RWE Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RWE Group Bundle

Curious about RWE Group's strategic positioning? This glimpse into their BCG Matrix reveals where their energy ventures might be thriving as Stars, generating consistent revenue as Cash Cows, lagging as Dogs, or emerging as exciting Question Marks. Understand the nuances of their portfolio to anticipate future growth and identify areas for optimization.

Ready to move beyond speculation? Purchase the full RWE Group BCG Matrix report to unlock detailed quadrant placements, data-driven assessments of each business unit's market share and growth potential, and actionable strategic recommendations. Gain the clarity needed to make informed investment decisions and steer RWE Group towards sustained success.

Stars

RWE is a major player in offshore wind, a rapidly expanding industry with substantial investment potential. The company is actively growing its offshore wind portfolio, with many projects currently in development and construction, alongside strategic alliances designed to boost its capacity and market reach.

This offshore wind business is a cornerstone of RWE's 'Growing Green' strategy. While it demands significant capital expenditure, the sector is expected to deliver strong future returns as these projects become operational. For instance, RWE's global offshore wind pipeline stands at over 10 GW, with a significant portion expected to reach financial close in the coming years.

RWE is making significant strides in expanding its onshore wind energy capabilities, especially in the United States. As of early 2024, the company has already exceeded 10 gigawatts (GW) of installed onshore wind capacity in the US, a testament to its aggressive development strategy.

This substantial installed base is a key driver of RWE's financial performance, with the onshore wind segment contributing positively to the company's earnings. The strong growth trajectory in this market, coupled with RWE's increasing portfolio, solidifies its position as a leader.

RWE's commitment to building new onshore wind farms and securing long-term power purchase agreements (PPAs) further strengthens its competitive edge. These strategic moves are crucial for capitalizing on the high-growth potential within the onshore wind sector, ensuring continued revenue streams and market influence.

Utility-scale solar development is a crucial high-growth sector for RWE, mirroring their established strength in wind energy. The company is actively bringing new solar farms online, particularly within the United States, bolstering its renewable energy portfolio. This strategic focus taps into the booming global solar market, allowing RWE to secure substantial market share.

Battery Energy Storage Systems (BESS)

RWE is significantly expanding its Battery Energy Storage Systems (BESS) portfolio, viewing it as a cornerstone for grid modernization and renewable energy adoption. This strategic focus is evident in their substantial investments and ambitious growth targets. By 2030, RWE aims to deploy 6 GW of battery storage capacity globally, a clear indicator of their commitment to this high-potential sector. These systems are crucial for balancing the grid, especially as intermittent sources like solar and wind power become more prevalent.

The company's BESS projects are actively progressing in key markets. For instance, RWE has multiple large-scale battery storage facilities under construction in regions with high electricity demand, such as Texas, where grid reliability is paramount. This expansion not only addresses immediate energy needs but also positions RWE to capitalize on the growing demand for flexible energy solutions. By enhancing the value of renewable energy generation, BESS plays a vital role in creating a more sustainable and resilient energy future.

- RWE's Global BESS Target: 6 GW by 2030.

- Key Investment Area: Grid stability and integration of renewable energy.

- Growth Driver: Enhancing the value of intermittent renewable generation.

- Active Development: Projects underway in high-demand regions like Texas.

Global Renewable Project Pipeline

RWE is strategically positioned with a substantial global pipeline, featuring nearly 150 renewable generation projects currently under construction. This impressive portfolio represents a significant 12.5 GW of new capacity, underscoring RWE's commitment to leading the energy transition and its robust market standing.

The sheer scale of this investment, spread across diverse green technologies, solidifies RWE's role as a major player in the evolving energy landscape. These projects are meticulously managed to deliver strong internal rates of return, a key characteristic that places them firmly in the 'Stars' category within the BCG matrix.

- Global Renewable Project Pipeline: Nearly 150 projects underway worldwide.

- Capacity Under Construction: 12.5 GW of new renewable generation.

- Strategic Importance: Reinforces leadership in the energy transition.

- Financial Outlook: Expected to yield robust internal rates of return.

RWE’s extensive global pipeline of nearly 150 renewable projects under construction, totaling 12.5 GW of new capacity, firmly places these ventures in the Stars category of the BCG matrix. These projects, spanning various green technologies, are strategically vital for RWE's energy transition leadership and are meticulously managed to generate strong internal rates of return, indicating high growth potential and market share.

| Category | Business Area | Key Data Point | Growth Outlook | Market Share |

| Stars | Offshore Wind | 10+ GW Pipeline | High | Leading |

| Stars | Onshore Wind (US) | 10+ GW Installed Capacity (Early 2024) | Strong | Significant |

| Stars | Solar Development | Expanding Portfolio | Very High | Growing |

| Stars | Battery Storage (BESS) | 6 GW Target by 2030 | High | Increasing |

| Stars | Projects Under Construction | 12.5 GW Capacity | High | Dominant |

What is included in the product

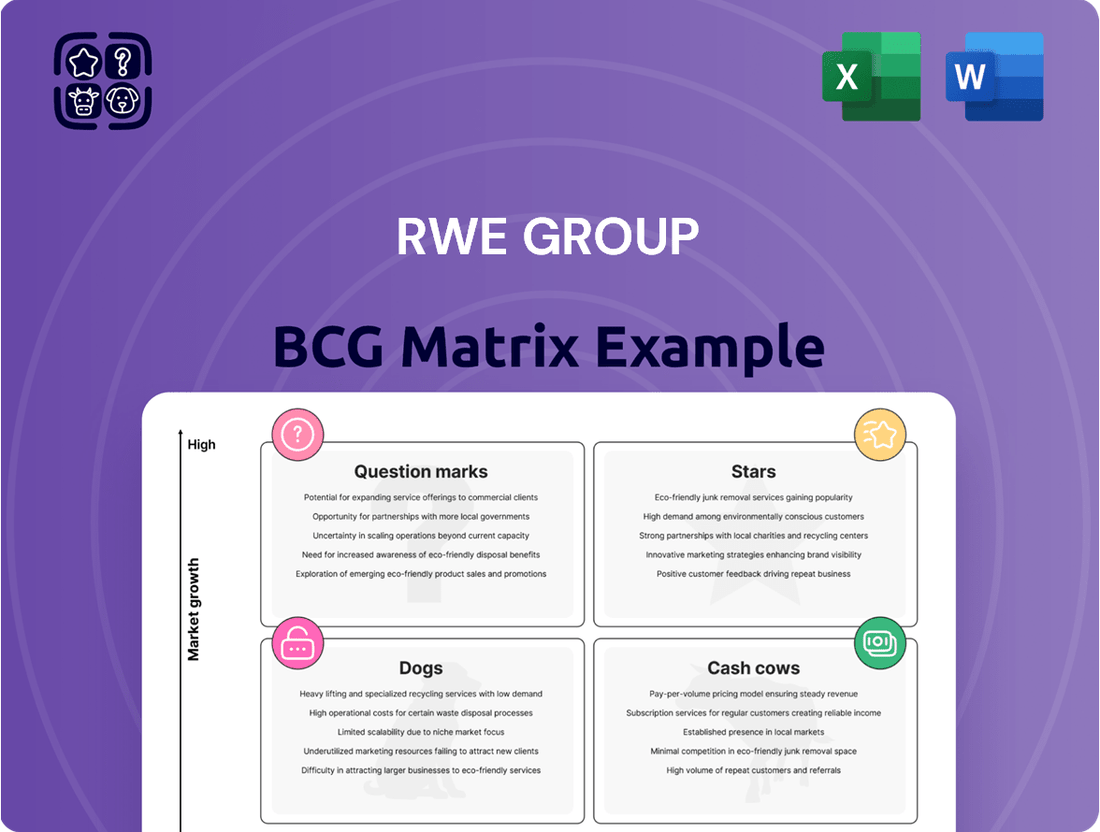

This overview analyzes RWE Group's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment within each BCG Matrix quadrant.

RWE Group BCG Matrix provides a clear, visual pain point reliever by offering a one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

RWE's established offshore wind farms are the epitome of Cash Cows within the BCG framework. These operational assets are generating substantial and consistent cash flow, a direct result of their mature stage and secure revenue streams, often backed by long-term power purchase agreements.

For instance, RWE's portfolio includes significant operational capacity, such as the Rampion offshore wind farm in the UK, which has been reliably contributing to earnings since its commissioning. These farms, while not exhibiting rapid growth in new installations, benefit from high market share in their respective operational areas, ensuring their status as profit engines.

The capital expenditure required for these existing farms is primarily for maintenance and optimization, rather than new development, allowing for a significant portion of their revenue to translate directly into free cash flow. This financial robustness allows RWE to fund investments in other areas of its business.

As of early 2024, RWE continues to operate a substantial offshore wind generation capacity across Europe, with these established sites being the bedrock of its renewable energy earnings. The predictable nature of their cash generation makes them invaluable assets for the company.

Established onshore wind farms within RWE Group act as significant cash cows, much like their offshore counterparts. These mature assets, primarily located in well-developed markets, consistently generate substantial and reliable cash flows. In 2023, RWE's onshore wind portfolio demonstrated robust performance, contributing significantly to the company's adjusted EBITDA, which reached €8.3 billion for the full year.

These established onshore wind facilities have secured a competitive advantage through years of operation and optimization. Their stable and predictable earnings allow RWE to effectively 'milk' these assets, channeling the generated capital towards strategic investments in higher-growth segments of the energy market. This financial flexibility is crucial for funding RWE's ambitious expansion plans in renewables and new technologies.

RWE's established solar parks, especially those with long-term power purchase agreements (PPAs), represent significant cash cows for the group. These operational utility-scale assets provide a stable and predictable revenue stream, crucial for RWE's financial stability.

The operational expenditure for these mature solar installations is notably low relative to the substantial energy output they generate. This efficiency directly translates into strong, consistent profitability, making them reliable income generators.

As of the end of 2023, RWE's global solar capacity continued to grow, with its established parks contributing significantly to its overall renewable energy portfolio. For instance, RWE Renewables reported substantial operational capacity in solar, underpinning its cash cow status.

The predictable cash flow from these solar cash cows is instrumental in funding RWE's ambitious investments in emerging, high-growth areas within the renewable energy sector, such as offshore wind and green hydrogen projects, thereby fueling future expansion.

Energy Trading Operations

RWE's energy trading operations represent a classic cash cow within the RWE Group's BCG matrix. This segment has been a consistent profit generator, though recent exceptional earnings are anticipated to moderate. The company's deep-seated market presence and extensive trading expertise ensure a steady and reliable cash flow stream.

This mature business effectively navigates market volatility and maximizes the value derived from RWE's diverse generation assets. For instance, RWE reported adjusted EBITDA of €1.8 billion for its Supply & Trading segment in 2023, highlighting its substantial contribution to the group's overall financial performance.

- Mature Segment: Energy trading benefits from RWE's established infrastructure and deep market knowledge.

- Robust Cash Flow: Historically a significant profit driver, providing stable financial resources.

- Risk Management: Efficiently optimizes RWE's generation portfolio value by managing market fluctuations.

- Financial Contribution: The Supply & Trading segment achieved €1.8 billion in adjusted EBITDA in 2023.

Flexible Generation Assets

RWE's flexible generation assets, predominantly efficient gas-fired power plants, are vital for grid stability, particularly in managing the intermittency of renewables. These assets are a cornerstone of RWE's portfolio, ensuring reliable power supply.

While these assets are not positioned for rapid expansion, they are significant contributors to RWE's financial performance. In 2023, RWE's Conventional Power Plants segment, which includes these flexible assets, reported adjusted EBITDA of €1.9 billion. This revenue stream, though normalizing, provides crucial financial underpinning and operational adaptability for the broader group.

- Significant Revenue Contribution: The flexible generation assets, primarily gas-fired plants, generated substantial adjusted EBITDA, contributing €1.9 billion to RWE's Conventional Power Plants segment in 2023.

- Grid Stability Role: These assets are essential for balancing the grid, especially as renewable energy sources like wind and solar become more prevalent.

- Operational Flexibility: They offer RWE the ability to ramp generation up or down quickly, adapting to fluctuating energy demand and supply.

- Mature but Stable Income: While not a growth engine, these assets provide a consistent and reliable income stream, supporting RWE's overall financial health and investment capacity in growth areas.

RWE's established solar parks, particularly those with long-term power purchase agreements, are key cash cows. These operational assets deliver stable and predictable revenue streams essential for RWE's financial stability.

The low operational expenditure relative to their substantial energy output translates directly into strong, consistent profitability. As of the end of 2023, RWE's global solar capacity continued to grow, with these established parks underpinning its cash cow status and providing predictable cash flow to fund investments in growth areas like green hydrogen.

| Asset Type | BCG Category | Key Financial Characteristic | 2023 Data Point | Strategic Role |

| Established Solar Parks | Cash Cow | Stable, predictable revenue from PPAs | Contributed significantly to overall renewable energy portfolio | Funds investment in high-growth segments |

Full Transparency, Always

RWE Group BCG Matrix

The RWE Group BCG Matrix preview you are currently viewing is the complete and final document you will receive upon purchase. This means no watermarks or demo content will obscure the strategic insights; you'll get the fully formatted, analysis-ready report designed for immediate application in your business planning. The preview accurately represents the professional quality and detail of the RWE Group BCG Matrix you'll download, ensuring no surprises and full readiness for your strategic decision-making. What you see here is the exact RWE Group BCG Matrix file you’ll get once your purchase is complete, immediately available for your use without any further modifications needed. This is the authentic RWE Group BCG Matrix document, ready for your business strategy, offering a clear and actionable framework for evaluating RWE's portfolio.

Dogs

RWE is strategically phasing out its lignite and coal-fired power generation, with a target for decommissioning units by 2030. This business segment operates in a declining market characterized by low growth prospects and a shrinking market share due to global decarbonization initiatives.

These legacy assets are increasingly viewed as cash traps. Despite some units potentially operating for a transitional period, they are prime candidates for divestiture or eventual shutdown as RWE pivots towards renewable energy sources.

RWE has officially ceased its briquette production operations. This move underscores the company's strategic shift away from fossil fuel-based activities, particularly those in low-growth markets.

The discontinuation of briquette production firmly places this segment within the Dogs quadrant of the BCG matrix. This classification is due to its status as a non-core business with no significant future growth potential within RWE's evolving green energy strategy.

By exiting briquette production, RWE is not only divesting from a declining sector but also freeing up valuable resources. This strategic decision also contributes to the company's broader objective of reducing its overall carbon footprint.

Older, inefficient conventional power plants within RWE's portfolio, excluding strategic lignite assets or those earmarked for hydrogen conversion, are likely positioned as Dogs in the BCG matrix. These facilities are grappling with mounting regulatory hurdles and escalating operational expenses. In 2024, the European Union continued to strengthen emissions standards, making it more costly to operate older, high-emission plants.

The profitability of these aging power stations is steadily declining as the energy market pivots decisively towards renewable sources like wind and solar. RWE, like many utilities, is actively divesting or phasing out such assets to focus on cleaner technologies. Data from 2023 indicated a significant drop in the utilization rates for conventional thermal power plants across Europe, a trend expected to persist.

Divested Non-core Assets

RWE’s strategic divestment of non-core assets, such as its stake in Amprion, aligns with its focus on renewable energy growth. These divested operations, while potentially profitable, were in areas with lower growth prospects and less strategic importance for RWE. This action mirrors the divestiture of a 'Dog' in portfolio management, where resources are reallocated to more promising ventures.

The sale of RWE’s stake in Amprion, a transmission system operator, exemplifies this strategy. While Amprion is a vital energy infrastructure company, its business model is distinct from RWE's core focus on renewable power generation and integrated energy solutions.

- Divestment Rationale: RWE seeks to concentrate capital and management attention on its core renewable energy portfolio, including wind and solar power.

- Amprion’s Role: Amprion operates electricity transmission grids in Germany, a critical but separate segment from RWE’s generation and retail businesses.

- Financial Impact: While specific sale figures fluctuate, such divestitures aim to strengthen the balance sheet and fund investments in high-growth renewable projects. In 2024, RWE continued to prioritize investments in renewables, signaling a clear strategic direction.

Small-scale, Remote Legacy Assets

Small-scale, remote legacy assets, particularly in the conventional energy sector, often fall into the Dogs category of the RWE Group BCG Matrix. These are assets that demand significant operational and maintenance expenditure relative to their minimal energy output. For instance, an aging, small-scale hydroelectric dam in a remote region might require extensive repairs to its turbine and dam structure, while only contributing a fraction of the power generated by newer, larger facilities. This disproportionate cost burden, coupled with their limited strategic value, makes them prime candidates for divestment or phased retirement.

The financial implications of retaining such assets can be substantial. Consider that in 2024, the average cost of decommissioning a small conventional power plant can range from tens to hundreds of millions of dollars, depending on its size and environmental remediation needs. For RWE, holding onto these underperforming legacy assets means tying up capital that could be reinvested in more promising renewable energy projects, which are crucial for the company's transition strategy.

- Limited Output: These assets contribute minimally to the overall energy generation portfolio.

- High Maintenance Costs: Geographically remote locations and age often necessitate disproportionately high upkeep expenses.

- Strategic Divestment: Their low market share and profitability make them prime candidates for sale or decommissioning.

- Capital Reallocation: Selling these assets frees up capital for investment in higher-growth, more sustainable energy sources.

RWE's legacy fossil fuel assets, such as older lignite and coal plants, are clearly categorized as Dogs in the BCG matrix due to their declining market share and low growth prospects. These are assets facing closure or divestment as RWE aggressively pursues renewable energy.

The discontinuation of briquette production and the strategic divestment of stakes in businesses like Amprion highlight RWE's commitment to shedding low-growth, non-core segments. These moves are essential for reallocating capital to its expanding renewable energy portfolio.

Aging conventional power plants, especially those with high operational and regulatory costs, are increasingly becoming cash traps. In 2024, stricter EU emissions standards further pressured these facilities, making their continued operation economically challenging.

Small-scale, remote legacy assets in conventional energy also fall into the Dogs category. Their high maintenance costs relative to minimal output and limited strategic value make them prime candidates for divestiture or decommissioning to free up capital for renewable investments.

| Segment | BCG Category | Market Growth | Market Share | RWE Strategy |

| Lignite/Coal Power Generation | Dog | Declining | Low | Phased Decommissioning/Divestment |

| Briquette Production | Dog | Negligible | Minimal | Discontinued Operations |

| Certain Conventional Plants (Non-Hydrogen) | Dog | Declining | Low | Phased Retirement/Divestment |

| Small, Remote Legacy Assets (Conventional) | Dog | Low | Very Low | Divestment/Decommissioning |

Question Marks

RWE's green hydrogen production projects, such as those in Lingen, Eemshaven, and Rostock, represent significant investments in a sector poised for substantial growth but currently characterized by low market penetration and high initial capital needs.

These ventures are still in their nascent stages, with RWE actively pursuing permits and securing off-take agreements, positioning them as question marks within the BCG matrix. The ultimate market success and RWE's future market share in this burgeoning field remain uncertain, reflecting the inherent risks and potential rewards.

RWE is strategically positioning itself in the emerging market for hydrogen-ready gas power plants, recognizing their potential as a key component of future flexible and decarbonized energy systems. This forward-looking investment aligns with RWE's broader decarbonization strategy, aiming to secure a strong position in a sector poised for significant growth as the hydrogen economy develops.

While the current market share for dedicated hydrogen-ready plants is nascent, RWE's proactive investment is designed to capture a substantial portion of this high-growth potential. By investing now, RWE aims to establish a leading presence as hydrogen infrastructure and adoption accelerate, anticipating a substantial shift in the energy generation landscape.

For instance, RWE announced in 2024 a significant investment in building new gas-fired power plants designed to be hydrogen-ready, signaling a commitment to this technology's future. These facilities are crucial for providing grid stability and backup power as renewable energy sources become more prevalent, and are designed to transition to hydrogen fuel as it becomes commercially viable.

Early-stage floating offshore wind projects are RWE’s Question Marks. While fixed-bottom offshore wind is a Star for RWE, floating technology is still developing in the high-growth offshore wind market. RWE is investing in these nascent projects to explore their potential and commercial viability, recognizing they require substantial research and development to scale up.

Advanced Grid Services & Digitalization Initiatives

As the energy landscape shifts towards decentralization and renewables, advanced grid services, smart grid technologies, and digitalization are becoming critical growth sectors for utility companies. RWE is actively engaging in these areas to enhance its operational efficiency and portfolio optimization.

While RWE's overall presence in the energy market is substantial, its market share in these specialized, emerging digital and grid service segments may currently be developing. This suggests a strategic focus on investment and innovation to build a stronger foothold.

- High-Growth Potential: The global smart grid market is projected to reach over $100 billion by 2027, indicating significant expansion opportunities.

- RWE's Digitalization Efforts: RWE is investing in digital platforms to manage distributed energy resources and improve grid stability, aiming to leverage data analytics for better asset performance.

- Strategic Investments: The company is likely to pursue partnerships or acquisitions to accelerate its capabilities in areas like demand-response management and virtual power plants.

- Market Positioning: RWE's position in these niche, technology-driven services is still evolving, requiring focused strategies to capture market share against established tech providers and agile startups.

Strategic Investments in Emerging Renewable Technologies

RWE's strategic investments in emerging renewable technologies align with its goal of shaping the green energy world. These ventures, such as advanced geothermal or green hydrogen production, represent RWE's "Question Marks" in the BCG matrix. While they currently have a low market share, their significant long-term growth potential necessitates substantial, strategic capital allocation to foster development and assess their future viability.

For instance, RWE has been actively involved in pilot projects for green hydrogen, aiming to decarbonize industrial processes. In 2024, RWE announced plans to expand its hydrogen portfolio, signaling a commitment to nurturing these nascent technologies. The company understands that these early-stage investments, though costly and uncertain, are crucial for building a diversified and resilient renewable energy business for the future.

- Investment Focus: RWE is exploring technologies like advanced geothermal, tidal energy, and next-generation solar PV beyond its established wind and solar farms.

- Capital Allocation: Significant R&D and pilot project funding is required to overcome technical hurdles and prove commercial viability for these emerging areas.

- Market Potential: While current market share is negligible, these technologies hold the promise of substantial future growth as decarbonization efforts accelerate globally.

- Strategic Importance: Identifying and nurturing these "Question Marks" is vital for RWE to maintain its leadership position and adapt to evolving energy landscapes.

RWE's investments in emerging green hydrogen production and hydrogen-ready power plants are prime examples of Question Marks in the BCG matrix. These initiatives, while demonstrating significant growth potential, currently hold a low market share due to their early stage of development and high capital requirements. RWE is actively pursuing these ventures to establish a future market leadership position.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.