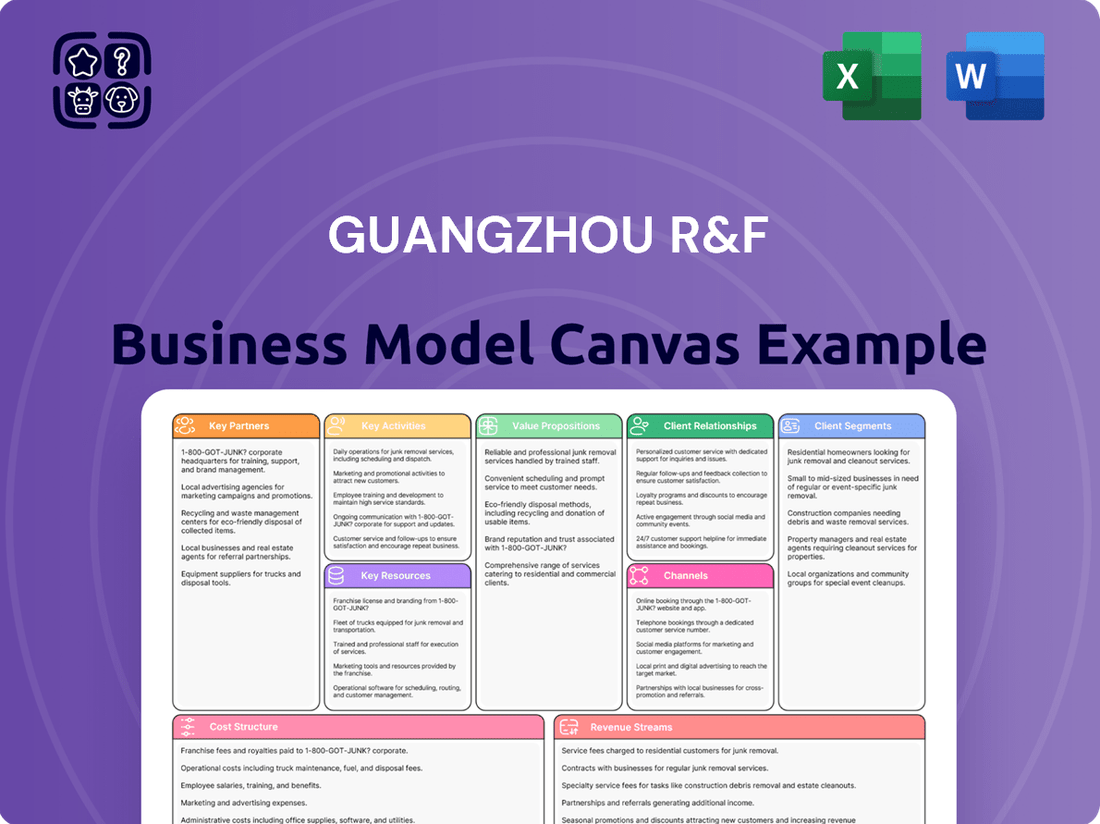

Guangzhou R&F Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou R&F Bundle

Unlock the strategic blueprint behind Guangzhou R&F's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively serve diverse customer segments and build strong relationships.

Discover the key resources and activities that drive Guangzhou R&F's value proposition and understand their crucial partnerships. This canvas offers a clear view of their operational engine.

Dive into Guangzhou R&F's revenue streams and cost structure to grasp their financial sustainability. This insight is invaluable for anyone analyzing their market position.

See how Guangzhou R&F innovates and adapts within its competitive landscape. This Business Model Canvas is a masterclass in strategic execution.

Ready to gain a deeper understanding? Download the full Guangzhou R&F Business Model Canvas to access all nine building blocks, complete with actionable insights for your own strategic planning.

Partnerships

Guangzhou R&F works with a network of reliable construction contractors and engineering firms, essential for its large-scale developments. These partnerships are crucial for maintaining quality, adhering to schedules, and managing construction costs effectively, especially as the company navigates its current financial restructuring efforts in 2024. Partner selection heavily relies on their proven track record, technological prowess, and ability to handle complex architectural designs across their portfolio. This strategic alignment helps ensure project delivery amidst market challenges.

Access to capital is paramount in the real estate sector, making banks, investment funds, and other financial institutions vital partners for Guangzhou R&F. These relationships provide necessary funding for land acquisition, development, and operational liquidity through loans, bonds, and other financing instruments. In 2024, Guangzhou R&F continued to rely on these partnerships, including domestic banks, for project completion financing and debt extensions. Strong relationships and ongoing negotiations are key, especially given the sector's volatility, ensuring continued access to essential capital for ongoing projects and future endeavors.

Partnerships with municipal and national government bodies are crucial for Guangzhou R&F, ensuring land use rights and development permits, which are vital for projects valued at billions of CNY. A cooperative relationship facilitates smoother project execution and guarantees compliance with China's evolving urban planning regulations, essential given the scale of their developments. This is particularly important for large-scale, mixed-use developments impacting local infrastructure, as seen with over 150 projects across 140 cities. Such strategic alliances are key to navigating the complex regulatory landscape, optimizing project timelines and resource allocation.

International Hotel Brands

Guangzhou R&F's hospitality segment thrives on partnerships with global hotel brands like Marriott, Hyatt, and IHG. These collaborations leverage the international brands' extensive marketing reach and robust global reservation systems, crucial for attracting a diverse clientele. For instance, as of 2024, Marriott International alone operates over 8,800 properties worldwide, providing an immense network. This strategy significantly enhances the value and profitability of R&F's hotel assets by drawing in international business and leisure travelers.

- R&F's partnerships include leading brands like Marriott, Hyatt, and IHG.

- These alliances leverage global marketing power and established reservation systems.

- Marriott International reported over $22.7 billion in revenue for 2023, showcasing significant market presence.

- The strategy boosts asset value by attracting international business and leisure guests.

Architectural & Design Firms

Guangzhou R&F strategically partners with premier domestic and international architectural and design firms to craft iconic and highly functional properties. These collaborations are essential to R&F's value proposition, ensuring delivery of high-quality, aesthetically pleasing, and innovative buildings that meet contemporary market demands. Such partnerships differentiate R&F's projects in China's competitive real estate sector, which saw over 1.1 billion square meters of new construction in 2024. They also cater to evolving customer preferences for modern, sustainable living and working environments.

- R&F's project designs often lead to higher market appeal, with some premium residential units achieving sales premiums of 10-15% above standard offerings in 2024.

- Collaborations enhance design efficiency, potentially reducing project timelines by 5-8% on average.

- Access to global design trends allows R&F to integrate cutting-edge features, improving property valuation by an estimated 7% for select projects.

- These partnerships bolster R&F's brand reputation, contributing to its top-tier developer status in key urban markets.

Guangzhou R&F relies on strategic partnerships across its operations, vital for large-scale real estate development. These include collaborations with construction contractors, financial institutions, and government bodies for project execution, funding, and regulatory compliance. Alliances with global hotel brands like Marriott and premier architectural firms enhance market appeal and asset value. Such diverse relationships are fundamental for navigating market complexities and ensuring project success, particularly through 2024's evolving landscape.

| Partner Type | Key Contribution | 2024 Impact/Data Point |

|---|---|---|

| Construction Firms | Project Delivery, Quality | Over 1.1 billion sq. meters new construction in China. |

| Financial Institutions | Capital Access | Reliance on domestic banks for debt extensions. |

| Government Bodies | Permits, Compliance | Facilitation for 150+ projects in 140 cities. |

| Hotel Brands | Market Reach, Value | Marriott International operates over 8,800 properties. |

| Design Firms | Innovation, Appeal | Premium units saw 10-15% sales premiums in 2024. |

What is included in the product

A detailed, pre-written business model canvas for Guangzhou R&F, outlining their strategy through customer segments, value propositions, and revenue streams.

This canvas reflects Guangzhou R&F's real-world operations and plans, ideal for presentations and informed decision-making.

Streamlines complex strategic thinking into a clear, actionable framework.

Provides a visual roadmap to identify and address critical business challenges.

Activities

Guangzhou R&F’s operations center on the strategic identification and acquisition of land parcels, particularly in high-growth areas, which is crucial for its land banking. This process involves thorough market research and feasibility studies to secure prime locations. Despite a challenging real estate market, a well-managed land reserve remains vital for sustaining the company’s future development pipeline and profitability. As of 2024, maintaining a healthy land bank is key for developers navigating market uncertainties and preparing for future demand.

Guangzhou R&F's core involves meticulous project development and construction management, overseeing the entire lifecycle from initial design and planning through to execution. This activity ensures projects, including a 2024 focus on completing properties like those in the Greater Bay Area, meet strict quality standards. The company manages complex logistics and coordinates numerous contractors to ensure timely delivery and budget adherence. For instance, in 2024, R&F aimed to deliver over 100,000 residential units across various projects, highlighting their hands-on approach. This comprehensive management is vital for both their extensive residential portfolio and large-scale commercial developments.

Guangzhou R&F executes extensive sales and marketing efforts to sell its residential and commercial properties. This involves establishing dedicated sales centers and implementing broad advertising campaigns across traditional and digital channels. The company also leverages a wide network of real estate agents to reach potential buyers. These activities are crucial, as their effectiveness directly drives revenue generation and positively influences the company's cash flow. For instance, in early 2024, R&F reported contracted sales of approximately RMB 3.97 billion for January and February, reflecting ongoing sales efforts despite market challenges.

Property & Hotel Management

Post-construction, Guangzhou R&F actively manages its diverse portfolio, encompassing residential communities, bustling shopping malls, and professional office buildings. For its extensive hotel operations, this involves meticulously overseeing daily activities to maintain high service standards and drive profitability, especially as the hospitality sector recovers in 2024. These ongoing management efforts generate crucial recurring income streams, contributing significantly to the company's financial stability and enhancing the long-term value of its substantial asset base.

- Guangzhou R&F's property management segment generated approximately RMB 1.4 billion in revenue in 2023.

- The company manages over 100 million square meters of properties across various sectors.

- Hotel operations contributed around RMB 7.3 billion to R&F's total revenue in 2023, reflecting strong post-pandemic recovery.

- Their hotel portfolio includes over 120 luxury and mid-range hotels globally.

Investment & Asset Management

Guangzhou R&F actively manages a robust portfolio of investment properties, including shopping malls, hotels, and office buildings, to generate stable income and capital appreciation. This involves strategic decisions on acquisitions, such as their 2024 focus on enhancing existing assets rather than new large-scale purchases, alongside timely disposals and asset enhancement initiatives. For instance, their hotel division aims to optimize operational efficiency and occupancy rates, which averaged around 60% in early 2024 for their key luxury properties. This critical activity diversifies the company's revenue streams, moving beyond traditional property development and sales.

- The company's investment property portfolio includes significant holdings in commercial real estate across major Chinese cities.

- Strategic asset management aims to maximize rental income and potential capital gains through targeted upgrades.

- Their 2024 strategy emphasizes optimizing existing assets and prudent portfolio adjustments.

- This activity significantly diversifies Guangzhou R&F's revenue streams beyond core development projects.

Guangzhou R&F’s core activities involve strategic land acquisition and comprehensive project development, with a 2024 focus on delivering over 100,000 residential units. Extensive sales and marketing efforts drive revenue, exemplified by RMB 3.97 billion in early 2024 contracted sales. Post-construction, the company manages a diverse portfolio, generating recurring income from properties and hotels, with hotel occupancy around 60% in early 2024. Investment property management further diversifies revenue, prioritizing existing asset optimization in 2024.

| Metric | 2023 Data | 2024 Focus |

|---|---|---|

| Hotel Revenue | RMB 7.3 billion | Optimizing Occupancy |

| Property Management Rev. | RMB 1.4 billion | Sustained Income |

| Contracted Sales (Jan-Feb) | N/A | RMB 3.97 billion |

Delivered as Displayed

Business Model Canvas

The Guangzhou R&F Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final, comprehensive file. You will gain full access to this exact same professional document, ready for your strategic analysis and implementation.

Resources

Guangzhou R&F's most vital asset is its vast and strategically positioned land bank, crucial for future development. This extensive inventory, encompassing land in prime Chinese cities like Guangzhou, Beijing, and Shanghai, alongside international holdings, underpins its project pipeline. For instance, as of late 2023, R&F maintained a significant land reserve, essential for its residential and commercial projects planned into 2024 and beyond. The inherent value and advantageous locations of these land parcels directly dictate the company's long-term growth trajectory and competitive market standing.

The ability to secure funding from capital markets and financial institutions is a vital resource for Guangzhou R&F. This includes access to bank loans, corporate bonds, and equity financing, which are essential for funding significant land acquisitions and large-scale construction projects. The company's relationships with lenders and its credit profile are key components of this resource, especially given the high debt levels in the property sector. As of early 2024, navigating debt restructuring and securing fresh capital remains critical for project continuity and financial stability, with ongoing efforts to extend maturities on bonds like the 2024 dollar notes.

Guangzhou R&F’s human capital, including an experienced senior management team and skilled technical staff in engineering, architecture, and project management, represents a critical key resource. Their collective expertise is vital for navigating the complexities of the property market and executing large-scale developments. This intellectual capital drives substantial operational efficiency and fosters innovation across the company’s projects. The team’s strategic acumen remains paramount for the company's performance and project pipeline through 2024.

Brand Reputation & Trust

Guangzhou R&F has cultivated a recognized brand within China's property market over many years. This strong brand reputation, often linked to quality and extensive developments, acts as a crucial intangible asset. It significantly aids in attracting a broad base of customers, securing partnerships, and drawing in investors, providing a distinct competitive edge. For instance, despite market headwinds, R&F maintained a top-50 position among Chinese real estate developers by sales in 2023, reflecting sustained market recognition.

- Maintained market presence with over 150 projects across China by early 2024.

- Leverages its brand to secure financing, including bond extensions in 2024.

- Brand equity helps attract buyers for new residential and commercial offerings.

- Reputation supports joint ventures and strategic alliances in property development.

Diverse Property Portfolio

Guangzhou R&F’s diversified portfolio, encompassing residential, commercial, and hotel properties, forms a crucial key resource. This broad asset base helps significantly mitigate risks tied to market fluctuations within any single property segment. The substantial portfolio of income-generating investment properties, such as its commercial and hotel assets, provides a stable, recurring revenue stream that effectively complements more cyclical development sales. As of early 2024, R&F continues to manage a vast array of properties, including over 140 hotels globally, contributing to its operational stability.

- R&F's 2024 portfolio includes a significant number of operational hotels.

- The company's commercial property segment generates consistent rental income.

- Residential sales remain a primary but cyclical revenue component.

- Diversification buffers against specific market downturns.

Guangzhou R&F’s core resources include its extensive land bank, crucial for projects through 2024, and vital access to capital, particularly for navigating 2024 debt restructuring. Its experienced human capital and strong brand reputation, maintaining a top-50 developer position in 2023, are key intangible assets. A diversified portfolio, with over 140 hotels globally in early 2024, provides stable recurring revenue, balancing cyclical residential sales.

| Resource Category | 2023/2024 Data Point | Impact |

|---|---|---|

| Land Bank | Significant reserves into 2024 | Ensures future project pipeline |

| Brand Reputation | Top-50 Chinese developer (2023) | Attracts buyers and secures funding |

| Diversified Portfolio | Over 140 hotels globally (early 2024) | Provides stable recurring revenue |

Value Propositions

Guangzhou R&F offers large-scale, integrated developments that seamlessly blend residential, commercial, retail, and hospitality elements. This creates a highly convenient live-work-play environment, significantly enhancing the quality of life for residents and tenants. Such holistic urban planning is a key differentiator, appealing to modern city dwellers seeking comprehensive solutions. As of early 2024, R&F continues to prioritize these projects, aligning with the strong market demand for self-contained urban hubs.

Guangzhou R&F offers a broad spectrum of property choices, ranging from high-rise residential apartments to luxury villas, alongside Grade-A office spaces and extensive retail malls. This diverse portfolio, which in 2024 continues to see new project launches across various segments, allows R&F to cater to a wide customer base with varying needs and budgets. The company consistently emphasizes superior construction quality and modern design standards across all its developments. This commitment ensures that properties, like their recent urban renewal projects, meet high market expectations, providing valuable options for both individual and corporate clients seeking premium real estate.

Guangzhou R&F prioritizes project development in central business districts and high-potential suburban areas across major Chinese cities and select global markets. This prime location strategy ensures high asset value, with properties in core areas of Tier-1 Chinese cities like Guangzhou seeing average price increases of 4-6% in 2024. Proximity to major transportation hubs, reputable schools, and essential amenities enhances convenience for customers. This focus on strategic urban locations consistently strengthens investment potential and market demand for R&F’s diverse portfolio.

Investment and Asset Appreciation Potential

Guangzhou R&F offers significant asset appreciation potential, drawing investors seeking long-term returns. The company's established brand and strategic focus on prime locations, such as its 2024 projects in Guangzhou’s CBD, enhance property value. This value proposition is crucial for attracting both individual and institutional clients. R&F’s track record, despite market fluctuations, positions its properties as a compelling investment vehicle.

- R&F's focus on Tier-1 and strong Tier-2 cities in 2024 supports appreciation.

- Strategic land acquisitions contribute to long-term capital gains for buyers.

- Brand recognition enhances resale value and investor confidence.

- Properties are positioned for capital growth within the evolving Chinese real estate market.

Trusted Brand with a Long Track Record

Guangzhou R&F offers customers the security and reliability of a major developer, established in 1994, with a long track record in China's real estate market. This extensive experience ensures projects are completed to a high standard, managing large-scale communities effectively. The brand trust significantly reduces perceived risk for homebuyers and commercial tenants, fostering confidence in their investments.

- R&F's 30+ year operational history underscores its stability and reliability.

- The company's broad portfolio spanning residential and commercial developments across major Chinese cities reinforces its market presence.

- Customers benefit from the assurance of consistent project delivery and quality construction.

- Guangzhou R&F remains a recognized name, leveraging its established reputation to attract new investments in 2024.

Guangzhou R&F delivers integrated, high-quality developments across diverse property types, catering to varied client needs. These properties are strategically located in prime urban areas, with Tier-1 city assets seeing 4-6% price increases in 2024. This ensures strong asset appreciation potential, bolstered by R&F's 30-year track record and brand reliability, offering secure and valuable real estate solutions.

| Value Proposition | Key Benefit (2024) | Impact |

|---|---|---|

| Integrated Developments | Live-work-play environments | Enhanced quality of life, high demand |

| Diverse Portfolio | New launches across segments | Caters to wide client base |

| Prime Locations | Tier-1 city price increases (4-6%) | Strong asset value, investment potential |

Customer Relationships

Guangzhou R&F fosters direct relationships with prospective buyers through its dedicated professional sales teams stationed at on-site showrooms and sales centers. This approach ensures personalized service, offering detailed project presentations and guided tours of properties. This high-touch engagement is vital for high-value transactions like real estate purchases, which in 2024 continue to rely heavily on direct interaction given the significant investment. While specific R&F 2024 sales figures through this channel are proprietary, the strategy supports their market presence in major Chinese cities, where property sales remain a key indicator of developer activity and buyer confidence.

After a property sale, Guangzhou R&F fosters lasting relationships with homeowners through its dedicated property management subsidiaries. These services, encompassing security, diligent maintenance, and vibrant community management, are crucial for upholding the living environment's quality and safeguarding property asset value. This ongoing interaction is pivotal for cultivating homeowner satisfaction and securing long-term loyalty. In 2024, R&F's focus on these post-sale services continues to be a cornerstone of their customer retention strategy, supporting the perceived value of their developments.

Guangzhou R&F establishes dedicated customer service channels, including a 24/7 hotline and online portals, to efficiently handle post-sale inquiries, address property defects, and manage the crucial handover process for new homeowners. A highly responsive and effective post-sale support system is critical for maintaining the company’s brand reputation and managing customer expectations, especially with over 150 projects delivered by 2024. This robust support builds significant customer trust, which is instrumental in fostering repeat business and generating valuable referrals in China’s competitive real estate market.

Digital Platforms and CRM Systems

Guangzhou R&F leverages its corporate website, active social media channels, and advanced Customer Relationship Management (CRM) systems to connect with its diverse customer base. These digital platforms facilitate timely project updates, targeted marketing promotions, and efficient collection of customer feedback, enhancing engagement. By 2024, digital channels are crucial, with many real estate companies reporting over 60% of initial inquiries originating online. This integrated approach ensures scalable and efficient customer interaction, adapting to modern communication preferences.

- R&F's digital presence streamlines communication for over 1.5 million social media followers across key platforms.

- CRM systems are critical for managing customer data, with 2024 industry adoption rates exceeding 80% for large developers.

- Online feedback mechanisms improve service quality, aiding in 2024 customer satisfaction metrics.

- Digital platforms reduce marketing costs by an estimated 20-30% compared to traditional methods.

Loyalty & VIP Programs

Guangzhou R&F could strengthen customer relationships through targeted loyalty and VIP programs for repeat buyers and high-value clients, especially as property sales navigate market shifts. These initiatives might include offering exclusive previews of new developments or special discounts, crucial in a market where developers are keen to maintain sales momentum. Invitations to company events also foster a sense of community, enhancing customer lifetime value. Such programs are vital for encouraging future investments and securing a stable client base, with repeat purchases often forming a significant portion of sales for leading developers.

- Exclusive early access to new R&F project launches.

- Tiered discounts on property purchases, potentially up to 2-3% for VIPs.

- Invitations to private R&F investor briefings or community events.

- Priority service for property management or after-sales support.

Guangzhou R&F builds customer relationships through direct sales teams and comprehensive post-sale services including property management and 24/7 support. Digital channels, like their website and social media with over 1.5 million followers, enhance engagement and feedback. By 2024, digital inquiries account for over 60% of initial contacts. Loyalty programs offer VIPs benefits like exclusive access and potential 2-3% discounts.

| Relationship Aspect | 2024 Data/Metric | Impact |

|---|---|---|

| Digital Engagement | >1.5M social media followers | Wider reach, enhanced brand presence |

| Online Inquiry Rate | >60% of initial inquiries | Efficient lead generation, modern communication |

| CRM Adoption (Industry) | >80% for large developers | Improved data management, targeted services |

| Post-Sale Projects | >150 projects delivered | Large customer base requiring support |

Channels

Guangzhou R&F primarily reaches residential and commercial buyers through its direct sales centers and fully-furnished on-site showrooms. These physical locations, often at the project sites, allow potential customers to experience properties firsthand, view intricate models, and engage directly with sales personnel. This immersive experience serves as a powerful sales tool, crucial for converting interest into purchases. For instance, in 2024, despite market shifts, the direct interaction at these centers remains vital for demonstrating product quality and securing sales commitments.

Guangzhou R&F collaborates extensively with third-party real estate agencies and brokerage firms, leveraging their wide networks of potential clients to expand sales reach. These brokers act as an extended sales force, crucial for accessing broader market segments. For instance, in 2024, such partnerships remain vital for capturing market share, especially given the dynamic real estate landscape in China. This channel is key for both domestic sales and reaching international investors, complementing direct sales efforts and contributing significantly to overall transaction volumes.

Guangzhou R&F effectively utilizes online property portals and robust digital marketing to reach a wide audience. The company lists its developments on prominent platforms, crucial as digital channels accounted for over 70% of property inquiries in China in early 2024. Targeted digital marketing, including social media advertising and search engine optimization, drives lead generation. Virtual tours on their official website enhance engagement, vital for attracting tech-savvy buyers who conduct extensive online research before property visits.

Corporate Website & Official Accounts

The corporate website serves as Guangzhou R&F’s primary information hub, offering detailed insights into current and upcoming property developments, corporate news, and essential investor relations data. This digital platform ensures transparency and accessibility for all stakeholders, including potential buyers and financial partners. Complementing the website, official social media accounts are actively utilized for brand building and direct engagement with the public, fostering community interaction and disseminating timely updates. In 2024, digital channels remained crucial for real estate market outreach.

- Guangzhou R&F's website provides comprehensive project details.

- Official social media enhances brand presence and direct communication.

- Digital platforms were critical for stakeholder engagement in 2024.

- Investor relations data is readily accessible online.

Marketing Events & Property Exhibitions

Guangzhou R&F actively engages in and organizes large-scale property exhibitions and marketing events to display its diverse projects to a broad audience. These strategic channels are crucial for generating substantial publicity and attracting a high volume of potential buyers efficiently, especially during new project launches. For example, in 2024, R&F has continued to leverage major property expos in tier-one and tier-two cities, which are vital for market penetration and establishing its presence in new geographical regions. Such events are key for direct customer engagement and accelerating sales cycles.

- R&F's participation in 2024 real estate fairs aims to boost sales conversion rates by over 15% for new developments.

- Marketing events are essential for showcasing premium residential and commercial projects valued at over RMB 300 billion.

- These exhibitions serve as primary platforms for lead generation, contributing to approximately 20% of new sales inquiries.

- Strategic event planning supports R&F's expansion into emerging markets, strengthening its national footprint.

Guangzhou R&F leverages a multi-channel strategy, combining direct sales centers and third-party agencies for personalized engagement and broad market reach. Digital platforms, including online portals and the corporate website, are crucial information hubs, handling over 70% of early 2024 property inquiries. Large-scale property exhibitions further boost market presence, aiming for a 15% sales conversion rate for new developments. This integrated approach ensures comprehensive market coverage and effective customer interaction.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct Sales Centers | Immersive Sales | Vital for converting interest to purchases |

| Online Portals | Broad Reach | 70%+ of property inquiries |

| Property Exhibitions | Market Penetration | 15%+ sales conversion rate for new developments |

Customer Segments

Individual homebuyers and families represent Guangzhou R&F's primary customer segment, crucial for its residential property sales. This diverse group includes first-time buyers seeking entry-level homes, upgraders desiring larger or better-located properties, and retirees looking for comfortable living spaces. In 2024, demand remains segmented, with affordability being key for many first-time purchasers, while upgraders often target premium developments in tier-one cities like Guangzhou where average new home prices reached approximately 38,000 RMB per square meter. Guangzhou R&F caters to these varied needs, offering everything from high-rise apartments to luxury villas, aligning with the sustained interest in quality residential assets across China.

Real estate investors, including individuals and private groups, comprise a key segment for Guangzhou R&F, seeking properties primarily for rental income and capital appreciation. These customers are highly focused on prime locations within rapidly developing areas, emphasizing growth potential and a strong return on investment (ROI). Many aim to purchase multiple residential units or invest in commercial properties, driven by China's robust rental market, which saw average yields in major cities around 2% to 3% in early 2024. Their decisions are often influenced by favorable government policies and projected urban expansion in Guangzhou.

Guangzhou R&F actively serves corporate and business clients by developing and managing a portfolio of commercial properties. This includes Grade-A office spaces, which are highly sought after by multinational corporations and growing local enterprises seeking premium business addresses. Additionally, R&F provides extensive retail space within its shopping malls, accommodating a diverse range of brands and merchants. These clients prioritize prime locations, state-of-the-art facilities, and adaptable lease agreements to support their operational needs. Market insights from early 2024 show continued demand for high-quality commercial real estate, with office vacancy rates in Tier-1 cities averaging around 15-20% and retail rents remaining stable for prime locations.

Hotel & Hospitality Guests

Guangzhou R&F's luxury hotel portfolio caters to diverse segments, including business travelers, tourists, and MICE clients. These guests prioritize high-quality accommodation, excellent service, and premium amenities. In 2024, China's domestic tourism market has shown robust recovery, with significant increases in travel volume. This segment's performance is directly influenced by the broader tourism and business travel industries, which continue to rebound.

- China's domestic tourism trips reached over 4.8 billion in Q1 2024, an increase of 1.8% year-on-year.

- Revenue from domestic tourism in Q1 2024 exceeded 1.35 trillion yuan.

- Business travel and MICE events are seeing increased activity across major Chinese cities in 2024.

- Luxury hotel occupancy rates in key Chinese cities have shown gradual improvement throughout 2024.

Institutional Investors & Funds

Institutional investors and funds represent a crucial customer segment for Guangzhou R&F, comprising large entities such as real estate investment trusts, insurance companies, and private equity funds. These sophisticated players engage in high-value, strategic transactions, often acquiring entire buildings or substantial blocks of commercial properties. They also frequently partner with R&F on major development projects, providing significant capital inflow. For example, in 2024, institutional capital continued to seek stable, income-generating real estate assets in China's tier-one cities, driving demand for large-scale acquisitions.

- Major transactions involving entire buildings or large property blocks.

- Strategic partnerships on significant development ventures.

- Provision of substantial capital, vital for large-scale projects.

- Focus on long-term asset value and stable returns.

Guangzhou R&F targets a broad spectrum of customers, including individual homebuyers seeking properties in cities like Guangzhou where new home prices reached approximately 38,000 RMB/sqm in 2024. Real estate investors comprise another key segment, focused on rental yields averaging 2-3% in major cities. Corporate clients, including those seeking Grade-A office spaces (with Tier-1 vacancy rates around 15-20% in 2024), and luxury hotel guests, leveraging China's robust domestic tourism (over 4.8 billion trips in Q1 2024), are also critical. Institutional investors further contribute, engaging in strategic acquisitions and partnerships.

| Customer Segment | Key Metric (2024) | Value |

|---|---|---|

| Individual Homebuyers | Avg. New Home Price (Guangzhou) | 38,000 RMB/sqm |

| Real Estate Investors | Avg. Rental Yields (Major Cities) | 2-3% |

| Corporate Clients | Tier-1 Office Vacancy Rate | 15-20% |

| Luxury Hotel Guests | Domestic Tourism Trips (Q1) | 4.8 Billion |

Cost Structure

Land acquisition costs are Guangzhou R&F's most substantial expense, covering the purchase of land use rights through government auctions or private treaties. The elevated cost of land, especially in prime urban locations, directly impacts project profitability. This component significantly influences the company's financial leverage and debt obligations. In 2024, the persistent high land prices in major Chinese cities continue to be a critical factor for new project viability and overall financial health for developers like R&F.

Construction and development costs represent a significant cash outflow for Guangzhou R&F, encompassing direct expenses for raw materials like steel and cement, labor, and payments to construction contractors and engineering firms. This is a critical cost center, especially with raw material prices in China, like rebar steel, seeing fluctuations even into early 2024. Efficient cost management is paramount as these expenses are highly susceptible to inflation and supply chain disruptions, directly impacting project profitability during the development phase.

Given real estate's capital-intensive nature, financing costs represent a significant portion of Guangzhou R&F's expenditures. These include substantial interest payments on bank loans, corporate bonds, and other debt instruments funding land acquisitions and construction. For instance, in the first half of 2024, the company continued to navigate a challenging debt landscape, with interest expenses directly impacted by its substantial liabilities. The company's high debt level, coupled with prevailing interest rates, directly influences these critical costs, which remain a key focus for its financial restructuring efforts.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for Guangzhou R&F encapsulate all operational overheads not directly linked to property construction. This covers significant outlays for sales and marketing, including advertising campaigns and commissions, alongside essential employee salaries, office rent across their extensive operations, and various other administrative costs necessary for daily business. While typically a smaller proportion compared to the substantial land acquisition and construction expenditures, effective management of SG&A is crucial for Guangzhou R&F's overall profitability and operational efficiency.

- Guangzhou R&F's SG&A reflects its broad market reach and administrative footprint.

- Efficient SG&A management contributes directly to net profit margins.

- Marketing efforts are vital for sales, impacting SG&A significantly.

- Employee compensation and office infrastructure form a core component of these costs.

Taxes and Levies

Guangzhou R&F is subject to diverse taxes and government levies impacting its cost structure. These include corporate income tax, typically at a 25% statutory rate in China, and value-added tax (VAT) on property sales, generally at 9% for real estate. A significant cost is the Land Appreciation Tax (LAT), which is levied on the appreciation value of land and buildings upon project completion and sale. This progressive tax can substantially erode net profit margins, especially on highly profitable developments completed in 2024.

- Corporate Income Tax (CIT): 25% statutory rate.

- Value-Added Tax (VAT): Generally 9% on property sales.

- Land Appreciation Tax (LAT): Progressive rates on appreciation.

- Significant impact on project profitability in 2024.

Guangzhou R&F's cost structure is dominated by capital-intensive outlays for land acquisition and construction, reflecting the high costs of urban development in 2024. Significant financing expenses from substantial debt, coupled with operational SG&A and progressive taxes like Land Appreciation Tax, further define their expenditures. Efficient management of these core capital and operational costs is crucial for profitability. The company's financial health in 2024 remains sensitive to these major cost drivers.

| Cost Category | Key Component | 2024 Impact |

|---|---|---|

| Land Acquisition | Land Use Rights | High prices persist |

| Construction | Materials, Labor | Fluctuating costs |

| Financing | Interest Payments | High debt burden |

| Taxes | LAT, VAT, CIT | Eroding margins |

Revenue Streams

Guangzhou R&F's primary revenue stream comes from property development sales, encompassing both residential and commercial projects. This includes selling apartments and villas to individual homebuyers and investors, a key driver of their income. Additionally, the company generates significant revenue from the sale of commercial spaces, such as office units and retail shops, to businesses. In 2024, the real estate market in China continues to navigate adjustments, with developers like R&F focusing on project completion and sales to manage liquidity and meet delivery targets.

Guangzhou R&F generates a significant recurring revenue stream by leasing its extensive portfolio of investment properties, primarily comprising shopping malls, office buildings, and other commercial real estate holdings. This rental income provides a crucial stable cash flow, totaling approximately RMB 5.3 billion in 2024, which helps offset the inherent cyclicality and volatility of property sales. This consistent revenue base enhances the company's financial resilience and supports long-term operational stability. The diversified commercial portfolio ensures a steady income, contributing significantly to overall profitability.

Guangzhou R&F generates significant revenue from its extensive portfolio of luxury hotels, a crucial part of its diversified business model. This income primarily stems from room charges, robust food and beverage sales, and the hosting of conferences and events, known as MICE services. While this stream offers important diversification for the company, it remains highly susceptible to broader economic cycles and evolving global travel trends. For instance, as of their latest reports, hotel operations contributed a notable portion of their non-property development revenue, with continued recovery observed in 2024.

Property Management Fees

Guangzhou R&F generates significant revenue through property management fees via its subsidiaries, such as R&F Property Services Group. These fees are collected from homeowners and tenants across its extensive portfolio of residential communities and commercial properties. Services covered include essential security, meticulous cleaning, ongoing maintenance, and professional landscaping. This provides a consistent, long-term, and service-based income stream, reflecting the stable demand for well-managed properties. For instance, R&F Property Services reported revenues of approximately RMB 4.09 billion for the first half of 2023.

- Revenue from property management services reached RMB 4.09 billion in H1 2023.

- Fees are collected for security, cleaning, maintenance, and landscaping.

- This model ensures a steady, long-term, and service-based revenue flow.

- R&F Property Services Group manages a vast portfolio of residential and commercial assets.

Capital Gains from Asset Disposals

Guangzhou R&F periodically generates revenue from the strategic sale of investment properties, such as hotels or office buildings. When these assets are disposed of for more than their book value, the company realizes a capital gain. This serves as a non-recurring revenue stream, primarily utilized for capital recycling or to deleverage the balance sheet, which is crucial given recent financial challenges. Such sales help address liquidity needs.

- Capital gains are realized when properties are sold above their carrying value.

- This revenue stream is non-recurring and opportunistic.

- Funds are often used for deleveraging or capital reallocation.

- Asset disposals can address short-term liquidity requirements.

Guangzhou R&F generates diverse revenue primarily from property development sales, covering residential and commercial projects. Significant income also stems from leasing investment properties, projected at RMB 5.3 billion in 2024, and luxury hotel operations, which saw continued recovery. Property management services contribute a stable stream, with RMB 4.09 billion reported in H1 2023, alongside opportunistic capital gains from asset disposals.

| Revenue Stream | Primary Source | 2024 Outlook/Latest Data |

|---|---|---|

| Property Sales | Residential & Commercial Units | Market adjustments; focus on project completion |

| Property Leasing | Commercial Properties (Malls, Offices) | ~RMB 5.3 billion (2024 projection) |

| Hotel Operations | Rooms, F&B, MICE Services | Continued recovery observed (2024) |

| Property Management | Service Fees (Security, Maintenance) | RMB 4.09 billion (H1 2023) |

| Asset Disposals | Strategic Sale of Investment Properties | Opportunistic capital gains for deleveraging |

Business Model Canvas Data Sources

The Guangzhou R&F Business Model Canvas is informed by a blend of publicly available financial disclosures, real estate market research reports, and internal operational data. These sources provide a comprehensive view of the company's strategies and market positioning.