Roku Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Roku Bundle

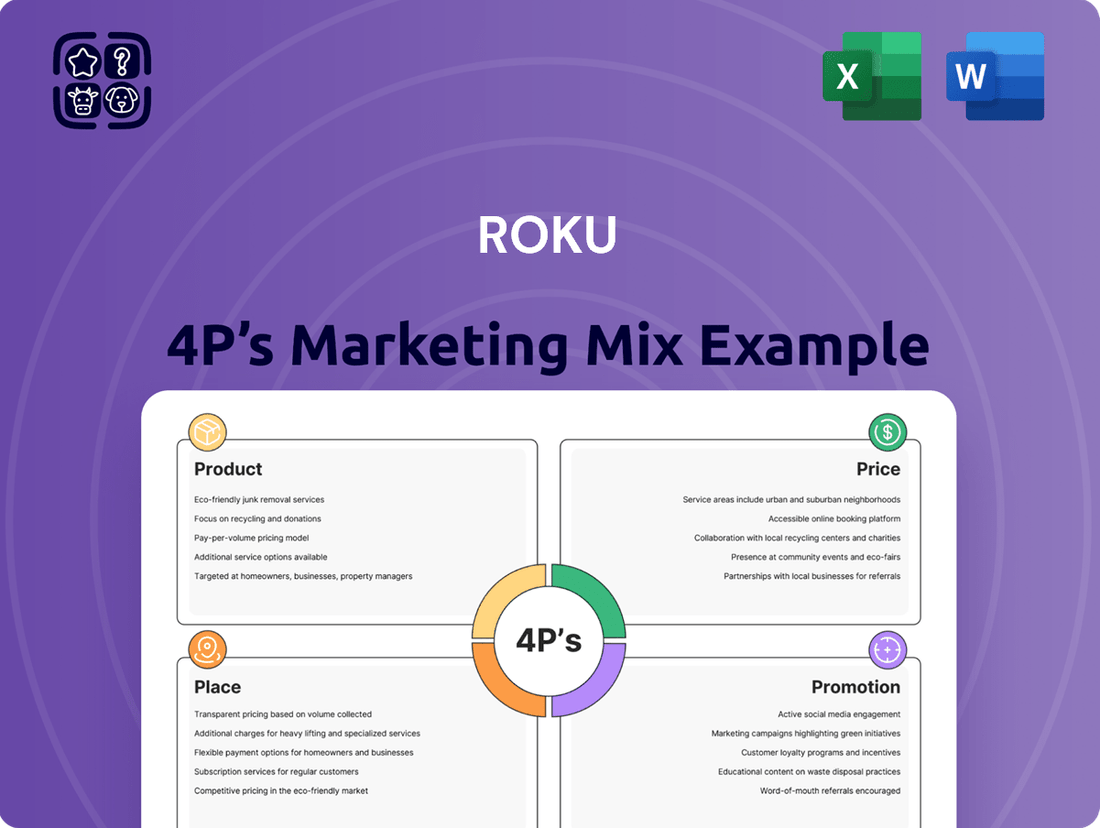

Roku's marketing mix is a masterclass in strategic execution, focusing on a diverse product portfolio that caters to various consumer needs in the streaming market. Their pricing strategy ensures accessibility while maintaining perceived value, making streaming solutions attainable for a broad audience.

The company's extensive distribution network, leveraging both online retailers and physical stores, ensures widespread availability of their devices and services. Roku's promotional efforts are highly targeted, utilizing digital advertising and partnerships to effectively reach and engage potential customers.

This integrated approach creates a powerful synergy, driving brand awareness and customer loyalty. Understanding these levers is crucial for anyone looking to replicate such market success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Roku. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Roku offers a diverse range of streaming players, including the Roku Express, Streaming Stick, and Ultra models, effectively catering to various consumer needs and price points. These devices are crucial entry points, providing access to over 80,000 free and premium streaming titles across thousands of channels as of early 2024. The hardware lineup is strategically priced, with models starting around $29.99, encouraging widespread adoption and solidifying Roku's platform dominance, which saw over 80 million active accounts globally by Q1 2024. This affordability drives significant engagement within the Roku ecosystem.

The Roku Operating System (OS) stands as a core product, licensed to major TV manufacturers including TCL, Hisense, and Sharp. This strategic approach has firmly established Roku OS as the leading smart TV operating system in the U.S., Canada, and Mexico, holding over 38% market share in North America as of early 2025. By integrating its software directly into diverse smart TVs, Roku significantly expands its active account base, which exceeded 81.6 million globally by Q1 2024, without solely depending on its own hardware sales.

The Roku Channel functions as the company's proprietary ad-supported video-on-demand (AVOD) service, providing users with a free library of movies, TV shows, and live linear channels.

This product is a major driver for user engagement across the Roku ecosystem and stands as a cornerstone of its advertising revenue strategy.

In Q4 2024, streaming hours on The Roku Channel surged by 82% year-over-year, highlighting its expanding reach and popularity.

Advertising Platform

Roku's advertising platform functions as a key revenue generator, allowing advertisers to reach a large and engaged audience through various ad formats on the home screen and within channels. The platform provides tools for targeted advertising and performance measurement, attracting a wide range of advertisers. This strategic focus ensures continued growth and market relevance. In Q4 2024, Roku's platform revenue, driven primarily by advertising, surpassed $1 billion for the first time, highlighting its significant financial contribution.

- Q4 2024 Platform Revenue: Over $1 billion.

- Primary Revenue Source: Advertising.

- Audience Reach: Large, engaged user base.

- Ad Tools: Targeted advertising, performance measurement.

Smart Home Ecosystem

Roku has strategically expanded its product line to include a Smart Home Ecosystem, featuring devices like cameras, video doorbells, and smart lighting, all integrating seamlessly with the Roku OS. This allows users to manage their home security and automation directly through their TV interface, enhancing convenience. This product diversification, launched in late 2022 and expanding through 2024, aims to boost customer loyalty and create a more interconnected entertainment and home management experience for its reported 80 million active accounts as of Q1 2024.

- Roku’s smart home product line includes cameras, video doorbells, and lighting.

- These devices integrate directly with the Roku OS for TV-based management.

- The expansion targets increased customer loyalty among 80 million active accounts.

- This strategy builds a cohesive home entertainment and automation ecosystem.

Roku's product strategy encompasses diverse streaming hardware, its dominant Roku OS, and the revenue-generating Roku Channel. The Roku OS holds over 38% market share in North America as of early 2025, expanding its active account base to over 81.6 million globally by Q1 2024. Platform revenue, primarily from advertising, exceeded $1 billion in Q4 2024. Strategic expansion into smart home devices further solidifies user engagement and ecosystem integration.

| Product Category | Key Offering | Market Impact/Data (2024/2025) |

|---|---|---|

| Streaming Hardware | Roku Express, Stick, Ultra | 80M+ active accounts (Q1 2024), entry price ~$29.99 |

| Operating System | Roku OS (licensed) | >38% NA smart TV OS share (early 2025), 81.6M+ global accounts (Q1 2024) |

| Content & Advertising | The Roku Channel, Ad Platform | Q4 2024 streaming hours +82% YoY; Q4 2024 platform revenue >$1B |

| Smart Home Ecosystem | Cameras, Doorbells, Lighting | Integrates with Roku OS, enhances customer loyalty |

What is included in the product

This analysis offers a comprehensive breakdown of the Roku 4P marketing mix, detailing product innovation, competitive pricing strategies, expansive distribution channels, and targeted promotional campaigns.

It's designed for professionals seeking to understand Roku's market positioning and competitive advantages.

This Roku 4P analysis acts as a relief by simplifying complex marketing strategies into actionable insights, addressing the pain point of information overload for busy executives.

It alleviates the frustration of scattered marketing data by consolidating the 4Ps into a clear, concise format, making strategic decision-making more efficient.

Place

Roku's hardware products are widely available through major big-box retailers like Best Buy, Walmart, and Target. This extensive retail network ensures high consumer visibility and accessibility across North America. In 2024, distribution for Roku-branded TVs expanded to include Target, Amazon, and Walmart.com. Further enhancing market penetration, these Roku-branded TVs entered Walmart physical stores in February 2025, significantly boosting their reach.

Roku leverages both its direct-to-consumer website, Roku.com, and major e-commerce platforms like Amazon to distribute its streaming devices. These online channels are vital for reaching a vast global customer base, complementing traditional retail partnerships. For instance, Roku's device sales, a significant portion of which occur online, saw approximately 7.9 million active accounts added in Q1 2024, demonstrating robust digital reach. This dual online presence offers consumers convenient purchasing options and competitive pricing, driving market accessibility.

The most significant place for Roku's platform is its deep integration into smart TVs from manufacturing partners. This B2B distribution strategy positions the Roku OS as the default user interface for millions of consumers right at the point of purchase. As of Q1 2025, Roku OS powered over 40% of all smart TVs sold in the United States, cementing its market presence. This ensures broad accessibility and reduces friction for user adoption, driving significant platform reach.

International Market Expansion

Roku is actively expanding its global footprint, now present in over 25 countries, strategically targeting key growth markets in the Americas and Europe. This involves establishing new retail partnerships, such as recent agreements with major European electronics retailers in early 2024, and securing localized content deals. This international push is crucial for long-term growth and diversifying revenue streams, with international active accounts growing to 20.9 million by Q1 2024, representing 29% of total active accounts.

- Roku's global presence spans over 25 countries as of early 2025.

- Focus on European and Latin American markets drives new retail partnerships.

- International active accounts reached 20.9 million by Q1 2024.

- International expansion is vital for diversifying revenue beyond the U.S. market.

The Digital Platform Interface

The ultimate place for Roku's marketing mix is its digital platform interface, primarily the Roku home screen, which serves as prime digital real estate viewed by over 81.6 million active accounts as of Q1 2024. This interface is where users seamlessly discover and access content, also functioning as the primary venue for Roku's promotional and advertising activities. Roku continuously innovates this home screen, integrating features like AI-powered recommendations to enhance user engagement and drive platform monetization, which saw revenue of $780 million in Q1 2024. This strategic digital placement maximizes content visibility and advertising reach.

- Active accounts reached 81.6 million as of Q1 2024.

- Platform revenue, driven by advertising, was $780 million in Q1 2024.

- AI-powered recommendations are central to user engagement.

Roku ensures broad product availability via major physical retailers like Walmart and key e-commerce platforms such as Amazon. Its strategic distribution integrates the Roku OS into over 40% of US smart TVs as of Q1 2025. Globally, Roku is present in over 25 countries, with its digital home screen reaching 81.6 million active accounts by Q1 2024, generating $780 million in platform revenue.

| Metric | Value | As of |

|---|---|---|

| Roku OS US Smart TV Share | 40%+ | Q1 2025 |

| Total Active Accounts | 81.6 Million | Q1 2024 |

| International Active Accounts | 20.9 Million | Q1 2024 |

| Platform Revenue | $780 Million | Q1 2024 |

| Global Presence | 25+ Countries | Early 2025 |

What You See Is What You Get

Roku 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Marketing Mix analysis for the Roku 4P is fully complete and ready for your immediate use. You are viewing the exact version of the analysis you'll receive, ensuring full transparency and no hidden details. Invest with confidence, knowing you're getting the definitive Roku 4P Marketing Mix analysis.

Promotion

Roku strategically engages in co-marketing with TV manufacturers such as TCL and Hisense, promoting both the TV hardware and the integrated Roku OS. This B2B2C approach leverages partners' marketing budgets and extensive retail channels, like Best Buy, for mutual benefit. This synergy amplifies sales and expands the Roku platform's user base, which reached 81.6 million active accounts by Q1 2024. These joint efforts are crucial for maintaining Roku's leading smart TV OS market share, strengthening its ecosystem.

Roku actively drives hardware sales through in-store promotions and prominent product placement at major retailers like Best Buy and Target, often leveraging seasonal discounts during periods such as the Q4 2024 holiday season. The company has innovated with shoppable TV advertising, notably expanding its partnership with Walmart to enable direct purchases from ads on Roku devices. This initiative, alongside collaborations with platforms like Shopify, aims to significantly shorten the consumer's path from ad viewing to purchase, enhancing conversion rates.

Roku leverages its home screen as a powerful promotional tool, featuring new content and highlighting streaming services to drive engagement with The Roku Channel. Features like the AI-powered content row and the Roku Sports Zone are designed to help users discover content, significantly increasing viewing hours. This strategy effectively uses Roku's own ecosystem to market directly to its existing user base, which reached 81.6 million active accounts by Q1 2024. The platform's promotional efforts directly contribute to the 29.5 billion streaming hours reported in the same period.

Digital and Programmatic Advertising

Roku actively invests in digital marketing campaigns, deepening its programmatic advertising relationships to attract more advertisers to its platform. The company launched Roku Ads Manager, a self-service tool, enabling marketers to efficiently manage campaigns. Enhanced data capabilities allow for more effective ad targeting, crucial as Roku aims to capture a larger share of CTV ad spend, which is projected to reach over $30 billion in 2025. These efforts are designed to demonstrate the tangible value of connected TV advertising.

- Roku's platform reaches an estimated 81.6 million active accounts as of Q1 2024.

- The company's programmatic ad revenue continues to grow, leveraging its first-party data.

- Roku Ads Manager streamlines ad buying for diverse businesses, from SMBs to large brands.

- CTV advertising spend is projected to significantly increase through 2025, benefiting Roku's growth strategy.

Public Relations and Industry Presence

Roku actively maintains a strong media presence through strategic public relations. The company consistently issues press releases on new product launches and financial results, such as its Q1 2024 platform revenue reaching $780 million. Roku also features prominently at major industry events, including CES 2025, to showcase innovations and strengthen its market leadership. This consistent communication shapes investor and consumer perception, reinforcing its standing.

- Q1 2024 Platform Revenue: $780 million reported, demonstrating strong monetization.

- CES 2025 Participation: Expected to showcase the latest streaming device and smart TV innovations.

- New Product Announcements: Recent press releases highlighted new Roku TV models and software updates in 2024.

Roku utilizes a multifaceted promotional strategy, including co-marketing with TV manufacturers and in-store placements to expand its 81.6 million active accounts. The platform's home screen and innovative shoppable TV ads, like the Walmart partnership, drive engagement and content discovery. Digital campaigns and strategic PR, including CES 2025 participation, bolster its share of the over $30 billion projected CTV ad spend by 2025.

| Metric | Q1 2024 Data | 2025 Proj. |

|---|---|---|

| Active Accounts | 81.6 Million | Growth Expected |

| Platform Revenue | $780 Million | N/A |

| CTV Ad Spend | N/A | >$30 Billion |

Price

Roku strategically prices its streaming players and branded TVs affordably, often at low margins, to maximize platform adoption. The success of this strategy is measured by the growth of active accounts, not hardware profit. By the close of 2024, Roku’s active accounts were approaching 90 million. This pricing model significantly lowers the barrier for consumers to enter the Roku ecosystem.

Roku strategically licenses its operating system to TV manufacturers at no cost, which is crucial for market penetration, with over 80 million active accounts reported in Q1 2024. For consumers, the platform uses a freemium model; the core OS is free, driving engagement. Roku generates substantial revenue, reaching $883 million in platform revenue in Q1 2024, through advertisements, premium subscriptions, and transaction fees. This model significantly reduces entry barriers for both manufacturing partners and end-users, fueling ecosystem growth.

Roku's financial strategy centers on its robust advertising business, leveraging its extensive user base. The company offers a wide array of free, ad-supported content through The Roku Channel and various partner applications. This approach attracts a significant audience, which Roku effectively monetizes by selling valuable ad inventory. Platform revenue, predominantly from advertising, impressively reached $3.5 billion in 2024, highlighting its core profitability.

Revenue Sharing on Subscriptions

Roku diversifies its platform income by earning a percentage of revenue from subscription services, like Netflix, and transactional purchases made directly through its streaming platform.

This strategy establishes a recurring revenue stream directly tied to the success and growth of its content partners. Notably, Q4 2024 marked the highest quarter for Premium Subscription net additions since the service's inception, underscoring Roku's focus on expanding this profitable segment.

- Roku's platform income includes a percentage of content subscription and transactional revenues.

- The company reported Q4 2024 as the strongest quarter for Premium Subscription net additions ever.

- This model creates a recurring revenue stream, aligning Roku's success with content partners.

Promotional and Dynamic Pricing

Roku actively utilizes promotional and dynamic pricing, especially during peak shopping periods like the 2024 holiday season, to drive hardware sales and expand its user base. The company prices its TV lineup, including models starting under $150 for entry-level 32-inch options in early 2025, to attract price-sensitive consumers. This aggressive strategy aims to capture significant market share and foster user ecosystem growth.

- Roku's smart TV market share in North America approached 20% in 2024, partly due to competitive pricing.

- Promotional events during Black Friday 2024 and Cyber Monday 2024 saw significant discounts on Roku streaming devices.

- The average selling price for Roku-powered TVs remained highly competitive, often under $300 for 4K models in 2025.

- This pricing strategy supports Roku's platform revenue growth by increasing the active account base.

Roku employs a dual pricing strategy, offering streaming players and branded TVs at competitive, often low margins, such as entry-level 32-inch models under $150 in early 2025, to significantly expand its user base, which approached 90 million active accounts by the close of 2024. The core operating system is provided free, allowing Roku to generate substantial platform revenue, reaching $3.5 billion in 2024, primarily through advertising, premium subscriptions, and transaction fees. Dynamic promotional pricing during events like Black Friday 2024 further drives hardware sales and ecosystem growth. This model prioritizes platform monetization over hardware profitability, evidenced by average 4K Roku TV selling prices often under $300 in 2025.

4P's Marketing Mix Analysis Data Sources

Our Roku 4P Marketing Mix Analysis is powered by a blend of direct company communications, including investor relations materials and official press releases, alongside comprehensive industry data and competitive intelligence. We meticulously gather information on product launches, pricing strategies, distribution partnerships, and promotional activities to ensure a robust and accurate representation of Roku's market approach.