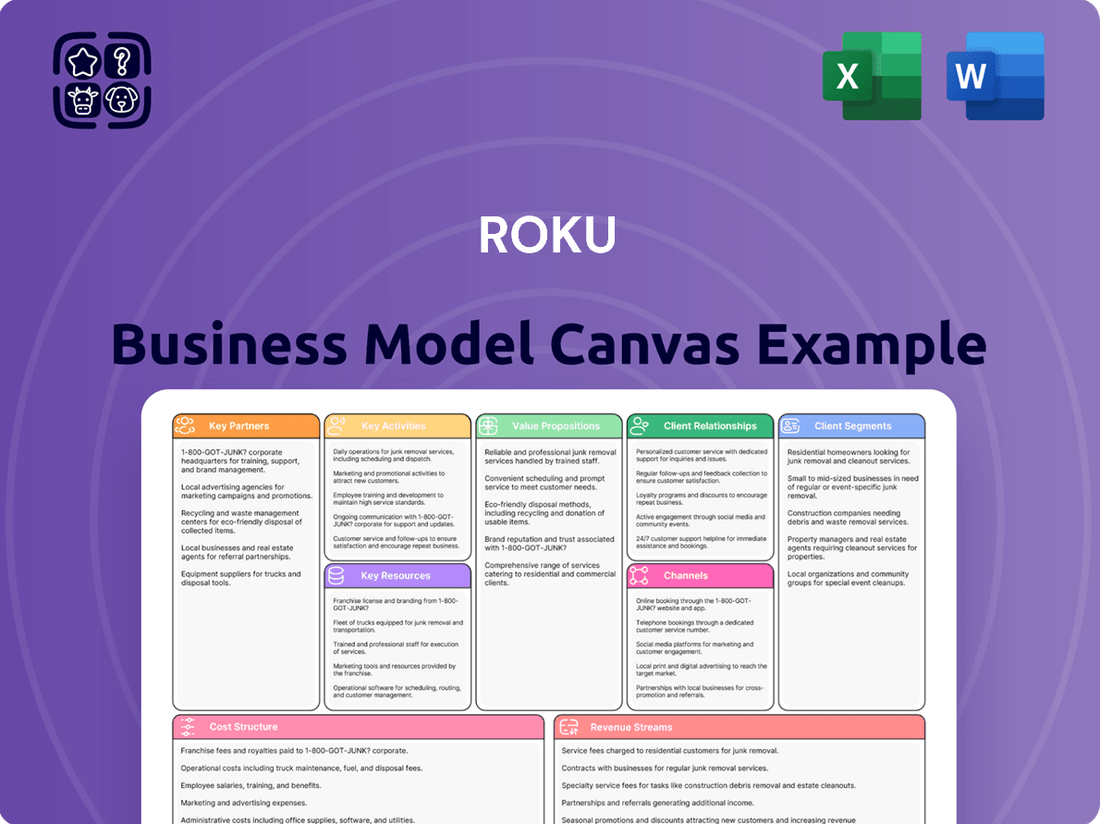

Roku Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Roku Bundle

Unlock the full strategic blueprint behind Roku's innovative business model. This in-depth Business Model Canvas reveals how the company masterfully connects content creators, advertisers, and consumers to drive value and capture market share in the fast-paced streaming landscape.

Discover Roku's core customer segments, from cord-cutters to smart TV manufacturers, and understand how their value propositions are tailored to each. You'll see how key partnerships are leveraged to expand reach and content offerings.

Delve into Roku's diversified revenue streams, including hardware sales, advertising, and platform revenue, and understand the intricate interplay that fuels their growth. This canvas provides a clear, actionable view of their financial architecture.

See how Roku's key resources and activities are orchestrated to deliver a seamless streaming experience and maintain their competitive edge. It's a masterclass in platform strategy.

Ready to gain a comprehensive understanding of Roku's success? Download the full Business Model Canvas to access all nine building blocks, complete with company-specific insights and strategic analysis designed to inspire your own business endeavors.

Partnerships

Roku licenses its operating system to television original equipment manufacturers such as TCL, Hisense, and Sharp, establishing the Roku OS as the native smart TV platform. This is a critical partnership for scaling the user base, driving Roku to over 81.6 million active accounts globally as of Q1 2024, without relying solely on player sales. These relationships create a powerful, built-in distribution channel for the Roku platform, significantly expanding its reach.

Key partnerships with content publishers like Netflix, Disney+, and YouTube are vital for Roku's platform. Roku provides access to its 81.6 million active accounts as of Q1 2024, offering content partners a vast distribution network. In return, these partners deliver the diverse content that attracts and retains Roku users. This symbiotic relationship ensures mutual benefit, driving user engagement and contributing to Roku's average revenue per user of $40.65 for the trailing twelve months ending March 31, 2024.

Advertisers and advertising agencies are paramount to Roku's high-margin platform business, serving as core customers. Roku provides these partners with direct access to a vast and engaged streaming audience, totaling 81.6 million active accounts as of Q1 2024, alongside advanced targeting capabilities. Cultivating strong relationships with major brands and agencies is crucial, as platform revenue, primarily driven by advertising, grew 19% year-over-year to $754.9 million in Q1 2024. This symbiotic relationship ensures continued advertising revenue growth and strengthens Roku's market position.

Retail & E-commerce Distributors

Roku relies heavily on strategic partnerships with major retail and e-commerce distributors such as Best Buy, Walmart, and Amazon to sell its physical streaming players. These crucial alliances ensure widespread market availability and prominent visibility for Roku's hardware products across North America and beyond. By leveraging these established sales channels, Roku effectively drives new user acquisition, onboarding millions of active accounts, which reached 81.6 million globally as of Q1 2024. While device revenue was $83.6 million in Q1 2024, these partnerships are vital for expanding its ecosystem.

- Best Buy, Walmart, and Amazon serve as primary sales channels for Roku devices.

- These partnerships enhance product visibility and market reach significantly.

- They are critical for driving new active account growth, which hit 81.6 million by Q1 2024.

- Device sales, though a smaller revenue segment ($83.6M in Q1 2024), are foundational to platform growth.

Data & Ad Measurement Partners

Roku collaborates with key data and ad measurement partners to validate its advertising platform. These partnerships, including with Nielsen, provide advertisers with trusted, independent metrics on ad performance and reach. Such validation is crucial for building credibility and justifying advertising spend on the Roku platform, especially as digital advertising continues its robust growth in 2024. For instance, Nielsen ONE helps advertisers understand cross-platform engagement.

- Partnerships with companies like Nielsen provide independent ad measurement.

- These collaborations ensure trusted metrics on ad performance and reach.

- It builds credibility, justifying advertiser spending on Roku's platform.

- Validated measurement is crucial for securing ad budgets in 2024.

Roku's ecosystem thrives on key partnerships with TV OEMs like TCL, expanding its platform to 81.6 million active accounts by Q1 2024. Collaborations with major content providers and advertisers drive platform revenue, which reached $754.9 million in Q1 2024. Retailers such as Walmart ensure broad device distribution, while data partners like Nielsen validate ad performance for clients. These alliances are fundamental to Roku's market leadership and continued growth.

| Partner Type | Key Contribution | 2024 Metric |

|---|---|---|

| TV OEMs | OS distribution, user scale | 81.6M active accounts (Q1 2024) |

| Advertisers | Platform revenue | $754.9M (Q1 2024 platform revenue) |

| Retailers | Device sales, user acquisition | $83.6M (Q1 2024 device revenue) |

What is included in the product

A detailed breakdown of Roku's strategy, outlining key customer segments, revenue streams, and partnerships that drive its platform's growth.

This model emphasizes Roku's role as an ecosystem facilitator, connecting content providers and advertisers to a large, engaged user base.

Provides a structured framework to identify and address operational inefficiencies, streamlining the complex process of outlining a business strategy.

Simplifies the identification of critical value propositions and customer segments, alleviating the challenge of articulating a clear market approach.

Activities

Roku’s core activity involves the continuous research and development, along with robust maintenance, of its proprietary operating system and intuitive user interface. This commitment ensures a seamless experience for over 81.6 million active accounts as of Q1 2024. Key efforts include regularly rolling out performance enhancements and introducing new features that keep the platform competitive and user-friendly. Such ongoing innovation directly improves user engagement and strengthens relationships with content partners, reflecting in strong platform monetization. This focus on stability and advancement is crucial for retaining its market position and fostering growth.

Roku's core monetization stems from operating its advanced advertising technology stack, including the OneView ad platform. This involves meticulous ad inventory management and robust programmatic ad sales capabilities. The platform also continuously develops sophisticated targeting and measurement tools to enhance ad effectiveness for advertisers. This strategic focus drives high-margin platform revenue, which reached $809.9 million in Q1 2024, fueled by 81.6 million active accounts and 30.8 billion streaming hours.

Roku actively licenses and acquires a diverse range of content for its ad-supported platform, The Roku Channel. This strategic activity involves sourcing popular movies and TV series, alongside the development of exclusive Roku Originals. These efforts are crucial for driving consistent user engagement, with streaming hours on the platform reaching 123 billion in Q1 2024. By offering a compelling content library, Roku creates exclusive, high-value advertising inventory, attracting advertisers and bolstering its platform revenue.

Hardware Design & Supply Chain Management

Roku’s hardware design and supply chain management are critical, encompassing the development and manufacturing of its streaming players and audio products. This includes overseeing relationships with contract manufacturers globally, ensuring efficient production and delivery of devices. This activity is vital for Roku’s player-driven user acquisition strategy, as the physical hardware serves as the initial gateway for users to access the platform. Efficient supply chain operations ensure devices are readily available, supporting continued growth in active accounts.

- Roku's hardware segment accounted for $872.2 million in revenue for the full year 2023, reflecting the scale of its device operations.

- The company continuously invests in R&D for new hardware, with total R&D expenses reaching $972.1 million in 2023.

- Efficient supply chain management is key to navigating global component availability and logistics challenges.

- Player sales are essential for expanding Roku's active account base, which stood at 81.6 million as of Q1 2024.

Building & Managing Partner Relationships

A key activity for Roku involves the active management of strategic relationships with TV original equipment manufacturers, content publishers, and major advertisers. These efforts include robust partner support, collaborative co-marketing initiatives, and continuous contract negotiations to secure advantageous terms. Such diligent management ensures the vitality and expansion of the entire Roku ecosystem, driving platform revenue, which reached $882.9 million in Q1 2024 alone.

- Roku's active accounts hit 81.6 million in Q1 2024, emphasizing partner reach.

- Platform revenue, driven by these relationships, was $882.9 million in Q1 2024.

- Strategic OEM partnerships enable Roku to be a leading smart TV OS in North America.

- Content deals ensure a diverse library, crucial for subscriber engagement.

Roku’s key activities center on developing and maintaining its proprietary operating system, which supports 81.6 million active accounts as of Q1 2024, alongside operating its advanced advertising technology stack that drove $882.9 million in Q1 2024 platform revenue. This includes active content licensing for The Roku Channel, driving 123 billion streaming hours in Q1 2024, and managing hardware design and supply chains for its devices. Strategic relationship management with OEMs and content partners is crucial for ecosystem expansion.

| Metric | Q1 2024 Data | Full Year 2023 Data |

|---|---|---|

| Active Accounts | 81.6 million | 80.0 million |

| Platform Revenue | $882.9 million | $3.08 billion |

| Streaming Hours | 30.8 billion | 123.6 billion |

| Hardware Revenue | $872.2 million (FY 2023) | N/A for Q1 2024 standalone |

Full Version Awaits

Business Model Canvas

The Roku Business Model Canvas you are previewing is the actual, unedited document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered, ensuring complete transparency. You are not viewing a sample or a mockup, but a direct snapshot of the final product. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

The proprietary Roku Operating System (OS) stands as Roku's most significant intellectual property and the central pillar of its entire ecosystem. This software is a key resource, ensuring a consistent and user-friendly experience across all Roku devices, from streaming players to integrated TVs. It's also a crucial asset licensed to TV manufacturers, significantly driving platform growth; for instance, Roku OS powered over 40% of smart TVs sold in the US during Q1 2024. This widespread adoption through licensing strengthens Roku's platform and advertising revenue streams.

Roku's large and engaged active user base, reaching 81.6 million active accounts by Q1 2024, is its most valuable asset for monetization. This substantial audience is highly attractive to advertisers seeking to reach a broad demographic across streaming content. The platform's scale also draws in numerous content partners, eager to distribute their offerings to millions of viewers. This extensive user base fosters a powerful network effect, continuously enhancing Roku's value proposition for all stakeholders.

Roku gathers extensive first-party data on user viewing habits, detailing what content is watched, when, and on which devices, encompassing over 80 million active accounts as of Q1 2024.

This rich dataset is crucial for personalizing the streaming experience and significantly enhances the precision of ad targeting, allowing advertisers to reach specific audiences effectively.

This proprietary data asset, including insights from over 120 billion hours streamed in 2023, represents a major competitive advantage, enabling Roku to offer unmatched targeting capabilities compared to traditional TV.

It underpins Roku’s platform business model, driving revenue through highly relevant advertising and content discovery for users.

Advertising Technology Stack (OneView)

Roku's proprietary advertising technology stack, OneView, is a critical resource for monetizing its extensive user base. This sophisticated platform enables programmatic advertising, precise audience targeting, and robust performance measurement, acting as the core engine converting viewership into substantial revenue. For example, Roku reported platform revenue of $882 million in Q1 2024, largely driven by this ad tech. It leverages data from 81.6 million active accounts as of Q1 2024 to optimize ad delivery.

- OneView serves as Roku's proprietary demand-side platform.

- It powers programmatic ad sales and audience targeting.

- Converts user engagement into significant advertising revenue.

- Contributed to Roku's $882 million Q1 2024 platform revenue.

Brand Recognition & Neutrality

Roku’s brand is widely recognized and trusted by consumers as an easy-to-use, content-agnostic streaming platform. This reputation as a neutral aggregator is a crucial resource, enabling partnerships with diverse content providers without prioritizing proprietary content. This approach differentiates Roku from competitors like Apple or Amazon, who often favor their own content ecosystems. In 2024, Roku maintained its strong market presence, with active accounts reaching 81.6 million globally by Q1.

- Roku's brand neutrality fosters broad content partnerships.

- Its user-friendly interface enhances consumer trust and adoption.

- This neutrality sets Roku apart from content-owner competitors.

- Active accounts reached 81.6 million by Q1 2024, demonstrating widespread recognition.

Roku’s essential key resources encompass its proprietary Roku OS, powering over 40% of US smart TVs in Q1 2024, and a vast active user base of 81.6 million accounts. This scale generates crucial first-party data, enhancing its OneView advertising technology, which drove $882 million in platform revenue in Q1 2024. The trusted, neutral Roku brand solidifies content partnerships and consumer adoption, underpinning its ecosystem.

| Key Resource | Description | 2024 Data Point |

|---|---|---|

| Roku OS | Proprietary operating system; core IP | 40%+ US smart TVs (Q1 2024) |

| Active Accounts | Large, engaged user base | 81.6 million (Q1 2024) |

| First-Party Data | User viewing habits data | From 81.6 million accounts |

| OneView Ad Tech | Proprietary advertising platform | $882 million platform revenue (Q1 2024) |

| Roku Brand | Trusted, neutral platform recognition | 81.6 million active accounts (Q1 2024) |

Value Propositions

Roku offers viewers a remarkably simple, unified streaming experience. Its platform aggregates virtually all streaming services, both free and paid, into one easy-to-navigate interface. This content-agnostic approach simplifies access, allowing users to effortlessly switch between options like Netflix, Max, and its own Roku Channel. For example, as of Q1 2024, Roku reported 81.6 million active accounts, highlighting the widespread adoption of its intuitive system. This value is delivered through affordable hardware, making premium content accessible without complexity.

Roku empowers advertisers to precisely reach a massive, cord-cutting audience, a segment increasingly inaccessible via traditional linear TV. By leveraging sophisticated data, Roku's advertising platform offers highly targeted campaigns and robust measurement tools. This enhances advertising ROI, making TV ad spend significantly more precise and effective for brands. In Q1 2024, Roku reported 81.6 million active accounts, providing substantial reach.

Roku offers content publishers a powerful distribution channel to reach millions of engaged streaming households. As of Q1 2024, Roku reported 81.6 million active accounts, providing immense audience reach. It provides tools for publishers to build, distribute, and monetize their applications on the platform. This helps both large media companies and niche content providers significantly grow their audience and engagement.

For TV OEMs: A Leading, Turnkey Smart TV Platform

Roku offers TV manufacturers a leading, licensed operating system, allowing them to power smart TVs with a competitive, feature-rich user experience. This eliminates the high cost and complexity of in-house software development for OEMs, significantly accelerating their time-to-market. It also enhances their product value, attracting consumers with a trusted and widely adopted platform. Roku's installed base of active accounts reached 81.6 million globally by Q1 2024, demonstrating its widespread adoption.

- OEMs avoid significant R&D costs for smart TV software.

- Accelerated product launch cycles, often by months.

- Access to a pre-established ecosystem with over 80 million active accounts in 2024.

- Enhanced brand appeal through a recognized and user-friendly platform.

The Roku Channel: A Universe of Free Content

The Roku Channel serves as a core value proposition, offering consumers a vast library of free, ad-supported movies, TV shows, live news, and sports. This no-cost access significantly enhances user value and retention on the platform. For Roku, it drives substantial user engagement, creating valuable proprietary ad inventory that diversifies revenue streams beyond hardware sales. As of Q1 2024, The Roku Channel was a top-five channel by reach on the Roku platform, underscoring its pivotal role.

- Provides over 80,000 free movies and TV episodes to users.

- Generates significant advertising revenue for Roku, contributing to platform segment growth.

- Enhances user stickiness by offering diverse content at no direct cost.

Roku provides a seamless, content-agnostic streaming experience for its 81.6 million active accounts as of Q1 2024, offering diverse content via affordable hardware. It empowers advertisers with precise targeting on a massive cord-cutting audience, enhancing ROI. For TV manufacturers and content publishers, Roku delivers a cost-effective operating system and a broad distribution channel, accelerating market entry and monetization. The Roku Channel further enriches user value with extensive free content.

| Stakeholder | Core Value Proposition | 2024 Data Point |

|---|---|---|

| Viewers | Simplified, unified streaming access | 81.6M active accounts (Q1 2024) |

| Advertisers | Precise reach to cord-cutters | 81.6M active accounts (Q1 2024) |

| OEMs | Cost-effective smart TV OS | 81.6M active accounts (Q1 2024) |

| Content Publishers | Broad audience distribution | 81.6M active accounts (Q1 2024) |

| The Roku Channel | Free content, ad inventory | Top-five channel by reach (Q1 2024) |

Customer Relationships

The primary customer relationship with Roku's end-users is largely automated, driven by the intuitive Roku OS. This interface is designed for self-service, empowering users to manage everything from device setup to content discovery independently. This highly scalable, low-touch model allows Roku to efficiently serve its vast user base. As of Q1 2024, Roku reported 81.6 million active accounts, underscoring the effectiveness of this automated approach in managing customer interactions at scale.

Roku cultivates strategic, high-touch relationships with key partners through dedicated direct sales and partner management teams. These teams are vital for managing engagements with large advertisers, content publishers, and TV OEMs, providing tailored support. This B2B focus is crucial, as Roku's platform revenue, largely driven by advertising, reached $754.9 million in Q1 2024. These relationships ensure continued content availability and advertising spend across Roku's 81.6 million active accounts as of Q1 2024, driving strategic initiatives.

Roku fosters robust customer relationships with its expansive ecosystem of content developers and advertisers through self-service online portals. These intuitive platforms provide essential tools, comprehensive documentation, and performance analytics. This empowers partners to seamlessly publish channels and manage their ad campaigns efficiently. This scalable, long-tail partner strategy is crucial, especially as Roku reported platform revenue of $3.05 billion in 2023, largely driven by advertising. These portals facilitate broad engagement, supporting Roku's continued growth into 2024.

Digital Customer Support & Community

Roku manages its end-user customer relationships primarily through efficient digital channels, providing essential support while minimizing service costs. This includes comprehensive online FAQs and vibrant community forums where users can find solutions and engage with peers. Automated support systems further streamline assistance, allowing Roku to scale its support operations effectively. This digital-first strategy is crucial for maintaining profitability, especially as Roku's active accounts reached an estimated 81.6 million globally in Q1 2024.

- Roku's primary customer support leverages extensive online FAQs.

- Community forums facilitate peer-to-peer problem-solving.

- Automated support systems are key to cost efficiency.

- Digital channels support Roku's 81.6 million active accounts as of Q1 2024.

Data-Driven Personalization Engine

Roku cultivates ongoing user relationships through a sophisticated data-driven personalization engine. The platform analyzes viewership habits and engagement metrics to recommend highly relevant content, enhancing the user experience. This data also fuels targeted advertising, which optimizes ad delivery based on individual preferences. Such personalized interactions are critical for boosting user engagement and increasing the perceived value of the Roku platform, contributing to its strong retention rates.

- Roku reported 81.6 million active accounts as of Q1 2024.

- Users streamed 31.3 billion hours in Q1 2024, indicating high engagement.

- Platform revenue, driven by advertising and content distribution, increased 19% year-over-year in Q1 2024.

- Personalized content recommendations aim to extend viewing sessions and platform stickiness.

Roku manages its extensive customer base primarily through automated, self-service digital channels, supporting 81.6 million active accounts as of Q1 2024. Simultaneously, it cultivates high-touch relationships with key B2B partners, including advertisers and content publishers, crucial for its platform revenue. Data-driven personalization enhances user engagement, contributing to 31.3 billion streaming hours in Q1 2024. These diverse approaches ensure scalable support and strategic growth.

| Relationship Type | Primary Method | Key Metric (Q1 2024) |

|---|---|---|

| End-Users | Automated, Self-Service | 81.6M Active Accounts |

| Key Partners (B2B) | High-Touch, Direct Teams | $754.9M Platform Revenue |

| Developers/Advertisers | Self-Service Portals | $3.05B Platform Revenue (2023) |

| Ongoing User Engagement | Data-Driven Personalization | 31.3B Streaming Hours |

Channels

Roku leverages major brick-and-mortar retailers like Walmart, Best Buy, and Target as crucial channels for its streaming players. This physical retail presence is essential for reaching a broad consumer base, especially for consumers preferring in-store purchases or immediate access. Such partnerships are critical for driving hardware sales and facilitating new user acquisition, contributing significantly to Roku's platform growth. As of early 2024, these retail avenues remain vital for device visibility and accessibility across diverse demographics.

Roku effectively utilizes major online e-commerce platforms, most notably Amazon.com, as a vital distribution channel for its hardware products.

This strategy allows Roku to access a vast online consumer base, crucial for driving sales of its streaming devices and smart TVs.

The reach of platforms like Amazon, which commanded an estimated 37.6% of the US e-commerce market share in 2023, significantly boosts Roku's brand visibility and market penetration.

In 2024, maintaining a strong presence on these marketplaces remains essential for Roku to compete in the crowded streaming hardware landscape and sustain its growth.

Roku operates its Roku.com website to directly sell its streaming players and audio devices, such as the Roku Streambar Pro. This direct-to-consumer channel provides higher margins on hardware sales compared to traditional retail distribution, impacting profitability in 2024. It also allows Roku to establish a direct relationship with customers, gathering valuable insights. The site serves as a central hub for comprehensive product information and support, enhancing the user experience.

Integrated Roku TV OEMs

Integrated Roku TV OEMs represent a crucial and expanding channel for Roku, directly embedding its operating system onto smart TVs from major partners like TCL and Hisense. This pre-installation bypasses the need for consumers to purchase separate streaming hardware, making Roku instantly accessible. This strategy is a powerful driver for platform growth, significantly increasing Roku's reach and active accounts. By early 2024, Roku OS powered over 40% of smart TVs sold in the U.S., establishing a dominant market presence.

- Roku OS pre-installed on TVs from partners such as TCL, Hisense, and Onn.

- Eliminates the need for separate streaming devices, simplifying user access.

- Drives substantial growth in active accounts, reaching 81.6 million by Q1 2024.

- Contributed to over 30.8 billion hours streamed on the platform in Q1 2024.

Direct Ad Sales Force & Programmatic Platforms

Roku leverages a direct ad sales force to forge relationships with major brands and advertising agencies, securing significant advertising commitments. Complementing this, its proprietary programmatic ad platform, OneView, enables advertisers to purchase inventory efficiently through automated processes. These channels are paramount for generating platform revenue, which continues to be Roku's largest segment. For example, in Q1 2024, Roku's platform revenue reached $754.7 million, up 19% year-over-year, showcasing the effectiveness of these sales channels in driving financial performance.

- Roku's direct ad sales force targets major brands and agencies.

- OneView, Roku's programmatic ad platform, facilitates automated ad inventory purchases.

- Platform revenue, primarily from advertising, was $754.7 million in Q1 2024.

- These channels are critical for Roku's overall revenue growth and profitability.

Roku employs a diversified channel strategy, utilizing major brick-and-mortar retailers, prominent online e-commerce platforms like Amazon, and its direct-to-consumer website, Roku.com, for hardware distribution. A significant channel is the integration of Roku OS into smart TVs from OEMs like TCL, which accounted for over 40% of U.S. smart TV sales by early 2024. Furthermore, Roku's direct ad sales force and programmatic platform are crucial channels for monetizing its platform. These diverse channels collectively drive hardware sales, expand active accounts, and generate substantial platform revenue.

| Channel Type | Key Partners/Method | Impact (2024 Data) |

|---|---|---|

| Hardware Distribution | Brick-and-mortar (Walmart), Online (Amazon), Direct (Roku.com) | Amazon's 2023 US e-commerce share: 37.6% |

| Platform Growth | Integrated Roku TV OEMs (TCL, Hisense) | Over 40% of U.S. smart TVs powered by Roku OS (early 2024) |

| Revenue Generation | Direct Ad Sales, OneView Programmatic Platform | Q1 2024 Platform Revenue: $754.7 million |

Customer Segments

Streaming Media Consumers represent Roku's largest customer segment, encompassing individuals and households who actively use Roku devices or Roku TVs for content streaming.

This group includes cord-cutters, cord-nevers, and traditional TV viewers seeking an enhanced experience.

As of Q1 2024, Roku reported 81.6 million active accounts, underscoring the size of this audience.

These consumers are the primary audience Roku monetizes through advertising, content distribution, and subscription services on its platform.

Advertisers and brands represent a core business-to-business customer segment for Roku, encompassing companies and their advertising agencies. These entities actively seek to engage the vast streaming media consumer base available through Roku's platform. They purchase ad inventory to promote their products and services, making this segment the primary driver of Roku's platform revenue. In 2023, Roku's platform revenue, largely from advertising, reached $2.9 billion, underscoring its critical importance. For Q1 2024, platform revenue continued strong at $754.9 million.

Content publishers and media companies, from major studios to niche creators, use Roku to distribute their content. They leverage the platform to build streaming channels and reach Roku's substantial active account base, which stood at 81.6 million globally in Q1 2024. Roku generates revenue from these partners through revenue-sharing agreements and distribution fees, contributing significantly to its platform revenue. This symbiotic relationship ensures a diverse content library for users and broad reach for publishers, driving platform engagement.

TV Original Equipment Manufacturers (OEMs)

TV Original Equipment Manufacturers (OEMs) represent a crucial B2B customer segment for Roku. These television manufacturers license the Roku OS, integrating it as the smart platform within their TVs, enhancing product competitiveness. For these OEMs, Roku acts as a vital technology supplier, providing a robust and user-friendly operating system. By early 2024, Roku announced over 800 models of Roku TVs from more than 15 brands globally, showcasing the breadth of these partnerships.

- By Q1 2024, Roku had 81.6 million active accounts, many facilitated by Roku OS TVs.

- Roku OS powers popular TV brands like TCL, Hisense, and Sharp in various markets.

- Roku's platform revenue, driven partly by OS licensing and advertising on these devices, was $882 million in 2023.

- The prevalence of Roku OS in smart TVs contributes significantly to Roku's overall market penetration.

Users of The Roku Channel (Free Content Seekers)

Users of The Roku Channel are a key customer segment primarily drawn to its extensive library of free, ad-supported content. This segment is highly valuable as their viewership directly generates ad inventory, which Roku controls and monetizes at significant margins, driving platform revenue. Their engagement is crucial for scaling advertising income. Roku reported 81.6 million active accounts as of Q1 2024, with streaming hours reaching 29.5 billion, underscoring the broad reach of its ad-supported ecosystem.

- Roku's active accounts hit 81.6 million as of Q1 2024, many of whom engage with free content.

- Streaming hours reached 29.5 billion in Q1 2024, contributing to ad inventory.

- Platform revenue, largely driven by advertising, was $700 million in Q1 2024.

- The Roku Channel is central to Roku's strategy for high-margin ad monetization.

Roku primarily serves streaming media consumers, reaching 81.6 million active accounts as of Q1 2024, who are monetized through advertising and content. Key business customers include advertisers, driving platform revenue, and content publishers utilizing the vast user base for distribution. TV OEMs also license the Roku OS, integrating it into over 800 TV models by early 2024, expanding Roku's ecosystem.

| Customer Segment | Q1 2024 Data | Monetization |

|---|---|---|

| Streaming Media Consumers | 81.6M Active Accounts | Advertising, Subscriptions |

| Advertisers & Brands | $754.9M Platform Revenue | Ad Inventory Sales |

| Content Publishers | 29.5B Streaming Hours | Revenue Sharing, Fees |

Cost Structure

The Cost of Revenue for Roku's Platform segment primarily covers expenses directly tied to generating platform income, notably content acquisition for The Roku Channel. This includes significant revenue-sharing arrangements with content publishers, which are based on advertising generated on their channels. Operating the robust advertising platform itself also contributes to these costs. This component represents a substantial and growing portion of Roku's overall cost structure, reflecting its focus on content and advertising monetization.

Roku's Cost of Revenue: Player primarily covers expenses tied to manufacturing and delivering its streaming hardware, including components, assembly, and global logistics. Roku strategically prices these devices, often at low margins or as loss leaders, to accelerate user acquisition. For instance, in Q1 2024, Roku reported player segment revenue of $85.3 million against a cost of revenue of $106.6 million, reflecting a negative gross margin for the segment. This approach views player costs as a crucial investment to expand the active account base. Ultimately, this drives higher-margin platform revenue from advertising and subscriptions.

Research and Development (R&D) represents a significant operating expense for Roku, crucial for innovating and maintaining its Roku OS, advertising platform, and hardware. This cost structure primarily encompasses salaries for its extensive team of engineers and developers. Roku's investment in R&D is critical for sustaining its competitive edge in the streaming market, ensuring continuous improvement and new feature development. For instance, Roku reported R&D expenses of $219.7 million in Q1 2024, highlighting its ongoing commitment to technological advancement.

Sales and Marketing (S&M)

Roku’s Sales and Marketing (S&M) costs encompass significant advertising expenses, particularly for promoting its streaming devices and platform services across various media channels. These costs also cover retail channel marketing efforts to ensure product visibility and availability in stores, driving user acquisition. A substantial portion is allocated to the salaries of sales and marketing teams responsible for brand building and selling advertising inventory to brands and agencies. For instance, in Q1 2024, Roku reported S&M expenses of $187.9 million, reflecting ongoing investments in user growth and platform monetization.

- Advertising campaigns across digital and traditional media.

- Retail promotions and merchandising for Roku devices.

- Salaries and commissions for global sales and marketing personnel.

- Brand building initiatives to expand market share.

General and Administrative (G&A)

General and Administrative (G&A) expenses for Roku encompass the essential overhead costs of running the entire business, separate from direct production or sales activities. These include crucial functions such as finance, legal, human resources, and executive compensation, all necessary to support the company's broad operations.

For instance, Roku reported G&A expenses of $132.3 million in the first quarter of 2024, reflecting the ongoing investment in corporate infrastructure. These costs are vital for maintaining organizational stability and compliance as Roku expands its platform and device ecosystem.

- Finance and accounting operations ensure fiscal health and reporting accuracy.

- Legal teams manage intellectual property and regulatory compliance.

- Human resources oversee talent acquisition, development, and employee welfare.

- Executive salaries compensate leadership for strategic direction.

Roku's cost structure balances high-margin platform revenue with strategic player segment losses to drive user acquisition. Significant investments in R&D, like $219.7 million in Q1 2024, ensure competitive technology. Sales and marketing expenses, at $187.9 million in Q1 2024, are crucial for growth, alongside G&A maintaining corporate infrastructure.

| Cost Category | Q1 2024 Expense (Millions) | Primary Function |

|---|---|---|

| Cost of Revenue: Platform | $332.9 | Content acquisition, ad platform operations |

| Cost of Revenue: Player | $106.6 | Device manufacturing, logistics (loss leader) |

| Research and Development | $219.7 | OS and platform innovation, competitive edge |

| Sales and Marketing | $187.9 | User acquisition, ad inventory sales |

| General and Administrative | $132.3 | Corporate overhead, support functions |

Revenue Streams

Platform Advertising Revenue is Roku's largest and most vital income stream, generated by selling video and display ad inventory across its platform. This includes ads on The Roku Channel and within ad-supported partner channels. This high-margin revenue is the core driver of profitability, with Roku reporting platform revenue, largely advertising, reaching $828 million in Q1 2024, reflecting its continued growth and dominance.

Roku generates significant revenue by distributing content publishers' services and applications on its platform. This includes a share of subscription fees and transaction revenues processed seamlessly through Roku Pay. For instance, in Q1 2024, platform revenue, which largely encompasses this stream along with advertising, grew 19% year-over-year to $754.9 million. This revenue stream directly benefits from the continued expansion and adoption of the overall streaming market, driving higher engagement and monetization opportunities for Roku.

Roku generates revenue from the sale of its physical streaming players, sticks, and audio products. While these player hardware sales contribute significantly in absolute terms, it remains a low-margin business for the company. Its primary strategic purpose is to expand Roku's user base, acquiring new customers who then engage with the high-margin platform segment. For instance, in Q1 2024, player revenue was $83.6 million, reflecting this essential user acquisition role rather than significant profitability.

Roku OS Licensing Fees

Roku generates revenue by licensing its operating system to TV OEM partners, embedding Roku OS directly into smart TVs. This creates a recurring revenue stream tied to the TV manufacturing cycle, which is a crucial element of Roku's platform growth strategy. By 2024, Roku OS powered a significant share of smart TVs sold in North America, expanding its user base without direct hardware sales. This strategy diversifies Roku's income beyond advertising, ensuring a steady flow from its foundational technology.

- Roku OS licensing contributed to platform revenue, which reached approximately $2.6 billion in 2023.

- OEM partnerships significantly expanded Roku's active accounts, reaching 81.6 million globally by Q1 2024.

- The strategy reduced customer acquisition costs by leveraging TV manufacturer distribution channels.

- Roku OS maintained its position as the top-selling smart TV OS in the US for several years, including 2024 projections.

Branded Content & Promotions

Roku generates significant revenue from branded content and promotional placements. This includes prominent spots on its home screen, sponsored content discovery, and even branded channel buttons on remotes. By leveraging its prime digital real estate, Roku secures high-margin revenue from partners seeking increased visibility for their content. This segment is a growing component of platform revenue, which reached 731.5 million USD in Q1 2024, demonstrating a 19% year-over-year increase.

- Roku earns revenue from promotional placements on its home screen.

- Branded channel buttons on remotes contribute to this revenue stream.

- Sponsored content discovery leverages Roku's prime digital real estate.

- Platform revenue, driven by advertising, grew 19% year-over-year to 731.5 million USD in Q1 2024.

Roku primarily generates revenue from its high-margin platform, largely driven by digital advertising and content distribution fees from publishers. Player hardware sales, while lower margin, are essential for user acquisition. Roku OS licensing to TV manufacturers further expands its user base and recurring income. Promotional placements also contribute significantly to its platform revenue.

| Revenue Stream | Q1 2024 Value | Notes |

|---|---|---|

| Platform Revenue | $754.9M | Includes advertising, content distribution |

| Player Revenue | $83.6M | Primarily for user acquisition |

| Total Active Accounts | 81.6M | Global accounts by Q1 2024 |

Business Model Canvas Data Sources

The Roku Business Model Canvas is informed by a blend of internal financial reports, user engagement metrics, and market research on connected TV advertising. These diverse data streams ensure a comprehensive understanding of Roku's ecosystem.