms; 2023 green investments of €5.4 billion. |

| Wholesale Energy Market Participants | Energy utilities, traders, TSOs | Energy trading, balancing services | Market volatility in 2024 highlights need for efficient trading. |

| Residential & Small Commercial | Millions of households and businesses | Electricity and gas supply | Significant retail operations in Germany; stable income contributor. |

| Governments & Regulatory Bodies | Policy makers, driving energy transition | Alignment with energy transition goals | Early coal phase-out in Germany; investments support national strategies. |

| Investors (Institutional & Individual) | Providers of capital | Financial returns, transparency | 2023 adjusted EBITDA of €8.3 billion; crucial for 'Growing Green' strategy. |

Cost Structure

A major part of RWE's expenses comes from the massive investments needed to build and buy new renewable energy projects. This means spending billions of euros each year on things like offshore and onshore wind farms, solar power facilities, and battery storage solutions.

For example, RWE's capital expenditure in 2023 reached €10.7 billion, with a substantial portion directed towards expanding its renewables portfolio. This significant outlay is a key driver for RWE's long-term growth strategy.

These substantial upfront costs are essential for RWE to secure its position in the rapidly evolving energy market and to meet increasing global demand for clean energy sources.

Operations and Maintenance (O&M) costs are a significant expenditure for RWE Group, covering the upkeep of its diverse power generation assets. These ongoing expenses are crucial for ensuring the reliable and efficient operation of both conventional and renewable energy facilities.

These costs encompass routine servicing, repairs, and the general upkeep necessary to keep RWE's extensive portfolio running smoothly. For instance, maintaining wind turbines and solar farms requires specialized labor and replacement parts, contributing to these operational expenses.

In 2024, RWE's O&M expenses are influenced by various factors, including the age of its assets and the specific maintenance needs of different technologies. For example, older fossil fuel plants may require more intensive maintenance compared to newer renewable installations, impacting the overall cost structure.

Fluctuations in weather patterns can also affect O&M costs. Extreme weather events might necessitate urgent repairs to renewable energy infrastructure, leading to unpredictable spikes in maintenance spending. For 2024, RWE anticipates O&M costs to remain a key focus for efficiency improvements.

RWE Group's cost structure heavily features expenses tied to energy procurement and trading. These costs encompass the purchasing of electricity, natural gas, and other energy commodities essential for both their supply operations and active trading strategies. For instance, in 2024, the company's significant investments in renewable energy sources and the associated supply chain continue to drive these procurement expenses.

The price volatility inherent in global commodity markets directly impacts these procurement costs. Fluctuations in natural gas prices, for example, can substantially alter the expense of securing supply to meet customer demand or to capitalize on trading opportunities. RWE's financial reports for 2024 would detail how these market dynamics influenced their overall energy purchasing expenditures.

Research and Development (R&D) Expenses

RWE's commitment to innovation is reflected in its significant investment in Research and Development (R&D). The company prioritizes developing cutting-edge energy technologies, with a particular focus on areas like green hydrogen production and advanced energy storage solutions. These R&D expenditures are absolutely vital for RWE to maintain its competitive edge in the rapidly evolving energy sector and to successfully achieve its ambitious long-term decarbonization targets.

These R&D costs encompass a range of activities, including the funding of pilot projects to test new technologies and the necessary expenses associated with protecting intellectual property. For instance, in 2023, RWE reported capital expenditures of €3.6 billion, a substantial portion of which is allocated to future-oriented investments, including R&D initiatives aimed at securing its position in the energy transition. The company's strategic direction clearly indicates a sustained focus on R&D as a cornerstone of its business model.

- Investment in Green Hydrogen: RWE is actively researching and developing efficient methods for green hydrogen production, a key element in decarbonizing industries.

- Advanced Storage Solutions: The company is investing in the development of innovative battery storage and other advanced solutions to stabilize renewable energy grids.

- Pilot Projects: Significant funding is directed towards pilot projects to test and scale up new energy technologies in real-world scenarios.

- Intellectual Property: Costs are incurred for patents and other intellectual property protection to safeguard RWE's technological advancements.

Personnel and Administrative Costs

As a vast multinational enterprise, RWE's personnel and administrative costs represent a significant portion of its overall expenditure. With a workforce exceeding 20,000 individuals globally, substantial investments are made in salaries, comprehensive benefits packages, and continuous employee development programs. These human capital investments are crucial for maintaining operational excellence and driving innovation across its diverse energy portfolio.

Beyond personnel, administrative expenses are considerable, encompassing the upkeep of a robust IT infrastructure, essential for managing complex global operations, and significant outlays for ensuring strict adherence to various regulatory frameworks. These overheads, while not directly tied to energy production, are foundational for RWE's ability to function effectively and responsibly on a worldwide scale.

For instance, in 2023, RWE reported personnel expenses amounting to approximately €3.2 billion. This figure underscores the significant investment in its workforce.

- Global Workforce: RWE employs over 20,000 people worldwide, necessitating substantial investment in salaries and benefits.

- Employee Development: Significant resources are allocated to training and development to ensure a skilled and adaptable workforce.

- Administrative Overhead: Costs include IT infrastructure, corporate functions, and essential regulatory compliance activities.

- 2023 Personnel Costs: RWE's personnel expenses in 2023 were around €3.2 billion, reflecting the scale of its human capital investment.

RWE's cost structure is dominated by capital expenditures for renewable energy projects, amounting to €10.7 billion in 2023 for expansion. Operations and Maintenance (O&M) are ongoing, with 2024 costs influenced by asset age and weather, and personnel costs were approximately €3.2 billion in 2023 for its global workforce.

| Cost Category | 2023/2024 Impact | Key Components |

|---|---|---|

| Capital Expenditures (Renewables) | €10.7 billion (2023 CAPEX) | Offshore wind, onshore wind, solar, battery storage development |

| Operations & Maintenance (O&M) | Ongoing, influenced by asset age & weather | Servicing, repairs, upkeep of diverse energy assets |

| Energy Procurement & Trading | Driven by market volatility | Purchasing electricity, natural gas, other commodities |

| Research & Development (R&D) | Significant investment for future tech | Green hydrogen, energy storage, pilot projects |

| Personnel & Administrative Costs | €3.2 billion (2023 Personnel Costs) | Salaries, benefits, employee development, IT, regulatory compliance |

Revenue Streams

RWE's core revenue generation stems from selling electricity produced by its extensive renewable energy infrastructure. This includes power from wind farms, solar installations, and hydroelectric facilities.

These sales are channeled through various mechanisms, notably long-term Power Purchase Agreements (PPAs) that offer stable, predictable income, as well as direct sales on the open wholesale electricity markets.

In 2024, RWE achieved a significant milestone, with its renewable electricity production hitting a record high of nearly 50 terawatt-hours (TWh), directly boosting its sales revenue.

This increased generation from green sources is a key driver of profitability and market position for the company.

RWE actively participates in energy trading, buying and selling electricity, natural gas, and CO2 emission certificates. This dynamic segment capitalizes on market volatility and sophisticated optimization techniques to achieve profitability. In 2023, RWE’s trading segment demonstrated robust performance, contributing significantly to the group's overall financial results, though specific figures for this segment are often integrated within broader financial reporting.

RWE generates revenue from its flexible generation assets, including gas-fired power plants and battery storage. These assets play a crucial role in grid stability and meeting peak electricity demand. For instance, in 2024, RWE's flexible generation portfolio is designed to earn income through capacity markets, where it's compensated for being available to supply power, as well as through providing essential balancing services to maintain grid reliability.

Short-term optimization of power plant dispatch also contributes to revenue. This involves strategically deciding when to run its flexible assets to capitalize on favorable market prices. Battery storage solutions represent a particularly dynamic and expanding revenue stream. In 2023, RWE announced significant investments in battery storage projects, highlighting its commitment to this growing sector and its potential for future revenue generation.

Long-term Power Purchase Agreements (PPAs)

Long-term Power Purchase Agreements (PPAs) are crucial for RWE, offering stable and predictable income from its renewable energy assets. These agreements, typically with large corporate and industrial clients, lock in electricity prices for extended periods, shielding RWE from the unpredictable swings in wholesale energy markets. This financial certainty is vital for securing investment in new renewable energy developments.

These PPAs are increasingly instrumental in financing RWE's ambitious growth plans in renewables. For instance, in 2023, RWE secured a significant number of new PPAs, contributing to its goal of growing its renewable portfolio. The company continues to actively pursue such long-term contracts as a core element of its business strategy to ensure consistent revenue generation.

- Revenue Stability: PPAs provide a reliable revenue stream by fixing electricity prices, mitigating market volatility for RWE's renewable projects.

- Financing Mechanism: These long-term contracts are essential for attracting the significant capital required to fund new renewable energy installations.

- Customer Base: RWE engages with a diverse range of corporate and industrial customers seeking to secure their energy supply and meet sustainability targets through PPAs.

- Market Trend: The demand for corporate PPAs has been steadily rising, making them a key channel for RWE to monetize its renewable energy generation.

Dividends from Investments and Share Buybacks

RWE aims to deliver consistent shareholder returns through dividends, with a strategic objective to grow these payouts annually. This commitment is a cornerstone of their investor relations strategy, signaling financial health and growth potential.

Share buyback programs are another key mechanism RWE utilizes to enhance shareholder value. By repurchasing its own shares, the company can increase earnings per share and signal confidence in its future prospects.

For the fiscal year 2023, RWE reported a significant increase in its dividend payout, proposing €1.00 per share. This reflects the company's strong financial performance and its dedication to rewarding its investors.

These financial strategies are vital for attracting and retaining capital, allowing RWE to fund its ongoing investments in renewable energy and infrastructure development.

- Dividend Growth: RWE's stated goal is to increase dividends annually, providing a predictable income stream for shareholders.

- Share Buybacks: The company actively uses share buybacks to boost shareholder value and demonstrate financial strength.

- Investor Relations: These practices are fundamental to maintaining positive relationships with investors and attracting new capital.

- 2023 Performance: RWE proposed a dividend of €1.00 per share for 2023, underscoring its commitment to shareholder returns.

RWE's revenue streams are diverse, primarily driven by the sale of electricity generated from its substantial renewable energy portfolio, which includes wind, solar, and hydro assets. In 2024, RWE's renewable electricity generation reached a new peak, nearing 50 TWh, directly translating into increased sales revenue.

Beyond direct electricity sales, RWE leverages its flexible generation assets, like gas plants and battery storage, to earn income through capacity markets and grid balancing services. Furthermore, the company actively engages in energy trading, capitalizing on market dynamics for electricity, natural gas, and CO2 certificates, a segment that showed strong performance in 2023.

| Revenue Stream | Description | 2023/2024 Data Highlight |

| Renewable Electricity Sales | Selling power from wind, solar, hydro | Nearly 50 TWh generated in 2024 |

| Flexible Generation & Trading | Capacity markets, grid balancing, energy trading | Trading segment contributed significantly in 2023 |

| Power Purchase Agreements (PPAs) | Long-term contracts for stable revenue | Secured numerous new PPAs in 2023 |

| Shareholder Returns | Dividends and share buybacks | Proposed €1.00 dividend per share for 2023 |

Business Model Canvas Data Sources

The RWE Group Business Model Canvas is informed by a robust blend of internal financial reports, operational performance data, and extensive market research. This approach ensures that each component of the canvas is grounded in empirical evidence and reflects current business realities.