Guangzhou R&F PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou R&F Bundle

Navigate the complex external landscape impacting Guangzhou R&F with our comprehensive PESTLE analysis. Understand the political shifts, economic volatilities, social trends, technological advancements, environmental regulations, and legal frameworks that are shaping the company's trajectory. Gain a critical advantage by uncovering potential opportunities and mitigating unforeseen risks. This expert-crafted analysis is your essential tool for informed strategic decision-making.

Unlock a deeper understanding of the forces at play for Guangzhou R&F. Our PESTLE analysis delves into how government policies, market dynamics, consumer behavior, and industry innovations are influencing the real estate giant. Equip yourself with actionable intelligence to refine your strategies and stay ahead of the curve. Download the full version now for unparalleled market clarity.

Political factors

The Chinese government is actively intervening to stabilize its struggling real estate market, a sector that has seen a significant downturn since 2021. As of mid-2024, these efforts include reducing mortgage interest rates, with some cities seeing rates drop below 3%, and lowering down payment ratios for first-time homebuyers to as low as 15%. Furthermore, financial support is being channeled to local governments, enabling them to acquire unsold properties from developers, a strategy designed to alleviate developer debt and reduce excess inventory.

These stabilization policies are crucial for Guangzhou R&F, as they directly impact market demand and developer liquidity. By easing financing conditions and providing a mechanism for inventory reduction, the government aims to prevent further price erosion and rebuild confidence among potential buyers. The success of these measures in 2024 and into 2025 will be a key determinant in the sector's recovery and, by extension, R&F's ability to navigate its financial challenges.

New government directives set for 2025 are targeting the optimization of urban spatial structures and land use in Guangzhou. A key focus will be on maximizing the utility of existing land resources and the redevelopment of urban villages, aiming to create more efficient city layouts. This strategic shift will likely influence how developers, including Guangzhou R&F, approach new projects and resource allocation within the city.

Furthermore, there's a significant push to increase the supply of affordable housing, a directive that could reshape the real estate landscape. Developers might find themselves incentivized or even mandated to allocate a portion of their projects towards affordable housing solutions. This could potentially shift Guangzhou R&F's development focus towards segments that align with these new housing policies, impacting their project pipelines and market positioning.

The Chinese government is actively using its real estate financing coordination mechanism to ensure that housing projects are completed on schedule and to stop more real estate companies from defaulting on their debts. This includes expanding the list of projects that can receive financial help.

Guangzhou R&F, a major developer, has been working through a significant restructuring of its offshore debt, reflecting the widespread financial difficulties in the real estate sector and the government's focus on stabilizing it. For instance, by late 2023, the company was still negotiating with creditors to manage its substantial liabilities, estimated to be in the tens of billions of dollars.

Foreign Investment Policy Adjustments

China's ongoing efforts to refine its foreign investment landscape, particularly through 2024 and 2025, involve actively lowering barriers and expanding market access. This strategic pivot aims to attract more foreign direct investment (FDI), as evidenced by the implementation of the Foreign Investment Law and supporting regulations designed to streamline processes.

Despite these liberalizations, certain sectors remain subject to national security reviews and are categorized within 'Negative Lists,' which can present hurdles for international collaboration. For Guangzhou R&F, this means careful navigation when seeking foreign capital or forming international partnerships, especially in sensitive or strategically important industries.

These policy adjustments directly influence Guangzhou R&F's strategic options:

- Attracting FDI: Reduced restrictions enhance the potential for securing foreign capital for new developments and existing projects.

- Market Access: Expanded market access can open doors for international joint ventures or acquisitions in previously restricted sectors.

- Regulatory Compliance: Navigating security reviews and 'Negative Lists' remains crucial to avoid project delays or rejections.

Geopolitical Risks and Trade Conflicts

Global geopolitical tensions and ongoing trade disputes are casting a shadow over international investment, particularly concerning China. This heightened uncertainty often prompts governments to adopt more cautious policy stances, which can directly affect capital flows into markets like China’s real estate sector.

For companies with international operations, such as Guangzhou R&F, this broader global unease can significantly dampen investor confidence. The impact is a potential slowdown in investment and a more hesitant approach from international capital, impacting the company's ability to secure funding and pursue growth opportunities.

- Global Uncertainty: Increased geopolitical risks, including regional conflicts and trade friction, create a less predictable environment for international businesses.

- Investor Sentiment: Negative sentiment stemming from these risks can lead to reduced foreign direct investment (FDI) into China, affecting sectors like real estate.

- Policy Caution: Governments worldwide are re-evaluating their economic ties and investment strategies, potentially leading to tighter regulations or increased scrutiny on cross-border capital movements.

- Impact on Guangzhou R&F: Guangzhou R&F, with its international exposure, faces challenges in attracting foreign capital and maintaining investor trust amidst these geopolitical headwinds.

Government intervention to stabilize the real estate market through lower mortgage rates and down payment reductions is a key political factor for Guangzhou R&F. The state's active role in coordinating financing for stalled projects, as seen in late 2023 and continuing through 2024, aims to prevent further developer defaults and ensure project completion.

New urban planning directives for 2025 in Guangzhou focus on efficient land use and redevelopment, which will shape how developers like R&F approach new projects and resource allocation. Simultaneously, policies promoting affordable housing supply could redirect development strategies toward segments that align with these governmental priorities.

China's efforts to attract foreign investment by lowering barriers by 2024-2025 present opportunities for Guangzhou R&F to secure capital. However, national security reviews and 'Negative Lists' for certain sectors necessitate careful navigation for international partnerships, impacting R&F's strategic options.

Global geopolitical tensions and trade disputes create a cautious environment for international investment into China, potentially slowing capital flows into the real estate sector. This broader unease can affect Guangzhou R&F's ability to attract foreign capital and maintain investor confidence.

What is included in the product

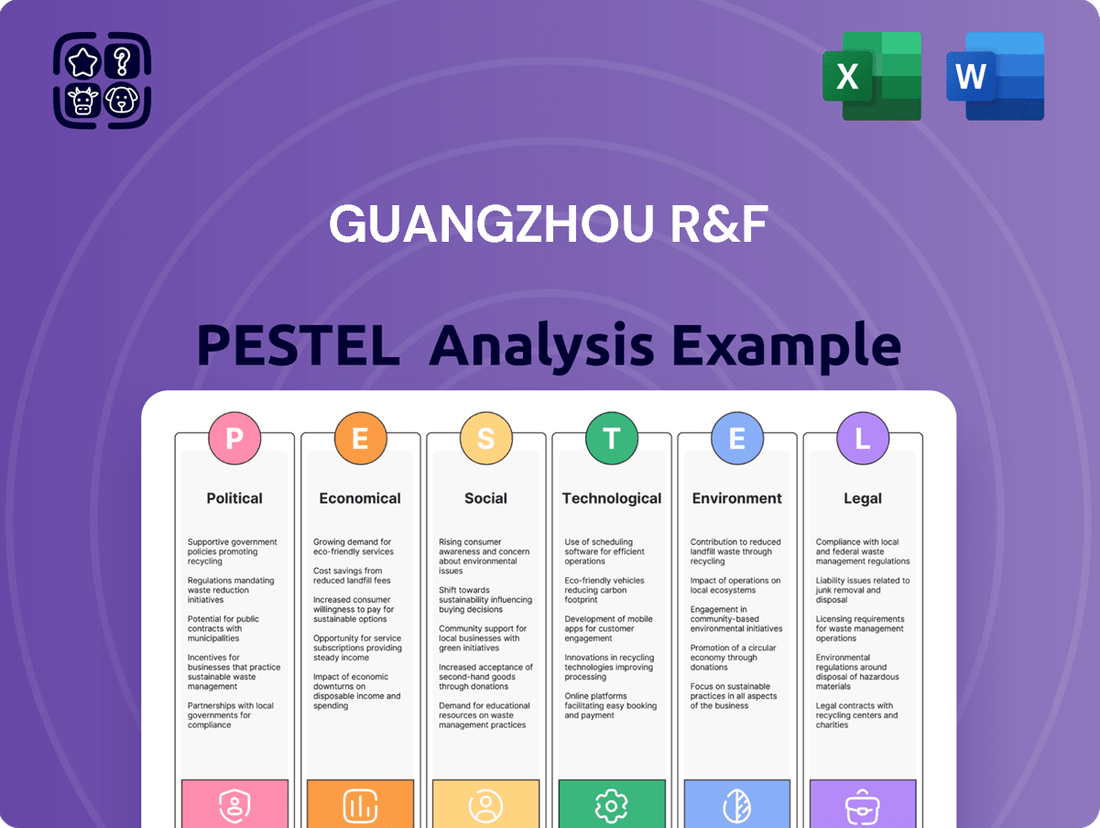

This PESTLE analysis of Guangzhou R&F examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, providing a comprehensive view of the external landscape.

A Guangzhou R&F PESTLE Analysis provides a structured framework to identify and address potential external threats and opportunities, relieving the pain point of navigating complex market dynamics by offering actionable insights for strategic decision-making.

Economic factors

China's property sector is navigating a significant downturn, with widespread price declines persisting through 2024. New home prices saw a notable drop, a trend anticipated to continue into 2025, though the pace of decline might moderate.

Guangzhou, as a first-tier city, is experiencing a slight easing in its property price drops. However, the broader market challenges remain substantial, fueled by elevated inventory levels and a generally cautious consumer sentiment.

The People's Bank of China has actively pursued policies to reduce mortgage interest rates, a significant move impacting homebuyers. In May 2025, they enacted substantial cuts to personal housing provident fund loans, a key initiative designed to alleviate financial pressure on those purchasing homes.

These policy adjustments are vital for enhancing housing affordability across Guangzhou and the broader Chinese market. By lowering borrowing costs, the aim is to stimulate demand within the real estate sector, contributing to its overall stability.

Consumer confidence, especially concerning household wealth and property values, is crucial for Guangzhou's market rebound. Early 2025 surveys suggest a slight improvement in consumer mood, but persistent job worries and declining real estate values are still holding back spending.

For instance, the Guangzhou Consumer Confidence Index, while showing signs of leveling off in Q1 2025, still reflects underlying caution. This hesitancy directly impacts discretionary spending, a key driver for many sectors within Guangzhou's economy, including retail and tourism.

The real estate sector's performance significantly influences consumer spending power. As of mid-2025, average property prices in Guangzhou have seen a modest decrease year-on-year, impacting the perceived wealth of many households and leading to more conservative spending habits.

This cautious spending environment translates into a more selective approach from consumers. Businesses in Guangzhou are observing a trend towards prioritizing essential goods and services, with less emphasis on luxury or non-essential purchases, directly affecting revenue streams for many companies.

Developer Liquidity and Debt Restructuring

Developer liquidity remains a critical concern, with many major property firms, including Guangzhou R&F, grappling with significant debt defaults and actively engaged in restructuring. This financial strain is a pervasive issue across the sector.

Guangzhou R&F, for instance, experienced a substantial downturn in contracted sales during 2024. Its ability to manage near-term obligations hinges heavily on effectively reducing existing inventory and liquidating current assets, underscoring the severe financial pressures the industry is facing.

- Debt Defaults: Numerous large property developers have defaulted on their debt obligations, necessitating complex restructuring agreements.

- Sales Decline: Guangzhou R&F saw a significant drop in contracted sales in 2024, indicating reduced market demand and developer revenue.

- Liquidity Reliance: The company's immediate financial health is dependent on selling off existing properties and managing inventory turnover.

- Sector-Wide Strain: These challenges reflect a broader liquidity crisis affecting many participants in the property development market.

GDP Growth and Economic Rebalancing

China's economic trajectory is set for continued growth, with projections indicating a GDP expansion of approximately 4.7% for 2025. This growth is underpinned by a strategic focus on maintaining economic stability and stimulating domestic consumption.

The real estate sector's challenges have been a significant drag on overall GDP, highlighting the government's urgent priority to stabilize this market. Successfully rebalancing the economy away from investment and towards consumption is crucial for achieving these growth targets.

- Projected 2025 GDP Growth: Around 4.7% for China.

- Key Economic Driver: Emphasis on domestic demand and consumption.

- Major Economic Challenge: Downturn in the real estate market impacting GDP.

- Government Priority: Stabilizing the real estate sector for economic rebalancing.

China's economic growth is projected at around 4.7% for 2025, with a strong emphasis on boosting domestic consumption to offset the drag from the struggling property sector. The People's Bank of China's policy moves, like significant cuts to housing provident fund loan rates in May 2025, aim to improve housing affordability and stimulate demand. Despite these efforts, consumer confidence in Guangzhou remains subdued, influenced by job market uncertainties and declining property values, leading to more cautious spending habits. Developer liquidity issues persist, with companies like Guangzhou R&F facing debt challenges and relying on asset liquidation to manage obligations.

| Economic Indicator | Value/Trend (2024-2025) | Impact on Guangzhou R&F |

|---|---|---|

| China GDP Growth Projection | ~4.7% (2025) | Broader economic health supports market demand, though sector-specific issues are critical. |

| Property Price Trend (Guangzhou) | Slight easing of declines | May indicate stabilizing local demand, but overall market weakness persists. |

| Mortgage Interest Rates | Reduced (e.g., Provident Fund Loans cut May 2025) | Aims to increase affordability, potentially boosting buyer interest and sales. |

| Consumer Confidence Index (Guangzhou) | Slight improvement but cautious | Directly impacts purchasing power for new homes and discretionary spending. |

| Developer Liquidity Issues | Widespread, including debt defaults | Creates significant operational and financial challenges for Guangzhou R&F, impacting project delivery and sales. |

Full Version Awaits

Guangzhou R&F PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Guangzhou R&F PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. You'll gain valuable insights into the market dynamics and challenges faced by Guangzhou R&F. What you're previewing here is the actual file—fully formatted and professionally structured, offering a complete picture of the PESTLE factors.

Sociological factors

While China's overall urbanization rate growth is slowing, it still reached approximately 65.22% by the end of 2023, according to the National Bureau of Statistics. This continued, albeit slower, trend means a consistent influx into cities. Guangzhou R&F, like other developers, will see this drive demand for housing in urban centers.

Household formation in China remains robust, with an increasing number of smaller, independent households emerging. This demographic shift is key. It means that demand is gradually moving away from sheer size and more towards quality, amenities, and efficient living spaces. Guangzhou R&F will likely focus its development efforts on properties catering to these evolving preferences, particularly in economically vibrant, higher-tier cities.

Consumer demand in Guangzhou is increasingly prioritizing health and sustainability in housing. This means a growing preference for eco-friendly materials, energy-efficient designs, and properties that promote well-being. For instance, a 2024 survey indicated that over 60% of potential homebuyers in major Chinese cities, including Guangzhou, consider green building certifications a key factor in their decision-making process.

The integration of smart home technology is also becoming a significant driver of housing preferences. Buyers are looking for convenience and enhanced security, with features like automated lighting, climate control, and advanced security systems becoming more desirable. This trend is reflected in the rapid growth of the smart home market, which is projected to reach over $10 billion in China by 2025, showcasing a clear shift in what consumers expect from residential properties.

There's a growing push from both the government and society in China to build more affordable housing and improve existing neighborhoods. This trend is particularly relevant in major cities like Guangzhou, where rising living costs are a concern. For instance, by the end of 2024, many Chinese cities were implementing policies to encourage the development of rental housing and renovate older urban areas, directly addressing the demand for better quality and more accessible homes.

This societal shift creates a significant market opportunity for real estate developers like Guangzhou R&F. By focusing on projects that cater to the demand for affordable and quality housing, companies can tap into a large and motivated segment of the urban population. This aligns with national development goals and can lead to increased sales and improved brand reputation within the sector.

Impact of Debt Crisis on Public Sentiment

The severe downturn in Guangzhou's property market, marked by developer defaults, has created a deep sense of unease among the public. This crisis has significantly eroded trust in the presale system, a common practice where buyers purchase properties before construction is complete. For instance, by mid-2024, a substantial portion of presale projects in major Chinese cities, including Guangzhou, faced delays or cancellations, directly impacting hundreds of thousands of homebuyers and their savings.

This loss of confidence directly translates to a sharp decline in consumer sentiment regarding real estate purchases. Many potential buyers are now hesitant to commit to new projects, fearing similar financial losses. This reluctance is a major hurdle for market stabilization, as buyer demand is essential for absorbing existing inventory and encouraging new development.

Restoring public trust is therefore paramount for Guangzhou's property sector. This will likely require robust government intervention and stricter regulations on developers to ensure project completion and protect consumer investments. Without this renewed confidence, the property market will struggle to recover, impacting broader economic sentiment.

- Erosion of Trust: Developer defaults have made consumers wary of the presale model.

- Impact on Confidence: Buyer sentiment has plummeted due to financial anxieties.

- Market Stabilization Needs: Restoring confidence is key to stimulating demand.

- Future Outlook: Regulatory reforms are crucial for rebuilding trust and reviving the market.

Lifestyle Trends and Mixed-Use Developments

Lifestyle trends are increasingly pushing for more integrated living and working environments. This means people want places where they can live, work, shop, and play all within close proximity, leading to a surge in demand for mixed-use developments. Guangzhou R&F Properties, as a major player in the real estate sector, is well-positioned to capitalize on this shift by incorporating these elements into its projects.

This growing demand for flexibility and convenience directly influences the commercial property segment. Developers like Guangzhou R&F are seeing a greater need to create spaces that aren't just offices or retail outlets but holistic environments. For instance, in 2024, the commercial real estate market in major Chinese cities continued to see a preference for well-located, mixed-use properties offering amenities that support work-life balance.

The appeal of mixed-use developments lies in their ability to cater to diverse needs and foster vibrant communities.

- Increased demand for flexible workspaces: Companies are seeking adaptable office layouts that can accommodate hybrid work models.

- Integration of residential, retail, and office spaces: This creates self-sufficient communities and enhances convenience for residents and workers.

- Focus on lifestyle amenities: Developments incorporating green spaces, entertainment, and dining options are more attractive.

- Growing preference for transit-oriented developments: Properties with easy access to public transportation are highly sought after, aligning with sustainable lifestyle choices.

The severe downturn in Guangzhou's property market has deeply shaken public confidence, particularly concerning the presale system. By mid-2024, many presale projects in major Chinese cities, including Guangzhou, experienced significant delays or cancellations, impacting hundreds of thousands of homebuyers.

This loss of trust has led to a sharp decline in consumer sentiment, making potential buyers hesitant due to fears of financial losses. Restoring this confidence is crucial for market stabilization and requires robust government intervention and stricter developer regulations.

Societal shifts also favor mixed-use developments that integrate living, working, and leisure. This trend is evident in the continued preference for well-located properties offering amenities that support work-life balance in major Chinese cities throughout 2024.

| Sociological Factor | Impact on Guangzhou R&F | 2024/2025 Data/Trend |

|---|---|---|

| Erosion of Trust (Presale System) | Decreased buyer willingness, increased demand for transparency and guarantees. | Mid-2024: Significant presale project delays/cancellations in major Chinese cities. |

| Shifting Lifestyle Preferences | Increased demand for mixed-use developments, flexible workspaces, and integrated communities. | 2024: Continued preference for properties supporting work-life balance in urban centers. |

| Focus on Affordability and Quality | Opportunity for developments catering to budget-conscious buyers and those seeking improved living conditions. | End of 2024: Cities implementing policies for rental housing and urban area renovation. |

Technological factors

Guangzhou R&F, like many real estate developers, is navigating the increasing adoption of smart building technologies across China. The smart building market there is experiencing robust growth, fueled by significant government backing for sustainable development initiatives and ambitious smart city projects. This trend is directly impacting how buildings are designed, managed, and operated.

Key technologies like the Internet of Things (IoT), artificial intelligence (AI), cloud computing, and sophisticated sensors are becoming standard integrations. These advancements are not just about convenience; they are crucial for optimizing energy management, bolstering security systems, and automating various building functions. For instance, by 2025, China's smart building market is projected to reach approximately USD 46 billion, up from USD 20 billion in 2020, showcasing a compound annual growth rate of over 18%.

The integration of these technologies enhances overall building efficiency and promotes greater sustainability. This means lower operational costs, improved occupant comfort, and a reduced environmental footprint, all factors that can influence property valuations and tenant appeal. Guangzhou R&F's strategic decisions regarding smart technology implementation will therefore be critical for maintaining competitiveness in the evolving real estate landscape.

Proptech innovations, such as AI-driven design tools and advanced robotics in construction, are significantly impacting how real estate is developed and managed. For Guangzhou R&F, these technologies offer a path to enhanced operational efficiency and precision in its vast portfolio. For instance, the adoption of digital twins allows for real-time monitoring and predictive maintenance, potentially reducing operational costs by up to 20% in large-scale developments.

The integration of robotics in construction sites, a growing trend globally, can improve project timelines and site safety. Guangzhou R&F could see faster completion rates for its new builds, estimated to be 10-15% quicker with robotic assistance for tasks like bricklaying and surveying. This technological shift also promises higher quality finishes and a safer working environment for construction crews.

The demand for sustainable construction is accelerating, with a growing preference for low-carbon and energy-efficient materials and systems. This includes innovations like green roofs and integrated photovoltaic roofing solutions that contribute to both environmental goals and operational cost savings.

China's commitment to environmental sustainability is a significant driver. By 2025, new urban buildings are mandated to meet stringent green building standards. This policy directly fosters market opportunities for companies like Guangzhou R&F that can supply and integrate eco-friendly construction materials and advanced building systems.

The global green building materials market was valued at approximately $255.5 billion in 2023 and is projected to reach $447.8 billion by 2028, growing at a compound annual growth rate of 11.9%. This trend signifies substantial growth potential for businesses aligning with these technological advancements.

Construction Automation and Robotics

The construction industry in China, including areas like Guangzhou, is seeing a significant uptake in industrial robots. This automation is not just about efficiency; it’s about improving the precision and overall quality of building projects, while also making job sites much safer. For developers in Guangzhou R&F's operating regions, this means a pathway to more cost-effective construction methods.

Government initiatives, such as the ambitious Made in China 2025 strategy, are actively promoting the integration of robotics across various sectors, with construction being a key focus. This policy support is a crucial driver for increased investment in automated construction technologies, potentially lowering project costs and speeding up delivery times.

- Increased Robot Adoption: The number of industrial robots deployed in China's manufacturing and construction sectors has been steadily climbing, with projections indicating continued growth through 2025.

- Efficiency Gains: Studies suggest that robotic automation in construction can improve productivity by up to 30% on certain tasks.

- Cost Reduction Potential: While initial investment can be high, automated processes are expected to reduce labor costs and material waste in the long term, making projects more economically viable.

- Policy Support: Government incentives and R&D funding for robotics are designed to accelerate the adoption of advanced manufacturing and construction techniques.

Data Analytics and Building Management Systems

Guangzhou R&F, like many real estate developers, is increasingly leveraging advanced data analytics and sophisticated building management systems (BMS) to enhance property performance. These technologies are vital for optimizing energy consumption, a key operational cost. For instance, a 2024 report indicated that smart building technologies can reduce energy usage by as much as 30% in commercial properties, directly impacting profitability and sustainability.

The integration of real-time data collection and analysis within BMS allows for predictive maintenance, minimizing costly downtime and unexpected repairs. This proactive approach not only saves money but also ensures a better experience for tenants. By monitoring equipment health, R&F can anticipate failures, leading to more efficient resource allocation and improved asset longevity.

Intelligent decision-making powered by data analytics translates into significant operational efficiencies. For example, in 2024, the global building management system market was valued at approximately USD 8.5 billion, with a projected compound annual growth rate of over 12%, highlighting the significant investment and expected returns in this sector. This growth underscores the critical role these systems play in modern property management.

- Energy Optimization: Data analytics can identify patterns in energy usage, allowing for automated adjustments to lighting, HVAC, and other systems to reduce waste.

- Predictive Maintenance: Sensors integrated into BMS can detect anomalies in equipment performance, predicting potential failures before they occur.

- Operational Cost Reduction: By improving efficiency and preventing breakdowns, these systems directly contribute to lower operating expenses for Guangzhou R&F properties.

- Enhanced Tenant Experience: Consistent building performance and comfort, driven by data-driven management, lead to higher tenant satisfaction and retention.

The increasing integration of smart building technologies, including IoT and AI, is transforming real estate development. By 2025, China's smart building market is projected to reach USD 46 billion, a significant increase from USD 20 billion in 2020, reflecting a strong growth trend driven by smart city initiatives.

Proptech innovations like AI-powered design and robotics in construction are boosting efficiency. For instance, digital twins can cut operational costs by up to 20%, and robotic automation in construction could speed up project completion by 10-15% while enhancing safety and quality.

| Technology Area | 2024/2025 Projection/Data | Impact on Guangzhou R&F |

|---|---|---|

| Smart Building Market (China) | USD 46 billion by 2025 | Drives adoption of integrated building management systems for efficiency and sustainability. |

| Robotics in Construction | Potential 10-15% faster project completion | Improves project timelines, site safety, and quality of builds. |

| Building Management Systems (BMS) Market (Global) | USD 8.5 billion in 2024, 12% CAGR | Enables data-driven optimization of energy usage and predictive maintenance, reducing operational costs. |

Legal factors

China's real estate regulatory landscape is a dynamic space, with local governments actively shaping policies. In 2024, many cities rolled out measures aimed at boosting property market activity. These included easing restrictions on home purchases and modifying deed tax regulations, showing a clear intent to stimulate transactions.

These evolving regulations directly influence how property sales and investment opportunities unfold. For instance, the relaxation of purchase limits in several major cities during early 2024 has been observed to correlate with a modest uptick in transaction volumes in those specific areas, offering a more favorable environment for buyers and developers alike.

China's Foreign Investment Law (FIL), enacted in 2020, along with its associated 'Negative List', plays a crucial role in shaping foreign investment opportunities, particularly in sectors like real estate development. This framework explicitly delineates industries where foreign participation is either limited or entirely disallowed, requiring meticulous attention from international developers or those seeking foreign capital. For instance, the 2021 version of the Negative List continued to phase out restrictions in areas like value-added telecommunications services and financial services, though specific caveats remained for sectors like real estate brokerage and development.

Navigating these regulations is paramount for companies like Guangzhou R&F Properties, which has international projects and relies on foreign capital. While China's stated goal is to attract foreign investment by progressively easing restrictions, the FIL's negative list system creates a dynamic legal landscape. For 2024 and looking into 2025, developers must stay abreast of any updates to these lists, as they directly impact market access and the feasibility of foreign capital infusions into specific real estate sub-sectors or geographic regions within China.

Guangzhou R&F's ongoing offshore debt restructuring highlights the crucial influence of legal frameworks on managing developer defaults. These complex processes depend heavily on legally binding agreements and court-supervised procedures to ensure all debtholders are accounted for and their rights protected. As of early 2024, the company was still navigating these intricate legal pathways.

Environmental Protection Laws and Building Standards

China's intensifying focus on environmental protection is significantly reshaping the real estate sector. Stricter regulations are compelling developers to adopt renewable materials and adhere to new carbon-neutral construction standards, with substantial penalties for non-compliance. This shift is driven by national objectives like the '14th Five-Year Plan for Building Energy Conservation and Green Building Development,' which targets green building standards for all new urban constructions by 2025.

Compliance with these evolving environmental protection laws and building standards presents both challenges and opportunities for companies like Guangzhou R&F. The mandate for green buildings implies increased upfront costs for sustainable materials and technologies, potentially impacting project budgets. However, it also opens avenues for innovation and differentiation in a market increasingly valuing eco-friendly properties. For instance, the push for energy efficiency could lead to lower operational costs for buildings over their lifecycle, offering long-term financial benefits.

- Increased Costs: Adoption of renewable materials and green technologies can raise initial construction expenses.

- Regulatory Compliance: Meeting the '14th Five-Year Plan' targets, requiring all new urban buildings to be green by 2025, necessitates significant adaptation.

- Market Demand: Growing consumer and investor preference for sustainable properties creates a competitive advantage for compliant developers.

- Emissions Penalties: Failure to meet emissions standards can result in financial penalties, impacting profitability.

Land Use Rights and Property Ownership

In Guangzhou, adherence to the People's Republic of China's (PRC) laws regarding land use and property ownership is paramount for all stakeholders, especially developers. These regulations dictate that leased properties must be used strictly according to their designated zoning. For instance, a commercial property cannot be converted into residential use without proper legal channels and approvals, impacting project feasibility and potential revenue streams.

A critical aspect for tenants is the prohibition against altering load-bearing structures without explicit landlord consent. This legal constraint ensures the structural integrity of buildings and prevents unauthorized modifications that could lead to safety hazards or legal disputes. Developers must factor these limitations into their design and construction plans from the outset.

Understanding and meticulously complying with these land use regulations and property rights is not merely a procedural step; it is fundamental to the operational success and long-term viability of any development project in Guangzhou. Failure to do so can result in significant penalties, project delays, and even outright cancellation, as seen in past instances where zoning violations led to halted construction.

- Zoning Compliance: Leased premises must match their designated land use zoning under PRC law.

- Structural Integrity: Tenants require landlord approval for any modifications to load-bearing structures.

- Legal Foundation: Developers must prioritize understanding and adhering to land use and property rights laws for project viability.

- Risk Mitigation: Non-compliance can lead to penalties, delays, or project termination.

China's evolving property market regulations continue to shape developer strategies, with a focus on stimulating transactions and managing financial risks. For 2024, many cities relaxed purchase limits and adjusted deed taxes to encourage activity, a trend expected to persist into 2025.

Guangzhou R&F's offshore debt restructuring underscores the critical role of legal frameworks in managing defaults and ensuring debtholder rights, a process that remained ongoing in early 2024.

The nation's increasing environmental protection mandates, including the '14th Five-Year Plan' aiming for all new urban buildings to be green by 2025, present both compliance costs and opportunities for sustainable development.

Strict adherence to PRC laws on land use, zoning, and property rights, including obtaining landlord consent for structural modifications, is vital for project legality and success in Guangzhou.

Environmental factors

China's commitment to environmental sustainability is accelerating, with a national mandate for all new urban buildings to meet green building standards by 2025. This policy shift, moving the focus from mere energy consumption to a building's overall carbon footprint, directly influences construction practices.

Guangzhou R&F, like other developers, must adapt to these evolving standards, which increasingly favor low-carbon materials and energy-efficient designs. The demand for green certifications, such as LEED or China's Three Star system, is rising, impacting material sourcing and construction techniques.

This regulatory push is creating market opportunities for companies offering sustainable building solutions, as adherence to these standards becomes a competitive advantage. The 2025 deadline underscores the urgency for developers to integrate green building principles into their core operations and project planning.

China's ambitious goal to peak carbon emissions by 2030 and achieve carbon neutrality by 2060 significantly impacts the construction industry, including companies like Guangzhou R&F. This national agenda translates into concrete action plans aimed at boosting energy conservation and reducing carbon footprints across all sectors.

These policies are directly pushing real estate developers and construction firms towards adopting low-carbon materials and implementing energy-efficient building designs. For instance, by the end of 2023, China had already seen a substantial increase in the adoption of green building standards, with over 2.5 billion square meters of new construction adhering to these principles.

Guangzhou R&F, like its peers, must navigate these evolving environmental regulations. This means investing in research and development for sustainable building technologies and potentially adapting their project portfolios to align with government mandates on energy efficiency and emissions reduction.

The financial implications are also considerable, as compliance with stricter environmental standards may necessitate upfront investments in new technologies and materials, which could affect project costs and timelines. However, it also presents opportunities for innovation and market differentiation in a sector increasingly scrutinized for its environmental impact.

Guangzhou R&F, like many developers in China, is navigating a significant shift towards sustainable materials and circular construction principles. This emphasis is driven by growing environmental awareness and government policies promoting resource efficiency and waste reduction within the building sector. By 2024, the adoption of green building materials in new constructions across major Chinese cities is expected to reach over 70%, a trend R&F is actively integrating into its development strategies.

The push for a circular economy in construction encourages practices like material reuse and recycling, aiming to minimize landfill waste. Guangzhou R&F is exploring the incorporation of recycled content in its projects and investigating modular construction techniques that facilitate deconstruction and component reuse. This aligns with national targets to reduce construction waste by 10% by 2025, a key environmental objective for the industry.

Climate Change Impacts on Property Development

Climate change presents significant challenges for property development in Guangzhou. Rising sea levels and increased frequency of extreme weather events like typhoons and heavy rainfall, as experienced in recent years, necessitate robust, climate-resilient construction practices. For instance, Guangdong province, where Guangzhou is located, has seen a noticeable uptick in intense rainfall events, impacting urban drainage and infrastructure.

Developers must proactively integrate sustainable design principles and materials to mitigate long-term environmental risks and ensure property longevity. This includes considering factors like flood protection, heat island effects, and the availability of essential resources such as water. Guangzhou's commitment to green building standards, with a target to have over 70% of new buildings meet green building standards by 2025, underscores the growing importance of environmental sustainability in the sector.

- Increased Construction Costs: Implementing climate-resilient features and sustainable materials can lead to higher upfront development costs, potentially impacting project feasibility.

- Regulatory Compliance: Stricter environmental regulations and building codes related to climate change adaptation are likely to be introduced, requiring developers to invest in compliance.

- Market Demand for Green Properties: Growing consumer and investor awareness of climate change is driving demand for properties with strong environmental credentials and resilience.

- Resource Scarcity: Potential shortages or increased costs of water and energy due to climate change impacts could affect construction processes and operational expenses for properties.

Pollution Control and Environmental Compliance

Guangzhou R&F, like other developers in China, faces increasingly stringent environmental regulations. These rules, focused on pollution control, directly impact construction practices and add to operational costs. The government's commitment to ecological civilization means developers must adhere to stricter standards for waste management, air emissions, and water conservation. For instance, by the end of 2023, China had set targets to reduce major pollutant emissions, impacting construction material sourcing and site operations.

Meeting these compliance burdens involves significant investment in new technologies and processes. Guangzhou R&F must ensure they are managing construction waste effectively, controlling dust and exhaust emissions to improve air quality, and optimizing water usage throughout their projects. Failure to comply can result in substantial fines and reputational damage.

- Stricter Regulations: National and local governments are enforcing tighter rules on pollution, affecting all stages of construction.

- Compliance Costs: Developers incur additional expenses for waste disposal, emission control equipment, and sustainable water management systems.

- Waste Management: Proper handling and recycling of construction debris are now mandatory, requiring dedicated infrastructure and protocols.

- Air Quality: Measures to control dust, volatile organic compounds (VOCs), and other airborne pollutants from construction sites are critical.

- Water Usage: Efficient water management practices, including water recycling and conservation, are increasingly emphasized.

China's environmental policies are rapidly evolving, pushing for greener construction. By 2025, all new urban buildings must meet green building standards, focusing on the entire carbon footprint. This means Guangzhou R&F needs to prioritize low-carbon materials and energy-efficient designs, with green certifications becoming increasingly important. The national goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060 are directly influencing the real estate sector.

By the end of 2023, over 2.5 billion square meters of new construction in China already adhered to green building principles. Guangzhou R&F must invest in sustainable technologies to align with government mandates on energy efficiency and emissions reduction, a move that presents both upfront costs and opportunities for innovation.

| Environmental Factor | Impact on Guangzhou R&F | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Green Building Mandates | Adaptation to new standards, favoring low-carbon materials and energy-efficient designs. | National mandate for all new urban buildings to meet green building standards by 2025. |

| Carbon Neutrality Goals | Integration of low-carbon practices and emissions reduction strategies. | China's goal to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. |

| Circular Economy in Construction | Adoption of material reuse, recycling, and modular construction. | Target to reduce construction waste by 10% by 2025; over 70% adoption of green building materials expected in major cities by 2024. |

| Climate Change Adaptation | Development of climate-resilient infrastructure and sustainable design. | Increased frequency of extreme weather events; Guangdong province seeing more intense rainfall. |

| Pollution Control Regulations | Investment in emission control, waste management, and water conservation. | Stricter standards for waste management, air emissions, and water conservation; targets to reduce major pollutant emissions by end of 2023. |

PESTLE Analysis Data Sources

Our Guangzhou R&F PESTLE analysis is meticulously constructed using data from official Chinese government publications, reputable economic forecasting agencies, and leading real estate market research firms. This comprehensive approach ensures a grounded understanding of political stability, economic trends, and regulatory landscapes impacting the company.