Roku Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Roku Bundle

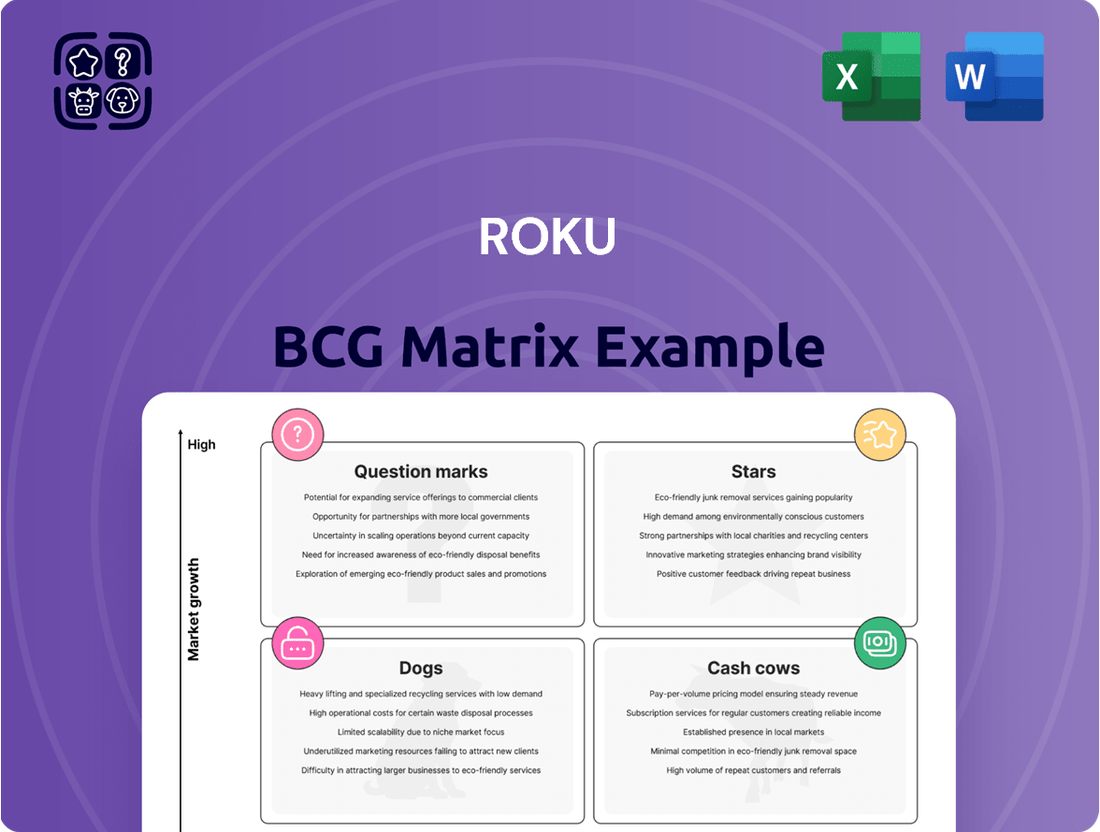

Roku's BCG Matrix offers a snapshot of its product portfolio, but this is just the surface. Uncover the strategic nuances behind each product category—from streaming devices to ad platforms. Understand which areas drive revenue and which require careful management. The full matrix delivers detailed quadrant analysis, actionable insights, and a clear path to informed decision-making. Get the complete Roku BCG Matrix now for a strategic edge!

Stars

Roku's platform revenue, a key "Star," dominates its financial performance. In Q4 2024, this segment, fueled by advertising and content distribution, surpassed $1 billion. Roku's strategic partnerships and expanding ad capabilities bolster its market leadership. This revenue stream is projected to maintain its growth trajectory into 2025, solidifying its position.

Roku holds a prominent position in the U.S. authenticated CTV advertising market, reaching millions of households. In 2024, Roku's platform powers over 60% of the U.S. broadband-connected TVs. This positions Roku well to benefit from the increasing ad spend shift. Partnerships, like the one with Amazon, boost its advertising potential.

Roku's platform boasts substantial user engagement, reflected in the impressive streaming hours. This high engagement level is a major draw for advertisers and content providers, enhancing revenue possibilities. In Q1 2024, Roku users streamed 32.3 billion hours. The growth in streaming hours on The Roku Channel showcases user adoption and platform loyalty.

The Roku Channel

The Roku Channel, Roku's ad-supported streaming service, is a star in its BCG Matrix, experiencing significant growth in reach and user engagement. It is integral to Roku's platform strategy, offering a variety of content and opportunities for advertising revenue. The expansion of ad-supported streaming positions The Roku Channel as a valuable asset in the industry. In 2024, The Roku Channel saw a 20% increase in streaming hours. This growth is fueled by the increasing popularity of free, ad-supported content.

- Significant growth in reach and engagement.

- Key component of Roku's platform strategy.

- Offers a mix of live and on-demand content.

- Provides opportunities for advertising monetization.

International Expansion

Roku's international expansion is a crucial strategy. This move capitalizes on growth opportunities outside its core North American markets. It's designed to boost user numbers and platform revenue globally. Roku is available in countries like the UK, France, and Brazil.

- International revenue grew by 27% in Q1 2024.

- Roku is present in over 20 countries.

- The company aims to increase its global market share.

Roku's Stars, including platform revenue and The Roku Channel, exhibit strong growth and market share. Platform revenue exceeded $1 billion in Q4 2024, driven by advertising. The Roku Channel saw a 20% increase in streaming hours in 2024, affirming its significant user engagement.

| Star Segment | 2024 Metric | Growth/Share |

|---|---|---|

| Platform Revenue | Q4 2024 | >$1B |

| US CTV Share | 2024 | >60% |

| Roku Channel | 2024 | +20% hours |

What is included in the product

Tailored analysis for the featured company’s product portfolio.

One-page overview placing each business unit in a quadrant.

Cash Cows

Roku's OS licensing to TV makers is a cash cow. This strategy boosts its user base without hardware costs. Roku's OS is a leading smart TV platform. In Q1 2024, Roku had 81.6 million active accounts. Licensing provides a steady revenue stream.

Roku holds a firm position in the mature U.S. streaming market, boasting a substantial user base. This strong presence allows for consistent revenue streams from advertising. Despite slower growth compared to international markets, Roku's established position ensures steady financial performance. In 2024, Roku's platform generated $3.48 billion in revenue.

Roku's content distribution agreements are crucial for its platform revenue, stemming from partnerships with various content providers. These deals involve Roku receiving a portion of subscription revenue or placement fees. In 2024, platform revenue constituted a significant portion of Roku's total revenue, with a 19% increase year-over-year.

Advertising Inventory on Established Platform

Roku's established platform, boasting a substantial user base, is a lucrative advertising inventory. Advertisers are eager to reach this audience, translating into consistent revenue for Roku. The ongoing shift of advertising spending towards connected TV (CTV) further strengthens Roku's advertising business. In Q1 2024, Roku's platform revenue reached $984 million.

- Large User Base: Roku has millions of active accounts.

- Advertising Revenue: A key revenue driver for Roku.

- CTV Shift: Benefits Roku's ad business.

- Platform Revenue: Significant revenue stream.

Existing User Base Monetization

Roku's substantial user base offers significant monetization opportunities. The company aims to boost its average revenue per user (ARPU) by enhancing engagement. Roku leverages advertising, subscriptions, and potential new services to achieve this goal. Expanding its revenue streams from its existing users is a key strategy.

- In Q1 2024, Roku's ARPU reached $43.00, a 14% increase year-over-year.

- Roku's active accounts totaled 81.6 million in Q1 2024.

- Advertising revenue grew 19% year-over-year in Q1 2024.

Roku's substantial U.S. platform and OS licensing act as cash cows, driving consistent revenue. Advertising on its large user base and content distribution agreements provide steady income. In Q1 2024, Roku reported 81.6 million active accounts, with platform revenue reaching $984 million.

| Metric | Q1 2024 Data | YOY Growth |

|---|---|---|

| Active Accounts | 81.6 million | |

| Platform Revenue | $984 million | 19% |

| ARPU | $43.00 | 14% |

What You’re Viewing Is Included

Roku BCG Matrix

The Roku BCG Matrix report you're previewing is identical to the one you'll receive after purchase. This means you get the full, unedited document, ready for your strategic analysis, complete with all features.

Dogs

Roku's device segment, primarily streaming players, has lower profit margins than its platform segment. In Q1 2024, player revenue was $186.8 million, but gross profit margins are often slim. Device sales focus on user acquisition, not primary profitability drivers. Seasonal discounts can further squeeze these margins.

The streaming device market is fiercely competitive. Roku faces pressure from Amazon, Google, and others. This competition can squeeze Roku's hardware margins. In Q4 2023, Roku's gross profit decreased by 14% year-over-year, reflecting this challenge.

Roku's hardware, although popular, is manufactured by third parties. This dependence on external manufacturers can lead to supply chain issues, impacting production and potentially increasing costs. In 2024, Roku's gross profit margin for player revenue was around 47%, indicating the impact of hardware costs. This model contrasts with higher-margin software licensing.

Potential for Device Obsolescence

The Dogs quadrant of the Roku BCG Matrix reflects the risk of device obsolescence. Rapid tech advancements mean streaming devices can quickly become outdated, impacting future sales of older models. This hardware business risk is significant. In 2024, Roku's revenue was $3.48 billion, highlighting the scale of its operations.

- Roku's stock price has faced volatility, reflecting market concerns about its long-term viability.

- Competition from larger tech companies with more resources exacerbates this risk.

- Software updates and feature enhancements may not fully offset hardware limitations.

Impact of Supply Chain Issues on Device Availability and Cost

Roku's device segment faces supply chain vulnerabilities, impacting device availability and costs. This can squeeze margins, especially since hardware often has lower profit margins. In Q1 2024, Roku's gross profit decreased by 17% year-over-year, partly due to these pressures. These disruptions can lead to decreased sales and profitability for the device segment.

- Supply chain issues can limit device production.

- Higher costs due to supply chain problems can reduce profitability.

- Lower margins make the device segment a "dog" in the BCG Matrix.

- The company's gross profit decreased by 17% year-over-year in Q1 2024.

Roku's device segment operates as a Dog, characterized by low profit margins and intense competition. Player revenue was $186.8 million in Q1 2024, but gross profit margins for player revenue were around 47% in 2024. These devices primarily serve user acquisition for the platform business, facing supply chain vulnerabilities that further constrain profitability.

| Metric | 2024 Q1 | 2024 (approx.) | ||

|---|---|---|---|---|

| Player Revenue | $186.8M | |||

| Player Gross Profit Margin | 47% | |||

| Gross Profit YoY Change | -17% |

Question Marks

Roku's move into smart home devices positions it in a high-growth market. However, Roku faces established competitors. In 2024, the smart home market was valued at roughly $140 billion globally. Roku's market share is still developing. Its success hinges on effective market penetration.

Roku ventured into the TV market with its own branded TVs. This strategic move enhances control over the user experience. It also places Roku in direct competition with major TV manufacturers. In 2024, Roku's TV sales accounted for a significant portion of its hardware revenue, approximately 30%.

Roku's primary revenue source is advertising, but it's actively expanding into other areas. They are developing subscription services and other offerings to diversify income streams. These newer monetization strategies' success and scalability are still evolving within the market. In 2024, Roku's platform revenue was about $3.5 billion, with advertising making up a significant portion.

Growth in Emerging International Markets

Roku's international expansion is a Star, but not without challenges. Success in newer markets is uncertain, demanding significant investments. Monetizing users in these regions takes time and resources, impacting profitability. For example, in Q1 2024, Roku's international revenue grew, but profitability lagged.

- International revenue growth is ongoing, but profitability is still a challenge.

- Building market share requires sustained investment in marketing.

- Monetization strategies must be adapted to local user behavior.

- Long-term profitability depends on user growth and engagement.

Acquisition of Content and Original Programming

Roku's strategy includes acquiring content and producing original programming, primarily for The Roku Channel. This move aims to boost user engagement, but it's a high-stakes game. The streaming market is saturated, and content production is expensive. For example, in 2024, Netflix spent over $17 billion on content.

- Content spend is a major cost, as seen by Netflix's massive investments.

- Original content aims to attract and retain users.

- ROI in streaming is often uncertain, requiring careful planning.

- Roku competes with many well-funded streaming services.

Roku's smart home devices and branded TVs are Question Marks, operating in high-growth areas like the $140 billion 2024 smart home market, but currently holding low market share. Their expansion into new monetization beyond advertising also represents a developing area, with success and scalability still uncertain. These ventures require significant investment to capture market share and prove profitability.

| Category | Market Growth | Roku's Share/Status |

|---|---|---|

| Smart Home Devices | High (2024: $140B) | Developing |

| Roku Branded TVs | Moderate-High | Building (30% hardware revenue) |

| New Monetization | Evolving | Success/Scalability Unproven |

BCG Matrix Data Sources

Roku's BCG Matrix utilizes financial reports, market share data, industry research, and competitor analysis for an informed strategic assessment.