Guangzhou R&F Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou R&F Bundle

Guangzhou R&F's marketing success hinges on a carefully orchestrated 4Ps strategy. Their product offerings cater to diverse market needs, while their pricing reflects a keen understanding of value perception. The brand's distribution channels are strategically chosen to maximize reach and accessibility, ensuring their products are available where and when consumers want them.

Delving deeper into Guangzhou R&F's marketing mix reveals the intricate connections between their product development, pricing architecture, place in the market, and promotional activities. Understanding these elements is crucial for anyone looking to replicate their strategic approach or benchmark against a successful player.

Want to uncover the full story behind Guangzhou R&F's marketing prowess? Go beyond this glimpse and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable insights.

Product

Guangzhou R&F Properties boasts a diverse product portfolio, encompassing residential developments, high-end hotels, and Grade-A office buildings across key Chinese cities. This broad mix, including large-scale shopping malls and cultural centers, caters to a wide spectrum of market segments, from individual homebuyers to corporate clients. For instance, as of early 2025, their hotel portfolio alone includes over 90 operational hotels globally, generating significant recurring revenue. This comprehensive product strategy allows R&F to capture multiple revenue streams and effectively mitigate risks associated with reliance on a single property type, enhancing financial resilience.

Guangzhou R&F's product offering extends beyond physical structures, encompassing integrated development services like property design, construction, and comprehensive project management. This vertical integration ensures quality and consistency across its projects, aiming for a seamless client experience. The company further enhances its value proposition by providing interior design, financial, and consultancy services, positioning itself as a one-stop solution for property needs. For instance, in 2024, R&F focused on optimizing operational efficiency, with its property management segment contributing significantly to recurring revenue streams.

Guangzhou R&F's product strategy heavily emphasizes urban renewal, transforming old towns, factories, and villages into modern, livable communities. These projects upgrade living environments, contributing to high-quality city development, with a focus on amenities like schools and parks. For instance, in 2024, the company continued significant work on the Huangpu District's Jiulong Village renewal, a multi-billion RMB initiative. This strategic niche aligns with governmental pushes for sustainable urban growth and offers a specialized competitive advantage in China's real estate market, targeting substantial social and economic value creation.

Expansion into New Business Areas

Guangzhou R&F is strategically expanding its product offerings beyond traditional real estate, diversifying into promising new business areas like healthcare, the 'Internet +' industry and trade, and cutting-edge science and technology. This proactive shift aims to enhance quality of life for consumers while establishing fresh growth engines for the company, moving away from core property sector reliance. These nascent ventures, such as the R&F International Hospital network, represent a forward-looking product strategy designed to capture emerging market trends and ensure long-term stability.

- By Q1 2025, R&F's non-property segments are projected to contribute a growing percentage to overall revenue, reflecting successful diversification.

- Investment in healthcare, particularly high-end medical facilities, aligns with China's escalating demand for quality health services.

- The 'Internet +' initiatives leverage digital transformation to enhance existing businesses and explore new e-commerce opportunities.

- Science and technology ventures position R&F to capitalize on innovation-driven economic growth.

Commitment to Green Buildings

Guangzhou R&F actively promotes developing green, sustainable buildings, incorporating energy-saving and environmental protection principles into its projects. The company has secured numerous green building certifications, reflecting its commitment to reducing its environmental footprint and fostering sustainable urban development. This focus not only meets regulatory requirements but also appeals to a growing market segment of environmentally conscious buyers and investors, enhancing its brand appeal in 2024.

- R&F's green building initiatives aim for significant energy consumption reduction across its portfolio.

- The company integrates advanced environmental protection technologies in new developments.

- Demand for certified green properties is projected to grow by over 15% in China by 2025.

- This commitment enhances R&F's market position among eco-conscious investors.

Guangzhou R&F's product strategy encompasses a diverse real estate portfolio, including over 90 operational hotels by early 2025, alongside integrated development and property management services. The company prioritizes urban renewal projects, such as the multi-billion RMB Jiulong Village initiative in 2024, and strategically diversifies into healthcare and 'Internet+' industries. A strong commitment to green building, aiming for significant energy reduction, further defines their offerings. This broad approach mitigates risk and aligns with evolving market demands.

| Product Aspect | Key Metric (2024/2025) | Strategic Impact |

|---|---|---|

| Hotel Portfolio | >90 operational hotels (early 2025) | Significant recurring revenue, diversified income. |

| Urban Renewal | Jiulong Village Project (multi-billion RMB, 2024) | Aligns with government policy, specialized advantage. |

| Non-Property Segments | Growing revenue contribution (Q1 2025 projection) | Future growth engines, reduced core property reliance. |

What is included in the product

This analysis provides a comprehensive deep dive into Guangzhou R&F's marketing strategies, meticulously examining their Product, Price, Place, and Promotion efforts.

It's designed for professionals seeking a thorough understanding of Guangzhou R&F's market positioning and competitive landscape.

Provides a clear, actionable framework to address Guangzhou R&F's marketing challenges by optimizing product, price, place, and promotion strategies.

Offers a structured approach to identify and resolve key marketing pain points, enabling more effective customer engagement and competitive positioning.

Place

Guangzhou R&F Properties maintains an extensive footprint across Mainland China, with projects spanning over 145 cities and regions. Its sales network reaches 27 provinces, strategically focusing on tier-1 and tier-2 cities which generated 62% of total contracted sales in the first half of 2024. This widespread domestic presence enables the company to capitalize on diverse regional economic conditions and evolving housing demands. Key operational hubs include major economic centers such as Guangzhou, Beijing, and Shanghai.

Guangzhou R&F has strategically expanded its global footprint since 2013, establishing a presence in key markets such as the United Kingdom, Australia, Malaysia, Cambodia, and South Korea. This international diversification significantly reduces its reliance on the volatile Chinese property market, mitigating inherent regional risks. Notable overseas projects include substantial developments in London and a significant project in Incheon, South Korea. This consistent expansion underscores Guangzhou R&F's clear ambition to solidify its position as a prominent global real estate developer.

Guangzhou R&F utilizes a robust multi-channel distribution strategy for its properties, integrating direct and indirect approaches. Physical sales offices at project sites, often featuring showrooms, provide direct engagement with potential buyers, contributing significantly to sales conversions. The company also heavily leverages its corporate website and digital platforms, generating leads and providing comprehensive project information to a broader audience. These direct efforts are effectively supplemented by collaborations with external real estate agencies and brokers, expanding market reach and facilitating sales across various regions.

Focus on High-Value Urban Locations

Guangzhou R&F strategically focuses on high-value urban locations, positioning its investment properties, like Grade-A office buildings and shopping malls, within the central business districts of China's tier-1 and tier-2 cities. This prime placement ensures high visibility, accessibility, and attractiveness, maximizing rental income and property value. This approach is critical to their commercial property strategy, helping properties retain higher value, with prime commercial real estate in top-tier cities often seeing stable occupancy rates, such as Guangzhou's Grade-A office vacancy rate around 15.5% in early 2024, despite broader market shifts.

- Prime locations in cities like Guangzhou and Beijing enhance asset appeal.

- Strategic placement supports rental income stability, a key revenue driver.

- High-value urban assets maintain stronger valuations even amidst market volatility.

- This focus aligns with demand for modern, accessible commercial spaces.

Integrated Hotel Network

Guangzhou R&F's hotel portfolio is strategically integrated within its larger mixed-use developments across China. As of late 2024, the company operated 90 hotels, managed by renowned international groups like Marriott and Hyatt. This extensive network generates significant hospitality revenue, contributing to the company's financial stability. These hotels also enhance the appeal and value of adjacent residential and commercial properties, serving both business and leisure travelers, especially with China's relaxed entry conditions.

- 90 hotels operated by late 2024, managed by global brands.

- Strategic integration within mixed-use developments enhances property value.

- Contributes steady hospitality revenue streams to R&F's financials.

- Benefits from relaxed entry conditions, attracting diverse travelers.

Guangzhou R&F strategically leverages a vast domestic presence across over 145 cities, with 62% of H1 2024 contracted sales from tier-1/tier-2 cities. Its global expansion to markets like the UK and South Korea diversifies risk, while a multi-channel distribution strategy maximizes reach. The company prioritizes prime urban locations for commercial assets, ensuring high visibility and stable rental income, with 90 hotels integrated into mixed-use developments by late 2024. This comprehensive approach optimizes market penetration and asset value.

| Location Type | Coverage | Key Metric (2024) |

|---|---|---|

| Domestic Footprint | 145+ Cities, 27 Provinces | 62% H1 2024 Sales from Tier-1/2 Cities |

| Global Presence | UK, Australia, Malaysia, Cambodia, South Korea | Diversifies Chinese Market Risk |

| Commercial Properties | Tier-1/2 CBDs (e.g., Guangzhou) | Guangzhou Grade-A Office Vacancy ~15.5% (Early 2024) |

| Hotel Portfolio | Integrated Mixed-Use Developments | 90 Hotels Operated (Late 2024) |

Preview the Actual Deliverable

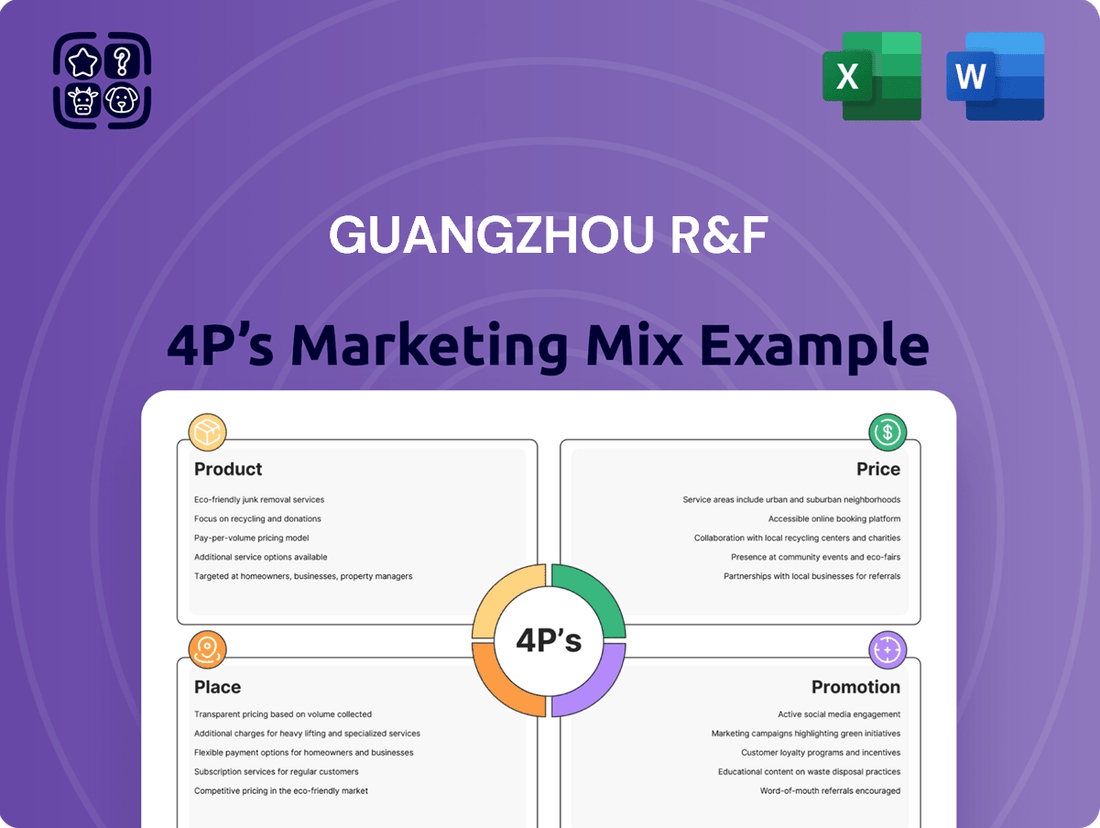

Guangzhou R&F 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Guangzhou R&F 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into the club's current marketing efforts and potential areas for improvement. Everything you see is complete and ready for your immediate use.

Promotion

Guangzhou R&F promotes its brand by emphasizing its 30-year history and its mission of creating a quality living with the heartbeat of the city. The company consistently leverages its recognition as one of the Top 10 Real Estate Development Enterprises in China for consecutive years. This long-standing reputation for quality and comprehensive development is central to its marketing communications. Furthermore, Guangzhou R&F's ESG reports highlight its commitment to sustainability and community care, integral to its corporate identity and public perception. This robust branding strategy reinforces trust among stakeholders.

Guangzhou R&F actively engages the financial community through robust investor relations, a key promotional element. The company conducts regular briefings and communicates essential operational and financial data via announcements and press releases, ensuring transparency with its shareholders and bondholders. This focus on clear communication is particularly critical as R&F navigates its debt restructuring, with approximately $4.9 billion in offshore bonds due for repayment or extension by early 2025. Maintaining open dialogue with creditors and the market helps manage expectations and facilitate a smoother resolution process for its liabilities.

Guangzhou R&F leverages its corporate website and digital platforms like WeChat to showcase its diverse property portfolio and services. The company regularly publishes monthly sales performance updates, such as its cumulative sales for 2024 reaching approximately RMB 10.5 billion by May, offering timely market information to potential customers. These announcements, often distributed via news wires and financial media, serve as a consistent promotional tool. This digital strategy ensures continued market presence and interest, despite ongoing market adjustments.

Sales s and Events

Guangzhou R&F actively deploys various sales promotions to stimulate demand, particularly crucial in the current challenging real estate climate where destocking inventory is a primary objective. The company likely leverages incentives such as discounted pricing or flexible payment schemes to attract buyers. Furthermore, their participation in prestigious industry events and receipt of design and commercial landmark awards serve as powerful promotional tools, enhancing brand reputation and market appeal.

- Guangzhou R&F focuses on sales promotions to reduce existing property inventory, a key strategy in the 2024-2025 market.

- Incentives are crucial for driving buyer interest and accelerating property absorption.

- Participation in industry events like property expos helps showcase their portfolio and garner attention.

- Accolades for design and commercial achievements are strategically used to bolster marketing efforts and perceived value.

Public Relations and Crisis Management

Given its significant financial challenges, including debt defaults and ongoing restructuring efforts in 2024, Guangzhou R&F's promotional strategy heavily emphasizes public relations and crisis management. The company issues formal announcements, such as its April 2024 update on the offshore debt restructuring, to address market rumors and provide transparency on litigation and debt resolution progress. This proactive communication is crucial for maintaining a degree of stakeholder confidence amidst its reported liabilities, which stood near CNY 295 billion as of late 2023. This reactive form of promotion is critical for maintaining a degree of stakeholder confidence during turbulent times.

- Offshore debt restructuring progress was a key PR focus in Q1 2024.

- Formal announcements counter market rumors regarding its debt position.

- Updates on litigation and asset disposals are communicated to stakeholders.

- Maintaining investor confidence is paramount given CNY 295 billion liabilities.

Guangzhou R&F's promotion in 2024-2025 heavily emphasizes brand legacy and transparent investor relations, crucial amidst its $4.9 billion offshore bond maturities by early 2025. The company uses digital platforms to share updates, including RMB 10.5 billion in cumulative sales by May 2024, alongside sales promotions like discounts to clear inventory. Proactive public relations, such as April 2024 debt restructuring updates, manage stakeholder confidence concerning its CNY 295 billion liabilities.

| Promotional Focus | Key Tactic | 2024/2025 Data Point |

|---|---|---|

| Brand Building | Leveraging history & awards | Top 10 Developer recognition |

| Investor Relations | Transparent communication | $4.9B offshore bonds due by early 2025 |

| Digital Marketing | Online sales updates | RMB 10.5B cumulative sales by May 2024 |

| Crisis Management | Formal PR announcements | April 2024 offshore debt restructuring update |

Price

Guangzhou R&F adopts a value-oriented pricing strategy, positioning its properties to deliver significant value to buyers. This approach is evident in its average selling price of approximately RMB14,200 per square meter in the first half of 2024, targeting the mid-to-upper market segment rather than pure luxury. The company meticulously balances generating crucial cash flow from inventory sales with upholding its established brand value. Furthermore, the strategic placement of its properties predominantly within higher-tier cities significantly contributes to their sustained higher market value.

Guangzhou R&F's pricing strategy is highly reactive to the challenging Chinese property market conditions, especially through 2024. The significant year-on-year decline in contracted sales, reflecting ongoing sector pressures, limits the company's pricing power. This necessitates competitive pricing to stimulate demand and move inventory. Such a strategy is crucial for managing liquidity by prioritizing the sale of existing assets and completed inventory, a key focus for 2025 amidst debt restructuring efforts.

Guangzhou R&F has engaged in significant asset disposals due to severe liquidity pressure. These sales frequently occur at what are effectively distressed prices, prioritizing immediate cash flow over profit maximization. A notable example is the 2022 sale of its London One Nine Elms project for a nominal HKD 1, with the buyer assuming all associated debts. This pricing strategy reflects the company's urgent need for debt reduction and reflects its critical financial situation in 2024.

Financing and Restructuring Terms

The pricing aspect for Guangzhou R&F, in a broader sense, extends to the terms offered to its creditors, representing a crucial financial negotiation. The company has been in a formal stage of offshore debt default since early 2022 and is undergoing a major restructuring process, which continued into 2024. The proposed restructuring plan, involving approximately $4.9 billion in offshore debt, offers creditors various options, including upfront cash payments, new bonds with extended maturities, and convertible bonds, which effectively represent a new 'price' for their claims. This is a critical pricing negotiation aimed at ensuring the company's long-term financial survival and stability.

- Offshore debt restructuring ongoing for $4.9 billion.

- Creditors offered cash, new bonds, and convertible bonds.

- New terms aim for debt maturity extensions up to 2028-2030.

- Restructuring is a core pricing strategy for R&F's solvency.

Diverse Pricing Across Portfolio

Guangzhou R&F employs diverse pricing strategies across its varied portfolio. Residential property prices, like those for units completed in 2024, are determined by location, size, and current market demand, reflecting regional economic conditions. Commercial properties, such as office buildings contributing to a rental income of RMB 2,058.2 million in 2024, are priced based on rental yields and long-term investment potential. Hotel room rates are dynamically set based on seasonality, occupancy levels, and local market competition, significantly contributing to the overall revenue mix.

- Residential pricing reflects market demand, with sales of RMB 11,351.4 million recorded in 2024.

- Commercial properties are priced for rental yields, contributing RMB 2,058.2 million in rental income in 2024.

- Hotel room rates adjust dynamically based on occupancy and seasonal demand, with revenue reaching RMB 7,126.3 million in 2024.

Guangzhou R&F's pricing strategy in 2024/2025 is primarily value-oriented yet highly reactive to market pressures. The company balances mid-to-upper segment property sales, averaging RMB14,200 per square meter in H1 2024, with urgent asset disposals at distressed prices to generate liquidity. Critically, its ongoing $4.9 billion offshore debt restructuring represents a major pricing negotiation, offering creditors new terms for financial survival. This multi-faceted approach also includes dynamic pricing for residential sales (RMB 11,351.4 million in 2024) and commercial rentals (RMB 2,058.2 million in 2024).

| Metric | Value | Period/Context |

|---|---|---|

| Average Property Selling Price | RMB 14,200/sqm | H1 2024 |

| 2024 Residential Sales Revenue | RMB 11,351.4 million | Full Year 2024 |

| 2024 Commercial Rental Income | RMB 2,058.2 million | Full Year 2024 |

| Offshore Debt Under Restructuring | $4.9 billion | Ongoing 2024-2025 |

4P's Marketing Mix Analysis Data Sources

Our Guangzhou R&F 4P's analysis is built on a foundation of verified data, including official company reports, real estate listings, and news articles detailing their projects and sales strategies. We also incorporate industry analysis and competitor benchmarking to provide a comprehensive view.